- Home

- »

- Petrochemicals

- »

-

Grinding Fluids Market Size, Share & Growth Report, 2030GVR Report cover

![Grinding Fluids Market Size, Share & Trends Report]()

Grinding Fluids Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Water-soluble, Synthetic), By Application (Disk Drivers, Silicon Wafer, Metal Substrates), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-160-7

- Number of Report Pages: 113

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Grinding Fluids Market Size & Trends

The global grinding fluids market size was estimated at USD 695.5 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 3.8% from 2024 to 2030. This growth is attributed to the fact that grinding process is widely adopted in various industries for achieving precise dimensions and smooth surface finishes of products while enabling their tight tolerances. These fluids are crucial as they lubricate and cool down grinding tools and workpieces and remove chipped pieces. Thus, these fluids are used as lubricants as well as coolants during grinding process. Moreover, the rise in demand for industrial machinery, which is used for extracting and processing minerals and ores, is fueling the demand for grinding fluids.

This machinery includes heavy equipment such as excavators, bulldozers, crushers, and conveyors, which are essential for mining operations. According to the Federal Ministry of the Republic of Australia, the global mining industry produced 17.9 billion metric tons in 2019, with Asia Pacific accounting for 58.9% of this total production. According to a report released by the Government of India, mineral production in the country grew from USD 1,010.5 million in 2020 to USD 1,400.4 million in 2021. All these factors are anticipated to drive the demand for grinding fluids worldwide over the forecast period.

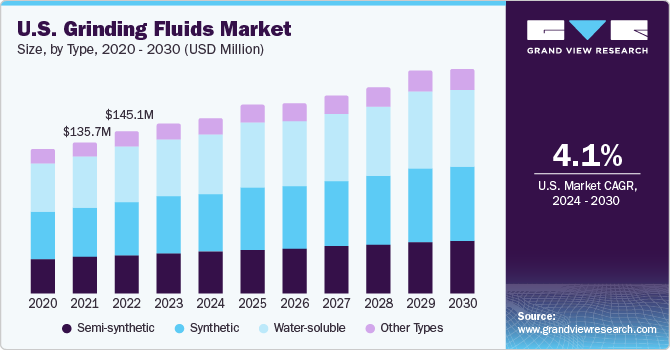

The U.S. is a major consumer of the product in North America with, revenue share of 79.9% in 2023. The growth of the product market during the forecast period can be attributed to the growth in industrial activities, particularly in sectors such as automotive, manufacturing, heavy machinery, and metalworking, in the U.S. The advancement in automotive industry has resulted in more complex machining operations. Grinding fluids are essential in these operations to dissipate heat and ensure successful machining and high-quality products.

According to the International Organization of Motor Vehicle Manufacturers (OICA), automotive production in the U.S. witnessed a growth of 10%, accounting for 10.1 million units in 2022. Moreover, the U.S. accounts for over two-thirds of the total steel demand in North America. The demand for iron and steel products in the U.S. comes from automotive, construction, transportation, and electronic sectors. The modest growth in construction and automotive sectors is expected to steadily drive the demand for synthetic grinding fluids over the forecast period.

Type Insights

Based on type, synthetic segment dominated the market in 2023 with a revenue share of 35.0%. This is attributed to its exceptional cooling and lubricating capabilities, surpassing other grinding fluids. Advancements in additive technology have further solidified their position as the preferred choice in the product market. These fluids are further enhanced with additional additives to inhibit corrosion. This extends their lifespan, reduces maintenance requirements, and minimizes downtime for fluid replacement.

They are used in a diluted form, ranging from 3 to 20% concentration. They are known for their stability and compatibility with various materials. They can be used for grinding metals, including ferrous and non-ferrous materials, without compromising performance or causing damage to the workpiece. Thus, the growing industrialization is anticipated to drive the demand for synthetic grinding fluids over the forecast period.

Semi-synthetic segment is anticipated to witness growth over the forecast period. It is a blend of synthetic and mineral oil-based components, resulting in a fluid that combines the best properties of both types. The synthetic portion comprises carefully selected additives, emulsifiers, and surfactants, which enhance lubricity, cooling, and corrosion resistance. Meanwhile, the mineral oil base provides excellent chip-carrying and flushing capabilities. One of the key advantages of the product is improved lubrication. The synthetic components in these fluids offer superior lubrication properties, reducing friction between the grinding wheel and the workpiece. This reduction in friction leads to reduced tool wear, improved surface finish, and enhanced dimensional accuracy in grinding operations.

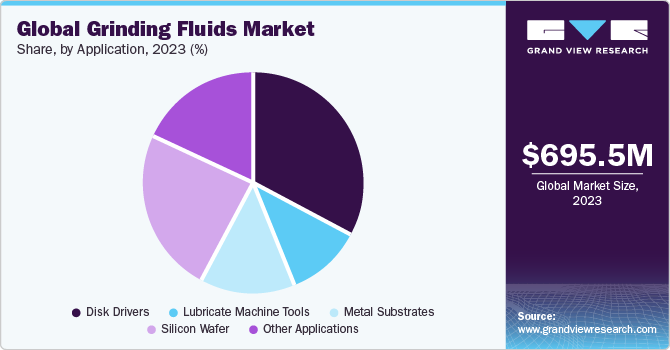

Application Insights

Disk drivers in application segment dominated the market in 2023 with a revenue share of 33.2 %. This is attributed to the fact that grinding fluids play a crucial role in manufacturing disk drivers, particularly in producing drive platters. Disk drivers, such as hard disk drives (HDDs), rely on precise and efficient grinding processes to shape and refine the drive platters, which house the magnetic media for data storage. These fluids have significant cooling properties crucial for dissipating the heat generated during the high-speed grinding of disk drivers. It helps maintain stable temperatures of the machinery, thereby safeguarding the workpieces and the grinding wheels from potential damage caused by its operation.

Another significant benefit of the product is its ability to facilitate chip removal. As the grinding process generates chips and debris, these fluids effectively flush them away, thereby preventing interference of chips and debris with the grinding process and protecting the disk driver components from any potential damage. By ensuring efficient chip removal, the grinding process becomes highly effective and efficient, improving the overall manufacturing process of disk drives.

Metal substrates are another application anticipated to witness growth over the forecast period. Metals, especially with high thermal conductivity, can quickly absorb and retain heat during grinding. Without proper cooling, this heat buildup can result in thermal deformation, surface cracks, or even metallurgical changes in metal substrates. This leads to the requirement for grinding fluids, which help in heat dissipation and maintaining stable temperatures during the process. The risk of thermal damage to metal substrates is reduced significantly by controlling the temperature, ensuring their dimensional accuracy, and preserving the integrity of materials used in their development.

Regional Insights

Asia Pacific region dominated the market with a revenue share of 45.1% in 2023. This is attributable to the increasing production volumes in various sectors such as automobile, defense, marine, and aerospace in the region. Globally, the production of metals such as titanium and aluminum was dominated by China as of 2022, according to the International Aluminum Association. The aluminum production in the country in 2023 was around 3,500 thousand metric tons. Therefore, the increase in aluminum production due to the production capacity additions by several manufacturers in China is expected to augment the demand for grinding fluids over the forecast period.

Furthermore, India is the world’s second-largest producer of crude steel with an output of 125.32 MT in 2023, as per the India Brand Equity Foundation (IBEF). The easy availability of resources like manpower with cheap labor and presence of iron ore reserves, has made India one of the leading steel producers. Thus, increasing steel production owing to its increasing demand from different end-use industries like automobile, defense, electronics, construction equipment, mining machinery, and metallurgical machinery is expected to drive the demand for products in the region.

Europe is another region anticipated to witness growth over the forecast period. The strong manufacturing base in Germany and Russia's automobile industry and the increasing demand for automotive components are expected to boost the demand for the product in Europe in the coming years. According to the European Automobile Manufacturers' Association (ACEA), car production in Europe grew by 7.1% in 2022 compared to the previous year. Thus, the advancing end-use industries in the region are anticipated to drive product demand over the forecast period.

Key Companies & Market Share Insights

The product market is highly competitive, with companies continuously expanding their regional presence by adopting different growth strategies such as expansion, new product launches, and partnerships. For instance, in May 2023, Amsoil Inc., a synthetic lubricant manufacturer, acquired Benz Oil Inc. This acquisition is expected to help Amsoil Inc. strengthen its expertise in metalworking fluids.

Key Grinding Fluids Companies:

- Benz Oil, Inc.

- Carborundum Universal Limited

- CASTROL LIMITED

- CGF, Inc.

- EnviroServe Chemicals, Inc.

- ETNA Products, Inc.

- ExxonMobil Corporation

- FUCHS

- Lincoln Chemical Corporation

- oelheld GmbH

- Sun Chem Pvt. Ltd

- TotalEnergies SE

Grinding Fluids Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 714.9 million

Revenue forecast in 2030

USD 905.6 million

Growth rate

CAGR of 3.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons, revenue in USD Million, and CAGR from 2024 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada, Mexico; Germany; UK; France; Italy; Spain; Netherlands; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Benz Oil, Inc.; Carborundum Universal Limited; CASTROL LIMITED; CGF, Inc.; EnviroServe Chemicals, Inc.; ETNA Products, Inc, Exxon Mobil Corporation; FUCHS; Lincoln Chemical Corporation; oelheld GmbH; Sun Chem Pvt. Ltd; TotalEnergies SE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Grinding Fluids Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global grinding fluids market report based on type, application, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Semi-synthetic

-

Synthetic

-

Water-soluble

-

Other Types

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Disk Drivers

-

Lubricate Machine Tools

-

Metal Substrates

-

Silicon Wafer

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global grinding fluids market size was estimated at USD 695.5 million in 2023 and is expected to reach USD 714.9 million in 2024.

b. The global grinding fluids market is expected to grow at a compound annual growth rate of 3.9% from 2024 to 2030 to reach USD 905.6 million by 2030.

b. Asia Pacific dominated the grinding fluids market with a share of 45.1% in 2023. This is attributable to the increasing production volumes in various sectors including automobile, defense, marine, and aerospace in the region.

b. Some key players operating in the grinding fluids market include Benz Oil Inc., Carborundum Universal Limited, CASTROL LIMITED, CGF, EnviroServe Chemicals, Inc, ETNA Products, Inc, Exxon Mobil Corporation, FUCHS, Lincoln Chemical Corporation, oelheld GmbH, Sun Chem Pvt. Ltd, and TotalEnergies

b. Key factors that are driving the market growth include the growing adoption of the grinding process in various industries for achieving precise dimensions and smooth surface finishes of products, as well as enabling their tight tolerances. These fluids play a crucial role in this process as they lubricate and cool grinding tools and workpieces, as well as remove chipped pieces.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.