- Home

- »

- Clothing, Footwear & Accessories

- »

-

Gym Apparel Market Size, Share And Growth Report, 2030GVR Report cover

![Gym Apparel Market Size, Share & Trends Report]()

Gym Apparel Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (Top Wear, Bottom Wear), By End-user (Men, Women), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-443-6

- Number of Report Pages: 108

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Gym Apparel Market Summary

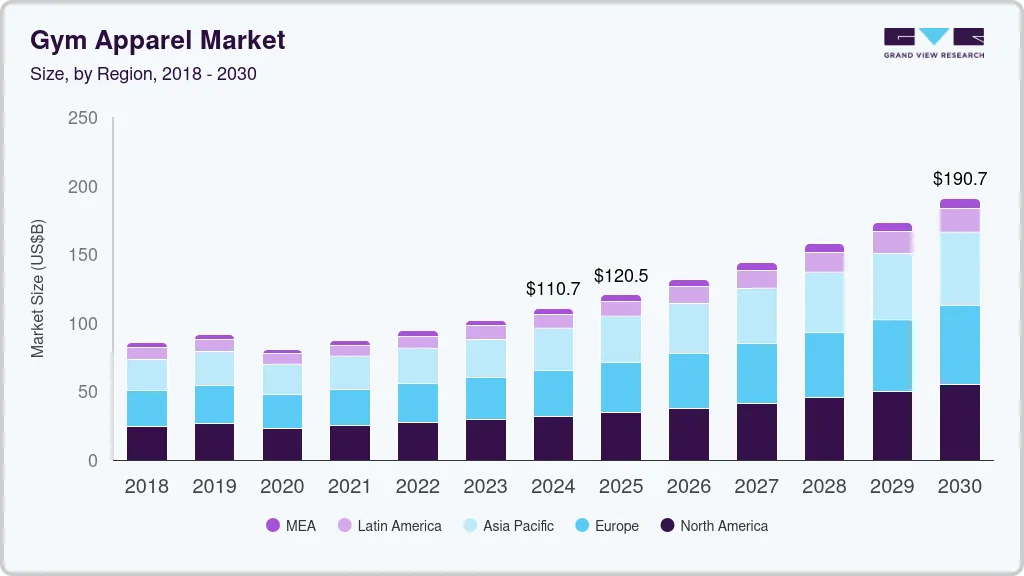

The global gym apparel market size was estimated at USD 110.68 billion in 2024 and is projected to reach USD 190.68 billion by 2030, growing at a CAGR of 9.6% from 2025 to 2030. The gym apparels market, also known as activewear or sportswear, encompasses clothing designed for physical exercise and sports activities.

Key Market Trends & Insights

- The gym apparel market in North America captured a revenue share of over 28.85% in the market.

- The U.S. gym apparels market is projected to grow at a significant CAGR from 2024 to 2030.

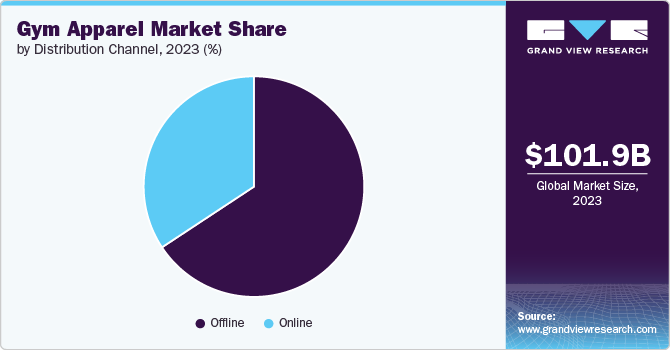

- The sales of gym apparel through offline accounted for a revenue share of 65.72% in 2023.

- Based on product type, the top wear segment accounted for a revenue share of 57.99% of the global revenue in 2023.

- Men’s gym apparel segment accounted for a share of 41.39% of the global revenue in 2023.

Market Size & Forecast

- 2024 Market Size: USD 110.68 Billion

- 2030 Projected Market Size: USD 190.68 Billion

- CAGR (2025-2030): 9.6%

- Asia Pacific: Fastest growing market

This market includes a wide range of products such as leggings, shorts, T-shirts, sports bras, hoodies, jackets, and accessories like socks and headbands which are categorized in top wear, bottom wear, and others. Gym apparel is designed to provide comfort, flexibility, moisture-wicking, and breathability, which are essential for workout sessions.The market has experienced significant growth in recent years, driven by increasing health awareness, the rising popularity of fitness activities, and the growing trend of athleisure-where gym wear is worn not only for exercise but also as casual everyday clothing. The market has expanded across different demographics, with a focus on both performance and style. The market has experienced significant growth in recent years, driven by increasing health awareness, the rising popularity of fitness activities, and the growing trend of athleisure-where gym wear is worn not only for exercise but also as casual everyday clothing. The market has expanded across different demographics, with a focus on both performance and style.

The rise in health consciousness and awareness of the benefits of regular exercise has led to an increased demand for gym apparel. People are more focused on leading healthy lifestyles, which include regular participation in physical activities like gym workouts, yoga, running, and cycling. Innovations in fabric technology, such as moisture-wicking, odor control, stretchability, and temperature regulation, have enhanced the performance of gym apparel. Brands that incorporate these technologies into their products appeal to consumers looking for high-performance gear.

Nowadays, there is a growing trend towards sustainability in the market. Consumers are increasingly looking for products made from recycled materials, organic cotton, and other eco-friendly fabrics. Brands are also adopting sustainable manufacturing processes to reduce their carbon footprint. Consumers are seeking personalized gym apparel that reflects their individuality. Brands are offering customizable options, allowing customers to choose colors, and designs, and even add personal logos or text to their clothing.

The market is set for sustained growth, driven by innovations in product formulations, strategic marketing efforts, and expanding distribution networks. Manufacturers and stakeholders in this sector have significant opportunities to capitalize on changing consumer trends and strengthen their positions in the global market. The market is moving towards greater inclusivity, with brands offering a wider range of sizes and designs that cater to different body types and preferences. This trend is driven by the growing demand for apparel that is both functional and fashionable for all consumers, regardless of size or gender.

Women's gym apparel, particularly sports bras, leggings, and yoga pants, has seen substantial growth. Brands are focusing on creating stylish, supportive, and functional activewear for women, driven by the rising participation of women in fitness activities. Many manufacturers are ramping up their investments in marketing, R&D, and product development, recognizing the lucrative potential of the gym apparel segment. This is leading to increased competition and a wider array of product offerings for consumers.

Product Type Insights

The top wear segment accounted for a revenue share of 57.99% of the global revenue in 2023. Top wear is a fundamental part of gym attire and is worn by individuals across all types of workouts, from weightlifting and running to yoga and group fitness classes. Because these items are used frequently, consumers often purchase multiple pieces, which drives demand in this segment. Stylish and comfortable tops are often worn outside of the gym, expanding their use and driving market growth. This trend has blurred the lines between activewear and casual wear, increasing the frequency of purchases in this segment.

The bottom wear segment is expected to grow at a CAGR of 9.6% from 2024 to 2030. Bottom wear items like leggings, joggers, and yoga pants have become integral to the athleisure trend. These garments are no longer confined to the gym but are worn as part of everyday casual outfits. Their versatility, combining comfort with style, has made them a staple in many wardrobes, leading to increased demand. Compression tights and leggings are increasingly popular for their ability to enhance athletic performance by improving blood circulation and reducing muscle fatigue. The growing awareness of these benefits is expected to drive demand for compression wear.

End-user Insights

Men’s gym apparel segment accounted for a share of 41.39% of the global revenue in 2023. Fitness has become an integral part of many men's lives, with gym memberships, fitness classes, and personal training sessions becoming more common. The gym is now a social hub as much as it is a place for physical activity, leading men to invest more in quality gym clothing that suits both performance and appearance. The athleisure trend, where athletic wear is worn in casual, non-sporting contexts, has significantly boosted the popularity of men's gym clothing. Men are increasingly wearing gym clothes like joggers, hoodies, and performance T-shirts in everyday situations, blurring the lines between gym wear and casual wear.

The women’s gym apparel segment is expected to grow at a CAGR of 9.8% from 2024 to 2030. There has been a significant increase in the number of women engaging in various fitness activities, including gym workouts, yoga, pilates, running, and group fitness classes. This rise in participation directly drives demand for women-specific gym apparel designed to meet their unique needs in terms of fit, comfort, and style. The athleisure trend has been particularly popular among women, with gym clothing often worn as part of everyday outfits. Items like leggings, sports bras, and tank tops have become staples not just for workouts but for casual wear, school, or running errands. This crossover appeal significantly boosts the demand for women's gym apparel.

Distribution Channel Insights

The sales of gym apparel through offline accounted for a revenue share of 65.72% in 2023. Many well-known gym apparel brands have established a strong presence in physical retail stores, creating a sense of trust and reliability among consumers. Shoppers may prefer to visit these stores where they can be assured of the authenticity and quality of the products. Retailers are increasingly focusing on creating immersive and engaging in-store experiences. This includes well-designed store layouts, interactive displays, and fitness events or workshops that attract customers and encourage them to spend more time (and money) in the store.

The sales of gym apparel through online retail are expected to grow at a CAGR of 9.8% from 2024 to 2030. Online retailers are increasingly using data analytics and AI to personalize the shopping experience. Consumers receive product recommendations based on their browsing history, preferences, and past purchases, making it easier for them to find gym apparel that suits their needs. This personalized experience enhances customer satisfaction and drives sales growth. Moreover, DTC brands often leverage social media platforms like Instagram, TikTok, and YouTube to reach their target audience, promote their products, and drive traffic to their online stores. The effective use of social media marketing has been a key factor in the growth of online gym apparel sales.

Regional Insights

The gym apparel market in North America captured a revenue share of over 28.85% in the market. There is a growing emphasis on health and fitness in North America, with more individuals engaging in regular exercise and sports activities. This trend drives demand for high-quality, comfortable, and stylish gym apparel. Major brands dominating the North American gym apparels market include Nike, Adidas, Under Armour, Lululemon Athletica, and Puma. These brands are known for their extensive product lines and strong market presence.

U.S. Gym Apparel Market Trends

The U.S. gym apparels market is projected to grow at a significant CAGR from 2024 to 2030.The rise of fitness culture, including the popularity of gyms, yoga studios, and boutique fitness classes, contributes to the increased need for specialized gym wear. The market also features emerging brands and direct-to-consumer (DTC) companies that are gaining popularity through unique product offerings and digital marketing strategies. There is a growing emphasis on fitness and wellness in the U.S., with more individuals participating in gym workouts, yoga, running, and other physical activities. This trend drives demand for high-quality, functional gym apparel.

Europe Gym Apparel Market Trends

The gym apparels market in Europe is expected to grow at a CAGR of 9.5% from 2024 to 2030. There is an increasing demand for sustainable and eco-friendly gym apparel in Europe. Brands are responding by offering products made from recycled materials, organic fabrics, and sustainable production practices. Consumers are becoming more aware of the environmental and ethical implications of their purchases, leading to a greater emphasis on transparency and responsible sourcing in the gym apparel market. Technological advancements in fabric technology, such as moisture-wicking, anti-odor, and breathable materials, are influencing gym apparel trends. European consumers are attracted to products that offer enhanced performance and comfort during workouts.

Asia Pacific Gym Apparel Market Trends

The Asia Pacific gym apparels market is expected to witness a CAGR of 9.8% from 2024 to 2030. These highly populated countries including China and India are significant growth drivers for the APAC gym apparel market. In India, urbanization and a rising middle class are contributing to increased demand for fitness-related products. In China, the growing popularity of fitness and health trends is driving market growth. Fitness influencers and celebrities play a significant role in shaping gym apparel trends in Asia Pacific. Social media platforms are used to promote products, set trends, and engage with consumers.

Key Gym Apparel Company Insights

The market is characterized by dynamic competitive dynamics shaped by a combination of factors including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality products.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Key manufacturers in the gym apparels market utilize their expansive distribution networks and robust brand recognition to sustain a substantial market presence. They prioritize quality, innovation, and regional preferences, thereby reinforcing their leadership in international markets that embrace gym clothing.

Key Gym Apparel Companies:

The following are the leading companies in the gym apparels market. These companies collectively hold the largest market share and dictate industry trends.

- Adidas AG

- ASICS Corp

- Columbia Sportswear

- Dick’s Sporting Goods Inc.

- G-III Apparel Group Ltd.

- Gildan Activewear Inc.

- Hanesbrands Inc.

- Nike Inc.

- PUMA SE

- VF Corporation

Recent Developments

-

In March 2024, Jennifer Sey, a former Levi Strauss & Co. executive and competitive gymnast, launched her own D2C athletic apparel brand, XX-XY Athletics. The debut collection focuses on casual cotton essentials, such as T-shirts, joggers, and fleece items. This will be followed by a second release featuring performance fabrics, including leggings, tees, bike shorts, and tanks for women, along with shorts, T-shirts, and layering pieces for men.

-

In February 2024, Athleta, a premium sports and activewear brand under Gap Inc., introduced a new women’s workout collection designed with proprietary fabrics tailored for high-intensity activities. This collection is the result of over three years of extensive wear testing involving both elite professional athletes and everyday consumers, alongside third-party lab tests. These tests focused on perfecting the fit and design by ensuring shape retention, and durability against pilling and snagging, as well as optimizing breathability and moisture-wicking properties.

Gym Apparel Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 120.49 billion

Revenue forecast in 2030

USD 190.68 billion

Growth rate

CAGR of 9.6% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, end-user, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Argentina; South Africa

Key companies profiled

Adidas AG; ASICS Corporation; Columbia Sportswear; Dick’s Sporting Goods Inc.; G-III Apparel Group Ltd.; Gildan Activewear Inc.; Hanesbrands Inc.; Nike, Inc.; PUMA SE; VF Corporation

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Gym Apparel Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global gym apparel market report based on product type, end-user, distribution channel, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Top Wear

-

Bottom Wear

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Men

-

Women

-

Children

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global gym apparel market size was estimated at USD 101.91 billion in 2023 and is expected to reach USD 110.68 billion in 2024.

b. The global gym apparel market is expected to grow at a compounded growth rate of 9.5% from 2024 to 2030 to reach USD 190.68 billion by 2030.

b. The top wear segment dominated the gym apparel market with a share of 57.99% in 2023. Top wear is a fundamental part of gym attire and is worn by individuals across all types of workouts, from weightlifting and running to yoga and group fitness classes. Because these items are used frequently, consumers often purchase multiple pieces, which drives demand in this segment.

b. Some key players operating in the gym apparel market include Adidas AG; ASICS Corporation; Columbia Sportswear; Dick’s Sporting Goods Inc.; G-III Apparel Group Ltd.; Gildan Activewear Inc.; and Hanesbrands Inc.

b. Key factors that are driving the market growth include increasing health awareness, the rising popularity of fitness activities, and the growing trend of athleisure—where gym wear is worn not only for exercise but also as casual everyday clothing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.