Gyroscope Market Size & Trends

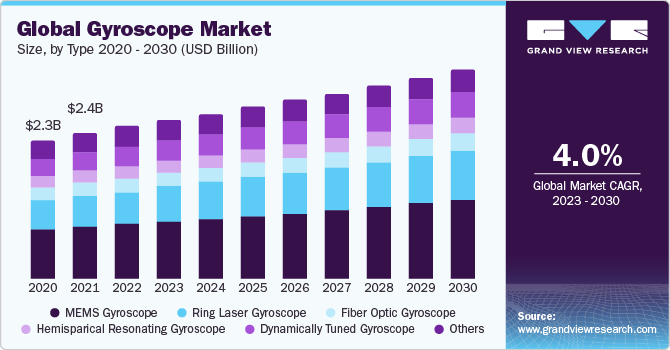

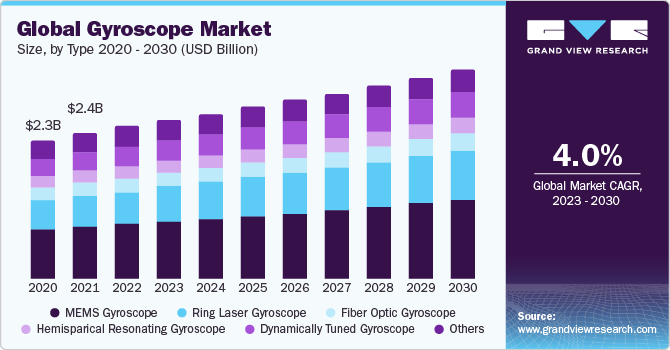

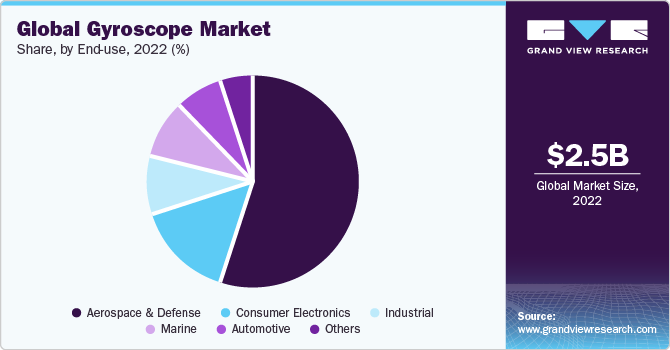

The global gyroscope market was valued at USD 2.50 billion in 2022 and is expected to grow at a CAGR of 4.42% over the forecast period. The market growth in the defense and commercial sectors is being driven by the rising adoption of drones and unmanned aerial vehicles (UAVs), along with the increasing utilization of gyroscopes in smartphones and handheld devices. These factors are playing a pivotal role in enhancing market expansion and driving industry advancements.

The outbreak of the COVID-19 pandemic has brought unprecedented challenges to various industries worldwide, and the market is no exception. The market heavily relies on a complex global supply chain, encompassing the production of raw materials, components, and final assembly. The pandemic-induced lockdowns, travel restrictions, and factory closures significantly disrupted this intricate network, leading to supply chain bottlenecks and delays in production. The reduced availability of essential components and manpower posed challenges for manufacturers, impeding the timely delivery of gyroscopes to customers.

The gyroscope market is experiencing rapid growth and innovation, revolutionizing various industries. A gyroscope is a device used to measure and maintain orientation, providing precise motion sensing capabilities. It plays a crucial role in navigation systems, aerospace applications, robotics, virtual reality, and more. With the increasing demand for autonomous vehicles, drones, and smartphones, the market has witnessed substantial expansion. These devices enable accurate motion tracking, enhancing user experience and safety in various applications. Moreover, advancements in micro-electro-mechanical systems (MEMS) technology have led to the development of smaller, more affordable gyroscopes, further fueling market growth. The aerospace and defense sectors heavily rely on gyroscopes for navigation, stabilization, and control systems. From aircraft to spacecraft, these devices ensure precise positioning, contributing to the safety and efficiency of these vehicles. Additionally, industries like healthcare, gaming, and sports are adopting gyroscopes to enhance motion sensing capabilities in medical devices, gaming consoles, and fitness trackers.

Type Insights

Based on the type, the gyroscope market is segmented into MEMS gyroscope. MEMS-based gyroscopes, short for micro-electro-mechanical systems gyroscopes, have emerged as a significant technological breakthrough in the field of motion sensing and orientation measurement. These gyroscopes leverage miniaturized mechanical structures, integrated circuits, and microfabrication techniques to achieve highly accurate and efficient motion sensing capabilities.

The introduction of MEMS-based gyroscopes has revolutionized various industries, including aerospace, automotive, consumer electronics, robotics, and healthcare. These gyroscopes offer key advantages over their traditional counterparts, such as reduced size, lower cost, improved reliability, and lower power consumption.

Sales Channel Insights

Gyroscopes, versatile devices with various applications, are sold through a diverse range of sales channels. Manufacturers have the option to sell directly to end-users, especially for high-end or custom gyroscopes. This direct sales approach can be facilitated through the manufacturer's own website, sales representatives, or even through established distributors. On the other hand, gyroscopes are also made available to customers through a network of distributors who supply retailers and end-users. These distributors play a crucial role in understanding the local market dynamics and providing valuable support to their customers. They have the expertise to navigate the complexities of the market and ensure that the right gyroscopes reach the intended users.

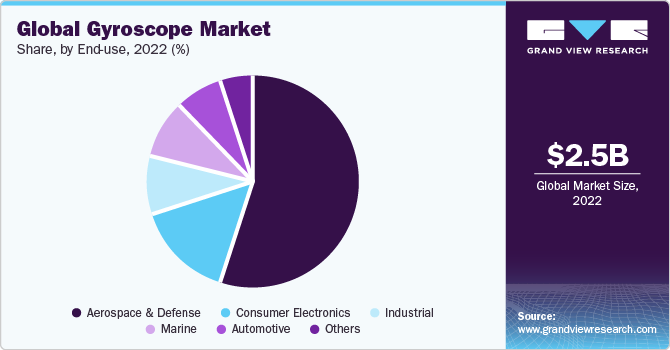

End-Use Insights

Based on end-use, the market is segmented into hospitals & clinics, ambulatory surgical centers, and homecare. The ambulatory surgery centers segment is the fastest growing segment during the forecast period. The substantial presence of Ambulatory Surgery Centers (ASCs) drives the market, making ambulatory surgical centers the fastest growing segment. It has been reported that every year, Ambulatory Surgery Centers (ASCs) carry out around 22.5 million procedures in over 5,900 Medicare-certified facilities across the United States. Additionally, Medicare's participation in the ASC industry results in significant cost savings exceeding USD 4.2 billion per annum, primarily for the procedures that are performed in these centers.

Regional Insights

The Asia-Pacific region has demonstrated the sole growth in capacity within the oil and gas industry in recent years, presenting promising prospects for this market in terms of its application in measuring object orientation and rotation. According to data provided by BP, the region yielded approximately 7.34 million barrels of oil per day in 2021. China emerged as the largest producer, with a daily production of around four million barrels, followed by India and Indonesia.

For instance, in the Chinese oil and gas industry, a specialized gyroscope has been developed specifically for borehole drilling applications. This gyroscope is capable of overcoming technical challenges, such as monitoring operating temperatures of up to 100 degrees Celsius. Inertial devices, predominantly, exhibit greater adaptability and are more effectively employed within the drilling field.

Key Companies & Market Share Insights

The market exhibits a fragmented landscape, characterized by the presence of multiple players. The substantial growth witnessed in unmanned vehicles, coupled with significant technological advancements, has created a favorable environment for lucrative opportunities within the gyroscopes market. The competitive rivalry among existing competitors remains intense, emphasizing the need for continuous innovation strategies to drive market demand. In this context, several noteworthy developments have emerged in this field.

In August 2022 EMCORE Corporation has recently made an announcement regarding its acquisition of the Fiber Optic Gyroscope and Inertial Navigation Systems business from KVH Industries Inc. This transaction involved a substantial cash payment of approximately USD 55 million, which encompassed the transfer of all assets and liabilities, intellectual property, as well as the acquisition of a production facility located in Illinois.

In May 2022, STMicroelectronics has successfully developed the ASM330LHHX, an advanced inertial measurement unit (IMU) that serves the purpose of facilitating intelligent driving and supporting the automotive industry's pursuit of enhanced automation levels through its embedded machine-learning (ML) core. This automotive-qualified ASM330LHHX IMU incorporates a 3-axis accelerometer and a 3-axis gyroscope within a compact outline measuring 2.5mm x 3mm x 0.83mm. The integration of these six-axis modules enables the IMU to effectively sense and track movement, as well as provide crucial data for vehicle positioning and digital stabilization functionalities.