- Home

- »

- Pharmaceuticals

- »

-

Hair Growth Supplements Market Size, Industry Report, 2030GVR Report cover

![Hair Growth Supplements Market Size, Share & Trends Report]()

Hair Growth Supplements Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Single Ingredient, Multi-Ingredient), By Form (Powder, Gummies & Soft Gels, Tablets, Capsules, Liquid), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-092-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Hair Growth Supplements Market Summary

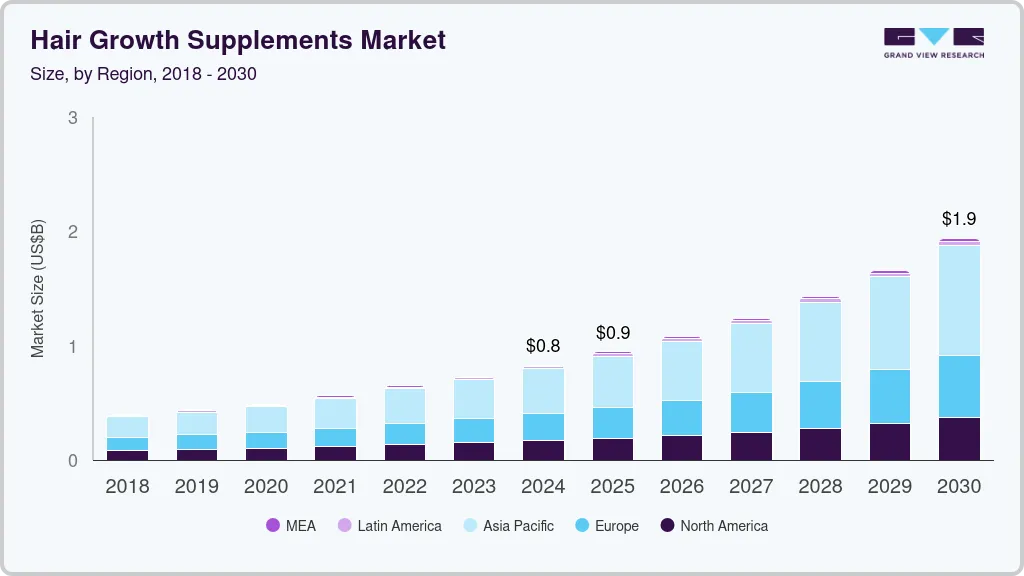

The global hair growth supplements market size was estimated at USD 830.6 million in 2024 and is projected to reach USD 1,938.8 million by 2030, growing at a CAGR of 15.5% from 2025 to 2030. The growth of the hair growth supplements industry can be attributed to the shift from pharmaceuticals to nutraceuticals owing to higher safety index, and an increase in awareness about nutritional benefits of supplements.

Key Market Trends & Insights

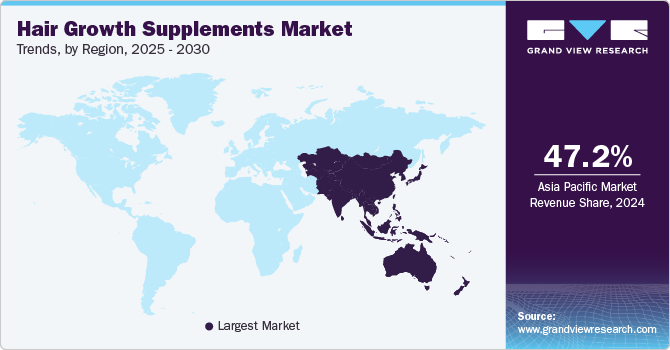

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, single ingredient accounted for a revenue of USD 690.6 million in 2024.

- Multi-ingredient is the most lucrative type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 830.6 Million

- 2030 Projected Market Size: USD 1,938.8 Million

- CAGR (2025-2030): 15.5%

- Asia Pacific: Largest market in 2024

Excessive hair loss from numerous conditions and increasing awareness of maintaining healthy hair have fueled an adoption of hair growth supplements.

The COVID-19 pandemic had a positive impact on the global hair growth supplements industry as hair fall has been observed in COVID-19 patients and is also the major side effects from the treatment. According to the International Association of Trichologists, COVID-19 caused two major types of conditions, alopecia areata and diffuse hair loss. Thus, it has created a robust demand for hair supplements during the pandemic. The demand for such supplements is anticipated to further grow owing to higher awareness among consumers, and shift in trend toward preventive healthcare, thereby driving the market at significant pace.

Moreover, the pandemic shifted the trend of buying toward e-commerce. The increasing number of people opting for online platforms is significantly impacting the industry momentum. For instance, Amazon witnessed a significant rise in online purchases of nutritional and personal care supplements, particularly in the U.S., due to the COVID-19 outbreak. All these factors are expected to drive the market over the forecast period.

Changing lifestyle has resulted in nutritional deficiency, which is projected to increase demand and consumption of supplements. Moreover, an increase in the working and middle-class population is likely to support market demand in the coming years. Furthermore, the rising demand for organic and natural products owing to several benefits associated with them are projected to fuel demand for natural growth products. Hair growth products blended with herbal ingredients such as, essential oils, minerals, vitamins, and omega-3 are gaining traction now-a-days. Also, the robust demand from consumers and recent product launches are projected to cater market demand. For instance, in May 2022, OUAI launched new vegan hair strengthening supplements and scalp serum to support healthy hairs.

Type Insights

Single ingredient accounted for the larger market share of 73.6% in 2024 and is expected to witness significant growth during the forecast period. Factors such as increasing geriatric population, growing consumer interest for nutritional products, easy product availability, and several product launches are projected to support segment uptake. In October 2022, Lakshmi Krishna Naturals launched a range of health and wellness products including biotin hair gummies. These newly launched gummies can promote regrowth and prevent thinning. Some of the common single ingredient products are, collagen based, biotin based, vitamin E, keratin based, zinc among others.

However, multi-ingredient segment is projected to register faster CAGR of 18.0% during 2025-2030. Factors such as higher demand for comprehensive care products, rising demand for natural and holistic solutions, and synergistic effects from multi-ingredient formulations are driving the segment uptake. Combination of two or more ingredients in a single formulation can help in avoiding thinning and promoting growth. The higher demand for multi-ingredient solutions pushed manufacturers to introduce novel formulations. For instance, in March 2022, GIMME Beauty launched drops and gummies to offer a unique blend of minerals and vitamins to support hair health and vitality.

Form Insights

The form segment of the market was dominated by the capsule segment in 2024 with a market share of 52.2% and expected to grow at a fastest CAGR over the forecast period. The segment is projected to register fastest growth throughout the projected period. High number of products available in capsule form owing to its lower cost, high convenience, high shelf life and greater patient compliance are projected to drive segment growth. Capsules appear to be more feasible in the case of smaller formulations. Furthermore, they require minimal excipients (such as binders), which increases their appeal to the end user. Manufacturing advancements have provided capsule manufacturers with a wide range of options to offer brand owners, including various shell colors, designs, shapes, and imprints.

Gummies and softgel segment is expected to grow at a significant CAGR over the forecast period. The rising demand from young and middle-aged population, rising preferences over tablets and capsules and surging interest of manufacturers to develop gummies and softgel based hair growth supplements are fueling segment uptake. For instance, in September 2022 Swisse, an Australian manufacturer introduced biotin gummies, melatonin gummies and plant protein powder in India for healthy skin and hair. Such product launches are expected to drive the segment growth by 2030.

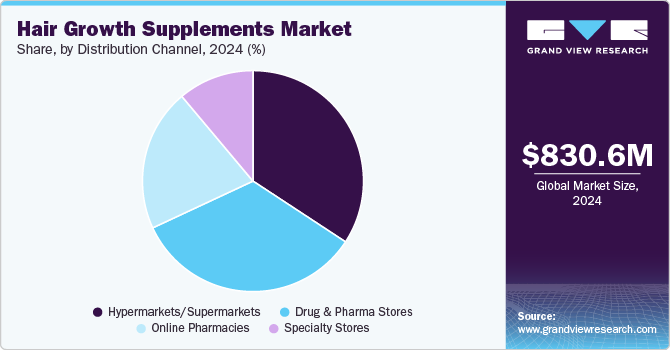

Distribution Channel Insights

Drug and pharma stores captured the largest market share of 33.8% in 2024. The growth of the segment is attributed to, high number of drug stores offering supplement products. For instance, stores like CVS health, Walgreens, Walmart among others offer various supplement products. In addition, presence of advanced healthcare infrastructure, rising patient awareness regarding potential side effects from supplements if not consumed under observation of pharmacist/ doctor are expected to drive segment growth forward.

Increase in the number of self-directed consumers is one of the important factors driving the online pharmacies segment. In addition, various discounts offered by online pharmacies in form of coupons, cashbacks is another factor fueling segment uptake. Moreover, owing to growing need for personalized products and relative ease of purchasing supplements through online channels compared to traditional modes have facilitated the demand of online pharmacies.

Regional Insights

The North American hair growth supplements market is driven by the growing prevalence of hair thinning and loss caused by stress, aging, and dietary deficiencies. Increasing awareness of hair health among consumers, coupled with a strong focus on wellness and self-care, has spurred demand for nutraceutical solutions. The market benefits from advanced product innovations, with key players emphasizing science-backed formulations, including biotin, keratin, and collagen-based supplements. Moreover, the widespread availability of products through online and offline retail channels further bolsters market growth in the region.

U.S. Hair Growth Supplements Market Trends

In the U.S., the hair growth supplements market is propelled by a high prevalence of hair loss conditions such as androgenic alopecia and traction alopecia, often exacerbated by stress and lifestyle factors. Rising consumer interest in natural and personalized hair care solutions has driven demand for supplements featuring organic and clinically tested ingredients. The influence of celebrities, social media campaigns, and endorsements has also heightened consumer interest. In addition, the robust e-commerce sector, combined with increasing health-consciousness and disposable income, has made these supplements more accessible and appealing to a broad demographic.

Asia Pacific Hair Growth Supplements Market Trends

Asia Pacific hair growth supplements market dominated the global industry with a share of 47.2% in 2024. The rapid growth is accounted to high awareness among people, rising disposable income, easy access to products owing to highly developed retail pharmacy chains. The rising health and wellness consciousness among population is pushing them to adopt supplements in their day-to-day lives. In addition, significant demand from young and middle-aged population, rising burden of hair thinning disorders, and various initiatives undertaken by market players in form of new launches, collaboration, distribution have supported regional market. For instance, in January 2023 Medicare, an India based company expanded its well range with the launch of “Well Gummies”. The well range offers different variants including Well Hair, Skin, Nail Gummy, Detox Gummy, etc.

China's hair growth supplements industry is driven by rising awareness of hair health among the urban population, fueled by increasing hair loss issues due to stress, pollution, and aging. The growing demand for natural and herbal products is influencing the market, with consumers preferring traditional Chinese medicine-inspired formulations. E-commerce platforms play a critical role in boosting accessibility and sales of these supplements, while celebrity endorsements and social media trends further enhance consumer interest.

In Japan, the hair growth supplements industry benefits from an aging population highly conscious of personal appearance and hair health. The emphasis on science-backed, high-quality formulations aligns with consumer preferences for innovative and effective products. In addition, cultural trends that prioritize grooming and aesthetic appeal, along with a robust retail ecosystem, including pharmacies and health stores, support market growth.

Europe Hair Growth Supplements Market Trends

Europe's hair growth supplements market is driven by increasing consumer awareness of wellness and the rising prevalence of hair thinning due to stress and lifestyle changes. Growing interest in sustainable and organic products has shifted consumer preferences toward plant-based supplements. The strong presence of premium brands and government support for nutritional health products further stimulate the market.

The UK market for hair growth supplements is influenced by rising concerns over hair loss caused by stress, environmental factors, and post-COVID-19 health issues. Consumers are drawn to supplements that promise visible results, with preference for clinically validated formulations. The influence of beauty influencers, along with the expanding e-commerce market, ensures easy accessibility and widespread awareness of these products.

France's market is driven by an increasing focus on natural beauty and holistic health solutions. French consumers prioritize high-quality, clean-label products, propelling the demand for natural and organic hair growth supplements. The country's strong pharmaceutical and dermo-cosmetic heritage supports innovation in this segment, catering to both local and global markets.

Germany’s hair growth supplements market thrives on a health-conscious population that values preventive care and nutritional solutions for hair health. The country’s advanced healthcare infrastructure and consumer preference for scientifically proven products boost market adoption. Additionally, the rising popularity of vegan and cruelty-free products aligns with Germany's sustainability-driven consumer base.

MEA Hair Growth Supplements Market Trends

In the Middle East & Africa, the market is driven by increasing disposable incomes and heightened awareness of personal grooming among both men and women. Hair loss concerns due to harsh climatic conditions, such as extreme heat and dryness, contribute to the demand for supplements. Local traditions and preferences for natural remedies also encourage the growth of herbal and nutrient-based products.

Saudi Arabia's hair growth supplements market is fueled by a young and beauty-conscious population, coupled with increasing hair loss issues due to climatic conditions and high chemical hair treatment usage rates. The growing influence of social media and rising disposable incomes support the demand for premium and clinically backed hair growth supplements, particularly those with halal certification.

Kuwait’s market benefits from high disposable incomes and an increasing focus on luxury grooming products. Hair loss issues due to frequent hair styling and exposure to environmental stressors drive the demand for hair growth supplements. The preference for international brands, combined with growing health awareness, further supports market expansion in the country.

Key Hair Growth Supplements Company Insights

The key players in hair growth supplements are undertaking various strategic initiatives to maintain their market presence. In addition, various strategic initiatives help market players to bolster their business avenues.

Key Hair Growth Supplements Companies:

The following are the leading companies in the hair growth supplements market. These companies collectively hold the largest market share and dictate industry trends.

- Nutraceutical Wellness Inc. (Uniliver)

- Viviscal Limited. (Church & Dwight)

- Amway

- GNC Holdings, Inc. (Harbin Pharmaceutical Group)

- OUAI HAIRCARE (P&G)

- InVite Health

- codeage LLC

- Viva Naturals

- KLAIRE LABS

- Hair La Vie

Recent Development

-

In November 2024, Hum Nutrition, a wellness brand, has introduced its newest offering: the Hair Strong Capsule. Clinically tested, this innovative formula is proven to boost hair growth while enhancing strength, providing a comprehensive solution for healthier, more resilient hair.

-

In November 2024, wellness brand, Lemme, has recently introduced a hair growth supplement. This product incorporates a keratin formula enriched with amino acids, vitamins, and minerals.

-

In September 2024, NiceTop, a U.S.-based anti-aging research organization, has introduced a new hair growth supplement, expanding its footprint in the personal care and nutrition industry. The formula addresses three primary areas of hair health: reducing DHT-induced hair loss, supplying vital nutrients to support hair growth, and enhancing the process with biotin for accelerated results.

-

In January 2023 Capillus announced the launch of Nurish, a first line of hair supplements for women and men. The supplement is formulated with specialty ingredients to promote healthy hair growth.

Hair Growth Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 945.2 million

Revenue forecast in 2030

USD 1,938.8 million

Growth rate

CAGR of 15.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Type, form, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Nutraceutical Wellness Inc. (Uniliver); Viviscal Limited. (Church & Dwight); Amway; GNC Holdings, Inc. (Harbin Pharmaceutical Group); OUAI HAIRCARE (P&G); InVite Health; codeage LLC; Viva Naturals; KLAIRE LABS; Hair La Vie

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Hair Growth Supplements Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global hair growth supplements market based on type, form, distribution channel, and region:

-

Type Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

Single Ingredient

-

Multi-ingredient

-

-

Form Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

Powder

-

Gummies & Soft Gels

-

Tablets

-

Capsules

-

Liquid

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets/Supermarkets

-

Specialty Stores

-

Online Pharmacies

-

Drug & Pharma Stores

-

-

Regional Outlook (Revenue, USD Million, 2018- 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hair growth supplements market size was estimated at USD 830.6 million in 2024 and is expected to reach USD 945.2 million in 2025.

b. The global hair growth supplements market is expected to grow at a compound annual growth rate of 15.5% from 2025 to 2030 to reach USD 1,938.8 million by 2030.

b. Asia Pacific dominated the hair growth supplements market with a share of 47.2% in 2024. This is attributable to increasing awareness regarding hair growth supplements in countries such as India, Japan, and China

b. Some key players operating in the hair growth supplements market include Nutraceutical Wellness Inc., Viviscal, Amway, OUAI , GNC, InVite Health, codeage LLC, Viva Naturals, KLAIRE LABS, and Hair La Vie,

b. Key factors that are driving the hair growth supplements market growth include the increasing geriatric population, increasing awareness regarding hair supplements, and inclination towards overall aesthetics and beauty

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.