- Home

- »

- Medical Devices

- »

-

Handheld Ultrasound Devices Market Size Report, 2030GVR Report cover

![Handheld Ultrasound Devices Market Size, Share & Trends Report]()

Handheld Ultrasound Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By End Use (Hospitals, Primary Clinics), By Application (Trauma, Urology), By Technology (3D/4D, 2D, Doppler), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-133-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Handheld Ultrasound Devices Market Summary

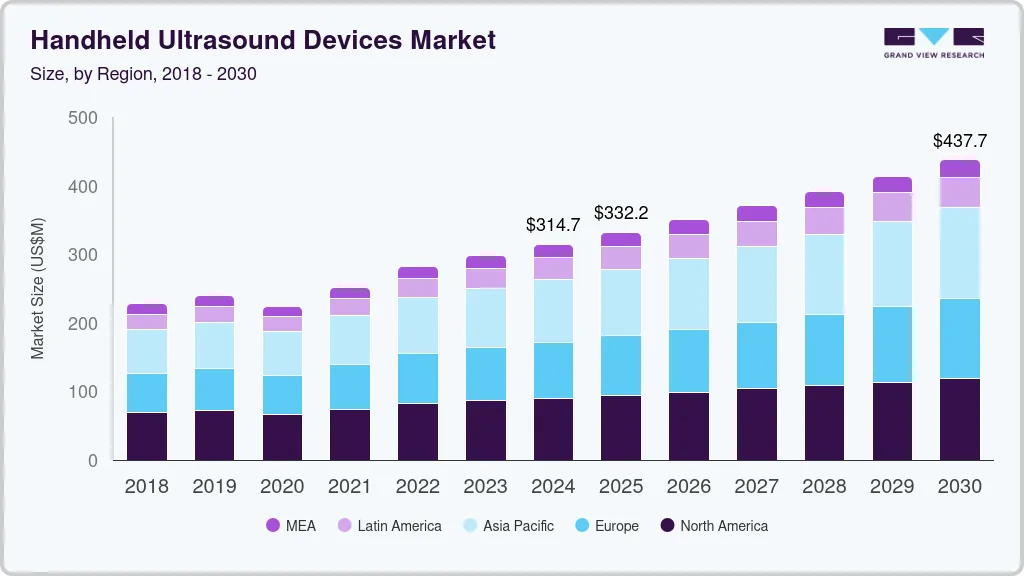

The global handheld ultrasound devices market size was estimated at USD 314.7 million in 2024 and is projected to reach USD 437.7 million by 2030, growing at a CAGR of 5.7% from 2025 to 2030. The handheld ultrasound devices industry growth is driven by several factors, such as rapid advancements in healthcare technology and the increasing prevalence of chronic diseases, such as gastrointestinal, neurological, endocrine, cardiovascular diseases, and cancer, in older people.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- Country-wise, Kuwait is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, 3D/4D ultrasound accounted for a revenue of USD 134.1 million in 2023.

- 3D/4D Ultrasound is the most lucrative technology segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 314.7 Million

- 2030 Projected Market Size: USD 437.7 Million

- CAGR (2025-2030): 5.7%

- Asia Pacific: Largest market in 2024

In addition, the growing demand for home healthcare equipment is fueling market growth. Home ultrasound equipment can help individuals with chronic pain get some relief and fasten the healing process after an injury.

Homecare therapeutic ultrasound devices are easily accessible and often portable and handheld. Rapid technological advancements in handheld ultrasound systems are expected to enhance the diagnosis and treatment of various diseases, such as cardiovascular diseases and cancer. Rising demand for minimally invasive treatments and advancements in imaging devices, such as 3D and 4D image detailing, accelerated processing speed, automated workflow, and Point-of-Care (PoC) solutions, is expected to boost the adoption during the forecast period. Also, the demand for early diagnosis is increasing, leading to more patients opting for handheld ultrasound devices to obtain instant results.

For instance, in July 2023, Konica Minolta Healthcare Americas, Inc. launched PocketPro H2, a wireless handheld ultrasound machine designed for general radiology in PoC applications. Konica Minolta Healthcare collaborated with Healcerion to distribute PocketPro H2 in the U.S. for veterinary and human applications. Moreover, technological advancements in the market are expected to create lucrative growth opportunities in the forecast period. Several handheld ultrasound systems use AI software programs that perform calculations, such as ejection fraction and bladder volume assessment. With the help of image recognition software, structures can be automatically identified and labeled, and the quality of the images produced is continuously monitored.

The Kosmos device has telemetry leads that can be linked to the patient and do digital cardiac auscultation and image acquisition. This allows for integrating electrocardiogram results and rhythm interpretation into the ultrasound investigation. Most handheld ultrasound devices employ app-based smartphone technology, typically for Android or iOS, which reduces boot times and simplifies complex knobology into easy-to-learn finger swipes and taps, lowering the entry barrier for new users. Numerous handheld ultrasound devices include Health Insurance Portability and Accountability Act (HIPAA)-compliant cloud-based storage with an interface that fosters cooperation and prompt input from distant reviewers without needing middleware.

Powerful smart gadgets allow for remote guidance and tele-ultrasound straight from the device without additional apparatus. In addition, the introduction of novel handheld ultrasound systems is fueling market growth. Due to their portability, ease of use, PoC accessibility, simplified user-friendly controls, and improved image quality with various technologies, such as Doppler imaging. Key and emerging players are developing handheld devices to cater to the market demands. For instance, in February 2023, Shenzhen Mindray Bio-Medical Electronics Co., Ltd. introduced a new handheld ultrasound system, TE Air. It is a compact-sized device with a wire-free design that fits in the pocket, flexible charging for extreme mobility, and high-level disinfection tolerance.

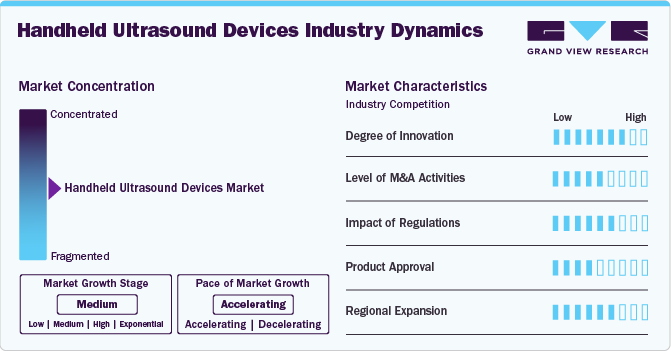

Market Concentration & Characteristics

The handheld ultrasound devices industry is expanding due to several factors such as advancements in technology, the growing demand for point-of-care diagnostics, and the rise in chronic diseases. In addition, these devices are affordable and portable which makes them more accessible to healthcare professionals in various settings including remote locations and primary care clinics. This has made them popular as they help provide quick and accurate diagnoses, enhance patient outcomes, and reduce healthcare expenses.

Companies operating in the handheld ultrasound devices industry are taking several initiatives to expand their market reach. For instance, they are actively pursuing product launches as a strategic approach to increase their product offerings and attract more customers. For instance, in September 2023, Mindray introduced its TE Air Wireless Handheld Ultrasound, which is a compact and wireless imaging solution that improves accessibility to ultrasound. This device can be easily carried in the pocket of healthcare professionals, providing comprehensive scanning capabilities in various clinical scenarios. The TE Air is the industry's first wireless handheld ultrasound device that can be connected to either a mobile device or the touch-based TE X Ultrasound System, making it more versatile and accessible.

Handheld ultrasound devices industry have undergone significant innovation in recent years, driven by remarkable technological advancements. These advancements have contributed to increased adoption of these devices in various healthcare settings. For instance, in January 2024, Clarius Mobile Health, a leading global provider of wireless ultrasound solutions, received FDA approval for its latest innovation, the Clarius Bladder AI. This non-invasive tool automatically measures bladder volume within seconds, making it a valuable addition to healthcare professionals' diagnostic tools.

Manufacturers of handheld ultrasound devices are increasingly engaging in integration through merger and acquisition activities. This strategic approach enables them to augment their technological capabilities, broaden their market reach, and ensure competitiveness in the rapidly evolving healthcare landscape. For instance, in February 2023, GE Healthcare announced its agreement to acquire Caption Health, Inc., a privately held AI healthcare provider. Caption Health develops clinical applications that leverage artificial intelligence to enable early disease diagnosis and enhance ultrasound scans. This acquisition is expected to enhance GE Healthcare's AI capabilities and expand its portfolio of ultrasound solutions.

Regulations play a crucial role in the development, manufacturing, and marketing of handheld ultrasound devices. These regulations are put in place to ensure that these devices are safe and effective for patients and healthcare professionals. To ensure compliance with regulatory standards, manufacturers must follow guidelines established by regulatory bodies such as the Food and Drug Administration (FDA) in the U.S. and the European Medicines Agency (EMA) in Europe.

Several industry players are engaged in product innovation and securing regulatory approval to hold a substantial market share. By introducing new and innovative products, manufacturers can attract more customers and gain a competitive edge in the market. For instance, in January 2024, Butterfly Network, Inc. recently announced that its next-generation handheld point-of-care ultrasound system, the Butterfly iQ3, has received FDA clearance. This innovative device is expected to enhance accessibility to ultrasound and improve patient outcomes by providing quick and accurate diagnoses.

The geographical reach of handheld ultrasound devices has been expanding at a moderate to high level, primarily driven by increased adoption in developed economies. As these devices become more affordable and accessible, they are gaining popularity in various healthcare settings across the world. For instance, in July 2023, Konica Minolta Healthcare Americas, Inc. has recently introduced the PocketPro H2, a new wireless handheld ultrasound device designed for general imaging in point-of-care applications in the U.S. This device is expected to improve accessibility to ultrasound and provide healthcare professionals with quick and accurate diagnoses, improving patient outcomes.

Technology Insights

The 3D/4D ultrasound segment dominated the market with the highest revenue share of around 46.69% in 2024, and it is expected to grow at the highest compound annual growth rate (CAGR) of 6.16% from 2025 to 2030. 3D and 4D handheld ultrasound devices are widely used in cardiovascular monitoring to determine blood flow through arteries and veins. In addition, 3D/4D units are increasingly being used in breast imaging for breast cancer screening, as they provide better visualization of the coronal plane. Therefore, the growing prevalence of cancer is likely to boost the demand for 3D/4D handheld ultrasound devices. For instance, according to the International Agency for Research on Cancer in 2022 about 2,380, 189 cancer cases were observed. Also, 3D/4D ultrasound imaging is gaining acceptance in obstetrics/gynecology. These factors are expected to propel the handheld ultrasound device market during the forecast period.

The 2D ultrasound segment is also expected to grow at a significant rate from 2025 to 2030. The demand for 2D handheld ultrasound is primarily attributed to its easy user interface and affordable cost. 2D handheld ultrasound devices are more commonly used in obstetrics, cardiology, and women's health. 2D handheld ultrasound devices create black-and-white images that show the baby's skeletal structure and make internal organs visible. The frequent launch of new products that offer improved imaging, workflow, and ergonomic capabilities is anticipated to drive this segment. For instance, in August 2023, Siemens Healthineers introduced a dedicated cardiovascular ultrasound system with 2D HeartAI and 4D HeartAI robust artificial intelligence (AI) features.

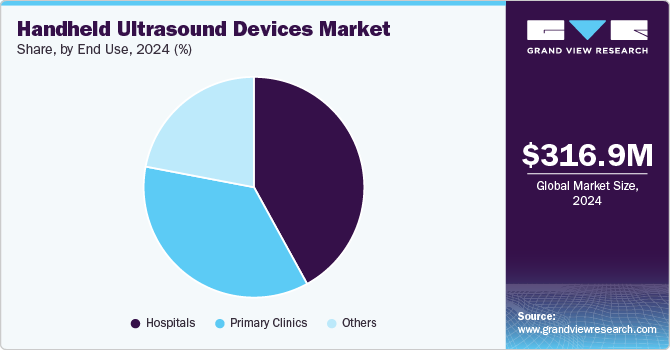

End Use Insights

The hospital segment held the largest revenue share of 42.09% in 2024. This growth can be attributed to the higher number and type of ultrasound studies performed in hospitals than in any other healthcare setting. On average, a hospital may require at least three ultrasound scanners, one dedicated to general radiology, one for obstetrics and gynecology, and one for cardiac scanning. Also, the increasing number of private hospitals to address the growing burden of chronic illness is expected to drive the demand for handheld ultrasound devices. On the other hand, handheld ultrasound is becoming one of the key diagnostic tools during emergency visits and bedside monitoring.

In October 2020, GE Healthcare partnered with St. Luke’s University Health Network-a nonprofit, fully integrated, regional, nationally recognized network providing services at 12 hospitals-to install 76 ultrasound systems. The primary clinics segment is expected to grow at the highest CAGR of 6.30% from 2025 to 2030. In primary care, POCUS has been shown to increase the physician’s ability to detect heart failure accurately, improving management. It was also more sensitive to identifying pneumonia than the combined chest X-ray and clinical examination. POCUS is the benchmark of care for procedural guidance and enables the clinician to quickly recognize a variety of life-threatening entities and guide the management of hemodynamically unstable patients.

Application Insights

Based on application, the musculoskeletal segment dominated the market with a revenue share of 21.53% in 2024. The identification, highlighting, and measurement of tendon structures in the foot, ankle, and knee are done automatically by an Artificial Intelligence (AI) used for musculoskeletal (MSK) imaging that operates with handheld point-of-care ultrasound devices. Technological advancements in products and the launch of novel products by industry key players are boosting the industry's growth. GE HealthCare's Vscan Air offers simple patient imaging at the point of care. It assesses diseases, such as joint effusion, tendon and ligament injuries, bone fractures, and inflammation (tendonitis) across the MSK system of the body. MSK ultrasound is utilized with Vscan Air to support injury identification and guided interventions in clinics, radiology, sports medicine, outpatient settings, or everywhere necessary.

The trauma segment is expected to grow at the highest CAGR of 6.21% from 2025 to 2030. Trauma physicians use point-of-care ultrasonography (POCUS) as a helpful imaging method. Rapidly identifying injuries that threaten life and necessitate action is made possible by ultrasonography. A few ultrasound applications in the trauma department include obstetrics, soft tissue/MSK, abdominal ultrasonography of the right upper quadrant and appendix, and testicular and ocular ultrasonography. When traditional diagnostic techniques either take too long or put a person in more danger, ultrasonography is utilized to quickly diagnose a small number of injuries or pathologic diseases in the emergency medicine department.

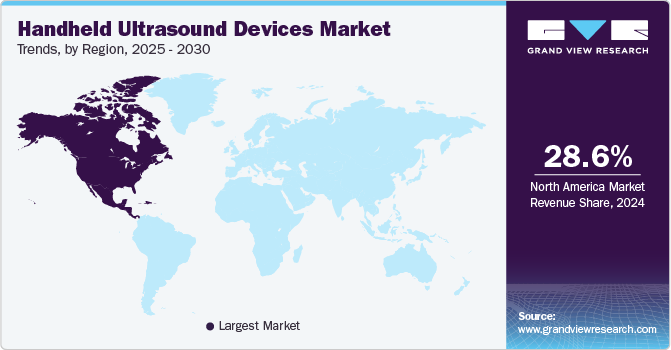

Regional Insights

North America dominated the global market in 2024 with the largest share of around 28.58% by revenue. Owing to factors such as the increased use of ultrasound technology in primary care settings, easy accessibility, and high healthcare spending in countries with effective reimbursement policies. The growing incidence of chronic disorders in this region, including breast cancer, cardiovascular disorders, and neurological diseases, has created a high demand for imaging analysis. The region is expected to maintain its dominance over the forecast period. Technological innovations and the growing incidence of chronic conditions are anticipated to propel the handheld ultrasound device market in the region.

U.S. Handheld Ultrasound Devices Market Trends

The U.S. handheld ultrasound devices market is expected to grow over the forecast period driven by aging demographic trends, advancing technologies, changing patient care strategies, and evolving epidemiological patterns. As the population ages, the demand for portable and affordable diagnostic solutions is increasing, making handheld ultrasound devices a popular choice for healthcare professionals. In addition, the emergence of new technologies is enhancing the capabilities of these devices, making them a valuable addition to healthcare practices.

Europe Handheld Ultrasound Devices Market Trends

Rising demand for healthcare devices and growing prevalence of chronic disorders & pain-associated disorders in Europe are some of the major factors anticipated to propel handheld ultrasound devices market in Europe.

The UK handheld ultrasound devices market is expected to grow at a fastest rate over the forecast period owing to technological advancements, growing awareness regrading diagnostic imaging methods and the increasing prevalence of chronic disorders.

The France handheld ultrasound devices market is expected to grow over the forecast period as it has a strong healthcare infrastructure, which meets the healthcare needs of its citizens. This favors the use of advanced handheld ultrasound devices.

The Germany handheld ultrasound devices market is expected to grow over the forecast period due to the need for advanced and efficient diagnostic devices, the presence of a sophisticated healthcare system, and a highly qualified workforce. These factors are anticipated to increase the adoption of handheld ultrasound devices in Germany and drive market growth.

Asia Pacific Handheld Ultrasound Devices Market Trends

Asia Pacific handheld ultrasound devices market in Asia Pacific is anticipated to exhibit significant growth over the forecast period. This can be attributed to rapid growth of the population and increased R&D activity in this region. In addition, there is a high need for traditional and as well as advanced devices in Asia Pacific.

Handheld ultrasound devices market in China is expected to grow owing to the changes in demographics & disease patterns and the growth of the private healthcare sector.

Japan handheld ultrasound devices market is projected to experience the fastest growth, over the forecast period. This growth can be attributed to the country's strong focus on technological innovation and Research & Development (R&D), providing an ideal environment for the advancement of handheld ultrasound devices technology.

Latin America Handheld Ultrasound Devices Market Trends

The handheld ultrasound devices market in Latin America is anticipated to undergo moderate growth throughout the forecast period. This growth is driven by several factors, including the presence of rapidly developing economies (such as Brazil & Mexico).

MEA Handheld Ultrasound Devices Market Trends

The Middle East & Africa handheld ultrasound devices market is anticipated to experience moderate growth during the forecast period owing to the increased focus of countries like Saudi Arabia and Kuwait towards enhancing their healthcare sectors.

Saudi Arabia handheld ultrasound devices market is expected to grow at a significant rate owing to technological advancements and growing awareness regarding early diagnosis by imaging devices.

Handheld ultrasound devices market in Kuwait is expected to grow owing to the favorable medical insurance and rapid adoption of advanced imaging in the country.

Key Handheld Ultrasound Devices Company Insights

The competitors in the handheld ultrasound devices industry are involved in developing and launching new products. Also, they are focusing on forming strategic partnerships with the major players to strengthen their presence in the market. Some of the leading market players are GE healthcare, Koninklijke Philips N.V., Shenzhen Mindray Bio-Medical Electronics Co., Ltd., and others.

Key Handheld Ultrasound Devices Companies:

The following are the leading companies in the handheld ultrasound devices market. These companies collectively hold the largest market share and dictate industry trends.

- GE HealthCare

- Koninklijke Philips N.V.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- BenQ Medical Technology

- CHISON Medical Technologies Co., Ltd.

- Dawei Medical (Jiangsu) Corp., Ltd.

- Viatom Technology Co., Ltd.

- Telemed Medical Systems S.r.l.

- Butterfly Network, Inc.

- Pulsenmore Ltd.

- Leltek Inc.

Recent Developments

-

In August 2023, GE HealthCare launched the Vscan Air SL - a wireless handheld ultrasound device that enables quick and efficient assessments of cardiac and vascular patients.

-

In May 2023, Philips and Wuxi CHISON Medical Technology Co., Ltd. entered into a partnership agreement. The companies agreed to offer domestic ultrasound technology to Chinese clients for a larger range of care settings while concentrating on local clinical demands.

-

In April 2023, Butterfly Network, Inc. announced that its AI-enabled lung tool, the Auto B-Line Counter, received FDA clearance.

Handheld Ultrasound Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 334.8 million

Revenue forecast in 2030

USD 442.7 million

Growth rate

CAGR of 5.74% from 2025to 2030

Actual period

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, end use

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

GE HealthCare; Koninklijke Philips N.V.; Shenzhen Mindray Bio-Medical Electronics Co., Ltd.; BenQ Medical Technology; CHISON Medical Technologies Co., Ltd.; Dawei Medical (Jiangsu) Corp., Ltd.; Viatom Technology Co., Ltd.; Telemed Medical Systems S.r.l.; Butterfly Network, Inc; Pulsenmore Ltd.; Leltek Inc,

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Handheld Ultrasound Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global handheld ultrasound devices market report on the basis of technology, application, end use and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

2D Ultrasound

-

3D/4D Ultrasound

-

Doppler Ultrasound

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Obstetrics/Gynecology

-

Cardiovascular

-

Urology

-

Gastroenterology

-

Musculoskeletal

-

Trauma

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Primary Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global handheld ultrasound market size was estimated at USD 316.9 million in 2024 and is expected to reach USD 334.8 million in 2025.

b. The global handheld ultrasound device market is expected to grow at a compound annual growth rate of 5.74% from 2025 to 2030 to reach USD 442.7 million by 2030.

b. North America dominated the handheld ultrasound device market with a share of 28.58% in 2024. This is attributable to increase adoption of ultrasound technology in primary care settings, improved accessibility, and the presence of high healthcare spending in countries with efficient reimbursement policies

b. Some key players operating in the handheld ultrasound device market include GE HealthCare; Koninklijke Philips N.V.; Shenzhen Mindray Bio-Medical Electronics Co., Ltd.; BenQ Medical Technology; CHISON Medical Technologies Co., Ltd.; Dawei Medical (Jiangsu) Corp., Ltd.; Viatom Technology Co., Ltd.; TELEMED MEDICAL SYSTEMS S.r.l.; Butterfly Network, Inc; Pulsenmore Ltd.; Leltek Inc.; Others

b. Key factors that are driving the market growth include rising demand for minimally invasive surgical procedures, technological advancements, and increasing adoption of handheld ultrasound devices for diagnosis and treatment.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.