- Home

- »

- Medical Devices

- »

-

Sports Medicine Market Size, Share & Growth Report, 2030GVR Report cover

![Sports Medicine Market Size, Share & Trends Report]()

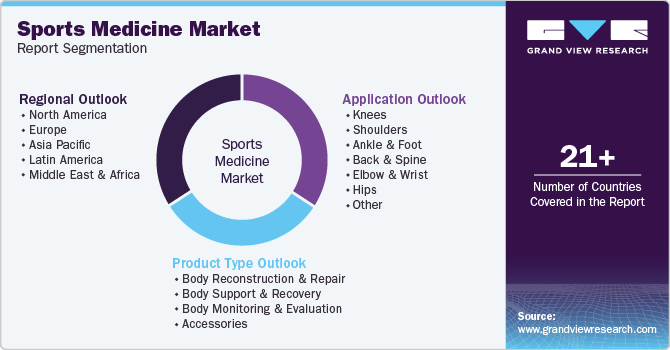

Sports Medicine Market Size, Share & Trends Analysis Report By Product Type (Body Reconstruction & Repair, Body Support & Recovery, Accessories), By Application (Knee, Shoulder, Ankle & Foot), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-050-7

- Number of Report Pages: 140

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Sports Medicine Market Size & Trends

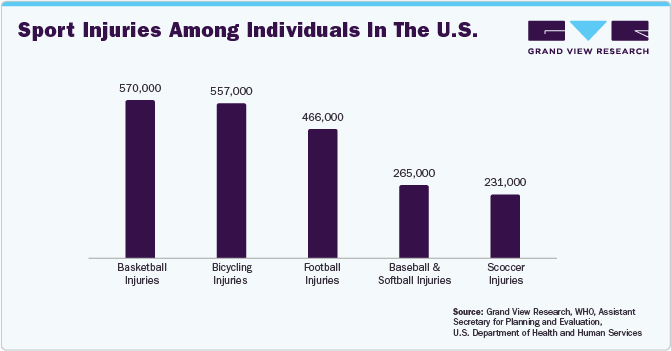

The global sports medicine market size was valued at USD 5.46 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 8.2% from 2024 to 2030. Demand for sports medicine has gained traction in recent years, owing to the rising incidences of sports injuries and growing participation in sports and fitness-related activities by people. In addition, a gradual shift from proactive care to preventive care concerning sports injuries is further projected to drive the market. For instance, according to The Johns Hopkins University, 30 million people participate in some kind of sports, and over 3.5 million injuries are reported annually in the U.S.

Similarly, according to the latest estimates provided by the CDC, in 2020, about 54.1% of children in the age group of 6-17 years participated in sporting activities in the U.S. Furthermore, according to statistics provided by Stanford Medicine Children’s Health, around 3.5 million injuries in the age group of 14 years or less are reported in the U.S. every year. High participation rate of children in sports, coupled with increased injuries, is creating significant demand for sports medicine products.

The COVID-19 pandemic has significantly affected the sports medicine industry with disruption of routine care & supply chains, a decrease in sports activities, increase in financial constraints, rise in the adoption of telemedicine, a shift toward home-based fitness, delays in research & development, and an increased focus on mental health. Lockdowns and restrictions disrupted routine healthcare services, affecting elective procedures.

The closure of sports facilities and restrictions on gatherings led to a decline in sports-related injuries, impacting the demand for sports medicine. Economic uncertainties resulted in financial constraints for individuals and healthcare systems, affecting nonessential healthcare services. The growing adoption of telemedicine and focus on home-based fitness emerged as trends, while supply chain disruptions and delays in research & development posed significant challenges. Despite these challenges, gradual recovery, adaptation to new healthcare norms, and ongoing advancements are shaping the future trajectory of the sports medicine industry.

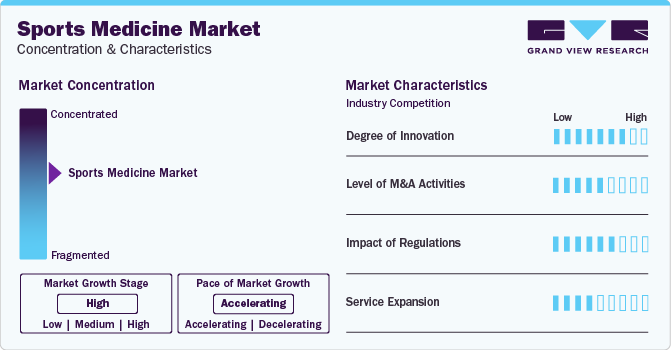

Market Concentration & Characteristics

The global sports medicine market is characterized by significant innovation, continuous development, and introduction of new technologies. It has become a popular option as a minimally invasive procedure that provides lower pain and fatigue. As a result, key market players are investing in innovative technologies to strengthen their market position.

Several market players such as Enovis (DJO, LLC), Performance HealthZimmer Biomet, and DePuy Synthes (Johnson & Johnson) are involved in merger and acquisition activities. Through M&A activity, these companies can expand their geographic reach and enter new territories.

The regulatory process for product approvals in the Asia Pacific region is comparatively less stringent, which has facilitated the easy entry of advanced products and medical devices into market.

Market Dynamics

Moreover, increasing utilization of technologically advanced wearable devices such as fitness bands supports market growth. For instance, a performance-based company in Nova Scotia named Athletigen Technology, Inc. works with various athletes to use the collected or gathered information on their respective DNA to improve their health and performance, thus reducing stances of sports-related injuries. Such initiatives are anticipated to support market growth over the forecast period.

Increasing career opportunities and a growing inclination toward fitness owing to rising health awareness have increased the number of people choosing sports as a hobby or a career. For instance, according to a survey conducted by Safe Kids World on emergency room visits, young athletes globally are admitted to emergency departments over a million times annually for sports-related injuries. Of these, 15% of injuries were related to ankles and 9% to the knees. This, in turn, is expected to rise in market growth.

The need for minimally invasive procedures is increasing due to reduced trauma and faster recovery compared to invasive alternatives. During minimally invasive knee replacement surgeries, fewer muscles & tendons are affected, offering more natural results. Wound closure is easier, and recovery time is shorter than traditional procedures. Growing concern about surgical scars is a major driver of this segment. Lesser blood loss is also an added advantage of these surgeries. For instance, in May 2021, Stryker Corporation installed more than 1,000 Mako surgical robots worldwide and performed more than 500,000 procedures with these surgical robots.

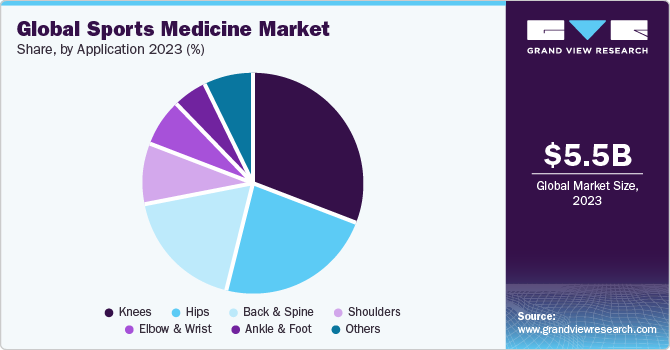

Application Insights

The knee application segment accounted for the largest revenue share in 2023, aided by rising incidences of knee injuries. They are commonly reported during sports or other physical activities, as excessive running and jumping lead to wear and tear of the knee joint. Various advanced treatments include dry needling, soft tissue massage, osteopathic manipulation, platelet-rich plasma therapy, and arthroscopic surgeries for knee repair. Availability of a wide number of treatments and growing incidence of knee injuries are some of the major factors driving the segment’s growth.

Ankle & foot segment is estimated to register the fastest CAGR over the forecast period. This is due to increased participation in sports and physical activities, increasing the likelihood of ankle and foot injuries. Athletes and fitness enthusiasts who engage in high-impact sports and activities, such as basketball, football, and running, are particularly susceptible to ankle and foot injuries.

Furthermore, the market expansion is supported by introducing new products with advanced technologies, such as 3D printing, to produce implants simulating anatomical structures. In addition, key players are contributing to extensive Research and development (R&D) and seeking approval from regulatory bodies for manufacturing safe & effective devices. For instance, in February 2021, Additive Orthopaedics announced the approval of its Patient-Specific Talus Spacer by the U.S. FDA for treating avascular necrosis of the talus.

Regional Insights

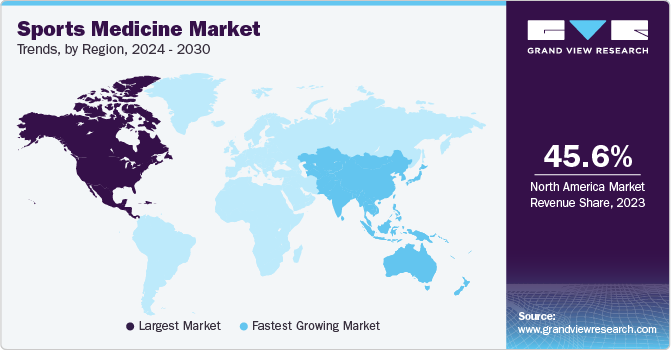

North America dominated the market and accounted for the largest revenue share of 45.6% in 2023. Presence of a well-developed healthcare infrastructure, high spending, and availability of technologically advanced medical devices to treat various orthopedic injuries are some of the major factors driving the market. For instance, in December 2022, Stryker introduced Citrefix, a suture anchor system for foot & ankle surgeries that utilizes the company’s Citregen material, developed to mimic the structure and chemistry of native bone to support natural healing and bone regeneration.

The U.S. accounted for the largest share of the market in North America in 2023. Increasing popularity of sports among youth is a major factor fueling growth of the U.S. sports medicine sector. Moreover, public health advocates and clinicians promote physical activity to maintain health and reduce the risk of obesity and other chronic disorders. As more people are engaged in sports and recreational activities, injuries resulting from these activities are a growing public health concern, further increasing market growth.

Asia Pacific region is expected to grow at the fastest rate during the forecast period. Increasing awareness about benefits of physical activity among the regional population has led to a rise in number of people participating in sports. Owing to this, usage rate of sports medicine in countries such as China, Japan, and South Korea is increasing continuously. Presence of a large population base in the region, coupled with rising incidences of sports-related injuries, has led to a higher demand for sports medicine products and services. Regional governments are investing in developing sports infrastructure and promoting sports activities, further contributing to growth of the market for sports medicine.

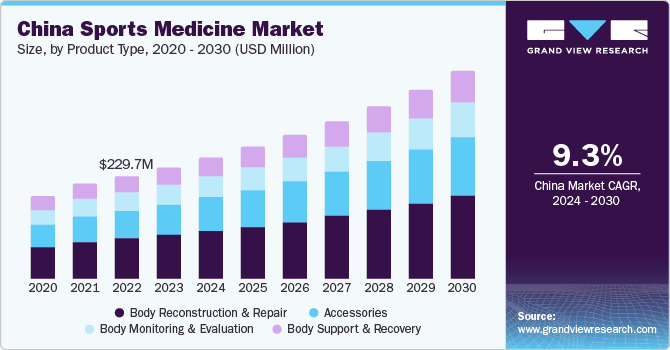

China's sports medicine sector is growing, owing to well-established sports infrastructure and increased awareness about sports & fitness. China has undergone a transformative shift in its public health and sports development approach. Furthermore, the government implemented impactful policies, including the "Healthy China 2030" and Medium- and Long-term Plan for Prevention and Treatment of Chronic Diseases (2017–2025).

Product Type Insights

Based on product type, the body reconstruction and repair segment accounted for the largest revenue share of 39.09% in 2023. The body reconstruction and repair segment includes soft tissue repair equipment, bone reconstruction devices, and surgical equipment. A significant market share is attributed to growing fracture and ligament repair device usage and increasing adoption of arthroscopy devices in minimally invasive surgeries.

Moreover, growing incidence of traumatic injury due to rising number of accidents is expected to drive the growth of the body reconstruction & repair segment. According to the National Center for Health Statistics, around 31 million people in the U.S. require medical treatment due to injuries every year. Of these, around 2 million suffer from severe injuries and require hospitalization.

The accessories segment is anticipated to witness the fastest market growth over the forecast period. This segment includes bandages, tapes, wraps, disinfectants, and other products required for treating minor sports injuries. Growing usage of PRICE (Protection, Rest, Ice, Compression, Elevation) therapy as an immediate treatment for any sports injury is one of the major factors driving this segment's growth.

Key Companies & Market Share Insights

-

Smith+Nephew; Stryker; Arthrex, Inc.; and Enovis (DJO; LLC) are some of the dominant players operating in the market.

-

Smith+Nephew has been listed on the London Stock Exchange since 1937. It distributes its products in more than 100 countries.

-

Stryker offers products & services in medicine, surgery, orthopedics, sports medicine, and neurotechnology. The company has a presence in more than 100 countries.

-

Arthrex, Inc. is a manufacturing firm focusing on product development, especially in orthopedics. The company has expanded its portfolio to more than 8,500 products

Key Sports Medicine Companies:

- Smith+Nephew

- Stryker

- Zimmer Biomet

- Arthrex, Inc.

- Enovis (DJO, LLC)

- DePuy Synthes (Johnson & Johnson)

- CONMED Corporation

- Mueller Sports Medicine, Inc.

- Breg, Inc.

- Performance Health

- Bauerfeind

- Karl Storz SE & Co. KG

Recent Developments

-

In October 2023, Smith+Nephew launched its REGENETEN Bioinductive Implant in Japan, providing a healing option for patients with rotator cuff tears.

-

In August 2023, Smith+Nephew introduced OR3O Dual Mobility System in India for primary and revision hip arthroplasty use.

-

In March 2023, Arthrex, Inc. received U.S. FDA 510(k) clearance for the TightRope Implant. It is used for the surgical treatment of orthopedic injuries and is the only device cleared for pediatric ACL surgery.

-

In January 2023, Enovis (DJO, LLC) launched DynaClip Quattro and DynaClip Delta bone staples. They offer foot and ankle surgeons ease of use & procedural efficiency.

-

In September 2022, Zimmer Biomet received U.S. FDA 510(k) clearance for the Identity Shoulder System for reverse, anatomic, and revision shoulder replacement.

-

In February 2022, DePuy Synthes acquired CrossRoads Extremity Systems, a foot and ankle solution provider. This acquisition helps to drive podiatric, orthopedic, and medtech advancements through internal and external innovation.

Sports Medicine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.87 billion

Revenue forecast in 2030

USD 9.45 billion

Growth rate

CAGR of 8.2% from 2023 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Smith+Nephew; Stryker; Zimmer Biomet; Arthrex, Inc.; Enovis (DJO, LLC); DePuy Synthes (Johnson & Johnson); CONMED Corporation; Mueller Sports; Medicine, Inc.; Breg, Inc.; Performance Health; Bauerfeind; Karl Storz SE & Co. KG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sports Medicine Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sports medicine market report based on product type, application, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Body Reconstruction & Repair

-

Surgical Equipment

-

Soft Tissue Repair

-

Bone Reconstruction Devices

-

-

Body Support & Recovery

-

Braces and Other Support Devices

-

Compression Clothing

-

Hot & Cold Therapy

-

-

Body Monitoring & Evaluation

-

Cardiac

-

Respiratory

-

Hemodynamic

-

Musculoskeletal

-

Others

-

-

Accessories

-

Bandages

-

Tapes

-

Disinfectants

-

Wraps

-

Other

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Knees

-

Shoulders

-

Ankle & Foot

-

Back & Spine

-

Elbow & Wrist

-

Hips

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the sports medicine market growth include increasing demand for sports medicine, owing to the shift towards a healthy lifestyle adopted by the young population, and rising incidences of injuries among athletes and fitness enthusiasts.

b. The global sports medicine market size was estimated at USD 5.46 billion in 2023 and is expected to reach USD 5.87 billion in 2024.

b. The global sports medicine market is expected to grow at a compound annual growth rate of 8.2% from 2024 to 2030 to reach USD 9.45 billion by 2030.

b. Body Reconstruction & Repair segment dominated the sports medicine market with a share in 2023. This is attributable to the growing usage of fracture and ligament repair devices, and the increasing adoption of arthroscopy devices in minimally invasive surgeries.

b. Some key players operating in the sports medicine market include Arthrex, Inc.; Smith and Nephew; Stryker; Zimmer Biomet; Wright Group N.V.; and DJO Global.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."