- Home

- »

- Next Generation Technologies

- »

-

Harmonic Filter Market Size, Share And Growth Report, 2030GVR Report cover

![Harmonic Filter Market Size, Share & Trends Report]()

Harmonic Filter Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Active, Passive, Hybrid), By Phase (Single Phase, Three Phase), By Voltage, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-716-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Harmonic Filter Market Size & Trends

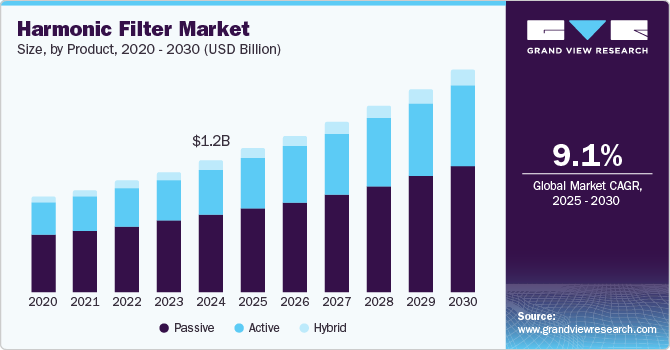

The global harmonic filter market was valued at USD 1.18 billion in 2024 and is projected to grow at a CAGR of 9.1% from 2025 to 2030. The increasing reliability of sensitive electronics equipment in multiple industries is a key growth driver for this market. The growing use of variable frequency drives (VFDs) has increased harmonic distortion and sparked a larger demand for harmonic filters that can mitigate distortions in power systems.

The rapid pace of digital transformation in multiple industries backed by technology advancements and the emergence of artificial intelligence (AI) has led to the rising use of sensitive electronic equipment. This includes CMOS ICs, graphics ICs, laser diodes, plasma TVs, LEDs, high-precision resistors, and others. The dependability of these systems has developed vulnerability for industries and businesses, as any disruptions in power quality may lead entire infrastructure into an inoperative state and major equipment damage. This has created an inevitable need for harmonic filters, which can prevent or lessen the gravity of potential damages that distortions can cause.

Another key factor that has encouraged industries and organizations to invest in advanced harmonic filters proactively is stringent regulations and standards regarding connectivity with the power grids-in addition to increasing awareness regarding the benefits of power quality and uninterrupted operational workflows. A continuous rise in demand for power quality, growing dependency on equipment, increasing automation of industrial processes, and data-driven decision-making backed by the utilization of sensitive electronic devices are expected to generate an upsurge in demand for the harmonic filter market during the forecast period.

Product Insights

Based on product, the passive harmonic filter segment dominated the market and accounted for a revenue share of 58.4% in 2024. Large-scale applications in uninterruptible power supply (UPS) devices, VFDs for motors, transformers, rectifiers, and others are key growth driving factors for this segment. The cost-effectiveness provided by passive harmonic filters, especially when used for fixed-frequency harmonic mitigation, along with its growing industrial applications in medium to high voltage requirements, is expected to develop further growth in demand for this segment. The presence of front-end power supply units and VFDs in the IT industry’s equipment structure is known to draw harmonic currents that require harmonic filters to maintain current distortion and voltage distortion to safer levels.

The active harmonic filter segment is expected to experience the fastest CAGR of 10.0% from 2025 to 2030. This segment is primarily driven by growing semiconductor production and rising use of semiconductor production equipment, increased development of new data centers, rising industrial demand for power quality, and more. The ability of active harmonic filters to provide compensation performance is projected to fuel the growth of this segment in the approaching years.

Phase Insights

The three-phase segment accounted for the largest revenue share of the global harmonic filter market in 2024. The increasing use of sensitive electronic devices has led to increased non-linear load, which has resulted in rising harmonic pollution, which needs mitigation. In addition, an increase in awareness regarding energy efficiency, growing dependency on power quality and electronic devices for attaining operational efficiencies, and advancements in filter technology are developing growth for this segment.

The single-phase harmonic filters segment will experience a significant CAGR from 2025 to 2030. The rising application mainly influences this segment in areas such as residential and commercial buildings, industrial plants, the telecommunication sector, and data centers, as well as in remote or rural areas where three-phase power availability is challenging. An increasing use of density electronic devices, solar inverters, and others is increasing demand for single-phase harmonic filters.

Voltage Insights

Based on voltage, the low voltage segment dominated the global harmonic market in 2024. The rise influences this segment in using sensitive electronic devices, common in industrial sectors such as data centers, manufacturing, and other areas. Low-voltage harmonic filters are equipped with capacities to ensure power quality, uninterrupted operations, and improved energy efficiency. Growth in newer integration of renewable energy projects into existing grids is expected to drive demand for low-voltage harmonic filters.

The medium voltage segment is anticipated to experience substantial growth over the forecast period. Industries that utilize heavy machinery and high-power-consuming equipment, such as manufacturing, mining, chemical processing, gas and petroleum, paper, and others, use this type of harmonic filter. Rising demand from multiple industries and increased dependency on power quality are anticipated to fuel the growth of this segment in the next few years.

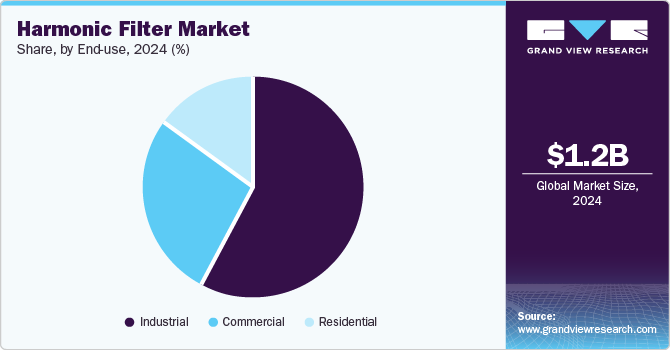

End-use Insights

Based on end use, the industrial segment accounted for the largest revenue share of the global market in 2024. This is attributed to factors such as the rising use of electronic devices in industrial processes, the higher dependency of industrial operations on VFDs and sensitive devices such as computers, CPUs, and others, and the increasing adoption of modern technologies that require the use of advanced electronic equipment for control and remote monitoring. The growing use of non-linear loads, regulatory compliances regarding the installation of harmonic filters, and economic benefits associated with improved energy efficiency and uninterrupted workflows are projected to drive growth for this segment.

The commercial segment is projected to experience the fastest CAGR from 2025 to 2030. This segment is driven by the growing use of electronic devices in offices and sectors such as banking, financial services, healthcare, and others. The presence of inverters, electronically commutated (EC) motors, LEDs, electronic ballasts, and voltage stabilizers in commercial systems draws harmonic current, which is expected to generate an upsurge in demand for harmonic filters in the approaching years.

Regional Insights

North America harmonic filter market accounted for a significant revenue share of global industry in 2024. A large number of data centers in the region, increasing application in industrial facilities, rapid rate of digital transformations in multiple sectors, and growing global footprint of businesses resulting in rising dependability on advanced technologies and power quality are some of the key growth driving factors for this regional market. The presence of a robust IT and telecom industry in the region and the growing adoption of technologies such as the internet of things (IoT) or Artificial Intelligence (AI), resulting in the increasing use of sensitive electronic equipment, is projected to generate demand for the harmonic filter market in North America during the forecast period.

U.S. Harmonic Filter Market Trends

The U.S. harmonic filter market held the largest revenue share of the regional industry and accounted for 75.6% in 2024. This market is primarily driven by factors such as the robust IT & telecom industry operating in the country, a large number of data centers, and higher adoption of modern technologies leading to the rising use of sensitive electronic devices and growth in demand for effective solutions on harmonic pollution. The increasing use of technology-driven electronic devices, including home appliances, smartphones, computers, and others in residential and commercial applications, is expected to fuel the growth of this market in the approaching years.

Europe Harmonic Filter Market Trends

Europe harmonic filter market was identified as a lucrative region for the global harmonic filter market in 2024. The increase in renewable energy initiatives by governments across various regions fuels the market growth. For instance, the European Climate Law aims to make the EU climate neutral by 2050. The financial support from the government is boosting the implementation program of these initiatives. Installation of new systems and equipment in existing power grids is expected to drive demand for this regional industry.

The UK harmonic filters market is projected to experience significant growth during the forecast period. This is attributed to factors such as the rise in demand for passive harmonic filters, the rapid pace of digital transformation in the country, growing government support in shaping the digital future of the UK, and the growth in the use of sensitive electronic devices triggered by all these activities.

Asia Pacific Harmonic Filter Market Trends

Asia Pacific harmonic filter market is projected to grow at the fastest CAGR of 9.6% from 2025 to 2030. This market is primarily driven by factors such as the presence of large enterprises in the IT and IT services industry, increasing adoption of electronic devices in the region, especially by economies such as China and India, rising use of harmonic filters in industrial applications, and growing stringency of regulations regarding installation of harmonic filters for ensuring power quality. Proactive efforts of government authorities in India and China to enhance digital ecosystems and increase the efficiency of digitally backed infrastructures are expected to fuel demand for harmonic filters in the region.

The China harmonic filter market held a significant revenue share of the regional industry in 2024. This market's growth is mainly influenced by factors such as the increasing adoption of sensitive electronic devices such as plasma TVs, computers, and others for commercial and residential use, the robust manufacturing industry, and the unceasing growth in urbanization.

Key Harmonic Filter Company Insights

Some of the key companies in the harmonic filter market include ABB, Siemens, Emerson Electric Co, Eaton, Schneider Electric, and others. To address growing competition, the companies are adopting strategies such as enhanced portfolios, collaborations and partnerships with other organizations, and innovation.

-

Eaton, a diversified power management company, operates in various segments, including electrical products, electrical systems and services, aerospace, automotive, and eMobility. Its portfolio features Eaton DX passive harmonic filters and more.

-

Siemens is a technology company specializing in industry, infrastructure, digital transformation, transportation, and electrical power generation and transmission. It offers almost everything in the energy value chain, from oil and gas extraction to power generation and transmission.

Key Harmonic Filter Companies:

The following are the leading companies in the harmonic filter market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Schneider Electric

- Siemens

- Emerson Electric Co

- Danfoss A/S

- Schaffner Holding AG

- TDK Corporation

- Eaton

- Comsys AB

- MTE Corporation

- Baron Power

Recent Developments

-

In January 2023, Danfoss A/S launched efficient harmonic mitigation that reduces filter power loss by 60%. It provides harmonic mitigation, imbalance compensation, and power factor correction. This compiles with the latest regulating standards. It detects harmonic distortion within the system and introduces an opposing current to eliminate the electrical noise.

Harmonic Filter Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.28 billion

Revenue forecast in 2030

USD 1.98 billion

Growth rate

CAGR of 9.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, phase, voltage, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia

Key companies profiled

ABB; Schneider Electric; Siemens; Emerson Electric Co; Danfoss A/S; Schaffner Holding AG; TDK Corporation; Eaton; Comsys AB; MTE Corporation; Baron Power

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Harmonic Filter Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the harmonic filter market report based on product, phase, voltage, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Active

-

Passive

-

Hybrid

-

-

Phase Outlook (Revenue, USD Million, 2018 - 2030)

-

Single Phase

-

Three Phase

-

-

Voltage Outlook (Revenue, USD Million, 2018 - 2030)

-

Low Voltage

-

Medium Voltage

-

High Voltage

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Commercial

-

Residential

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

- Australia

-

-

Latin America

-

MEA

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.