- Home

- »

- Advanced Interior Materials

- »

-

Hazardous Waste Management Market Size Report, 2030GVR Report cover

![Hazardous Waste Management Market Size, Share & Trends Report]()

Hazardous Waste Management Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Solid, Liquid, Sludge), By Treatment (Physical, Chemical, Thermal, Biological), By Disposal Method, By Source, By Chemical Composition, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-531-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Hazardous Waste Management Market Summary

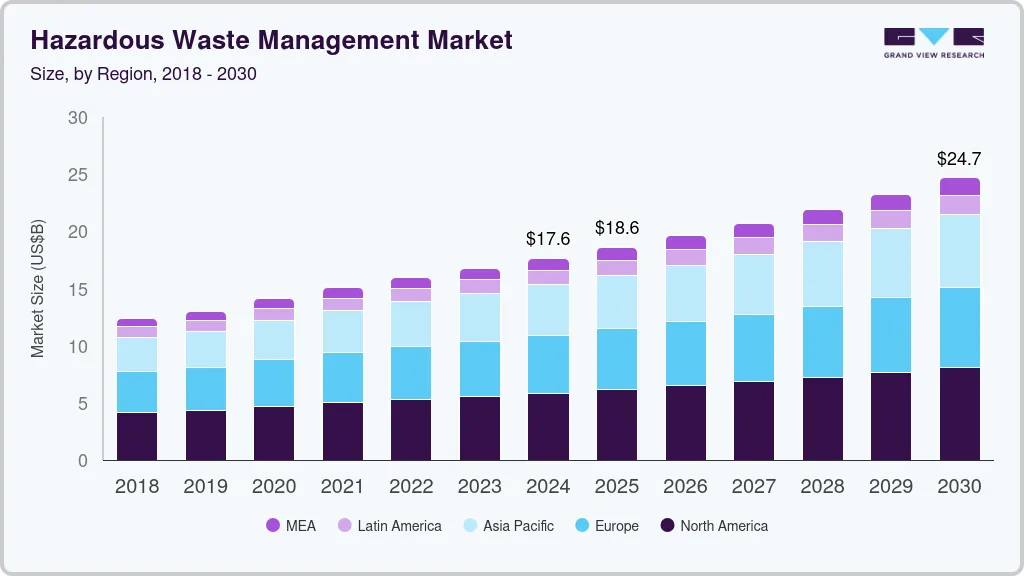

The global hazardous waste management market size was estimated at USD 17,637.7 million in 2024 and is projected to reach USD 24,677.6 million by 2030, growing at a CAGR of 5.8% from 2025 to 2030. The global hazardous waste management market is growing due to increasing industrialization, rising environmental concerns, and stringent government regulations on waste disposal and environmental protection.

Key Market Trends & Insights

- The market in North America dominated in terms of global revenue share in 2024.accounting for 33.1% of the market share.

- The market in the U.S. is projected to expand at a CAGR of 5.5% over the forecast period.

- By type, the solid segment dominated the market in 2024 by accounting for a share of 53.2%.

- By disposal method, the detonation segment dominated the market in 2024 by accounting for a share of 32.8%.

- By source, the industrial segment dominated the market in 2024 by accounting for a share of 46.1%.

Market Size & Forecast

- 2024 Market Size: USD 17,637.7 Million

- 2030 Projected Market Size: USD 24,677.6 Million

- CAGR (2025-2030): 5.8%

- North America: Largest market in 2024

In addition, growing awareness about the environmental impact of hazardous waste, the push by associations and governments across the globe for the adoption of recycling and waste-to-energy technologies are further driving market growth.

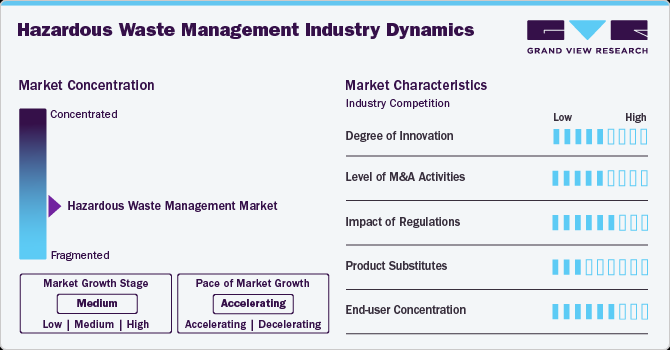

Market Concentration & Characteristics

The global hazardous waste management market is moderately fragmented, with a mix of large multinational companies and regional players competing for market share. Leading players are focusing on the development of innovative and sustainable waste management solutions to cater to the increasing demand from industries such as chemicals, pharmaceuticals, manufacturing, and healthcare. The market is witnessing growth as companies prioritize safe and environmentally friendly disposal and recycling methods in response to stricter regulations and increasing public awareness of environmental issues. Manufacturers are also investing in advanced technologies such as waste-to-energy and automated waste tracking systems to enhance efficiency and reduce costs.

Regulatory pressures from governments and environmental agencies such as the EPA and the EU are playing a significant role in shaping the market. These organizations are imposing stricter guidelines on waste disposal, recycling, and emissions, pushing industries to adopt more sustainable practices. Compliance with these regulations is crucial for market players to remain competitive, as businesses aim to meet sustainability goals and minimize their environmental footprints. As a result, the demand for hazardous waste management services is growing, with a particular focus on advanced treatment and safe disposal methods.

To maintain their competitive edge, key players in the hazardous waste management market are focusing on strategic mergers and acquisitions, technological advancements, and expanding their global reach. Companies are leveraging innovations in waste treatment technologies, including thermal, chemical, and biological methods, to provide more efficient and eco-friendly solutions. In addition, as the market shifts towards sustainability, companies are investing in greener solutions, such as waste recycling and waste-to-energy, to capture the growing demand for environmentally responsible waste management services.

Drivers, Opportunities & Restraints

As industries such as manufacturing, chemicals, and pharmaceuticals expand, the need for effective and safe waste management systems is becoming more critical. Governments worldwide are implementing stricter environmental laws, demanding companies to adopt sustainable waste management practices.

The hazardous waste management market faces challenges such as high operational and compliance costs, which can be particularly burdensome for smaller businesses. In addition, the complexity of managing hazardous waste, along with the lack of infrastructure in some regions, can slow the market’s growth.

The market presents opportunities through the development of advanced waste management technologies, including automation and digital monitoring systems, which can improve efficiency and reduce costs. As governments continue to impose stricter environmental regulations, there is significant potential for growth in waste treatment and recycling services.

Type Insights

The solid segment dominated the market in 2024 by accounting for a share of 53.2% due to rising industrial activities and urbanization, generating large volumes of solid hazardous waste. The growing need for safe disposal methods and recycling to reduce environmental impact is driving the market. In addition, governments and organizations are putting more emphasis on sustainable waste management practices, creating more opportunities for the development of innovative solutions.

The growth of the sludge management market is driven by increasing industrial waste generation, particularly in sectors like wastewater treatment, food processing, and pharmaceuticals. The rising need for proper sludge treatment and disposal to prevent environmental contamination is boosting demand. Advances in sludge treatment technologies, including dewatering and stabilization processes, are also enhancing the efficiency and safety of disposal methods.

Disposal Method Insights

The detonation segment dominated the market in 2024 by accounting for a share of 32.8% due to its ability to contain contaminants safely underground. This method is being driven by regulations that require secure and environmentally safe disposal practices. In addition, deep well injection allows industries to manage large volumes of hazardous liquid waste, which further contributes to its popularity as an efficient waste disposal option.

Engineered storage solutions are becoming more popular as industries look for controlled environments for hazardous waste storage. Stringent environmental regulations requiring safe and long-term containment of hazardous waste are driving this segment’s growth. Furthermore, advancements in materials and storage technologies are making engineered storage more secure and effective, ensuring that waste is safely contained for the required duration without posing a risk to the environment.

Source Insights

The Industrial segment dominated the market in 2024 by accounting for a share of 46.1%, as industrial processes generate large amounts of hazardous waste. Increasing industrial production and the need for compliance with environmental laws are fueling the demand for waste management solutions. In addition, industries are increasingly adopting green and sustainable practices, pushing for innovative waste treatment and recycling solutions to minimize their environmental impact.

The healthcare sector is driving demand for hazardous waste management due to the rising volume of medical waste generated from hospitals, clinics, and pharmaceutical production. Strict regulations on the safe disposal of biomedical waste are propelling market growth. Moreover, as the healthcare industry grows and new medical technologies emerge, the need for safe, compliant waste management solutions becomes even more critical to ensure public health and environmental protection.

Chemical Composition Insights

The organic segment dominated the market in 2024 by accounting for a share of 75.1% driven by the growing use of hazardous chemicals in industries such as pharmaceuticals, agriculture, and manufacturing. The need for safe disposal and recycling of organic chemicals is boosting market demand. Furthermore, the increasing public and regulatory focus on reducing the environmental impact of chemical pollutants is further propelling the demand for effective waste management solutions.

The need for managing inorganic chemical waste, particularly from industries such as mining, manufacturing, and electronics, is growing due to environmental regulations aimed at minimizing pollution and ensuring safe disposal practices. As inorganic chemicals can be highly toxic and harmful to ecosystems, there is an increasing demand for advanced treatment and disposal technologies that can safely handle and neutralize these substances.

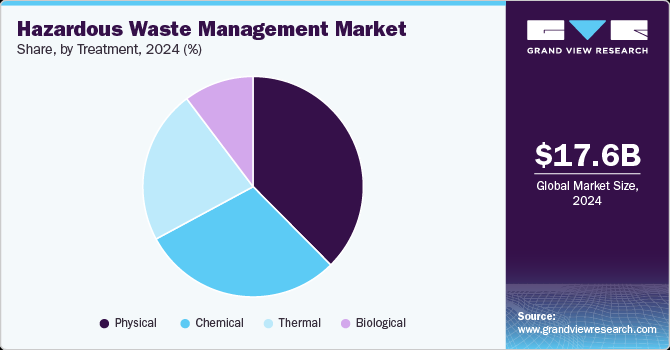

Treatment Insights

The physical segment dominated the market in 2024 by accounting for a share of 37.6% due to their effectiveness in removing contaminants and the increasing need for cost-effective and efficient hazardous waste management technologies. This method is particularly popular in industries where high levels of physical separation are required. In addition, the growing demand for energy-efficient and low-cost solutions in hazardous waste management is further propelling the adoption of physical treatment technologies.

Thermal treatment methods such as incineration are in demand because of their ability to effectively reduce the volume of hazardous waste and destroy harmful components. This method is gaining popularity due to the growing need for efficient waste disposal and compliance with environmental regulations. As industries face increasing pressure to minimize waste volume and improve disposal practices, thermal treatment provides an effective solution, especially for organic and high-hazard materials.

Regional Insights

The market in North America dominated in terms of global revenue share in 2024.accounting for 33.1% of the market share. Market growth in the region is driven by increasing industrialization, energy efficiency regulations, and a growing demand for sustainable solutions in industries such as Organic, Inorganic, and HVAC. Strong investments in renewable energy and infrastructure modernization further contribute to market expansion.

U.S. Hazardous Waste Management Market Trends

The market in the U.S. is projected to expand at a CAGR of 5.5% over the forecast period due to stringent regulations from the EPA and increasing industrial waste from sectors such as manufacturing, pharmaceuticals, and chemicals. In addition, there is a growing focus on sustainable waste disposal methods, including recycling and waste-to-energy technologies.

Europe Hazardous Waste Management Market Trends

Europe’s hazardous waste management market is largely driven by strict EU regulations on waste disposal, recycling, and emissions reduction. Countries in the region are heavily investing in advanced recycling, waste-to-energy technologies, and the circular economy, which creates significant demand for hazardous waste management services.

The industry in Germany is expected to grow at a rapid CAGR of 5.8% over the forecast period driven by the country’s strong environmental regulations and commitment to sustainability. With a focus on recycling, waste-to-energy solutions, and eco-friendly disposal methods, the market is expanding as industries comply with EU waste management directives and circular economy principles.

The country’s market in UK is expected to grow at a rapid CAGR of 5.8% over the forecast period due to robust environmental policies and waste management regulations. The government’s commitment to reducing landfill waste and promoting recycling initiatives, along with increasing industrialization, is driving demand for hazardous waste management services across sectors such as chemicals and manufacturing.

Asia Pacific Hazardous Waste Management Market Trends

The Asia Pacific region is witnessing rapid industrialization, leading to a substantial increase in hazardous waste generation. In addition, the growing adoption of environmental sustainability measures and government-imposed waste management regulations are pushing industries to adopt efficient waste disposal and recycling systems. China and India, in particular, are seeing significant demand for hazardous waste management solutions.

The market in China is projected to grow at a CAGR of 6.8% over the forecast period due to industrialization, increasing hazardous waste generation, and stringent environmental regulations. The Chinese government is placing a strong emphasis on waste disposal and recycling to combat pollution, which is boosting demand for effective hazardous waste management solutions.

The market in India is projected to grow at a CAGR of 7.0% over the forecast period driven by rapid industrial growth and the implementation of more rigorous environmental regulations. Sectors like chemicals, textiles, and electronics are generating increasing amounts of hazardous waste, creating a demand for efficient disposal, treatment, and recycling solutions.

Middle East & Africa Hazardous Waste Management Market Trends

In the Middle East and Africa, the market’s growth is driven by industrial growth in oil, gas, and chemical sectors. Stricter environmental regulations, along with efforts to diversify economies and adopt sustainable practices, are pushing for more efficient waste management solutions. The growing awareness of environmental impact is also contributing to the market’s expansion.

The market in Saudi Arabia is projected to grow at a CAGR of 6.8% over the forecast period. Saudi Arabia’s hazardous waste management market is expanding due to the country’s focus on diversifying its economy and increasing industrial activity, particularly in oil, gas, and petrochemicals. The government’s stricter environmental regulations are pushing for more efficient and sustainable waste management practices

Latin America Hazardous Waste Management Market Trends

In Latin America, the hazardous waste management market is growing as industrial activity increases, especially in sectors such as oil and gas, mining, and chemicals. Governments are increasingly enforcing regulations related to waste disposal, and there is a rising focus on sustainable development, which is boosting the demand for waste management services.

The market in Argentina is projected to grow at a CAGR of 5.8% over the forecast period. In Argentina, the hazardous waste management market is being driven by industrial expansion, especially in sectors such as oil and gas, chemicals, and mining. Government regulations focused on environmental protection are encouraging industries to adopt more sustainable waste management practices.

Key Hazardous Waste Management Company Insights

Some of the key players operating in the market include Bechtel Corporation. and Veolia Environment SA among others.

-

Veolia is a global company engaged in designs and of solutions for water, waste and energy management. With a presence in over 40 countries, the company has a strong position in the market and an excellent product portfolio. The company’s waste management operations offer provides solutions for recycling, treatment, and recovery of waste materials among other solutions.

-

Bechtel Corporation is a prominent global engineering, procurement, construction, and project management company known for delivering large-scale construction projects across various sectors. The company has built a strong reputation in the market for its expertise in infrastructure development, waste management solutions, power plants, mining operations, and water treatment facilities.

Key Hazardous Waste Management Companies:

The following are the leading companies in the hazardous waste management market. These companies collectively hold the largest market share and dictate industry trends.

- Avalon Holdings Corp.

- Averda

- Bechtel Corp.

- Chloros Environmental Ltd.

- Clean Harbors Inc.

- Daniels Health

- ENVIRON INDIA

- GreenTech Environ Management Pvt. Ltd.

- Grupo Tradebe Medioambiente SL

- Morgan Industries Ltd.

- Recology Inc.

- REMONDIS Medison GmbH

- Republic Services Inc.

- Seche Environnement SA

- Sharps Compliance Corp.

- SMS Envocare Ltd.

- Veolia Environment SA

- Waste Connections Inc.

- Waste Management Inc.

Recent Developments

-

In March 2024, Jereh Group showcased introduced GreenWell, a distributed hazardous waste treatment equipment that offers enabling wastewater recycling, on-site treatment, reducing waste, and boosting processing efficiency. Additionally, the company introduced Jereh Apollo Turbine Fracturing Equipment, which features an integrated design and a strong 5000 HP plunger pump.

-

In November 2024, CVC DIF announced buying a major share (49.9%) of ECO, a prominent hazardous waste management company in the country. This deal gives CVC DIF its first foothold in the Asian market. ECO will benefit from the partnership with CVC DIF and Séché Environnement (who remains the majority owner), bringing financial and strategic expertise to expand its operations in Southeast Asia.

Hazardous Waste Management Market Report Scope

Report Attribute

Details

Market size in 2025

USD 18.6 billion

Revenue forecast in 2030

USD 24.7 billion

Growth rate

CAGR of 5.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, & CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Type, treatment, disposal methods, source, chemical composition, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; India; Japan; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Avalon Holdings Corp.; Averda; Bechtel Corp.; Chloros Environmental Ltd.; Clean Harbors Inc.; Daniels Health; ENVIRON INDIA; GreenTech Environ Management Pvt. Ltd.; Grupo Tradebe Medioambiente SL; Morgan Industries Ltd.; Recology Inc.; REMONDIS Medison GmbH; Republic Services Inc.; Seche Environnement SA; Sharps Compliance Corp.; SMS Envocare Ltd.; Veolia Environment SA; Waste Connections Inc.; Waste Management Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hazardous Waste Management Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global hazardous waste management market report on basis of type, treatment, disposal methods, source, chemical composition, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solid

-

Liquid

-

Sludge

-

-

Treatment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Physical

-

Chemical

-

Thermal

-

Biological

-

-

Disposal Methods Outlook (Revenue, USD Billion, 2018 - 2030)

-

Deep Well Injection

-

Detonation

-

Engineered Storage

-

Land Burial

-

Ocean Dumping

-

Incineration

-

-

Source Outlook (Revenue, USD Billion, 2018 - 2030)

-

Industrial

-

Commercial

-

Municipal

-

Healthcare

-

Agricultural

-

-

Chemical Composition Outlook (Revenue, USD Billion, 2018 - 2030)

-

Organic

-

Inorganic

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global hazardous waste management market size was estimated at USD 17.6 billion in 2024 and is expected to reach USD 18.6 billion in 2025.

b. The global hazardous waste management market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.8% from 2025 to 2030 to reach USD 24.7 billion by 2030.

b. The market in North America dominated the global revenue share in 2024 accounting for 33.1% of the global revenue share due to stringent environmental regulations and increased industrial waste generation across sectors like manufacturing, chemicals, and healthcare.

b. Some of the key players operating in the market are Avalon Holdings Corp., Averda, Bechtel Corp., Chloros Environmental Ltd., Clean Harbors Inc., Daniels Health, ENVIRON INDIA, GreenTech Environ Management Pvt. Ltd., Grupo Tradebe Medioambiente SL, Morgan Industries Ltd., Recology Inc., REMONDIS Medison GmbH, Republic Services Inc., Seche Environnement SA, Sharps Compliance Corp., SMS Envocare Ltd., Veolia Environment SA, Waste Connections Inc., and Waste Management Inc.

b. The hazardous waste management market is driven by stricter environmental regulations, increasing industrial activities, and the rising need for sustainable waste disposal and recycling solutions. Growing public awareness about environmental impact and safety concerns also contributes to the demand for effective hazardous waste management practices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.