- Home

- »

- Medical Devices

- »

-

Healthcare 3D Printing Market Size And Share Report, 2030GVR Report cover

![Healthcare 3D Printing Market Size, Share & Trends Report]()

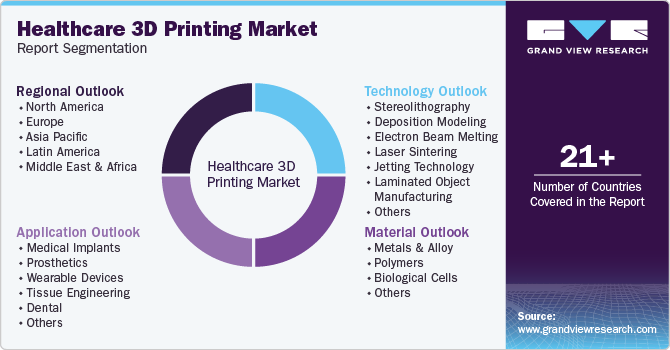

Healthcare 3D Printing Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Medical Implants, Prosthetics), By Technology (Stereolithography), By Material (Metal, Polymer), By Region, And Segment Forecasts

- Report ID: 978-1-68038-088-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Healthcare 3D Printing Market Summary

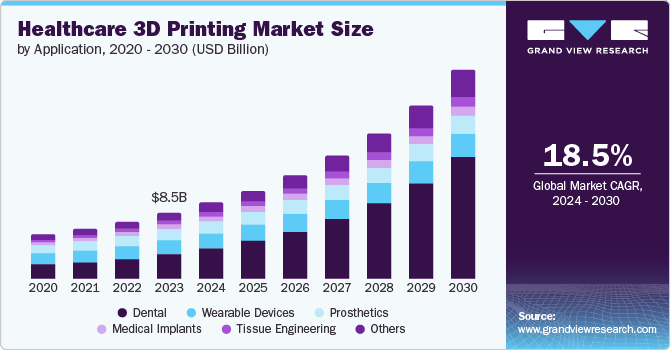

The global healthcare 3D printing market size was valued at USD 8.52 billion in 2023 and is projected to reach USD 27.29 billion by 2030, growing at a CAGR of 18.5% from 2024 to 2030. This growth is attributed to technological advancements, increasing medical applications, and the trend toward customized 3D printing.

Key Market Trends & Insights

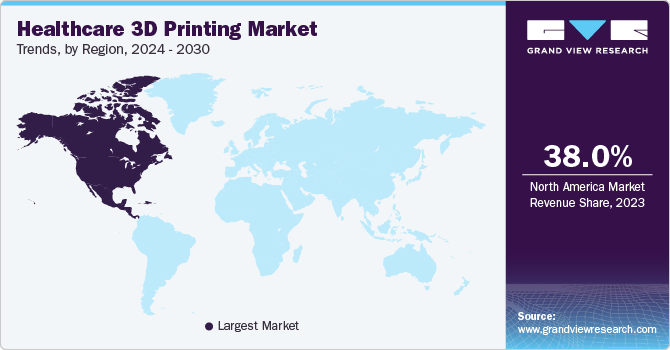

- North America healthcare 3D printing market dominated the global market and accounted for the largest revenue share of 38.0% in 2023.

- The healthcare 3D printing market in the U.S. dominated the North American market with the largest revenue share of 86.5% in 2023.

- By application, the dental application segment dominated the market and accounted for a revenue share of 36.7% in 2023.

- By technology, laser sintering technology led the market and accounted for the largest revenue share of 30.1% in 2023.

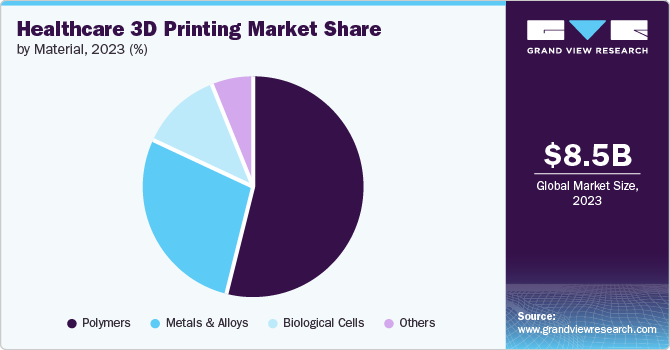

- By material, polymers dominated the market with a share of 54.6% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 8.52 billion

- 2030 Projected Market Size: USD 27.29 billion

- CAGR (2024-2030): 18.5%

- North American: Largest market in 2023

In addition, factors such as public-private funding, growing demand for patient-specific implants, and high production accuracy are also contributing to its growth. Furthermore, the rising adoption of 3D printing in North America and strategic initiatives by key players are propelling the market forward.

3D printing, or additive manufacturing, involves constructing a three-dimensional item by layering raw materials on top of each other until the final product is formed. Advanced 3D printing technologies in the healthcare sector offer the potential for enhanced patient outcomes, shorter surgical procedures, and the innovation of new medical tools. Apart from current applications of 3D printing in healthcare, high-level innovation is expected to be enhanced and modest in the upcoming year. Moreover, 3D printing is also used by orthopedic surgeons to plan surgeries. Those clinicians have found that it reduces surgical time and fluoroscopy use; it also deals with creating prosthetic molds, including those for ears and arms and spacers for growing children.

Further, the advantage of 3D printing in the healthcare sector is that it decreases operating room duration due to the availability of 3D-printed anatomical models and surgical guides. These tools enable surgeons to familiarize themselves with the patient's anatomy before surgery, resulting in shorter times. This helps hospitals save money and minimizes the chances of complications for the patient.

Application Insights

The dental application segment dominated the market and accounted for a revenue share of 36.7% in 2023. This growth is driven by the increased utilization of 3D printing in dentistry, which enhances the design of personalized dental prosthetics and revolutionizes traditional manufacturing methods. The advantage of 3D printing is that it has excellent potential for prosthetics, as doctors can prepare, scan, and print patients' teeth in a session in clinically relevant scenarios, saving energy, time, and money.

Tissue engineering is expected to grow at a CAGR of 15.0% over the projected years. The ability of 3D printing to create customized scaffolds that closely match the shape and structure of damaged tissues. This allows for the accurate engineering of scaffolds with the optimal porosity, pore structure, and biomaterial composition to support cell growth and tissue regeneration. Furthermore, the integration of growth factors into 3D-printed scaffolds has further enhanced cellular activities and tissue repair. The rising demand for personalized medical solutions and the trend toward regenerative medicine also propel the adoption of 3D printing in tissue engineering applications.

Technology Insights

Laser sintering technology led the market and accounted for the largest revenue share of 30.1% in 2023. Laser sintering allows for creating highly customized and precisely-engineered medical devices and implants. The layer-by-layer fabrication process enables the production of complex geometries that closely match patient anatomy. In addition, this technology can utilize a range of biocompatible materials such as titanium alloys, cobalt-chromium alloys, and polymers such as polyetheretherketone (PEEK). This allows for fabricating implants and prosthetics that are well-suited for medical applications.

Deposition modeling is expected to grow at a CAGR of 20.8% over the forecast years. This technology enables the melting of extruded drug-loaded filaments to create various dosage forms, providing the flexibility to produce personalized medicine with unique shapes, diverse, active pharmaceutical ingredients, and controlled drug release rates. In addition, deposition modeling technology in automating the 3D printing process has significantly increased the precision of drug product manufacturing, enhancing safety measures.

Material Insights

Polymers dominated the market with a share of 54.6% in 2023, owing to their ability to create minimally invasive devices. In addition, polymers offer vital characteristics such as flexibility, biocompatibility, and precise engineering in healthcare to ensure optimal functionality and performance. Furthermore, they allow for faster product development, the creation of unique final-use components, and the customization of medical devices that would be difficult to execute.

Biological cells are expected to grow at a CAGR of 20.3% over the forecast years. This growth is attributed to the ability to create complex tissue structures, incorporate growth factors for enhanced cellular activities, and use biocompatible materials that support cell growth and tissue regeneration. Furthermore, advancements in 3D printing technology enable precise spatial control and dosage control of growth factors, minimizing complications and enhancing therapeutic effects.

Regional Insights

North America healthcare 3D printing market dominated the global market and accounted for the largest revenue share of 38.0% in 2023. This growth is driven by increasing demand for customized additive manufacturing, rising medical applications, and new patent expirations. In addition, the widespread use of 3D printing during the COVID-19 pandemic to produce critical medical devices has also fueled adoption. Furthermore, the ability of 3D printing to create accurate anatomical models to assist surgeons is driving demand from healthcare providers.

U. S. Healthcare 3D Printing Market Trends

The healthcare 3D printing market in the U.S. dominated the North American market with the largest revenue share of 86.5%. It is a center for technological innovation, nurturing the enhancement and implementation of 3D printing in the healthcare industry. The country’s innovative healthcare facilities and research organizations that dynamically employ 3D printing for patient-specific models, surgical planning, and medical device creation lead to an exponentially growing market.

Asia Pacific Healthcare 3D Printing Market Trends

The Asia Pacific healthcare 3D printing marketis expected to grow exponentially with a CAGR of 19.8% over the forecast period. This growth is attributed to the increasing demand for customized 3D printed medical devices and instruments, the rising adoption of precision medicine, and patent expirations that enable more competition, propelling the market's growth. The COVID-19 pandemic also positively impacted the market, as 3D printing was extensively used to produce critical medical supplies locally. However, the high cost of additive manufacturing and lack of skilled professionals remain challenges hindering more widespread adoption in the region.

The healthcare 3D printing market in Japan dominated the market and accounted for the largest revenue share of 30.1% in 2023. This growth is attributed to continuous innovation and growth in 3D printing applications in the medical and pharmaceutical sectors, which are driven by ongoing investment in research and development activities in the country.

Thailand healthcare 3D printing market is expected to grow with a significant CAGR of 22.1% over the forecasted years. In addition, the adoption of 3D printing for personalized healthcare solutions, customized implants, prosthetics, and medical models is on the rise, along with the increasing use of 3D printing methodologies for surgeries, therapies, and producing prosthetics for patients nationwide.

Europe Healthcare 3D Printing Market Trends

The healthcare 3D printing market in Europe is expected to grow significantly due to improved infrastructure and reimbursement policies. Several factors that are expected to contribute to the market growth in the future are increasing its applications in the healthcare industry and accessibility of enhanced latest 3D printing equipment for dental, surgery, and cosmetics, boosting the demand.

Germany healthcare 3D printing market led the European market with a commanding share of 25.7% in 2023. The market offers ample opportunities to invest in 3D printing's proficiencies for customization. Moreover, the environment is favorable for investors to explore the potential of biocompatible materials designed for the 3D printing of tissues, implants, and scaffolds.

Key Healthcare 3D Printing Company Insights

Some of the key companies in the healthcare 3D printing market include 3D Systems, Inc., ENVISIONTEC US LLC, regenHU, Allevi, Inc., EOS GmbH, Materialise, Stratasys, Nanoscribe GmbH & Co. KG, and Fathom Manufacturing. These companies focus on development and gaining a competitive edge in the industry. Therefore, key players are taking several strategic initiatives.

-

ENVISIONTEC US LLC offers a wide range of 3D printing systems with proficiency in mass production of polymer parts, speed, and quality as required for demanding end-use applications.

-

Fathom Manufacturing offers CNC machining, plastic and metal additive technologies, injection molding and tooling, sheet metal fabrication, and innovative engineering solutions worldwide.

Key Healthcare 3D Printing Companies:

The following are the leading companies in the healthcare 3D printing market. These companies collectively hold the largest market share and dictate industry trends.

- 3D Systems, Inc.

- ENVISIONTEC US LLC

- regenHU

- Allevi, Inc.

- EOS GmbH

- Materialise

- Stratasys

- Nanoscribe GmbH & Co. KG

- Fathom Manufacturing

- 3T Additive Manufacturing Ltd.

Recent Developments

-

In April 2024, Fathom Manufacturing acquired GPI Prototype & Manufacturing Services, a prominent metal additive manufacturing services provider. The combined entity, operating under the Fathom brand, is the largest privately held digital manufacturing company in the United States. The acquisition expands Fathom's metal additive manufacturing capabilities, including Direct Metal Laser Sintering (DMLS) and CNC machining, enabling it to serve a broader range of customers across medical, aerospace, defense, and industrial industries.

-

In March 2024, EOS GmbH, an industrial 3D printing company, added a new machine to its EOS M 290 segment, the EOS M 290 1Kw. Designed considering serial production, the new Laser Powder Bed Fusion (LPBF) metal additive manufacturing (AM) platform meets the specific requirements of copper and copper alloys, which are often critical to processing for applications such as heat exchangers and inductors.

Healthcare 3D Printing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.86 billion

Revenue forecast in 2030

USD 27.29 billion

Growth rate

CAGR of 18.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, technology, material, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

3D Systems, Inc.; ENVISIONTEC US LLC; regenHU; Allevi, Inc.; EOS GmbH; Materialise; Stratasys; Nanoscribe GmbH & Co. KG; Fathom Manufacturing; 3T Additive Manufacturing Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Healthcare 3D Printing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global healthcare 3D printing market report based on Application, technology, material, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Implants

-

Prosthetics

-

Wearable Devices

-

Tissue Engineering

-

Dental

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Stereolithography

-

Deposition Modeling

-

Electron Beam Melting

-

Laser Sintering

-

Jetting Technology

-

Laminated Object Manufacturing

-

Others

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Metals and Alloys

-

Steel

-

Titanium

-

Others

-

-

Polymers

-

Nylon

-

Glass-filled Polyamide

-

Epoxy Resins

-

Photopolymers

-

Plastics

-

Biological Cells

-

Others

-

-

Biological Cells

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U. S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.