- Home

- »

- Healthcare IT

- »

-

Healthcare Cloud Computing Market Size Report, 2030GVR Report cover

![Healthcare Cloud Computing Market Size, Share & Trends Report]()

Healthcare Cloud Computing Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Clinical Information Systems, Non-clinical Information Systems), By Deployment, By Pricing Model, By Service Model, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-361-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Healthcare Cloud Computing Market Summary

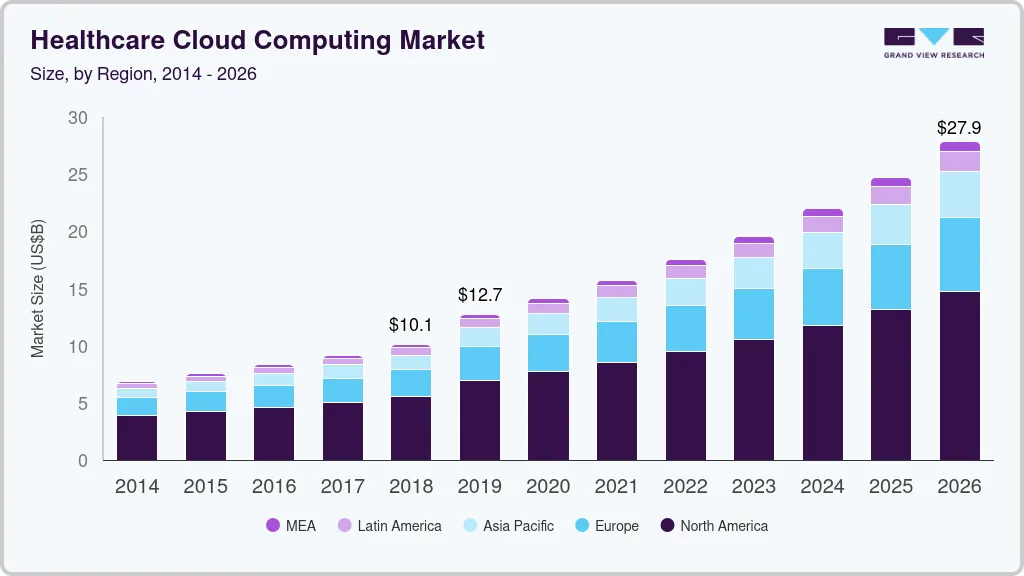

The global healthcare cloud computing market size was valued at USD 19.6 billion in 2023 and is projected to reach USD 45.1 billion by 2030, growing at a CAGR of 12.7% from 2024 to 2030. The rise in the prevalence of chronic diseases and the geriatric population demands an integrated information system, which acts as a significant contributing factor for the healthcare cloud computing market to grow.

Key Market Trends & Insights

- North America healthcare cloud computing market dominated the global industry in 2023.

- The U.S. healthcare cloud computing market dominated the global market with a share of 44.1% in 2023.

- Based on type, the nonclinical information systems accounted for a market share of 50.7% in 2023.

- Based on deployment, the private cloud segment accounted for a market share of 37.6% in 2023.

- Based on pricing model, the pay-as-you-go segment accounted for a market share of 55.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 19.6 Billion

- 2030 Projected Market Size: USD 45.1 Billion

- CAGR (2024-2030): 12.7%

- North America: Largest market in 2023

In addition, the increased adoption of telehealth, e-prescribing, mobile health, and electronic health records are also boosting the market’s growth. The increasing demand for the rising volume of patient information, remote monitoring, integration of data, and real-time access enabled using big data analytics, IoT in the health sector, and wearable devices are expected to drive the market to grow over the forecast period. The U.S. health systems and hospitals use remote patient monitoring technology. It leverages connected devices with IoT sensors and offers providers a continuous stream of real-time health data such as heart rate, glucose monitoring, and blood pressure.

The growing geriatric population in the U.S. is also a contributing factor to the development of telehealth services. For instance, in January 2024, according to the Population Reference Bureau, the geriatric population is projected to increase by 82 million by 2050. This would spur telehealth services' usage, driving the healthcare computing market growth. According to the Centers for Disease Control and Prevention, in the U.S., an estimated 129 million people suffered from at least one major chronic disease by 2024. The severity and increase of chronic diseases would allow people to opt for telehealth services while sitting comfortably at home. Thus, driving the market to grow over the forecast period.

Various government initiatives and programs have been launched to develop healthcare IT infrastructure and to enhance digital hospitals. For instance, the government of India extended the Digital Health Incentive Scheme and linked it with the Ayushman Bharat Digital Health Account, which is expected to help in digitizing the health records of patients by 2025. Such initiatives are expected to boost the healthcare cloud computing market in the long run.

Furthermore, variety of services are offered by digital medical libraries, such as library management systems, query languages and indexing services, enabling physicians to improve their practice. The management information system is used for billing, manage finance & human resource. Thus, adopting advanced technology for decision-making & forecasting is anticipated to provide significant growth opportunities to this market in the near future.

Type Insights

Nonclinical information systems dominated the market and accounted for a market share of 50.7% in 2023. It can be attributed to the larger penetration of cloud computing services for various applications such as fraud management, financial management, healthcare information exchange, and others. In February 2024, the American Health Information Management Association (AHIMA) introduced its AI Resource Hub, which is expected to help provide health information (HI) professionals with knowledge and resources related to the use of nonclinical AI in the healthcare industry. Such initiatives are expected to drive segment growth.

The clinical information systems segment is expected to grow at a significant CAGR during the forecast period. The growing prevalence of chronic diseases creates the need for the storage of clinical information data, which has resulted in a high demand for clinical information systems by medical professionals. For instance- patient-generated health data (PGHD) helps doctors to treat and understand their patients quickly, as all the information and data are recorded with real-time interactions. It facilitates easy analysis and development of a suitable plan for the treatment. In addition, government initiatives such as the Rural Telehealth Initiative launched in August 2020 in the U.S. further help to collaborate and share information to address health disparities and promote broadband services and technology to rural areas. These factors have helped drive this segment positive.

Deployment Insights

Private cloud dominated the market and accounted for a market share of 37.6% in 2023. Private clouds enable healthcare organizations to maintain high levels of security, access control, and customization. It makes digital transformation more seamless and smoother within the multicloud landscape, which is expected to boost the growth of this segment over the forecast period.

The hybrid cloud segment is expected to grow significantly during the forecast period. This is attributed to the fact that it provides flexibility to scale resources as required. It enables healthcare organizations to rapidly shift workloads across private and public cloud environments based on their specific needs, which is likely to boost the segment growth over the forecast period. In November 2023, Atos extended its partnership with WA Health’s Health Support Services (HSS), which provides ICT services to the Western Australian public health system. The five year contract worth USD 162.76 million is expected to assist in delivering hybrid cloud and core infrastructure services. Such developments are likely to increase the adoption of hybrid cloud computing in the industry and foster market growth.

Pricing Model Insights

Pay-as-you-go dominated the market and accounted for a market share of 55.0% in 2023. It can be attributed to the various benefits it provides such as the less initial investment. PAYG can enable healthcare organizations to eliminate the need for substantial upfront investments in infrastructure. Organizations only have to pay for the resources they need, which can help in reducing waste and optimizing costs. In addition, it provides scalability and flexibility with improved resource management in the healthcare sector, which is likely to foster segment growth over the forecast period.

Spot pricing segment is expected to grow at a significant CAGR during the forecast period. It provides a suitable option for healthcare organizations looking to optimize their cloud infrastructure costs, especially for non-critical, interruptible workloads owing to its flexibility and cost saving facilities. Thus, impacting the market growth positively during the forecast period.

Service Model Insights

Software-as-a-service dominated the market and accounted for a market share of 45.3% in 2023. It is attributed to its ability to deliver ready-to-use, cloud-based software, such as clinical information systems. In SaaS, healthcare companies get access to cloud-based software, but it is hosted and managed by a third-party cloud provider. It is the most preferred choice for many healthcare organizations due to its flexibility, accessibility, and comprehensive nature, driving its share in the healthcare cloud computing market.

The infrastructure-as-a-service segment is expected to grow significantly during the forecast period. This is attributed to the various benefits offered by IaaS, including enhanced security, flexibility and customization, simplified management and maintenance, and predictable costs. In addition, it allows healthcare organizations to rapidly acquire additional computing resources from the cloud provider as needed. These applications are expected to drive segment growth over the forecast period.

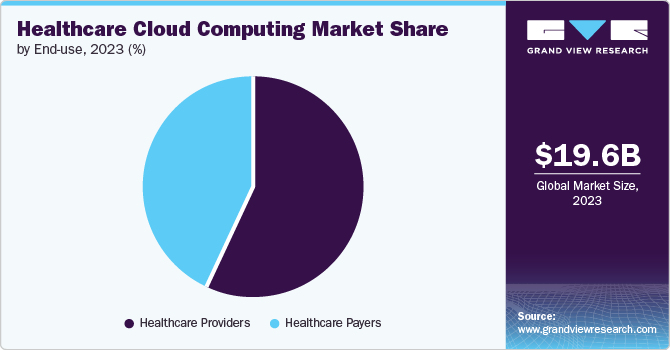

End-use Insights

Healthcare providers dominated the market and accounted for a market share of 57.0% in 2023. It can be attributed to the rising number of hospital connections over the cloud impacting the demand of the SaaS model. In addition, healthcare providers are rapidly adopting cloud computing to support telehealth services, mobile health applications, and integrated care models. This shift towards value-based care for patients has helped adopt cloud-based computing, thereby driving the market growth.

The healthcare payers segment is expected to grow at a significant CAGR during the forecast period. Healthcare payers are increasingly adopting cloud solutions to streamline operations, enhance data management, and improve decision-making processes. In addition, it helps in data management such as identifying trends, detecting fraud, and making informed decisions about coverage and reimbursement policies. It also facilitates collaboration and integration between payers, providers, and other stakeholders in the healthcare ecosystem. This is likely to help in driving the market growth positively over the forecast period.

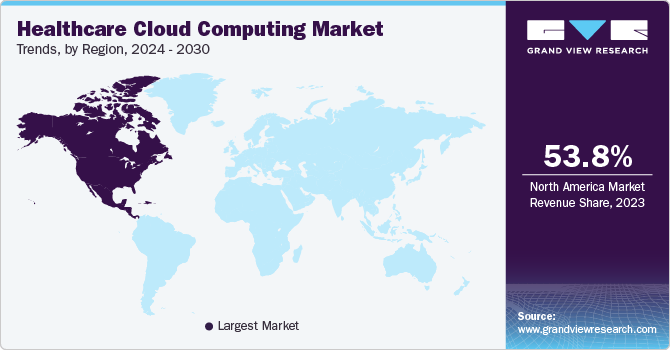

Regional Insights

North America healthcare cloud computing market dominated in 2023. This can be attributed to the increasing geriatric population and the growing prevalence of various chronic diseases in this region. The improved healthcare sector and government investments have driven market growth. In addition, the rise in IT initiatives and adoption of healthcare IT, such as an increase in the EHR adoption rate, further adds to the market growth. For instance- in 2021, according to a report published in the Office of the National Coordinator for Health Information Technology (ONC), about 88% of U.S. office-based physicians adopted any electronic health record, and nearly 78% adopted certified EHR in the U.S.

U.S. Healthcare Cloud Computing Market Trends

The U.S. healthcare cloud computing market dominated the global market with a share of 44.1% in 2023 owing to factors such as improved healthcare facilities and expenditure, and the increasing geriatric population leading to various chronic diseases. Various strategies are adopted by government bodies in digitizing healthcare sector in the U.S. For instance- in February 2021, the U.S. Department of Agriculture (USDA) invested USD 42.3 million in telemedicine infrastructure to improve education and health outcomes. All these factors have contributed for the significant change and development of healthcare cloud computing, thereby impacting the healthcare cloud computing market and boosting its growth.

Asia Pacific Healthcare Cloud Computing Market Trends

The Asia Pacific healthcare cloud computing market is anticipated to witness significant growth over the forecast period. The rising burden of chronic diseases, improvement in healthcare infrastructure, and growing usage of IT solutions in the medical field are increasing the demand for the digitalized IT healthcare sector in this region. Government initiatives have also contributed to the growth of this market. For instance- in 2023, cloud based Health Information Management Systems (HIMS) was integrated with the Ayushman Bharat Digital Mission (ABDM), in India, to enhance security, scalability, data redundancy, accessibility, and streamlining administrative tasks in the Indian healthcare sector.

Europe Healthcare Cloud Computing Market Trends

Europe healthcare cloud computing market was identified as a lucrative region in 2023. The growing geriatric population and prevalence of chronic diseases are expected to impact the market growth in the region. According to German Federal Statistical Office report, the population over 65 is expected to rise to 33% by 2060. It was also observed that 3.5 million teleconsultations were done in 2021. The increasing emphasis on boosting digital health infrastructure is further expected to drive the market.

MEA Healthcare Cloud Computing Market Trends

MEA healthcare cloud computing market is anticipated to witness significant growth in the healthcare cloud computing market. MEA region has implemented cloud-based Electronic Health Record (EHR) systems. These systems enable healthcare providers to access patient data in real-time, understand pre-existing conditions, and design more effective treatment plans. This improves clinical decision-making and streamlines care processes. Demographic shifts in the Middle East and Africa, such as urbanization and lifestyle changes, have increased the prevalence of chronic diseases and contributed to the growing demand for healthcare cloud computing, thereby increasing the market growth in this region. For instance- in June 2023, according to a report published in the Health Systems Reform series in the MENA region, people over the age of 60 are more prone to chronic disease risk, currently ranging from 0.8% in the UAE to 10.6% in Turkey. In addition, around 461,000 new cancer cases and over 274,000 cancer-related deaths in the region were predicted in the year 2020.

Key Healthcare Cloud Computing Company Insights

Some of the key companies in the healthcare cloud computing market include Amazon Web services, Microsoft, Google Inc, athenahealth and others. These companies are growing their market revenue by launching new products, collaborations and adopting various other strategies.

-

AWS provides a comprehensive suite of cloud services for healthcare organizations, including computing, storage, database, analytics, machine learning, and security services. The company has also partnered with healthcare technology companies such as Cerner and Epic to deliver cloud-based solutions for electronic health records (EHRs) and population health management.

-

Athenahealth is one of the providers of cloud-based services and mobile applications for medical groups and health systems. The company delivers cloud solutions for revenue cycle management, medical billing, patient engagement, electronic health records (EHRs), care coordination, population health management, and clinical intelligence/decision support. Its various products and services include AthenaOne - athenaClinicals, athenaCollector, and athenaCommunicator.

Key Healthcare Cloud Computing Companies:

The following are the leading companies in the healthcare cloud computing market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web services

- Microsoft

- Google Inc

- athenahealth

- CareCloud, Inc.

- Siemens Healthineers AG

- Salesforce, Inc.

- Oracle (Cerner Corporation)

- Epic Systems Corporation

Recent Developments

-

In March 2024, Genesys collaborated with Epic to ensure a more consistent, connected experience between patients and the care team and help in recording clinical data across systems and departments.

-

In March 2024, Microsoft collaborated with NVIDIA to accelerate life sciences and healthcare innovation with advanced cloud, accelerated computing capabilities, and AI.

-

In May 2023, Amazon Web Services invested USD 12.7 billion into cloud infrastructure in India.

Healthcare Cloud Computing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 22.0 billion

Revenue forecast in 2030

USD 45.1 billion

Growth rate

CAGR of 12.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, deployment type, pricing model, service model, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; KSA; UAE; South Africa; Kuwait

Key companies profiled

Amazon Web services, Microsoft, Google Inc, athenahealth, CareCloud, Inc., Siemens Healthineers AG, Salesforce, Inc., Oracle (Cerner Corporation), Epic Systems Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Healthcare Cloud Computing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Healthcare Cloud Computing market report based on type, deployment, pricing model, service model, end-use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical Information Systems

-

EMR

-

PACS, VNA, and Image Sharing Solutions

-

PHM

-

Telehealth

-

LIMS

-

PIS

-

RIS

-

Other CIS

-

-

Nonclinical Information Systems

-

RCM

-

Billing and Accounts Management

-

Financial Management

-

HIE

-

Fraud Management

-

Supply Chain Management

-

Other NCIS

-

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Private cloud

-

Hybrid cloud

-

Public cloud

-

-

Pricing Model Outlook (Revenue, USD Million, 2018 - 2030)

-

Pay-as-you-go

-

Spot Pricing

-

-

Service Model Outlook (Revenue, USD Million, 2018 - 2030)

-

Software-as-a-service

-

Infrastructure-as-a-service

-

Platform-as-a-service

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare Providers

-

Healthcare Payers

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global healthcare cloud computing market size was estimated at USD 12,740.9 million in 2019 and is expected to reach USD 14,123.3 million in 2020.

b. The global healthcare cloud computing market is expected to grow at a compound annual growth rate of 11.8% from 2019 to 2026 to reach USD 27,856.1 million by 2026.

b. North America dominated the healthcare cloud computing market with a share of 54.74% in 2019. This is attributable to growing adoption of EHRs and expanding applications of analytical IT solutions in health management, advancements in healthcare IT infrastructure and rise in IT initiatives by public and private players.

b. Some key players operating in the healthcare cloud computing market include CareCloud Corporation; Athenahealth; ClearData Networks, Inc.; Cerner Corporation; Epic Systems Corporation; NextGen Healthcare; Carestream Corporation; Dell, Inc.; DICOM Grid, Inc.; INFINITT Healthcare; Sectra AB; Merge Healthcare, Inc.; Siemens Healthineers; iTelagen, Inc.; NTT DATA Corporation; Nuance Communications; and Ambra Health.

b. Key factors that are driving the healthcare cloud computing market growth include growing demand for integrated information systems majorly due to increase in prevalence of chronic diseases and aging population coupled with high demand for cloud-based information systems and technologically advanced healthcare infrastructure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.