- Home

- »

- Medical Devices

- »

-

Healthcare Consulting Services Market Size Report, 2030GVR Report cover

![Healthcare Consulting Services Market Size, Share & Trends Report]()

Healthcare Consulting Services Market (2024 - 2030) Size, Share & Trends Analysis Report By Services (Strategic Management Consulting, Financial Management Consulting), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-017-7

- Number of Report Pages: 111

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Healthcare Consulting Services Market Summary

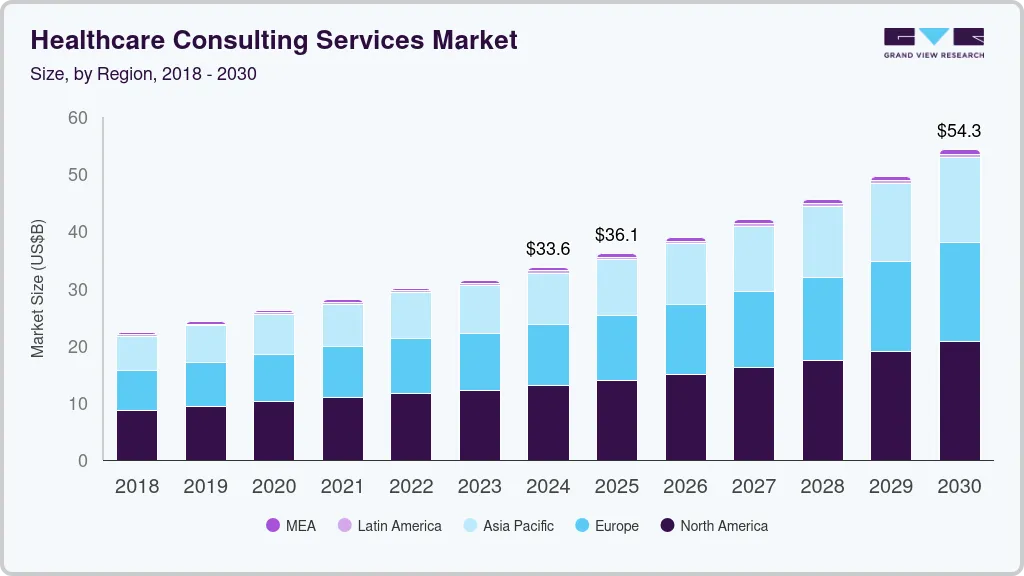

The global healthcare consulting services market size was estimated at USD 28.19 billion in 2023 and is projected to reach USD 51.98 billion by 2030, growing at a CAGR of 9.33% from 2024 to 2030. The high adoption of digitalization in healthcare firms, the increased demand for improving the efficiency of these firms, and the growing demand for a structured organization are some of the key factors contributing to the demand for management consulting services in healthcare firms.

Key Market Trends & Insights

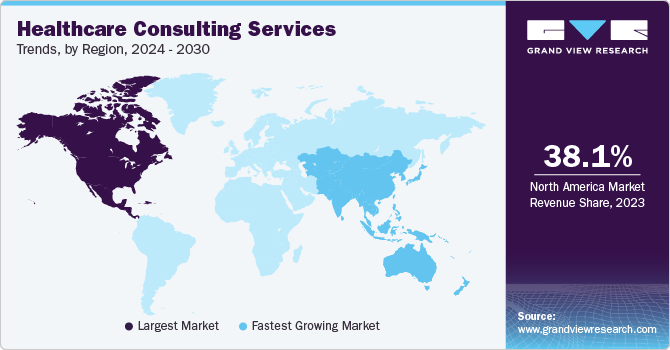

- North America dominated the market and accounted for a 38.14% share in 2023.

- Asia Pacific is anticipated to witness the fastest growth in the market.

- By services, the strategic management consulting segment accounted for 42.39% of the global revenue in 2023.

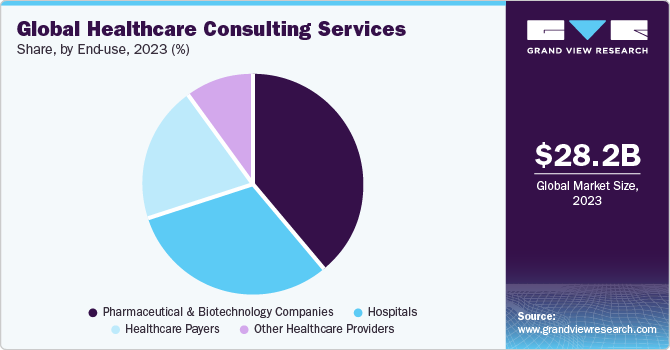

- By end-use, the pharmaceutical and biotechnology companies segment dominated the market in 2023

Market Size & Forecast

- 2023 Market Size: USD 28.19 Billion

- 2030 Projected Market Size: USD 51.98 Billion

- CAGR (2024-2030): 9.33%

- North America: Largest market in 2023

During the COVID-19 pandemic, institutions such as pharma & biotech companies, healthcare payers, providers, medical device companies, and government organizations adopted advanced technologies, and software to improve their overall functioning. For instance, during the pandemic, Microsoft consulting services helped in the secure and efficient distribution of the COVID-19 vaccine through its software, Vaccination Registration and Administration Solution (VRAS).

The demand for technology in the healthcare industry is expected to improve in the coming years owing to the advantages associated with these technologies in healthcare. Thus, supporting the healthcare consulting services market in the post-pandemic period. The industry is required to adapt to the ever-changing regulatory framework. It is difficult to adapt to every change in regulatory requirements. The healthcare industry spends a significant amount of money to keep up with regulatory requirements. The Medicare and Medicaid reforms, such as MACRA state that healthcare organizations must do more with less.

In the forecasted period, such factors are expected to boost demand for healthcare advisory services to understand regulatory requirements. The healthcare industry is complex. It is required to follow different policies, regulations, and laws, and there are daily developments in treatment and diagnosis; owing to these reasons, pharma and biotechnology organizations have a lot to keep track of all such activities professionally and thoroughly, which is very important for their success. These factors are further supporting the demand for healthcare consulting services.

Market Concentration & Characteristics

Market growth stage is high, and the pace of the market growth is accelerating. The healthcare consulting services market is characterized by a high degree of innovation due to rapid technological advancements such as adopting machine learning and artificial intelligence in advisory services and platforms. Companies are entering the market and bringing novel technologies and platforms, which are expected to drive innovation in the industry. For instance, in October 2023, Avallano collaborated with Elligo Health Research and introduced an AI-powered clinical trial recruitment and engagement platform, myTrialsConnect. This platform is useful to identify qualified patients and engage them during, before and after clinical study. Such developments are expected to bring innovative platforms to the market.

The market is characterized by the high level of merger and acquisition (M&A) activity by leading players operating in the industry. This is due to numerous factors, including the desire to gain a competitive advantage in the industry and the need to consolidate in a rapidly growing market. Major industry participants are acquiring firms providing services and solutions for pharmaceuticals and medtech. For instance, in September 2023, Accenture, a major advisory organization, acquired the UK-based leading digital healthcare consultancy firm Nautilus Consulting. This acquisition is expected to bring expertise in operational and strategic consulting services and assist clients in implementing and optimizing their digital solutions. Such acquisitions are expected to propel industry growth in coming years.

Furthermore, the industry participants operating across the industry are focusing on increasing their presence in several regions and improving access to the services and solutions needed during pharmaceutical and biotechnology studies and procedures across the globe. For instance, in June 2023, Axis Consulting, a Dublin headquartered firm announced plans to expand in the UK market by opening a new office in Edinburgh. The company serves biopharma and health tech businesses, providing them with the local knowledge required to access different markets and health tech assessments. Thus, regional expansions by the major players are expected to improve access to the services of the markets.

Services Insights

The strategic management consulting segment accounted for 42.39% of the global revenue in 2023. The growing number of mergers and acquisitions among healthcare organizations such as pharmaceutical companies, biotechnology companies, and others is one of the major factors supporting the demand for strategic management consulting services. Moreover, there has been an increase in drug research activities, which is contributing to the demand for launch strategy consulting and further supporting the segment market growth.

On the other hand, the information technology consulting segment is anticipated to witness the fastest growth over the forecast period. This is due to the high adoption rate of digitalization solutions such as big data, artificial intelligence, telehealth, and others in healthcare organizations. These technologies help optimize systems, streamline physicians’ work, reduce human error, improve patient outcomes, and lower the cost of services. The consulting firms provide advisory services on choosing the best use of the technology and how the technology can be used for the betterment of the organization. These factors are supporting the segment market.

End-use Insights

The pharmaceutical and biotechnology companies segment dominated the market in 2023 and it is also expected to witness the fastest growth over the forecast period. Growing demand for optimizing costs associated with API operations, formulations development, supply chain management, and the increasing need to understand mergers and acquisition strategy implementation among these companies are some of the key factors supporting the segment market. Furthermore, the growing need to understand product launch plans and brand management of existing products are other factors supporting the segment demand.

The hospital segment is projected to witness significant growth over the forecast period. Escalating hospital expenses have made it essential to manage hospitals by maintaining operational and financial performance. Moreover, while launching a new hospital, it is essential to understand certain factors, such as how to license the hospital, raise funds, recruit talent, and improve the branding and marketing of hospitals, among others. These are some key factors that are improving the demand for hospital advisory services. Moreover, there is also a rising interest in the adoption of new technologies in hospitals for improving patient experiences, which further contributes to the demand for hospital consulting services.

Regional Insights

North America dominated the market and accounted for a 38.14% share in 2023. This can be attributed to the increased adoption of digital solutions by healthcare organizations such as public agencies, pharmaceutical companies, biotechnology companies' hospitals, and other institutions. Moreover, North America has a stringent regulatory framework in order to keep up with the changing regulations; there is an increased demand for regulatory consulting services across the region among healthcare organizations, which further drives market growth of the region.

Asia Pacific is anticipated to witness the fastest growth in the market. Increasing regional expansions in business by the health care organizations across region and the presence of a significant number of consultants are some key factors supporting market growth in Asia-Pacific. Moreover, in the last five years, there has been an improvement in the number of new launches of drugs and medical devices in the region, which further promotes the demand for advisory services across the region. Furthermore, there is an increasing adoption of digital solutions among government organizations and pharmaceutical and biotechnology companies, which is further driving the growth in Asia Pacific market.

Key Healthcare Consulting Services Company Insights

Key players operating in the market offer a wide range of solutions and have a vast global geographic presence. These companies adopt strategies such as partnerships, collaborations, and acquisitions to maintain their leading market share.

L.E.K. Consulting and Bain & Company, Inc are some of the emerging market participants in the market. These players focus on expanding their offerings and geographic presence. Some of the strategies adopted by these players include partnerships for geographic expansion, customer acquisition strategies and development of personalized solutions for their clients.

Key Healthcare Consulting Services Companies:

The following are the leading companies in the healthcare consulting services market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these healthcare consulting services companies are analyzed to map the supply network.

- Accenture

- McKinsey & Company

- Deloitte Global

- L.E.K. Consulting

- PwC

- Huron Consulting Group Inc. and affiliates.

- Cognizant

- EY

- Bain & Company, Inc.

- IQVIA Inc,

- Boston Consulting Group

Recent Developments

-

In May 2023, VMG Health, a major healthcare strategy company acquired the specialist healthcare advisory firm, BSM Consulting. With this acquisition, BSM added new services, including recruitment, subscription-based membership programs, and leadership development resources that can help advance VMG Health’s wider array of solutions.

-

In February 2023, Accenture, a major industry participant, purchased a strategy and advisory firm, Bionest. The acquired company helps biopharma companies address complex strategic decisions across innovative areas of science, including diagnostics, precision medicine, cell & gene therapy (CGT), oncology, and rare diseases. With this acquisition, the company expanded its strategy capabilities in life sciences.

-

In August 2023, Nordic Consulting, a technology and health consulting firm collaborated with the Workday, a major player in enterprise cloud applications for human resources and finance.

Healthcare Consulting Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 30.44 billion

Revenue forecast in 2030

USD 51.98 billion

Growth rate

CAGR of 9.33% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

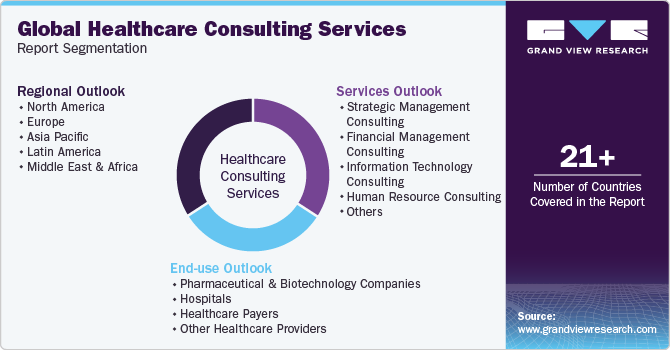

Services, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Accenture; McKinsey & Company; Deloitte Global; PwC; L.E.K. Consulting; Huron Consulting Group Inc.; Cognizant; EY; Bain & Company, Inc.; IQVIA, Inc. Boston Consulting Group.,

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Healthcare Consulting Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global healthcare consulting services market report based on services, end-use and region.

-

Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Strategic Management Consulting

-

Financial Management Consulting

-

Information Technology Consulting

-

Human Resource Consulting

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical Companies

-

Hospitals

-

Insurance Companies

-

Government Organizations

-

Other Healthcare Providers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global healthcare consulting services market size was estimated at USD 28.19 billion in 2023 and is expected to reach USD 30.44 billion in 2024.

b. The global healthcare consulting services market is expected to grow at a compound annual growth rate of 9.33% from 2024 to 2030 to reach USD 51.98 billion by 2030.

b. North America dominated the healthcare consulting services market with a share of 38.14% in 2023. This can be attributed to the increased adoption of digital solutions by healthcare organizations such as public agencies, pharmaceutical companies, biotechnology companies' hospitals, and other institutions.

b. Some key players operating in the healthcare consulting services market include Accenture; Accenture, McKinsey & Company, Deloitte Global, L.E.K. Consulting, PwC, Huron Consulting Group Inc. and affiliates., Cognizant, EY, Bain & Company, Inc., IQVIA Inc, and Boston Consulting Group.

b. The need to implement new technologies such as big data analytics, cloud deployment, and IoT by healthcare institutions including life sciences corporations and government bodies, as well as the desire to improve operational efficiency are some of the main factors driving the market for healthcare consulting services.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.