- Home

- »

- Next Generation Technologies

- »

-

Healthcare Data Integration Market Size, Share Report, 2030GVR Report cover

![Healthcare Data Integration Market Size, Share & Trends Report]()

Healthcare Data Integration Market (2023 - 2030) Size, Share & Trends Analysis Report By Component (Tools, Services), By Deployment (Cloud, On-premise), By Organization Size, By Business Application, By End-user, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-149-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Healthcare Data Integration Market Summary

The global healthcare data integration market size was estimated at USD 1.05 billion in 2022 and is projected to reach USD 3.11 billion by 2030, growing at a CAGR of 14.5% from 2023 to 2030. The industry expansion is driven by the widespread adoption of electronic health records (EHRs) and other healthcare IT systems.

Key Market Trends & Insights

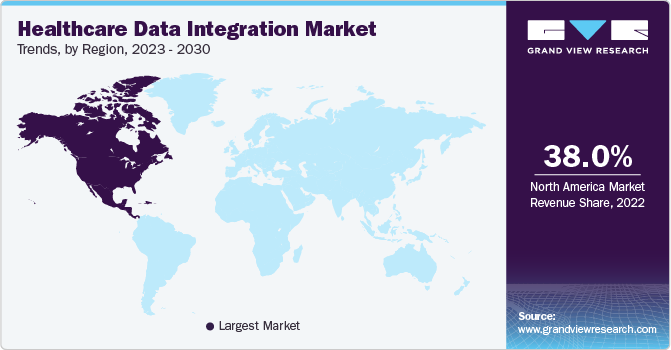

- North America dominated the market in 2022, accounting for over 38% share of the global revenue.

- Asia Pacific is likely to possess lucrative market opportunities in the coming years.

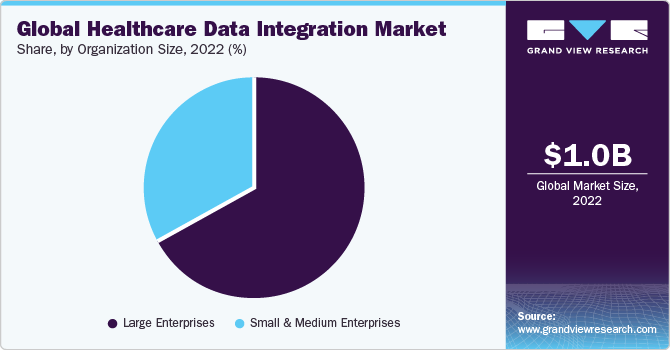

- Based on organization size, the large enterprise segment dominated the market in 2022 and accounted for a revenue share of over 66%.

- In terms of end use, the hospital's segment dominated the market in 2022 and accounted for a revenue share of over 51%.

- On the basis of component, the tools segment led the market in 2022, accounting for over 69% share of the global revenue.

Market Size & Forecast

- 2022 Market Size: USD 1.05 billion

- 2030 Projected Market Size: USD 3.11 billion

- CAGR (2023-2030): 14.5%

- North America: Largest market in 2022

Moreover, the importance of amalgamating data from different sources for a comprehensive patient health overview, as well as a rapidly rising demand for value-based healthcare, contributes to the market's expansion. Additionally, a strong focus on improving patient care, streamlining information access, and supporting value-driven healthcare initiatives are helping reshape the market. For instance, in August 2022, the Indonesian government introduced SATUSEHAT, a healthcare data integration platform that means "ONEHEALTHY" in Indonesian.

This platform connects all healthcare facilities in the country, creating a unified national health data repository. SATUSEHAT is a key component of Indonesia's digital health transformation plan, focused on enhancing healthcare quality, efficiency, and accessibility for all citizens. Data integration in the healthcare market is the process of unifying patient health information from various sources, including EHRs, claims data, lab results, and medication history. It utilizes tools like data warehouses, data lakes, and master data management solutions to create a comprehensive patient 360 view. This holistic view aids healthcare providers in addressing fraud by identifying irregularities and patterns in data from multiple sources, thereby enhancing the integrity of healthcare systems.

Also, it contributes significantly to medical research by providing researchers access to extensive datasets accelerating the development of new treatments for diseases. The rising demand for healthcare data integration is mainly driven by the need for data-based decision-making and improved patient care. Data integration provides clinical decision support by offering real-time access to patient information, improving the accuracy and timeliness of medical decisions. It also boosts operational efficiency by optimizing resource allocation and supply chain management through data analysis.

For patient care, data integration enables personalized medicine, early disease detection, and care coordination for better outcomes and cost reduction. In addition, it promotes patient engagement through data access and supports telehealth. Research and development in healthcare benefit from data integration by facilitating clinical research and drug discovery, while it also aids in quality reporting and compliance with regulatory requirements. During the COVID-19 pandemic, data integration in the healthcare market played a crucial role in identifying and treating high-risk patients.

Healthcare institutions collaborated by consolidating data to pinpoint individuals with medical histories, putting them at greater risk of severe illness. Predictive models were developed, enabling a proactive approach to treatment. The potential of data integration in public health management in the healthcare market was also recognized, with healthcare providers harnessing diverse data sources, including hospital databases, medical websites, fitness devices, and mobile apps, to gain deeper insights into the health needs of specific populations. This data integration was instrumental in implementing preventive measures and avoiding potential crises.

Organization Size

The large enterprise segment dominated the market in 2022 and accounted for a revenue share of over 66%. The segment's growth is attributed to the more complex data integration requirements of large enterprises compared to smaller businesses, and they possess larger budgets to invest in robust data integration solutions. Moreover, EHRs generate substantial volumes of data that necessitate integration with other healthcare systems, including laboratory and radiology information systems. Furthermore, the increasing demand for value-based care, which aims to enhance patient outcomes while curbing costs, has driven healthcare providers to employ data integration for collecting and analyzing data from various sources to enhance their care provision and overall performance.

The small & medium enterprises segment is anticipated to register the fastest CAGR. This growth is driven by several factors, including the escalating adoption of cloud-based data integration solutions, which offer affordability, scalability, and user-friendliness that align with the needs and resources of SMEs. Furthermore, SMEs face ongoing pressure to enhance operational efficiency and reduce costs, with data integration solutions serving as a vital tool to achieve these objectives. These solutions automate manual data entry, eliminate separate data repositories, and provide a unified view of all data. Moreover, increasing compliance requirements, such as the Health Insurance Portability and Accountability Act (HIPAA) and General Data Protection Regulation (GDPR), place additional demands on SMEs, and data integration solutions play a pivotal role in ensuring data management and protection in alignment with these regulations. Further, by expanding its data integration and business intelligence solution, a process of automation was induced to minimize the use of manual intervention.

End-user Insights

The hospital's segment dominated the market in 2022 and accounted for a revenue share of over 51% as hospitals represent the largest consumers of healthcare data and necessitate the integration of data from multiple sources, including EHRs, billing systems, and patient portals. Healthcare data integration in hospitals yields several advantages, including enhanced patient care by providing clinicians with comprehensive medical histories for informed decision-making. Moreover, it contributes to cost reduction by streamlining administrative processes and bolstering operational efficiency, automating tasks, such as billing and insurance claims processing. The integration of healthcare data further enhances hospital efficiency by minimizing the need for manual data entry and reconciliation, allowing staff to redirect their focus to more critical patient care tasks.

The laboratories segment is expected to witness significant growth in the market. This growth is driven by the increasing volume and complexity of laboratory data, with advancements in testing technology and the rising prevalence of chronic diseases generating more data. Data integration solutions are crucial for managing this complex data efficiently. In addition, there is a growing need for improved laboratory efficiency and productivity, with data integration enabling task automation, streamlined workflows, and enhanced staff communication, resulting in substantial efficiency and productivity gains. Furthermore, as the importance of value-based care models grows, data integration becomes essential for laboratories to collect and analyze data, identifying areas for improving the quality of their services.

Regional Insights

North America dominated the market in 2022, accounting for over 38% share of the global revenue. The region's growth is driven by the region's forefront adoption of digital health technologies like EHRs, clinical decision support systems (CDSSs), and telemedicine. These technologies generate substantial data volumes, emphasizing the need for effective integration. Regulatory mandates and financial encouragement by North American governments have let healthcare providers adopt IT solutions, driving the adoption of healthcare data integration. In addition, North America's healthcare industry is embracing a shift towards value-based care, a model focused on enhancing patient outcomes and cost reduction.

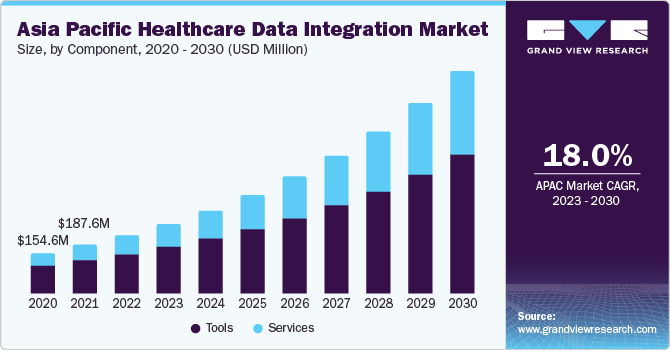

Asia Pacific is likely to possess lucrative market opportunities in the coming years. The region's substantial and expanding population, with a rising prevalence of chronic diseases, fuels the demand for healthcare data integration solutions. These solutions aim to enhance patient care and cost reduction. Moreover, key players in the APAC region are strategically expanding their product portfolios, making substantial investments, and forming strategic partnerships. This strategic approach caters to the increasing demand for healthcare data integration solutions that offer affordability and user-friendliness, ensuring accessibility and robust functionality.

Component Insights

The tools segment led the market in 2022, accounting for over 69% share of the global revenue. The segment's growth is attributed to the escalating adoption of data integration tools by healthcare organizations. These tools serve multiple critical purposes, such as enhancing data quality and precision, fostering a deeper comprehension of patients and demographics, facilitating informed decision-making, boosting overall efficiency and productivity, and driving down operational costs. As healthcare data volumes from diverse sources continue to expand, data integration tools have become essential for healthcare entities seeking to optimize their operations and provide higher-quality care.

The service segment is predicted to foresee significant growth in the forecast years. The segment growth is driven by various factors, such as the growing complexity of healthcare data integration projects and the rising demand for specialized expertise to effectively implement & manage data integration solutions. Moreover, the adoption of cloud-based data integration services is rapidly advancing, thus fueling the growth of the service segment. Small- and medium-sized healthcare organizations are contributing to this trend, as they increasingly seek data integration services to meet particular needs and enhance overall operational efficiency.

Deployment Insights

The on-premises segment held the largest revenue share of over 61% in 2022. This was primarily attributed to the advantages offered by on-premises data integration solutions to healthcare organizations. These advantages include enhanced control and security, which is crucial for ensuring compliance with stringent data security and privacy regulations within the healthcare sector. On-premises solutions also excel in terms of performance and reliability, particularly for healthcare organizations dealing with real-time processing of extensive data volumes. In addition, the ability to customize on-premises data integration solutions to align with the specific and complex needs of healthcare organizations leads to the segment's growth in the market.

The cloud segment will witness significant growth in the coming years. The growth is mainly attributed to the rising adoption of cloud computing in the healthcare sector, owing to benefits such as flexibility, scalability, and cost savings. Healthcare organizations generate vast amounts of data from sources such as patient portals, EHRs, and wearable devices, highlighting the need for data integration for a comprehensive patient health history and data-driven decision-making. Furthermore, cloud-based data integration solutions offer advantages in terms of ease of deployment, scalability, and affordability, thus growing their demand in the market.

Business Application Insights

The marketing segment led the market in 2022, accounting for over 32% of global revenue. Marketing teams are increasingly utilizing data to enhance their campaigns and target their audiences more effectively. Healthcare data integration solutions empower marketing teams to amalgamate data from various sources, including EHRs, customer relationship management (CRM) systems, and social media, enabling a more comprehensive understanding of their customers. This data is leveraged to create precisely tailored and personalized marketing campaigns. Healthcare data integration solutions further facilitate audience segmentation based on demographics and health history, fostering more targeted marketing efforts, personalized messaging, and improved measurement of marketing campaign ROI. Thus, these tools are instrumental in refining future campaigns and optimizing marketing resource allocation.

The HR segment will witness significant growth in the coming years. The segment's growth is driven by the increasing reliance of healthcare organizations on data for making HR decisions, spanning areas like recruitment, training, and performance management. Data integration solutions enable HR teams to consolidate data from various sources, including EHRs, talent management systems, and payroll systems, creating a comprehensive view of their employees and facilitating data-driven decision-making. In addition, healthcare organizations contend with complex and ever-changing HR regulations, making data integration solutions instrumental in ensuring compliance by offering a centralized view of employee data.

Key Companies & Market Share Insights

Major players are actively engaged in bolstering their product portfolios and global market presence through strategic alliances and product development initiatives. These efforts encompass both organic and inorganic growth strategies, including product enhancements, the introduction of new products, forging agreements, and partnerships, expanding business operations, and engaging in mergers and acquisitions. These collaborative ventures and mergers are anticipated to offer market players opportunities to pool knowledge, enhance their technologies, and strengthen internal capabilities, ultimately leading to environmental and economic advantages in the market.

For instance, in January 2023, CipherHealth Inc., a patient engagement technology company, partnered with SADA, Inc., a prominent business and technology consultancy, to enhance patient care by integrating social determinants of health (SDOH) data integration. This partnership focuses on making SDOH data integration more accessible and actionable for healthcare providers, thus contributing to a more equitable and effective healthcare system.

Key Healthcare Data Integration Companies:

- Astera Software

- Cloud Software Group, Inc.

- Denodo Technologies

- Innovaccer, Inc.

- Microsoft

- Oracle

- QlikTech International AB

- Talend

- Ursa Health LLC

- Vorro

Healthcare Data Integration Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.21 billion

Revenue forecast in 2030

USD 3.11 billion

Growth Rate

CAGR of 14.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, organization size, business application, end-user, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, U.K., France, China, India, Japan, Australia, South Korea, Brazil, Kingdom of Saudi Arabia, UAE, South Africa

Key companies profiled

Astera Software; Cloud Software Group, Inc.; Denodo Technologies; Innovaccer, Inc.; Microsoft; Oracle; QlikTech International AB; Talend; Ursa Health LLC; Vorro

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Healthcare Data Integration Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global healthcare data integration market report based on component, deployment, organization size, business application, end-user, and region.

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Tools

-

Services

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cloud

-

On-premises

-

-

Organization Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

Business Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Marketing

-

Sales

-

Operations & Supply Chain

-

Finance

-

HR

-

-

End-user Outlook (Revenue, USD Billion, 2017 - 2030)

-

Hospital

-

Clinics

-

Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

MEA

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global healthcare data integration market size was estimated at USD 1.05 billion in 2022 and is expected to reach USD 1.21 billion in 2023.

b. The global healthcare data integration market is expected to grow at a compound annual growth rate of 14.5% from 2023 to 2030 to reach USD 3.11 billion by 2030.

b. North America dominated the healthcare data integration market with a share of 38.8% in 2022. The region's growth is driven by the region's forefront adoption of digital health technologies like EHRs, clinical decision support systems (CDSSs), and telemedicine.

b. Some key players operating in the healthcare data integration market include Astera Software, Cloud Software Group, Inc.; Denodo Technologies; Innovaccer, Inc.; Microsoft; Oracle; QlikTech International AB; Talend; Ursa Health LLC; and Vorro

b. Key factors that are driving the healthcare data integration market growth include growing demand for digital transformation and EHR adoption, and data-driven decision making and improved patient care.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.