- Home

- »

- Healthcare IT

- »

-

Healthcare e-Learning Services Market Size Report, 2030GVR Report cover

![Healthcare e-Learning Services Market Size, Share & Trends Report]()

Healthcare e-Learning Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Content Type (Clinical Training Modules, Non-clinical Modules), By Delivery Mode, By Technology Platform, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-581-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Healthcare e-Learning Services Market Overview

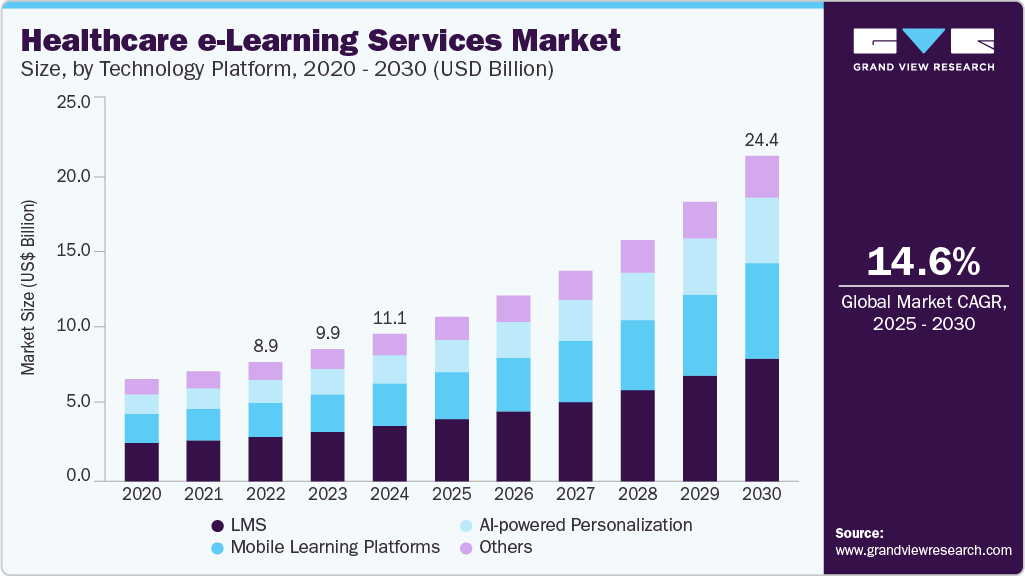

The global healthcare e-learning services market size was estimated at USD 11.10 billion in 2024 and is projected to grow at a CAGR of 14.58% from 2025 to 2030. Increasing demand for clinical training modules, rising preference for self-paced learning, and growing adoption of LMS platforms for centralized training and compliance management are factors contributing to market growth.

Key Highlights:

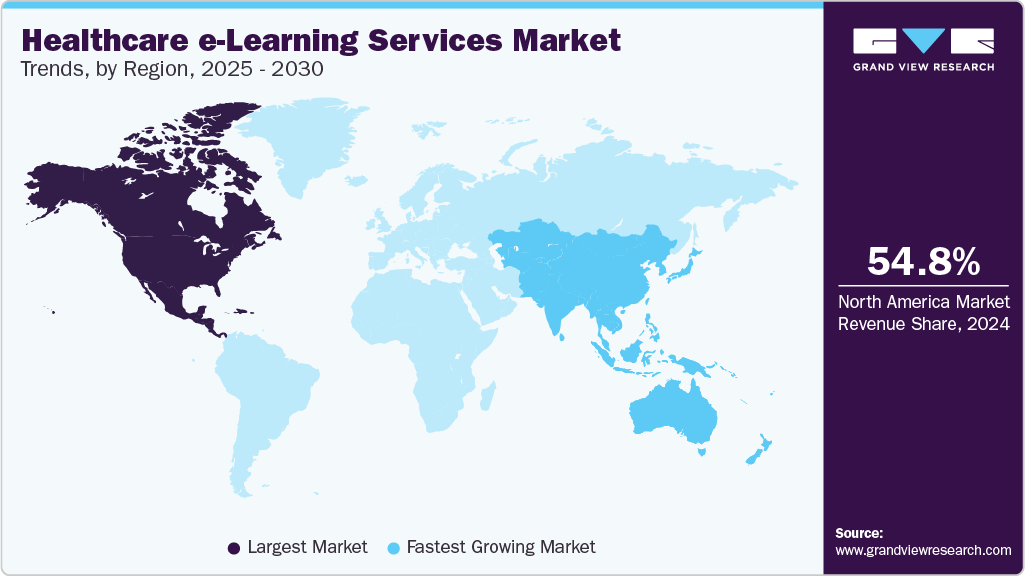

- North America healthcare e-learning services market accounted for the largest revenue share of 54.76% in 2024.

- The healthcare e-learning services market in the U.S. held the largest market share in 2024.

- Based on content type, the clinical training modules segment dominated the market with the largest revenue share of 61.68% in 2024.

- Based on delivery mode, the self-paced learning segment held the largest market share of 32.74% in 2024.

- Based on technology platform, the LMS segment accounted for the largest revenue share of 37.56% in 2024.

The rise of innovation in medical procedures, diagnostics, and treatment protocols has underscored the necessity for ongoing clinical training. As a result, healthcare providers are increasingly utilizing e-learning platforms to keep their workforce updated. Clinical training modules enable hospitals, academic institutions, and pharmaceutical companies to provide standardized, high-quality instruction without the limitations of in-person training. These modules cover advanced life support, infection control, diagnostic imaging, and telemedicine practices, which are critical in ensuring patient safety and treatment efficacy.

Moreover, regulatory bodies and accreditation institutions globally require structured clinical continuing education, increasing the demand for certified, trackable e-learning content. In addition, integrating AI and simulation technologies into clinical training enables learners to engage in scenario-based, interactive simulations that enhance decision-making and procedural accuracy. This demand for precision, flexibility, and scalability increases the demand for clinical training.

Furthermore, self-paced learning modules are cost-effective and scalable, enabling healthcare providers to deploy standardized training content across hundreds of employees. Moreover, the healthcare industry is increasingly adopting Learning Management Systems (LMS) due to their ability to centralize training, automate compliance tracking, and scale across different locations and departments.

Recent Product Launches in the Healthcare e-Learning Services Market

Institute / Company

Month & Year

Initiative

Dubai Government

March 2025

The Dubai Health Authority (DHA) introduced NABIDH Clinical Portal Training to enhance healthcare efficiency. This initiative aims to empower healthcare professionals by enabling them to access and navigate patients' comprehensive medical histories, improving patient care across the UAE.

PAGB

February 2025

PAGB introduced an e-learning platform offering online courses on UK medicines regulations and specialized topics like CBD.

Qatar Government

November 2024

Qatar's Ministry of Public Health launched an e-learning platform for healthcare practitioners. The platform features 17 evidence-based educational modules, designed to provide practitioners with essential knowledge and skills, ultimately improving the quality of healthcare services in the country.

St. George's University (SGU) School of Medicine

November 2024

St. George's University (SGU) School of Medicine in Grenada, West Indies, launched an online learning platform, SGU Global Medic Club, to enhance medical education.

“We are thrilled to launch this exciting new e-learning platform across our global affiliate network. The SGU Global Medic Club is easy to enroll in, and students can benefit from specially tailored resources created by our expert faculty, ensuring each course collection is relevant to their individual preferences.”

-Aurelie Lily Phommarack, Associate Director, International Academic Affiliations at SGU

Royal Australian College of General Practitioners (RACGP)

November 2024

The Royal Australian College of General Practitioners (RACGP) launched an e-learning platform focused on arthritis management. This resource aims to enhance the knowledge and skills of healthcare professionals in diagnosing and treating arthritis.

King's College, London

October 2024

King's College, London, introduced new e-learning modules to enhance the involvement of nurses and midwives in research development opportunities. This initiative aims to address the underrepresentation of these professionals in research, providing them with essential skills and knowledge to participate effectively in research activities within healthcare settings.

Hospitals and pharmaceutical companies often need to manage training for thousands of employees across clinical, administrative, IT, and operational functions. LMS platforms simplify this process by offering dashboards, audit trails, customizable learning paths, and automated notifications for certification expirations or incomplete modules. The rise in cloud-based LMS solutions also supports remote learning, mobile access, and integration with existing hospital systems such as HR platforms and electronic health records (EHRs). As healthcare organizations prioritize digital transformation, the demand for robust, scalable, and analytics-rich LMS platforms is growing rapidly.

In addition, academic medical institutions are increasingly adopting e-learning platforms and services, driven by the need to provide standardized, scalable, and engaging education to undergraduate medical students, residents, and faculty. The transition to hybrid learning accelerated the use of virtual classrooms, simulation-based training, and AI-driven personalization in medical education. These institutions are now incorporating e-learning into their curricula for various purposes, including theoretical knowledge, clinical skill development, exam preparation, and continuing medical education (CME).

Moreover, medical schools are expanding their reach globally through online programs, creating new revenue models and widening access to medical education. Simulation-based e-learning and case-based virtual modules train students in complex scenarios, including diagnostics, patient communication, and ethical decision-making. As governments worldwide continue investing in digital health infrastructure, e-learning is expected to remain a strategic tool for rapid, scalable workforce education.

Recent Strategic Initiatives in the Healthcare e-Learning Services Market

Institute/ Company

Month & Year

Initiative

Archer Review

April 2025

Archer Review acquired PulsedIn's technology to create student-driven healthcare education communities.

Education Management Solutions (EMS)

February 2025

The Education Management Solutions (EMS) partnered with Lumeto to sell the InvolveXR platform in North America. This collaboration aims to enhance AI-enabled virtual reality healthcare training and management, providing healthcare institutions with a comprehensive suite of innovative tools for improved education and training outcomes.

"By introducing InvolveXR into our catalog of offerings, EMS will be able to provide healthcare education institutions with a holistic solution that combines state-of-the-art VR technology and EMS's robust suite of management and analytics tools.”

-Matt Merino, CEO of EMS.

MGH Institute of Health Professions

October 2024

MGH Institute of Health Professions expanded its partnership with 2U to enhance its online Master of Health Administration program. This collaboration is expected to make the program accessible to learners globally through edX.org, supporting advanced healthcare leadership and management education.

2U

May 2024

2U expanded its partnership with Pepperdine University to launch six new online degree programs in education and healthcare, bringing the total to 12 programs.

The Helper Bees

March 2024

The Helper Bees, a provider of wellness and independence programs for older adults, partnered with BBC Maestro to provide online learning, empowering older adults in Long-Term Care Insurance (LTCI) insureds and Medicare Advantage (MA) beneficiaries.

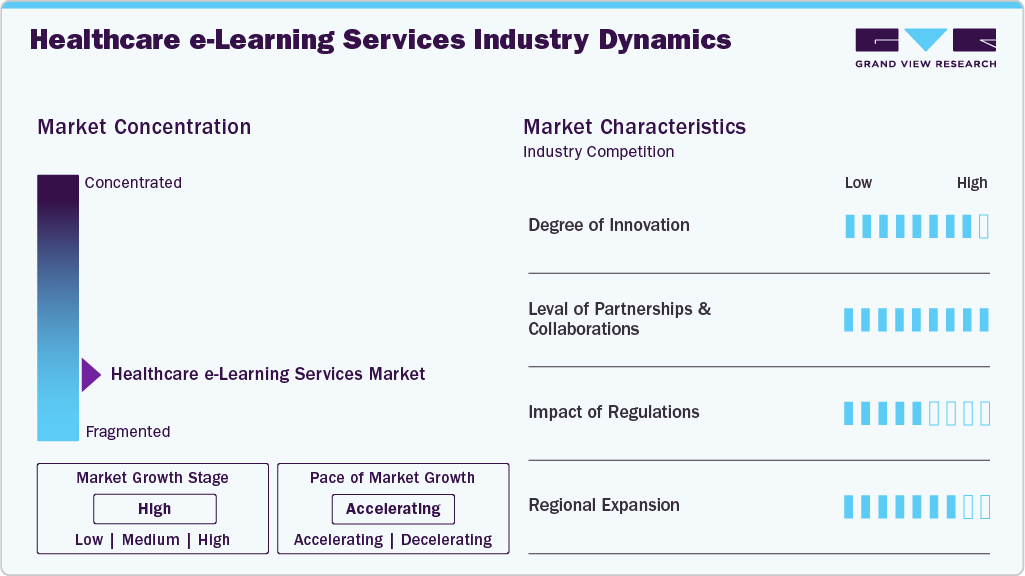

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, level of partnerships & collaborations, degree of innovation, impact of regulations, and regional expansion. The healthcare e-learning services market is fragmented, with the presence of several emerging solution providers dominating the market. The degree of innovation and the level of partnership & collaboration activities is high. The impact of regulations on industry is moderate. Moreover, the regional expansion of the industry is high.

The healthcare e-learning services market in healthcare experiences a high degree of innovation driven by technological advancements. Companies are increasingly launching new products to enhance their market presence. For instance, in April 2024, Osso VR launched Osso Health, a surgical training app for the Apple Vision Pro. This app allows users to practice surgical techniques virtually, focusing on procedures such as total knee replacement and carpal tunnel release.

The industry is experiencing a high level of partnership & collaboration activities undertaken by several key players. This is due to the desire to gain a competitive advantage in the industry, enhance technological capabilities, and consolidate in a rapidly growing market. For instance, in August 2023, Nevvon and Maxwell Healthcare formed a strategic partnership to enhance compliance training for home care agencies. This collaboration enables Maxwell Healthcare to provide its clients with access to Nevvon's extensive library of online training modules, streamlining the training process and effectively addressing compliance challenges.

“At MHA, we believe the ideal future for the post-acute industry begins with empowering caregivers to provide the highest quality care possible. This is why we are delighted to partner with Nevvon. Their transformative e-learning solutions, combined with MHA’s industry influence, provide agencies with higher access, satisfaction, retention, and success.”

-Jay Duty, COO at Maxwell Healthcare Associates

Impact of Regulations:Global regulations governing healthcare e-learning platforms and services are evolving rapidly to ensure that digital medical education is safe, compliant, and effective. In the U.S., platforms offering Continuing Medical Education (CME) must adhere to ACCME (Accreditation Council for Continuing Medical Education) standards. In Addition, HIPAA-compliant platforms are essential when handling case studies or real patient data. In Europe, e-learning providers must comply with the General Data Protection Regulation (GDPR), especially when storing or processing learner or patient-related information. Moreover, health education content must align with the directives of national medical boards or agencies like the European Accreditation Council for CME (EACCME).

Companies providing healthcare e-learning platforms & services sector seek geographic expansion strategies to maintain their foothold in emerging markets and attract customers from these regions.The industry is witnessing high geographical expansion, driven by an increasing customer demand for traditional and AI-based educational platforms. With the growing adoption of digital healthcare solutions, the market is expected to grow significantly in the coming years, especially in developing countries.

Content Type Insights

Based on content type, the clinical training modules segment dominated the market with the largest revenue share of 61.68% in 2024. In addition, this segment is anticipated to grow at the fastest CAGR during the forecast period. Rising demand for clinical skill development, adoption of simulation-based learning, and increased clinical education digitalization are factors contributing to the segment’s growth. Moreover, increasing regulatory and accreditation requirements and a shortage of skilled healthcare workforce increase adoption of clinical training modules, propelling market growth further.

The non-clinical modules segment is expected to grow significantly from 2025 to 2030. With the widespread use of EHRs, telehealth platforms, and AI tools, healthcare support staff need ongoing training on new software systems, cybersecurity, and data entry protocols. Non-clinical training modules help bridge the digital skills gap and ensure consistent use of these systems. Moreover, modules covering compliance, workplace safety, anti-harassment, data security, and ethics are increasingly mandated, thus increasing the use of non-clinical modules.

Delivery Mode Insights

Based on delivery mode, the self-paced learning segment held the largest market share of 32.74% in 2024. Self-paced modules enable learners to access training at any time and from any location, without the limitations of fixed classroom schedules. This flexibility makes them ideal for those who need to learn on the go. In addition, the increasing use of smartphones, tablets, and laptops among healthcare professionals facilitates easy access to modular, mobile-friendly e-learning content. Furthermore, healthcare organizations benefit from the cost-effective delivery and reusability of self-paced content, contributing to the growth of this educational approach.

The instructor-led virtual training segment is expected to grow at the fastest CAGR over the forecast period. Instructor-led virtual training offers scheduled, real-time interaction with expert instructors, allowing for structured learning and immediate clarification of complex topics. Hospitals, nursing colleges, and training centers adopt this delivery mode for cohort-based learning, performance tracking, and scheduled assessments.

Technology Platform Insights

Based on technology platform, the LMS segment accounted for the largest revenue share of 37.56% in 2024. LMS platforms provide a centralized, scalable, and analytics-driven infrastructure to manage healthcare organizations' increasingly complex and diverse training needs. In addition, LMS platforms support modular course design, allowing healthcare systems to personalize learning by role (e.g., nurse, surgeon, admin staff). Moreover, LMS platforms support self-paced modules, instructor-led virtual training (ILVT), assessments, and simulation videos within a unified interface. Thus, the healthcare industry's complex regulatory environment, workforce diversity, and need for consistent, high-quality training demand high adoption of LMS platforms.

The AI-powered personalization segment is anticipated to grow at the fastest CAGR over the forecast period. AI analyzes user profiles, past performance, and job roles to create personalized course paths. In addition, AI tools identify patterns in quiz performance, interaction data, and user behavior to detect knowledge gaps before they impact clinical performance. Furthermore, AI adapts learning methods, such as videos, simulations, and quizzes, based on user preferences and performance, helping to keep learners more engaged. For instance, in November 2023, MedCerts introduced innovative healthcare training programs that integrate Conversational AI, Generative AI, and Natural Language Processing.

“This combination of AI technologies replicates real-life patient cases in the virtual environment, uniquely preparing our students for success in the field.”

-Dana Janssen, Chief Product Officer at MedCerts.

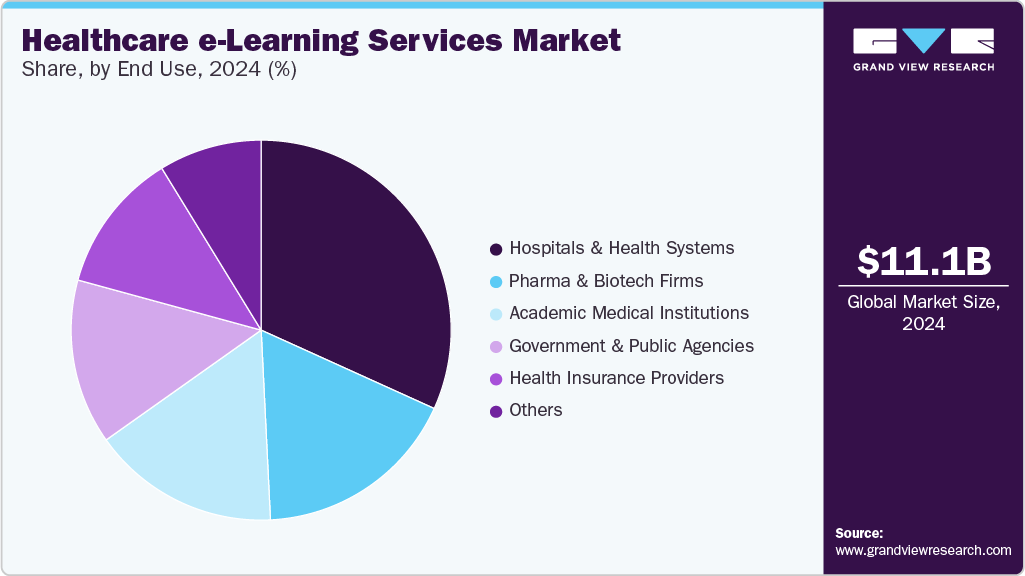

End Use Insights

Based on end use, the hospitals & health systems segment held the largest market share of 31.77% in 2024. This growth is attributed to the increasing need for standardized, scalable, and cost-effective training across a diverse and often overburdened workforce. E-learning helps healthcare institutions meet regulatory demands, reduce training costs, improve clinical outcomes, and support workforce development.

The academic medical institutions segment is anticipated to grow at the fastest CAGR from 2025 to 2030, owing to the rise of advanced content delivery technologies, accreditation, competency-based education, and expanding postgraduate and continuing medical education. In addition, institutions are using e-learning to build online global medical campuses, offering certifications, diplomas, and micro-credentials to international learners, thus fueling market growth further.

Regional Insights

North America Healthcare e-Learning Services Market Trends

North America healthcare e-learning services market accounted for the largest revenue share of 54.76% in 2024. This is attributed to a well-established digital infrastructure and a strong emphasis on continuous professional development. Integrating advanced technologies such as AI and VR into medical training enhances interactive learning experiences. In addition, regulatory mandates for ongoing education and the need to address workforce shortages contribute to adopting e-learning platforms.

U.S. Healthcare e-Learning Services Market Trends

The healthcare e-learning services market in the U.S. held the largest market share in 2024. The market benefits from substantial investments in digital education. In addition, the presence of leading e-learning providers and widespread internet accessibility facilitates the delivery of online medical education. Moreover, the need for upskilling due to advancing healthcare technologies and practices fuels the expansion of e-learning services. For instance, in July 2024, HomeCEU launched a new website to improve access to continuing education for healthcare & rehabilitation professionals across the U.S.

“We understand the unique needs of healthcare professionals because we are health professionals. Our goal with this new website is to provide visitors with an easier way to find and complete healthcare CE, review information needed about licensure renewal, and utilize our free resources.”

-Jami Cooley, Director of Marketing, Healthcare, at Colibri Group (parent company of HomeCEU)

Europe Healthcare e-Learning Services Market Trends

Europe healthcare e-learning services market is expected to witness significant growth during the forecast period. The market is influenced by the European Union's digital education initiatives and the need for standardized training across member states. Countries such as Germany and the UK are leveraging e-learning to address healthcare workforce shortages and to provide accessible training solutions. The emphasis on multilingual content and compliance with EU regulations ensures the effectiveness and reach of e-learning programs. Moreover, the presence of EU regulatory standards encouraging harmonization of training across member states also drives the adoption of standardized, accredited e-learning services.

Healthcare e-learning services market in the UK is expected to grow over the forecast period. The UK’s NHS Learning Hub and Health Education England initiatives are reshaping medical education delivery, with a focus on improving clinical competencies and compliance training. For instance, in May 2022, Imperial launched three online courses on public health for all NHS staff. These courses aim to enhance public health knowledge and practice among healthcare professionals, contributing to improved health outcomes within the National Health Service.

Germany healthcare e-learning services market is expected to grow over the forecast period. This is attributed to the growing shortages of skilled healthcare professionals, the high adoption of mobile devices, and robust internet infrastructure, which ensure seamless access to e-learning platforms. In addition, the Digital Healthcare Act (DVG) promotes the use of digital solutions, including e-learning for clinical staff. Hospitals and medical schools are increasingly adopting virtual simulation labs and interactive modules to meet continuous education mandates.

Asia Pacific Healthcare e-Learning Services Market Trends

Asia Pacific healthcare e-learning services market is projected to experience growth at the fastest CAGR from 2025 to 2030. Increasing demand for healthcare services, government support for digital education, and the expansion of mobile technology are factors contributing to the market growth. In addition, favorable government initiatives that support and promote the adoption of AI-based technologies by healthcare organizations are anticipated to boost market growth. Moreover, rising healthcare expenditure and technological advancements in healthcare IT contribute to market growth.

Healthcare e-learning services market in Japan is expected to grow significantly over the forecast period. Japan’s aging population and emphasis on geriatric care training have driven the adoption of e-learning in nursing and allied health. Advanced IT infrastructure and high internet penetration have enabled the delivery of AI-integrated simulation tools and multilingual content.

Healthcare e-learning services market in India is expected to grow rapidly, owing to the shortage of healthcare professionals, especially in rural areas, increasing smartphone penetration, and government’s support for digital health. For instance, in March 2019, Medvarsity Online Ltd. and Lecturio.com partnered to deliver Digital Education for Medical Colleges in India.

Latin America Healthcare e-Learning Services Market Trends

Latin America healthcare e-learning services market is anticipated to grow at a significant CAGR over the forecast period. This is attributed to the increasing efforts to improve healthcare access and education in remote areas. Government initiatives and partnerships with international organizations facilitate the development and implementation of e-learning programs across the region.

Middle East and Africa Healthcare e-Learning Services Market Trends

Middle East and Africa healthcare e-learning services market is expected to grow at a significant CAGR over the forecast period. This is attributed to the increasing demand for healthcare services and the need for efficient training methods. In addition, investments in digital infrastructure and government support for e-learning initiatives contribute to the market's expansion.

The UAE healthcare e-learning services market is expected to grow rapidly over the forecast period. In the UAE, initiatives like the National Innovation Strategy and Vision 2021 promote the integration of smart technologies, including digital learning tools, in medical training and CME. For instance, in August 2022, Thumbay Group launched Healthvarsity, the region's first online healthcare education platform. This innovative initiative aims to provide over 200 quality medical courses, positioning the UAE as a hub for advanced medical education and state-of-the-art healthcare, enhancing learning opportunities for healthcare professionals.

Key Healthcare e-Learning Services Company Insights

Key players operating in the healthcare e-learning services market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as new product launches and partnerships are playing a key role in propelling the market growth.

Key Healthcare e-Learning Services Companies:

The following are the leading companies in the healthcare e-learning services market. These companies collectively hold the largest market share and dictate industry trends.

- Resbee info Technologies Pvt Ltd.

- AcademyOcean

- AMBOSS

- Xpeer MedEd SL

- Wolters Kluwer N.V.

- HITE GLOBE GROUP PVT LTD

- Capita plc.

- Day One Technologies Ltd

- G-Cube

- Goavega Software

- Aurion Learning

- Learning Nurse Resources Network

- Docebo

- Relias

- MedBridge, Inc.

- Coursera

- SAP Litmos

- Cornerstone OnDemand

- Scitent

- CAE Healthcare

- Axonify

Recent Developments

-

In December 2024, Johnson & Johnson participated in the inauguration of the WHO Academy, committing a USD 7 million grant to the Institut de France. This funding is expected to support the Academy in providing both online and in-person educational opportunities, aimed at enhancing the training and education of health workers worldwide.

-

In October 2024, MGH Institute of Health Professions expanded its partnership with 2U to enhance its online Master of Health Administration program. This collaboration is expected to make the program accessible to learners globally through edX.org, supporting advanced healthcare leadership and management education.

-

In September 2024, Arthrex introduced OrthoPedia Patient, an online learning tool designed for orthopedic patients. This resource offers educational content, including videos and animations, to help patients understand common orthopedic conditions, injuries, and the latest treatment options, enhancing their knowledge and engagement in their healthcare journey.

"OrthoPedia Patient was created as part of our long-standing commitment to medical education and our mission of Helping Surgeons Treat Their Patients Better. This comprehensive website provides health care professionals and patients understandable educational resources when navigating the most common orthopedic conditions, injuries and treatment options as surgical technology rapidly evolves."

-Arthrex President and Founder Reinhold Schmieding

-

In April 2024, FranU launched a new hub aimed at enhancing professional development for healthcare workers.

“In Baton Rouge alone, we have more than 30,000 people employed in the healthcare sector and in Louisiana, there are 300,000 people who work in our industry, highlighting a clear need for upscaled and targeted training. We are thrilled to offer these advanced learning opportunities and to be a major partner in the state’s workforce development. From specific nursing skills to finance in healthcare, there will be options that help all ranges of healthcare professionals continue to best care for our friends and neighbors.”

-FranU Assistant Professor and Director of Health Administration Laurinda Calongne

-

In December 2022, the Postgraduate Institute for Medicine and VieCure partnered to provide continuing medical education (CME) for multidisciplinary cancer care teams using the VieCure platform.

-

In February 2022, Vivactis Group launched a virtual 3D gamification platform for healthcare education. The platform allows participants to engage in treating clinical cases, enhancing their learning experience through interactive simulations that mimic real medical scenarios.

-

In February 2021, Olympus introduced the "Olympus Continuum," a global educational platform for healthcare professionals.

Healthcare e-Learning Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 12.38 billion

Revenue forecast in 2030

USD 24.45 billion

Growth rate

CAGR of 14.58% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Content type, delivery mode, technology platform, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Resbee info Technologies Pvt Ltd.; AcademyOcean; AMBOSS; Xpeer MedEd SL; Wolters Kluwer N.V.; WHITE GLOBE GROUP PVT LTD; Capita plc.; Day One Technologies Ltd; G-Cube; Goavega Software; Aurion Learning; Learning Nurse Resources Network; Docebo; Relias; MedBridge, Inc.; Coursera; SAP Litmos; Cornerstone OnDemand; Scitent; CAE Healthcare; Axonify

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Healthcare e-Learning Services Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global healthcare e-learning services market report based on content type, delivery mode, technology platform, end use, and region.

-

Content Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical Training Modules

-

Non-clinical Modules

-

-

Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Self-paced Learning

-

Instructor-led Virtual Training

-

Blended E-learning

-

Simulation-based E-learning

-

-

Technology Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

LMS

-

Mobile Learning Platforms

-

AI-powered Personalization

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Health Systems

-

Pharma & Biotech Firms

-

Academic Medical Institutions

-

Health Insurance Providers

-

Government & Public Agencies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global healthcare e-learning services market size was estimated at USD 11.10 billion in 2024 and is expected to reach USD 12.38 billion in 2025.

b. The global healthcare e-learning services market is expected to grow at a compound annual growth rate of 14.58% from 2025 to 2030 to reach USD 24.45 billion by 2030.

b. The clinical training modules segment held the largest market share of 61.68% in 2024.

b. Some key players operating in the healthcare e-learning services market include Resbee info Technologies Pvt Ltd.; AcademyOcean; AMBOSS; Xpeer MedEd SL; Wolters Kluwer N.V.; WHITE GLOBE GROUP PVT LTD; Capita plc.; Day One Technologies Ltd; G-Cube; Goavega Software; Aurion Learning; Learning Nurse Resources Network; Docebo; Relias; MedBridge, Inc.; Coursera; SAP Litmos; Cornerstone OnDemand; Scitent; CAE Healthcare; and Axonify.

b. Key factors that are driving the healthcare e-learning services market are increasing demand for clinical training modules, rising preference for self-paced learning, and growing adoption of LMS platforms for centralized training and compliance management.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.