- Home

- »

- Pharmaceuticals

- »

-

Hemoglobinopathies Market Size And Share Report, 2030GVR Report cover

![Hemoglobinopathies Market Size, Share & Trends Report]()

Hemoglobinopathies Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Thalassemia, Sickle Cell Disease, Other Hemoglobin (Hb) Variants), By Diagnosis, By Therapy, By Region, And Segment Forecasts

- Report ID: 978-1-68038-736-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

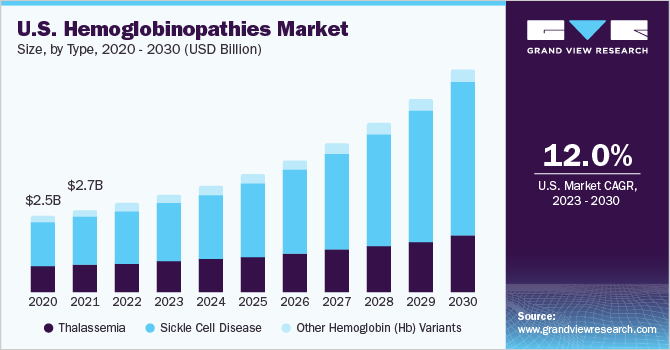

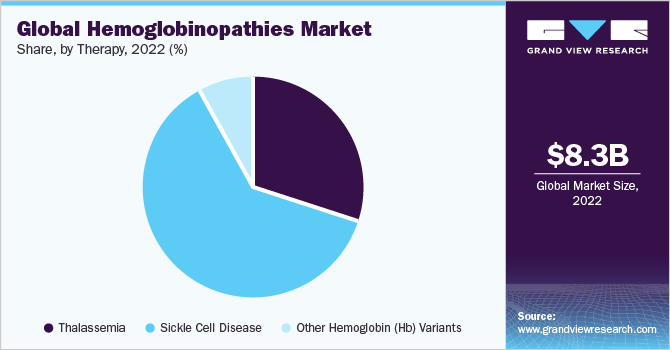

The global hemoglobinopathies market size was valued at USD 8.28 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 12.6% from 2023 to 2030. The increasing prevalence of conditions such as sickle cell disease and thalassemia, strong product pipeline for treating hemoglobinopathies, are the major factors driving the market for hemoglobinopathies. As per WHO estimates, thalassemia affects around 4.4 per 10,000 live births globally. Furthermore, the WHO also states that over 330,000 babies are born with hemoglobin disorders yearly. The COVID-19 pandemic has had a significant impact on the market. The disruption of healthcare services, including reduced access to diagnostics and treatments, has adversely affected individuals with hemoglobinopathies.

Clinical trials for new therapies have also faced delays and interruptions, potentially slowing down advancements in the field due to the COVID-19 pandemic. However, the pandemic has increased awareness of the vulnerabilities of individuals with hemoglobinopathies and highlighted the importance of maintaining essential care and support services for these patients during public health emergencies.

The market is experiencing significant growth due to several factors. One notable trend is the development and commercialization of novel therapies, including gene editing and gene therapies, aimed at addressing the underlying genetic abnormalities in hemoglobinopathies. For instance, in August 2022, the U.S. Food and Drug Administration approved the first cell-based gene therapy Zynteglo (betibeglogene autotemcel), for treating Adult and Pediatric Patients suffering from Beta-thalassemia. Moreover, in May 2020, Vertex Pharmaceuticals and CRISPR Therapeutics Incorporated announced that the USFDA granted Regenerative Medicine Advanced Therapy label to CTX001, an autologous, investigational, gene-edited hematopoietic stem cell therapy, for treating the transfusion-dependent beta-thalassemia and sickle cell disease.

The market is also witnessing increased investment in research and development and collaborations between pharmaceutical companies and academic institutions to advance innovative treatment options. For instance, in October 2022, in a USD 5.4 billion deal, Pfizer acquired Global Blood Therapeutics, a biopharmaceutical firm specializing in the research, development, and distribution of life-altering therapies that offer hope to underserved patient communities beginning with sickle cell disease (SCD). Additionally, a rising focus is on improving access to affordable and equitable hemoglobinopathy treatments worldwide. For instance, in July 2022, the Vice President of India inaugurated an advanced diagnostic laboratory and blood transfusion unit at Hyderabad's sickle cell and thalassemia society.

The increasing prevalence of hemoglobinopathies in developing and low-income countries is anticipated to boost market growth over the forecast period. According to the CDC, it is estimated that about 1,000 people in the United States have thalassemia. Thalassemia is more prevalent among individuals of Mediterranean, African, and Southeast Asian descent. Beta thalassemia, particularly beta thalassemia major, is the most severe condition. Furthermore, According to the CDC, SCD affects approximately 100,000 Americans. It is more common among individuals of African descent, although it can also occur in other populations. It is estimated that about 1 in 365 African Americans and 1 in 16,300 Hispanic Americans are born with sickle cell disease.

The launch of technologically advanced products for diagnosis, coupled with numerous government initiatives, is another major factor augmenting the market growth. For instance, in June 2021, Hemex Health launched Company's first virtual upgrade to its Sickle Cell Disease test and Gazelle platform. In many nations, Gazelle incorporates miniature versions of well-known technologies, cutting-edge optics, and artificial intelligence to detect malaria and sickle cell illness. This adaptable strategy enables the business to grow to new people and continuously add ailments to its menu of tests. In addition, in June 2021, a team of scientists at the Indian Institute of Science developed a diagnostic test to identify sickle cell trait and sickle cell disease.

Type Insights

The sickle cell disease segment held the largest share of 58.61% of the market in 2022 and is expected to grow at the fastest CAGR during the forecast period. This is attributed to biopharmaceutical companies' growing initiatives, and nonprofit organizations focused on improving access to SCD treatment. Furthermore, SCD affects around 300,000 newborns annually. An estimated 10% to 40% of the individuals in many African countries are carriers of the sickle cell gene, which has resulted in a prevalence of around 2% in these countries. The increasing global disease burden is expected to fuel market growth over the forecast period.

In addition, awareness programs for disease diagnosis play an important role in the market's growth. For instance, in the United States, various sickle cell disease awareness programs focus on promoting early diagnosis and providing support. Organizations like the Sickle Cell Disease Association of America (SCDAA) and local chapters organize educational events, community workshops, and health fairs. They collaborate with healthcare professionals to offer free or subsidized screenings, genetic counseling, and educational resources to increase awareness and improve early detection of sickle cell disease among high-risk populations.

Furthermore, several scientific facilities are conducting trials to develop new cures and methods for these diseases. For instance, in May 2023, the researchers and scientists at the University of Colorado successfully treated a patient with SCD, who is now cured due to a clinical trial for gene therapy.

Diagnosis Insights

The sickle cell disease diagnosis segment dominated the market and accounted for a 50.46% share in 2022 and is expected to grow at fastest CAGR during the forecast period. The sickle cell disease diagnosis market has witnessed prominent trends in recent years. One substantial trend is the development and adoption of innovative diagnostic technologies. Advances in genetic testing, including next-generation sequencing and molecular diagnostics, have enabled more accurate and efficient identification of sickle cell disease and its variants. Point-of-care testing (POCT) devices and rapid diagnostic kits have also emerged, allowing for quick and convenient screening in various healthcare settings. For instance, in May 2023, Molbio Diagnostics collaborated with ShanMukha Innovations to design, develop, and commercialize reasonably priced point-of-care diagnostic devices for diagnosing hemoglobinopathy-related diseases.

The market for hemoglobinopathies has also seen an increased focus on newborn screening programs, ensuring early detection and timely interventions. Furthermore, there is a growing emphasis on expanding access to diagnostic services in underserved regions, improving overall patient care and outcomes.

Therapy Insights

The sickle cell disease segment held the largest revenue share of 62.05% of the hemoglobinopathies market in 2022 and is expected to grow at fastest CAGR during the forecast period. Development and approval of novel therapies, including gene therapies and targeted therapies, aimed at modifying the underlying genetic abnormalities or managing disease symptoms is one of the major factor driving the market growth. In addition, stem cell transplantation, particularly from matched unrelated donors, is also gaining traction as a curative treatment option. Additionally, there is a growing focus on supportive care interventions such as pain management, infection prevention, and hydroxyurea therapy. Furthermore, there is an increasing emphasis on personalized medicine approaches and patient-centric care models to optimize treatment outcomes for individuals with sickle cell disease.

Blood transfusion is considered to be the first line of treatment for hemoglobin disorders. The frequency of blood transfusion is higher in thalassemia cases as compared to other hemoglobinopathies. The transfusion is done every 3 to 4 weeks to help maintain the normal level of blood components. However, blood transfusion at frequent intervals increases the risk of acquiring infectious diseases and high blood iron levels. In 2020, the blood supply was interrupted because of a complete lockdown due to COVID-19 in many countries. This supply has now gotten back up and is expected to reach its potential status over the forecast period.

Bone marrow transplant (BMT) therapy is expected to expand at a significant growth rate over the forecast period. BMT is often used when blood transfusion and other therapies fail. BMT is reported to be effective when performed in the early stages of disease progression. It helps to provide healthy bone marrow to patients who are unable to produce a sufficient number of normal cells. BMT infuses healthy stem cells in the patient’s body to replace the diseased or damaged bone marrow and is increasingly being used to treat severe cases of sickle cell disease and thalassemia.

Regional Insights

North America held the largest revenue share of 37.77% of the market in 2022, owing to increasing awareness of hemoglobinopathies among people and improving healthcare facilities. Various organizations spread awareness by conducting different programs. For instance, SCDAA is a national organization in the United States that promotes awareness, advocacy, and support for individuals and families affected by sickle cell disease. They provide resources and educational materials and host events to increase understanding and improve the lives of those with the condition. Various initiatives undertaken by research organizations and government bodies to promote research to develop novel therapies for treating hemoglobinopathies are likely to contribute to the market growth in the region.

Asia Pacific is anticipated to exhibit the fastest growth rate over the forecast period. The presence of many patients with sickle cell disease and thalassemia is expected to propel market growth in the coming years. Favorable government initiatives to improve the standard of care provided to patients affected with hemoglobinopathies contribute to the region's market growth. For instance, in May 2023, the Union Minister of State for Health and Family Welfare launched the third phase of the Thalassemia Bal Sewa Yojana of the Health Ministry. The government also launched Thalassemia Bal Sewa Yojana Portal.

Key Companies & Market Share Insights

Market players are taking up various initiatives, such as mergers & acquisitions, partnerships, collaborations, and extensive R&D, in order to gain a greater share in the market. In March 2023, Bluebird Bio submitted application for its sickle cell gene therapy, lovo-cel to FDA for approval. The drug upon approval would compete with CRISPR Therapeutics and Vertex Pharmaceuticals. The therapy is expected to be commercialized by second half of 2023. Some prominent players in the global hemoglobinopathies market include:

-

Sangamo Therapeutics, Inc.

-

Global Blood Therapeutics, Inc.

-

bluebird bio, Inc.

-

Emmaus Life Sciences Inc.

-

Pfizer, Inc.

-

Novartis AG

-

Prolong Pharmaceuticals, LLC

-

Bioverativ Inc.

-

Gamida Cell

-

Celgene Corporation

Hemoglobinopathies Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 9.02 billion

Revenue forecast in 2030

USD 20.70 billion

Growth Rate

CAGR of 12.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, diagnosis, therapy, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Russia; Denmark; Sweden; Norway; India; China; Japan; Singapore; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Sangamo Therapeutics; bluebird bio, Inc.; Global Blood Therapeutics, Inc.; Pfizer, Inc.; Emmaus Life Sciences, Inc.; Prolong Pharmaceuticals, LLC; Celgene Corporation; Bioverativ Inc.; Gamida Cell; Novartis AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional and segment scope.

Global Hemoglobinopathies Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-markets from 2018 to 2030. For this study, Grand View Research has segmented the global hemoglobinopathies market report based on type, diagnosis, therapy, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Thalassemia

-

Sickle Cell Disease

-

Other Hemoglobin (Hb) Variants

-

-

Diagnosis Outlook (Revenue, USD Million, 2018 - 2030)

-

Thalassemia

-

Blood Test

-

Genetic Test

-

Prenatal Genetic Test

-

Pre-implantation Genetic Diagnosis

-

Electrophoresis

-

Others

-

-

Sickle Cell Disease

-

Blood Test

-

Genetic Test

-

Prenatal Genetic Test

-

Electrophoresis

-

Others

-

-

Other Hemoglobin (Hb) Variants

-

Blood Test

-

Genetic Test

-

Prenatal Genetic Test

-

Electrophoresis

-

Others

-

-

-

Therapy Outlook (Revenue, USD Million, 2018 - 2030)

-

Thalassemia

-

Blood Transfusion

-

Iron Chelation Therapy

-

Bone Marrow Transplant

-

Others

-

-

Sickle Cell Disease

-

Blood Transfusion

-

Hydroxyurea

-

Bone Marrow Transplant

-

Others

-

-

Other Hemoglobin (Hb) Variants

-

Blood Transfusion

-

Hydroxyurea

-

Iron Chelation Therapy

-

Bone Marrow Transplant

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Italy

-

Spain

-

Russia

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Singapore

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Argentina

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Saudi Arabia

-

United Arab Emirates

-

South Africa

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hemoglobinopathies market size was estimated at USD 8.28 billion in 2022 and is expected to reach USD 9.02 billion in 2023.

b. The global hemoglobinopathies market is expected to grow at a compound annual growth rate of 12.6% from 2023 to 2030 to reach USD 20.70 billion by 2030.

b. Sickle cell disease dominated the hemoglobinopathies market with a share of 62.05% in 2022. This is attributable to increasing efforts to improve patient awareness about the disorder and subsequent improvement in diagnosis and treatment.

b. Some key players operating in the hemoglobinopathies market include Sangamo Therapeutics, Inc., Global Blood Therapeutics, Inc., bluebird bio, Inc., Emmaus Life Sciences Inc., Gamida Cell, Pfizer, Inc., and others.

b. Key factors that are driving the hemoglobinopathies market growth include increasing cases of sickle cell disease & thalassemia and the presence of a strong product pipeline for the treatment of hemoglobinopathies.

b. North America held the largest revenue share of 37.77% in the hemoglobinopathies market during the year 2022, owing to increasing awareness of hemoglobinopathies among people and improving healthcare facilities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.