- Home

- »

- Medical Devices

- »

-

Hemostasis Valve Market Size & Share, Industry Report 2033GVR Report cover

![Hemostasis Valve Market Size, Share & Trends Report]()

Hemostasis Valve Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Hemostasis Valve Y- Connectors, Double Y- Connector Hemostasis Valves), By Application (Angiography, Angioplasty), By End Use, By Region and Segment Forecasts

- Report ID: GVR-4-68040-342-2

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hemostasis Valve Market Summary

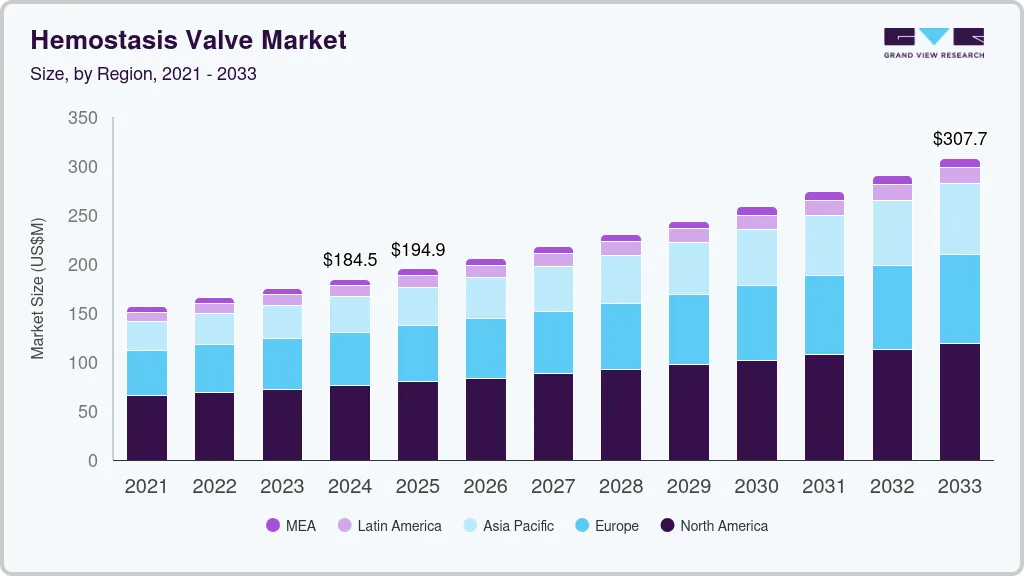

The global hemostasis valve market size was estimated at USD 184.5 million in 2024 and is projected to reach USD 307.7 million by 2033, growing at a CAGR of 5.9% from 2025 to 2033. The increasing prevalence of cardiovascular diseases, supportive regulatory frameworks, rising geriatric population, and technological advancements are significantly driving the market growth.

Key Market Trends & Insights

- North America dominated the hemostasis market with a revenue share of 41.1% in 2024.

- The U.S. hemostasis valve market is one of the largest globally.

- Based on type, the hemostasis valve y-connectors segment held the largest market share of 37.4% in 2024.

- Based on application, the angiography segment held the largest market share of 64.4% in 2024.

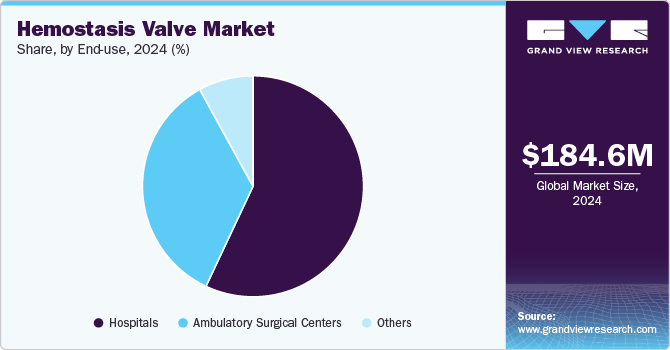

- Based on end-use, the hospitals segment held the largest market share of 57.36% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 184.5 Million

- 2033 Projected Market Size: USD 307.7 Million

- CAGR (2025-2033): 5.9%

- North America: Largest market in 2024

The World Heart Report 2024 highlights that air pollution worsens all major cardiovascular diseases (CVDs). In 2019, nearly 70% of the 4.2 million deaths linked to ambient air pollution were due to cardiovascular issues, particularly ischaemic heart disease (1.9 million deaths) and stroke (900,000 deaths). This, in turn, drives the demand for diagnostic and therapeutic procedures like angiography and angioplasty, where hemostasis valves are essential to ensure patient safety by controlling blood flow during catheterization procedures.

The growing preference for minimally invasive procedures is another significant factor propelling the market growth. Minimally invasive techniques offer numerous benefits over traditional open surgeries, including reduced pain, shorter hospital stays, faster recovery times, and lower risk of complications. As a result, there is a heightened demand for medical devices that facilitate these procedures. Hemostasis valves are integral to minimally invasive catheter-based interventions, as they enable precise control of blood flow and prevent leakage during the procedure. In June 2024, an article in the Journal of the Society for Cardiovascular Angiography & Interventions discussed how hemostasis during transfemoral transcatheter aortic valve replacement (TAVR) is usually achieved with a suture-mediated vascular closure device (VCD) via a preclosure technique. Recently, a hybrid approach has been introduced, incorporating a collagen-plug VCD after sheath removal in cases where hemostasis fails.

The global demographic landscape is undergoing a notable shift towards aging, driven by declining birth rates and advancements in healthcare that have prolonged life expectancy. According to the World Health Organization (WHO), the number of people aged 60 years and older is expected to double by 2050, reaching approximately 2.1 billion globally. This demographic transition underscores the increasing prevalence of age-related conditions, including cardiovascular diseases (CVDs) among older adults. According to the article published by the American Heart Association in November 2023, heart failure is a widespread and multifaceted cardiovascular condition impacting more than 6.7 million Americans, particularly prevalent among individuals aged 65 and older. The aging population is susceptibility to cardiovascular diseases drive the demand for diagnostic and therapeutic procedures, driving the market growth.

Technological advancements in medical devices are pivotal in driving the market growth. Materials, design, and functionality innovations have developed more effective and reliable hemostasis valves. For instance, using advanced polymers and coatings has improved the durability and biocompatibility of these devices, reducing complications such as thrombosis and infection. In addition, incorporating novel features such as easy-to-use locking mechanisms and enhanced sealing capabilities has increased the efficiency of hemostasis valves in clinical settings. For instance, the WATCHDOG Hemostasis Valve by Boston Scientific Corporation incorporates an innovative cross-slit design to minimize leakage, complemented by an 8F inner lumen that simultaneously accommodates multiple devices. In addition, it includes a thumb rest feature designed for enhanced comfort during procedures. The design elements collectively contribute to reducing blood loss and the risk of air embolism, prioritizing patient safety throughout medical interventions. These technological improvements ensure that procedures are safer and more efficient, boosting the adoption of hemostasis valves.

Market Concentration & Characteristics

The degree of innovation in the hemostasis valve industry is high, driven bythe increasing demand for more efficient and precise devices in minimally invasive surgeries. Manufacturers are focusing on improving valve designs for better blood flow control, enhanced safety, and ease of use. Technological advancements in materials, automation, and integration with other surgical instruments are also contributing to innovation in the market, aiming to provide more effective solutions for complex interventional procedures.

The level of mergers and acquisitions in the hemostasis valve industry is medium. While large medical device companies occasionally acquire smaller firms to expand their portfolios and gain access to innovative technologies, the market is not experiencing an overwhelming amount of consolidation. M&A activity tends to be more focused on companies that specialize in complementary medical devices or those that provide niche products in the broader hemostasis and surgical intervention space.

Regulations play a significant role in the hemostasis valve industry, and their impact is high,as medical devices are subject to strict regulatory standards in most regions, including FDA approval in the U.S. and CE marking in Europe. These regulations ensure the safety and efficacy of devices, but they also create barriers to entry for new companies and can delay the launch of new products. Companies must navigate complex approval processes, which can influence the speed of innovation and market entry.

Product expansion in the hemostasis valve industry is medium,as companies are continuously improving and expanding their product offerings to cater to different types of interventional procedures. However, the market's focus remains on refining existing products rather than launching entirely new categories of devices. Manufacturers are introducing new features such as user-friendly designs, improved durability, and compatibility with a wider range of surgical applications to meet evolving healthcare needs.

Regional expansion in the hemostasis valve industry is high,increasing demand in emerging markets, particularly in Asia Pacific, Latin America, and the Middle East. As healthcare infrastructure improves and the adoption of minimally invasive procedures rises globally, manufacturers are expanding their presence in these regions. In addition, companies are entering untapped markets in countries such as India, China, and Brazil, where healthcare spending and the need for advanced medical technologies are rapidly growing.

Type Insights

Based on type, the hemostasis valve y-connectors segment held the largest market share of 37.4% in 2024, owing to their versatile functionality, extensive clinical adoption, and pivotal role in enhancing patient outcomes during minimally invasive procedures. Their ability to facilitate multiple device manipulations while maintaining hemostasis and their proven reliability and ongoing innovations ensure their dominant position in the global market. For instance, OKAY II by Nipro is a hemostatic connector designed to minimize blood loss during medical procedures effectively. Its spacious 3.33mm inner diameter accommodates a wide range of Percutaneous Coronary Intervention (PCI) devices and techniques, ensuring versatility and compatibility in clinical settings. As the demand for minimally invasive cardiovascular interventions continues to rise, the importance and utilization of Y-connectors are expected to grow, further reinforcing their market leadership.

The one-handed hemostasis valve segment is expected to grow at the fastest CAGR of 6.6% during the forecast period. This growth is attributed to their ergonomic design, technological advancements, and expanding applications. Traditional hemostasis valves require two hands to operate, making them cumbersome and time-consuming. One-handed hemostasis valves allow clinicians to control blood flow and manage catheters with a single hand, freeing the other hand for additional tasks. For instance, Merit Medical Systems offers the PhD Hemostasis Valve, which enhances interventional procedures through its intuitive one-handed, push-and-release mechanism. This design allows clinicians to easily manage their instruments while maintaining control over the valve, simplifying the overall process.

Application Insights

The angiography segment, categorized by application, held the largest market share of 64.4% in 2024 and is expected to grow at the fastest CAGR of 6.1% during the forecast period. This predominance is primarily attributed to the rising number of angiographic procedures performed globally. According to the article published by the National Library of Medicine in September 2023, coronary angiography (CAG) is the gold standard for diagnosing obstructive coronary artery disease (CAD). Approximately 4 million angiograms are annually performed across Europe and the U.S., underscoring its critical role in cardiovascular care. This advanced imaging technique allows for precise visualization of coronary arteries, aiding in identifying significant blockages.

The angioplasty segment is also expected to grow at a significant CAGR during the forecast period. The increasing prevalence of cardiovascular diseases, technological advancements, a shift towards minimally invasive procedures, the expansion of healthcare infrastructure in emerging economies, and rising awareness about early diagnosis and treatment drive the market growth. In May 2024, Qosina offers a diverse range of hemostasis valve connectors designed to minimize fluid loss during interventional and diagnostic procedures. The valves feature a rotating male luer lock and a silicone gasket for secure sealing, made from clear polycarbonate to enhance fluid visibility. They accommodate devices up to 10 FR and come with sterilization options, meeting USP Class VI criteria.

End-use Insights

The hospitals segment, categorized by end use, held the largest market share of 57.36% in 2024. This dominance can be attributed to its advanced medical infrastructure, high volume of procedures, role in emergency and critical care, comprehensive patient care approach, adoption of technological advancements, and regulatory and reimbursement support. Hospitals have advanced medical infrastructure and state-of-the-art facilities for performing diagnostic and therapeutic procedures. These factors collectively highlight the pivotal role of hospitals in utilizing hemostasis valves for a wide range of medical interventions, ensuring patient safety and improving clinical outcomes.

The ambulatory surgical centers (ASCs) segment is the fastest-growing application in the hemostasis valve market. owing to the shift towards minimally invasive procedures, cost-effectiveness and efficiency, patient convenience and accessibility, technological advancements, increasing number of ASCs, and regulatory and reimbursement support. ASCs are becoming integral to the healthcare landscape, offering high-quality, efficient, and patient-friendly alternatives to traditional hospital-based care. Many healthcare systems and insurance providers recognize the cost-efficiency of ASCs and are more willing to reimburse procedures conducted in these settings. This financial support encourages more healthcare providers to adopt ASCs for various medical interventions, including those requiring hemostasis valves.

Regional Insights

North America dominated the hemostasis market with a revenue share of 41.1% in 2024. The region boasts one of the most advanced healthcare systems in the world, equipped with state-of-the-art facilities and cutting-edge medical technologies. This robust infrastructure supports a wide range of complex medical procedures, including those that require hemostasis valves. Hospitals and healthcare centers across the region are well-equipped with the latest medical devices, ensuring high standards of care and efficient patient management. In August 2024, BioCardia, Inc. received FDA clearance for its Morph DNA Steerable Introducer product family, designed for introducing medical instruments into the vascular system. This advanced product line, featuring bidirectional steering and an innovative hemostasis valve, aims to enhance various interventional procedures by improving navigation and control.

U.S. Hemostasis Valve Market Trends

The U.S. hemostasis valve market is one of the largest globally, driven by the high demand for minimally invasive surgical procedures and the increasing prevalence of cardiovascular and diagnostic procedures. In July 2024, the CDC reported that over 944,800 Americans die from heart disease or stroke each year, accounting for over one-third of all deaths. These conditions also impose an economic burden, costing the healthcare system USD 254 billion annually and resulting in USD 168 billion in lost workplace productivity. The market is supported by advanced healthcare infrastructure, the rising number of surgeries, and technological advancements in valve designs. Key players in the U.S. market offer innovative hemostasis valves, which help in controlling bleeding during catheter-based interventions and improving procedural efficiency.

Europe Hemostasis Valve Market Trends

The hemostasis valve market in Europe is characterized by its advanced healthcare infrastructure, significant burden of cardiovascular diseases, stringent regulatory frameworks, and emphasis on minimally invasive procedures. In October 2023, the European Commission noted that in 2021, 1.1 million transluminal coronary angioplasty procedures were carried out in 25 EU countries. Croatia had the highest rate at 553 procedures per 100,000 inhabitants, followed by Germany with 390, and Latvia, Austria, and Bulgaria with 328, 324, and 303 respectively. These factors collectively create a dynamic and promising landscape for the market growth in Europe, ensuring its continued growth and development in the coming years.

The UK market for hemostasis valve is driven by the increasing number of diagnostic and interventional procedures, such as angioplasty and endoscopy, where hemostasis valves play a critical role in managing blood loss. The market is also supported by advancements in minimally invasive technologies, where hemostasis valves are essential in maintaining vascular access during surgeries. With the UK healthcare system’s focus on improving patient outcomes and reducing complications, the adoption of hemostasis valves is expected to continue rising, contributing to the market's growth.

Germany hemostasis valve market is driven by its advanced healthcare system, high adoption rate of medical technologies, and a large volume of cardiovascular and endovascular surgeries. The market benefits from Germany's focus on quality healthcare services and innovation in medical devices, which includes the integration of advanced hemostasis valves in procedures such as catheterization and stent placements. In November 2024, a study compared two hybrid vascular closure strategies after transcatheter aortic valve implantation: ProGlide/AngioSeal (P/AS) and ProGlide/FemoSeal (P/FS). The findings indicated that P/AS was associated with higher rates of major and minor bleeding and lower successful hemostasis compared to P/FS. In addition, anterior wall calcification at the access site significantly increased the risk of complications.

Asia Pacific Hemostasis Valve Market Trends

The Asia Pacific region is rapidly expanding in the hemostasis valve market, driven by increasing healthcare investments, rising awareness about minimally invasive procedures, and the growing burden of chronic diseases such as cardiovascular conditions and diabetes. Countries such as China, Japan, and India are seeing a surge in diagnostic and surgical interventions that require the use of hemostasis valves. In April 2024, a study assessed the 10-year cardiovascular disease (CVD) risk among Thai physicians, revealing that 20% exhibited moderate to very high risk. It found that 33.6% of these physicians had a higher risk compared to the general population of the same age and gender. The prevalence of coronary artery disease (CAD) increased with higher CVD risk levels.

The hemostasis valve market in China is growing due to the country’s rapidly expanding healthcare sector, a rising number of interventional procedures, and an increasing aging population. As medical technology becomes more advanced, Chinese healthcare providers are adopting high-quality hemostasis valves for procedures such as catheterization, angioplasty, and endoscopic surgeries. In June 2024, the World Health Organization reported that China is experiencing one of the most rapidly expanding elderly populations globally. It is estimated that by 2040, approximately 28% of China's population will be aged 60 and above, attributed to increased life expectancy and a decrease in birth rates.

Japan’s hemostasis valve market is a leader in adopting hemostasis valve, is well-established, with a strong focus on innovation and high standards of medical care. The country’s aging population and increasing incidence of cardiovascular diseases contribute to the rising demand for minimally invasive surgeries, which often require hemostasis valves to manage bleeding during catheter-based procedures. In September 2023, the Journal of Cardiology highlighted that Japan's crude mortality rate from heart disease has increased, with varying myocardial infarction (MI) criteria across prefectures. While stroke mortality rates are declining, the incidence of MI has risen in some regions. However, the age-adjusted stroke incidence rate has consistently decreased.

The hemostasis valve market in India is growing due to an increase in interventional procedures, especially in cardiovascular, gastrointestinal, and urological treatments. The demand for hemostasis valves is fueled by the expansion of private healthcare facilities, improvements in medical technology, and the rising prevalence of chronic conditions. In September 2024, according to the India Ageing Report 2023, India's elderly population (aged 60 and above) is expected to reach 158.7 million by 2025, comprising 11.1% of the total population. This demographic shift is associated with an increase in chronic diseases among the elderly, including hypertension, diabetes, cardiovascular diseases, and chronic lung diseases.

Latin America Hemostasis Valve Market Trends

In Latin America, hemostasis valve market, Brazil is driving the adoption due to the growing demand for minimally invasive surgeries and the increasing prevalence of cardiovascular and other chronic diseases. In 2022, a study published in Medicina (B Aires) reported that 41.5% of Argentine patients with type 2 diabetes mellitus had cardiovascular disease (CVD), surpassing the global rate of 34.8%. Atherosclerotic CVD was the most prevalent type, and the use of antidiabetic drugs with cardiovascular benefits was low at 12.8% in Argentina. As healthcare infrastructure improves across countries such as Brazil, and Argentina, there is a rising adoption of advanced medical devices, including hemostasis valves, to enhance patient outcomes and minimize complications.

Brazil’s hemostasis valve market is agrowing healthcare sector due to the increasing demand for minimally invasive surgeries, particularly in fields such as cardiology, urology, and gastroenterology. The country has a large population with a high prevalence of chronic diseases such as cardiovascular conditions, diabetes, and hypertension, which drives the need for interventional procedures that require hemostasis valves to manage bleeding during surgeries. In July 2024, a study published in Frontiers in Medical Case Reports analyzed treatments for Chronic Limb Ischemia in Brazil from 2004 to 2023, comparing open revascularization and angioplasty. A total of 114,417 angioplasties and 47,502 open revascularizations were performed, with expenditures reaching USD 98.5 million.

Middle East and Africa Hemostasis Valve Market Trends

The Middle East and Africa’s markets are experiencing growing demand for hemostasis valve, especially in Saudi Arabia and Kuwait due to improvements in healthcare infrastructure, increasing surgical procedures, and rising demand for advanced medical devices. In August 2024, a BMJ Journals article reported that 20% of TIAs and ischaemic strokes occur in the posterior circulation, with vertebrobasilar stenosis responsible for 25% of these cases. Patients with at least 50% atherosclerotic stenosis face a heightened risk of recurrent strokes within 90 days, particularly compared to those with anterior circulation stenosis. Countries such as the UAE, Saudi Arabia, and South Africa are seeing a surge in diagnostic and interventional procedures, particularly in cardiology and urology, which require the use of hemostasis valves.

The market for hemostasis valve in Saudi Arabia is expanding due to the country’s substantial healthcare investment and a rising number of interventional procedures, especially in cardiovascular and neurology fields. In March 2024, BMC Cardiovascular Disorders reported that the prevalence of cardiovascular diseases (CVDs) among Saudis aged 15 and older is 1.6% (n = 236,815), with a higher rate in males (1.9%) compared to females (1.4%). Saudi Arabia’s government initiatives to enhance healthcare infrastructure and provide high-quality care are leading to the increased adoption of advanced medical devices such as hemostasis valves.

Key Hemostasis Valve Company Insights

Some of the key market players operating in the hemostasis valve market include Boston Scientific Corporation, Teleflex Incorporated, Merit Medical Systems, B. Braun SE, TERUMO CORPORATION, and Abbott. These companies are making significant infrastructure investments, which enable them to develop, manufacture, and commercialize a high volume of valves worldwide. In addition, to increase their presence globally, companies engage in several strategic partnerships with distributors and other companies.

Key Hemostasis Valve Companies:

The following are the leading companies in the hemostasis valve market. These companies collectively hold the largest market share and dictate industry trends.

- Boston Scientific Corporation

- Teleflex Incorporated

- Merit Medical Systems

- B. Braun Melsungen AG

- TERUMO CORPORATION

- Abbott

- Argon Medical Devices

- Freudenberg Medical

- SCW Medicath Ltd

- Lepu Medical Technology(Beijing)Co.,Ltd.

- Nipro

- DeRoyal Industries, Inc.

- Antmed Corporation

- Beijing Demax Medical Technology Co

Recent Developments

-

In November 2024, APT Medical announced that its Distail microcatheter and Braidin Pro adjustable valve large sheath received CE certification under the EU Medical Device Regulation. This certification underscores the company's commitment to innovative, high-performance medical devices, featuring advanced designs for enhanced pushability and trackability to meet diverse clinical needs.

-

In November 2024, BioCardia, Inc. launched its Morph DNA steerable introducer family, improving control in biotherapeutic delivery with a swiveling side port in the hemostasis valve to reduce tangling. The company continues to focus on its CardiAMP Heart Failure trials, expecting significant results by early 2025.

-

In October 2024, a recall was issued for the Monarch Inflation Device and the Access-9 Large Bore Hemostasis Valve Metal Insertion Tool. These devices are used for inflating and deflating balloon angioplasty catheters, injecting fluids, and monitoring pressure, and are classified as angiographic injectors and syringes.

Hemostasis Valve Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 194.9 million

Revenue forecast in 2033

USD 307.7 million

Growth rate

CAGR of 5.9% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Boston Scientific Corporation; Teleflex Incorporated; Merit Medical Systems; B. Braun Melsungen AG; TERUMO CORPORATION; Abbott; Argon Medical Devices; Freudenberg Medical; SCW Medicath Ltd; Lepu Medical Technology(Beijing)Co.,Ltd.; Nipro; DeRoyal Industries, Inc.; Antmed Corporation; Beijing Demax Medical Technology Co

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hemostasis Valve Market Report Segmentation

This report forecasts revenue growth at global, regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global hemostasis valve market report based on type, application, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Hemostasis Valve Y- Connectors

-

Double Y- Connector Hemostasis Valves

-

One- Handed Hemostasis Valves

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Angiography

-

Angioplasty

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hemostasis valve market size was estimated at USD 184.6 million in 2024 and is expected to reach USD 194.9 million in 2025.

b. The global hemostasis valve market is expected to grow at a compound annual growth rate of 5.8% from 2025 to 2030 to reach USD 258.2 million by 2030.

b. North America dominated the hemostasis valve market with a share of 41.1% in 2024. The presence of advanced healthcare infrastructure, rising incidence of CVDs, and the presence of well-established manufacturers of hemostasis valve are some of the key factors boosting the market growth.

b. Some key players operating in the market include Boston Scientific Corporation; Teleflex Incorporated; Merit Medical Systems; B. Braun Melsungen AG; TERUMO CORPORATION; Abbott; Argon Medical Devices; Freudenberg Medical; SCW Medicath Ltd; Lepu Medical Technology(Beijing)Co.,Ltd.; Nipro; DeRoyal Industries, Inc.; Antmed Corporation; Beijing Demax Medical Technology Co

b. Key factors that are driving the increasing prevalence of cardiovascular diseases, supportive regulatory frameworks, rising geriatric population, and technological advancements are significantly driving the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.