- Home

- »

- Advanced Interior Materials

- »

-

Hemp-based Building Products Market, Industry Report 2033GVR Report cover

![Hemp-based Building Products Market Size, Share & Trends Report]()

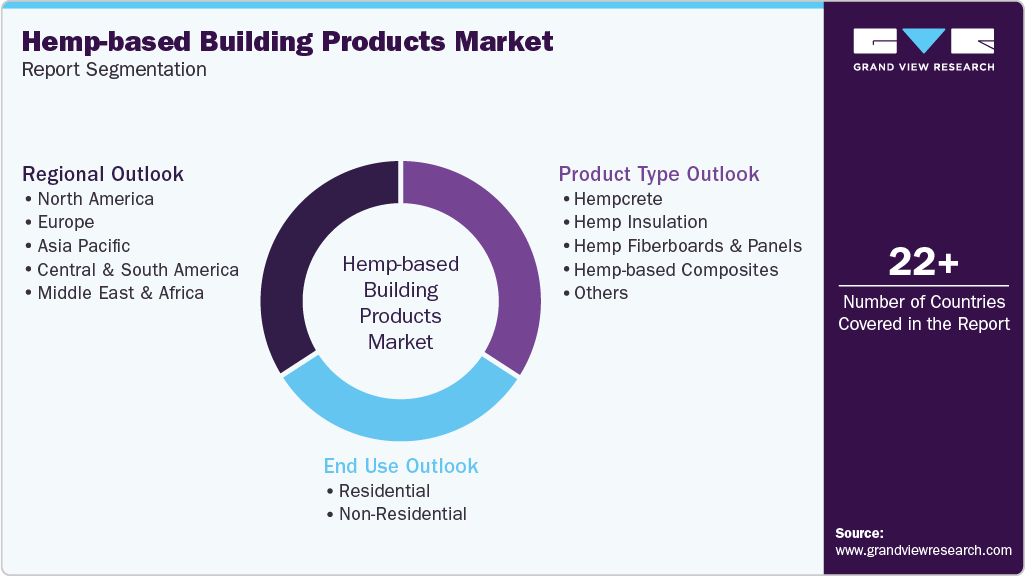

Hemp-based Building Products Market (2025 - 2033) Size, Share & Trends Analysis Report By Product Type (Hempcrete, Hemp Insulation, Hemp Fiberboards & Panels, Hemp-based Composites), By End-use (Residential, Non-residential), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-798-6

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hemp-based Building Products Market Summary

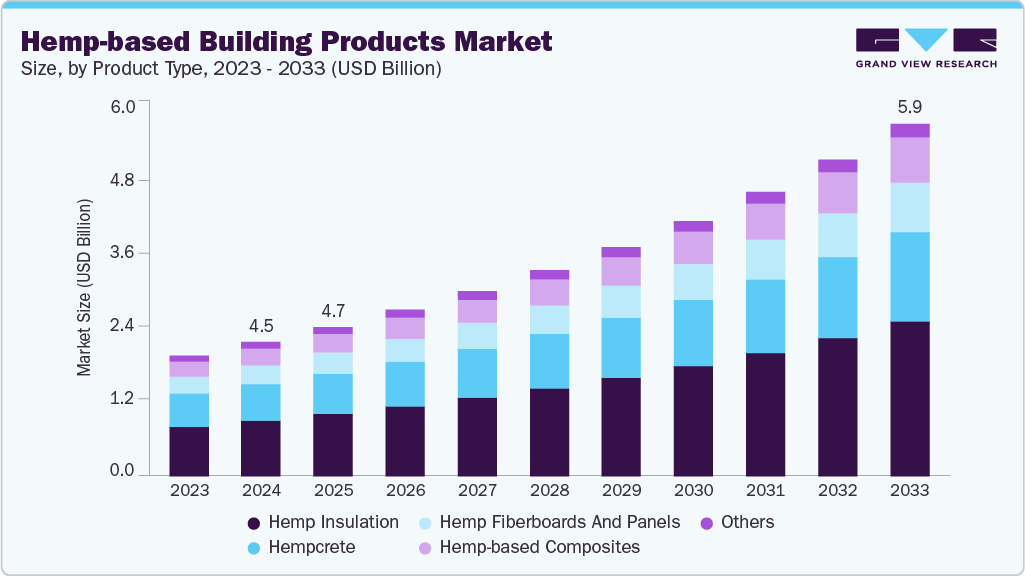

The global hemp-based building products market size was estimated at USD 35.97 billion in 2024 and is projected to reach USD 94.27 billion by 2033, growing at a CAGR of 11.3% from 2025 to 2033. The growth is driven by the increasing global demand for sustainable and renewable construction materials.

Key Market Trends & Insights

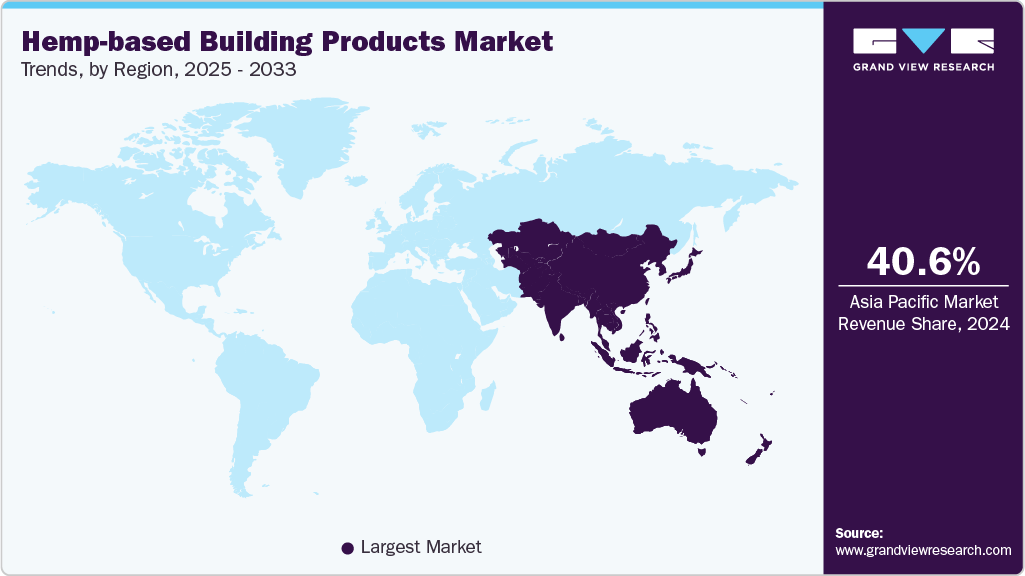

- Asia Pacific dominated the hemp-based building products market with the largest revenue share of 40.6% in 2024.

- By product type, hemp insulation segment is expected to grow at the fastest CAGR of 12.0% over the forecast period.

- By end use, non-residential segment is expected to grow at the fastest CAGR of 11.6% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 35.97 Billion

- 2033 Projected Market Size: USD 94.27 Billion

- CAGR (2025-2033): 11.3%

- Asia Pacific: Largest market in 2024

As environmental concerns rise, builders and architects are turning toward natural alternatives such as hempcrete, hemp insulation, and fiber-reinforced panels. These products offer significant reductions in carbon emissions compared to conventional materials such as concrete or fiberglass. The biodegradability and energy efficiency of hemp-based materials further align with green building certification standards such as LEED and BREEAM. This growing shift toward eco-conscious construction is accelerating market expansion across both residential and commercial sectors.Government initiatives promoting carbon-neutral construction and low-impact materials are major drivers of the hemp-based building products market. Many countries are revising their building codes and sustainability regulations to encourage the use of renewable raw materials. Subsidies, tax incentives, and research grants for bio-based construction innovation have also strengthened industrial adoption. In regions such as Europe and North America, policymakers have recognized hemp as an effective crop for carbon sequestration and rural economic development. This regulatory backing is creating a favorable environment for manufacturers and developers to scale production and commercialization.

Rapid advancements in material processing technologies are enhancing the performance and versatility of hemp-based construction products. Innovations in fiber treatment, composite engineering, and binder formulation have improved structural strength, moisture resistance, and thermal insulation properties. These technological improvements are enabling hemp-based materials to compete directly with traditional products on both performance and cost. Furthermore, automation and digital design tools in construction are making it easier to integrate hemp-based panels and blocks into modern architectural systems. As production efficiency increases, cost competitiveness is expected to further strengthen market growth.

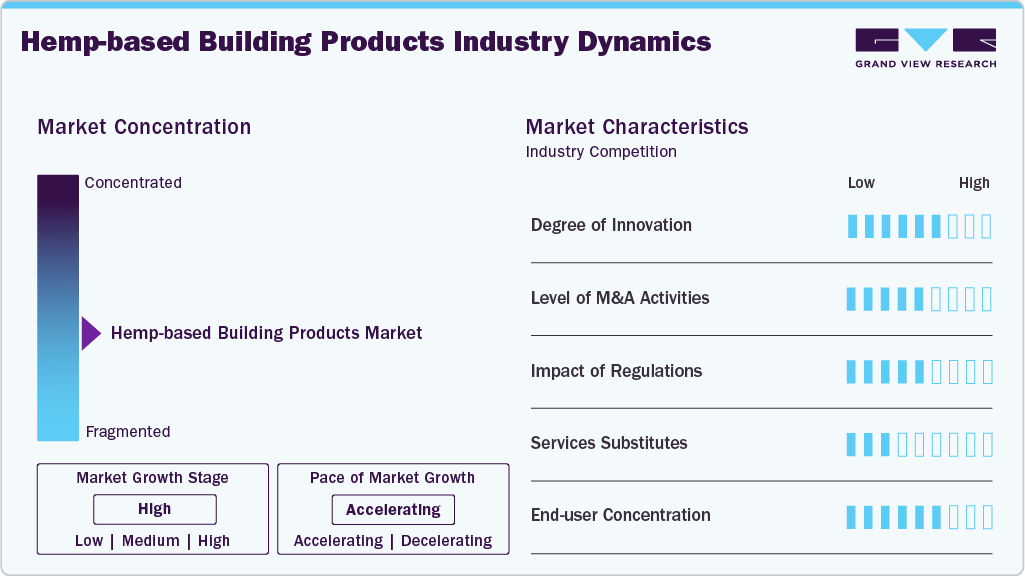

Market Concentration & Characteristics

The hemp-based building products market is moderately fragmented, with a mix of emerging startups, regional producers, and established construction material companies integrating bio-based portfolios. The degree of innovation is high, driven by advancements in material science, composite engineering, and sustainable binder technologies. Continuous R&D efforts are focused on improving durability, fire resistance, and insulation performance of hemp-based materials to meet global building standards. Strategic collaborations between agricultural, chemical, and construction firms are enhancing product development and commercialization. The growing emphasis on lifecycle sustainability and low-carbon materials has positioned innovation as a key competitive differentiator within the market.

The market has witnessed a moderate level of mergers and strategic partnerships as companies aim to strengthen supply chains and expand geographical reach. Regulatory frameworks promoting green construction and the legalization of industrial hemp cultivation in several countries have had a significant positive impact on market growth. Strict environmental regulations and government incentives for carbon-neutral infrastructure are accelerating adoption. While service substitutes such as recycled concrete or natural fiber composites exist, hemp-based materials offer unique benefits in insulation and carbon sequestration. End user concentration remains relatively dispersed, with growing adoption across residential, commercial, and institutional sectors, indicating a balanced and expanding demand base globally.

Product Type Insights

Hemp insulation segment led the market and accounted for the largest revenue share of 41.7% in 2024, driven by the increasing demand for eco-friendly and non-toxic insulation solutions in modern construction. Hemp insulation offers superior thermal and acoustic performance while being fully biodegradable and free from harmful chemicals such as VOCs and formaldehyde. The growing emphasis on indoor air quality and occupant health has encouraged the adoption of plant-based materials. Moreover, the rising cost of energy and tightening building efficiency regulations are pushing builders toward high-performance natural insulation.

Hemp-based composites segment is expected to grow at the fastest CAGR of 11.6% over the forecast period, driven by advancements in material engineering and the need for sustainable alternatives to synthetic composites. These materials combine hemp fibers with lime, bio-resins, or recycled polymers to create lightweight yet strong components for walls, panels, and structural elements. The increasing focus on circular economy principles and carbon-negative construction practices supports market expansion. Hemp-based composites also offer excellent moisture regulation, fire resistance, and durability, making them ideal for diverse climatic conditions.

End-use Insights

Residential segment dominated the market and accounted for the largest revenue share of 55.4% in 2024, driven by the growing consumer preference for sustainable, energy-efficient, and health-conscious housing solutions. Homeowners are increasingly seeking natural materials that minimize environmental impact and improve indoor comfort. Hemp-based products such as insulation, lime-hemp blocks, and breathable plasters are gaining traction in eco-homes and passive house designs. Rising awareness of carbon footprints and the long-term cost savings associated with energy-efficient construction are further promoting adoption.

Non-residential segment is expected to grow at the fastest CAGR of 11.6% over the forecast period, driven by the growing integration of sustainable construction practices in commercial, institutional, and industrial projects. Corporations and public institutions are increasingly adopting hemp-based materials to align with ESG goals and carbon reduction commitments. Hemp composites and insulation are being used in offices, educational buildings, and retail spaces due to their energy efficiency and acoustic benefits. The segment also benefits from large-scale investments in green infrastructure and smart city projects across developed and emerging economies.

Regional Insights

The North America hemp-based building products market is driven by growing environmental awareness and strong regulatory support for sustainable construction practices. The legalization of industrial hemp cultivation under the U.S. Farm Bill has significantly boosted raw material availability. Increasing demand for carbon-neutral and energy-efficient housing has led to greater adoption of hempcrete, hemp insulation, and hemp fiber panels. Government-backed green building programs and tax incentives for renewable materials further stimulate market growth. Collaboration between hemp producers and construction innovators is enhancing product development and commercialization. Additionally, the rising popularity of eco-friendly home renovations continues to strengthen regional demand.

U.S. Hemp-based Building Products Market Trends

In the U.S., the market is fueled by federal and state-level initiatives promoting carbon reduction and renewable resource utilization in construction. The Department of Energy’s focus on low-emission building technologies supports hemp-based material integration in sustainable housing. Increasing consumer preference for healthy, non-toxic indoor materials drives the use of hemp insulation and wall systems. The presence of innovative startups and research collaborations with universities accelerates technological advancements in hempcrete and biocomposites. Moreover, growing investment in sustainable infrastructure under the Inflation Reduction Act contributes to rapid market expansion. Rising construction of green residential units further reinforces national demand for hemp-based products.

Asia Pacific Hemp-based Building Products Market Trends

APAC hemp-based building products marketheld the largest revenue share of 40.6% in 2024, expanding due to rapid urbanization and a growing emphasis on environmentally responsible building materials. Countries such as India, Japan, and Australia are promoting bio-based construction to curb rising carbon emissions. The availability of affordable agricultural land and favorable climatic conditions for hemp cultivation strengthen the regional supply chain. Governments are encouraging sustainable infrastructure through green building certifications and low-carbon city projects. Increasing construction of smart and eco-cities is also stimulating demand for innovative materials such as hempcrete and natural fiber composites. Furthermore, partnerships between regional manufacturers and global bio-material companies are supporting technological transfer and product diversification.

Hemp-based building products market in China is primarily driven by government-backed sustainability goals aligned with the nation’s “dual carbon” strategy aimed at achieving carbon neutrality. The Chinese construction industry’s focus on green transformation has accelerated the integration of hemp-based materials in both residential and industrial projects. Investments in R&D for eco-friendly construction materials and rural revitalization programs are expanding domestic production. The country’s large-scale infrastructure development and urban renewal initiatives promote demand for energy-efficient insulation and wall systems. In addition, the rising popularity of prefabricated and modular green buildings supports broader use of hemp composites. Continuous government regulation promoting renewable building inputs further fuels market momentum.

Europe Hemp-based Building Products Market Trends

Europe’s hemp-based building products market is driven by stringent environmental regulations and strong policy support for circular economy initiatives. The European Green Deal and national sustainability programs encourage the adoption of renewable construction materials with low embodied carbon. Growing consumer preference for green-certified and energy-efficient buildings has increased the use of hempcrete and hemp insulation products. Innovation hubs across France, the Netherlands, and the UK are advancing research in bio-based composites and binders. The availability of well-established hemp farming networks ensures consistent raw material supply. Moreover, the region’s mature regulatory framework fosters standardization and trust in hemp-based construction solutions.

Germany’s market growth is supported by its ambitious climate protection goals and commitment to sustainable architecture. The government’s emphasis on reducing the carbon footprint of buildings drives adoption of hemp-based insulation, lime-hemp composites, and breathable wall systems. Strong R&D capabilities and collaboration between construction firms and academic institutions are promoting material innovation. The country’s construction industry is integrating bio-based materials in prefabricated homes and energy-efficient building designs. In addition, supportive policies under Germany’s Climate Action Plan 2050 enhance investment in green materials. The growing preference for healthy, VOC-free interiors further strengthens market adoption.

Latin America Hemp-based Building Products Market Trends

The hemp-based building products market in Latin America is gaining momentum due to expanding green construction initiatives and increasing focus on sustainable housing. Countries such as Brazil, Mexico, and Chile are encouraging hemp cultivation and renewable material development to support environmental goals. Growing investment in eco-friendly urban development projects is boosting demand for hemp-based panels, blocks, and insulation. The region’s abundance of agricultural land offers cost advantages for large-scale hemp production. Moreover, collaboration with international green material companies is enhancing technological capability and product quality. Rising awareness of climate-resilient infrastructure is further contributing to long-term market growth.

Middle East & Africa Hemp-based Building Products Market Trends

In the Middle East & Africa, the market is driven by the growing shift toward sustainable urbanization and diversification of non-oil economies. Government programs such as Saudi Vision 2030 and the UAE’s Green Building Regulations promote bio-based materials for energy-efficient construction. The region’s extreme climatic conditions have increased demand for thermally efficient and breathable materials such as hempcrete and hemp insulation. International collaborations are helping transferring hemp-processing technologies to local industries. In addition, sustainability-driven investments in smart city projects and carbon-neutral architecture are fostering market expansion. Growing environmental awareness among developers and policymakers is expected to further strengthen regional adoption of hemp-based products.

Key Hemp-based Building Products Company Insights

Some of the key players operating in market includeHempitecture Inc., American Lime Technology Ltd.

-

Hempitecture Inc. specializes in HempWool insulation and hempcrete blocks designed for superior thermal and acoustic performance. Its products are carbon-negative and free from harmful chemicals, promoting healthy indoor environments.

-

American Lime Technology Ltd. focuses on developing natural and low-carbon building systems. The company is known for its proprietary Hemcrete technology, which combines hemp shiv and lime binder for high-performance wall systems. These products offer excellent insulation, moisture regulation, and sustainability benefits.

HempFlax Group B.V., BAFA Neu GmbH are some of the emerging market participants in hemp-based building products market.

-

HempFlax Group B.V. offers hemp fibers, shives, and hempcrete mixes used in insulation panels, plasters, and composite materials. Its vertically integrated operations ensure quality control from cultivation to final production.

-

BAFA Neu GmbH specializes in producing eco-friendly hemp-based construction materials. The company manufactures hemp insulation boards, hemp-lime blocks, and natural fiber composites for sustainable building applications. BAFA Neu’s products are recognized for their superior thermal performance, durability, and recyclability.

Key Hemp-based Building Products Companies:

The following are the leading companies in the hemp-based building products market. These companies collectively hold the largest Market share and dictate industry trends.

- Hempitecture Inc.

- American Lime Technology Ltd.

- HempFlax Group B.V.

- BAFA Neu GmbH

- Dun Agro Hemp Group

- IsoHemp SA

- Green Building Store

- JustBioFiber Structural Solutions Corp.

- Limetec Ltd.

Recent Developments

- In October 2025, Heidelberg Materials announced the launch of a cement-free hemp lime product designed to promote sustainable and low-carbon construction. The new material combines processed hemp fibers with a natural lime binder, offering excellent insulation, moisture regulation, and carbon sequestration properties. This innovation reflects the company’s commitment to decarbonizing the construction sector and expanding its portfolio of eco-friendly building solutions.

Hemp-based Building Products Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 40.03 billion

Revenue forecast in 2033

USD 94.27 billion

Growth rate

CAGR of 11.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-use, product type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan

Key companies profiled

Hempitecture Inc.; American Lime Technology Ltd.; HempFlax Group B.V.; BAFA Neu GmbH; Dun Agro Hemp Group; IsoHemp SA; Green Building Store; JustBioFiber Structural Solutions Corp.; Limetec Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hemp-based Building Products Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global hemp-based building products market report based on product type, end-use, and region.

-

Product Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Hempcrete

-

Hemp Insulation

-

Hemp Fiberboards and Panels

-

Hemp-based Composites

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Non-Residential

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global hemp-based building materials market size was estimated at USD 35.97 billion in 2024 and is expected to reach USD 40.03 billion in 2025.

b. The hemp-based building materials market is expected to grow at a compound annual growth rate of 11.3% from 2025 to 2033 to reach USD 94.27 billion by 2033.

b. Residential segment dominated the market and accounted for the largest revenue share of 55.4% in 2024, driven by the growing consumer preference for sustainable, energy-efficient, and health-conscious housing solutions

b. Some of the key players in the hemp-based building materials market are Hempitecture Inc., American Lime Technology Ltd., HempFlax Group B.V., BAFA Neu GmbH, Dun Agro Hemp Group, IsoHemp SA, Green Building Store, JustBioFiber Structural Solutions Corp., and Limetec Ltd.

b. The key factors driving the hemp-based building materials market include growing demand for sustainable construction materials, supportive government regulations, advancements in bio-composite technologies, and rising awareness of energy-efficient and healthy indoor environments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.