- Home

- »

- Advanced Interior Materials

- »

-

Hempcrete Market Size And Share, Industry Report, 2030GVR Report cover

![Hempcrete Market Size, Share & Trends Report]()

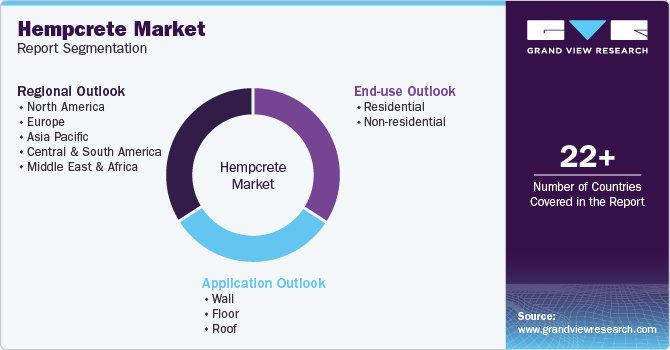

Hempcrete Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Wall, Floor, Roof), By End-use (Residential, Non-residential), By Region (North America, Europe, Asia Pacific, Central & South America, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-4-68040-496-2

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Hempcrete Market Summary

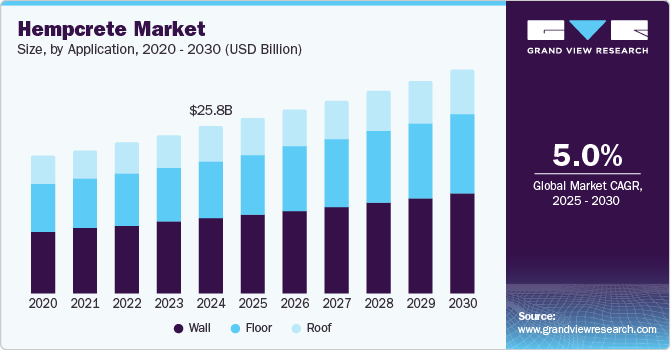

The global hempcrete market size was estimated at USD 25.83 billion in 2024 and is projected to reach USD 34.61 billion by 2030, growing at a CAGR of 5.0% from 2025 to 2030. This growth can be attributed to the increasing global emphasis on sustainable and eco-friendly construction materials.

Key Market Trends & Insights

- The hempcrete market in North America accounted with a revenue share of 40.7% in 2024.

- France hempcrete market is expected to grow at a CAGR of 5.6% over the forecast period.

- By application, the wall segment accounted for a significant market share in 2024.

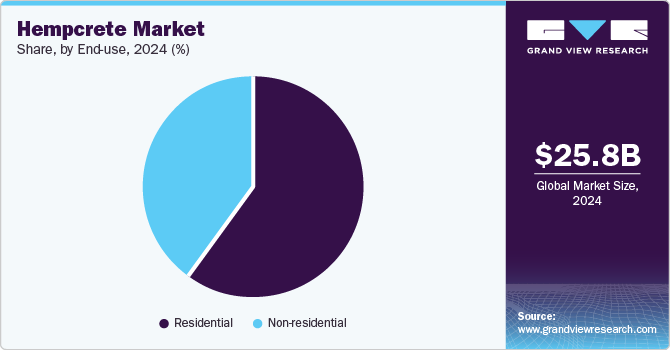

- By end use, the residential segment accounted for a major share of 59.8% of the global revenue in 2024.

Market Size & Forecast

- 2024 Market Size: USD 25.83 Billion

- 2030 Projected Market Size: USD 34.61 Billion

- CAGR (2025-2030): 5.0%

- North America: Largest market in 2024

Hempcrete is a biocomposite material made from hemp hurds, lime, and water, offering a carbon-negative building solution. It significantly reduces construction's carbon footprint compared to traditional materials like concrete. With governments and environmental organizations promoting green building practices and energy-efficient construction under programs such as LEED and BREEAM, hempcrete is expected to emerge as a preferred choice for sustainable construction.

Properties such as thermal insulation, moisture regulation, fire resistance, and durability of hempcrete are driving its adoption in residential and commercial buildings. Its ability to regulate indoor temperature and humidity levels enhances energy efficiency, reducing heating and cooling costs. Its fire-resistant nature and pest-repellent characteristics make it a safer and healthier alternative to traditional construction materials. These benefits align with the increasing consumer demand for durable, comfortable, and eco-conscious living spaces.

The relaxation of hemp cultivation laws in several countries, including India, the U.S., and Canada, has significantly boosted the supply chain for hemp-based products, including hempcrete. Governments are recognizing hemp as a versatile and sustainable crop with potential applications in construction, textiles, and bioplastics. Subsidies, tax incentives, and funding for hemp-based businesses encourage farmers and manufacturers to enter the market, driving its production and adoption.

However, the market has a higher upfront cost than conventional materials like concrete. While it offers long-term savings through energy efficiency, the higher cost of hemp cultivation, processing, and transportation impacts its affordability. Furthermore, limited market awareness about hempcrete's benefits and applications restricts its adoption. Consumers and builders often opt for familiar materials due to a lack of knowledge or misconceptions about hempcrete's performance and regulatory compliance.

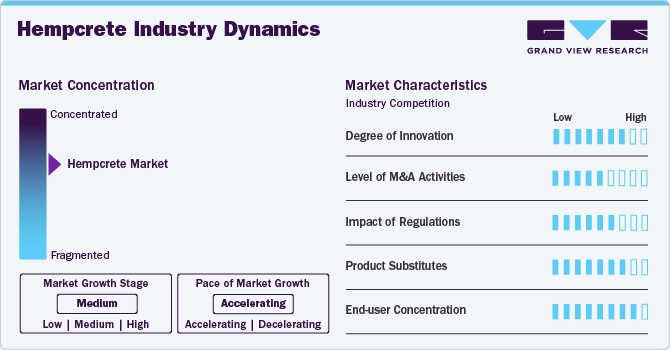

Market Concentration & Characteristics

The market growth stage is high, and the pace of growth is accelerating. The market is marked by moderate to high innovation, driven by advancements in material science and green building technologies. Techniques like pre-casting hempcrete panels and developing hybrid composites with other eco-friendly materials are gaining traction. Despite these developments, the sector still faces challenges in scaling up production and addressing performance limitations compared to traditional building materials.

Regulations play a crucial role in the market, as industrial hemp cultivation and processing are subject to varying legal frameworks worldwide. The market has seen significant growth in regions where hemp cultivation is legalized and supported, such as the EU, Canada, and parts of the U.S. However, stringent licensing requirements, lack of standardized building codes for hempcrete, and lingering stigma around hemp pose regulatory hurdles.

The degree of product substitution is moderate, as it primarily competes with conventional materials like concrete, fiberglass, and foam-based insulators. While hempcrete offers superior sustainability and thermal regulation, its lower compressive strength and higher cost make it less suitable as a direct substitute for load-bearing applications. However, hempcrete is a viable alternative to traditional materials for insulation and non-structural uses, especially for environmentally conscious builders and projects adhering to green certifications.

The market has a fragmented end user base, encompassing residential, commercial, and industrial sectors. Green construction initiatives and rising awareness about sustainable building materials are driving demand, particularly among eco-conscious homeowners, architects, and developers.

Application Insights

The wall segment accounted for a significant market share in 2024 owing to its excellent thermal insulation and moisture-regulating properties. Walls made from hempcrete provide natural insulation, keeping interiors warm in winter and cool in summer, which reduces energy consumption for heating and cooling. Its breathability prevents condensation and mold growth, making it ideal for environments with high humidity. In addition, hempcrete’s lightweight nature simplifies handling and construction, while its fire-resistant properties enhance safety in residential and commercial buildings. These attributes make hempcrete walls particularly appealing for sustainable and eco-friendly construction projects, leading to its high growth over the projected period.

The floor segment is expected to grow at the fastest CAGR of 5.5% over the forecast period. Hempcrete floors provide good insulation against heat and noise, enhancing comfort in residential and commercial spaces. These floors are often combined with lime-based screeds, offering a breathable and moisture-resistant base that is ideal for regions with fluctuating humidity levels. These qualities are driving their adoption of green buildings, particularly for flooring in eco-conscious homes and offices. Due to their thermal efficiency and eco-friendly properties, hempcrete roofs generated revenue of USD 5.22 billion in 2023. Their lightweight nature minimizes structural load, making them suitable for retrofitting existing buildings. Furthermore, hempcrete roofs absorb CO2 during curing, contributing to carbon-neutral construction. These benefits are expected to drive the product demand for sustainable residential and commercial roofing projects.

End-use Insights

The residential segment accounted for a major share of 59.8% of the global revenue in 2024, driven by the growing demand for energy-efficient and eco-friendly housing solutions. Its fire resistance, pest repellence, and non-toxic nature add to its appeal, particularly for families seeking healthier living environments. Hempcrete is commonly used in walls, floors, and roofs of residential buildings, aligning with the increasing adoption of green certifications like LEED and GRIHA in the housing sector. However, the adoption of hempcrete in the residential segment is hindered by its high initial cost and lack of widespread awareness. Many homeowners are unfamiliar with hempcrete's benefits, and builders often favor conventional materials due to ease of use and established supply chains. Nevertheless, rising interest in sustainable living and government incentives for green construction are expected to drive the adoption of hempcrete in residential projects. Hence, the segment is expected to grow at the fastest CAGR from 2025 to 2030.

The non-residential end-use segment, which includes commercial buildings, offices, and industrial facilities, is expected to grow at a CAGR of 4.3% over the forecast period. Corporations, governments, and green building initiatives encourage the use of eco-friendly materials like hempcrete in non-residential construction. Moreover, hempcrete is being adopted to retrofit old structures to improve energy efficiency and reduce operational costs. Despite its growing use, the industry faces challenges, including limited strength for load-bearing applications and higher costs compared to traditional materials. Large-scale projects often prioritize cost-effectiveness and speed, making hempcrete less competitive. However, increased focus on environmental responsibility and the long-term cost savings offered by hempcrete is expected to drive its adoption in non-residential construction, particularly in niche markets like green offices and low-carbon industrial facilities.

Regional Insights

The hempcrete market in North America accounted with a revenue share of 40.7% in 2024, driven by the increasing adoption of sustainable construction practices and favorable regulations supporting industrial hemp cultivation. Factors such as increasing investment in affordable housing, smart city construction, infrastructure upgrades and construction, and investment in the tourism sector are expected to boost the demand for Hempcrete products over the forecast period. The U.S. and Canada are key contributors, with expanding applications in residential and commercial construction as well as retrofitting projects. However, supply chain limitations and high costs remain challenges for broader market penetration.

U.S. Hempcrete Market Trends

The hempcrete market in the U.S. is primarily propelled by progressive hemp cultivation policies following the 2018 Farm Bill, which legalized industrial hemp. The material’s carbon-negative footprint aligns with the country’s environmental goals, particularly in states with robust green building initiatives, like California and Oregon. However, a lack of standardized building codes for hempcrete poses a barrier to widespread adoption

Europe Hempcrete Market Trends

The hempcrete market in Europe is expected to grow significantly over the forecast period. Countries like France, Spain, and Italy dominate the market due to well-established industrial hemp cultivation and a growing preference for carbon-neutral materials. The European Union’s emphasis on renewable energy and eco-friendly infrastructure is expected to positively impact the growth of the hempcrete market in Europe over the forecast period.

France hempcrete market is expected to grow at a CAGR of 5.6% over the forecast period. Favorable agricultural policies and strong government incentives for sustainable construction have fostered the development of a robust hempcrete supply chain. French architects and developers are increasingly adopting hempcrete for both residential and non-residential projects, driven by the material’s thermal efficiency and carbon-negative properties.

Asia Pacific Hempcrete Market Trends

The hempcrete market in Asia Pacific is growing at a CAGR of 6.1% from 2025 to 2030. Countries like India, China, and Japan are key markets, with growing investments in green infrastructure and industrial hemp cultivation. Challenges such as limited awareness, regulatory hurdles, and underdeveloped supply chains are being addressed through government initiatives and private-sector collaborations.

China hempcrete market accounted for the largest revenue share of 52.1% due to the country’s developed industrial sector and rising demand for residential and commercial buildings. China’s vast agricultural resources and government support for industrial hemp farming position it as a potential key player in the market. The country’s focus on sustainable urban development and eco-friendly construction aligns with the adoption of hempcrete in residential and commercial projects. However, challenges such as high production costs and limited expertise in hemp-based materials hinder large-scale adoption.

The hempcrete market in India is growing at the highest CAGR of 7.4% over the forecast period of 2024 to 2030. The ongoing construction projects, such as the Mumbai Trans Harbor Link, the Navi Mumbai International Airport, the Noida International Airport, and the construction of Dholera Smart City, are expected to boost product demand. The market is gaining traction, fueled by a growing focus on sustainable and affordable housing solutions. The government’s push for green building practices and initiatives like Smart Cities Mission is driving demand for eco-friendly materials. However, challenges such as limited hemp cultivation, lack of awareness, and high costs restrict widespread adoption.

Central & South America Hempcrete Market Trends

The hempcrete market in Central and South America is growing at a CAGR of 4.0% from 2025 to 2030. The demand is driven by the region’s increasing focus on sustainable construction and abundant agricultural resources for hemp cultivation. Brazil is a leading market, with rising investments in green building initiatives and infrastructure development. Limited awareness and underdeveloped supply chains remain key challenges, but growing environmental consciousness presents opportunities for future growth.

Brazil hempcrete market accounted for USD 0.26 billion in 2024, supported by its growing construction sector. The country’s favorable climatic conditions for hemp cultivation and the rising adoption of eco-friendly materials in residential and commercial construction are driving market growth.

Middle East & Africa Hempcrete Market Trends

The hempcrete market in the Middle East & Africa is at an early stage, with growing interest in energy efficiency. The adoption of hempcrete in this region is primarily driven by its thermal insulation properties, which are beneficial for hot climates. However, challenges such as limited hemp cultivation, regulatory restrictions, and a lack of awareness hinder market growth.

Key Hempcrete Company Insights

Some of the key players operating in the market include IsoHemp, Hempcrete Natural Building Ltd., Americhanvre Cast Hemp, Lime Technology, and Just BioFiber Structural Solutions:

-

IsoHemp is a leading manufacturer of hempcrete blocks, specializing in eco-friendly building materials for residential, commercial, and industrial construction. IsoHemp’s products are widely used for their thermal insulation, fire resistance, and moisture regulation properties. The company operates a state-of-the-art production facility in Belgium and exports its products to over 25 countries.

-

Hempcrete Natural Building Ltd. specializes in providing high-quality hempcrete construction solutions. The company offers pre-cast hempcrete blocks, insulation materials, and customized building systems. Known for its expertise in sustainable construction, it caters to a diverse client base, including residential developers, heritage building renovators, and eco-conscious architects.

HempEco Systems, Hempitecture Inc., Australian Hemp Masonry Company, Hemp Block USA, and Dun Agro Hemp Group are some of the emerging market participants in the market.

-

HempEco Systems is a pioneering company in the Indian market. It focuses on developing affordable and sustainable building materials for the local construction industry. The company specializes in hempcrete walls, insulation panels, and prefabricated structures. It is gaining recognition for its contributions to India's green building initiatives and affordable housing projects.

-

Hempitecture Inc. is a rapidly growing U.S.-based company specializing in hempcrete and other hemp-based construction materials. The company’s flagship product, HempWool, is a non-toxic and eco-friendly insulation material gaining popularity in the green building market. With increasing investment in R&D, the company is expected to position itself as a key player in the sustainable construction industry.

Key Hempcrete Companies:

The following are the leading companies in the hempcrete market. These companies collectively hold the largest market share and dictate industry trends.

- IsoHemp

- Hempcrete Natural Building Ltd.

- Americhanvre Cast Hemp

- Lime Technology

- Just BioFiber Structural Solutions

- HempEco Systems

- Hempitecture Inc.

- Australian Hemp Masonry Company

- Hemp Block USA

- Dun Agro Hemp Group

Recent Developments

-

In February 2024, Americhanvre Cast Hemp received USD 1.9 million research and development grant from the U.S. Army’s Small Business Innovation Research Program (SBIR). The research will include analyzing the key performance factors for hempcrete construction. The project further helped advance the testing of materials to make it easier for builders to embark on large-scale hempcrete projects.

-

In June 2022, Homeland Hempcrete used 9.25 to 12 inches thick wall panels made of hurd from industrial hemp fiber to replace exterior walls in homes and other structures. This helped the company gain more product traction and strengthen its market position.

Hempcrete Market Report Scope

Report Attribute

Details

Market size in 2025

USD 27.12 billion

Revenue Forecast in 2030

USD 34.61 billion

Growth rate

CAGR of 5.0% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; France; Italy; Spain; China; India; Japan; Brazil

Key companies profiled

IsoHemp; Hempcrete Natural Building Ltd.; Americhanvre Cast Hemp; Lime Technology; Just BioFiber Structural Solutions; HempEco Systems; Hempitecture Inc.; Australian Hemp Masonry Company; Hemp Block USA; Dun Agro Hemp Group

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hempcrete Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hempcrete market report based on application, end-use, and region.

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Wall

-

Floor

-

Roof

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Non-residential

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global hempcrete market size was estimated at USD 25.83 billion in 2024 and is expected to reach USD 27.12 billion in 2025.

b. The global hempcrete market is expected to grow at a compound annual growth rate of 5.0% from 2025 to 2030, reaching USD 34.61 billion by 2030.

b. The wall segment dominated the market based on applications and was valued at USD 11.79 billion in 2024 due to its excellent thermal insulation and moisture-regulating properties

b. Key players operating in the hempcrete market are IsoHemp, Hempcrete Natural Building Ltd., Americhanvre Cast Hemp, Lime Technology, and Just BioFiber Structural Solutions.

b. The key factors driving hempcrete include increasing global emphasis on sustainable construction materials along with the relaxation of hemp cultivation laws in several countries, including India, the U.S., and India has significantly boosted the supply chain for hempcrete.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.