- Home

- »

- Advanced Interior Materials

- »

-

Industrial Hemp Market Size & Share, Industry Report, 2030GVR Report cover

![Industrial Hemp Market Size, Share & Trends Report]()

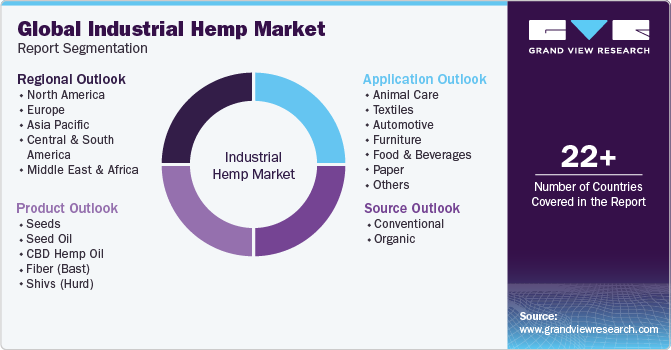

Industrial Hemp Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Animal Care, Textiles, Food & Beverages), By Product (Seeds, Fiber, Shivs), By Region (North America, Asia Pacific), And Segment Forecasts

- Report ID: GVR-2-68038-389-8

- Number of Report Pages: 143

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Hemp Market Summary

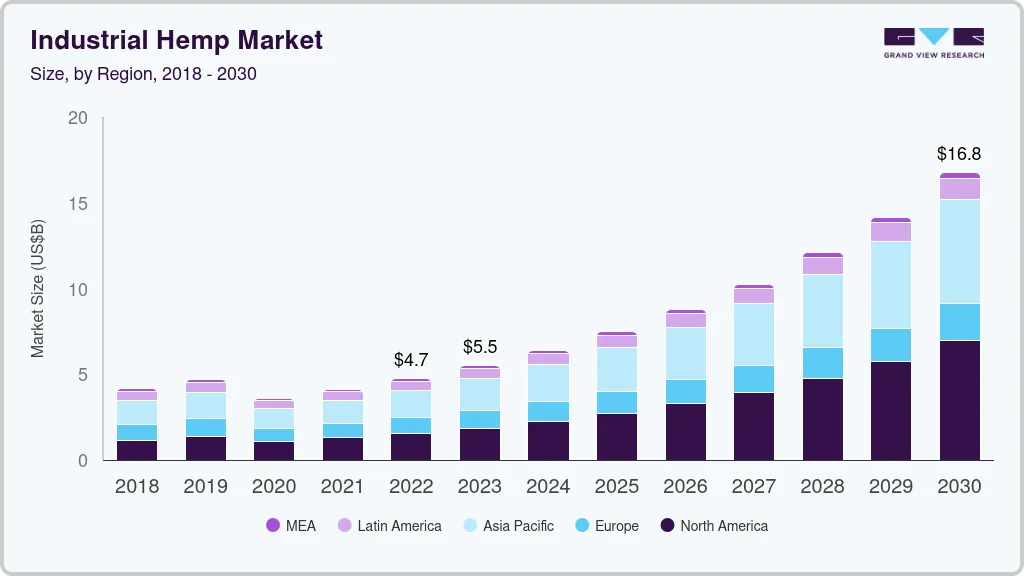

The global industrial hemp market size was estimated at USD 5.49 billion in 2023 and is projected to reach USD 16.82 billion by 2030, growing at a CAGR of 17.5% from 2024 to 2030. The growth is driven by the rising product demand from application industries, such as food & beverage, personal care, and animal care, across the globe.

Key Market Trends & Insights

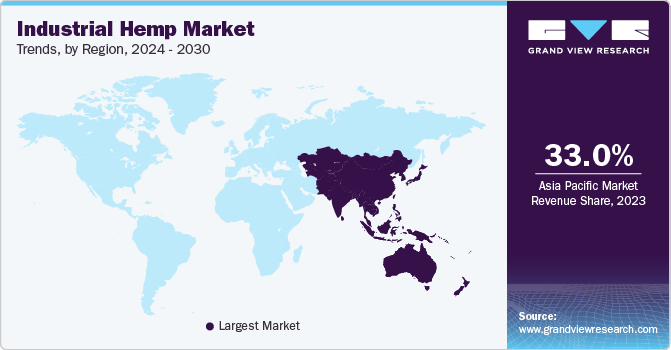

- Asia Pacific is one of the major consumers of industrial hemp and accounted for a revenue share of more than 33% in 2023.

- Based on product, the hemp seeds product segment led the market and accounted for more than 29.97% revenue share of the global revenue in 2023.

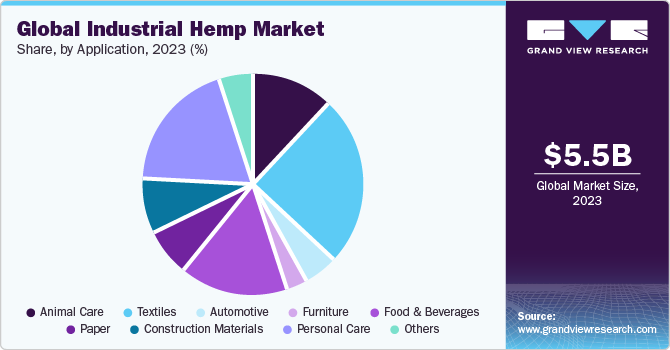

- Based on application, the textile application segment led the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 5.49 Billion

- 2030 Projected Market Size: USD 16.82 Billion

- CAGR (2024-2030): 17.5%

- Asia-Pacific: Largest Market in 2023

Growing demand for hemp products including fiber, seed, stalks, hurds, and oils from the aforementioned application industries is expected to drive market growth. Industrial hemp production is associated with several agricultural and environmental benefits. With its fast growth period of 120-150 days and significant biomass yield, hemp enables efficient use of agricultural land. It is useful in carbon sequestration as it yields a large amount of biomass along with providing a useful break in crop rotation.

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating. The market is highly competitive owing to the presence of large number of domestic and international players operating in the industrial hemp market. The potential for growth in industrial hemp production and processing, fueled by the growing demand from key application industries, including personal care, food, hemp CBD, consumer textiles, and many others, is expected to drive the market over the forecast period. Increasing research & development activities to develop new genetically enhanced industrial hemp products and variants capable of offering higher yields and improved product quality are expected to have a positive impact on commercial industrial hemp production.

The cultivation of industrial hemp has been illegal for a number of years in many countries, necessitating complete re-establishment of the supply chain while achieving economies of scale. The profitability of hemp production is speculative at present and does not include additional costs of growing hemp in regulated markets such as the costs of licensing, monitoring, and verification. However, expansion of market opportunities with the liberalization of regulations on cultivation, processing, transportation, and the use of industrial hemp is expected to drive the market growth over the forecast period.

The market is expected to witness a low threat of substitutes owing to the presence of limited number of industrial hemp products that have characteristics similar to industrial hemp for use in different applications. However, products such as chia and flax seeds have nutritional value as high as hemp seeds. This is anticipated to result in moderate threat of substitution in the market.

Market Dynamics

The global market growth is driven by the rising demand from industries, such as personal care, recycling, agriculture, automotive, textiles, furniture, food & beverage, paper, and construction materials. The increasing product usage in different end-use industries has resulted in increased cultivation and trading of hemp in the global market. China has emerged as a significant producer and exporter of industrial hemp followed by Canada and France. The increasing use of hemp in textile and medical applications is expected to significantly propel the demand for industrial hemp in the global market. However, the production of industrial hemp and its products faces several obstacles owing to the presence of stringent government drug policies and concerns about the impact these products on the illegal marijuana market.

The U.S. is heavily investing in developing different varieties of industrial hemp with THC content of less than 0.3% on account of the rising demand from different application industries. The Government of the U.S. announced a COVID-19 relief stimulus of USD 1.9 trillion in January 2021, which helped in the market recovery. Moreover, the steady growth of small market players in hemp-based industrial and consumer products is anticipated to drive the U.S. market over the forecast period.Growing awareness regarding the dietary advantages of hempseed and hempseed oil, along with high demand from the cosmetics and personal care industries, will support market growth. Rising production of soaps, shampoo, bath gels, hand and body lotions, UV skin protectors, massage oils, and a range of other hemp-based products is expected to have a major impact on market growth.

High nutritional values and beneficial fatty acid and protein profiles of hemp are driving the demand for hemp products. High absorbency of hemp fiber is beneficial for livestock bedding, oil & gas cleanup, and the personal hygiene market. In addition, increasing product demand in textile, paper, and building materials markets is growing owing to its favorable acoustic and aesthetic properties. The products manufactured from hemp are eco-friendly, renewable, and associated with less harmful methods of preparation. Paper produced from hemp fiber requires fewer chemicals for processing as compared to paper produced from wood pulps. Thus, the rising awareness about product benefits is projected boost market growth.

Product Insights

The hemp seeds product segment led the market and accounted for more than 29.97% revenue share of the global revenue in 2023. Hemp seeds are gaining popularity in food and nutraceutical markets to obtain seed, oil, and food matter. Rising use of hemp oil seed in lotions, shampoos, soaps, bath gels, and cosmetics, further benefits market growth. Hemp seeds are widely used in the production of oil, which is utilized in personal care, food & beverages, and animal feed industries. In addition, oil is used in nutritional supplements and medicinal & therapeutic products, such as pharmaceuticals. The market for seeds is expected to grow over the forecast period on account of rising demand from application industries.

Hemp fibers are used in paper, carpeting, home furnishing, construction materials, insulation materials, auto parts, and composites. Insulation materials and bio-composites consume a significant amount of hemp fibers on account of their lightweight, superior strength, biodegradability, and thermodynamic properties. Hemp shivs cost half the value of fibers and have several applications in different industries, which is expected to drive market growth over the forecast period. Hemp shivs are majorly used in animal bedding materials on account of their high absorbance ability, which is around four times its dry weight.

Application Insights

The textile application segment led the market in 2023. Hemp fabric is strong, hypo-allergic, and naturally resistant to UV light, mold, and mildew, which represents an added advantage over other fabrics. In addition, it can be blended with cotton or linen, which adds stretch and strength to the fabric. Hemp seeds are rich in protein content and majorly used as birdseed and animal feed. Bird and fish feed are important markets for hemp seeds in animal nutrition. Fish and birds need fatty acids with a high share of omega-3 and omega-6 fatty acids for optimum development, hence consume hemp seeds. Growing product demand in the animal care industry is likely to fuel overall market growth.

Hemp oil is widely used in the manufacturing of food & beverages on account of its high nutritional content, including fatty acids, proteins, and several other ingredients. Several food manufacturing processes make use of hemp seeds and oil, which is expected to propel market growth. In addition, rising consumer awareness about the product’s benefits is likely to fuel market’s growth. This product is increasingly used in insulation and construction materials, such as fiberboard, cement blocks, putty, stucco and mortar, coatings, and other products as a fiberglass substitute. Construction materials using industrial hemp also include roofing underlay, acoustic materials, pipe wraps, house wraps, and shingles.

Regional Insights

Asia Pacific is one of the major consumers of industrial hemp and accounted for a revenue share of more than 33% in 2023. Economies, such as China, India, Japan, Korea, Australia, New Zealand, and Thailand, are actively involved in the production and consumption of industrial hemp and products, such as fiber, seed, hurds, and oil. Increasing global product demand along with advancing technologies and innovation are making harvesting easier for cultivators, thereby changing the face of hemp production in the region. Increasing consumption of hemp-based food products and supplements in developing economies with a growing geriatric population is expected to drive market growth.

North America is a major product consumer. These products are consumed in different application industries. High consumer disposable income, growing aging population, and rising concerns related to skin diseases and UV protection are expected to drive the demand for hemp oil in the personal care industry in this region. Industrial hemp in Europe is majorly consumed in automotive parts, construction materials, textiles, and fabrics in the form of fibers. However, growing demand for hemp oil in the food & supplements, cosmetics, and personal care markets is expected to drive market growth.

Key Companies & Market Share Insights

Industry players produce large-quantity and high-quality industrial hemp along with a wide range of variants, in terms of seed size and oil composition. Potential yields and processing methods, technologies used for processing, along with the cost of production and returns, play a major role in driving the competition in the industry. Industrial hemp companies are focusing on increasing product cultivation and processing facilities in economies where the plant can be grown legally. Major industry players are investing heavily in R&D activities to achieve high yields from cultivation. These players offer diverse varieties of hemp-derived products and can penetrate large markets.

-

In January 2023, HempMeds Brasil launched two new full-spectrum products. These new products were created to suit the new requirements of Brazilian doctors who intend to suggest it to their patients.

-

In October 2021, HempFlax Group announced an investment of about USD 3.2 million in the advancement of its Dutch headquarters. Out of this, about USD 1.9 million is to be spent on machinery improvements, which is expected to double the hemp fiber processing capacity from 3 tons per hour to 6 tons per hour. The upgrades are expected to allow the company to reduce its operational period from 24 to 16 hours per day, lowering energy consumption while improving productivity.

Key Industrial Hemp Companies:

- Parkland Industrial Hemp Growers Cooperative Ltd.

- CBD Biotechnology Co.

- Botanical Genetics, LLC

- Marijuana Company of America Inc.

- HempMeds Brasil

- Terra Tech Corp.

- American Cannabis Company, Inc.

- HempFlax B.V.

- Industrial Hemp Manufacturing, LLC

- American Hemp

- Hemp, Inc.

- Boring Hemp Company

- Plains Industrial Hemp Processing Ltd.

- Ecofiber Industries Operations

- Valley Bio Limited

Industrial Hemp Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.3 billion

Revenue forecast in 2030

USD 16.82 billion

Growth rate

CAGR of 17.5% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in tons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Source, application, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France; China; India; Japan; Brazil

Key companies profiled

Parkland Industrial Hemp Growers Cooperative Ltd.; CBD Biotechnology Co.; Botanical Genetics, LLC; Marijuana Company of America Inc.; HempMeds Brasil; Terra Tech Corp.; American Cannabis Company, Inc.; HempFlax B.V.; Industrial Hemp Manufacturing, LLC; American Hemp; Hemp, Inc.; Boring Hemp Company; Plains Industrial Hemp Processing Ltd.; Ecofiber; Industries Operations; Valley Bio Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Hemp Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the industrial hemp market on the basis of product, source, application, and region:

-

Product Outlook (Volume, Tons; Revenue, USD Million; 2018 - 2030)

-

Seeds

-

Seed Oil

-

CBD Hemp Oil

-

Fiber (Bast)

-

Shivs (Hurd)

-

-

Source Outlook (Volume, Tons; Revenue, USD Million; 2018 - 2030)

-

Conventional

-

Organic

-

-

Application Outlook (Volume, Tons; Revenue, USD Million; 2018 - 2030)

-

Animal Care

-

Textiles

-

Automotive

-

Furniture

-

Pharmaceuticals

-

Biofuel

-

Food & Beverages

-

Paper

-

Construction Materials

-

Personal care

-

Other

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global industrial hemp market size was estimated at USD 5.49 billion in 2023 and is expected to reach USD 6.3 billion in 2024.

b. The global industrial hemp market is expected to grow at a compound annual growth rate of 17.5% from 2024 to 2030 to reach USD 116.82 billion by 2030.

b. North America dominated the industrial hemp market with a share of 33.9% in 2023, owing to rising production and consumption of industrial hemp in the region coupled with the presence of well-established market players with robust supply chains.

b. Some key players operating in the industrial hemp market include Parkland Industrial Hemp Growers Cooperative Ltd., CBD Biotechnology Co., Botanical Genetics, LLC, Marijuana Company of America Inc., and HempMeds Brasil.

b. Key factors that are driving the market growth include rising demand from the application industries coupled with agricultural and environmental product benefits.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.