- Home

- »

- Beauty & Personal Care

- »

-

Herbal Shampoo Market Size & Share, Industry Report, 2030GVR Report cover

![Herbal Shampoo Market Size, Share & Trends Report]()

Herbal Shampoo Market (2025 - 2030) Size, Share & Trends Analysis Report By Form (Liquid, Bars, Powder), By Gender (Men, Women), By Distribution Channel (Hypermarket & Supermarket, Specialty Stores, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-595-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Herbal Shampoo Market Summary

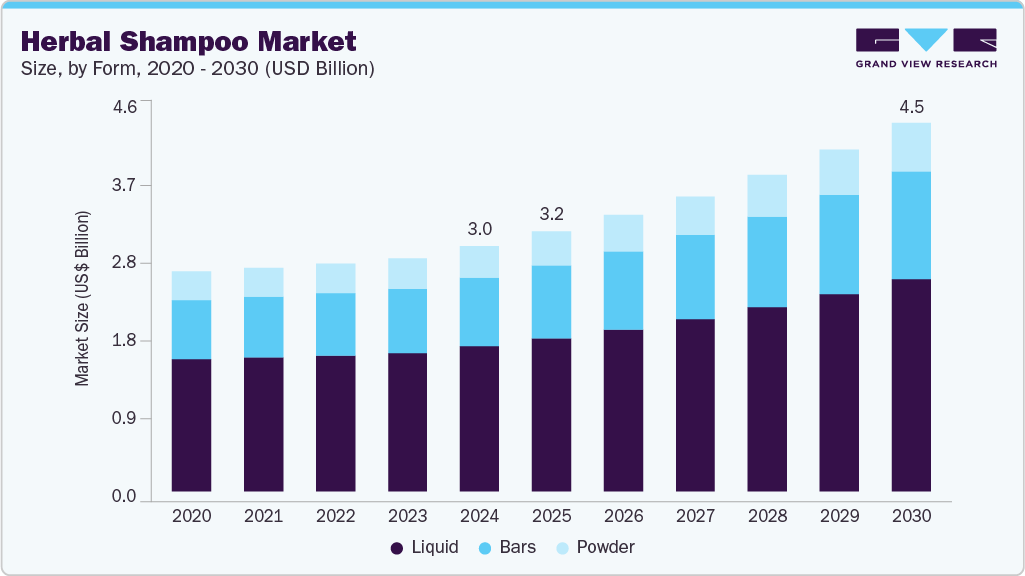

The global herbal shampoo market size was estimated at USD 3010.2 million in 2024, and projected to reach USD 4525.0 million by 2030, growing at a CAGR of 7.3% from 2025 to 2030. Increasing awareness of the potential health risks associated with synthetic chemicals in conventional shampoos has led consumers to prefer herbal alternatives from natural ingredients such as aloe vera, neem, and hibiscus.

Key Market Trends & Insights

- The herbal shampoo industry in Asia Pacific held a market share of 35.02% of the global revenue in 2024.

- The U.S. herbal shampoo industry is projected to experience substantial growth in the coming years.

- By form, the liquid herbal shampoo segment held a share of about 59.05% of the market in 2024.

- By gender, women accounted for a share of about 71.07% of the overall market in 2024.

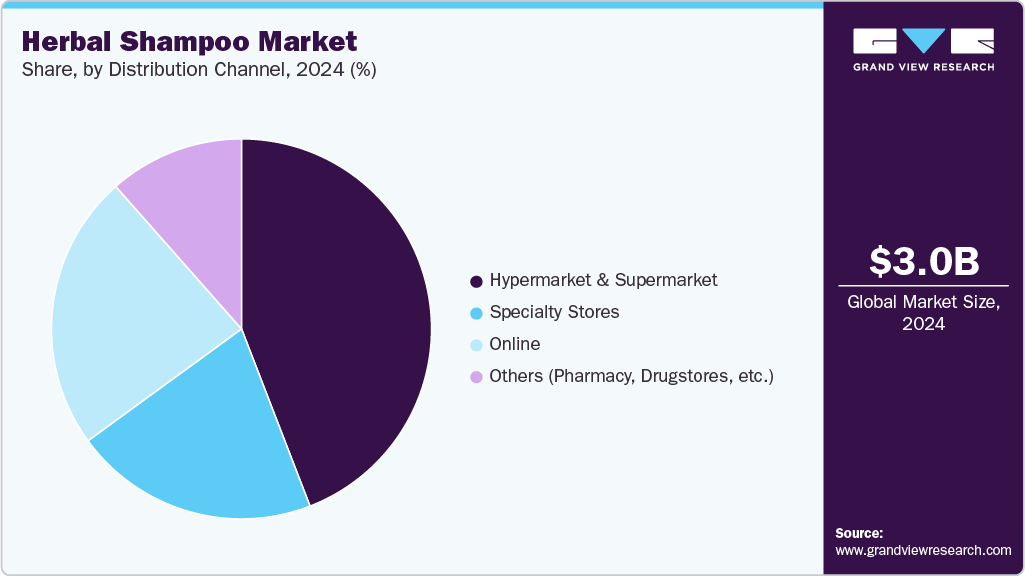

- By distribution channel, the distribution through hypermarkets and supermarkets accounted for a share of 44.13% of the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3010.2 Million

- 2030 Projected Market Size: USD 4525.0 Million

- CAGR (2025-2030): 7.3%

- Asia-Pacific: Largest market in 2024

- North America: Fastest growing market

The renewed popularity of traditional medicinal systems such as Ayurveda has boosted consumer interest in herbal shampoos that use proven natural ingredients. A significant growth driver for the herbal shampoo industry is the increasing preference for natural ingredients, especially essential oils. Valued not only for their pleasant aroma but also for their therapeutic properties, essential oils support hair growth and improve scalp health. Brands incorporating these oils into their formulations are well-positioned to attract consumers seeking products with both functional and nourishing benefits. As demand grows for multi-purpose hair care solutions, including essential oils, which offer a clear competitive edge.

Another emerging trend in the market is the shift toward sulfate-free formulas. Sulfates, which are strong cleansing agents, can remove natural oils from the hair, leading to dryness and brittleness. As a result, many people choose sulfate-free shampoos for their gentler effect on hair and scalp. In addition, the influence of social media and beauty influencers who advocate for natural and organic products is significantly boosting market growth.

One of the major influences is the growing demand for personalization, with many brands now offering customizable shampoos tailored to individual hair types, concerns, and preferences. Sustainability is also a key factor, as eco-conscious consumers increasingly seek products made using environmentally friendly practices, packaged in recyclable materials, and free from harmful chemicals. The rising focus on health and wellness has further fueled interest in shampoos formulated with natural, non-toxic ingredients that support overall hair and scalp health.

An emerging trend in the market is the introduction of innovative product formats like shampoo tablets. These tablets dissolve in water to create a lather, offering a sustainable alternative to traditional liquid shampoos. Brands such as EarthSuds have developed biodegradable, plastic-free shampoo tablets made from natural ingredients, catering to eco-conscious consumers seeking convenient and travel-friendly options. Companies like Jungbunzlauer have also formulated effervescent shampoo tablets that remain stable in humid environments and dissolve quickly upon contact with water, enhancing user experience while minimizing environmental impact.

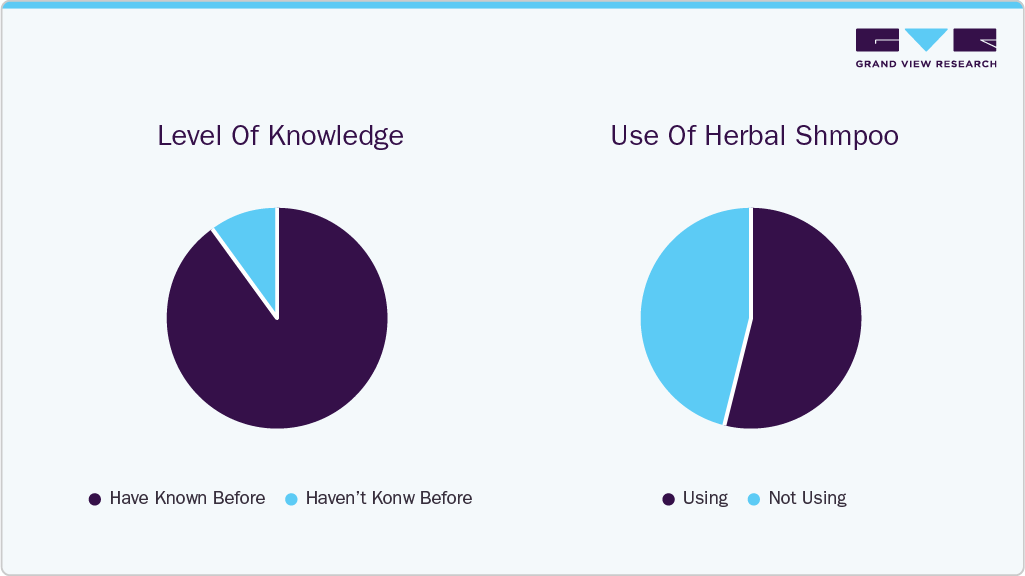

Consumer Insights & Surveys

According to the survey conducted by the International Journal of Education, Business and Economics Research (IJEBER) on herbal shampoo in Hanoi city, China, in May 2024, of the 201 survey participants, 180 people knew about herbal shampoo (90%) and only 21 people did not know about herbal shampoo (10%). Of the 180 people who know about herbal shampoo, 97 of them use it (54%), and 83 of them do not use it (46%)

The results indicate that "Natural ingredients" is the most valued advantage among respondents, receiving the highest selections at 169. This highlights a strong consumer preference for herbal shampoos that are free from synthetic chemicals. Following this, "Nourishes hair and scalp" was the second most chosen benefit, with 129 selections, suggesting that users are looking for products that offer both cosmetic and health benefits for their hair. "Non-irritation" and "Does not harm the environment" were also significant factors, each garnering 115 choices, reflecting growing awareness about skin sensitivity and environmental impact. Meanwhile, benefits such as "Improves scalp condition" (93 choices), "Stimulates hair growth" (91 choices), and "Hair moisturizing" (69 choices) show that while consumers appreciate these features, they are secondary to the broader appeal of natural, safe, and eco-friendly formulations. The analysis indicates a clear trend toward holistic hair care solutions that align with health and sustainability values.

Options

No. of Respondents

Percentage

Regularly

128

30.9%

Often

124

30.0%

Sometimes

72

17.4%

Very Rarely

33

8.0%

Not at all

57

13.8%

Total

414

100.0%

According to the survey conducted by IRJMETS in Mumbai, in November 2024, it is showing that herbal shampoos are widely accepted and used among the respondents. A significant portion, comprising 30.8% who use it regularly and 30.0% who use it often, indicates that over 60% of the participants incorporate herbal shampoo into their routine. This high usage level reflects a strong preference for natural and chemical-free personal care products, likely driven by growing health awareness and a shift toward eco-friendly and ayurvedic solutions. In addition, 17.4% of respondents use herbal shampoo sometimes, showing potential for conversion into regular users through targeted marketing, improved availability, or price incentives.

Form Insights

The liquid herbal shampoo segment held a share of about 59.05% of the market in 2024 due to several practical advantages that align with consumer needs and habits. One of the primary reasons is their ease of use and familiarity-most consumers are accustomed to liquid formats, making them easy to apply and seamlessly integrate into daily hair care routines. In addition, liquid shampoos are widely accessible through various distribution channels such as supermarkets, pharmacies, and e-commerce platforms, ensuring convenience and availability for users globally. Their formulation versatility also contributes to their popularity, as liquid shampoos can be infused with various herbal ingredients to address different hair types and concerns.

Demand for herbal shampoo bars is projected to rise at a CAGR of 8.1% from 2025 to 2030. Solid shampoo bars are gaining popularity as a sustainable alternative to traditional liquid shampoos, driven by growing environmental awareness and the shift toward zero-waste, eco-friendly lifestyles. These bars appeal to conscious consumers due to their minimal packaging and significantly lower carbon footprint. One of their key advantages is longevity-a single bar can last two to three times longer than a bottle of liquid shampoo, as they are more concentrated and require less product per use, making them cost-effective in the long run. Their compact, spill-proof nature makes them highly portable and ideal for travel. Solid shampoo bars often contain natural, sulfate-free ingredients, making them a healthier choice for sensitive scalps and those avoiding harsh chemicals. With increasing demand, a wide range of formulations now caters to different hair types and concerns, incorporating nourishing components such as shea butter, essential oils, and herbal extracts. Moreover, the reduced size and weight of these bars help cut emissions during transportation, and studies suggest switching to solid formats can reduce packaging waste by up to 80%, highlighting their environmental and practical benefits in the evolving hair care market.

Gender Insights

Women accounted for a share of about 71.07% of the overall market in 2024, due to a blend of biological, behavioral, and cultural influences that shape their hair care habits. They generally exhibit a higher awareness of hair health and engage in consistent routines to address issues like dryness, frizz, hair fall, and scalp sensitivity-concerns that herbal shampoos, known for their gentle and natural formulations, effectively address. Societal beauty standards and the influence of social media have further fueled this trend, as women are frequently exposed to beauty ideals and endorsements from influencers promoting herbal products. Marketing strategies also play a crucial role, with brands specifically targeting female consumers through tailored formulations, appealing packaging, and values such as sustainability. Cultural practices, particularly in countries like India, emphasize natural hair care, and women are more likely to follow these traditions, favoring herbal and ayurvedic ingredients.

The men's segment is expected to grow at a CAGR of 8.0% from 2025 to 2030, owing to the increasing awareness among men about the importance of using natural and organic products for hair care, leading to a rising demand for these products. The growing trend of men's grooming and self-care is encouraging more men to invest in high-quality natural hair care solutions. In addition, the influence of social media and marketing campaigns that promote men's hair care products as essential for maintaining healthy and stylish hair is boosting market growth.

Distribution Channel Insights

The distribution through hypermarkets and supermarkets accounted for a share of 44.13% of the market in 2024 due to their ability to offer various products, competitive pricing, and enhanced customer convenience. Consumers prefer such retail stores as they offer attractive discounts and schemes. The physical presence of supermarkets and hypermarkets allows consumers to engage directly with products-examining packaging, reading ingredient lists, and making informed choices-which remains a significant factor in purchasing decisions despite the rise of e-commerce. In addition, these stores often feature dedicated sections for various hair care needs, catering to different demographics and preferences, and enhancing the shopping experience. Major retailers such as Walmart, Target, and Kroger have capitalized on these advantages by offering diverse brand portfolios and implementing loyalty programs to enhance customer retention.

The online sales channels are anticipated to register a CAGR of 8.2% from 2025 to 2030. Consumers are increasingly turning to e-commerce platforms for the convenience of 24/7 access, wider product variety, and the ability to read reviews and compare prices before purchasing. Moreover, brands leverage digital marketing techniques, such as influencer campaigns and targeted ads, to raise awareness about herbal ingredients and their benefits. Online platforms also allow companies to reach customers in remote and untapped regions, further accelerating growth. This rapid expansion is supported by increasing internet penetration, smartphone usage, and consumer comfort with digital payments, making online sales the most dynamic.

Regional Insights

The herbal shampoo industry in North America held a market share of 18.18% of the global revenue in 2024, primarily driven by increasing consumer demand for natural and chemical-free hair care products. A robust regulatory framework restricts the use of harmful chemicals, prompting manufacturers to innovate and provide safer, cleaner alternatives. Consequently, heightened awareness of health and environmental concerns has led consumers in the region to prefer organic shampoos. For example, brands like Aveda, known for focusing on naturally sourced ingredients and eco-friendly practices, strongly appeal to consumers who prioritize effectiveness and sustainability in their hair care choices.

U.S. Herbal Shampoo Market Trends

The U.S. herbal shampoo industry is projected to experience substantial growth in the coming years, driven by rising consumer awareness of the harmful effects of synthetic chemicals commonly present in conventional hair care products. As more people focus on health and wellness, the demand for herbal shampoos formulated with natural ingredients, free from sulfates, parabens, and artificial fragrances, is increasing. For Instance, U.S. female hair care consumers are increasingly prioritizing products with natural and clean ingredients, expressing a preference for formulations such as biotin, plant extract and roots, essential oils, and botanicals. Overall, these preferences highlight that women are seeking multi-functional products that combine natural ingredients with proven efficacy to support hair health, strength, moisture, and scalp care, aligning closely with the clean beauty movement. This trend is further supported by social media influence and celebrity endorsements, highlighting the benefits of using herbal products. Moreover, the growing popularity of e-commerce platforms for personal care items has made it more convenient for consumers to explore and purchase a wide range of herbal shampoo options.

Asia Pacific Herbal Shampoo Market Trends

The herbal shampoo industry in Asia Pacific held a market share of 35.02% of the global revenue in 2024. The region's strong cultural affinity for herbal and ayurvedic remedies, particularly in India and China, has driven widespread acceptance and demand for natural hair care products. Consumers increasingly prefer herbal shampoos formulated with aloe vera, neem, and shikakai due to their perceived safety, effectiveness, and minimal side effects. For instance, in May 2023, CavinKare launched the Nyle Natural and Pure range, featuring no-sulfate formulations targeted at consumers seeking premium herbal shampoos. In May 2022, Medimix launched a total care shampoo enriched with natural ingredients suitable for all hair types in India, reflecting the growing trend toward organic and herbal formulations in personal care products. Consumer behavior has also evolved, with a significant shift towards personalized hair care solutions that address specific concerns such as dryness, frizz, and color treatment. The proliferation of e-commerce platforms and digital marketing has further enhanced product accessibility and awareness, allowing consumers to explore various herbal shampoos tailored to their needs. The region also benefits from a growing middle-class population with increasing disposable income, enabling greater spending on premium personal care products.

Key Herbal Shampoo Company Insights

The dominance of major herbal shampoo companies such as Procter & Gamble (P&G), Unilever, L'Oréal, and Kao Corporation continues to define the upper tier of the competitive spectrum.

-

L'Oréal S.A. is a French multinational company and the world’s largest cosmetics and beauty brand. Founded in 1909 and headquartered in Clichy, France, L'Oréal specializes in a wide range of beauty and personal care products, including skincare, haircare, makeup, and fragrances. The company operates in over 150 countries and owns numerous globally recognized brands such as L'Oréal Paris, Garnier, Maybelline, Lancôme, and Kérastase.

-

Kao Corporation is a leading Japanese multinational company headquartered in Tokyo, Japan. Founded in 1887, Kao specializes in consumer goods, with a strong focus on beauty care, personal care, and household products. Its product portfolio includes skin and hair care brands like Asience, Essential, Biore, and John Frieda, as well as household items like detergents and sanitary products.

Key Herbal Shampoo Companies:

The following are the leading companies in the herbal shampoo market. These companies collectively hold the largest market share and dictate industry trends.

- The Procter and Gamble Company (Herbal Essences)

- Unilever PLC

- L'Oréal S.A.

- Kao Corporation

- Biotique Ayurvedics Pvt. Ltd.

- Forest Essentials (A luxasia Company)

- Khadi Natural Healthcare

- Shiseido Company, Limited

- Giovanni Cosmetics, Inc.

- Lush Retail Ltd.

Recent Developments

-

In April 2024, Kao introduced a new hair care brand called Melt, designed to offer "beauty care for relaxing moments." The Melt Moisture Shampoo and Moisture Treatment features a hybrid repair formulation targeting both the outer and inner hair layers, aiming to enhance the user's self-care ritual through sensory experiences like sound, bubbles, texture, and aroma.

-

In February 2024, Herbal Essences launched the "Pure Plants of Aloe and Camellia Oil" collection, comprising 11 new shampoos and conditioners. These products are formulated with at least 96% natural-origin ingredients, including aloe and camellia oil, and are certified by the Royal Botanic Gardens, Kew. The new formulations aim to provide nourishment without weighing down the hair and are free from parabens and sulfates. Additionally, the packaging has been redesigned to use 25% less plastic and includes tactile markings to assist visually impaired consumers.

-

In June 2022, P&G announced the launch of its first high-performing shampoo and conditioner bars across its European haircare portfolio, including Herbal Essences. These solid bars are packaged in recyclable, FSC-certified paper boxes, aligning with the company's commitment to reducing plastic waste. Each bar is designed to last as long as two 250ml bottles of liquid shampoo, offering an eco-friendly alternative without compromising performance. The bars feature easy-to-hold shapes with integrated cotton ropes for convenient storage in the shower. This initiative is part of P&G Beauty's broader goal to reduce virgin plastic usage by 50% by 2025, equivalent to eliminating approximately 300 million plastic bottles annually.

Herbal Shampoo Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3188.0 million

Revenue forecast in 2030

USD 4526.0 million

Growth rate (Revenue)

CAGR of 7.3% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, gender, distribution channel, and region

Regional Scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; South Korea; Argentina; Brazil; UAE

Key companies profiled

The Procter and Gamble Company (Herbal Essences); Unilever PLC; L'Oréal S.A.; Kao Corporation; Biotique Ayurvedics Pvt. Ltd.; Forest Essentials (A luxasia Company); Khadi Natural Healthcare; shiseido Company, Limited; Giovanni Cosmetics, Inc.; Lush Retail Ltd.

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Herbal Shampoo Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global herbal shampoo market report based on form, gender, distributional channel, and region:

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid

-

Bars

-

Powder

-

-

Gender Outlook (Revenue, USD Million, 2018 - 2030)

-

Women

-

Men

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarket and Hypermarket

-

Specialty Stores

-

Online

-

Others (Pharmacy, Drugstores, etc.)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global herbal shampoo market was estimated at USD 3010.2 million in 2024 and is expected to reach USD 3188.0 million in 2025.

b. The global herbal shampoo market is expected to grow at a compound annual growth rate of 7.3% from 2025 to 2030 to reach USD 4526.0 million by 2030.

b. The liquid herbal shampoo segment accounted for a share of about 59.05% of the herbal shampoo market in 2024 due to several practical advantages that align with consumer needs and habits. One of the primary reasons is their ease of use and familiarity—most consumers are accustomed to liquid formats, making them easy to apply and seamlessly integrate into daily hair care routines.

b. Some of the key players in the herbal shampoo market are Procter and Gamble Company (Herbal Essences), Unilever PLC, L'Oréal S.A., Kao Corporation, Biotique Ayurvedics Pvt. Ltd., Forest Essentials (A Luxasia Company), Khadi Natural Healthcare, Shiseido Company, Limited, Giovanni Cosmetics, Inc., and Lush Retail Ltd.

b. Some of the key factors driving the market growth are the increasing awareness of the potential health risks associated with synthetic chemicals in conventional shampoos, the growing demand for multi-purpose hair care solutions, and the emerging trend in the market is the shift toward sulfate-free formulas.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.