- Home

- »

- Pharmaceuticals

- »

-

Hereditary Angioedema Therapeutics Market Report, 2030GVR Report cover

![Hereditary Angioedema Therapeutics Market Size, Share & Trends Report]()

Hereditary Angioedema Therapeutics Market Size, Share & Trends Analysis Report By Treatment (Bradykinin B2 Receptor Antagonist, C1-Esterase Inhibitor), By Route of Administration, By End Use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-156-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global hereditary angioedema therapeutics market size was estimated at USD 3.3 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.4% from 2023 to 2030. Growing cases of hereditary angioedema (HAE) globally is a key growth driver for the market. According to the National Organization for Rare Disorders (NORD), about 1 in 50,000 to 150,000 individuals are affected by HAE globally. The actual number of individuals with the condition can be significantly higher due to under-reporting and misdiagnosis.

Lack of awareness about HAE is a major reason for misdiagnosis, which in turn, leads to inadequate treatment being provided to patients. Most patients with hereditary angioedema are misdiagnosed for conditions related to appendicitis, gastrointestinal disorders, and other non-allergic angioedema. A significant number of patients being misdiagnosed for the condition has generated a vast patient pool with substantial medical needs. This is likely to be a key driving factor for the market growth.

Rising initiatives for improving awareness levels among the general population is another factor contributing to the growth of the market. HAE International (HAEi), an international hereditary angioedema patient organization, along with other patient organizations from across the globe lend their support to HAEday, which is marked on May 16th every year. The initiative aims to facilitate faster diagnosis and also provide optimal standards of treatment and care to patients.

Pharmaceutical drug manufacturers are increasingly focusing on developing novel therapeutics for hereditary angioedema in order to cater to the largely unmet medical needs. For instance, in August 2018, Adverum Biotechnologies, Inc. announced that it had received an orphan drug designation from the FDA for its preclinical gene therapy product candidate ADVM-053. The grant of orphan drug designation from the regulatory body is a positive step for ADVM-053, which is designed to be provided as a single †‘administration for sustained expression of the C1 esterase inhibitor protein used in HAE treatment.

Similarly, in April 2022, Takeda, a biopharmaceutical company, announced that the company had successfully completed the phase 3 study of TAKHZYRO (lanadelumab) that evaluated the safety profile and pharmacokinetics (PK) in patients aged 2 to 12 years. The company reported that the study had met its objectives related to safety profiling, clinical outcomes in preventing HAE, and characterizing pharmacodynamics of TAKHZYRO in the target patient group. These developments are likely to improve treatment options for patients.

Moreover, rare genetic disorders such as HAE have gained more attention and recognition in the past decade which has led to increased funding for research and development. This funding can enable the development of advanced HAE therapeutics as well as improve patients’ access to the treatment. For instance, in November 2021, BioCryst Pharmaceuticals, Inc. received funding of USD 350 million to support the development of ORLADEYO, an oral therapy for the treatment of HAE and its investigational oral Factor D inhibitor. Furthermore, in 2022, the company also received approval for the marketing of ORLADEYO from the Public Health Institute (ISP) of Chile to prevent the attacks of HAE in patients aged 12 and above in Israel.

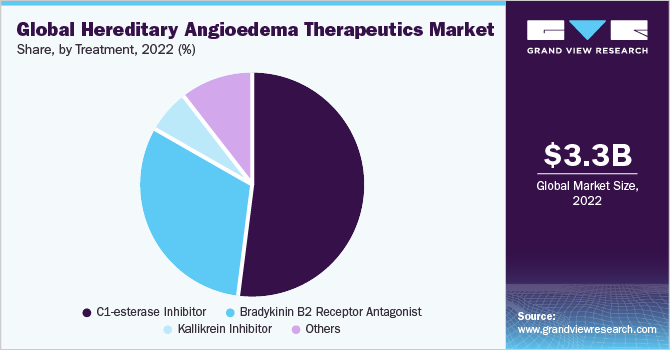

Treatment Insights

On the basis of treatment, the market is segmented into C1-esterase inhibitor, Kallikrein inhibitor, B2 bradykinin receptor antagonist, and other drugs such as attenuated androgens and tranexamic acid. The C1-esterase inhibitor segment accounted for the largest revenue share of 52.2% in 2022. The dominance of the segment is attributed to the use of the products in both on-demand and prophylactic treatment of HAE.

The kallikrein inhibitor segment is expected to grow at the fastest CAGR of 10.6% during the forecast period. Inhibiting kallikrein can effectively reduce bradykinin, therefore reducing the frequency of HAE attacks. The growth of the segment can be attributed to the fact that kallikrein inhibitors as a targeted therapeutic approach have provided HAE patients with novel treatment options.

According to the research findings published in the National Library of Medicine in February 2023, Sebetralstat, an oral plasma kallikrein inhibitor, was tested on 84 individuals for phase 2 trials, which have shown that the inhibitor facilitated quick suppression of plasma kallikrein activity in the subjects. Such developments can further help in improving patient outcomes and boost the segment growth during the forecast period.

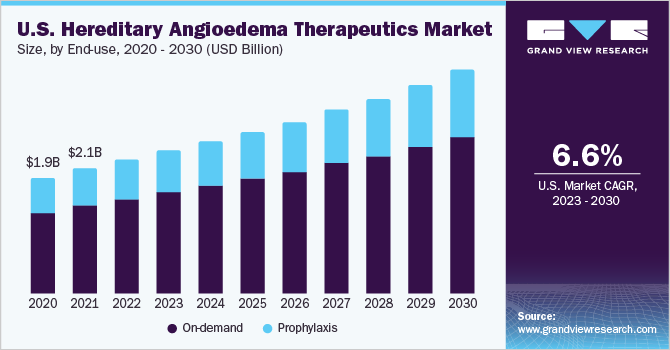

End-use Insights

Based on end-use, the market is segmented into on-demand and prophylaxis treatments. The on-demand treatment segment accounted for the largest revenue share in 2022. Continued use of on-demand products for the management of acute hereditary angioedema attacks is a high-impact rendering driver for the hereditary angioedema therapeutics market. In addition, the accessibility of acute treatment for angioedema has been vital in lessening the burden of disease for patients with HAE. These acute therapies, along with developments in prophylactic treatment, have enabled patients with HAE to live a normal life.

Moreover, development and approval of new and advanced products for on-demand treatments can further accelerate the growth of this segment. For instance, in June 2023, a clinical stage company named Pharvaris announced that U.S. FDA has lifted its clinical hold on the Investigational New Drug (IND) application for PHVS416 for on-demand treatment of HAE which can enable the company to continue its development.

Route of Administration Insights

By route of administration, the market is divided into intravenous, subcutaneous, and oral. The intravenous therapies segment dominated the market in terms of revenue in 2022. Existing therapies for the management of HAE are mostly administered intravenously, a factor that has been a key contributor to its growth.

Intravenously administered therapies have been the mainstay for treating hereditary angioedema patients for a long time. However, patients have limited vascular access, thus limiting the use of repeated IV medication. There are also additional risks associated with the placement of long-term catheters for therapy such as thrombosis and infection. Moreover, frequent administration of intravenous therapies also causes hardships to patients, affecting the treatment compliance rate.

Subcutaneously administered therapies are expected to exhibit the fastest CAGR throughout the forecast period due to advantages such as convenient dosing and superior efficacy as compared to intravenously administered drugs. Several research studies evaluating the outcomes of subcutaneously administered therapies have also shown positive results which can add to the growth of this segment. For instance, a research study published in the National Library of Medicine in May 2020 suggests that subcutaneous C1-INH has shown efficient results in the treatment of HAE in patients aged 65 and above with numerous comorbid diseases and polypharmacy.

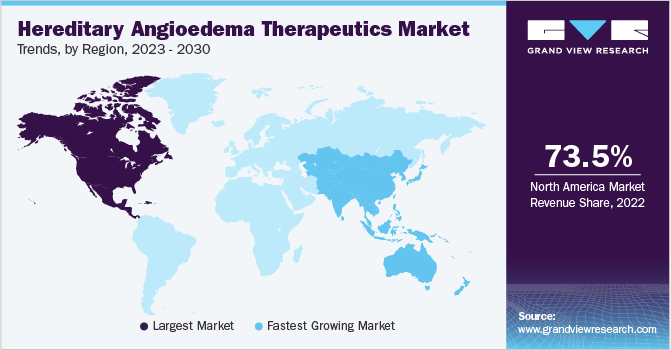

Regional Insights

North America dominated the market and accounted for the largest revenue share of 73.5% in 2022 owing to new product launches by major players, better reimbursement scenarios, and well-developed healthcare infrastructure. For instance, in February 2018, the FDA granted regulatory approval for Cinryze for expanded application in pediatric patients aged 6 years and above. In addition, in March 2023, Intellia Therapeutics, Inc. announced that it had received FDA clearance for its investigational new drug application for NTLA-2002 for the treatment of HAE. These launches can offer advanced treatment options and better outcomes to treat patients with HAE and foster growth in the market.

Asia Pacific is expected to grow at the fastest CAGR of 9.2% during the forecast period. The growth of the market can be attributed to increasing patient awareness about HAE and the launch of novel therapies for its treatment and management in the region. Furthermore, the increased funding from the government and private players is anticipated to provide further aid to market growth over the forecast period. For instance, in March 2021, the government of India launched the National Policy for Rare Diseases (NPRD) to assist in the diagnosis, prevention, and treatment of rare diseases and provided financial support of up to USD 60,000 to the patients.

Key Companies & Market Share Insights

Key players are entering into distribution agreements to increase their market share boost and their presence across different geographies. For instance, in January 2019, Takeda Pharmaceutical Company Limited completed the acquisition of Shire plc, the acquisition aided Takeda to expand geographically and made them leader in Japan and the U.S. market.

New product launches and increasing investment in the R&D of advanced products are further expected to boost the competition in the market. For instance, in September 2021, Cycle Pharmaceuticals launched SAJAZIR Injection, a novel treatment option for patients suffering from HAE. SAJAZIR, which is a bradykinin B2 receptor, can be used to treat acute bouts of HAE in adults aged 18 years and above. Similarly, in February 2023, Astria Therapeutics, Inc. announced that they had begun the ALPHA-STAR Phase 1b/2 clinical trial of STAR-0215 in individuals suffering from HAE. Some prominent players in the global hereditary angioedema therapeutics market include:

-

BioCryst Pharmaceuticals, Inc.

-

Ionis Pharmaceuticals

-

CSL

-

Attune Pharmaceuticals

-

Adverum Biotechnologies, Inc.

-

KalVista Pharmaceuticals, Inc.

-

Takeda Pharmaceutical Company Limited

-

Pharming

Hereditary Angioedema Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.5 billion

Revenue forecast in 2030

USD 5.8 billion

Growth rate

CAGR of 7.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Treatment, end-use, route of administration, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark, Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

BioCryst Pharmaceuticals, Inc.; Ionis Pharmaceuticals; CSL; Attune Pharmaceuticals; Adverum Biotechnologies, Inc.; KalVista Pharmaceuticals, Inc.; Takeda Pharmaceutical Company Limited; Pharming

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

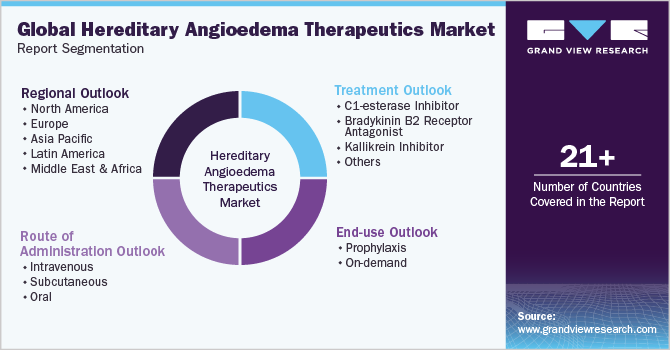

Global Hereditary Angioedema Therapeutics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hereditary angioedema therapeutics market report based on treatment, end-use, route of administration, and region:

-

Treatment Outlook (Revenue, USD Million, 2018 - 2030)

-

C1-esterase inhibitor

-

Bradykinin B2 receptor antagonist

-

Kallikrein inhibitor

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Prophylaxis

-

On-demand

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Intravenous

-

Subcutaneous

-

Oral

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hereditary angioedema therapeutics market size was estimated at USD 3.3 billion in 2022 and is expected to reach USD 3.5 billion in 2023.

b. The global hereditary angioedema therapeutics market is expected to grow at a compound annual growth rate of 7.4% from 2023 to 2030 to reach USD 5.8 billion by 2030.

b. The C1-esterase inhibitor segment accounted for the largest revenue share of 52.2% in 2022. The dominance of the segment is attributed to the use of the products in both on-demand and prophylactic treatment of HAE.

b. A few of the key players operating in the hereditary angioedema therapeutic market include BioCryst Pharmaceuticals, Inc.; Ionis Pharmaceuticals; CSL; Attune Pharmaceuticals; Adverum Biotechnologies, Inc.; KalVista Pharmaceuticals, Inc.; Takeda Pharmaceutical Company Limited; Pharming.

b. A significant number of patients being misdiagnosed for the condition has generated a vast patient pool with substantial medical needs. This is likely to be a key driving factor for the hereditary angioedema therapeutic market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."