- Home

- »

- Clinical Diagnostics

- »

-

Hereditary Testing Market Size, Share, Industry Report, 2033GVR Report cover

![Hereditary Testing Market Size, Share & Trends Report]()

Hereditary Testing Market (2025 - 2033) Size, Share & Trends Analysis Report By Disease Type (Hereditary Cancer Testing, Hereditary Non-cancer Testing), By Technology (Cytogenetic, Biochemical, Molecular Testing), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-999-9

- Number of Report Pages: 270

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Hereditary Testing Market Summary

The global hereditary testing market size was estimated at USD 16.16 billion in 2024 and is projected to reach USD 52.66 billion by 2033, growing at a CAGR of 14.42% from 2025 to 2033, due to the increasing prevalence of genetic disorders and related chronic conditions. As more individuals are diagnosed with inherited cancers, cardiovascular diseases, metabolic syndromes, and rare genetic abnormalities, the demand for early and accurate detection has surged.

Key Market Trends & Insights

- The Europe hereditary testing market dominated the global market and accounted for the largest revenue share of 34.40% in 2024.

- The Germany led the Europe market and held the largest revenue share in 2024

- Based on the disease type, the hereditary non-cancer testing segment dominated the global market with a 71.10% market share in 2024.

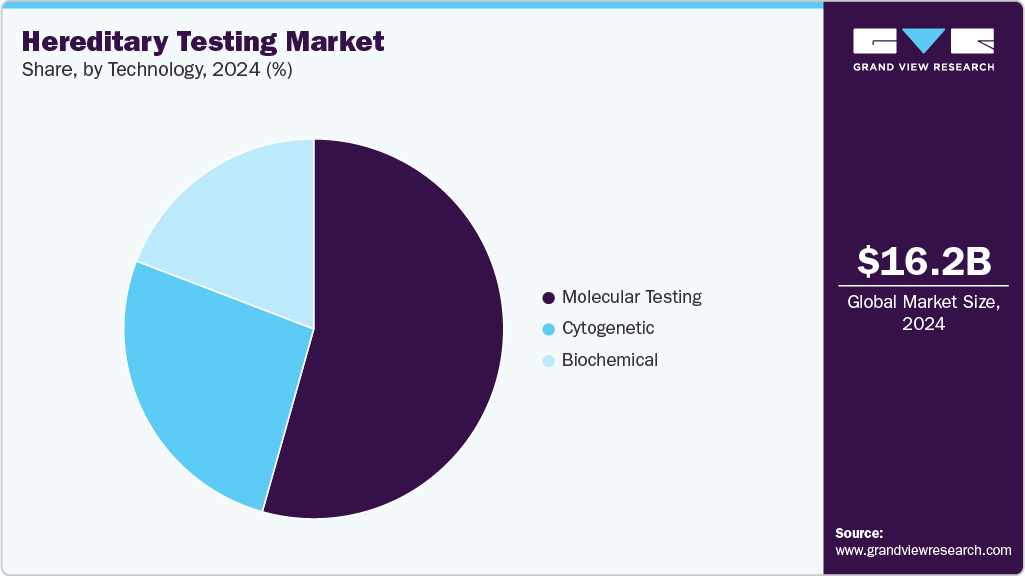

- Based on technology, the molecular testing segment held the largest revenue share of 54.37% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 16.16 Billion

- 2033 Projected Market Size: USD 52.66 Billion

- CAGR (2025-2033): 14.42%

- Europe: Largest Market in 2024

Many hereditary conditions often manifest later in life, making early testing essential for prevention, monitoring, and medical decision-making. Moreover, increased screening of newborns and infants has highlighted a substantial number of genetic abnormalities that previously went undetected. With better clinical awareness, physicians are recommending genetic testing more often as part of routine risk assessment. In addition, as populations age, age-related hereditary conditions-such as certain cancers and neurodegenerative disorders-are becoming more common, encouraging more genetic evaluations. Together, these factors drive sustained market growth by emphasizing the critical role of hereditary testing in identifying health risks before symptoms emerge.

Global Incidence Rate Of Genetic Disorders

Genetic Disorder

Frequency per 100,000 births

Autosomal Dominant Genetic Disorder

Familial combined hyperlipidemia

20 to 25

Familial Hypercholesterolemia

12 to 15

Dominant otosclerosis

10 to 15

Adult polycystic kidney disease

8 to 12

Multiple exostoses

5 to 10

Huntington’s disease

5 to 10

Autosomal Recessive Genetic Disorder

Cystic fibrosis

15 to 20

X-linked Recessive Genetic Disorder

Fragile X-syndrome

5 to 10

Duchene muscular atrophy

5 to 10

Source: WHO, U.S. CDC, FDA, Industry Journals, Investor Presentations, Primary Interviews, Grand View Research

Healthcare systems worldwide are increasingly prioritizing individualized treatment strategies based on patients’ genetic makeup. Hereditary testing enables clinicians to tailor therapies, avoid ineffective treatments, and predict disease progression with greater accuracy. Consumer awareness about the benefits of personalized healthcare-such as improved disease prevention, lifestyle planning, and early intervention-has expanded rapidly. Direct-to-consumer testing companies have also played a major role by educating the public and making genetic testing more accessible and affordable. As patients become more proactive about understanding their genetic risks, demand for hereditary testing continues to rise. Furthermore, precision oncology, pharmacogenomics, and reproductive health testing rely heavily on hereditary screening, strengthening the market’s position. Overall, the growing adoption of personalized medicine ensures long-term demand for accurate, reliable, and cost-effective hereditary testing solutions.

Rapid advancements in genetic testing technologies have significantly boosted the hereditary testing market. Innovations such as next-generation sequencing (NGS), whole genome sequencing (WGS), whole exome sequencing (WES), and advanced bioinformatics tools have transformed the accuracy, speed, and affordability of hereditary testing. For instance, in November 2024, CeGaT GmbH introduced an upgraded version (v6) of its proprietary exome enrichment product ExomeXtra, expanding non-coding splice region and CNV coverage - supporting improved diagnostics, including hereditary tumor syndromes. These technologies allow detection of a broader range of mutations, including rare or complex genetic variants that were previously difficult to identify. Automation and AI-driven analytics are also improving test efficiency and interpretation, enabling laboratories to process large volumes of data with minimal error. As testing becomes faster and more accessible, adoption rates across hospitals, research centers, and diagnostic laboratories have increased. Lower sequencing costs and improved computational capacity have further made hereditary testing more scalable. Such advancements not only enhance diagnostic capabilities but also enable continuous innovation in reproductive genetics, cancer screening, and preventive healthcare, driving strong market momentum.

Government initiatives and rising healthcare investments significantly influence the growth of the hereditary testing industry. Many countries have implemented national screening programs, reimbursement policies, and guidelines encouraging genetic evaluation for high-risk populations. Healthcare systems are increasingly recognizing the cost-effectiveness of early detection compared to long-term treatment of severe genetic disorders. Investments in genomic research, public-private partnerships, and population-wide genomic sequencing projects further stimulate innovation in the field. Furthermore, regulatory support has eased the approval of new genetic tests and allowed faster integration of advanced technologies into clinical practice. Developing regions are also expanding their diagnostic infrastructure, increasing access to hereditary testing services. These policy developments not only broaden availability but also enhance confidence among healthcare providers and patients. As governments continue prioritizing genomics and preventive healthcare, the hereditary testing market is expected to experience sustained global growth.

Hereditary testing is gaining wider use in reproductive and prenatal healthcare, contributing substantially to global market growth. Prospective parents are increasingly utilizing carrier screening to determine the risk of passing genetic disorders to their children. Prenatal genetic testing, such as non-invasive prenatal testing (NIPT), has gained popularity for identifying chromosomal abnormalities early in pregnancy. This helps families make informed decisions and prepare for potential medical needs. Besides, preimplantation genetic testing (PGT) is widely used in assisted reproductive technologies (ART) to ensure healthier embryo selection during IVF procedures. These applications reduce the likelihood of hereditary diseases in newborns and support safer pregnancies. As fertility treatments become more common worldwide, demand for hereditary testing continues to grow. The increasing acceptance of early diagnosis and preventive healthcare strategies reinforces the role of genetic screening as an essential component of modern reproductive medicine..

Although these hereditary tests have significant advantages over conventional tests, several industry experts have cited the cost and security concerns faced by consumers regarding the tests. Moreover, the lack of effective regulation of the tests is another key area that demands focused efforts. Despite these challenges, the genetic testing market is constantly expanding owing to the advantages of these innovative tests along with improved healthcare outcomes.

Market Concentration & Characteristics

The hereditary testing industry is experiencing a strong wave of innovation across a wide range of inherited conditions, extending far beyond hereditary cancers. Breakthrough technologies, including next-generation sequencing (NGS), advanced bioinformatics, and high-throughput platforms, are significantly improving accuracy, turnaround times, and affordability. These advancements continue to attract new entrants and substantial investment from both established diagnostics companies and emerging genomics start-ups. Leading players-including major global diagnostics firms-are heavily focused on sustained R&D efforts to strengthen their leadership positions, expand test panels, and address growing consumer and clinical demands. The rapid pace of technological advancement not only intensifies competition but also accelerates the expansion of testing applications in clinical, research, and consumer settings.

The market is also characterized by notable merger and acquisition (M&A) activity, driven largely by the need for companies to broaden their technical capabilities and enhance competitive advantage. Larger diagnostics and genomics organizations frequently acquire smaller, highly specialized firms to strengthen their test portfolios, integrate emerging technologies, and expand their geographical reach. A recent example is the acquisition of Ambry Genetics in 2024, when Tempus AI agreed to purchase the company for approximately USD 600 million in cash and stock. The acquisition strengthens Tempus’ hereditary testing expertise and expands its comprehensive genomic solutions portfolio. Such strategic deals reflect the industry's ongoing consolidation and underscore how companies are positioning themselves to capitalize on growing opportunities in hereditary risk assessment, precision medicine, and preventive healthcare.

Regulation plays a pivotal role in shaping the global market. Strict guidelines issued by authorities such as the FDA and CLIA ensure that genetic tests meet high standards of accuracy, clinical validity, and patient safety. While these frameworks safeguard consumers and enhance trust in test results, they also pose considerable challenges for new entrants. High compliance costs, rigorous documentation requirements, and lengthy review cycles often slow down product launches and limit competition. Nevertheless, some regions offer more adaptive regulatory pathways that encourage innovation, although these operate within clearly defined and tightly monitored boundaries.

The availability of product substitutes remains limited in the industry due to the specialized nature of genetic analysis in identifying inherited health risks. Conventional approaches-such as medical history evaluations, physical examinations, or imaging tests-may offer partial insights but cannot match the precision, predictive value, or molecular-level detail provided by genetic testing. As a result, hereditary tests remain the preferred and most scientifically reliable method for evaluating inherited disease risks. The lack of direct substitutes contributes to reduced price-based competition, reinforcing the dominance of established players with advanced testing technologies and bioinformatics capabilities.

End-user concentration within the hereditary testing landscape is moderate, primarily driven by demand from hospitals, diagnostic laboratories, academic research centers, and specialized genetic clinics. These institutions conduct the majority of clinical genetic testing due to their technical expertise and established patient pathways. However, the rapid rise of direct-to-consumer (DTC) genetic testing companies has expanded market access, allowing individuals to obtain hereditary insights without consulting a healthcare provider. Although DTC platforms expand the user base and reduce concentration, healthcare institutions still retain considerable influence. Their clinical credibility, integration with treatment decisions, and comprehensive testing capabilities ensure they remain key purchasers and influencers within the hereditary testing market.

Disease Type Insights

The hereditary non-cancer testing segment dominated the market in 2024, accounting for a revenue share of over 71.10%, and is projected to grow at a notable CAGR through the forecast period. This segment benefits from the rising prevalence of inherited cardiovascular, metabolic, neurological, and rare genetic disorders, driving consistent demand for comprehensive hereditary testing solutions. In parallel, product and service offerings across hereditary cancer testing have also expanded rapidly, supported by ongoing technological advances and greater clinical adoption. The entry of major diagnostic players such as Quest Diagnostics has further accelerated market growth by increasing accessibility, improving test availability, and intensifying competition. Breast cancer genetic testing, in particular, continues to represent a highly lucrative opportunity within hereditary cancer diagnostics. As a result, companies are deploying targeted business strategies-including expanded test panels, partnerships, and enhanced genetic counseling services-to strengthen their market presence and capitalize on growing consumer and clinical interest in hereditary risk assessment.

The hereditary cancer testing segment is expected to grow significantly in the market, driven by rising awareness of inherited cancer risks and increasing clinical adoption of preventive genetic screening. Demand continues to expand as individuals with a family history of cancers-such as breast, ovarian, colorectal, and prostate-seek early detection and personalized risk assessment. Technological advancements, particularly next-generation sequencing and expanded multigene panels, have enhanced test accuracy and reduced turnaround times, thereby promoting wider adoption in hospitals, oncology centers, and genetic counseling clinics. The growing emphasis on precision oncology also fuels this segment, as hereditary cancer testing increasingly guides treatment selection, surveillance strategies, and preventive interventions. Major diagnostic companies are enlarging their cancer-focused portfolios through new test launches, partnerships, and acquisitions, further accelerating market penetration. Overall, strong clinical relevance, technological innovation, and greater consumer awareness collectively support robust growth in the hereditary cancer testing segment.

Technology Insights

The molecular testing segment held the leading position in the hereditary testing industry, accounting for 54.37% of revenue in 2024. Its dominance is fueled by the growing need for early identification of hereditary disorders and the increasing role of genetics in guiding preventive and personalized medical decisions. As genetic mutations are recognized as core indicators of inherited conditions, molecular tests have become the preferred diagnostic method for detecting these variations with high sensitivity and precision. With rising public and clinical awareness of the benefits of genetic screening, demand for molecular testing continues to accelerate. The broader shift toward precision medicine further reinforces this trend, enabling clinicians to tailor treatment and management strategies to each patient’s unique genetic profile. Continuous technological advancements-particularly in next-generation sequencing (NGS)-are reshaping the segment. For instance, Exact Sciences’ launch of Oncodetect in April 2025 demonstrates progress in molecular residual disease detection across diverse hereditary-linked conditions.

The cytogentic segment held the second-largest market share in 2024 and is projected to grow at a lucrative rate over the forecast period, supported by expanding knowledge of how chromosomal abnormalities-including translocations, deletions, duplications, and aneuploidies-contribute to a wide spectrum of inherited disorders. Cytogenetic testing plays a vital role in genetic counseling by providing clearer insights into familial transmission risks, which helps guide reproductive and preventive decisions. Technological enhancements such as fluorescence in situ hybridization (FISH) and array comparative genomic hybridization (aCGH) have significantly increased testing accuracy, enabling more detailed visualization of chromosomal variations. As healthcare systems increasingly adopt genomic technologies, cytogenetic solutions are poised to advance rapidly, offering unmatched diagnostic clarity and supporting more personalized and informed patient care across global health settings.

Regional Insights

The North America hereditary testing industry is expected to grow at a significant CAGR over the forecast years, driven by advancements in next-generation sequencing (NGS), rising awareness of inherited disease risks, and broader insurance reimbursement for genetic screening. New technologies-including blood-based molecular tests-are improving early detection and enabling more personalized medical decision-making. Collaborative efforts in the region continue to strengthen market adoption. For example, in October 2023, a rural hospital system in North Carolina implemented universal hereditary testing for all breast cancer patients in partnership with Invitae. The program achieved a 91.4% testing rate and identified pathogenic germline variants in 13% of patients, influencing clinical management in 70% of cases. This demonstrates the impact of integrating hereditary testing into diverse healthcare environments, improving outcomes and optimizing resource use.

U.S. Hereditary Testing Market Trends

The U.S. hereditary testing industry is growing rapidly, supported by technological innovation, increasing consumer awareness, and expanding insurance coverage. Key companies-including Myriad Genetics, Invitae, Illumina, Natera, and Labcorp-continue to invest in R&D to expand their test portfolios across hereditary conditions. Rising cancer burden and changing epidemiology are central to market growth because a measurable fraction of cancers is attributable to inherited mutations. Between 5 and 10 percent of cancers are associated with an inherited pathogenic variant, which creates a sustained clinical need for germline assessment among newly diagnosed patients and survivors. Many clinicians now recognize that early-onset presentations, family clusters, and multigenerational risk signals warrant genetic evaluation, which expands the eligible population beyond historically tested groups.

Europe Hereditary Testing Market Trends

The hereditary testing industry in Europe accounted for the largest revenue share of over 34.40% in 2024 and is likely to maintain its lead during the forecast period. This can be attributed to the presence of key players providing genetic tests, the high adoption of advanced treatments, and recommendations provided by government agencies to ensure the quality of hereditary testing services. Variations in regulatory frameworks pertaining to genetic tests across the world have significantly impacted the approval and commercialization of tests in the global market. Currently, several key companies in the U.S. and various countries in Europe, the Asia Pacific, and other regions offer a wide variety of genetic tests.

The UK hereditary testing industry is expanding steadily, driven by the growing use of personalized treatment strategies and supportive government initiatives. Ongoing R&D efforts and advanced early-detection technologies are enhancing clinical outcomes. AI-enabled platforms are further improving accuracy and supporting genetic risk assessments, making hereditary testing more accessible and actionable.

The hereditary testing industry in Germany is also expanding rapidly, fueled by the rising prevalence of genetic disorders, strong government support, and widespread adoption of precision medicine. Leading companies such as Myriad Genetics, Illumina, Qiagen, and Thermo Fisher Scientific are broadening their gene panels and strengthening diagnostic solutions. Growing awareness, enhanced reimbursement, and AI-supported data interpretation continue to position Germany as a leading hub for hereditary diagnostics.

Asia Pacific Hereditary Testing Market Trends

The Asia Pacific hereditary testing industry is projected to record the fastest CAGR during the forecast period. Growth is driven by rising incidence of genetic disorders, increasing integration of precision medicine, and rapid advancement of NGS technologies. Regional expansions and strategic collaborations are further transforming the market. For instance, in November 2024, Advanced Genomics APAC partnered with 3BIGS to expand AI-powered hereditary screening across the Asia Pacific-reflecting strong demand for early detection and personalized healthcare solutions.

The hereditary testing industry in Japan is expanding steadily with support from government initiatives and increasing adoption of precision medicine. The National Cancer Center’s NCC Oncopanel has boosted access to multi-gene testing. Companies such as Myriad Genetics, Sysmex Corporation, and Ambry Genetics continue to enhance panel offerings and integrate AI for more accurate interpretation. Growing awareness and strong R&D pipelines are expected to drive sustained market expansion.

The China hereditary testing industry continues to grow rapidly due to rising disease prevalence, increasing public awareness, and improvements in healthcare infrastructure. Technologies such as NGS and direct-to-consumer (DTC) testing are making hereditary screening more accessible. Major players include BGI, Berry Genomics, Daan Gene, WuXi NextCODE, and Annoroad. Government programs, such as Healthy China 2030, and notable achievements-like the first IVF pregnancy guided by polygenic risk scoring-further accelerate growth.

Latin America Hereditary Testing Market Trends

The hereditary testing industry in Latin America is poised for substantial growth over the forecast period. The region is witnessing a rising adoption of personalized medicine, increasing healthcare investments, and a growing demand for the early identification of inherited disorders. Partnerships and innovation efforts are shaping the market landscape. For instance, in August 2021, Dasa expanded its collaboration with SOPHiA GENETICS to introduce Latin America’s first decentralized biomarker detection solution. These advancements are enhancing testing accessibility and improving diagnostic precision.

The Brazil hereditary testing industry is experiencing steady growth due to rising disease incidence, stronger government policies, and expanding precision medicine initiatives are key growth drivers. With major players such as Dasa, Myriad Genetics, Illumina, and Natera expanding hereditary testing accessibility, Brazil continues to advance early detection and personalized care. Improved insurance coverage and investments in genomic research further support market development.

Middle East And Africa Hereditary Testing Market Trends

The hereditary testing industry in the Middle East & Africa is experiencing steady growth, supported by increasing awareness of inherited conditions, improvements in healthcare infrastructure, and wider access to NGS technologies. Leading players include Illumina, Invitae, Centogene, and Eurofins Scientific. In January 2025, Diatech Pharmacogenetics partnered with Merck to expand access to personalized medicine solutions across the Middle East & Africa region, strengthening hereditary testing adoption. Despite challenges such as high testing costs and regulatory constraints, the market is expanding as early diagnosis and precision healthcare gain momentum.

The Saudi Arabia hereditary testing industry is growing, notably driven by government programs such as Vision 2030, rising disease awareness, and rapid improvements in healthcare infrastructure. Key participants include Anwa Medical Labs, NoorDX, Scientific Laboratories Alliance, ELAJ Group, and Genetrack Saudi Arabia. Growing adoption of precision medicine, expanding DTC testing services, and increasing preventive healthcare initiatives continue to support strong market growth across the region.

Key Hereditary Testing Company Insights

Understanding the role of genetic mutations in the development of inherited diseases has significantly accelerated R&D activities within the hereditary testing market. Numerous retrospective studies are being conducted to evaluate how inherited variants contribute to disease pathology, encouraging major diagnostic developers-such as Quest Diagnostics-to expand their presence in this sector. Continuous government approvals and authorizations for new genetic tests are further boosting the organic growth of operating companies.

For example, in February 2023, MedGenome launched a genetic test for diagnosing Facioscapulohumeral Muscular Dystrophy in India, enhancing access to specialized hereditary diagnostics. The competitive landscape is intensifying as companies broaden their product portfolios and prioritize product differentiation to gain market advantage.

A key example is CeGaT GmbH’s launch in November 2024 of its enhanced ExomeXtra v6 exome enrichment product, which offers expanded coverage of non-coding splice regions and copy number variations (CNVs), supporting more accurate diagnostics for hereditary conditions, including tumor syndromes. Prominent players across the global market continue to innovate and refine their offerings, driving sustained momentum and technological advancement.

Key Hereditary Testing Companies:

The following are the leading companies in the hereditary testing market. These companies collectively hold the largest Market share and dictate industry trends.

- Myriad Genetics, Inc.

- Invitae Corporation

- Illumina, Inc.

- Natera, Inc.

- Laboratory Corporation of America Holdings

- F. Hoffmann-La Roche Ltd.

- Quest Diagnostics Incorporated

- COOPERSURGICAL, INC.

- Agilent Technologies, Inc.

- Thermo Fisher Scientific, Inc.

- Twist Bioscience

- SOPHiA GENETICS

- Fulgent Genetics

- MedGenome

- CENTOGENE N.V.

Recent Development

-

In January 2025, CeGaT GmbH launched “CancerMRD” - a personalized, non-invasive minimal residual disease (MRD) monitoring service for solid tumors, complementing CeGaT’s hereditary tumor diagnostics offering.

-

In June 2025, GeneDx, LLC announced a partnership between GeneDx and Galatea Bio / Fabric Genomics to deliver integrated hereditary cancer panels with polygenic risk scores for breast, colorectal, prostate cancers.

-

In February 2025, Fulgent Genetics, Inc.entered a partnership with Foundation Medicine, Inc. to launch two hereditary germline tests (FoundationOne Germline and FoundationOne Germline More) in the U.S., powered by Fulgent’s technology platform.

-

In Decemebr 2024, Natera, Inc. launched the iPRS (integrated polygenic risk score) for breast cancer risk assessment in partnership with MyOme, offered alongside Natera’s Empower hereditary cancer test.

Hereditary Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 17.92 billion

Revenue forecast in 2033

USD 52.66 billion

Growth rate

CAGR of 14.42% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, disease type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; UAE; Saudi Arabia; Kuwait

Key companies profiled

Myriad Genetics, Inc.; Invitae Corporation; Illumina, Inc.; Natera, Inc.; Laboratory Corporation of America Holdings; F. Hoffmann-La Roche Ltd.; Quest Diagnostics Incorporated; COOPERSURGICAL, INC.; Agilent Technologies, Inc.; Thermo Fisher Scientific, Inc.; Twist Bioscience; SOPHiA GENETICS; Fulgent Genetics; MedGenome; CENTOGENE N.V.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Hereditary Testing Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global hereditary testing market report on the basis of disease type, technology, and region.

-

Disease Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Hereditary Cancer Testing

-

Lung Cancer

-

Breast Cancer

-

Colorectal Cancer

-

Cervical Cancer

-

Ovarian Cancer

-

Prostate Cancer

-

Stomach/Gastric Cancer

-

Melanoma

-

Sarcoma

-

Uterine Cancer

-

Pancreatic Cancer

-

Others

-

-

Hereditary Non-cancer Testing

-

Genetic Tests

-

Cardiac Diseases

-

Rare Diseases

-

Other Diseases

-

-

Preimplantation Genetic Diagnosis & Screening

-

Non-invasive Prenatal Testing (NIPT) & Carrier Screening Tests

-

Newborn Genetic Screening

-

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Cytogenetic

-

Biochemical

-

Molecular Testing

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Hereditary non-cancer testing dominated the hereditary testing market with a share of 71.10% in 2024. This is attributable to increasing acceptance and widespread implementation of preimplantation genetic diagnosis & screening and Non-invasive Prenatal Testing (NIPT).

b. Some key players operating in the hereditary testing market include Myriad Genetics, Inc.; Invitae Corporation; Illumina, Inc.; Natera, Inc.; Laboratory Corporation of America Holdings; F. Hoffmann-La Roche Ltd.; Quest Diagnostics Incorporated; COOPERSURGICAL, INC.; Agilent Technologies, Inc.; Thermo Fisher Scientific, Inc.; Twist Bioscience; SOPHiA GENETICS; Fulgent Genetics; MedGenome; CENTOGENE N.V.

b. Key factors that are driving the hereditary testing market growth include raising awareness of women's reproductive health, the decline in sequencing cost, and the expansion of the genetic testing registry.

b. The global hereditary testing market size was estimated at USD 16.16 billion in 2024 and is expected to reach USD 17.92 billion in 2025.

b. The global hereditary testing market is expected to grow at a compound annual growth rate of 14.42% from 2025 to 2033 to reach USD 52.66 billion by 2033.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.