- Home

- »

- Medical Devices

- »

-

Hernia Repair Devices Market Size, Industry Report, 2030GVR Report cover

![Hernia Repair Devices Market Size, Share & Trends Report]()

Hernia Repair Devices Market (2023 - 2030) Size, Share & Trends Analysis Report By Product Type (Hernia Mesh, Hernia Fixation Devices), By Procedure Type (Open Surgery, Laparoscopic Surgery), By Surgery Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-627-1

- Number of Report Pages: 95

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

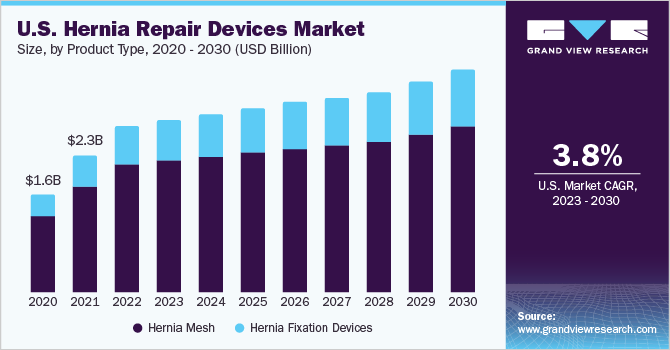

The global hernia repair devices market size was valued at USD 5.96 billion in 2022 and is anticipated to grow at a CAGR of 3.9% from 2023 to 2030. Owing to the increasing incidence of hernia, favorable reimbursement policies, and technological advancements related to repair devices. The high incidence of hernia is creating a growing demand for efficient repair devices, which is expected to supplement the market growth. According to the U.S. FDA, more than a million hernia repair procedures are done annually in the U.S. alone. The high incidence of hernia is creating demand for an efficient solution, which is expected to be responsible for the market growth.

The COVID-19 pandemic had a significant impact on the market. According to an article published by the Springer Journal, in February 2019, the proportion of emergency repairs and operations was approximately 2.5% for inguinal hernias and 5.9% for incisional and umbilical hernias. Additionally, in March 2020, an announcement was made by the German government to stop elective surgical interventions. Furthermore, the number of hernia repairs registered by Herniamed during March 2020 was reduced substantially. The lowest cases of hernia repair were registered in April 2020, during which, hernia repair surgeries were equivalent to about 25% of those conducted from February to June 2019. With the gradual decrease in COVID-19 cases after May 2020, restrictions executed on overall elective surgery across German hospitals were lifted, resulting in an increase in the number of elective hernia repairs. Despite the normalization of hospitalization policies in Germany, the caseload of hernia repairs in June 2020 was considerably lower than that in June 2019.

Hernia repair is one of the most common surgical procedures performed across the world. The incidence of hernia is higher in men than in women. Around 25% of males and 2% of females develop inguinal hernia. This disorder is associated with risk factors such as obesity, smoking, unhealthy lifestyle, and age. About 75% of all hernias occur in the groin among adults, leading to an increase in the adoption of hernia repair devices among the demographic. The high incidence of hernia is creating demand for efficient hernia repair, which is expected to boost market growth over the forecast period.

Technological advancements in hernia repair devices have rapidly increased in recent years. Advancements such as articulating fixation devices and self-fixating (gripping) meshes are developed to overcome the problems occurring during laparoscopic processes. In addition, such devices offer surgeons better access to weak spots within the abdominal wall and enable them to securely place the mesh at the desired body site, which is likely to boost market growth.

Product Type Insights

The hernia mesh devices segment dominated the market with the highest revenue share of 75.2% in 2022 owing to the wide adoption of these devices for treatment among the adult population especially in countries having high prevalence of hernia, such as the U.S., China, Japan, and India. The growth of this segment is primarily attributed to the resistance to infection and the ability to provide long-term tensile strength to prevent a recurrence. The utilization of hernia mesh products for surgical repair or reconstructing anatomical defects has been adopted widely.

According to the Food and Drug Administration (FDA), hernia mesh is used in approximately 90% of hernia repair surgeries. For instance, in March 2023, TELA Bio, Inc. announced the clearance from U.S. FDA 510(k)T for the company’s OviTex PRS Long-Term Resorbable product. Additionally, in September 2020, Surgical Innovation Associates got a CE mark for DuraSorb which is absorbable for aesthetic and reconstructive indications such as breast tissue support, prosthetic breast support, and hernia prophylaxis.

The hernia mesh segment is further segmented by biological and synthetic mesh. The synthetic mesh segment dominated the market in 2022 owing to the high product availability, the easy availability of product materials, and cost-effectiveness. For instance, in April 2022, Ariste Medical, a pre-commercial drug & device company, received a clearance from the U.S. FDA to retail its drug–embedded, synthetic hernia mesh in the U.S.

The hernia fixation devices segment is expected to expand at the fastest CAGR of 6.0% over the forecast period from 2023 to 2030. The segment is further segregated into sutures, tack applicators, and glue applicators. In August 2020, Deep Blue Medical, a company that addresses major hernia occurrences and reoccurrences, received FDA approval for its T-line Hernia Mesh with integrated suture-like extensions. Such product approvals and increasing adoption of hernia fixation devices in developing countries is expected to boost the growth of the segment over the forecast period.

Procedure Type Insights

The open procedures segment dominated the market with the largest revenue share of 75.3% in 2022 owing to its benefits such as the low cost of the procedure and fewer post-operative complications. Open hernia surgery involves making a large incision over the abdomen. The surgical mesh is placed over the repaired hernia to reinforce surrounding tissues. Benefits of open surgery include prevention of hernia reoccurrence, low cost of procedures, and lower chances of postoperative complications. However, complications associated with open surgery, such as excessive blood loss, injury to other organs, and blood clot formation, are likely to hamper the segment growth. In February 2021, W.L. Gore & Associates announced the launch of Synecor Intraperitoneal Biomaterial in Europe, South Africa, and the Middle East. This biomaterial is helpful in reconstructing and repairing hernias and abdominal wall soft tissue deficiencies.

The laparoscopic procedures segment is expected to grow at the fastest CAGR of 6.0% over the forecast period as it is widely accepted as a hernia treatment option. These minimally invasive surgeries are recommended owing to factors such as shorter hospital stays, faster recovery, fewer cuts, and reduced infection rate. For instance, in June 2020, W.L. Gore & Associates received a CE mark for Syncore tri-layer hybrid material which is helpful in laparoscopic, open, and robotic surgical procedures.

Surgery Type Insights

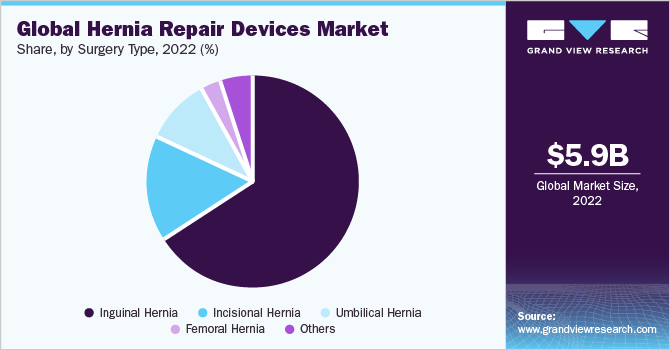

The inguinal hernia segment dominated the market with the largest revenue share of 66.1% in 2022. Factors driving this segment include patient feasibility due to tension-free procedures and the wide adoption of these surgical procedures. According to the FDA, there are more than 800,000 procedures of inguinal repair performed every year in the U.S. which peaks around age 5 and after age 70. According to an article by Medscape in March 2023, over 1 million wall hernia repair surgeries are performed annually in the U.S., with inguinal hernia repairs constituting around 770,000 of the cases, about 90% of all inguinal hernia repairs are conducted on men. Thus, the high incidence of these surgical procedures is creating demand for hernia repair devices.

Patients suffering from an inguinal hernia can be treated through open, laparoscopic, and robotic approaches. These approaches were identified after collecting a database in the Veterans Affairs Surgical Quality Improvement program who had elective inguinal hernia repair between 2008 and 2019. Also, in July 2020, Becton, Dickinson, and Company got clearance from FDA for its 3DMax MID Anatomical Mesh which helps in the reconstruction of soft and weak tissue, of inguinal hernias.

The incisional hernia segment is expected to grow at a lucrative CAGR over the forecast period from 2023 to 2030. An incisional hernia is caused due to a previously made abdominal wall incision or by incompletely healed surgical wounds. This surgery is the second most performed surgery after inguinal surgery. Furthermore, 50.0% of incisional hernias occur within 2 years after surgery, while 74.0% of incisional hernias occur within 3 years, thus creating the demand for hernia repair devices.

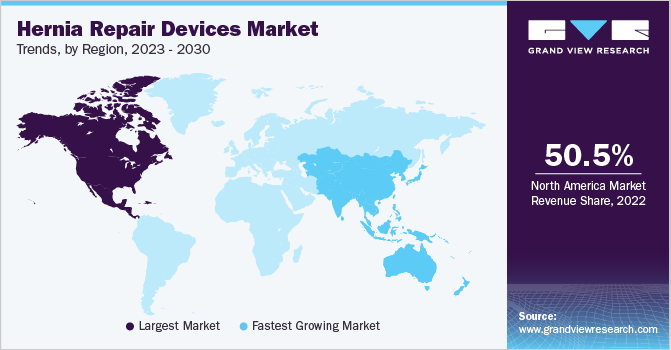

Regional Insights

North America dominated the market with the largest revenue share of 50.5% in 2022. Sedentary lifestyles, the increasing elderly population, and the high recurrence rate of hernia are some of the factors responsible for the market growth in North America. Moreover, rising healthcare expenditure and faster FDA approvals are adding to the market growth in the region. According to the National Center for Biotechnology Information, in March 2023, the U.S. had a high prevalence of ventral and incisional hernias. Ventral hernias affect around 20% of adults and incisional hernias develop in up to 30% of midline abdominal incisions.

Asia Pacific is expected to witness the fastest growth with a CAGR of 4.2% over the forecast period. Increasing medical tourism, affordable treatment, technological advancements, and rising healthcare reimbursements are some of the factors driving the market in this region. In addition, the demand for hernia repair devices is increasing in Asian countries, especially Japan and China, owing to a large patient pool. The region is expected to witness robust growth owing to a large number of undiagnosed and untreated cases, which is expected to further fuel the growth of the market in this region. According to National Center for Biotechnology Information, in March 2023, there were over 800,000 Incisional and Ventral Hernia Repair IVHR surgeries that took place in Australia. Australia had a sudden increase in IVHR surgeries in the last 20 years, specifically for primary ventral hernias.

Key Companies & Market Share Insights

The hernia repair devices market has been characterized by high competition owing to the presence of established players operating in the market. Thus, to maintain a greater market share, many large companies are coexisting with companies that specialize in a particular product line. For instance, in October 2022, DORC announced the acquisition of Peregrine Surgical LLC and WEFIS GmbH in order to increase the innovation and production capabilities of the business by expanding its geographic reach and speeding up the market. Furthermore, in April 2019, Cook Biotech announced a partnership with Progressive Medical to launch Biodesign Hernia in the U.S., which focuses on efficiency, improved patient outcomes, safety, and overall cost-effectiveness. Similarly, in December 2019, Johnson and Johnson announced the acquisition of Verb Surgical Inc., to contribute to developing medical technology such as; laparoscopic surgery, and open surgery for hernia and used in improving the outcomes for patients around the globe. Some prominent players in the global hernia repair devices market include:

-

Medtronic

-

Ethicon Inc.

-

BD

-

Atrium

-

W. L. Gore & Associates, Inc.

-

LifeCell International Pvt. Ltd.

-

B. Braun SE

-

Baxter

-

Cook

-

Herniamesh S.r.l.

Hernia Repair Devices Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 6.17 billion

Revenue forecast in 2030

USD 8.05 billion

Growth rate

CAGR of 3.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, procedure type, surgery type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Medtronic; Ethicon Inc.; BD; Atrium; W. L. Gore & Associates, Inc.; LifeCell International Pvt. Ltd.; B. Braun SE; Baxter; Cook; Herniamesh S.r.l.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hernia Repair Devices Market Report Segmentation

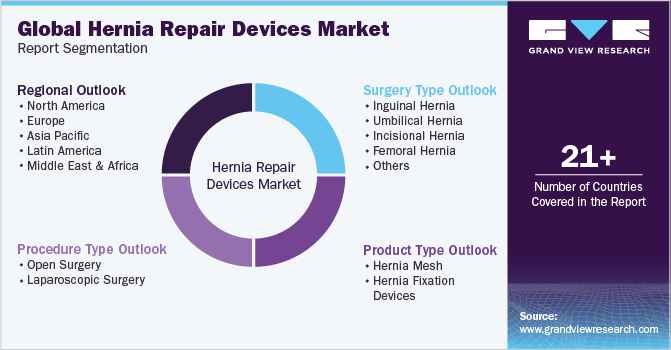

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hernia repair devices market report based on product type, procedure type, surgery type, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hernia Mesh

-

Biologic Mesh

-

Synthetic Mesh

-

-

Hernia Fixation Devices

-

Sutures

-

Tack Applicators

-

Glue Applicators

-

-

-

Procedure Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Open Surgery

-

Laparoscopic Surgery

-

-

Surgery Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Inguinal Hernia

-

Umbilical Hernia

-

Incisional Hernia

-

Femoral Hernia

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

- UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hernia repair devices market size was estimated at USD 5.96 billion in 2022 and is expected to reach USD 6.17 billion in 2023.

b. The global hernia repair devices market is expected to grow at a compound annual growth rate of 3.9% from 2023 to 2030 to reach USD 8.05 billion by 2030.

b. North America dominated the hernia repair devices market with a share of 50.5% in 2022. This is attributable to the presence of major players in the region.

b. Some key players operating in the hernia repair devices market include B Braun Melsungen AG, Cook Medical, Medtronic Plc, W.L. Gore & Associates, Ethicon Inc, C.R Bard Inc, Atrium, LifeCell Corporation, Baxter International, Inc., and Herniamesh S r l.

b. Key factors that are driving the hernia repair devices market growth include the rising incidence of hernia and technological advancements related to the repair devices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.