- Home

- »

- Organic Chemicals

- »

-

Hexane Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Hexane Market Size, Share & Trends Report]()

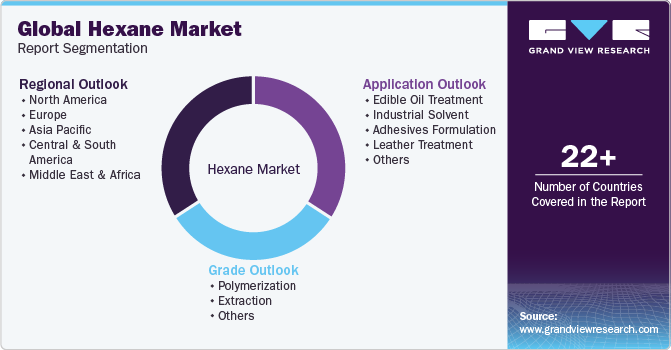

Hexane Market (2023 - 2030) Size, Share & Trends Analysis By Grade (Polymerization, Extraction, Others), By Application (Edible Oil Treatment, Industrial Solvent, Adhesives Formulation, Leather Treatment, Others), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-013-2

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hexane Market Summary

The global hexane market size was estimated at USD 2.17 billion in 2022 and is projected to reach USD 2.87 billion by 2030, growing at a CAGR of 3.5% from 2023 to 2030. owing to the widening application scope and increasing demand from the oil & gas extraction industry.

Key Market Trends & Insights

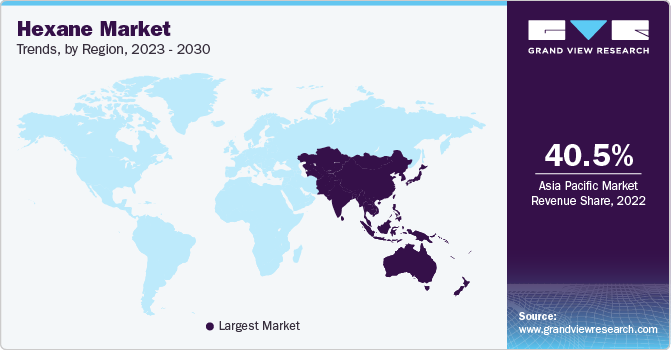

- The Asia Pacific dominated the market and accounted for the largest revenue share of 40.8% in 2022.

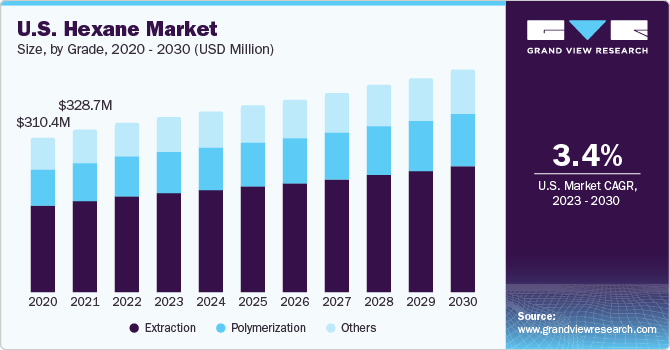

- The market in North America is expected to grow at a CAGR of 3.5% over the forecast period.

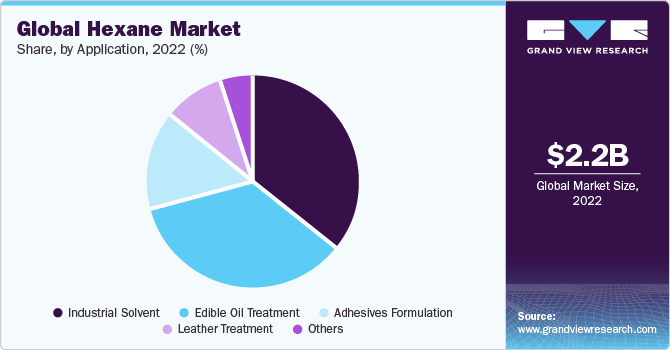

- Based on application, the industrial solvent segment held the largest revenue share of 36.0% in 2022.

- Based on grade, the extraction segment accounted for the largest revenue share of 56.4% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 2.17 Billion

- 2030 Projected Market Size: USD 2.87 Billion

- CAGR (2023-2030): 3.5%

- Asia Pacific: Largest market in 2022

It offers exceptional performance owing to properties such as transparency, low water solubility, and easy miscibility with chloroform, alcohol, and ether. Such characteristics are expected to drive the global market. Its increasing use in rubber and petrochemical industries is anticipated to boost the global market over the next eight years. Additionally, properties such as the ability to remove unwanted taste, color preservation, and other undesirable food properties are anticipated to drive its demand in the edible oil industry.

The primary use of solvents containing hexane is to extract vegetable oil from crops such as soybeans. The oil is extracted for various seed crops including cottonseed, mustard seed, rapeseed, peanuts, flax, soybeans, safflower seed, and corn germ, which are then processed into food. The solvents are increasingly being used as cleaning agents in the textile, shoemaking, furniture, and printing industries.

It is increasingly used in the healthcare and pharmaceutical industry as a liquid in the manufacturing of tablet molds along with a low-temperature thermometer and is anticipated to propel market growth. Furniture industry application includes its use as veneers which are manufactured from adhesives, lacquers, and cleaners.

Hexane, also known as n-hexane, is an organic compound derived from crude oil and natural gas by means of various catalytic and thermal cracking processes. It is both an anthropogenic as well as naturally occurring chemical. Therefore, volatility in crude oil and natural gas prices directly influences its price.

Global crude oil price dynamics are dependent on diverse factors, which primarily include the supply & demand balance, macroeconomic & geopolitical situations across the globe, currency exchange rates, and the existing condition of financial markets.

Hexane is primarily used in application as a special-purpose solvent and oil extraction owing to its use in various industries including edible oil, printing, textiles, leather, paints, and rubber. The growing use of hexane in the petrochemical and rubber industries and laboratories is anticipated to boost the global market over the forecast period.

Hexane also known as n-hexane is an organic compound derived from natural gas and crude oil through various thermal and catalytic cracking processes. Owing to its properties hexane in its highly purified form finds its application in chemical laboratories as an extractant for a wide range of non-polar organic compounds and hydrocarbons.

Rising environmental concern regarding the disposal of hexane owing to its highly flammable and toxic nature is expected to be a major challenge for the growth of the global hexane market over the forecast period.

Fluctuations in global crude oil prices have always been the focus of economic and financial news. Higher crude oil prices provide a positive outlook for oil-exporting countries, in contrast, countries dependent on petroleum imports suffer to varying degrees from higher prices to import bills increase.

Increasing demand from the solvent extraction application segment is expected to remain the key driving factor for the growth of polymerized grades over the forecast period. Expanding application scope in end-use industries such as pharmaceutical & drug delivery is further anticipated to boost demand significantly.

Strong demand from the edible oil treatment industry is anticipated to drive hexane demand significantly over the forecast period. The growth of the edible oil industry in emerging economies is another positive factor shaping industry dynamics in an upward manner.

The leather industry application of hexane includes use in leather dressing preparation particularly in assembling shoes. Hexane is one of the components in leather dressing that is applied as a lubricant on leather, particularly the ones that are in use in order to enhance its aesthetic appeal. Leather dressing is particularly used when the leather has lost its flexibility and is to be protected from humidity variation in the future.

Application Insights

The industrial solvent segment held the largest revenue share of 36.0% in 2022. Properties such as easy miscibility with ether, alcohol, and chloroform; low water solubility, and colorless nature make hexane a widely used solvent in industries such as textiles, footwear, furniture, and printing. The use of solvents has significantly changed modern living and is an invaluable solution for industries ranging from applications such as manufacturing printing ink, paints, coatings, adhesives, pharmaceuticals, and cosmetics, to applications in cleaning and printing products.

The edible oil treatment segment is expected to grow at a CAGR of 3.7% over the forecast period. Hexane is increasingly being used in the edible oil industry as an oil extractant for seed crops. Growth in this segment can be attributed to the rising awareness among consumers regarding the use of refined oil and the health impact associated with the same.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 40.8% in 2022. Increasing demand from the extraction application is expected to foster market growth over the forecast period. Rapid industrialization coupled with expanding healthcare facilities is expected to fuel the regional industry. The Asia Pacific dominated the global market owing to the rising economies in countries such as India, China, and South Korea. In addition, increasing industry players are venturing into the region on account of factors such as political support and low labor costs.

The market in North America is expected to grow at a CAGR of 3.5% over the forecast period on account of dwindling industrial production and high penetration of hexane applications in various industries. The North American market is perceiving restrained progress on expenses of deteriorating industrial production and high penetration consequently leading to a comparatively established economy.

Grade Insights

The extraction segment accounted for the largest revenue share of 56.4% in 2022. The industry is growing at a significant pace owing to the high standard of development required by the food and extraction industries.

The polymerization segment is projected to grow at a CAGR of 3.5% over the forecast period. Polymerization grade has been gaining traction in the industry owing to its purity, accurate composition, longer shelf life, and quality as per international standards. The grade is primarily used in various end-use industries such as wastewater treatment chemicals, soaps & detergents, tea-leaf processing, pre-metal treatment chemicals, and various other industries.

Key Companies & Market Share Insights

The hexane industry is more towards consolidation than fragmentation with presence the of a few industry players. Key players operational in the global hexane industry are adopting strategies such as production capacity expansion and product launches.

Key Hexane Companies:

- Exxon Mobil Corporation

- Shell Chemicals

- Chevron Phillips Chemical Company LLC.

- Bharat Petroleum Corporation Limited

- Sumitomo Chemical Co., Ltd.

- GFS Chemicals, Inc.

- China Petroleum & Chemical Corporation

- Junyuan Petroleum

- Idemitsu Kosan Co.,Ltd.

- TotalEnergies

Recent Developments

-

In May 2021, Chevron Phillips Chemical unveiled plans to enhance its alpha olefins business by constructing a second world-scale unit exclusively focused on manufacturing 1-hexene. The new unit is projected to have a capacity of 266 kilotons per annum (KTA) and is expected to commence operations in 2023. The facility will be located in Old Ocean, Texas, adjacent to Chevron Phillips Chemical’s existing Sweeny facility.

-

In August 2022, Chennai Petroleum Corporation Limited (CPCL) obtained approval from its board of directors to establish a joint venture (JV) in collaboration with Indian Oil Corporation and additional seed equity investors. The purpose of this JV is to undertake a refinery project with a capacity of 9 million metric tons per annum (MMTPA) at Cauvery Basin Refinery in Nagapattinam District, Tamil Nadu, India. Under the terms of the JV, Indian Oil and CPCL will each hold a 25% stake, resulting in a combined ownership of 50%. The remaining 50% stake in the JV will be held by other seed investors. CPCL’s product portfolio encompasses a range of items including LPG, hexane, aviation turbine fuel, superior kerosene, motor spirit, high-speed diesel, paraffin wax, lube base stocks, fuel oil, and petroleum coke.

Hexane Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.25 billion

Revenue forecast in 2030

USD 2.87 billion

Growth rate

CAGR of 3.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, Volume in Tons, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Grade, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Russia; Netherlands; China; Japan; India; South Korea; Southeast Asia; Brazil; Argentina; Saudi Arabia; South Africa ; UAE

Key companies profiled

Exxon Mobil Corporation; Shell Chemicals; Chevron Phillips Chemical Company LLC.; Bharat Petroleum Corporation Limited; Sumitomo Chemical Co., Ltd.; GFS Chemicals, Inc.; China Petroleum & Chemical Corporation; Junyuan Petroleum; Idemitsu Kosan Co., Ltd.; TotalEnergies

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hexane Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hexane market based on grade, application, and region:

-

Grade Outlook (Revenue, USD Million; Volume, Tons, 2018 - 2030)

-

Polymerization

-

Extraction

-

Others

-

-

Application Outlook (Revenue, USD Million; Volume, Tons, 2018 - 2030)

-

Edible Oil Treatment

-

Industrial Solvent

-

Adhesives Formulation

-

Leather Treatment

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Tons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Netherlands

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Southeast Asia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global hexane market size was estimated at USD 2.17 billion in 2022 and is expected to reach USD 2.25 billion in 2023.

b. The global hexane market is expected to grow at a compound annual growth rate of 3.5% from 2023 to 2030 to reach USD 2.87 billion by 2030.

b. Asia Pacific dominated the hexane market with a share of 40.81% in 2022. This is attributable to rapid industrialization coupled with expanding healthcare facilities.

b. Some key players operating in the hexane market include Mil-Spec Industries Corp., Environmental Equipment & Supply, GFS Chemicals, Inc., Continental Chemical, City Chemical LLC, AquaPhoenix Scientific and NOAH Technologies Corporation.

b. Key factors that are driving the market growth include widening application scope and increasing demand from the oil & gas extraction industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.