- Home

- »

- Next Generation Technologies

- »

-

High-speed Camera Market Size, Industry Report, 2030GVR Report cover

![High-speed Camera Market Size, Share & Trends Report]()

High-speed Camera Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Image Sensors, Processors, Lens, Memory), By Application, By Spectrum (Infrared, X-Ray, Visible RGB), By Frame Rate, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-384-9

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

High-speed Camera Market Summary

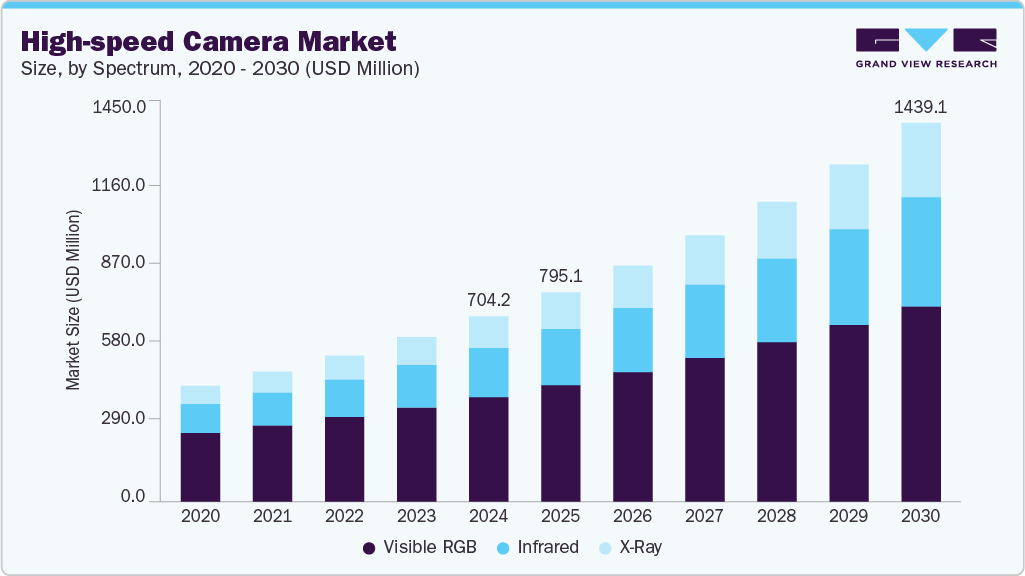

The global high-speed camera market size was estimated at USD 704.2 million in 2024 and is projected to reach USD 1,439.1 million by 2030, growing at a CAGR of 12.6% from 2025 to 2030. This growth is primarily driven by the increasing need for high-speed imaging and motion analysis across industries such as automotive, aerospace, manufacturing, and media.

Key Market Trends & Insights

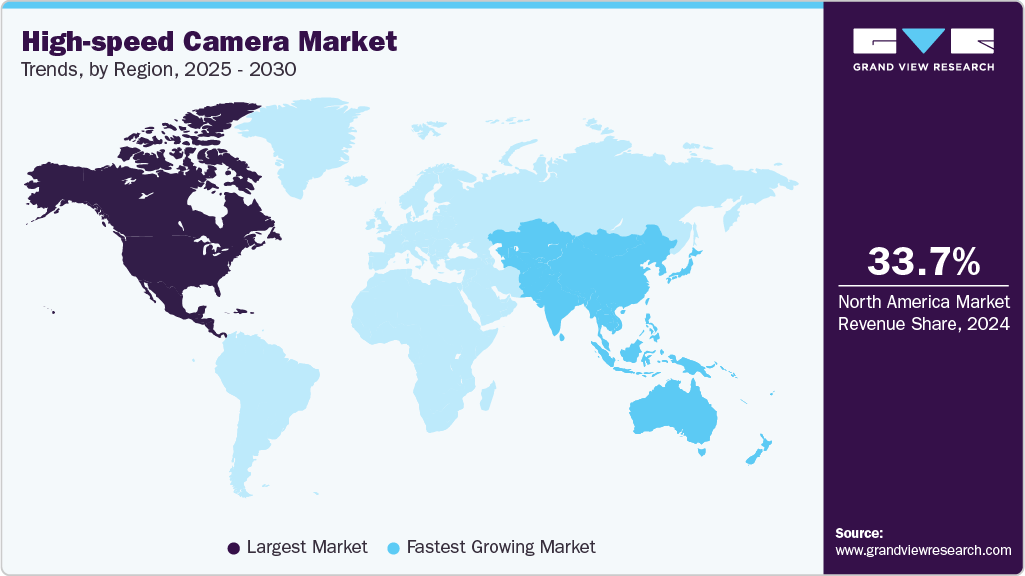

- The North America high-speed camera market generated the highest revenue share, accounting for over 33.74% in 2024.

- The U.S. high-speed camera market held a dominant position with the share of over 73% in 2024.

- By component, the image sensors segment captured highest market share of over 28% in 2024.

- Based on application, the aerospace and defense segment captured the highest market share in 2024.

- Based on spectrum, the visible RGB segment captured the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 704.2 Million

- 2030 Projected Market Size: USD 1,439.1 Million

- CAGR (2025-2030): 12.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The expansion of automation and quality assurance processes is boosting demand for precision imaging solutions. In addition, rising R&D activities and use in defense and scientific research are encouraging adoption of advanced systems. These factors, along with the integration of AI and machine vision, are anticipated to drive the growth of the high-speed camera market over the forecast period. The increasing demand for industrial automation and quality control is significantly boosting the high-speed camera industry. Manufacturers rely on these cameras to monitor fast-moving production lines and detect defects with high precision. Sectors such as automotive, electronics, and semiconductors are the primary drivers of this trend. Investments in advanced imaging technology reduce downtime and enhance overall product quality. As industries adopt more automated processes, the demand for reliable high-speed cameras will continue to rise.

The growing demand for AI and machine learning integration is transforming the high-speed camera industry by enhancing real-time image processing and defect detection. This integration enables companies to analyze large volumes of data swiftly, improving operational efficiency and accuracy. Automated systems powered by AI reduce human error and streamline quality assurance workflows. Predictive maintenance and process optimization are becoming standard with these advancements. Market leaders are investing heavily in AI to maintain a competitive edge.

The high-speed camera industry is expanding rapidly in the sports and entertainment sectors to capture ultra-slow-motion footage that enriches viewer experiences. Broadcasters and content creators are investing in high-speed cameras to provide detailed motion analysis and immersive replays. The demand is driven by rising consumer expectations for high-definition, dynamic content. Advances in portability and ease of use allow for flexible, on-location filming. This sector represents a growing and lucrative market for camera

The high-speed camera market is driven by increasing demand from scientific research and R&D to analyze rapid, transient phenomena across various disciplines. Fields such as material science, fluid dynamics, and biomechanics rely heavily on precise imaging for innovation and discovery. Research institutions and private laboratories are investing significantly in high-speed imaging technology. This capability to visualize previously imperceptible events fuels breakthroughs and enhances understanding. Continued funding in R&D is propelling steady growth in this segment.

The integration of advanced sensor and storage technologies is revolutionizing the high-speed camera industry, enabling higher frame rates and superior image quality. Innovations in sensor design improve sensitivity and resolution without compromising speed. Enhanced onboard memory and faster data transfer mechanisms help manage the massive data generated. These improvements are crucial for applications demanding real-time, high-quality imaging. Technology advancement is thus a critical factor in product differentiation and market growth.

Component Insights

The image sensors segment captured highest market share of over 28% in 2024, driving by the demand for higher resolution and frame rates, the image sensors segment is critical to advancing the high-speed camera industry. Innovations in CMOS and CCD technologies are enabling sensors to capture clearer, more detailed images even at ultra-high speeds. These improvements support applications across automotive safety systems, industrial inspection, and consumer electronics, where precision and speed are paramount. Companies are heavily investing in R&D to push the boundaries of sensor performance and maintain market leadership.

The memory segment is expected to witness a highest CAGR of over 15% from 2025 to 2030. primarily driven by the increasing demand for faster data acquisition and processing, the memory segment is pivotal in the high-speed camera industry. High-speed cameras generate massive volumes of data that require rapid, reliable storage solutions to avoid bottlenecks during capture and playback. Advances in high-speed RAM and solid-state memory enable seamless buffering and transfer of high-frame-rate footage. Companies investing in cutting-edge memory technologies gain a crucial advantage in delivering efficient, high-performance camera systems.

Application Insights

The aerospace and defense segment captured the highest market share in 2024, owing to the rising need for precision and safety in aerospace and defense testing, the high-speed camera market is experiencing significant growth. These cameras capture rapid events such as missile launches, aircraft component testing, and ballistics analysis with exceptional clarity and speed. Increasing defense budgets and technological modernization programs are fueling investment in advanced imaging solutions. The aerospace and defense segment remains a key revenue generator and innovation driver for the industry.

The healthcare segment is expected to witness the highest CAGR from 2025 to 2030. The increasing demand for precise diagnostic and surgical imaging is driving growth in the healthcare segment of the high-speed camera market. These cameras enable clinicians to capture rapid physiological processes with high clarity, improving outcomes in minimally invasive surgeries and rehabilitation. Expanding healthcare budgets and faster adoption of advanced medical technologies are accelerating market penetration. Healthcare is becoming a key focus area for high-speed camera manufacturers aiming to diversify their application portfolio.

Spectrum Insights

The visible RGB segment captured the highest market share in 2024. The increasing demand for high-quality color imaging is driving growth in the visible RGB segment of the high-speed camera market. Visible RGB sensors capture full-color details at ultra-high frame rates, which is essential for applications in broadcast media, sports analysis, and quality inspection. Advances in sensor technology are improving color accuracy and sensitivity without compromising speed, meeting the needs of visually demanding environments. As industries prioritize detailed color data for better insights and enhanced user experience, the visible RGB segment is becoming a critical growth driver.

The X-ray segment is expected to witness the highest CAGR from 2025 to 2030. The increasing demand for advanced imaging in non-destructive testing and medical diagnostics is fueling growth in the X-ray segment of the high-speed camera market. High-speed X-ray cameras enable the capture of rapid internal events, such as material stress tests, medical imaging, and industrial inspections, with exceptional temporal resolution. Innovations in sensor sensitivity and image processing are enhancing clarity and reducing exposure times, improving safety and efficiency. As industries seek more detailed internal analysis in real time, the X-ray segment is becoming an essential component of high-speed imaging solutions.

Frame Rate Insights

The 1000 - 10000 FPS segment captured the highest market share in 2024. The increasing demand for mid-range frame rate cameras operating between 1000 and 10,000 FPS is driving growth in the high-speed camera market. This segment strikes a balance between performance and cost, making it ideal for a wide range of applications including industrial inspection, sports analysis, and scientific research. Advances in sensor technology and data processing enable these cameras to deliver high-quality imaging without the complexity and expense of ultra-high-speed systems. As companies seek versatile and affordable solutions, the 1000–10,000 FPS segment is becoming a major growth area.

The 30000 - 50000 FPS segment is expected to witness the highest CAGR from 2025 to 2030. The growing demand for ultra-high-speed cameras capturing between 30,000 and 50,000 FPS is fueling advancements in the high-speed camera industry. This segment is essential for specialized applications such as ballistics testing, explosion analysis, and advanced scientific research that require capturing extremely fast transient events. Innovations in sensor speed, data bandwidth, and onboard memory enabling reliable performance at these frame rates. As industries push the limits of speed and precision, the 30,000–50,000 FPS segment is becoming critical for cutting-edge investigations and testing.

Regional Insights

The North America high-speed camera market generated the highest revenue share, accounting for over 33% in 2024, owing to strong investments in aerospace, defense, and automotive sectors, the high-speed camera industry in North America is expanding rapidly. The presence of leading technology firms and research institutions drives demand for advanced imaging solutions. Increasing adoption of automation and quality control in manufacturing further fuels market growth.

U.S. High-speed Camera Market Trends

The U.S. high-speed camera market held a dominant position with the share of over 73% in 2024,driven by growing defense modernization programs and automotive safety testing, the U.S. high-speed camera market is witnessing robust growth. Regulatory standards on vehicle safety and product quality are intensifying the need for precise high-speed imaging. Additionally, innovation hubs in Silicon Valley are accelerating product development and adoption.

Europe High-speed Camera Market Trends

The Europe high-speed camera market was expected to grow at a CAGR of over 13%, primarily driven by stringent industrial quality regulations and rising investments in scientific research, Europe’s high-speed camera market is evolving steadily. Countries such as Germany and the UK lead in adopting these technologies for manufacturing and R&D. The push toward Industry 4.0 and smart factories is also a significant market driver.

Germany’s high-speed camera market mobile gamers are driven by Germany’s strong automotive manufacturing base and emphasis on quality control; the high-speed camera industry is thriving. Industrial automation and precision testing in manufacturing plants boost demand for reliable imaging solutions. Continued innovation and export opportunities make Germany a central hub in the European market.

In the UK, high-speed camera is increasingly owing to increased government funding in defense research and a growing media production industry, the UK is a key market for high-speed cameras. The demand for detailed motion capture in sports and entertainment is rising sharply. Investments in automation and aerospace sectors further propel market expansion.

Asia Pacific High-speed Camera Market Trends

The Asia Pacific high-speed camera market in the Asia Pacific region is expected to grow at the highest CAGR of over 14% from 2025 to 2030, primarily driven by rapid industrialization, expanding electronics manufacturing, and growing automotive production, Asia Pacific is a fast-growing market for high-speed cameras. Rising investments in R&D and increasing adoption of automation technologies across China, Japan, and India accelerate growth. The expanding consumer electronics sector also contributes significantly to market demand.

China’s high-speed camera market is owing to large-scale infrastructure projects and booming electronics manufacturing; China is a dominant force in the high-speed camera market. Government initiatives to advance smart manufacturing and quality assurance drive adoption. In addition, growth in automotive safety testing and consumer media industries fuels demand.

Japan high-speed camera driven by Japan’s leadership in electronics, robotics, and automotive innovation, the high-speed camera industry is highly advanced in this region. High standards for manufacturing precision and quality control require sophisticated imaging solutions. Continuous R&D investments and integration of AI technologies are further accelerating market growth.

Key High-speed Camera Company Insights

Some of the key players operating in the market include Vision Research Inc., Photron Ltd., and Olympus Corporation.

-

Vision Research Inc.'s growth strategy in high-speed cameras focuses on innovation and expanding market reach. They invest in advanced technologies such as CXP-over-Fiber (CXPoF) for high data transfer rates and enhanced features such as Auto-exposure and Extreme Dynamic Range (EDR). The company aims to cater to diverse industries, including industrial, scientific, and media, by offering versatile solutions such as the Phantom series. They also emphasize user-friendly features and high performance to maintain leadership and attract new customers.

-

Olympus Corporation's growth strategy in high-speed cameras focuses on leveraging its expertise in optics and imaging technology to innovate and expand its product offerings. The company aims to enhance image quality, resolution, and frame rates, catering to advanced scientific and industrial applications. Strategic partnerships and investments in research and development are key components, enabling Olympus to integrate cutting-edge features like enhanced sensitivity and faster data processing. This approach positions Olympus to meet the increasing demand for high-speed imaging solutions.

Fastec Imaging, Optronis GmbH, and Motion Capture Technologies are some of the emerging market participants in the high-speed camera market.

-

Fastec Imaging's growth strategy in high-speed cameras focuses on delivering compact, portable, and user-friendly solutions tailored for industrial, scientific, and sports applications. The company emphasizes innovative features such as easy integration, high frame rates, and advanced software for precise motion analysis. By targeting niche markets and offering cost-effective, customizable products, Fastec aims to differentiate itself from competitors. In addition, they focus on expanding their global distribution network and providing robust customer support to enhance market presence and customer loyalty.

-

Optronis GmbH's growth strategy in high-speed cameras focuses on enhancing technological innovation and expanding market reach. They invest in developing advanced imaging technologies, such as higher frame rates and improved resolution. Optronis also aims to strengthen partnerships with industry leaders and expand their product offerings to meet diverse application needs. By emphasizing high-quality performance and customer-centric solutions, they target growth in sectors such as automotive testing, industrial applications, and scientific research.

Key High-speed Camera Companies:

The following are the leading companies in the high-speed camera market. These companies collectively hold the largest market share and dictate industry trends.

- Photron Ltd.

- Olympus Corporation

- NAC Image Technology

- Mikrotron GmbH

- Excelitas Technologies Corp

- Fastec Imaging

- Vision Research Inc.

- Optronis GmbH

- Motion Capture Technologies

- Del Imaging Systems LLC

- Ix-Cameras Inc.

Recent Developments

-

In June 2025, Ricoh introduced the RICOH360 THETA A1, a rugged 360° camera built for tough environments in industries like construction and real estate. The camera offers waterproof, dustproof, and temperature-resistant features along with long battery life and advanced video codecs for reliable immersive capture. Integrated with Ricoh’s RICOH360 ecosystem, it supports cloud storage, AI-enhanced image quality, and seamless workflow integration, enhancing professional 360° imaging capabilities.

-

In June 2025, Visteon launched manufacturing of high-resolution camera systems and display backlight units at its Chennai facility in India, supported by a USD10 million investment. These advanced cameras integrate with Advanced Driver Assistance Systems (ADAS) to enhance driver safety and support modern in-car displays. This initiative strengthens Visteon’s vertical integration, accelerates innovation, and reinforces India’s position as a key hub for automotive electronics manufacturing.

-

In May 2024, Excelitas Technologies Corp. introduced the pco.flim X Camera System, a successor to the pco.flim. The system, designed for life science and metrology applications, offered simplified setup with 1008 x 1008 pixel resolution and could read 45 double images per second. It supported a modulation frequency range of 5 kHz to 40 MHz and featured an enhanced cooling image sensor, achieving temperatures of -5°C with forced air and -20°C with water cooling. This improvement reduced readout noise below 15 [e-] and extended exposure times to 4 seconds, compared to the previous 2 seconds.

High-speed Camera Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 795.1 million

Revenue forecast in 2030

USD 1,439.1 million

Growth rate

CAGR of 12.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, application, spectrum, frame rate

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

Photron LTD.; Olympus Corporation; NAC Image Technology; Mikrotron GmbH; PCO AG; Weisscam, Vision Research Inc.; Optronis GmbH; Motion Capture Technologies; Del Imaging Systems, LLC; Ix-Cameras Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global High-speed Camera Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the high-speed camera market report based on component, application, spectrum, frame rate, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Image Sensors

-

Processors

-

Lens

-

Memory

-

Fans and Cooling

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive & Transportation

-

Consumer Electronics

-

Aerospace & Defense

-

Healthcare

-

Media & Entertainment

-

Others

-

-

Spectrum Outlook (Revenue, USD Million, 2018 - 2030)

-

Infrared

-

X-Ray

-

Visible RGB

-

-

Frame Rate Outlook (Revenue, USD Million, 2018 - 2030)

-

250 – 1000 FPS

-

1000 – 10000 FPS

-

10000 – 30000 FPS

-

30000 – 50000 FPS

-

Above 50000 FPS

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global high-speed camera market size was estimated at USD 704.2 million in 2024 and is expected to reach USD 795.1 million in 2025.

b. The global high-speed camera market is expected to grow at a compound annual growth rate of 12.6% from 2025 to 2030 to reach USD 1,439.1 million by 2030.

b. North America dominated the high-speed camera market with a share of over 33.0% in 2024; high-speed cameras are increasingly utilized in sports broadcasting and entertainment to capture slow-motion footage, providing audiences with detailed and immersive viewing experiences, thereby boosting market demand.

b. Some key players operating in the high-speed camera market include Photron LTD., Olympus Corporation, NAC Image Technology, Mikrotron GmbH, PCO AG, Weisscam, Vision Research Inc., Optronis GmbH, Motion Capture Technologies, Del Imaging Systems, LLC, Ix-Cameras Inc., and others.

b. Key factors that are driving the market growth include increasing demand for high-speed imaging in automotive and aerospace industries, rising adoption in entertainment and media production, and advancements in sensor technology improving image quality & frame rates.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.