- Home

- »

- Plastics, Polymers & Resins

- »

-

High-Temperature Polyamides Market Size Report, 2033GVR Report cover

![High-Temperature Polyamides Market Size, Share & Trends Report]()

High-Temperature Polyamides Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Polyphthalamide, PA46, PA9T), By Application (Automotive, Electronics & Electricals), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-828-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

High-Temperature Polyamides Market Summary

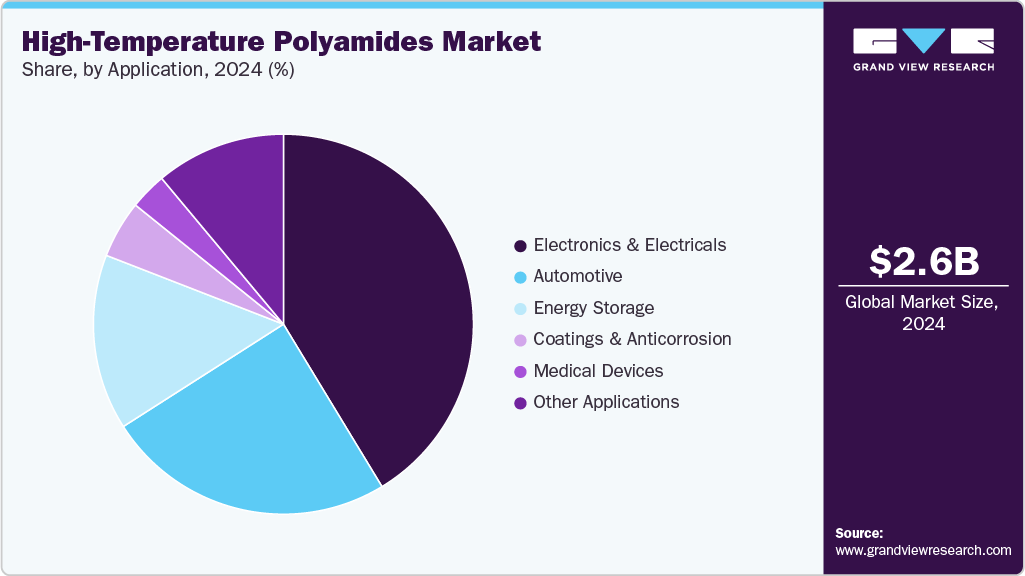

The global high-temperature polyamides market size was estimated at USD 2.61 billion in 2024 and is projected to reach USD 4.59 billion by 2033, growing at a CAGR of 6.5% from 2025 to 2033. Supply chain localization is driving more OEMs to source advanced polymers from regional producers, which increases demand for high-temperature polyamides with consistent quality.

Key Market Trends & Insights

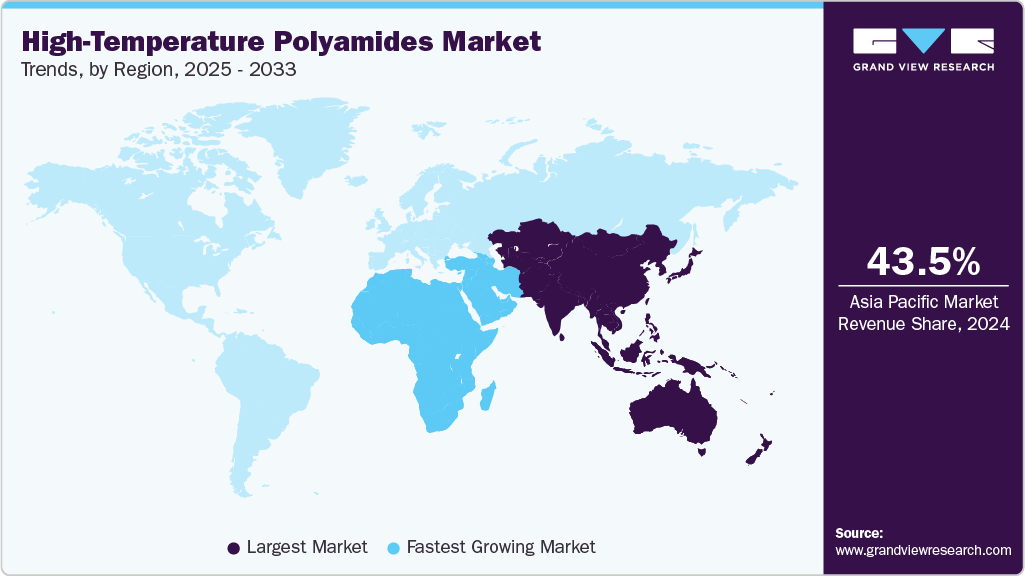

- Asia Pacific dominated the global high-temperature polyamides industry with the largest revenue share of 43.46% in 2024.

- The high-temperature polyamides industry in India is expected to grow at a substantial CAGR of 8.2% from 2025 to 2033.

- By type, the PA9T segment is expected to grow at a considerable CAGR of 7.2% from 2025 to 2033 in terms of revenue.

- By application, the automotive segment is expected to grow at a considerable CAGR of 7.1% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 2.61 Billion

- 2033 Projected Market Size: USD 4.59 Billion

- CAGR (2025-2033): 6.5%

- Asia Pacific: Largest market in 2024

- Middle East & Africa: Fastest growing market

The growing focus on component reliability in harsh environments is also prompting manufacturers to switch from standard nylons to higher-performing heat-resistant grades. High-temperature polyamides are shifting from niche engineering grades to mainstream high-performance materials. Demand is rising particularly in automotive electrification and in miniaturized power electronics where sustained heat resistance and dimensional stability matter. There is an increasing use of high-temperature polyamides in lightweight structural and thermal management applications. This shift reflects both the maturation of technology and increased OEM specification activity.

Drivers, Opportunities & Restraints

The most direct growth engine is system-level electrification: battery packs, charging systems, and powertrains require polymers that withstand higher continuous temperatures and chemical exposure. Parallel demand comes from 5G infrastructure and power conversion modules that concentrate heat in smaller volumes. These application requirements favor semi-aromatic and high-temperature polyamides that combine stiffness, creep resistance, and processability.

There is a clear opportunity to displace metal and high-cost specialty polymers in components that need moderate-to-high heat resistance but not the extreme performance of PEEK or PPS. Manufacturers can capture value by offering glass- or mineral-filled high-temperature polyamide compounds, long-fiber thermoplastic composites, and tailored formulations for injection molding and extrusion. Suppliers who couple material development with design-for-manufacture support will win OEM awards and downstream margin capture.

High-temperature polyamides face cost and handling headwinds. Their monomers and specialty intermediates are pricier than those of commodity nylons, and processing often requires higher melt temperatures and corrosion-resistant tooling, which increases manufacturing costs. Many high-temperature grades also absorb moisture, compromising dimensional stability unless dried and conditioned-adding supply-chain and cycle-time burdens. These factors limit rapid substitution in cost-sensitive segments.

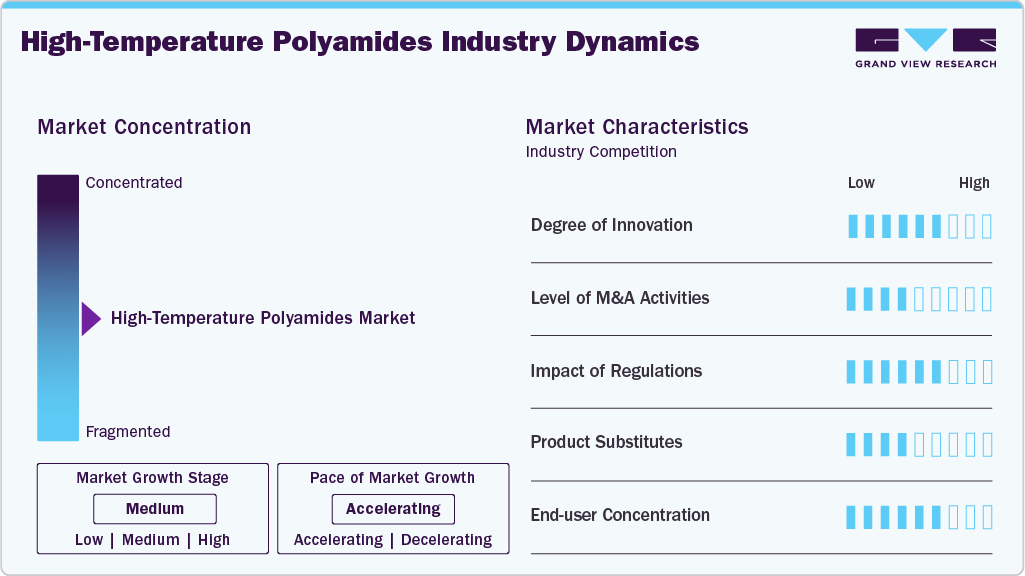

Market Concentration & Characteristics

The market growth stage is medium, and the pace of growth is accelerating. The market exhibits slight fragmentation, with key players dominating the industry landscape. Major companies such as DuPont de Nemours, Inc., Solvay S.A., BASF SE, Evonik Industries AG, and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet evolving industry demands.

Innovation in high-temperature polyamides today is practical and application-driven. Suppliers focus on compound engineering, glass and mineral fills, long-fiber thermoplastic formats, and improved flame-retardant packages to raise stiffness and thermal endurance while controlling costs. Process innovations reduce moisture uptake and enable reliable molding at lower cycle times, improving part-level yield. Manufacturers are also piloting bio-based monomers and co-development services to shorten OEM qualification timelines.

Substitution choices hinge on the performance versus cost equation. PEEK and polyimides replace polyamides where extreme temperature or chemical resistance is non-negotiable, while PPS and LCP serve as low-cost, high-heat alternatives in many electrical and industrial parts. Metals and ceramics remain preferred for structural load-bearing or wear-critical components, but are increasingly challenged where weight and corrosion matter. Regulatory pressure and lifecycle concerns are also prompting designers to favor engineered polyamides over certain fluoropolymers in specific applications.

Type Insights

PA9T dominated the market across the type segmentation in terms of revenue, accounting for a market share of 27.79% in 2024, and it is forecasted to grow at a 7.2% CAGR from 2025 to 2033. PA9T is gaining traction due to its semi-aromatic backbone, which delivers elevated continuous-use temperatures with superior hydrolysis resistance, making it preferable for components exposed to hot, humid environments. Suppliers and compounders are promoting PA9T for power-dense modules and under-the-hood applications where long-term thermal creep and chemical exposure matter. Rising OEM specifications for reliability in electrified powertrains and high-power electronics are shifting design wins toward PA9T compounds.

The PA46 segment is anticipated to grow at a substantial CAGR of 6.4% through the forecast period. PA46 commands premium use where short-term and long-term mechanical strength at very high temperatures is essential. Its intrinsic high melting point and creep resistance suit rotating and loaded parts in engines and transmissions, enabling direct substitution for metal in selected housings and gears. Market growth is supported by targeted licensing and specialty supplier strategies that maintain consistent grades available to automotive and industrial buyers.

Application Insights

Electronics & electricals dominated the market across the application segmentation in terms of revenue, accounting for a market share of 41.32% in 2024, and are forecasted to grow at a 6.6% CAGR from 2025 to 2033. The demand for high-temperature polyamides in electronics is driven by miniaturization and higher current densities, which raise local operating temperatures. Connectors, power modules, and insulators require materials that combine flame-retardancy, dimensional stability, and low electrical tracking; high-temperature polyamides meet this balance at lower cost than many fluoropolymers. Design-level trends toward compact power conversion and the expansion of 5G infrastructure are widening the qualified part lists for these resins.

The automotive segment is expected to expand at a substantial CAGR of 7.1% through the forecast period. Automotive demand is being pulled by electrification, which increases thermal and chemical stress on housings, connectors and battery-adjacent components. Lightweighting targets and emissions regulations push OEMs to replace metals with high-temperature polyamide solutions that reduce weight while maintaining heat endurance. Suppliers that provide validated, process-ready compounds and co-engineering support are winning larger volume programs in EV powertrain and thermal-management subsystems.

Regional Insights

Asia Pacific high-temperature polyamides industry held the largest share of 43.46% in terms of revenue in 2024 and is expected to grow at the fastest CAGR of 6.7% over the forecast period. The region’s role as a global manufacturing hub is driving steady uptake of high-temperature polyamides. Rapid capacity expansion in electronics manufacturing and rising EV production in countries across Asia require heat-resistant, process-stable resins at scale. Cost-competitive local compounders are enabling faster qualification cycles for large-volume parts. This combination of scale and application growth supports sustained regional demand.

China’s high-temperature polyamides industry’s large-scale electrification and domestic supply chain buildout create concentrated demand for high-performance polyamides. Local OEMs and battery makers are qualifying polyphthalamide and semi-aromatic grades for connectors, motor housings and thermal-management parts. State-led industrial policy and investments in EV and power-electronics capacity accelerate compounder expansion and substitution away from metal where feasible. Volume, cost and speed to market are the dominant commercial levers.

North America High-Temperature Polyamides Market Trends

North American high-temperature polyamides industry demand is being pulled by automotive electrification and advanced power electronics in pockets such as Michigan, California and Texas. OEMs and Tier suppliers are specifying high-temperature polyamides for battery enclosures, connectors and charging hardware to meet thermal and durability requirements. Regional sourcing priorities and nearshoring trends are strengthening local supply chains for specialty resins. These structural shifts are converting trial-grade usage into volume production.

U.S. High-Temperature Polyamides Market Trends

The high-temperature polyamides industry in the U.S. is driven by the federal policy and industrial incentives shaping procurement and manufacturing decisions. Support for domestic EV assembly and higher local content rules increase demand for validated, U.S.-sourced high-temperature polymers. Parallel funding for power electronics and semiconductor capacity boosts qualified part lists for heat-resistant resins. Suppliers able to offer certified supply, localized technical support and fast qualification gain a clear commercial edge.

Europe High-Temperature Polyamides Market Trends

The Europe high-temperature polyamides industry is anticipated to grow over the forecast period. Regulatory pressure on vehicle CO₂ and strict product safety standards are lifting demand for engineering-grade polyamides. OEMs target lightweighting and recyclability while meeting flame-retardancy and temperature endurance for EV and industrial applications. Circular-economy mandates push suppliers to provide traceable, recyclable high-temperature formulations. Vendors that combine regulatory compliance with validated design packages secure longer-term contracts.

Key High-Temperature Polyamides Company Insights

The high-temperature polyamides industry is highly competitive, with several key players dominating the landscape. Major companies include DuPont de Nemours, Inc., Solvay S.A., BASF SE, and Arkema S.A. The high-temperature polyamides industry is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key High-Temperature Polyamides Companies:

The following are the leading companies in the high-temperature polyamides market. These companies collectively hold the largest market share and dictate industry trends.

- DuPont de Nemours, Inc.

- Solvay S.A.

- BASF SE

- Evonik Industries AG

- Celanese Corporation

- Polyplastics Co., Ltd.

- Mitsui Chemicals, Inc.

- Ascend Performance Materials Operations LLC

- EMS-CHEMIE AG

- Arkema S.A.

Recent Developments

-

In November 2025, the European Commission cleared the acquisition of Ascend Performance Materials by Silver Point Capital. The deal reshapes ownership of a major polyamide producer and may influence global supply, pricing and strategic investment in high-temperature nylon capacity.

-

In October 2025, Mitsui Chemicals and Polyplastics announced a partnership to align marketing and go-to-market operations for engineering plastics. The collaboration aims to broaden regional access to specialty resins and speed product qualification for automotive and electronics customers across Asia.

High-Temperature Polyamides Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.77 billion

Revenue forecast in 2033

USD 4.59 billion

Growth rate

CAGR of 6.5% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Report Segmentation

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Spain; Italy; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

DuPont de Nemours, Inc.; Solvay S.A.; BASF SE; Evonik Industries AG; Celanese Corporation; Polyplastics Co., Ltd.; Mitsui Chemicals, Inc.; Ascend Performance Materials Operations LLC; EMS-CHEMIE AG; Arkema S.A.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global High-Temperature Polyamides Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the high-temperature polyamides market report based on type, application, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Polyphthalamide

-

PA46

-

PA9T

-

Specialty High-Temp Blends & Copolymers

-

Other Types

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Electronics & Electricals

-

Automotive

-

Energy Storage

-

Medical Devices

-

Coatings & Anticorrosion

-

Other applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global high-temperature polyamides market size was estimated at USD 2.61 billion in 2024 and is expected to reach USD 2.77 billion in 2025.

b. The global high-temperature polyamides market is projected to grow at a compound annual growth rate (CAGR) of 6.5% from 2025 to 2033, reaching a value of USD 4.59 billion by 2033.

b. Electronics & electricals dominated the high-temperature polyamides market across the application segmentation in terms of revenue, accounting for a market share of 41.32% in 2024, and is forecasted to grow at a 6.6% CAGR from 2025 to 2033.

b. Some key players operating in the high-temperature polyamides market include DuPont de Nemours, Inc., Solvay S.A., BASF SE, Evonik Industries AG, Celanese Corporation, Polyplastics Co., Ltd., Mitsui Chemicals, Inc., Ascend Performance Materials Operations LLC, EMS-CHEMIE AG, and Arkema S.A.

b. Supply chain localization is driving more OEMs to source advanced polymers from regional producers, which increases demand for high-temperature polyamides with consistent quality. The growing focus on component reliability in harsh environments is also prompting manufacturers to switch from standard nylons to higher-performing, heat-resistant grades.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.