- Home

- »

- Organic Chemicals

- »

-

Higher Alpha Olefins Market Size, Industry Report, 2030GVR Report cover

![Higher Alpha Olefins Market Size, Share & Trends Report]()

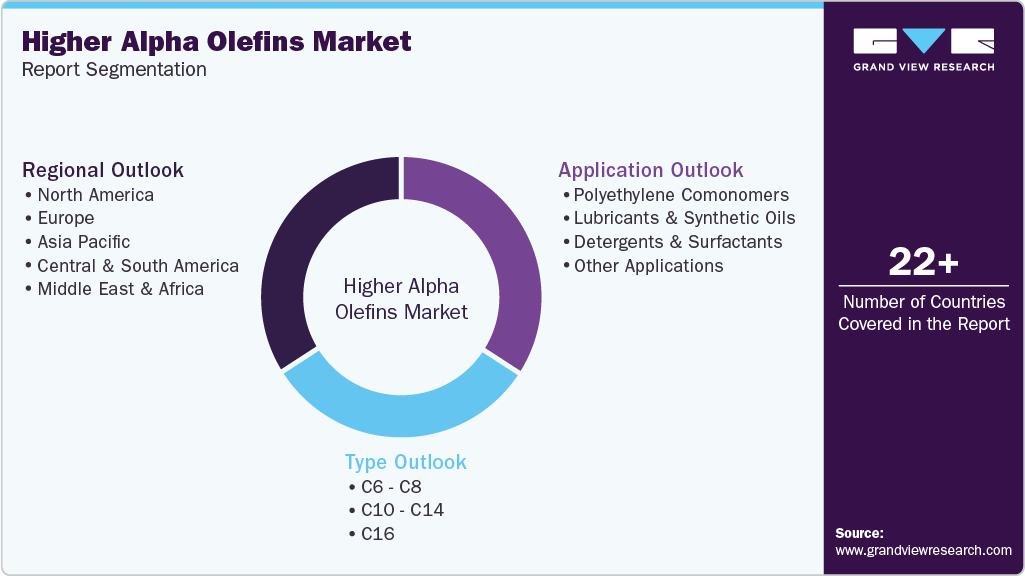

Higher Alpha Olefins Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (C6-C8, C10-C14, C16), By Application (Polyethylene Comonomers, Lubricants & Synthetic Oils), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-617-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Higher Alpha Olefins Market Summary

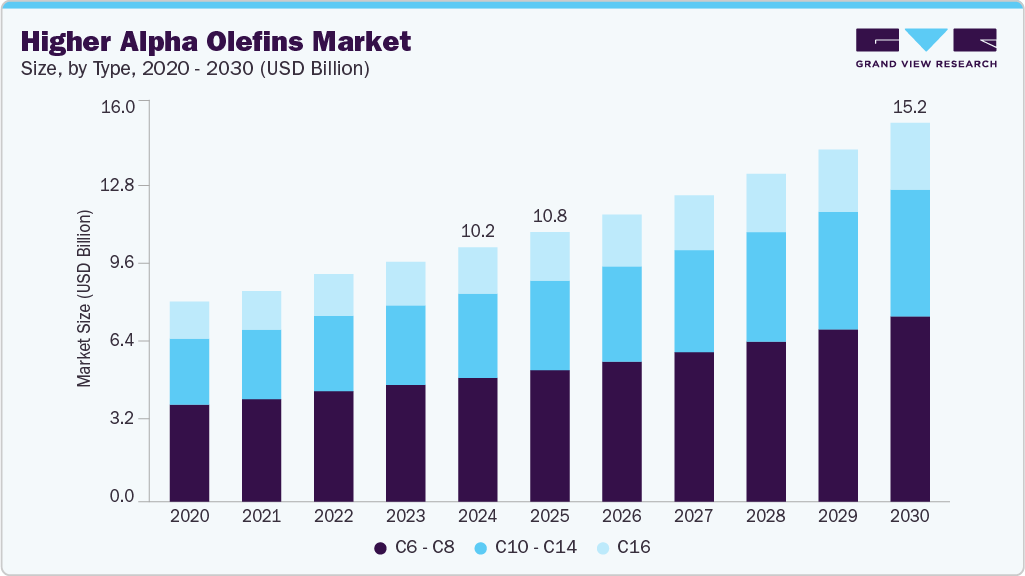

The global higher alpha olefins market size was estimated at USD 10.2 billion in 2024, and is projected to reach USD 15.2 billion by 2030, growing at a CAGR of 7.0% from 2025 to 2030. Higher alpha olefins (HAOs) are linear, terminal olefins characterized by a double bond located at the first carbon atom, primarily synthesized via the oligomerization of ethylene.

Key Market Trends & Insights

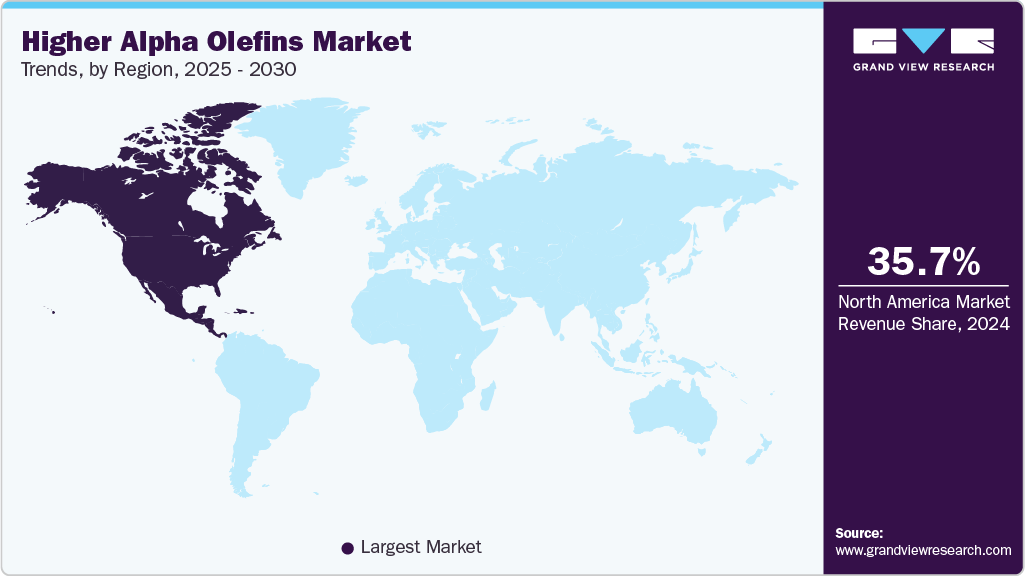

- North America dominated the market with the largest revenue share of 35.7% in 2024.

- The higher alpha olefins market in the U.S. accounted for a revenue share of over 90% in North America.

- By type, the C10-C14 segment higher alpha olefins market is expected to witness the fastest growth of 7.2% from 2025 to 2030.

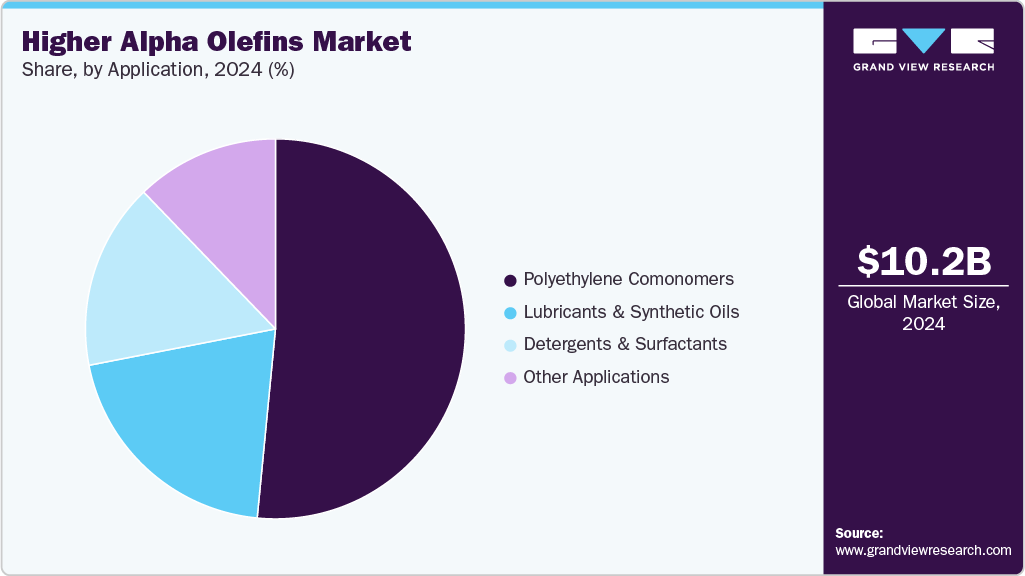

- By application, polyethylene comonomers segment dominated the market with a revenue share of 51.5% in 2024.

Market Size & Forecasts

- 2024 Market Size: USD 10.2 Billion

- 2030 Projected Market Size: USD 15.2 Billion

- CAGR (2025-2030): 7.0%

- North America: Largest market in 2024

- Asia-Pacific: Fastest growing market

These versatile hydrocarbons are foundational building blocks in the production of a wide range of downstream chemical products. Their most significant role lies in the manufacture of polyethylene comonomers, where HAOs enhance polymer flexibility, impact strength, and processability key properties required in packaging films, containers, and plastic products. In addition, HAOs serve as essential intermediates in the formulation of synthetic lubricants, surfactants, detergent alcohols, and oilfield chemicals, driven by their favorable physical properties such as low volatility, thermal stability, and biodegradability.The higher alpha olefins industry is benefiting from a confluence of industrial and regulatory shifts. There is an increasing emphasis on environmentally sustainable materials and formulations, with downstream manufacturers seeking raw materials that comply with stringent environmental standards. In particular, regulations such as REACH in Europe and FDA guidelines in the U.S. are encouraging innovation in the design of low-toxicity, high-purity HAO products. This is prompting producers to invest in cleaner processes, enhanced catalytic systems, and high-efficiency downstream integration.

Moreover, growing demand for high-performance plastics, energy-efficient lubricants, and bio-based surfactants is expanding the application base of HAOs. Innovations in polymer chemistry and customized olefin chain lengths are also helping manufacturers tailor products to meet specific functional requirements in fast-evolving industries such as automotive, consumer packaging, and personal care. As a result, the global HAO market is evolving from a commodity-focused sector to a value-added, application-specific industry with increasing demand for performance-oriented grades.

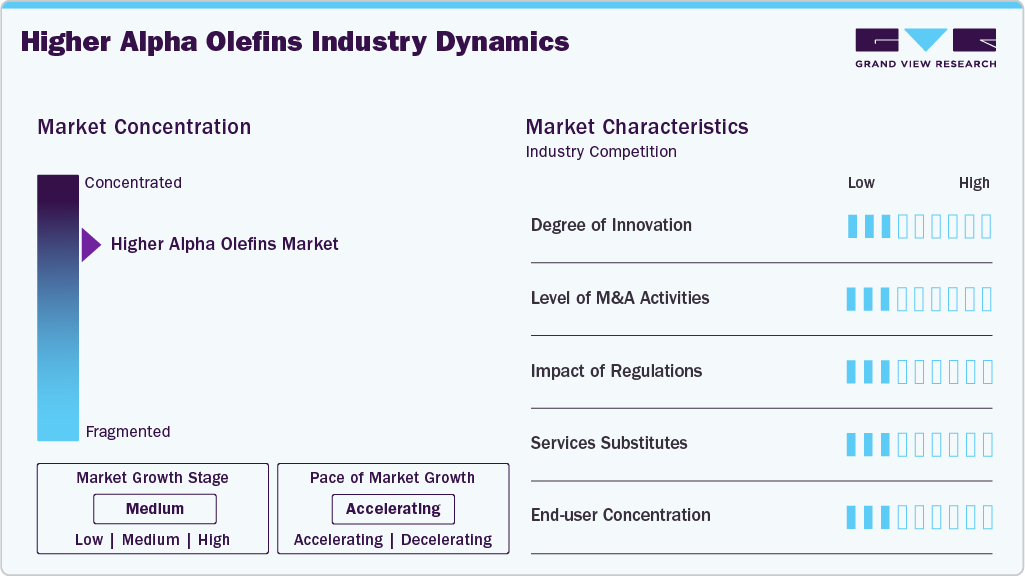

Market Concentration & Characteristics

The higher alpha olefins industry exhibits a consolidated structure, characterized by the dominance of several vertically integrated multinational corporations. Players such as Shell Chemicals, INEOS Oligomers, Chevron Phillips Chemical (CP Chem), ExxonMobil Chemical, and Sasol Ltd. occupy significant market shares by virtue of their well-established production capacities, global supply networks, and proprietary technologies in olefin oligomerization.

These industry leaders benefit from access to captive ethylene feedstock, enabling cost-effective, large-scale production of HAO through processes like the Shell Higher Olefin Process (SHOP) or metallocene-catalyzed technologies. Their integration across the petrochemical value chain from raw material extraction and ethylene production to alpha olefin synthesis and end-use product development provides them with greater pricing control, logistical efficiencies, and flexibility in catering to diverse customer segments.

Meanwhile, emerging regional players, particularly in Asia-Pacific and the Middle East, are entering the higher alpha olefins industry with cost-competitive and bulk-grade offerings, targeting high-volume applications such as detergent alcohols and polyethylene comonomers. These new entrants are supported by access to abundant natural gas-based ethylene and investment in downstream infrastructure within special economic zones or petrochemical parks.

Despite competition on volume and pricing, product innovation, regulatory compliance, and technical support services remain key differentiators. Global producers are increasingly focused on delivering value-added olefins that conform to evolving regulations especially for applications in medical, food-grade packaging, and cosmetics, which require high levels of purity, non-toxicity, and low migration rates.

Type Insights

The C6-C8 higher alpha olefins segment led the market with the largest revenue share of 48.7% in 2024. Their dominance is attributed to their compatibility with linear low-density polyethylene (LLDPE) and other polymer systems used in film and packaging applications. C10-C14 olefins, on the other hand, are gaining traction in the formulation of high-end synthetic lubricants and surfactants due to their favorable flow characteristics and low volatility.

The C16 segment is expected to grow at the fastest CAGR during the forecast period, driven by niche uses in specialty waxes, personal care bases, and high-viscosity lubricants. Advancements in catalyst systems and process optimization are supporting type diversification and performance customization.

Application Insights

The polyethylene comonomers segment led the market with the largest revenue share of 51.5% in 2024. These olefins are critical for enhancing the flexibility, clarity, and strength of polyethylene grades used in packaging films and containers. Lubricants and synthetic oils represent another significant share, particularly in automotive and industrial sectors where thermal stability and wear resistance are crucial.

The detergents and surfactants segment continues to expand, backed by consumer demand for high-performance, low-foaming cleaning agents. Other applications including adhesives, specialty polymers, and drag-reducing agents are benefiting from the development of tailored olefins with optimized chain lengths and functional properties.

The lubricants and synthetic oils segment is anticipated to grow at the fastest CAGR during the forecast period, driven by the increasing need for high-performance base oils and viscosity modifiers in the automotive, aerospace, and industrial machinery sectors. Higher alpha olefins serve as key feedstocks for the synthesis of polyalphaolefins (PAOs), which are widely regarded for their excellent oxidative stability, low volatility, and high-temperature performance. These attributes are especially valuable in synthetic engine oils, gear oils, hydraulic fluids, and transmission fluids. As original equipment manufacturers (OEMs) push for energy-efficient, long-life lubricants, demand for olefin-based synthetic oils continues to grow, particularly in electric vehicles, aviation, and heavy-duty equipment.

The detergents and surfactants segment is another key application area, benefiting from rising consumer awareness around clean-label and biodegradable formulations. Higher alpha olefins are used in the production of olefin sulfonates and alkylbenzene sulfonates, which are key ingredients in laundry detergents, dishwashing liquids, and personal care products. Their low-foaming properties, compatibility with hard water, and ability to remove oil-based stains efficiently make them ideal for both domestic and institutional cleaning products. As regulations increasingly favor non-phosphate, eco-friendly formulations, olefin-derived surfactants are expected to play a growing role in the household and industrial cleaning sectors.

Regional Insights

North America dominated the higher alpha olefins market with the largest revenue share of 35.7% in 2024, with the U.S. leading due to its mature petrochemical infrastructure, advanced regulatory frameworks, and extensive R&D activities. The U.S. market is well-established in sectors such as medical adhesives, polyethylene production, and industrial lubricants.

U.S. Higher Alpha Olefins Market Trends

The higher alpha olefins market in the U.S. continues to dominate the North American market. The country’s industrial infrastructure, access to low-cost ethylene, and emphasis on energy-efficient formulations have accelerated the use of alpha olefins in LLDPE, detergent alcohols, and lubricants. In addition, regulatory pressure to reduce volatile organic compounds (VOCs) is boosting the role of alpha olefins in clean, low-emission applications.

Asia Pacific Higher Alpha Olefins Market Trends

The higher alpha olefins market in Asia Pacific is witnessing increased investment in alpha olefin capacity, particularly in China, where domestic consumption of polyethylene and synthetic lubricants is rapidly expanding. Japan and South Korea contribute specialty applications in electronics and the medical fields, supported by strong technology and innovation ecosystems. Regional governments are also promoting local production of olefin-based intermediates to reduce import dependency.

Europe Higher Alpha Olefins Market Trends

The higher alpha olefins market in Europe is anticipated to grow at a significant CAGR during the forecast period. Stringent environmental and health safety regulations characterize Europe. This has encouraged local producers and users to shift toward olefins with high purity and lower toxicity. Industrial coatings, packaging, and automotive lubricants remain primary applications. Furthermore, the transition toward circular plastics and low-carbon chemistry is encouraging new investment in sustainable olefin production routes.

Middle East & Africa Higher Alpha Olefins Market Trends

The higher alpha olefins market in the Middle East & Africa region is emerging both as a production base and a growing market for alpha olefins. GCC countries are leveraging their abundant hydrocarbon resources to develop integrated olefin complexes. Local demand is modest but rising, particularly in sectors like construction coatings, lubricants, and packaging.

Key Higher Alpha Olefins Company Insights

Some of the key players operating in the market include Shell Chemicals, INEOS Oligomers, Chevron Phillips Chemical (CP Chem), ExxonMobil Chemical, Sasol Ltd., SABIC, QatarEnergy, Idemitsu Kosan Co., Ltd., Godrej Industries, and Linde plc.

-

Shell Chemicals, a division of Shell plc (formerly Royal Dutch Shell), is one of the world’s largest producers of petrochemicals, including higher alpha olefins. Shell’s chemical division is deeply integrated with its upstream oil and gas operations, allowing for a consistent supply of feedstock like ethylene, a critical input in alpha olefin production.

-

INEOS Oligomers is a key business unit within INEOS Group, one of the largest privately held chemical companies globally. INEOS Oligomers is a leading manufacturer of a wide range of linear alpha olefins, including short-chain and long-chain variants, used across polymers, lubricants, and surfactants.

Key Higher Alpha Olefins Companies:

The following are the leading companies in the higher alpha olefins market. These companies collectively hold the largest market share and dictate industry trends.

- Shell Chemicals

- INEOS Oligomers

- Chevron Phillips Chemical (CP Chem)

- ExxonMobil Chemical

- Sasol Ltd.

- SABIC

- QatarEnergy

- Idemitsu Kosan Co., Ltd.

- Godrej Industries

- Linde plc.

Recent Development

-

In 2024, INEOS Oligomers significantly enhanced its production capabilities at the Chocolate Bayou facility in Alvin, Texas, by expanding its linear alpha olefins (LAO) plant. This expansion increased the plant's capacity to 420,000 metric tons per year, making it one of the largest LAO production units globally. The LAO plant is fully integrated with INEOS's adjacent polyalphaolefins (PAO) production facilities, ensuring a seamless supply chain for the production of synthetic lubricants and other applications

Higher Alpha Olefins Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.8 billion

Revenue forecast in 2030

USD 15.2 billion

Growth rate

CAGR of 7.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea

Key companies profiled

Shell Chemicals; INEOS Oligomers; Chevron Phillips Chemical (CP Chem); ExxonMobil Chemical; Sasol Ltd.; SABIC; QatarEnergy; Idemitsu Kosan Co., Ltd.; Godrej Industries; Linde plc

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Higher Alpha Olefins Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global higher alpha olefins market report based on type, application and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

C6-C8

-

C10-C14

-

C16

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Polyethylene Comonomers

-

Lubricants & Synthetic Oils

-

Detergents & Surfactants

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global higher alpha olefins market size was estimated at USD 10.2 billion in 2024 and is expected to reach USD 10.83 billion in 2025.

b. The global higher alpha olefins market is expected to grow at a compound annual growth rate of 7% from 2025 to 2030 to reach USD 15.21 billion by 2030.

b. North America dominated the higher alpha olefins market with a share of 35.7% in 2024. This is attributable to well-established in sectors such as medical adhesives, polyethylene production, and industrial lubricants driving the product demand in the region.

b. Some key players operating in the higher alpha olefins market include Shell Chemicals, INEOS Oligomers, Chevron Phillips Chemical (CP Chem), ExxonMobil Chemical, Sasol Ltd., SABIC, QatarEnergy, Idemitsu Kosan Co., Ltd., Godrej Industries, and Linde plc

b. Key factors that are driving the market growth include growing demand for high-performance plastics, energy-efficient lubricants, and bio-based surfactants which is expanding the application base of HAOs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.