- Home

- »

- Specialty Polymers

- »

-

Hindered Amine Light Stabilizers Market Size Report, 2030GVR Report cover

![Hindered Amine Light Stabilizers Market Size, Share & Trends Report]()

Hindered Amine Light Stabilizers Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Monomeric, Oligomeric, Polymeric), By End-use (Automobile, Construction, Packaging), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-101-9

- Number of Report Pages: 124

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

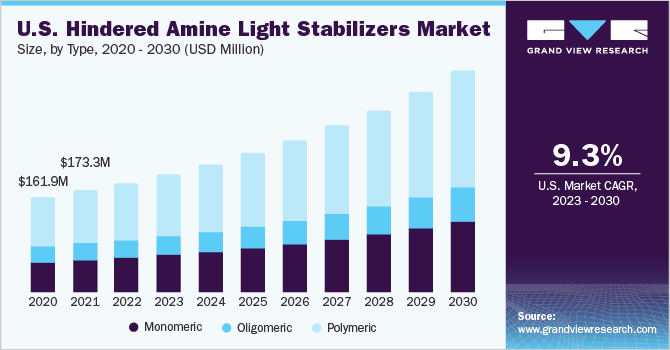

The global hindered amine light stabilizers market size was estimated at USD 1.4 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 9.3% from 2023 to 2030. This is attributable to the increasing adoption of the product in plastic manufacturing. According to Plastics Europe, global plastic production was at 365.5 million tons and 390.7 million tons in 2018 and 2021, respectively. Growth in the plastics industry further increased the demand for hindered amine light stabilizers (HALS). Hindered amine light stabilizers act as radical scavengers, interrupting the degradation process of paints and coatings caused by UV radiation. They are particularly effective in preventing the breakdown of polymers and maintaining the structural integrity of materials over an extended period.

These stabilizers capture and neutralize free radicals formed during the degradation process of paints and coatings. HALS are widely used in automobile exterior parts to protect them from UV radiation and maintain their appearance over time. Automotive components, such as bumpers, body panels, spoilers, mirror housings, and trim, are subjected to prolonged exposure to sunlight that can lead to their color fading, chalking, and degrading. The use of HALS additives in coatings and polymer formulations prevents the effects of sunlight on automobile components, ensuring that the exterior parts of vehicles retain their color and mechanical properties. Thus, the growing global automotive industry is expected to drive the growth of the product industry.

According to the World Paints & Coatings Industry Association, the global paints and coatings market grew from 164.9 billion in 2018 to 179.7 billion in 2022. This growth in the market has increased the demand for HALS across the world. Moreover, as per WPCIA, the paints and coatings market in North America and Europe was valued at USD 33.92 billion and USD 42.37 billion, respectively, in 2022. The growth observed in the paints and coatings market in these regions can be attributed to a rise in the number of house renovation projects in countries, such as Canada, Germany, and the U.S. This, in turn, has fueled the demand for HALS used in paints and coatings.

Currently, rising research activity in the industry is leading to the addition of new functional properties in HALS. For instance, the incorporation of the phenol group in hindered amine light stabilizers can exert the heat and oxygen aging resistance of light stabilizers. Sanol LS 2626 & TINUVIN 144 are examples of HALS with functional groups.

Type Insights

The polymeric HALS segment dominated the market with the highest revenue share of 50.4% in 2022. This is attributable to its wide usage in multiple industries, such as automotive, aerospace, construction, packaging, and agriculture, to prevent the photodegradation of polymers and plastics due to their exposure to UV radiation. Moreover, the rising demand for polymeric HALS over conventional monomeric HALS for use in different applications, due to their superior stabilization efficiency and better durability against UV radiation, contributes to the segment growth. As a result, manufacturers are increasingly investing in research and development activities to carry out large-scale production of these enhanced stabilizers.

Some of the polymeric HALS available in the market are highly compatible and fast-drying. Hostavin, offered by Clariant, has been specially designed for waterborne coatings. Tinuvin 880, developed by BASF, offers superior light stability and weathering resistance and is suitable for various applications. Cyasorb Cynergy Solutions, provided by Solvay, offers exceptional UVA and UVB protection and improved compatibility with various polymers. Furthermore, Adeka Ultra-Light Absorbers (AUL) have superior stability and weathering resistance, as well as enhance the durability of plastics, rubber, and coatings.

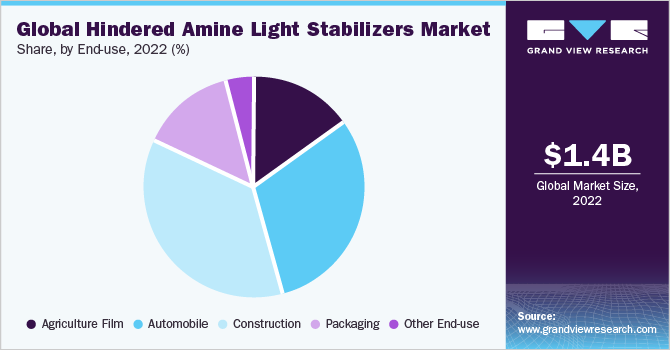

End-use Insights

The construction end-use segment dominated the market with the highest revenue share of 36.1% in 2022. This is attributed to the rising requirement for high-performance materials that can withstand harsh outdoor conditions, particularly in regions with high levels of solar radiation. The demand for HALS in the construction industry is expected to continue to grow as a large number of buildings adopt green construction practices aimed at reducing their environmental impact and creating highly energy-efficient structures. HALS also help increase the lifespan of materials used in building envelopes, roofs, etc., by protecting them against UV degradation and other environmental factors.

Manufacturers are adding HALS to roofing materials to improve their weathering resistance and thermal stability, as well as to reduce the risk of discoloration and cracking. For instance, in February 2021, Clariant launched a new generation of HALS, specifically designed for roofing applications under the brand name HOSTAVIA EXS. These stabilizers are designed to provide superior protection to roofing materials against UV radiation and heat, enabling them to maintain their appearance and durability over time.

Regional Insights

Asia Pacific dominated the market with the highest revenue share of 44.8% in 2022. This is attributed to the growing automobile and construction industries in India, China, Japan, and South Korea. The construction sector in Asia Pacific is undergoing rapid expansion, driven by a substantial number of infrastructural projects, a focus on affordable housing units, and the adoption of modular building technology. In addition, the Government of India's 'Make in India' campaign aims to attract infrastructure investments totaling USD 965.5 million by 2040, further contributing to the growth of the HALS industry in the region over the forecast period. North America is a prominent manufacturer of HALS on account of the presence of various end-use industries, including automobile, paints & coatings, and polymers, in countries such as the U.S., Canada, and Mexico.

This, in turn, is driving the market in the region. Automotive is one of the major end-users of HALS. As per OICA, in 2022, automobile production in Canada and the U.S. grew by 10% as compared to the production in 2021. HALS are additive stabilizers in paints, coating and plastics, and polymers. Thus, an increase in demand and production of automobiles in the North American region is expected to fuel the HALS demand in North America. Germany is the manufacturing hub of Europe, being the largest manufacturer of automobiles. The growth of the industrial and automotive sectors is expected to fuel the demand for HALS in Europe. Moreover, the growing construction industry is anticipated to create huge demand for HALS in the country.

Key Companies & Market Share Insights

The market is competitive owing to the presence of various well-established players that account for a significant share of the global industry. These companies have multiple channels for the production and global distribution of their products. Players adopt this strategy to increase the reach of their products in the market and increase the availability of their products & services in diverse geographical areas. For instance, in March 2023, BASF's plastic additives business collaborated with Noria Energy to install a first-of-its-kind floating solar system to power the McIntosh, Alabama site, which includes the production of UV absorbers and HALS. Some of the prominent players in the global hindered amine light stabilizers market include:

-

ADEKA Corporation

-

Arkema

-

BASF SE

-

CLARIANT

-

Chitec Technology Co., Ltd.

-

Double Bond Chemical Ind., Co., Ltd.

-

Everlight Chemical Industrial Co.

-

Greenchemicals S.r.l.

-

Mayzo, Inc.

-

MPI Chemie BV

-

Rianlon Corporation

-

SABO S.p.A.

-

Solvay

Hindered Amine Light Stabilizers Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.51 billion

Revenue forecast in 2030

USD 2.84 billion

Growth Rate

CAGR of 9.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Regional scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Market Players

ADEKA Corp.; Arkema; BASF SE; CLARIANT; Chitec Technology Co.; Ltd.; Double Bond Chemical Ind. Co., Ltd.; Everlight Chemical Industrial Co.; Greenchemicals S.r.l.; Mayzo, Inc.; MPI Chemie BV; Rianlon Corp.; SABO S.p.A.; Solvay

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

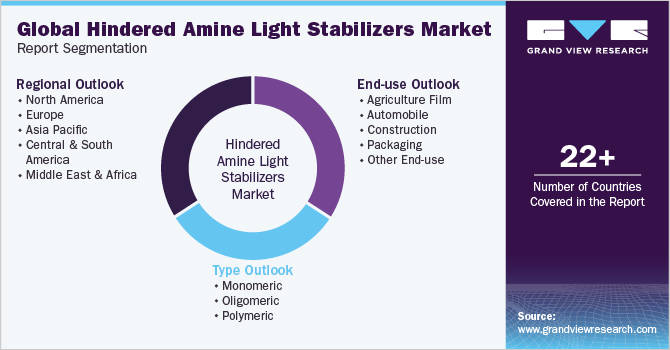

Global Hindered Amine Light Stabilizers Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hindered amine light stabilizers market report based on type, end-use, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Monomeric

-

Oligomeric

-

Polymeric

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Agriculture Film

-

Automobile

-

Construction

-

Packaging

-

Other End-use

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global hindered amine light stabilizers market size was estimated at USD 1.4 billion in 2022 and is expected to reach USD 1.51 billion in 2023.

b. The global hindered amine light stabilizers market is expected to grow at a compound annual growth rate of 9.3% from 2023 to 2030 to reach USD 2.84 billion by 2030.

b. Asia Pacific dominated the hindered amine light stabilizers market with a share of 44.8% in 2022. This is attributable to growing automobile and construction industries in India, China, Japan, and South Korea

b. Some key players operating in the HALS market include ADEKA CORPORATION, Arkema, BASF SE, CLARIANT, Chitec Technology Co., Ltd., DOUBLE BOND CHEMICAL IND., CO., LTD., Everlight Chemical Industrial Co., Greenchemicals S.r.l., Mayzo, Inc., MPI Chemie BV, Rianlon Corporation, SABO S.p.A., Solvay

b. Key factors that are driving the market growth include increasing increasing utilization of hindered amine light stabilizers (HALS) in plastics & polymers and paints & coatings, which are further utilized in various end-use industries such as automotive, construction, and packaging.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.