- Home

- »

- Petrochemicals

- »

-

Wax Market Size, Share & Growth, Industry Report, 2030GVR Report cover

![Wax Market Size, Share & Trends Report]()

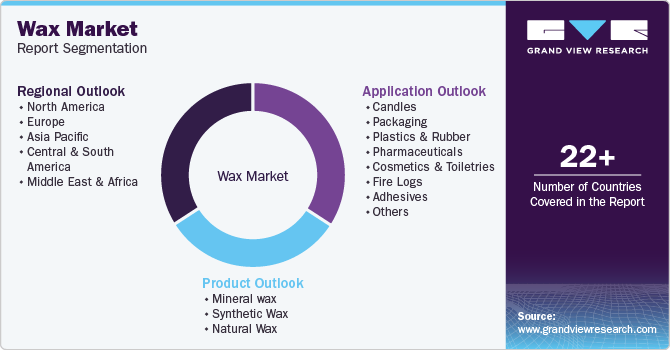

Wax Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Mineral, Synthetic, Natural), By Application (Candles, Packaging, Plastic & Rubber), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-024-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Wax Market Summary

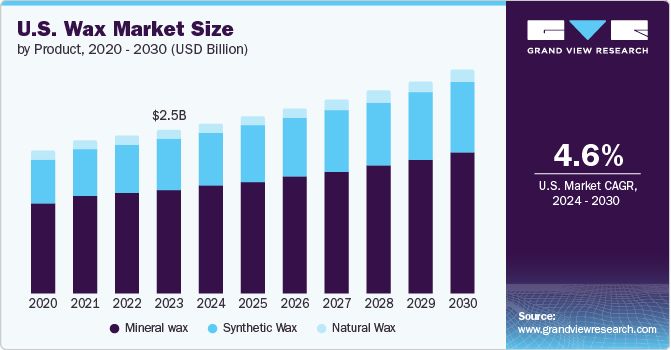

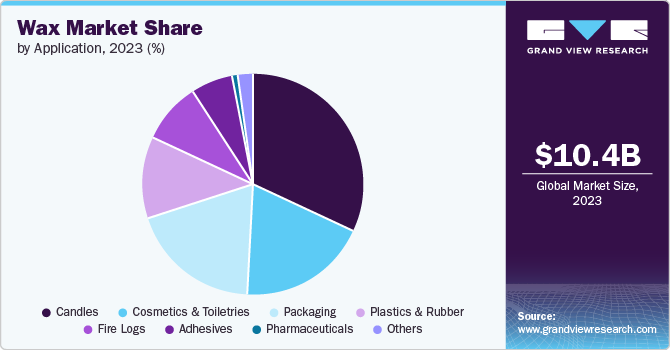

The global wax market size was estimated at USD 10,456.0 million in 2023 and is projected to reach USD 14,165.8 million by 2030, growing at a CAGR of 4.6% from 2024 to 2030. The rising product demand in various industries is fueled by its exceptional qualities, including high gloss, effective water repellency, and excellent chemical resistance.

Key Market Trends & Insights

- The Asia Pacific wax market dominated globally with a revenue share of 34.4% in 2023.

- Country-wise, UK is expected to register the highest CAGR from 2024 to 2030.

- By product, the mineral wax product dominated the market, with a revenue share of 67.7% in 2023.

- By application, the candle applications dominated the market with a revenue share of 31.6% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 10,456.0 Million

- 2030 Projected Market Size: USD 14,165.8 Million

- CAGR (2024-2030): 4.6%

- Asia Pacific: Largest market in 2023

Moreover, the increasing acceptance of synthetic alternatives contributes to the surge in demand due to their ability to withstand chemicals and water, enhanced stability during polishing, and resistance against scratches, scuffs, and metal marks. Polyethylene wax has a lower molecular weight than Fischer-Tropsch, microcrystalline, and paraffin wax. This distinction gives synthetic wax its toughness, while its varying slip characteristics and hardness make it a suitable additive for coatings and inks.

Wax is widely used in coating and printing formulations, finding significant applications in the paint, coating, and printing ink industry. Its properties, such as mark and scratch resistance, rub resistance, and water repellency, make it highly desirable in these industries. It is an additive in various inks, including letterpress, lithographic, gravure, and flexographic inks. In addition, it has essential functions in the coating and ink industry, such as blockage, friction improvement, anti-setting, and anti-sagging.

Drivers, Opportunities & Restraints

The demand for wax has been boosted by the growth of sectors like polymer processing, pharmaceuticals, food, and personal care in countries such as India, China, Brazil, the U.S., Germany, and the UK. Furthermore, the increasing demand for applications like adhesives, agriculture, and textiles is expected to drive advancements in the global wax industry. Waxes are organic compounds that are malleable and hydrophobic solids at room temperature. They include lipids and higher alkanes that are insoluble in water but soluble in nonpolar organic solvents. The production of various products, including mineral, natural, and synthetic wax, involves petroleum-based products like base oil and natural gas and chemicals like polyethylene.

Paraffin wax is obtained from crude oil, producing distillate (light) lubricating oil. Therefore, the raw materials for paraffin, microcrystalline, and semi-crystalline wax are carbon compounds and petroleum. Volatility in raw material prices is a restraint for using wax in industrial and consumer & commercial applications. Petroleum companies such as BASF SE, The International Group, Inc., Royal Dutch Shell Plc, ExxonMobil Corp., and Sinopec supply raw materials to product manufacturing companies. Variations in crude oil prices and fluctuations in international oil prices are the major factors that cause volatility in raw material prices.

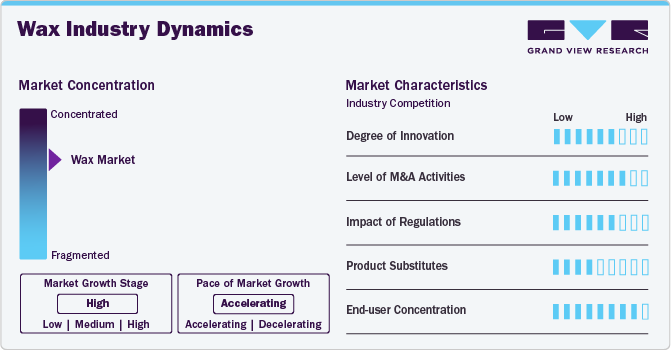

Industry Dynamics

The market concentration of the global wax industry is relatively high, with a few key players dominating the industry. Major companies such as Dow, BASF SE, Evonik Industries, and Shell hold significant shares due to their comprehensive product portfolios and extensive distribution networks. These companies invest heavily in research and development to innovate and improve their product offerings, which helps them maintain a competitive edge. The high market concentration is also driven by mergers and acquisitions, which allow these firms to achieve economies of scale and expand their presence in the industry.

The global market for natural wax is characterized by a moderate internal threat of substitution by synthetic wax products due to their widespread utility across industries such as packaging, printing inks, and cosmetics & toiletries. Synthetic counterparts are substituting natural. However, volatile raw material prices of crucial feedstock and regulations formulated by the environmental agencies affect the overall market supply of synthetic wax products. Furthermore, multiple natural wax producers focus on reducing production costs and positioning their products at competitive prices.

Product Insights

“Synthetic wax segment is expected to witness growth at 4.7% CAGR.”

The mineral wax product dominated the market, with a revenue share of 67.7% in 2023. This is attributed to the growing use of this product in cosmetic formulations and the surge in cosmetics demand across developing and emerging economies. Unlike plants and beeswax, which contain esters and alcohols, mineral waxes are pure hydrocarbons. These waxes come from natural resources like coal, petroleum, and shale oil through a refining process called fractional distillation.

Microcrystalline waxes offer a wide range of physical and melting point options, making them ideal for various applications like adhesives, chewing gum, cosmetics, and cheese coatings. Paraffin wax, a famous by-product of the oil industry, is easy to source and produce. It's a favorite for candles because it holds fragrance and color well. It is also used in skin softeners.

While paraffin excels in candles and cosmetics, microcrystalline wax has a higher melting point and more flexibility, making it suitable for heavy-duty industrial applications as well. Synthetic ones are predicted to be the fastest-growing segment in the wax industry due to the increasing demand for products like paperboard, building boards, cosmetics, adhesives, and inks.

Application Insights

“Cosmetics and Toiletries segment is expected to witness growth at 5.0% CAGR.”

Candle applications dominated the market with a revenue share of 31.6% in 2023. This large share is attributable to the growing demand for aromatherapy through scented candles, which have become a critical household essential. Candles come in various sizes and shapes, offering a wide range of options, from birthday and taper candles to utility and novelty candles. They serve multiple purposes, including aromatherapy for relaxation and stress reduction and enhancing home décor.

The National Candle Association reports that around 70% of households use candles for stress-related therapies and scented candles for home fragrances. The candle market is characterized by the availability and convenience of purchasing a diverse selection of candles through numerous distribution channels. The growing number of distribution channels, such as décor mass merchandise stores and e-commerce platforms, has contributed to the increasing demand for candles worldwide.

Wax is a big player in the packaging world, second in revenue generated. This is because it is increasingly used to coat, treat, and protect food packaging materials such as paper, cardboard, and aluminum foil. It acts as a lubricant during production to keep things running smoothly. It directly coats fruits, vegetables, and cheese to help them stay fresh.

Regional Insights

“Asia Pacific region is expected to witness growth at 4.9% CAGR.”

The North America wax market is anticipated to grow over the forecast period. The USA and Canada hold the number two spot for wax sales worldwide. This is attributed to the presence of key personal care and cosmetics companies like Colgate-Palmolive, Maybelline, and Johnson & Johnson, which are all constantly developing new products. As these products often contain wax, this trend is expected to positively impact the industry demand for the forecast period.

U.S. Wax Market Trends

The wax market in the U.S. is driven by the demand for cosmetic products and it is anticipated to grow on account of surged consumption of skincare products such as creams, peels, face masks, and other cosmetics. The cosmetics industry has witnessed a shift in consumer preference from synthetic personal care products toward natural-derived counterparts, which is expected to open new market avenues for natural wax forms. Rising consumer awareness about skin care product formulations coupled with increasing levels of disposable income is projected to significantly boost the growth of the global market in the coming years.

Asia Pacific Wax Market Trends

The Asia Pacific wax market dominated globally with a revenue share of 34.4% in 2023. The growth is attributed to rising living standards and increasing industrialization, especially in countries like China and India. Market growth is also anticipated due to low labor, raw material, and operational costs.

Young people in countries like China, Japan, India, Indonesia, and Korea are increasingly using more cosmetic products like creams, lotions, sunscreens, and makeup. This growing love for beauty products is expected to be a major driver for the wax industry.

Southeast Asian countries like Indonesia and Malaysia are seeing steady economic growth, projected to last until 2030. This growth is fueling a booming packaging sector, which in turn will require more printing ink. As wax is a key ingredient in many printing inks, this translates to a higher demand for wax in the region.

Europe Wax Market Trends

Europe wax market is home to several multinational cosmetic brands, including Unilever Group, Procter & Gamble Co., Kao Corp., L'Oréal Group, Estée Lauder Cos, Inc., and Colgate-Palmolive Co. The presence of these personal care manufacturing companies with an established brand presence across European countries has led to the dominance of cosmetics & personal care applications in the European market.

The wax market in Germany is anticipated to grow over the forecast period. In Germany, consumers are aware and significantly use cosmetic products with compositions that are proven to be less toxic and harmful for the skin. For the past couple of years, customers of cosmetic products in Germany have been switching to chemical-free and more organic alternatives to maintain their skin and hair. This has prompted local vendors to deliver high-quality natural wax products to their customer base to keep up with the trend of organic cosmetics in the marketspace. The most common sources of natural wax are plants, fruits, animals, and insects. Natural wax is used in cosmetics, scented candles, fire logs, packaging, and in adhesive applications.

The wax market in the UK is driven by the demand for candles and is expected to witness significant growth on account of various directives initiated by the European Candles Association with respect to maintaining the quality of candles circulated in the country and other countries across Europe. Moreover, the candle association prompts the development of new technologies as well as the identification of new raw materials in the wax market space.

Central & South America Wax Market Trends

The Central & South America wax marketis projected to witness substantial growth over the forecast period, primarily fueled by the increasing consumption of wax in key applications such as candles, cosmetics & toiletries, and adhesives manufacturing. Currently, only 15% of the total population in the region is served with the help of private healthcare investments. However, with the advent of liberalized policy frameworks in CSA, private healthcare investments are expected to bridge the gaps in the healthcare sector, thereby driving the demand for wax in medical adhesives, producing surgical tools, and more.

The Brazil wax market is anticipated to grow over the forecast period. With respect to carnauba wax, Brazil is characterized by sufficient supply and availability of raw material (palm oil). The extraction of the wax from the Brazilian palm tree leaves is a labor-intensive process, thus, resulting in high cost. However, the processing and subsequent filtering of the wax are cheaper and lead to low setup cost. Owing to the aforementioned reasons, the raw material suppliers extract the wax in one location and carry out the subsequent processes in a different location. Therefore, the majority of the manufacturers in the carnauba wax industry are based in Brazil.

Middle East & Africa Wax Market Trends

The wax market in Middle East & Africa is expected to grow significantly over the forecast period. Rapid industrialization coupled with improving infrastructure in the Middle East is expected to positively influence product demand. The expanding construction sector, mainly in the UAE and Qatar, on account of economic progress, advanced real estate regulatory frameworks, and increasing infrastructure projects, is expected to boost the growth of the Middle East and Africa industry over the coming years.

Key Wax Company Insights

Companies are moving into new markets by taking control of more steps in the production process, allowing them to sell directly to a broader range of customers worldwide. Major players like British Petroleum and Honeywell are pouring resources into research and development to create new and improved products. Many of these innovations are patented to give the companies a competitive edge.

The market is witnessing strategic evolution, with several multinational companies engaging in mergers and acquisitions, joint ventures, and project expansions to establish a strong presence worldwide. An example of this is HollyFrontier Corporation's acquisition of Puget Sound Refinery for USD 613.6 million in 2021.

Some of the key players operating in the market include

-

Sinopec Corp. is an energy and chemical company. It is listed on the Shanghai, Hong Kong, London, and New York Stock Exchange markets. The company operates as a subsidiary of China Petrochemical Corporation. It has more than 100 subsidiaries and a strong market presence across all geographical regions. Exploration & production, refining, marketing & distribution, chemicals, and corporate & others are the key business operating segments of the company

-

ExxonMobil Corporation is a U.S.-based, integrated energy company that produces and supplies oil and gas worldwide. The company operates through three business segments: upstream, chemical, and downstream. It markets its products under brands such as Exxon, Mobil, and Esso. The company’s product portfolio includes olefins, aromatics, fluids, synthetic rubber, polyethylene, polypropylene, and zeolite catalysts. The company owns 37 refineries located in 21 countries and has an overall manufacturing capacity of 6,300,000 barrels per day.

International Group, Inc., HollyFrontier Corporation, and others are some of the emerging players in the market.

-

The International Group, Inc. (IGI) is a company that manufactures and develops wax products. It is an ISO 9001:2015 and ISO 14001:2015 certified company. The company develops and manufactures wax-based products having a wide range of applications in plastics, inks, chewing gums, candles, rubber, cosmetics, adhesives, packaging, and specialty applications.

-

HollyFrontier Corporation is a petroleum refiner that produces & markets high value products. The company, along with its subsidiaries, produces and markets diesel, gasoline, asphalt, jet fuel, specialty lubricants, and heavy products. It has operations across the Rocky Mountains, mid-continent, and southwestern regions of the U.S. The company has four oil refineries with an overall crude oil processing capacity of over 405,000 barrels per day. Its refining operations are located in Artesia, New Mexico; Cheyenne, Wyoming; Tulsa, Oklahoma; Wood Cross, Utah; and El Dorado, Kansas. Various products manufactured by the company include wax, asphalt performance products, horticulture oils, base oils, process & specialty oils, and rubber process oils.

Key Wax Companies:

The following are the leading companies in the wax market. These companies collectively hold the largest market share and dictate industry trends.

- Sinopec Corp

- China National Petroleum Corporation

- HollyFrontier Corporation

- BP P.L.C

- Nippon Seiro Co., Ltd

- Baker Hughes Company

- Exxon Mobil Corporation

- Sasol Limited

- The International Group, Inc.

- Evonik Industries AG

- BASF SE

- Dow

- Honeywell International Inc.

- Royal Dutch Shell P.L.C

- Mitsui Chemicals, Inc.

Recent Developments

-

In April 2024, Exxon Mobil Corporation launched a new wax product brand, Prowaxx. Prowaxx serves as an anchor for the product portfolio, with differentiation across wax types and greater clarity tailored to customer decision-making.

Wax Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10,842.9 million

Revenue forecast in 2030

USD 14,165.8 million

Growth Rate

CAGR of 4.6% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Brazil, Argentina, Saudi Arabia and South Africa

Key companies profiled

Sinopec Corp; China National Petroleum Corporation; HollyFrontier Corporation; BP P.L.C; Nippon Seiro Co., Ltd; Baker Hughes Company; Exxon Mobil Corporation; Sasol Limited; The International Group, Inc.; Evonik Industries AG; BASF SE; Dow; Honeywell International Inc.; Royal Dutch Shell P.L.C; Mitsui Chemicals, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wax Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wax market report based on product, application, and region.

-

Product Outlook (Volume, Kiloton; Revenue, USD Million, 2018 - 2030)

-

Mineral wax

-

Synthetic Wax

-

Natural Wax

-

-

Application Outlook (Volume, Kiloton; Revenue, USD Million, 2018 - 2030)

-

Candles

-

Packaging

-

Plastics & Rubber

-

Pharmaceuticals

-

Cosmetics & Toiletries

-

Fire Logs

-

Adhesives

-

Others

-

-

Regional Outlook (Volume, Kiloton; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The Asia Pacific dominated the wax market with a share of over 34.4% in 2023. This is attributable to growing construction activities, particularly in emerging economies like India & China, coupled with technological developments leading to the growth of the adhesives market.

b. Some key players operating in the wax market include Sinopec Corp., China National Petroleum Corporation (CNPC), HollyFrontier Corporation, BP P.L.C., Nippon Seiro Co., Ltd., Baker Hughes Incorporated, Exxon Mobil Corporation, Sasol Limited, International Group Incorporated (IGI), Evonik Industries AG, BASF SE, Dow Corning Corporation, Honeywell International Inc.,Royal Dutch Shell Plc., and Mitusi Chemicals.

b. Key factors that are driving the wax market growth include superior properties of wax such as good water repellency, non-toxicity, & outstanding chemical resistance, and a rise in demand for paperboard, paper, & building boards.

b. The global wax market size was estimated at USD 10.4 billion in 2023 and is expected to reach USD 10,842.9 million in 2024.

b. The global wax market is expected to grow at a compound annual growth rate of 4.6% from 2024 to 2030, reaching USD 14,165.8 million by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.