- Home

- »

- Homecare & Decor

- »

-

Honeymoon Tourism Market Size, Industry Report, 2030GVR Report cover

![Honeymoon Tourism Market Size, Share & Trends Report]()

Honeymoon Tourism Market Size, Share & Trends Analysis Report By Type, By Duration, By Age Group, By Budget (Luxury, Mid-range, Low-range), By Destination, By Booking Mode, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-465-7

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Honeymoon Tourism Market Size & Trends

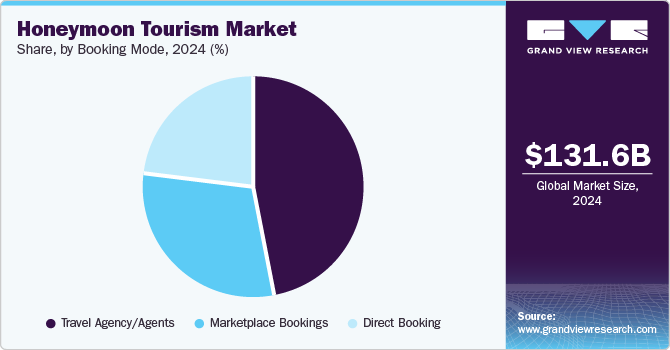

The global honeymoon tourism market size was estimated at USD 131.56 billion in 2024 and is projected to grow at a CAGR of 6.6% from 2025 to 2030. The influence of social media and digital platforms also plays a crucial role in driving the market. Social media platforms such as Instagram, Pinterest, and Facebook are filled with picturesque travel destinations and experiences, inspiring couples to plan extravagant honeymoons. Additionally, the rise of travel influencers and bloggers sharing their honeymoon journeys provides aspirational content encouraging couples to explore new destinations and luxury experiences.

The growing adoption of personalized and experiential travel experiences drives market growth. Modern couples prioritize unique, tailor-made experiences over traditional honeymoon destinations. They adopt adventure tourism, eco-friendly travel, and culturally immersive experiences. Travel companies and tourism boards offer customized honeymoon packages catering to specific interests, such as wildlife safaris, culinary tours, wellness retreats, and sustainable travel options. This emphasis on personalization and experience-driven travel is propelling the growth of the market.

Additionally, the proliferation of online travel agencies (OTAs) has also contributed to the growth of the honeymoon tourism market. The ease of booking travel services online, access to a wide range of options, and the ability to compare prices and read reviews have made planning a honeymoon more convenient and accessible. OTAs and travel platforms offer curated honeymoon packages, exclusive deals, and destination guides that simplify the planning process for couples.

Moreover, the increasing trend of destination weddings is boosting the market for honeymoon tourism. Many couples combine their wedding and honeymoon into a single extended trip, often held in picturesque and exotic locations. This trend has led to the rise of wedding tourism, where couples and their friends and family travel to a destination for the wedding ceremony and then continue their honeymoon in the same or nearby location. Destination weddings provide a seamless transition from the wedding festivities to the honeymoon, creating a demand for comprehensive weddings and honeymoon packages offered by travel companies and resorts.

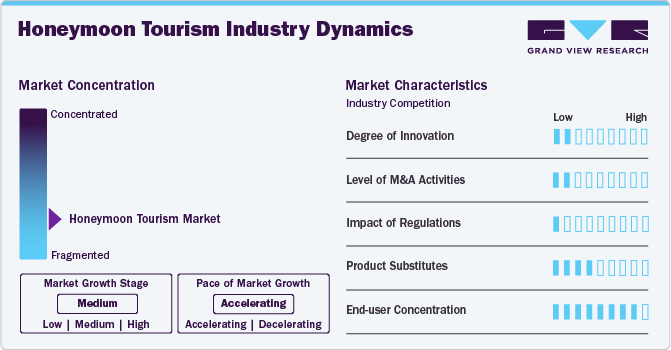

Market Concentration & Characteristics

The market growth stage is medium, and the pace is accelerating owing to the rise of boutique hotels, luxury villas, glamping sites, and private island resorts that provide couples with a wide range of exclusive and romantic accommodation options. These unique stays offer personalized services, privacy, and unique experiences that are adopted by honeymooners.

The market has a fragmented nature, featuring several global and regional players. The players are entering into partnerships and mergers & acquisitions as the market is characterized by innovation, disruption, and rapid change. In February 2024, dnata Travel Group partnered with the Community Development Authority in Dubai to launch a fresh lineup of customized honeymoon packages for UAE citizens. This partnership is aligned with the Dubai Wedding Programme, which aims to enhance family unity in Dubai by easing the financial burden of wedding planning. Through this collaboration, dnata Travel Group offers exclusive deals, discounted travel options, and additional travel perks for UAE nationals heading to popular and trending honeymoon destinations.

The honeymoon tourism market is characterized by the availability of substitute products that provide similar experiences but through different means. Adventure tourism packages might replace the typical beach resort honeymoon with activities such as trekking through remote landscapes or exploring vibrant cultures. Another substitute product category includes eco-friendly or sustainable honeymoon options, emphasizing responsible travel practices and immersive natural experiences. These alternatives resonate with couples prioritizing environmental consciousness and authenticity in their travel choices.

Type Insights

The beach honeymoon segment led the market with the largest revenue share of 26.3% in 2024 and is expected to continue to dominate the industry over the forecast period. The availability of all-inclusive beach resorts drives the segment's growth. These resorts offer comprehensive packages that include accommodation, meals, drinks, activities, and entertainment, providing couples with a hassle-free and luxurious experience. All-inclusive packages simplify the planning process and allow honeymooners to enjoy their vacation without worrying about additional costs or logistics. These resorts often feature private beaches, spa services, fine dining, and exclusive excursions, enhancing the honeymoon experience. According to the National Wedding Survey, in 2023, newlyweds opted for beach holidays, with more than half of couples spending their honeymoons by the coast.

The minimoon segment is anticipated to witness the highest CAGR during the forecast period. The growing popularity of multi-stage honeymoons is influencing the rise of minimoons. Many couples opt for a short minimoon immediately after their wedding, followed by a more extended and elaborate honeymoon at a later date. This approach allows couples to enjoy an initial celebration without delay and plan a more extended trip when they have more time and resources. The flexibility offered by multi-stage honeymoons enables couples who want to make the most of both short-term and long-term travel opportunities, thus enhancing the honeymoon experience.

Duration Insights

The 7 to 10-day segment led the market with the largest revenue share in 2024. The trend of combining honeymoons with pre- or post-wedding celebrations, such as destination weddings or pre-wedding vacations, contributes to the growth of this segment. Couples often integrate their honeymoon into a more extended celebration period, where the actual honeymoon lasts 7 to 10 days but is part of a broader travel plan. This approach allows for a more extended celebratory period without requiring the entire duration to be dedicated solely to the honeymoon. Integrating honeymoons with other wedding-related travel plans offers flexibility and enhances the overall experience.

The 4 to 6-day segment is expected to witness a significant CAGR during the forecast period. The trend of domestic travel and exploring local destinations has bolstered the 4 to 6-day honeymoon market. Many couples prefer to explore destinations within their own country or nearby regions. This trend is particularly relevant in the context of recent global travel restrictions and the growing emphasis on supporting local tourism. Domestic honeymoons offer the advantage of shorter travel times and reduced costs. This shift towards local travel has expanded the options for shorter.

Age Group Insights

The 25 - 35 years segment held the largest revenue share in 2024. The emphasis on experiential travel is driving age group segment growth. Young couples prioritize experiences over material possessions, and this mindset extends to their honeymoon planning. They seek destinations that blend adventure, culture, and relaxation. This focus on experiential travel leads to a demand for destinations that provide a mix of activities and opportunities to create lasting memories.

The less than 25 years segment is expected to witness the fastest CAGR during the forecast period. Younger couples are increasingly inclined towards frequent trips and romantic getaways. Due to budget constraints, younger couples prefer shorter trips, such as road trips, minimoons, and excursions. However, flexible payment and financing options offered by the booking platforms also encourage international honeymoon trips among these couples. Social media is another key driving factor that encourages couples less than 25 years old to consider an exotic location as their next honeymoon destination.

Budget Insights

The mid-range segment dominated the market in 2024. The rise of boutique hotels and smaller, independent accommodations has fueled the mid-range honeymoon segment. These establishments often provide personalized service and unique local experiences that differ from luxury resorts. The growing demand for staying in unique accommodations that reflect the local culture and provide personalized touches enhances the honeymoon experience.

The luxury segment is expected to witness the fastest CAGR during the forecast period. The exclusivity and privacy of luxury accommodations are driving the adoption of the luxury segment. Luxury resorts often feature secluded beaches, private pools, and spa facilities that allow couples to relax and unwind in a tranquil environment. The emphasis on privacy and seclusion enables honeymooners to have uninterrupted quality time together. These exclusive settings create a sense of intimacy and luxury, distinguishing the experience from everyday travel.

Booking Mode Insights

The travel agency/agents segment held the largest revenue share in 2024. The value-added services and exclusive perks offered by travel agencies further enhance their demand in the honeymoon market. Many agencies negotiate special rates, upgrades, and complimentary amenities for honeymooners, such as room upgrades, welcome gifts, spa credits, or romantic dining experiences. These exclusive perks elevate the honeymoon experience and enhance the romantic ambiance of their getaway. Travel agencies leverage their industry partnerships and affiliations to provide added value to honeymoon packages, ensuring that couples receive exceptional value and memorable experiences that exceed their expectations.

The direct booking segment is expected to witness the highest CAGR during the forecast period. The trend towards personalized travel experiences and unique adventures also contributes to the demand for direct booking among honeymooners. Couples prefer to tailor their honeymoon itinerary independently. Direct booking lets couples explore local traditions and participate in exclusive activities that align with their interests and passions.

Destination Insights

The domestic segment held the largest revenue share in 2024. The trend of destination weddings and multi-stage honeymoons also drives demand for domestic travel. Couples who choose to host their wedding ceremony in a specific location may extend their celebrations by exploring nearby destinations for their honeymoon. This multi-stage approach allows couples to combine their wedding festivities with honeymoon experiences, creating a seamless and extended celebration period. Domestic destinations offering various activities and accommodations facilitate this trend, providing couples with diverse options to enhance their wedding experience. According to a 2021 survey by Zola and Travelzoo, regional and domestic destinations are favored for honeymoon trips due to their ease of planning and budgeting, offering couples greater control over their travel experiences.

The international segment is expected to witness the fastest CAGR during the forecast period. The growing trend of delayed honeymoons has contributed to the segment's expansion. Many couples postpone their honeymoon due to work commitments, financial considerations, or seasonal preferences, opting instead to go on their honeymoon months or even years after their wedding. This flexibility in timing allows couples to plan their dream honeymoon when it best suits their schedules and desired travel conditions, extending the peak season for international honeymoon tourism throughout the year.

Regional Insights

The North America honeymoon tourism market is expected to grow at a significant CAGR over the forecast period. North America's calendar of events and festivals drives the demand for honeymoon tourism. Music festivals such as Coachella in California and South by Southwest (SXSW) in Texas and cultural celebrations such as Mardi Gras in New Orleans and Canada Day in Ottawa, North America, host a diverse array of events that offer couples unique opportunities to engage in local culture, music, and traditions. Attending these festivals and events allows honeymooners to connect with local communities and experience the vibrancy of North American culture.

U.S. Honeymoon Tourism Market Trends

The demand for honeymoon tourism in the U.S. is rising due to numerous factors, such as an increased interest in exploring domestic destinations and discovering new places within the country. Additionally, the emergence of luxury accommodations like cottages, cabins, ranches, and farms has supplemented this growing demand. The increasing trend of minimoons among couples, a short getaway close to their wedding and a venue followed by a megamoon, or luxury trip, several months later is further fueling the domestic market growth.

Asia Pacific Honeymoon Tourism Market Trends

Asia Pacific is expected to grow at the highest CAGR over the forecast period. Accessibility and travel infrastructure advancements contribute to the growth of the Asia Pacific honeymoon market. Many countries in the region have modern airports, efficient transportation networks, and visa policies that facilitate easy travel for international visitors. Direct flights from major cities worldwide connect couples to popular honeymoon destinations in Asia Pacific, reducing travel time and enhancing convenience. The accessibility and connectivity provided by well-developed travel infrastructure ensure that honeymooners can seamlessly navigate their journey and maximize their time exploring the region's diverse attractions.

China's honeymoon tourism dominated the market in 2024. Luxurious accommodations and world-class hospitality enhance the demand for This market. Major cities such as Shanghai and Beijing boast luxury hotels, boutique resorts, and romantic retreats catering to honeymooners' comfort, privacy, and indulgence. The blend of modern luxury and traditional hospitality ensures that honeymooners experience exceptional comfort and hospitality throughout their stay in China.

The honeymoon tourism market in India is anticipated to grow at the fastest CAGR during the forecast period. Tourism in India is developing at a considerable pace, and the country is becoming a key preference for destination weddings and honeymoons. The country’s diverse geography, culture, and growing hospitality industry offer plenty of options for couples to choose their preferred honeymoon type. The government of India is also promoting the country's destination wedding and honeymoon industry by launching programs such as Incredible India's wedding tourism campaign.

Europe Honeymoon Tourism Market Trends

Europe market dominated the global honeymoon market with a revenue share of 39.3% in 2024. Europe's arts and entertainment scene contributes to growing demand as a honeymoon destination. Opera performances in Vienna and classical concerts in Salzburg offer diverse cultural and entertainment options catering to varying interests and tastes. Honeymooners engage in Europe's artistic and theatrical performances, musical events, and cultural festivals that enrich their honeymoon experience.

Germany honeymoon tourism market dominated the market in 2024. Germany's cultural heritage and historical landmarks drive the country's adoption of the honeymoon tourism market. Cities such as Berlin, Munich, and Dresden offer a combination of ancient architecture, vibrant art scenes, and museums housing artworks and historical artifacts. Honeymooners experience iconic landmarks such as the Brandenburg Gate, Neuschwanstein Castle, and the Berlin Wall, engaging in Germany's history and cultural diversity. The opportunity to discover centuries-old castles, picturesque old towns, and charming cobblestone streets creates a romantic ambiance that resonates throughout the country.

The honeymoon tourism market in Spain is anticipated to grow at the fastest CAGR during the forecast period. Spain offers couples multiple honeymoon destination options. The country has some of the most beautiful beaches in the world and offers water sports, scuba diving, and snorkeling, among other activities. The country has a well-connected transportation system and provides affordable luxury. Such factors attract couples to have a lavish honeymoon while straining their budgets.

Key Honeymoon Tourism Company Insights

Some of the key players operating in the honeymoon tourism market include Booking.com, Marriott International, Inc., and Thomascook.in.

-

Booking.com, an online travel agency (OTA) under Booking Holdings Inc., offers a comprehensive range of travel-related services, including accommodation, flights, rental cars, airport transfers, and activities. The platform recognizes the unique needs of honeymooners, offering various options that cater specifically to romantic accommodation. These include luxurious beachfront resorts with private villas and intimate boutiques. Booking.com's user-friendly interface and extensive filtering options allow couples to refine their search based on criteria such as location, budget, amenities, and guest reviews, ensuring they find accommodation that align perfectly with their honeymoon expectations.

-

Marriott International, Inc., is a global hospitality company that has grown into one of the largest hotel chains worldwide. Marriott International strategically targets the honeymoon tourism market by offering tailored experiences and amenities to enhance the romantic getaway experience. Luxury brands like The Ritz-Carlton and St. Regis are trendy among honeymooners for their upscale accommodations, personalized service, and scenic locations. Their loyalty program, Marriott Bonvoy, further enhances the honeymoon experience by offering rewards and exclusive benefits for frequent guests, encouraging repeat visits and customer loyalty.

-

Thomascook.in is a travel and tourism company in India that offers a wide range of travel-related services, including tours, flights, hotels, cruises, visa services, travel insurance, and foreign exchange. Thomascook offers specially curated packages for honeymoon tourism. These packages typically include romantic destinations, luxurious accommodations, sightseeing tours, and experiences tailored to create memorable moments for newlyweds. The company leverages its extensive network and partnerships with hotels and resorts worldwide to provide many options for honeymooners. Thomascook offers destinations across Asia, Europe, the Americas, and other regions.

Key Honeymoon Tourism Companies:

The following are the leading companies in the honeymoon tourism market. These companies collectively hold the largest market share and dictate industry trends.

- Booking.com

- Abercrombie & Kent Ltd.

- Flight Centre Travel Group Limited

- Marriott International, Inc.

- Thomascook.in

- MakeMyTrip Limited

- Expedia, Inc.

- Bookmundi.com

- Exodus Travels

- The Turquoise Holiday Company Limited

- Honeymoon Inc.

- SANDALS

- BLACK TOMATO

- Exoticca

Recent Developments

-

In February 2023, MakeMyTrip Limited launched MMT Honeymoon, a specially curated honeymoon product collection featuring over 300 handcrafted itineraries across 26 global destinations. These itineraries include luxurious private accommodations such as private pool villas in Bali and beach villas in the Maldives. MMT Honeymoon also offers a wide range of pre-purchased inventory to ensure confirmed availability and protect travelers from fluctuating flight and hotel prices, with assured cab services. The all-inclusive packages cater to various budgets and preferences, including budget-friendly options, luxury packages, adventure packages, and more.

Honeymoon Tourism Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 139.46 billion

Revenue forecast in 2030

USD 191.85 billion

Growth Rate

CAGR of 6.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, duration, age group, budget, destination, booking mode, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain, Greece; China; India; Japan; Australia & New Zealand, Indonesia, Maldives; Brazil; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Booking.com; Abercrombie & Kent Ltd.; Flight Centre Travel Group Limited; Marriott International, Inc.; Thomascook.in; MakeMyTrip Limited; Expedia, Inc.; Bookmundi.com; Exodus Travels; The Turquoise Holiday Company Limited; Honeymoon Inc.; SANDALS; BLACK TOMATO; Exoticca

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Customized purchase options are available to meet your exact research needs. Explore purchase options

Global Honeymoon Tourism Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global honeymoon tourism market research report based on the type, duration, age group, budget, destination, booking mode, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Beach Honeymoon

-

All Inclusive Honeymoons

-

Adventure Honeymoon

-

Cruise Honeymoon

-

Minimoon

-

Road Trip Honeymoon

-

-

Duration Outlook (Revenue, USD Million, 2018 - 2030)

-

4 to 6 Days

-

7 to 10 Days

-

11 to 15 Days

-

Above 15 Days

-

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

25 - 35 Years

-

35 - 45 Years

-

45 - 55 Years

-

Above 55 Years

-

-

Budget Outlook (Revenue, USD Million, 2018 - 2030)

-

Luxury

-

Mid-range

-

Low-range

-

-

Destination Outlook (Revenue, USD Million, 2018 - 2030)

-

Domestic

-

International

-

-

Booking Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Travel Agency/Agents

-

Marketplace Bookings

-

Direct Booking

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

Spain

-

Greece

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

Indonesia

-

Maldives

-

-

Central and South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The beach honeymoon segment led the market with the largest revenue share of 26.3% in 2024 and is expected to continue to dominate the industry over the forecast period. The availability of all-inclusive beach resorts drives the segment's growth. These resorts offer comprehensive packages that include accommodation, meals, drinks, activities, and entertainment, providing couples with a hassle-free and luxurious experience.

b. Some key players operating in the honeymoon tourism market include Booking.com, Abercrombie & Kent Ltd., Flight Centre Travel Group Limited, Marriott International, Inc., Thomascook.in, MakeMyTrip Limited, Expedia, Inc., Bookmundi.com, Exodus Travels, The Turquoise Holiday Company Limited, Honeymoon Inc., SANDALS, BLACK TOMATO, Exoticca

b. Factors such Europe's arts and entertainment scene contributes to growing demand as a honeymoon destination

b. The global honeymoon tourism market size was estimated at USD 131.56 billion in 2024 and is expected to reach USD 139.46 billion in 2024

b. The global honeymoon tourism market is expected to grow at a compound annual growth rate of 6.6% from 2023 to 2030 to reach USD 191.85 billion by 2030

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."