- Home

- »

- Advanced Interior Materials

- »

-

Hose Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Hose Market Size, Share & Trends Report]()

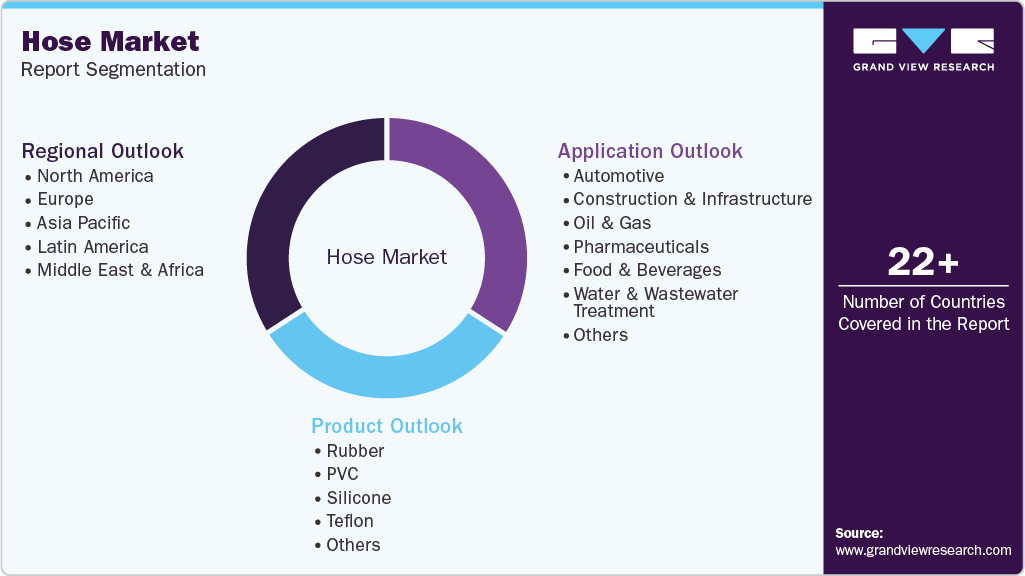

Hose Market (2026 - 2033) Size, Share & Trends Analysis Report By Material Type (Rubber, PVC, Silicone, Teflon), By Application (Oil & Gas, Automotive, Construction & Infrastructure, Pharmaceuticals, Food & Beverages, Mining, Residential), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-845-0

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hose Market Summary

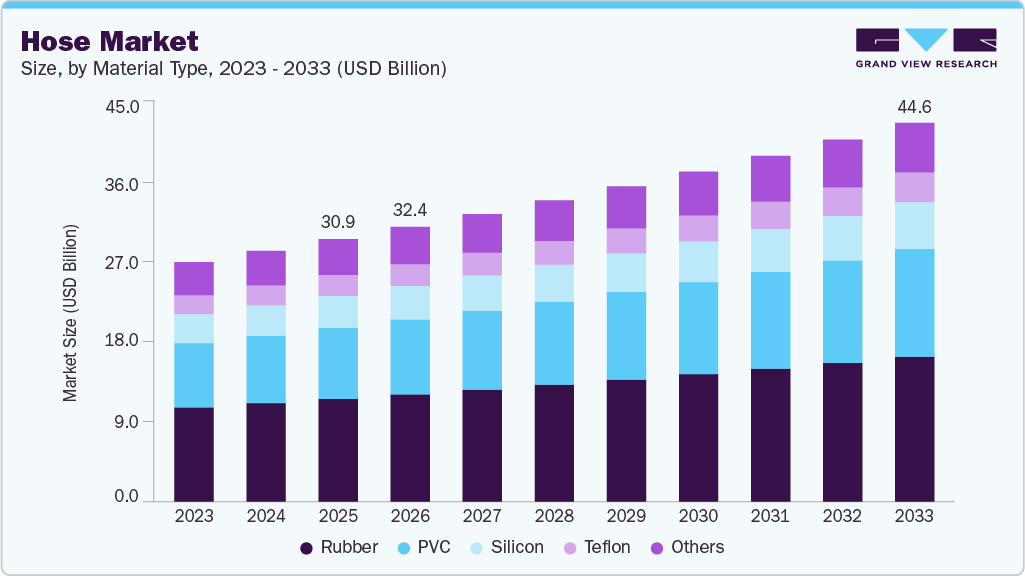

The global hose market size was estimated at USD 30.90 billion in 2025 and is projected to reach USD 44.62 billion by 2033, growing at a CAGR of 4.7% from 2026 to 2033. The hose industry is experiencing steady growth due to the increasing industrialization across the construction, manufacturing, agriculture, and energy sectors.

Key Market Trends & Insights

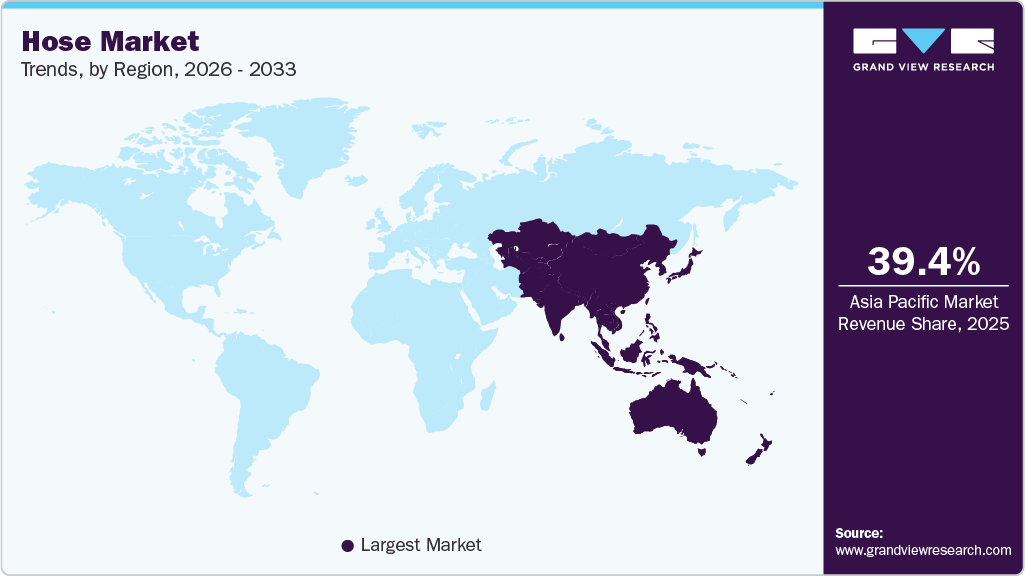

- Asia Pacific dominated the global hose market with the largest revenue share of 39.4% in 2025.

- By material type, the PVC segment is expected to grow at the fastest CAGR of 5.3% over the forecast period.

- By application, the pharmaceuticals segment is expected to grow at the fastest CAGR of 5.3% over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 30.90 Billion

- 2033 Projected Market Size: USD 44.62 Billion

- CAGR (2026-2033): 4.7%

- Asia Pacific: Largest market in 2025

Increasing use of hoses in fluid transfer, irrigation, firefighting, and material handling applications is driving consistent demand. Urban infrastructure expansion and smart city projects are further driving the demand for industrial and utility hoses. Growth in automotive production has also increased demand for fuel, coolant, and hydraulic hoses. In addition, rising focus on efficient fluid management in industries is supporting replacement demand. Harsh operating environments are shortening product life cycles, increasing recurring purchases.Key demand drivers include growth in construction and mining activities that require durable hydraulic and industrial hoses. The expansion of agriculture and irrigation systems, particularly in water-scarce regions, is increasing demand for rubber and PVC hoses. Industrial automation and mechanization are increasing the use of high-pressure and specialty hoses. Rising oil & gas exploration and refining activities are also supporting demand for chemical- and heat-resistant hoses. The automotive aftermarket's growth is driven by regular replacement cycles. Increasing emphasis on workplace safety is encouraging the adoption of certified, high-performance hose systems. Together, these drivers are creating stable long-term growth prospects.

Technological advancements in materials, such as reinforced thermoplastics and composite hoses, are enhancing durability and pressure resistance. Manufacturers are focusing on lightweight, flexible hoses to improve operational efficiency. Rising adoption of smart hoses with sensors for pressure and leakage monitoring is an emerging trend. Sustainability-focused innovations, including recyclable and bio-based materials, are gaining traction. Custom-designed hoses for specific industrial applications are becoming more common. Improved coupling and fitting technologies are enhancing system reliability. These innovations are helping manufacturers differentiate their offerings in a competitive market.

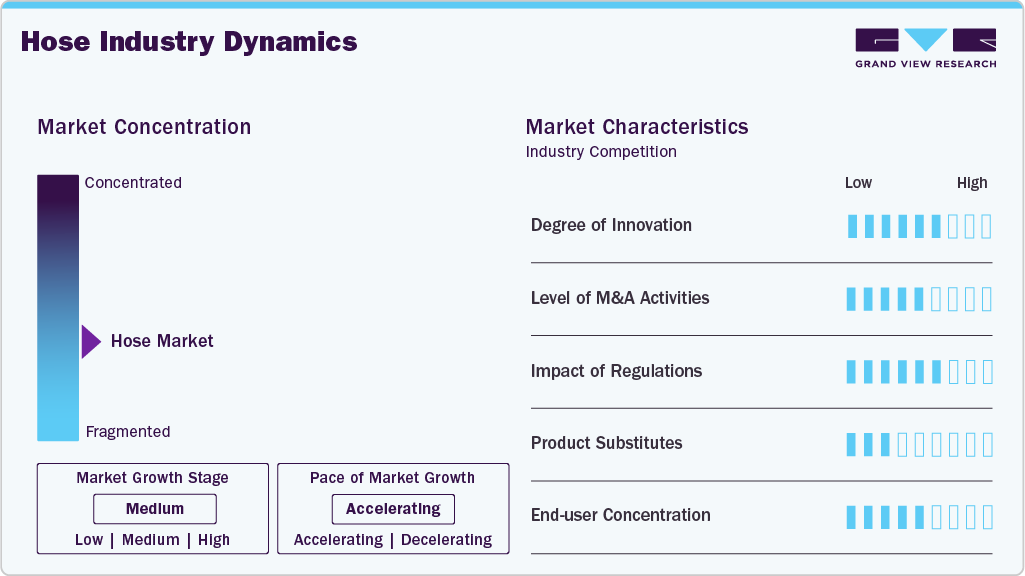

Market Concentration & Characteristics

The hose industry is moderately fragmented, with a mix of large multinational players and numerous regional manufacturers. Global companies dominate high-performance and specialty hose segments through strong R&D and brand recognition. Regional players focus on cost-competitive standard hoses for local markets. Entry barriers are moderate due to material sourcing and compliance requirements. Competition is driven by pricing, product quality, and customization capabilities. Strategic partnerships with OEMs play an important role in market positioning.

The threat of substitutes in the hose industry is moderate, as rigid pipes and tubing can replace hoses in certain fixed installations. However, hoses offer superior flexibility and ease of installation, limiting substitution in dynamic applications. Technological improvements in piping systems may pose some competitive pressure. Cost considerations influence substitution decisions in low-pressure applications. In high-pressure and mobile equipment applications, substitutes remain limited. Performance reliability and safety requirements favor hoses over alternatives. Hence, substitution risk exists but does not significantly restrain market growth.

Material Type Insights

The rubber segment led the market with the largest revenue share of 39.2% in 2025, due to its superior flexibility, durability, and resistance to abrasion, pressure, and extreme temperatures. Rubber hoses are widely used across construction, mining, oil & gas, and industrial applications where high-performance fluid transfer is required. Their ability to handle harsh operating conditions and heavy-duty usage makes them the preferred choice in demanding environments. In addition, longer service life and proven reliability continue to support strong replacement demand.

The PVC segment is expected to grow at the fastest CAGR of 5.3% over the forecast period, owing to its lightweight nature, cost-effectiveness, and ease of handling. PVC hoses are increasingly adopted in agriculture, irrigation, water supply, and light industrial applications. The growing focus on efficient water management and the expansion of irrigation infrastructure are supporting demand. Improvements in PVC formulations, enhancing flexibility and chemical resistance, are further broadening the application scope.

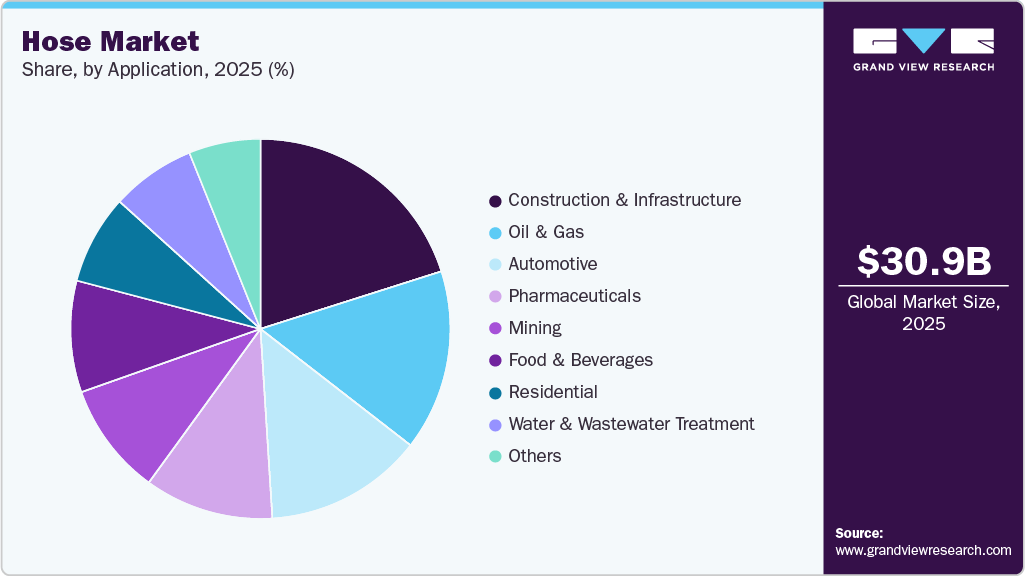

Application Insights

The construction & infrastructure segment led the market with the largest revenue share of 20.1% in 2025, driven by large-scale urbanization and infrastructure development projects. Hoses are extensively used for concrete pumping, water transfer, dust suppression, and material handling at construction sites. Rising investments in roads, bridges, smart cities, and commercial buildings are sustaining high demand. Frequent wear and tear in construction environments also drives strong replacement sales.

The pharmaceuticals segment is expected to grow at the fastest CAGR of 5.3% over the forecast period, driven by rising pharmaceutical production and stringent hygiene requirements. Specialized hoses are used for fluid transfer, processing, and cleaning applications under controlled conditions. Rising global demand for medicines and biologics is accelerating capacity expansions in the pharmaceutical manufacturing industry. In addition, regulatory compliance and the need for contamination-free operations are driving the adoption of high-quality, certified hose solutions.

Regional Insights

The hose market in North America is characterized by strong demand for high-quality and specialty hoses. Growth in oil & gas, construction, and industrial maintenance drives market expansion. Replacement demand is significant due to aging infrastructure. Strict safety and regulatory standards encourage the adoption of premium products. Technological innovation and customization are key competitive factors. The presence of established manufacturers strengthens market maturity.

U.S. Hose Market Trends

The hose market in the U.S. benefits from large-scale industrial and infrastructure activities. Automotive and aerospace industries generate consistent demand for specialty hoses. Oil & gas and chemical processing sectors contribute significantly. Emphasis on safety compliance and performance reliability supports premium pricing. Replacement and aftermarket sales dominate volume demand. Manufacturers focus on innovation and durability enhancements. The market remains stable with moderate growth.

Asia Pacific Hose Market Trends

Asia Pacific dominated the global hose market with the largest revenue share of 39.4% in 2025 and is anticipated to grow at the fastest CAGR during the forecast period, due to rapid industrialization and infrastructure development. Strong growth in construction, manufacturing, and agriculture is driving high consumption. Expanding automotive production in the region further supports demand. Availability of low-cost manufacturing and raw materials benefits regional suppliers. Government investments in water management and irrigation projects add to demand. Export-oriented manufacturing hubs strengthen regional market presence.

The hose market in China accounted for the largest market revenue share in the Asia Pacific in 2025, driven by its large industrial base. Infrastructure expansion and manufacturing growth are key drivers of demand. Strong presence of domestic hose manufacturers supports supply. Increasing quality standards are pushing the adoption of high-performance hoses. Growth in the automotive and heavy machinery industries is boosting demand. Export demand for industrial hoses also remains strong. The market continues to evolve toward advanced materials and products that focus on compliance.

Europe Hose Market Trends

The hose market in Europe is driven by industrial automation and stringent regulatory frameworks. Demand for environmentally compliant and high-performance hoses is strong. Construction, renovation, and maintenance activities support replacement demand. Automotive and manufacturing sectors remain key end users. Sustainability-focused product development is gaining importance. Regional players emphasize quality and certification. Growth is moderate but technologically advanced.

The Germany hose market held a significant share in Europe in 2025, due to its strong manufacturing and automotive base. Demand for precision-engineered and high-pressure hoses is high. Industrial automation and machinery exports support steady consumption. Strict quality and safety standards drive adoption of advanced hose systems. Local manufacturers focus on innovation and customization. Replacement demand remains stable across industries. Germany remains a technology-driven market.

Latin America Hose Market Trends

The hose market in Latin America is growing due to infrastructure development and mining activities. Agriculture and irrigation applications contribute significantly to demand. Industrial expansion in select countries supports growth. Price sensitivity remains high, favoring standard hose products. Imports play an important role in supply. Gradual adoption of higher-quality hoses is observed. Overall growth is moderate but improving.

Middle East & Africa Hose Market Trends

The hose market in the Middle East & Africa is driven by oil & gas, construction, and water management projects. Demand for heat- and chemical-resistant hoses is strong in energy applications. Infrastructure and urban development support market growth. Water scarcity is boosting demand for irrigation hoses. Harsh operating conditions increase replacement frequency. Imports dominate high-performance hose supply. The market is showing steady growth, supported by large-scale projects.

Key Hose Company Insights

Some of the key players operating in the global hose industry include THE YOKOHAMA RUBBER CO., LTD. and Eaton Corporation.

-

Founded in 1917 in Japan, The Yokohama Rubber Co., Ltd. is a leading manufacturer of tires and industrial rubber products, including high-performance hoses for automotive, industrial, and construction applications. The company focuses on durable, flexible hose solutions and global distribution networks to serve diverse industries.

-

Eaton Corporation, headquartered in Ireland, is a global power management company providing hydraulic, fluid conveyance, and industrial solutions. Its hose portfolio includes hydraulic and industrial hoses for high-pressure, heavy-duty, and mobile applications across construction, mining, and manufacturing.

Continental AG and Semperit AG Holding are some of the emerging market participants in the hose industry.

-

Continental AG, a German multinational founded in 1871, specializes in automotive components, including hoses, belts, and fluid transfer systems. Its hoses are known for quality, reliability, and high performance in automotive and industrial applications worldwide.

-

Semperit AG Holding, based in Austria, produces rubber and plastic products, including hoses for industrial, automotive, and medical applications. The company emphasizes high-quality, flexible, and durable hose solutions for both European and international markets.

Key Hose Companies:

The following key companies have been profiled for this study on the hose market.

- Parker Hannifin Corp

- Gates Corporation

- Continental AG

- Eaton Corporation

- Trelleborg Group

- Danfoss

- Semperit AG Holding

- Tesa

- THE YOKOHAMA RUBBER CO., LTD.

- Sumitomo Riko Company Limited

Recent Developments

-

In November 2025, Gates Corporation launched the Data Master Eco liquid cooling hose, a sustainable, halogen‑free cooling solution designed for high‑performance data centers.

-

In November 2025, Continental launched the Vantage hose product line, engineered for reliable performance across air and multipurpose industrial applications.

Hose Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 32.35 billion

Revenue forecast in 2033

USD 44.62 billion

Growth rate

CAGR of 4.7% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material type, application, region.

Regional scope

North America; Asia Pacific; Europe; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; France; China; Japan; India

Key companies profiled

Parker Hannifin Corp; Gates Corporation; Continental AG; Eaton Corporation; Trelleborg Group; Danfoss; Semperit AG Holding; Bridgestone Corporation; THE YOKOHAMA RUBBER CO., LTD.; Sumitomo Riko Company Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hose Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global hose market report based on the material type, application, and region:

-

Material Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Rubber

-

PVC

-

Silicone

-

Teflon

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Automotive

-

Construction & Infrastructure

-

Oil & Gas

-

Pharmaceuticals

-

Food & Beverages

-

Water & Wastewater Treatment

-

Mining

-

Residential

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Middle East and Africa

-

Frequently Asked Questions About This Report

b. The rubber segment held the highest revenue market share of 39.2% in 2025, due to its superior flexibility, durability, and resistance to abrasion, pressure, and extreme temperatures.

b. The global hose market size was estimated at USD 30.90 billion in 2025 and is expected to reach USD 32.35 billion in 2026.

b. The global hose market is expected to grow at a compound annual growth rate of 4.7% from 2026 to 2033 to reach USD 44.62 billion by 2033.

b. Some of the key players operating in the hose market include Parker Hannifin Corp, Gates Corporation, Continental AG, Eaton Corporation, Trelleborg Group, Danfoss, Semperit AG Holding, Bridgestone Corporation, Sumitomo Riko Company Limited, and THE YOKOHAMA RUBBER CO., LTD.

b. Rising industrialization, infrastructure development, agricultural irrigation expansion, growth in automotive and oil & gas sectors, and increasing replacement demand due to safety and efficiency requirements are the key factors driving the hose market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.