- Home

- »

- Homecare & Decor

- »

-

Hotel Furniture, Fixtures And Equipment Market Report, 2030GVR Report cover

![Hotel Furniture, Fixtures, And Equipment Market Size, Share & Trends Report]()

Hotel Furniture, Fixtures, And Equipment Market Size, Share & Trends Analysis Report By Product (Furniture, Fixtures, Equipment), By Hotel Type (Independent Hotels, Chain Hotels), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-442-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

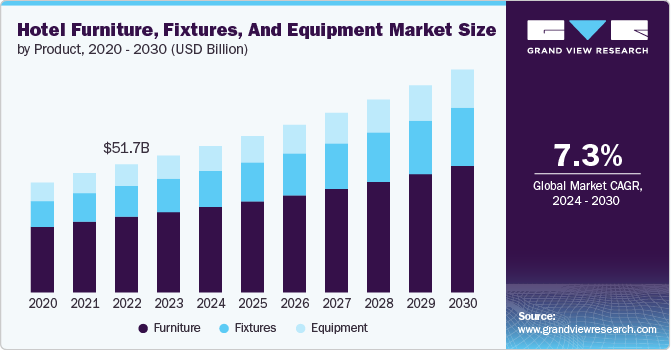

The global hotel furniture, fixtures, and equipment market size was estimated at USD 55.18 billion in 2023 and is projected to grow at a CAGR of 7.3% from 2024 to 2030. The global market is experiencing significant growth, directly influenced by the global expansion of the hospitality sector. The ongoing development of new hotels across both emerging and established markets has led to an increased demand for premium furniture, fixtures, and equipment (FF&E). The rise in international travel and tourism, alongside economic recovery in various regions, has prompted hotel chains to broaden their presence, necessitating considerable investments in FF&E. These investments are critical for creating environments that align with the evolving expectations of today's travelers, whether in luxury or budget accommodations. Consequently, the furniture, fixtures, and equipment market is benefiting from this wave of new hotel projects, with suppliers poised to capitalize on the expanding demand.

Existing hotels are increasingly focusing on renovation and refurbishment to remain competitive and enhance guest experiences, further driving demand for furniture, fixtures, and equipment. Many hotel operators are adopting cyclical renovation strategies to refresh their properties, ensuring they meet current design trends and technological advancements. This trend is particularly prevalent in mature markets where new hotel development is slower, and operators seek to maintain relevance. The growing emphasis on sustainability and energy efficiency also prompts hoteliers to replace outdated fixtures and equipment with environmentally friendly alternatives, fueling further growth in the FF&E market.

According to the statistics published in U.S. Construction Pipeline Trend Report by Lodging Econometrics' 2023, the U.S. hotel construction pipeline reached an unprecedented level in the fourth quarter of 2023, with 5,964 projects totaling 693,963 rooms. This marks a new record, surpassing the previous peak of 5,883 projects recorded in the second quarter of 2008. Notably, hotel conversions and renovations accounted for a significant portion of the pipeline, with a record 2,028 projects encompassing 303,330 rooms. This surge in construction, particularly in conversions and renovations, is expected to drive substantial growth in the hotel furniture, fixtures, and equipment market as demand for updated and modernized furniture, fixtures, and equipment intensifies across the industry.

Hotel chains are increasingly focusing on brand differentiation to attract diverse customer segments, which is significantly influencing the FF&E market. Global hotel brands maintain strict design and quality standards across their properties, driving consistent demand for specific types of furniture, fixtures, and equipment. Additionally, boutique and independent hotels seek unique FF&E solutions to create distinctive environments that set them apart from competitors. The need to adhere to brand standards while incorporating elements of local culture and design is pushing FF&E suppliers to innovate and provide customized solutions, thereby expanding their market opportunities.

The integration of smart technologies into hotel FF&E is emerging as a key growth driver. As hotels strive to offer enhanced guest experiences, they are increasingly investing in smart furniture and fixtures equipped with advanced features like wireless charging, automated lighting, and voice-activated controls. These innovations enhance guest comfort and improve operational efficiency by allowing hotels to monitor and manage energy consumption more effectively. The growing adoption of smart FF&E is opening new avenues for suppliers and driving market growth, as hotels seek to stay ahead in the competitive hospitality landscape.

The expansion of the luxury and lifestyle hotel segments is significantly contributing to the growth of the FF&E market. These segments demand high-end, bespoke FF&E solutions that reflect the brand's identity and appeal to affluent travelers. The rise of experiential travel, where guests seek unique and personalized experiences, has led to an increased focus on the design and quality of hotel interiors. This trend drives demand for premium materials, artisanal craftsmanship, and custom-designed furniture and fixtures, thereby boosting the FF&E market, particularly in regions with a high concentration of luxury hotels.

Product Insights

Furniture accounted for a market share of 58.8% in 2023. The ongoing expansion of the global hospitality sector is driving the need for new and renovated hotel properties. As international travel continues to recover and grow, hotel operators are increasingly investing in both new constructions and refurbishments to cater travelers' evolving preferences. This growth in hotel development naturally leads to a heightened demand for high-quality furniture that can enhance guest experiences and align with brand standards.

Moreover, the shift toward creating more personalized and differentiated guest experiences fuels the need for custom-designed furniture. Hotels are increasingly focusing on creating unique interiors that reflect their brand identity and appeal to specific target demographics, such as luxury travelers or eco-conscious guests. This trend is particularly strong in the boutique and lifestyle segments, where distinctive design is a key competitive advantage. Consequently, the demand for bespoke furniture solutions is rising as hotels seek to stand out in a crowded market. In addition, the growing emphasis on sustainability and environmentally responsible practices within the hotel industry is driving the demand for furniture made from sustainable materials. Hoteliers are increasingly prioritizing eco-friendly furnishings that contribute to their overall sustainability goals, such as reducing carbon footprints and achieving green certifications. This shift encourages manufacturers to innovate and offer sustainable furniture options, further boosting market demand.

The demand for fixtures is projected to grow at a CAGR of 8.3% from 2024 to 2030. As hotels increasingly prioritize enhancing guest experiences, there is a significant push to modernize and elevate the aesthetic appeal of their interiors. Fixtures, including lighting and decorative elements, play a critical role in creating a luxurious and comfortable environment that aligns with the expectations of contemporary travelers.

Moreover, the ongoing trend of hotel renovations and refurbishments, particularly in upscale and boutique segments, is contributing to the heightened demand for high-quality fixtures. These renovations are often part of broader strategies to maintain competitiveness, meet evolving design standards, and adhere to sustainability practices. Hotels are investing in fixtures that not only improve the visual appeal but also incorporate energy-efficient technologies, contributing to cost savings and environmental goals.

Hotel Type Insights

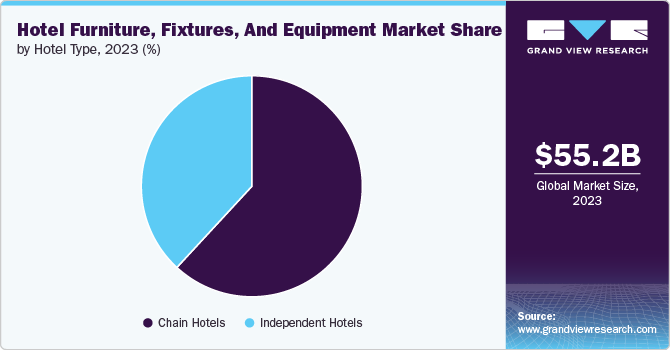

The demand for FF&E among chain hotels held the largest market share of 61.9% in 2023. Chained hotels typically dominate the FF&E market due to their larger operational scale and standardized procurement processes. These hotels, especially those belonging to global brands, often have well-established supplier networks and benefit from economies of scale. Their market share is bolstered by frequent renovations and new property openings, driven by brand mandates to maintain consistency in design and quality across locations. Chained hotels also tend to invest heavily in high-end, custom-designed FF&E to align with brand identity and enhance the guest experience, further expanding their market share.

The demand for FF&E among independent hotels is anticipated to grow with a CAGR of 8.0% from 2024 to 2030. Independent hotels, especially those in the boutique and luxury segments, are increasingly focused on creating distinctive and memorable guest experiences. To achieve this, they are investing in unique, high-quality FF&E that reflects their brand identity and appeals to their target demographics. This trend drives demand as these hotels seek to differentiate themselves in a competitive market.

Additionally, the rise of experiential travel has led independent hotels to prioritize customization and personalization in their design choices. Guests are seeking more than just a place to stay; they are looking for immersive environments that reflect local culture and offer a sense of authenticity. Independent hotels, with their flexibility and creative freedom, are well-positioned to meet this demand by incorporating bespoke FF&E that enhances the overall guest experience.

Moreover, the expansion of independent hotels in emerging markets and popular tourist destinations is fueling the need for FF&E. As new properties are developed, there is a corresponding rise in demand for furniture and fixtures that align with the hotel’s unique concept and appeal to a discerning clientele. This expansion is particularly significant as independent hotels continue to carve out a niche in markets traditionally dominated by large chains.

Regional Insights

The hotel furniture, fixtures, and equipment market in North America held a share of 39.2% of the global revenue Indigenous materials in hotel design is contributing using Indigenous materials in hotel design contributes to the increased demand for eco-friendly and bespoke FF&E. Meanwhile, in Mexico, the growth of tourism in coastal and resort areas is fueling demand for furniture and fixtures that cater to the luxury market and enhance the guest experience in these premium locations.

U.S. Hotel Furniture, Fixtures, And Equipment Market Trends

The furniture, fixtures, and equipment (FF&E) market in the U.S. is expected to grow at a CAGR of 7.3% from 2024 to 2030. The demand for FF&E in U.S. hotels is growing due to the ongoing trend of hotel renovations and the increasing focus on sustainability. Many U.S. hotels, particularly those in urban areas and popular tourist destinations, are investing heavily in upgrading their interiors to attract a diverse and discerning clientele. Additionally, the U.S. hotel industry is experiencing a resurgence in business travel and events, prompting hotels to invest in modern and flexible FF&E solutions that cater to the evolving needs of corporate clients.

Asia Pacific Hotel Furniture, Fixtures, And Equipment Market Trends

Asia Pacific accounted for a revenue share of around 21.2% in the year 2023. The Asia Pacific region is witnessing a significant surge in furniture, fixtures, and equipment (FF&E) demand due to rapid hotel expansion and the rise of domestic tourism. Countries like China, India, and Southeast Asian nations are seeing a boom in both new hotel constructions and renovations of existing properties to meet the expectations of a growing middle class and an influx of international tourists. According to the Hotel Construction Pipeline Trend Report from Lodging Econometrics (LE), the total construction pipeline in the region has reached a record high of 2,056 projects, encompassing 406,118 rooms. This represents a 6% year-over-year increase in the number of projects and a 1% rise in the total room count.

Europe Hotel Furniture, Fixtures, And Equipment Market Trends

The European market is projected to grow at a CAGR of 7.7% from 2024 to 2030. In Europe, the demand for furniture, fixtures, and equipment (FF&E) is being driven by a combination of heritage hotel renovations and the growing emphasis on design and sustainability in the hospitality sector. Many hotels in historic cities across Europe are undergoing refurbishments to preserve their architectural heritage while incorporating modern amenities, leading to a rise in demand for custom-made and high-quality FF&E that blends traditional aesthetics with contemporary functionality.

Key Hotel Furniture, Fixtures, And Equipment Company Insights

The competitive landscape of the hotel FF&E market is characterized by a diverse array of players, including established manufacturers, regional suppliers, and emerging companies that specialize in custom solutions. Major global manufacturers leverage their extensive distribution networks and economies of scale to offer a wide range of products, from standard furnishings to bespoke fixtures, allowing them to cater to the varying needs of different hotel segments. This competitive environment is further intensified by the growing trend of sustainability, prompting companies to innovate and develop eco-friendly products that align with the increasing demand for sustainable hospitality practices.

Regional suppliers often capitalize on local market knowledge, enabling them to provide tailored FF&E solutions that resonate with the cultural and aesthetic preferences of specific regions. This localization strategy allows them to compete effectively against larger players, particularly in boutique and independent hotel sectors where uniqueness and personalization are paramount. Furthermore, the rise of technology in the hospitality industry has introduced new dynamics to the FF&E market, with manufacturers incorporating smart technologies into their offerings. This trend enhances operational efficiency and guest experience, positioning companies that embrace technological innovation favorably within the competitive landscape.

Key Hotel Furniture, Fixtures, And Equipment Companies:

The following are the leading companies in the hotel furniture, fixtures, and equipment (FF&E) market. These companies collectively hold the largest market share and dictate industry trends.

- Kimball International

- Consolidated Hospitality Supplies (CHS)

- Milliken & Company

- Hotel Spec International, Inc.

- Benjamin West

- Carroll Adams

- Innvision Hospitality, Inc.

- Beyer Brown

- Avendra, LLC.

- Andreu World

Recent Developments

-

In August 2024, Vogue Decor Furniture announced the launch of its new line of restaurant and furniture, specifically designed to offer a modern aesthetic and comfortable ambiance for dining establishments in Canada. This collection aimed to enhance the overall dining experience through the provision of high-quality chairs, durable tables, and a versatile range of barstools.

-

In September 2022, Hospitality Furniture Group revolutionized furniture sourcing for luxury hospitality brands globally. With a commitment to high-quality materials and curated, modern designs, the furniture manufacturer established partnerships with prestigious luxury organizations, drawing on over 50 years of experience in hospitality design. This collaboration enabled luxury hotels and restaurants to update and renovate their spaces effortlessly, offering a range of products from elegant chairs and case goods to outdoor furniture and accessories. In response to the industry's high standards, Hospitality Furniture Group provided a catalog of sleek, modern, and easy-to-install furniture, which garnered admiration from prominent clients such as Kimpton Hotels and Restaurants, Wolfgang Puck, and Hyatt Hotels and Resorts.

Hotel Furniture, Fixtures, And Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 58.97 billion

Revenue forecast in 2030

USD 89.88 billion

Growth rate

CAGR of 7.3% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, hotel type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Kimball International; Consolidated Hospitality Supplies (CHS); Milliken & Company; Hotel Spec International, Inc.; Benjamin West; Carroll Adams; Innvision Hospitality, Inc.; Beyer Brown; Avendra, LLC.; Andreu World

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hotel Furniture, Fixtures, And Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global hotel furniture, fixtures, and equipment (FF&E) market report based on product, hotel type, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Furniture

-

Fixtures

-

Equipment

-

-

Hotel Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Independent Hotels

-

Chain Hotels

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global hotel furniture, fixtures, and equipment market was estimated at USD 55.18 billion in 2023 and is expected to reach USD 58.97 billion in 2024.

b. The global hotel furniture, fixtures, and equipment market is expected to grow at a compound annual growth rate of 7.3% from 2024 to 2030 to reach USD 89.88 billion by 2030.

b. North America dominated the hotel furniture, fixtures, and equipment market with a share of 39.2% in 2023. The regional demand is driven by the rising growth of hospitality and the demand for eco-friendly and bespoke FF&E.

b. Some of the key players operating in the hotel furniture, fixtures, and equipment (FF&E) market include Kimball International, Consolidated Hospitality Supplies (CHS), Milliken & Company, Hotel Spec International, Inc., Benjamin West, Carroll Adams, Innvision Hospitality, Inc., Beyer Brown, Avendra, LLC., and Andreu World.

b. Growth of the global hotel furniture, fixtures, and equipment market is majorly driven on account of the rising investment in the enhancement of their guest experiences through modernized furnishings and state-of-the-art equipment and integration of smart technology into hotel furniture and fixtures to revolutionize the guest experience.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."