- Home

- »

- Electronic & Electrical

- »

-

Household Kitchen Appliances Market, Industry Report, 2033GVR Report cover

![Household Kitchen Appliances Market Size, Share & Trend Report]()

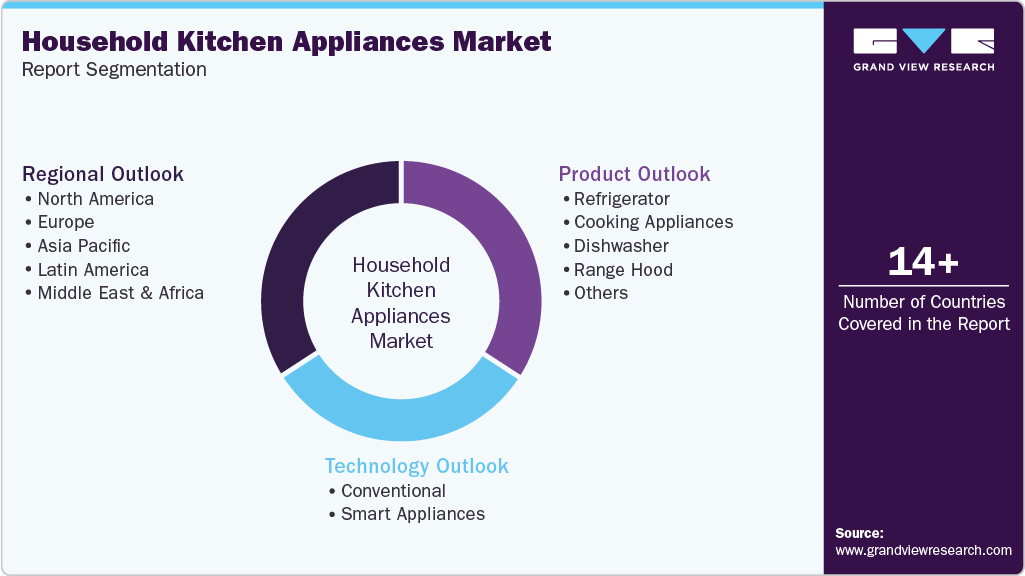

Household Kitchen Appliances Market (2025 - 2033) Size, Share & Trend Analysis Report By Product (Refrigerator, Cooking Appliances), By Technology (Conventional, Smart Appliances), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-571-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Household Kitchen Appliances Market Summary

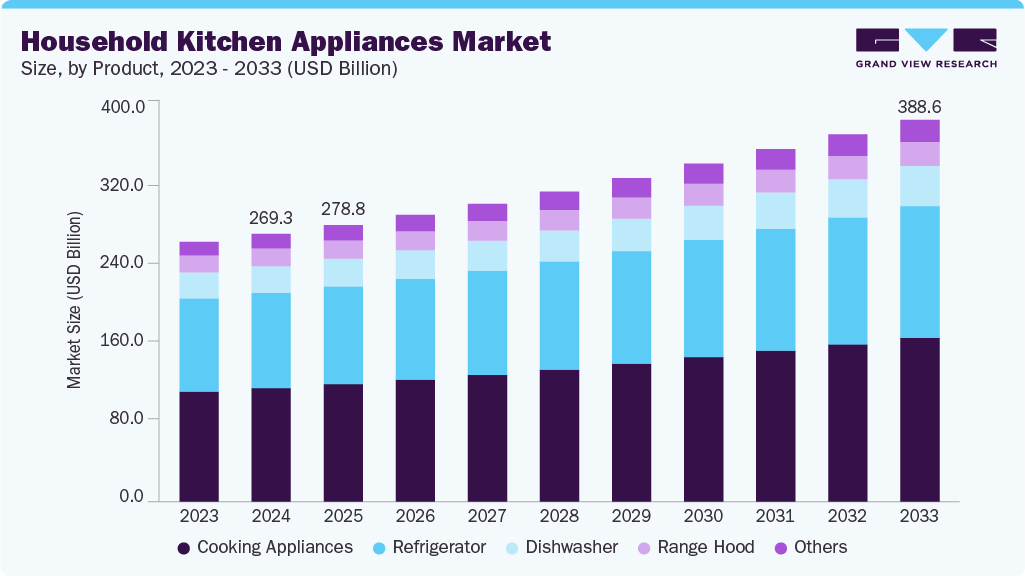

The global household kitchen appliances industry was estimated at USD 269.27 billion in 2024 and is projected to reach USD 388.58 billion by 2033, growing at a CAGR of 4.2% from 2025 to 2033. The industry is witnessing substantial growth fueled by rising disposable incomes, rapid urbanization, a growing emphasis on convenience, and advancements in technology.

Key Market Trends & Insights

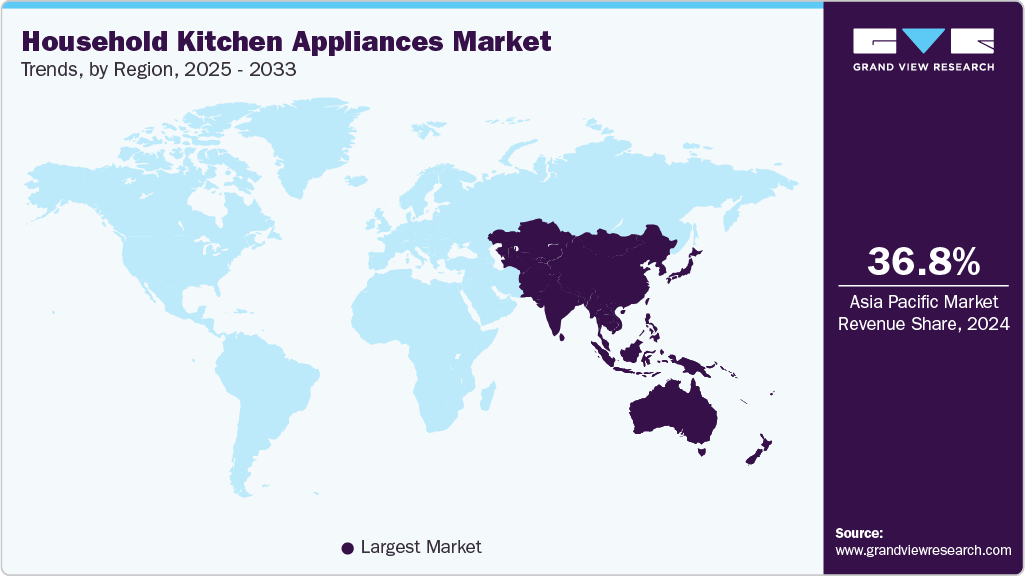

- Asia Pacific held the largest share in the global household kitchen appliances market in 2024, accounting for 36.8%.

- The Middle East & Africa household kitchen appliances market is experiencing the fastest growth, projecting a CAGR of 5.5%

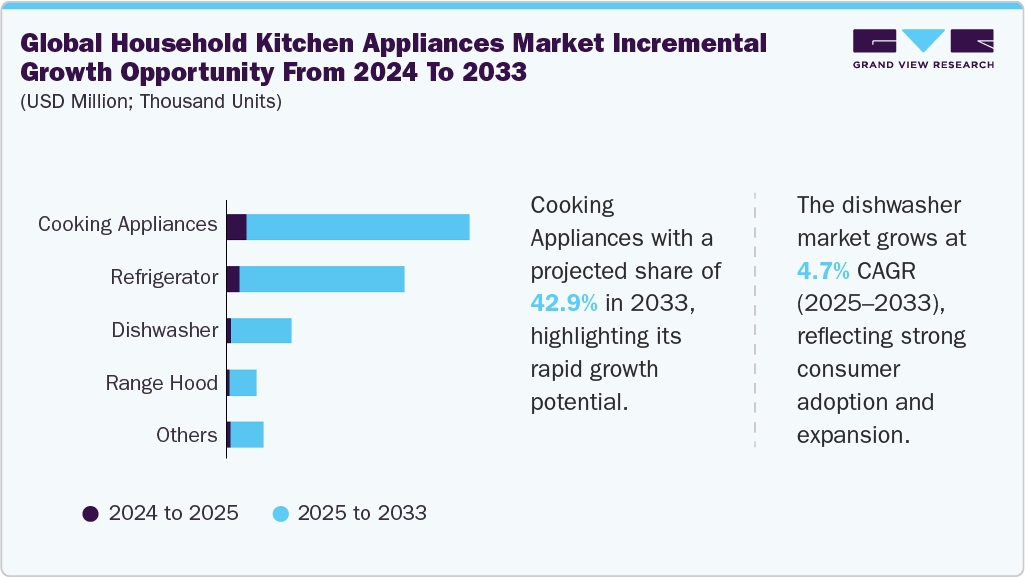

- By product, the cooking appliances in the global household kitchen appliances market held the largest market share, accounting for 42.4%.

- By product, the dishwasher in the household kitchen appliances market is experiencing significant growth, projecting a CAGR of 4.7%.

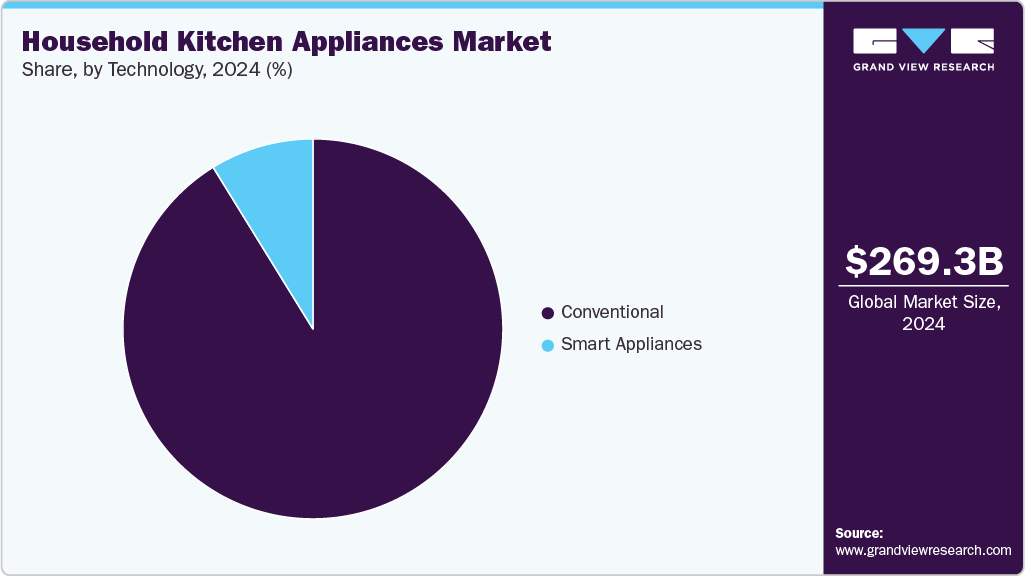

- By technology, the conventional technology market in the Global household kitchen appliances market held the largest share of 91.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 269.27 Billion

- 2033 Projected Market Size: USD 388.58 Billion

- CAGR (2025-2033): 4.2%

- Asia Pacific: Largest market in 2024

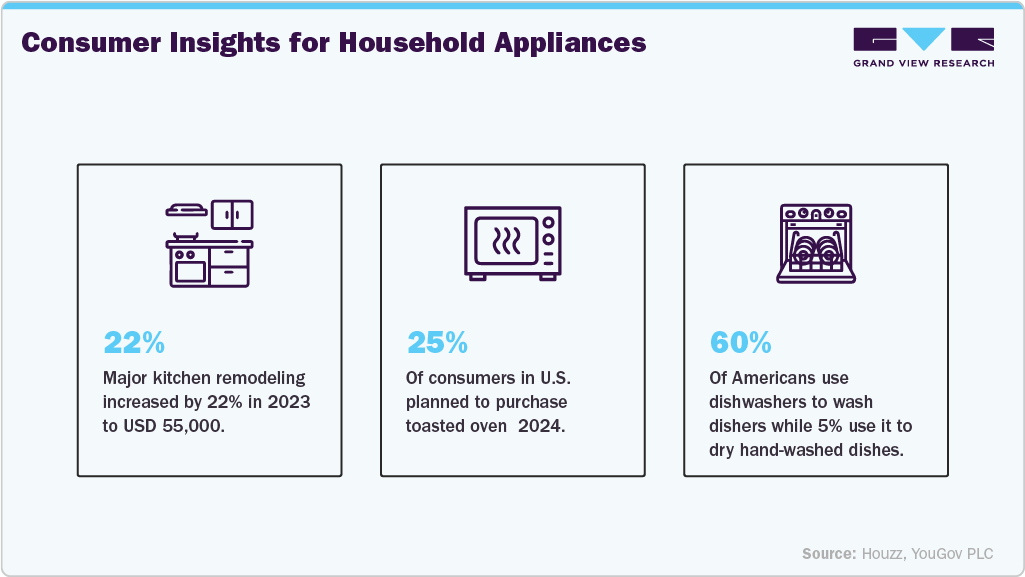

Additionally, the surge in home remodeling projects, evolving consumer lifestyles, and increased awareness of energy efficiency are further driving global demand and expanding the home appliances market. The market is also benefiting from the rapid expansion of e-commerce platforms, which provide consumers with easier access to a wide range of products and brands. Rising brand consciousness and preferences for aesthetically appealing appliances are influencing purchasing decisions. Government incentives and regulations promoting sustainable energy use are encouraging the adoption of compliant appliances. For instance, the Inflation Reduction Act of 2022, is a law signed by the Federal government to combat climate change and bolster clean energy adoption. Furthermore, the increasing penetration of electricity and improved infrastructure in rural areas are unlocking new growth opportunities for manufacturers.

Moreover, the Global household kitchen appliances market is driven by rising urbanization, increasing disposable incomes, and growing demand for convenience and smart home technologies. Technological advancements, such as energy-efficient and AI-integrated appliances, are also fueling market growth. Rapid electrification in developing regions is expanding consumer access. Additionally, environmental concerns are prompting innovations in sustainable and eco-friendly appliance designs.

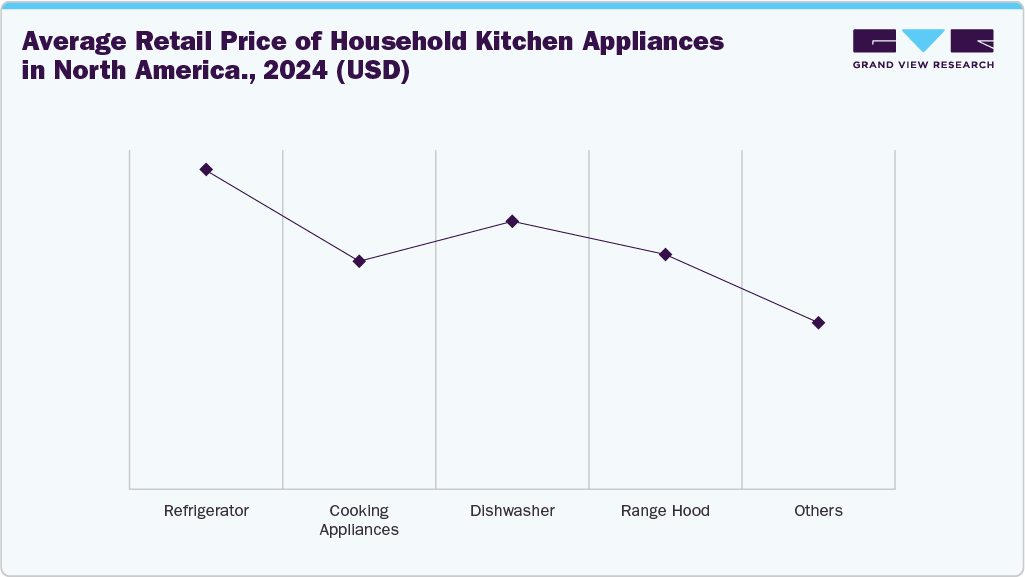

Pricing Analysis

Pricing analysis of the North America household kitchen appliances market shows a competitive landscape influenced by factors such as brand reputation, energy efficiency, and smart technology integration. Premium brands command higher prices due to advanced features and durable materials. Mid-range segments are expanding, driven by value-conscious consumers seeking functionality without the high costs. Entry-level products remain price-sensitive, often affected by inflation and raw material costs. Overall, dynamic pricing strategies and frequent promotional discounts influence consumer purchasing behavior in this mature market.

Product Insights

The cooking appliances in the global household kitchen appliances market accounted for the largest share of 42.4% of the revenue in 2024. The global market for cooking appliances, including cooktops, cooking ranges, and ovens, is driven by increasing consumer preference for modular kitchens and multifunctional appliances. Rising disposable incomes and busy lifestyles are boosting demand for time-saving, energy-efficient cooking solutions. Smart technology integration, such as IoT-enabled ovens, is enhancing user convenience and driving adoption. For instance, in May 2025, Bühler launched OptiBake, a wafer baking oven powered by induction heating, and efficient in saving up to 50% energy compared to conventional ovens. Additionally, growing awareness of home cooking for health and cost benefits further supports market growth.

The dishwashers in the global household kitchen appliances market are projected to grow at the fastest CAGR of 4.7% from 2025 to 2033. The global dishwasher market is fueled by rising disposable income and rapid urbanization, which drive demand for modern kitchen conveniences. Busy lifestyles and a growing number of dual-income households are creating a need for time-saving, labor-reducing appliances. Increasing awareness of water and energy efficiency encourages consumers to adopt eco-friendly dishwashers. For instance, in May 2023, Shabosh launched eco-friendly and compact dishwashers that use 80% less water and are 70 times more powerful compared to traditional dishwashers. Furthermore, smart-home connectivity and advanced features such as sensor-driven wash cycles and customizable programs are elevating user experience and accelerating market growth.

Technology Insights

The conventional technology in the global household kitchen appliances market accounted for the largest market share of 91.2% in 2024. The market is driven by its affordability, ease of use, and widespread availability. Many consumers, especially in developing regions, prefer traditional appliances over smart variants due to lower upfront costs and simpler maintenance. The strong presence of established brands and reliable performance also contributes to sustained demand. Additionally, limited internet connectivity and digital literacy in certain areas support continued reliance on conventional kitchen technologies. For instance, in November 2024, Häfele launched a range of household kitchen appliances including Midora Full Steam Oven, Renata Cookerhoods, featuring a filter-free design, and Altius Plus Hobs featuring in a TruMatt finish and sleek alloy knobs.

The smart appliances technology in the global household kitchen appliances market is projected to grow at the fastest CAGR of 5.7% from 2025 to 2033. Smart appliance technology in the global household kitchen appliances market is driven by increasing consumer demand for connectivity, automation, and personalized experiences. Integration with smart home ecosystems and voice assistants such as Alexa and Google Assistant enhances convenience and control. Advancements in AI and IoT enable features such as remote monitoring, energy optimization, and predictive maintenance. Additionally, growing awareness of sustainability and energy efficiency is encouraging the adoption of smart, eco-friendly kitchen solutions. For instance, in September 2024, LG Electronics launched the Wi-Fi Convertible Side-by-Side Refrigerator, which allows users to transform the freezer into a fridge through the LG ThinQ app. These refrigerators feature Smart Learner AI technology that monitors usage patterns and adjusts cooling for optimal performance.

Regional Insights

The North America household kitchen appliances market accounted for 25.3% in 2024. The North America household kitchen appliances market is driven by increasing consumer focus on energy efficiency and eco-friendly products, supported by stringent government regulations. Rising demand for smart appliances that offer convenience and connectivity is also propelling growth. Additionally, the growing trend of home cooking and meal preparation, especially post-pandemic, has boosted appliance purchases. The presence of major appliance manufacturers investing in innovation and product diversification further accelerates market expansion. For instance, in November 2023, Whirlpool Corporation introduced SlimTech insulation, a vacuum-insulated structure (VIS) technology for refrigerators. The company has invested approximately USD 65 million in the plant and will manufacture these refrigerators equipped with SlimTech technology at its Ohio operations.

U.S. Household Kitchen Appliances Market Trends

The U.S. led the North American household kitchen appliances market in 2024, holding the largest market share with 92.8% of the region’s total revenue. The U.S. household kitchen appliances market is driven by a strong preference for premium, high-quality products with advanced features such as touchscreens and smart integration. Growing awareness of health and wellness has increased demand for appliances that support healthier cooking options. The rise in home remodeling projects, especially in suburban areas, further boosts appliance sales. Additionally, the convenience and time-saving benefits of modern kitchen technologies continue to appeal to busy, dual-income households.

Europe Household Kitchen Appliances Market Trends

The household kitchen appliances market in Europe is projected to grow at a CAGR of 3.0% from 2025 to 2033. The Europe household kitchen appliances market is driven by a growing preference for high-tech, energy-efficient products due to increasing environmental awareness. Consumer demand for compact, space-saving appliances, particularly in urban areas with smaller living spaces, is on the rise. Additionally, the popularity of smart kitchens and IoT-enabled devices is pushing innovation in the sector. For instance, in November 2022, Haier Europe, a division of Haier Smart Home, expanded its manufacturing capabilities in Europe by opening a new dishwasher production facility in Turkey, with an investment exceeding USD 41.72 million. The new plant has an annual production capacity of 1 million units, further enhancing Haier’s footprint in the European market.

Germany household kitchen market led the Europe market in 2024, holding the largest market share with 24.0% of the region’s total revenue. Germany's household kitchen appliances market is driven by the country's strong emphasis on engineering excellence and high-quality, durable products. Increasing demand for sustainable and energy-efficient appliances aligns with Germany's environmental goals and green policies. The trend of smart home integration is also gaining traction, with consumers seeking appliances that offer connectivity and automation. Additionally, the rising popularity of cooking at home, along with busy lifestyles, is boosting the demand for time-saving kitchen solutions.

Asia Pacific Household Kitchen Appliances Market Trends

The Asia Pacific led the household kitchen appliances market and accounted for the largest market share of 36.8% in 2024. The Asia-Pacific household kitchen appliances market is primarily driven by rapid urbanization, rising disposable incomes, and the growing middle-class population. Increasing demand for modern, space-efficient appliances in smaller households and apartments is pushing growth, particularly in major cities. Additionally, the adoption of smart technology and the shift towards energy-efficient products are influencing consumer preferences. The Government initiatives are promoting sustainable energy use are encouraging the adoption of compliant appliances. For instance, according to the World Economic Forum data published in October 2024, the Japanese government offered rebates to promote the replacement of old home appliances with energy-efficient and sustainable appliances, reducing energy consumption.

Middle East & Africa Household Kitchen Appliances Market Trends

The household kitchen appliances market in the Middle East & Africa is projected to grow significantly at a CAGR of 5.5% from 2025 to 2033. The Middle East & Africa household kitchen appliances market is driven by a growing young population with increasing preference for convenience and modern living. Expanding e-commerce platforms are making appliances more accessible across urban and semi-urban regions. Cultural shifts and rising awareness of health and hygiene are boosting demand for advanced cooking and cleaning appliances. Local manufacturing and regional partnerships are also helping reduce costs and improve product availability.

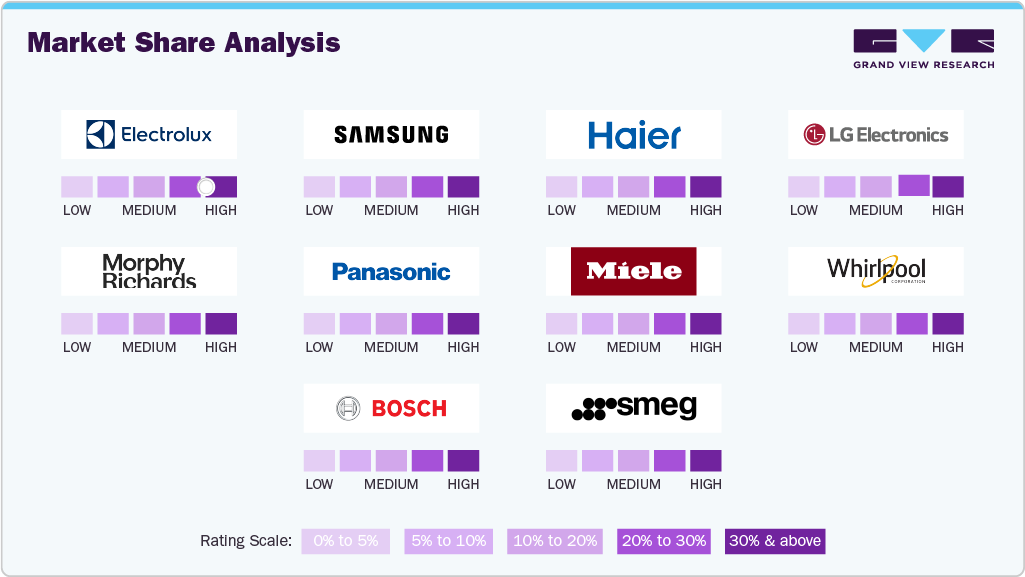

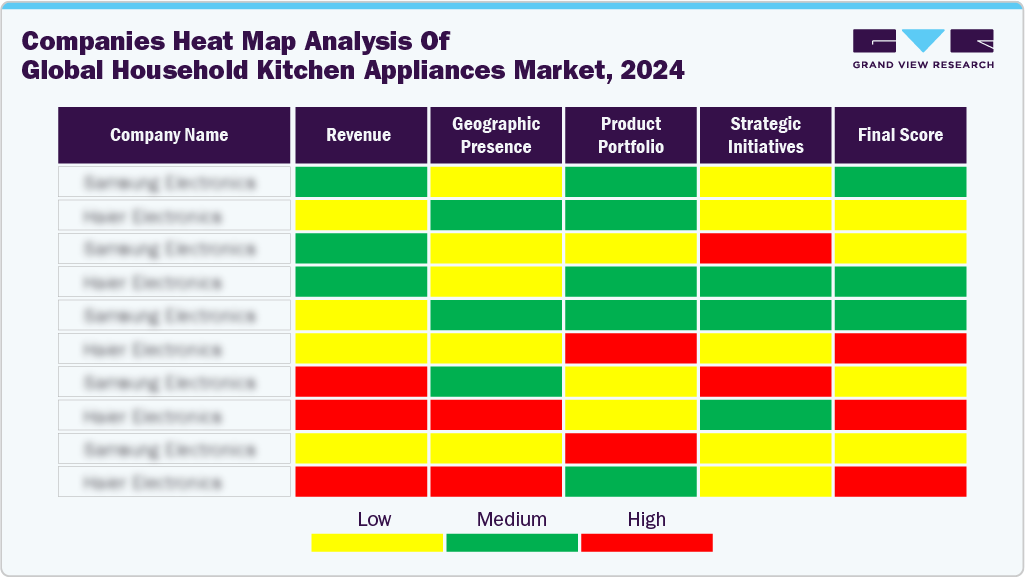

Key Household Kitchen Appliances Company Insights

Many brands in the global household kitchen appliances market have identified untapped opportunities within their product portfolios and are actively working to capitalize on these gaps. This includes launching innovative, multifunctional appliances, increasing smart home integration, and providing more sustainable, energy-efficient options.

Key Household Kitchen Appliances Companies:

The following are the leading companies in the household kitchen appliances market. These companies collectively hold the largest market share and dictate industry trends.

- AB Electrolux

- SAMSUNG

- Haier Group

- LG Electronics

- Morphy Richards

- Panasonic Holdings Corporation

- Miele & Cie. KG

- Whirlpool Corporation

- Robert Bosch GmbH

- Smeg S.p.A

Recent Developments

-

In July 2024, Whirlpool Corporation introduced a new collection of single-door refrigerators, the Ice Magic Pro Glass Door range. The range features three designs inspired by India's rich cultural heritage and craftsmanship. The refrigerators are designed with Insulated Capillary Technology, ensuring quicker cooling and minimal temperature fluctuations.

-

In July 2024, Bosch home appliances introduced its new 300 Series dishwasher, priced at USD 699, which comes with a full stainless-steel tub. This model features two racks and incorporates Bosch's PrecisionWash cleaning system along with PureDry drying technology for efficient dish cleaning and drying. Its design boasts a modern edge-to-edge recessed handle with integrated controls, offering both practicality and style.

Household Kitchen Appliances Market Report Scope

Report Attribute

Details

Market value size in 2025

USD 278.76 billion

Revenue forecast in 2033

USD 388.58 billion

Growth rate

CAGR of 4.2% from 2025 to 2033

Actuals data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD Million/Billion; Volume in Thousand Units, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; Japan; China; India; Australia; South Korea; Southeast Asia; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

AB Electrolux; SAMSUNG; Haier Group; LG Electronics; Morphy Richards; Panasonic Holdings Corporation; Miele & Cie. KG; Whirlpool Corporation; Robert Bosch GmbH; Smeg S.p.A

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Household Kitchen Appliances Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global household kitchen appliances market report on the basis of product, technology, and region.

-

Product Outlook (Revenue, USD Million; Volume, Thousand Units; 2021 - 2033)

-

Refrigerator

-

Cooking Appliances

-

Cooktops & cooking range

-

Ovens

-

Others

-

-

Dishwasher

-

Range Hood

-

Others

-

-

Technology Outlook (Revenue, USD Million; Volume, Thousand Units; 2021 - 2033)

-

Conventional

-

Smart Appliances

-

-

Regional Outlook (Revenue, USD Million; Volume, Thousand Units; 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Southeast Asia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global household kitchen appliances market size was estimated at USD 269.27 billion in 2024 and is expected to reach USD 278.76 billion in 2025.

b. The global household kitchen appliances market is expected to grow at a compound annual growth rate (CAGR) of 4.2 % from 2025 to 2033 to reach USD 388.58 billion by 2033.

b. Cooking Appliances accounted for a revenue share of 42.4% in 2024, driven by rising urbanization, increasing disposable incomes, and growing demand for convenience.

b. Some key players operating in the global household kitchen appliances market include AB Electrolux, SAMSUNG, Haier Group, LG Electronics, Morphy Richards, Panasonic Holdings Corporation, and Whirlpool Corporation.

b. Key factors driving growth in the global household kitchen appliances market include rising urbanization, increasing disposable incomes, and the growing demand for convenient and energy-efficient appliances. Additionally, technological advancements such as smart and connected appliances, the rising influence of modern lifestyles, and increasing awareness of sustainable and eco-friendly products are propelling market expansion worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.