- Home

- »

- Pharmaceuticals

- »

-

Human Growth Hormone Market Size & Share Report, 2030GVR Report cover

![Human Growth Hormone Market Size, Share & Trends Report]()

Human Growth Hormone Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Application (Growth Hormone Deficiency, Turner Syndrome), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-057-6

- Number of Report Pages: 129

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Human Growth Hormone Market Summary

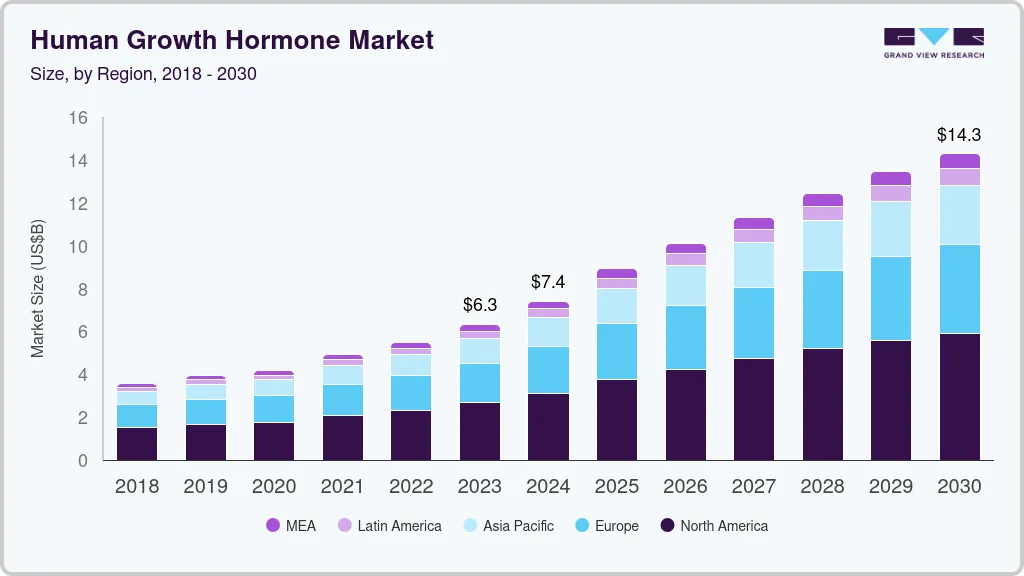

The global human growth hormone market size was estimated at USD 6,321.8 million in 2023 and is projected to reach USD 14,279.5 million by 2030, growing at a CAGR of 12.3% from 2024 to 2030. The market is experiencing expansion due to factors such as the growing awareness of growth hormones and its increased utilization for the treatment of hormonal imbalance disorders.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- Country-wise, Sweden is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, growth hormone deficiency accounted for a revenue of USD 3,093.3 million in 2023.

- Growth Hormone Deficiency is the most lucrative application segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 6,321.8 Million

- 2030 Projected Market Size: USD 14,279.5 Million

- CAGR (2024-2030): 12.3%

- North America: Largest market in 2023

Moreover, leading pharmaceutical and biopharmaceutical companies are undertaking significant R&D efforts to bring novel hormone therapies to the market. These therapies aim to provide long-term action and enhanced safety profiles, further driving the development of the market on a global scale.

The increasing incidence of growth hormone deficiencies resulting from congenital conditions, genetic disorders, brain injuries, and specific medical therapies has led to a higher demand for hormone treatments. According to the NCBI, pediatric growth hormone deficiency are diagnosed in approximately 1 in each 3,500-4,000 children in the UK. Additionally, the growth hormone industry is experiencing an increase due to ongoing research and development activities in this field. For example, in February 2022, OPKO and Pfizer obtained marketing approval from the European Union for its Once-Weekly NGENLA (somatrogon) Injection, which is used in the treatment of pediatric growth hormone deficiency.

Furthermore, the early detection of endocrine illnesses including Hashimoto thyroiditis, Graves' disease, Cushing's disease, Addison's disease, hyperthyroidism/hypothyroidism, and prolactinoma among others, plays a crucial role in improving treatment outcomes and preventing severe complications.

The expansion of human growth hormone market is expected to be influenced by the COVID-19 pandemic. According to a Frontiers article, individuals with low production of growth hormone are considered at risk for COVID-19, emphasizing the importance of preventive measures in this population. Individuals with Turner syndrome and Prader-Willi disorder are advised to take extra precautions due to their heightened susceptibility to severe illness caused by the COVID-19 virus. Growth hormone deficiency happens as the pituitary gland fails to produce an adequate amount of growth hormone. Such a hormone deficiency is usually managed through subcutaneous injections of human growth hormone. Genetic conditions such as Turner syndrome and Prader-Willi condition can also lead to deficiency, which has resulted in delayed puberty and shorter stature compared to the general population.

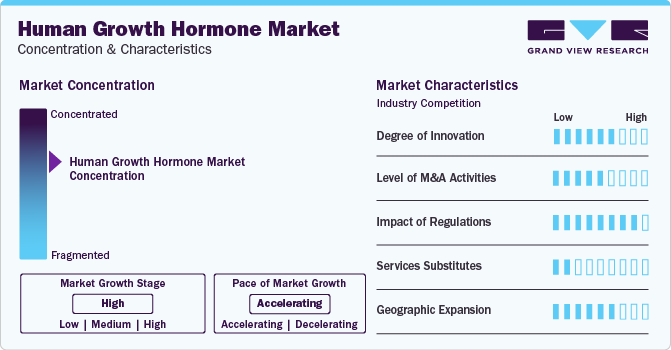

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating. Industry is characterized by a high degree of innovation. This can be attributed to high R&D investment and methodologies for transforming treatment practices. The space witnesses a notable M&A activities by the leading players. Industry participants are focusing their investments on the delivery and monitoring aspects of human growth hormone therapy to enhance effectiveness and scalability for future advancements. For instance, in October 2022, Merck KGaA partnered with Biocorp to develop and supply a customized version of the Mallya device for monitoring the treatment of HGH disorders.

The space is subject to increasing regulatory scrutiny. To launch products in the U.S. market, the company must submit a Biologic License Application (BLA) under section 351(a) under U.S. Public Health Service Act (PHSA). Medicare benefits are categorized into; Medicare Part A: Hospital Insurance, Medicare Part B, Medical Insurance. Medicare Part A and Part B pay for injectable drugs to treat HGH. Patients had to pay 20.0% of the Medicare approved cost of the drug and the Part B deductible applies under the reimbursement policy. A patient does not have to pay for the visit of a home health nurse to inject the drug. HGH treatment & associated medical services are eligible for reimbursement. However, prescriptions require for reimbursement with Health Savings Account (HSA), Health Reimbursement Arrangement (HRA), or a Flexible Spending Account (FSA).

Moreover, the industry is witnessing growing number of geographical expansion strategies, for instance, in January 2022, Ascendis Pharma A/S received approval from the European Commission for its product TransCon hGH. TransCon hGH is indicated for the treatment of paediatric patients diagnosed with growth hormone deficiency. It contains somatropin, a synthetic form of human growth hormone. The approval from the European Commission signifies that TransCon hGH has met the necessary regulatory requirements and can be marketed and used for the intended indication in the European Union.

Product Insights

Based on product, market is divided into long acting, and others. In 2023, the others segment accounted for the largest market share, representing 95.5% of the market size. This segment is projected to maintain a steady progress rate throughout the forecast period. Other segments within the market include short-acting and intermediate-acting growth hormones.

The segment is anticipated to witness significant traction over the forecast period owing to increase in incidence of insufficiency coupled with presence of various products, such as Genotropin (Pfizer Inc.), Humatrope (Eli Lilly & Co.), Saizen (Merck & Co. Inc.), and Norditropin (Novo Nordisk A/S), among others.In addition, the recent product launches and high adoption of short acting preparations owing to their less incidence of side effects is another factor contributing segment expansion.

Long-acting segment is expected to register a fastest growth rate throughout the forecast period. Advantages such as reduced frequency of administration, improved patient compliance, and convenience are augmenting segment uptake. Similarly, the robust investigational pipeline and recent product launches is fueling segment demand. For instance, In January 2022, Ascend is Pharma A/S announced the EC approval for marketing authorization of SKYTROFA for the treatment of children and adolescents ages 3 to 18 years with growth failure.

Application Insights

The growth hormone deficiency segment the human growth hormone market in 2023 and is anticipated to grow at the fastest rate during the forecast period. Increasing awareness about the importance of early diagnosis and treatment of hormone deficiency, along with the endeavors of biopharmaceutical companies to introduce innovative therapies, are driving the adoption of this segment. For instance, in May 2023, Novo Nordisk declared that the committee for Medicinal Products for Human Use of the European Medicines Agency has released a favorable statement recommending the use of once-weekly Sogroya (somapacitan). The recommendation is for the treatment of growth hormone deficiency in children aged three years and above, as well as adolescents with development failure. This positive development highlights the potential of Sogroya as a replacement therapy for endogenous growth hormone in these patient populations.

The high prevalence of Turner syndrome, increased research in the field of rare genetic conditions, and various initiatives by public and private organizations to raise awareness about the condition are key factors driving the significant market share of the Turner syndrome segment. Organizations such as the Turner Syndrome Foundation, Turner Syndrome Society of the United States, and Turner Syndrome Support Society are playing a crucial role in spreading awareness and promoting the diagnosis of Turner syndrome.

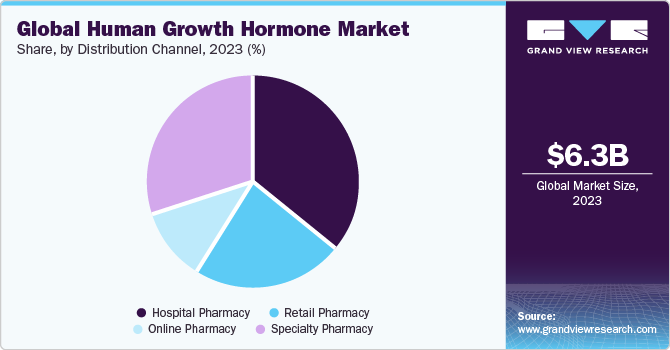

Distribution Channel Insights

The hospital pharmacy segment dominated the human growth hormone market with largest revenue share in 2023. The increasing prevalence of the disease, higher frequency of hospital visits, and favorable reimbursement policies are driving the adoption of this segment. Moreover, patients are showing a preference for recombinant and artificial human growth hormone (HGH), which is readily available in hospital pharmacies. These factors are contributing to the growth and application of this hospital pharmacy segment.

The online pharmacy segment is expected to experience rapid growth in the coming years. This increase can be attributed to the widespread presence of online pharmacies in lucrative regions such as Europe and North America, increased patient awareness, and the growing popularity of e-commerce and telehealth services. The online pharmacy segment benefits from factors such as flexibility, convenience, and attractive discounts on medicines, which further contribute to its rise in revenue.

Furthermore, the retail pharmacy segment held the second highest market share in terms of revenue, primarily due to the wide availability of major pharmacy chains such as Walgreens, Walmart, CVS Caremark, and others. These retail pharmacies play a significant role in providing access to a wide range of medications and healthcare products to consumers, contributing to the segment's revenue.

Regional Insights

North America led the overall human growth hormone market with a revenue share of 42.27% in 2023 due to growing healthcare awareness among people, significant government initiatives, and favorable reimbursement policies in the region. Increasing R&D activities in the region, adequate research funding and presence of organizations that facilitate awareness and treatment rates in the region is anticipated to support region expansion. Furthermore, the extensive presence of leading participants such as Pfizer Inc, Lilly and others is responsible for the lucrative revenue share of the region.

Europe holds the second-largest market share, primarily driven by factors such as the increasing burden of growth hormone deficiencies, the availability of artificial growth hormones, and extensive research and development activities in the region. The prevalence of growth hormone deficiency is on the rise in Europe due to factors such as stress, inadequate sleep, and low glucose levels among individuals. For instance, in 2023, the European Medicines Agency reported that growth hormone deficiency impacted around 4.7 out of 10,000 people in the European Union. Additionally, the Germany holds the largest market share in Europe, while the France is experiencing the fastest expansion in the region.

Asia Pacific is anticipated to have a lucrative growth rate during the forecast period, driven by factors such as the high disease burden of rare genetic conditions, unmet medical needs, and the increasing demand for innovative therapeutics. Furthermore, the region benefits from the rising investments made by leading market participants, attracted by the flourishing pharmaceutical sector in APAC, which is anticipated to support the expansion of the region in the market.

Key Companies & Market Share Insights

Some of the key players operating in the industry are Pfizer Inc., Novartis AG, Merck & Co., Inc. The leading players in space are focusing on growth strategies, such as product launches, and R&D investments. Furthermore, emerging players such as OPKO Health, Inc are employing strategies such as mergers & acquisitions to expand their footprint and grow at a fast pace

Key Human Growth Hormone Companies:

- Novo Nordisk A/S

- Eli Lilly and Company

- Pfizer, Inc

- Sandoz International GmbH (Novartis AG)

- Genentech, Inc. (Roche)

- Merck KGaA

- Ferring Pharmaceuticals

- Ipsen

- Teva Pharmaceutical Industries, Ltd.

Recent Developments

-

In August 2023, FDA approved Opko Health, Inc. and Pfizer’s once-weekly somatrogon for children with growth hormone deficiency, key players are strategically advancing their presence in the market. The long-acting injectable, Somatrogon-ghla (Ngenla), demonstrates noninferiority to somatropin in improving annual height velocity based on phase 3 trial data. With a similar safety profile to somatropin, this approval reinforces Opko Health and Pfizer's commitment to addressing growth failure in children through innovative therapeutic solutions.

-

In May 2023, Novo Nordisk advanced in the human growth hormone therapy market with a favorable statement from the European Medicines Agency, recommending once-weekly Sogroya for children aged three and above, addressing growth hormone deficiency and development failure in adolescents. This positions Sogroya as a promising replacement therapy, signaling a noteworthy stride in Novo Nordisk's strategic foothold.

Human Growth Hormone Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.41 billion

Revenue forecast in 2030

USD 14.28 billion

Growth rate

CAGR of 12.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Sweden; Norway; Denmark; Russia; China; Japan; India; Australia; South Korea;Singapore; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Novo Nordisk A/S; Pfizer, Inc; Eli Lilly and Company; Sandoz International GmbH (Novartis AG); Merck KGaA; Genentech, Inc (Roche); Ferring Pharmaceuticals; Teva Pharmaceutical Industries, Ltd; Ipsen.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Human Growth Hormone Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented global human growth hormone market report on the basis of product, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Long Acting

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Growth Hormone (GH) Deficiency

-

Adult GH Deficiency

-

Pediatric GH Deficiency

-

Turner Syndrome

-

Idiopathic Short Stature

-

Prader-Willi Syndrome

-

Small For Gestational Age

-

Other

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Online Pharmacy

-

Specialty Pharmacy

-

-

Regional Outlook (Revenue, USD Million, 2018- 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

Russia

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Singapore

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global human growth hormone market size was estimated at USD 5.47 billion in 2022 and is expected to reach USD 6.32 billion in 2023.

b. The global human growth hormone market is expected to witness a compound annual growth rate of 12.3% from 2023 to 2030 to reach USD 14.28 billion by 2030.

b. North America dominated the global human growth hormone market with a share of 42.27% in 2022. This is attributable to factors such as favorable reimbursement scenario, established healthcare infrastructure, significant government initiatives, and growing healthcare awareness.

b. Some of the key players operating in the human growth hormone market include Novo Nordisk A/S; Pfizer, Inc; Eli Lilly and Company; Sandoz International GmbH (Novartis AG); Merck KGaA; Genentech, Inc (Roche); Ferring Pharmaceuticals; Teva Pharmaceutical Industries, Ltd; and Ipsen.

b. Key factors that are driving the human growth hormone market growth include increasing R&D activities, a robust product pipeline, and initiatives taken by various government and private organizations to spread awareness about GH deficiencies and its treatment.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.