- Home

- »

- Biotechnology

- »

-

Human Organoids Market Size, Share, Industry Report, 2030GVR Report cover

![Human Organoids Market Size, Share & Trends Report]()

Human Organoids Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Media & Supplements, Reagents, Organoid Models), By Sources, By Organ Type, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-540-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Human Organoids Market Summary

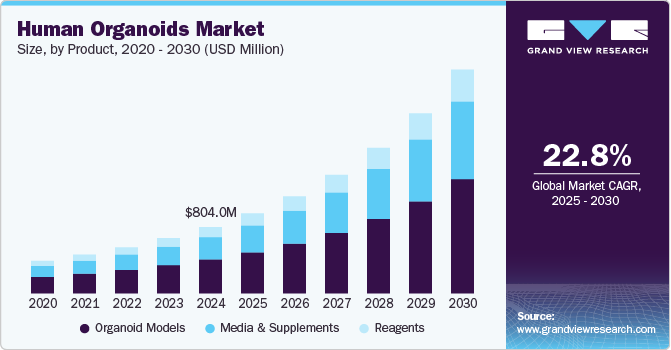

The global human organoids market size was estimated at USD 804.0 million in 2024 and is projected to reach USD 2,715.6 million by 2030, growing at a CAGR of 22.8% from 2025 to 2030. The advancement of human organoids is driven by biological principles, cutting-edge technologies, and market-driven applications.

Key Market Trends & Insights

- North America human organoids market held the market share of 49.33% in 2024.

- The U.S. human organoids market is growing rapidly due to strong biotech investments, advanced R&D infrastructure, and increasing drug discovery.

- By product, in 2024, the organoid models segment dominated the human organoids market with a 51.21%.

- By organ type, in 2024, the liver segment dominated the human organoids market with a revenue share of 23.34%.

- By source, in 2024, the adult stem cells segment led the human organoids market, holding a 42.72% share.

Market Size & Forecast

- 2024 Market Size: USD 804.0 Million

- 2030 Projected Market Size: USD 2,715.6 Million

- CAGR (2025-2030): 22.8%

- North America: Largest market in 2024

Organoids are transforming disease modeling, drug discovery, and regenerative medicine, offering cost-effective and high-fidelity alternatives to traditional research methods. With growing investment in personalized medicine and biotechnology, organoid-based platforms are poised to disrupt healthcare, accelerating drug development, reducing reliance on animal models, and paving the way for next-generation therapeutic solutions. Their commercial potential is vast and rapidly expanding.

The growing demand for stem cells is accelerating the expansion of the human organoids market. As advancements in stem cell research drive innovation, organoids are emerging as a cutting-edge solution for drug discovery, disease modeling, and personalized medicine. Their ability to replicate human tissue with high precision is attracting substantial investment from biotech and pharmaceutical companies. Additionally, breakthroughs in regenerative medicine and genetic engineering, including CRISPR, are unlocking new commercial opportunities. With increasing applications in healthcare and life sciences, the organoid market is poised for significant growth, fueling innovation and strategic partnerships across the industry.

For instance, the article published in February 2025 in the ‘Developmental Cell’ journal, discusses the advancements in human organoid research, focusing on the combination of stem cell-derived and tissue-derived organoids. It highlights their drug discovery, disease modeling, and personalized medicine applications. The market for human organoids expanded due to increasing biomedical research and pharmaceutical interest. Key challenges included scalability, reproducibility, and ethical concerns. The integration of multi-organ systems was explored to enhance commercialization opportunities, propelling the demand for human organoids over the forecast period.

Furthermore, human organoids are revolutionizing drug discovery and toxicology testing by offering a more precise and predictive model than traditional cell cultures. Their ability to replicate human tissue structures enhances drug efficacy screening and toxicity assessments, reducing reliance on animal testing and costly late-stage failures. Pharmaceutical companies are increasingly leveraging organoid technology to accelerate preclinical research, optimize drug development pipelines, and improve regulatory success rates. As demand for safer and more effective treatments rises, organoid-based platforms are driving innovation, enhancing R&D efficiency, and positioning themselves as a strategic asset in the evolving biopharmaceutical landscape.

Advancing Disease Modeling: The Business Potential of Human Organoids

Human organoids have emerged as a transformative technology in disease modeling, offering a cutting-edge approach for pharmaceutical companies, biotech firms, and research institutions. These lab-grown, three-dimensional cellular structures replicate human organ functions, enabling advanced studies on infectious diseases caused by viruses, bacteria, and parasites. For instance, brain organoids derived from pluripotent stem cells (PSCs) have been instrumental in understanding neurotropic viruses like Zika and Japanese encephalitis. Similarly, liver and kidney organoids are used to study SARS-CoV-2 and hepatitis B, significantly accelerating antiviral drug discovery and personalized medicine. As pharmaceutical investments in organoid-based disease modeling grow, companies can leverage these innovations to reduce clinical trial failures and enhance drug efficacy, ultimately optimizing R&D expenditures.

Organoids Used For Infectious Disease Modeling

Type

Organoid

Cell Source

Pathogen

Virus

Brain

PSCs

Zika virus

Japanese encephalitis virus

Liver

PSCs

SARS-CoV-2

Hepatitis B virus

Intestine

PSCs

Human norovirus

Rotavirus

SARS-CoV-2

Kidney

ASCs

BK virus

SARS-CoV-2

Respiratory tract

PSCs

Respiratory syncytial virus

ASCs

Influenza virus

Enterovirus 71

SARS-CoV-2

Bacterium

Intestine

PSCs

Salmonella typhi

Stomach

PSCs

Clostridium difficile

Helicobacter pylori

Parasite

Respiratory tract

ASCs

Clostridium difficile

Liver

ASCs

Plasmodium

Intestine

PSCs

Cryptosporidium

Source: The Organoid Society

Note: PSCs: Pluripotent Stem Cells; ASCs: Adult Stem Cells; SARS-CoV-2: Severe Acute Respiratory Syndrome Coronavirus 2.

Beyond virology, organoid technology is reshaping bacterial and parasitic disease research, further strengthening its commercial value. Intestinal and stomach organoids have been developed to model bacterial infections such as Salmonella typhi and Helicobacter pylori, providing biotech firms with high-throughput platforms for antibiotic screening. Additionally, respiratory and liver organoids aid in studying parasitic pathogens like Plasmodium and Cryptosporidium, driving advancements in antiparasitic drug development. With increasing regulatory support and strategic industry collaborations, the organoid market is poised for substantial growth, positioning itself as a cornerstone in next-generation precision medicine.

As the demand for precision medicine and efficient drug development rises, human organoids are set to revolutionize disease modeling. Their ability to mimic human physiology offers a competitive edge in pharmaceutical R&D, reducing costs and accelerating drug discovery. With increasing investments and collaborations, the organoid market is poised for exponential growth, shaping the future of biomedical innovation.

AI and Personalized Medicine: The Future of Human Organoid Disease Modeling

The future of human organoid disease modeling is set to be revolutionized by AI-driven drug discovery. By integrating artificial intelligence and machine learning, organoid-based research will become more efficient, enabling faster drug screening, predictive modeling, and optimized treatment strategies. This technological advancement will significantly reduce R&D costs while improving drug efficacy, allowing pharmaceutical companies to streamline their development pipelines and bring innovative therapies to market faster. AI-powered organoids will not only enhance data accuracy but also help in identifying potential drug candidates with greater precision, reducing clinical trial failures and accelerating regulatory approvals.

In parallel, personalized medicine using patient-derived organoids is transforming precision therapeutics. By replicating individual patient biology, these organoids allow researchers to test drug responses in a controlled environment, minimizing adverse reactions and improving clinical outcomes. This approach is particularly valuable in oncology and rare disease research, where customized treatment strategies are critical. As regulatory frameworks evolve to accommodate these innovations, pharmaceutical and biotech firms will increasingly adopt organoid-based models, driving efficiency and profitability. The synergy between AI and personalized medicine will position organoids as a cornerstone of next-generation drug development and healthcare innovation.

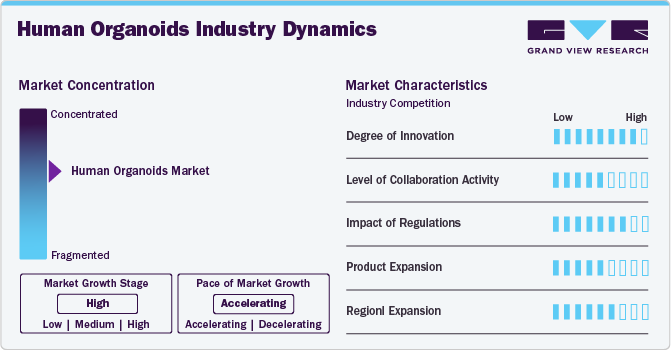

Market Concentration & Characteristics

The human organoids industry is set for exponential growth, driven by AI-powered drug discovery, personalized medicine, and advancements in bioprinting. As regulatory support increases, organoids will revolutionize disease modeling, accelerating drug development and enhancing precision therapeutics for pharmaceutical and biotech industries.

The human organoids market is growing steadily, with moderate collaboration among industry players. As research advancements and regulatory approvals increase, partnerships between biotech firms, pharmaceutical companies, and academic institutions will drive innovation, expanding organoid applications in drug discovery, personalized medicine, and disease modeling.

Regulations have highly influenced the human organoids market, shaping research, commercialization, and clinical applications. Stricter ethical guidelines and approval processes impact the adoption of organoid-based models while evolving regulatory frameworks are driving industry standardization, boosting investment confidence, and accelerating their integration into drug development and personalized medicine.

The human organoids industry has seen significant growth in product expansion, driven by advancements in stem cell technology, increasing adoption in drug discovery, and rising demand for personalized medicine. Enhanced bioprinting techniques and regulatory support further accelerate the development of innovative organoid-based solutions.

The human organoids industry is expanding strongly, driven by advancements in AI-driven drug discovery, increasing applications in personalized medicine, and growing investment in biotechnology. Strategic industry collaborations and regulatory support further accelerate innovation and commercialization in disease modeling and drug development.

Product Insights

In 2024, the organoid models segment dominated the human organoids market with a 51.21% share and is anticipated to grow at a significant CAGR over the forecast period. This growth is driven by increasing drug discovery, disease modeling, and regenerative medicine adoption. The ability of 3D models to closely mimic human tissue enhances research accuracy, reducing reliance on animal testing. Advancements in bioprinting and stem cell technology further support market expansion. Rising investments from biotech and pharmaceutical companies are also fueling demand, positioning Organoid Models as a key driver of innovation in the human organoids industry.

The media & supplements segment in the human organoids market is expected to grow at the highest CAGR from 2025 to 2030. This growth is driven by increasing demand for high-quality culture media, advancements in stem cell research, and rising adoption of organoid-based drug discovery. Expanding biotech investments and regulatory approvals further accelerate market expansion of the segment.

Organ Type Insights

In 2024, the liver segment dominated the human organoids market with a revenue share of 23.34%. The large share is driven by its critical role in drug metabolism and toxicity testing. The growing adoption of liver organoids in pharmaceutical R&D, regenerative medicine, and disease modeling has fueled market expansion. Advancements in stem cell technology and investment in liver disease research further support this growth.

The intestine segment in the human organoids market is expected to grow at the fastest CAGR from 2025 to 2030. This growth is driven by increasing research on gut-related diseases, rising demand for personalized medicine, and advancements in microbiome studies. Additionally, its drug testing and disease modeling applications further fuel market expansion.

Source Insights

In 2024, the adult stem cells segment led the human organoids market, holding a 42.72% share, driven by their widespread use in disease modeling, drug discovery, and regenerative medicine. Their ability to generate patient-specific organoids makes them highly valuable for personalized medicine and precision therapeutics. Increasing research in neurodegenerative and gastrointestinal diseases and advancements in 3D cell culture technology further fueled the segment’s adoption. Additionally, regulatory support and growing collaborations between biotech firms and research institutions contributed to the segment’s dominance, positioning adult stem cells as a key driver of innovation in the organoid industry.

The induced pluripotent stem cells (iPSCs) segment in the human organoids market is expected to grow at the highest CAGR from 2025 to 2030, driven by their ability to create patient-specific organoids for disease modeling and drug testing. Advancements in stem cell reprogramming, increasing applications in personalized medicine, and rising investments in regenerative therapies further fuel this growth, making iPSCs a key driver of innovation in the organoid industry.

Application Insights

In 2024, developmental biology dominated the human organoids market with a 30.16% share, driven by its critical role in understanding cellular processes, tissue engineering, and organoid development. Increasing research in stem cell biology, gene editing, and regenerative medicine further fueled its adoption. Advancements in bioconjugation techniques have enhanced molecular labeling and imaging, accelerating discoveries in developmental biology and biomedical applications.

The regenerative medicine segment in the human organoids market is expected to grow at the fastest CAGR from 2025 to 2030, driven by increasing demand for stem cell-based therapies, advancements in tissue engineering, and rising investment in personalized medicine. Organoids’ ability to mimic human tissues makes them valuable for cell therapy, disease modeling, and regenerative treatments, accelerating their adoption in medical research and clinical applications.

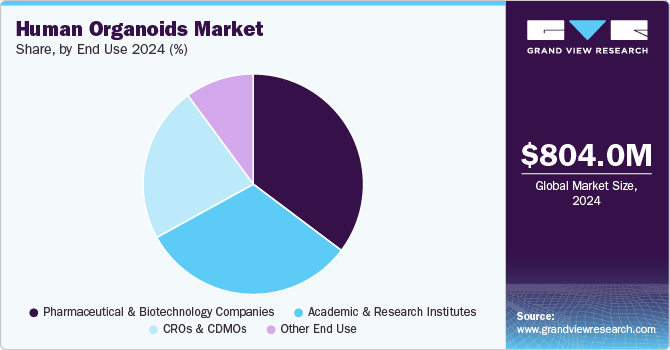

End Use Insights

In 2024, pharmaceutical & biotechnology companies held the largest market share of 35.24%, driven by the increasing adoption of organoid technology in drug discovery, preclinical testing, and personalized medicine. The need for more accurate disease models reduced reliance on animal testing, and advancements in regenerative medicine further fueled industry growth. Additionally, rising investments, strategic collaborations, and regulatory support have strengthened the role of organoids in accelerating drug development and improving treatment outcomes.

Meanwhile, the CROs & CMOs segment is expected to grow at a significant CAGR during the forecast period. The fast growth is driven by increasing outsourcing of drug development, rising demand for cost-effective research solutions, and the growing adoption of organoid-based models for preclinical testing. Expanding partnerships between pharmaceutical companies and CROs/CMOs, along with advancements in biomanufacturing and regenerative medicine, are further accelerating segment growth.

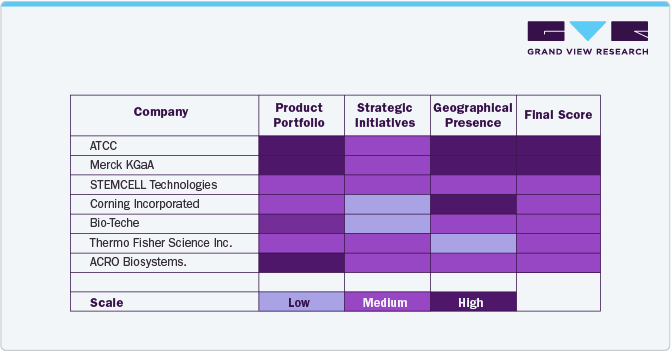

Competitive Scenario Insights

The human organoids market is witnessing increasing competition as key players focus on innovation, strategic collaborations, and technological advancements. Biotechnology and pharmaceutical companies invest heavily in organoid-based research to enhance drug discovery and disease modeling. Companies leverage AI-driven analytics, 3D bioprinting, and stem cell advancements to gain a competitive edge. Additionally, partnerships between research institutions and industry leaders are accelerating the commercialization of organoid technologies, fostering a dynamic and rapidly evolving market landscape.

Regulatory compliance and ethical considerations play a crucial role in shaping the competitive scenario. Companies that successfully navigate stringent approval processes and develop standardized, scalable organoid models will dominate the market. As the demand for precision medicine grows, firms investing in personalized organoid platforms will likely capture significant market share. The competition is further intensified by emerging startups introducing cost-effective, high-throughput organoid solutions, challenging established players. With continuous advancements and increasing regulatory support, the organoid market is poised for sustained growth, driving new opportunities across the biotech, pharma, and healthcare sectors.

The above analysis highlights the competitive landscape of the companies, with larger firms maintaining a more robust global footprint and strategic engagement. Companies like Merck KGaA, STEMCELL Technologies, and Thermo Fisher Scientific Inc. demonstrate strong positions across all three categories, suggesting a well-rounded market presence. Corning Incorporated and Bio-Techne show moderate strength, particularly in strategic initiatives and geographic reach. Meanwhile, ATCC and ACRO Biosystems appear to have relatively lower scores, indicating potential areas for growth.

Regional Insights

North America human organoids market held the market share of 49.33% in 2024, driven by strong investments in biotechnology, advanced healthcare infrastructure, and increasing adoption of organoid technology in drug discovery and personalized medicine. The presence of key industry players, extensive research collaborations, and supportive regulatory frameworks further fueled market growth. Additionally, rising demand for innovative disease models, particularly in oncology and neurology, has accelerated the adoption of organoid-based solutions. With continuous advancements in AI-driven analytics and bioprinting, North America is expected to maintain its global human organoids market leadership.

U.S. Human Organoids Market Trends

The U.S. human organoids market is growing rapidly due to strong biotech investments, advanced R&D infrastructure, and increasing drug discovery and personalized medicine adoption. Supportive regulatory policies, collaborations between industry and academia, and innovations in AI-driven disease modeling further drive market expansion.

Europe Human Organoids Market Trends

Europe is a key human organoids market, driven by strong government funding, advanced research facilities, and growing adoption in pharmaceutical R&D. Increasing collaborations between biotech firms and academic institutions, along with supportive regulatory frameworks, are accelerating innovation. The region’s focus on personalized medicine and ethical stem cell research further strengthens its position in the global organoid industry.

The UK human organoids industry is expanding due to increasing government and private sector investments in biotechnology, strong academic and industry collaborations, and a growing focus on personalized medicine. Advancements in stem cell research, supportive regulatory policies, and rising adoption of organoid technology in drug discovery further drive market growth.

Human organoids market in Germany is growing steadily, driven by strong government funding, advanced biomedical research, and a well-established pharmaceutical industry. The country’s focus on precision medicine, increasing collaborations between biotech firms and research institutions, and advancements in bioprinting and stem cell technology further accelerate market expansion.

Asia Pacific Human Organoids Market Trends

The Asia Pacific human organoids market is expected to grow the fastest at 23.89% CAGR from 2025 to 2030, driven by increasing investments in biotechnology, expanding pharmaceutical R&D, and rising demand for precision medicine. Countries like China, Japan, and South Korea are leading advancements in stem cell research, bioprinting, and AI-driven drug discovery. Government initiatives supporting biomedical innovation and growing collaborations between global and regional biotech firms further fuel market expansion. Additionally, the region’s large patient pool and increasing clinical applications of organoids contribute to rapid growth.

China human organoids market is growing rapidly due to strong government funding, biotech investments, and advancements in stem cell research. The country’s focus on precision medicine, AI-driven drug discovery, and 3D bioprinting, along with increasing industry collaborations, is driving innovation and accelerating organoid adoption in drug development and disease modeling.

Human organoids market in Japan is expanding due to strong government support, cutting-edge stem cell research, and advancements in regenerative medicine. The country’s leadership in biotechnology, increasing collaborations between academia and industry, and growing drug discovery and personalized medicine applications are driving market growth. With regulatory backing and innovation in 3D bioprinting, Japan is poised to be a key player in the global organoid industry.

Key Human Organoids Company Insights

Key players in the human organoids market are actively implementing strategic initiatives to enhance their market presence and expand product reach. Companies focus on expansion activities, research collaborations, and partnerships to drive innovation and commercialization. These efforts are crucial in strengthening their competitive position, accelerating product development, and increasing adoption across pharmaceutical and biotechnology sectors. By leveraging joint ventures, acquisitions, and technological advancements, industry leaders are propelling market growth and shaping the future of organoid-based research and therapeutics.

Key Human Organoids Companies:

The following are the leading companies in the human organoids market. These companies collectively hold the largest market share and dictate industry trends.

- ATCC

- Merck KGaA

- Bio-Techne.

- STEMCELL Technologies

- Corning Incorporated

- Thermo Fisher Scientific Inc.

- ACROBiosystems.

- PRIMACYT Cell Culture Technology GmbH

- AMSBIO

- Qkine Ltd.

Recent Developments

-

In December 2024, Merck signed a definitive agreement to acquire HUB Organoids Holding B.V. (HUB), a leading company in organoid technology. Organoids are advanced cell models that mimic real organs, helping to accelerate drug development, improve disease research across diverse populations, and reduce the need for animal testing. HUB is a recognized innovator in this field, and this acquisition strengthens Merck’s position in organoid-based research and therapeutics.

-

In March 2024, CHA Biotech signed a CDMO agreement with Cell in Cells, a regenerative medicine company specializing in cell therapies, to develop and manufacture organoid-based treatments for cartilage diseases. This partnership aims to advance regenerative medicine by leveraging organoid technology for innovative therapeutic solutions.

-

In August 2023, InSphero, a company specializing in robotics and intelligent automation, entered into a distribution agreement with Advanced BioMatrix, a provider of biomaterial solutions for cellular assays and regenerative medicine, to expand the use of 3D cell culture techniques beyond traditional suspension-based methods into scaffold-based models

Human Organoids Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 970.8 million

Revenue forecast in 2030

USD 2,715.6 million

Growth rate

CAGR of 22.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, organ type, source, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; and Kuwait

Key companies profiled

ATCC; Merck KGaA; STEMCELL Technologies; Corning Incorporated; Bio-Techne.; Thermo Fisher Scientific Inc.; ACROBiosystems; Qkine Ltd.; AMSBIO; PRIMACYT Cell Culture Technology GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Human Organoids Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global human organoids market report based on product, organ type, source, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Media & Supplements

-

Reagents

-

Organoid Models

-

-

Organ Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Stomach Models

-

Intestine Models

-

Liver Models

-

Pancreatic Models

-

Lung Models

-

Brain Models

-

Kidney Models

-

Other Products

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Adult Stem Cells

-

Induced Pluripotent Stem Cells

-

Embryonic Stem Cells

-

Other Sources

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Developmental Biology

-

Drug Toxicity & Efficacy Testing

-

Disease Pathology

-

Personalized Medicine

-

Regenerative Medicine

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

CROs & CDMOs

-

Academic & Research Institutes

-

Other End Use

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global human organoids market was valued at USD 804.0 million in 2024 and is expected to reach USD 970.8 million by 2025.

b. The global human organoids market is projected to grow at a compound annual growth rate (CAGR) of 22.84% from 2025 to 2030 to reach USD 2,715.6 million by 2030.

b. In 2024, developmental biology dominated the human organoids market with a 30.16% share, driven by its critical role in understanding cellular processes, tissue engineering, and organoid development.

b. Some of the key players in the market include ATCC; Merck KGaA; STEMCELL Technologies; Corning Incorporated; Bio-Techne.; Thermo Fisher Scientific Inc.; ACROBiosystems, Qkine Ltd., AMSBIO, PRIMACYT Cell Culture Technology GmbH

b. The advancement of human organoids is driven by biological principles, cutting-edge technologies, and market-driven applications. Organoids are transforming disease modeling, drug discovery, and regenerative medicine, offering cost-effective and high-fidelity alternatives to traditional research methods.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.