- Home

- »

- Biotechnology

- »

-

3D Cell Culture Market Size & Share, Industry Report, 2033GVR Report cover

![3D Cell Culture Market Size, Share & Trends Report]()

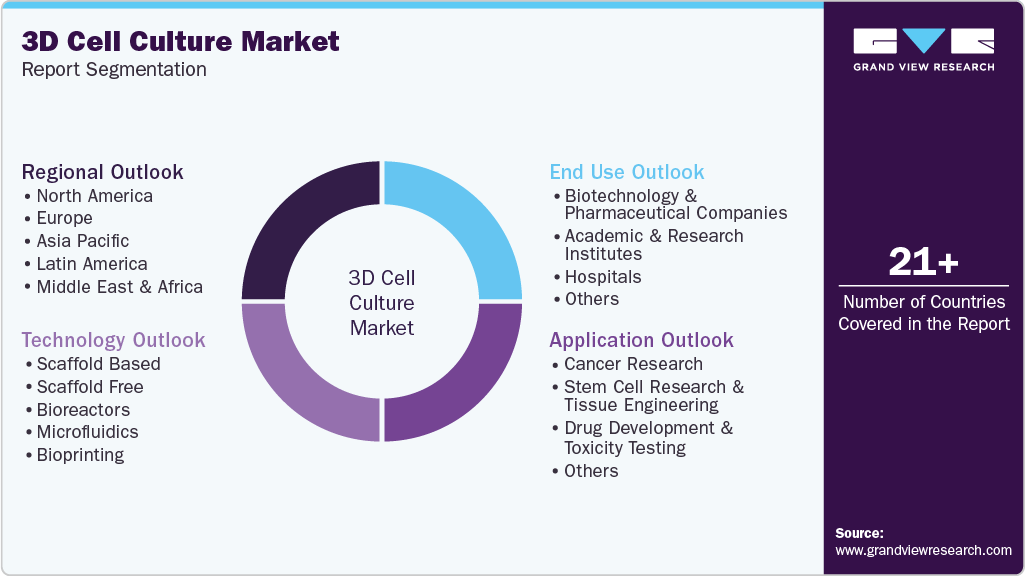

3D Cell Culture Market (2026 - 2033) Size, Share & Trends Analysis Report, By Technology (Scaffold Based, Scaffold Free, Bioreactors, Microfluidics), By Application (Cancer Research, Drug Development & Toxicity), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-091-0

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

3D Cell Culture Market Summary

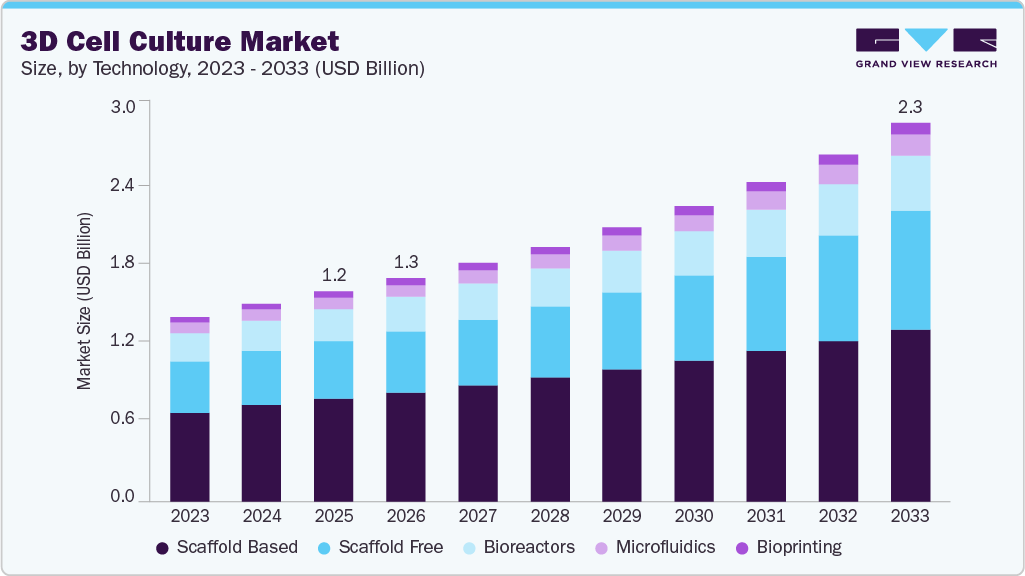

The global 3D cell culture market size was estimated at USD 1.26 billion in 2025 and is projected to reach USD 2.27 billion by 2033, growing at a CAGR of 7.84% from 2026 to 2033. The market's growth can be attributed to the rising efforts to develop potential alternatives to animal-based testing and the availability of funding programs for research.

Key Market Trends & Insights

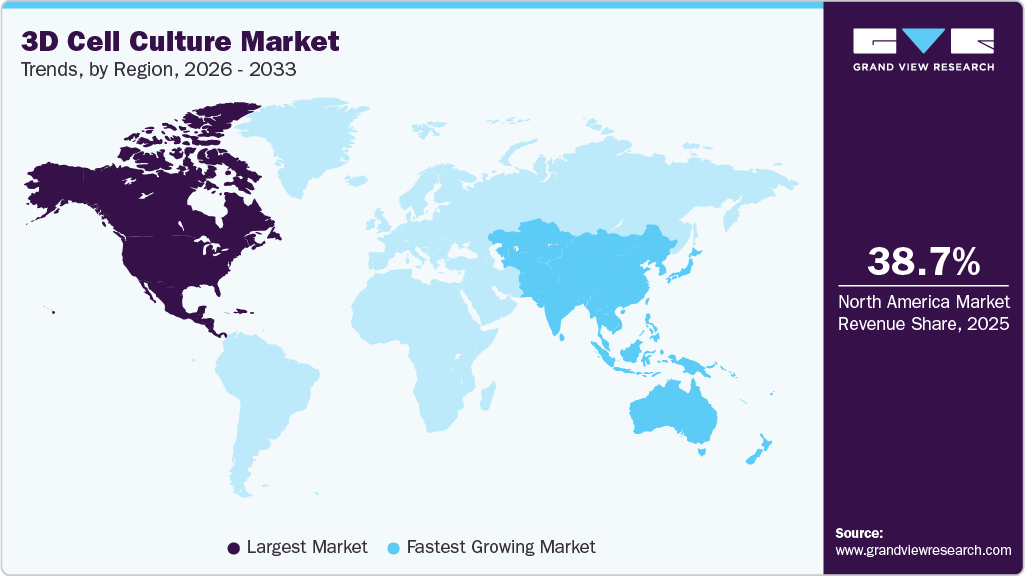

- The North America 3D cell cultureindustry held the largest share of 38.66% of the global market in 2025.

- The 3D cell culture industry in the U.S. is expected to grow significantly over the forecast period.

- Based on technology, the scaffold based segment held the largest market share of 48.91% in 2025.

- By application, the stem cell research & tissue engineering segment dominated the 2025 market share for the 3D cell culture industry.

- Based on end use, the academic & research institutes segment is anticipated to grow at the fastest CAGR over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 1.26 Billion

- 2033 Projected Market Size: USD 2.27 Billion

- CAGR (2026-2033): 7.84%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Moreover, other factors anticipated to fuel market growth over the projected period are consistent efforts in R&D activities by biopharmaceutical companies for drug development & discovery and emphasis on the adoption of 3D cell cultures in cancer research.

Animal models are largely used in cellular-based studies to study various diseases' outlook. However, they carry several demerits, such as a lack of response accuracy, differences in response from different species, etc. Thus, to manage these issues, various government organizations are involved in promoting alternative ways for drug development.

Shift Toward Reducing Animal Testing

The increasing emphasis on reducing animal testing is a significant driver accelerating the adoption of predictive in vitro 3D cell culture systems. Regulatory agencies, research organizations, and pharmaceutical companies are actively seeking alternative testing models that offer improved ethical compliance while maintaining scientific reliability. Compared to traditional animal models, 3D cell culture systems provide more physiologically relevant insights into human biology, enabling better prediction of drug safety and efficacy during early-stage development.

Advancements in 3D culture technologies, including organoids, spheroids, and organ-on-chip platforms, have strengthened their position as viable alternatives to animal testing. These models closely replicate human tissue architecture, cellular interactions, and biochemical gradients, allowing researchers to study disease mechanisms and therapeutic responses with greater accuracy. As a result, pharmaceutical and biotechnology companies are increasingly integrating 3D in vitro systems into preclinical workflows to improve translational outcomes and reduce development risks.

In addition, supportive regulatory frameworks and funding initiatives promoting the “3Rs” principles-replacement, reduction, and refinement of animal use-are reinforcing market adoption. Governments and regulatory bodies across key regions are encouraging the validation and standardization of advanced in vitro models. This shift is not only reducing ethical concerns but also lowering research costs and timelines, positioning 3D cell culture systems as essential tools in modern biomedical research and drug development.

Rising Investments in Stem Cell and Advanced Therapies

Growing investments in stem cell research, regenerative medicine, and cell & gene therapies are significantly driving demand for advanced 3D cell culture systems. Increasing prevalence of chronic and degenerative diseases has intensified the need for innovative therapeutic approaches, prompting governments and private organizations to allocate substantial funding toward stem cell-based research. Favorable regulatory frameworks and accelerated approval pathways are further encouraging the development and commercialization of cell and gene therapies, supporting wider adoption of physiologically relevant in vitro models.

In this environment, 3D cell culture technologies play a critical role in enabling accurate modeling of stem cell differentiation, tissue regeneration, and therapeutic response. Public funding programs, grants, and research incentives across major markets are strengthening academic and industry-led innovation. Combined with increasing participation from pharmaceutical and biotechnology companies, these investments are accelerating technology advancement, reducing development timelines, and reinforcing the role of 3D cell culture as a foundational tool in next-generation therapeutic research.

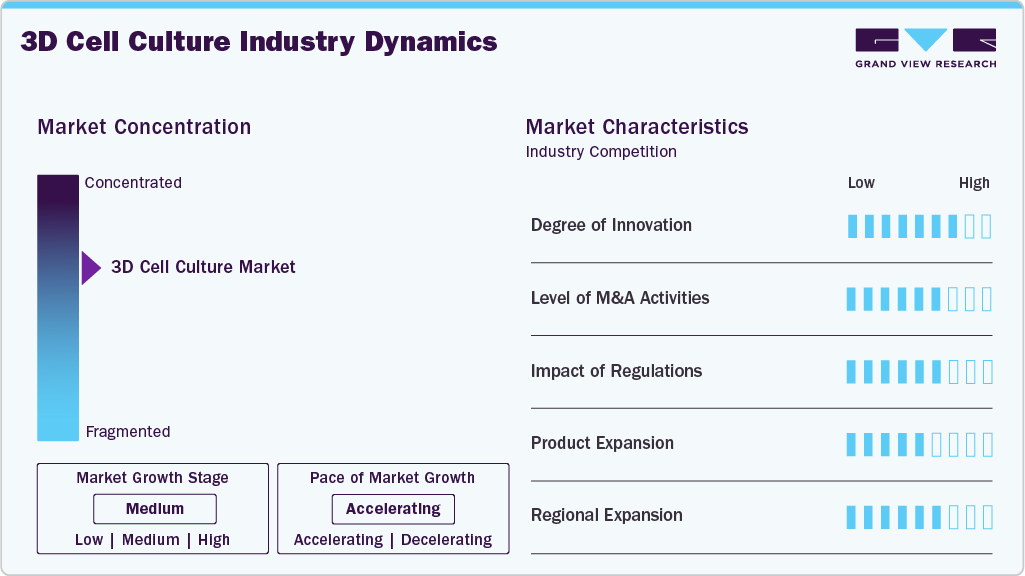

Market Concentration & Characteristics

Innovation intensity in the 3D cell culture industry remains high, driven by continuous advancements in scaffold materials, microfluidics, bioprinting, and organoid technologies. Strong R&D investments, increasing pharmaceutical demand for predictive in vitro models, and active collaboration between industry and academia further accelerate product development and technological differentiation.

The 3D cell culture industry has witnessed a strong increase in innovation, driven by rising demand for physiologically relevant in vitro models, advancements in scaffold and scaffold-free technologies, growing applications in oncology and regenerative medicine, and increased R&D investments by pharmaceutical companies and research institutions.

Regulatory frameworks in the 3D cell culture industry are evolving to support the validation and adoption of advanced in vitro models as alternatives to traditional animal testing, with increasing emphasis on standardization, data reliability, and translational relevance in drug discovery and safety assessment.

Product expansion in the 3D cell culture industry is expected to grow, driven by increasing demand for advanced and predictive in vitro models, continuous technological advancements in scaffolds, microfluidics, and bioprinting, rising pharmaceutical and biotechnology R&D activity, and expanding applications across oncology, stem cell research, and drug discovery.

Regional expansion in the 3D cell culture industry is being accelerated by growing pharmaceutical and biotechnology investments in emerging economies, improving research infrastructure, supportive government initiatives, and increasing adoption of advanced in vitro models across academic institutions and contract research organizations.

Technology Insights

The scaffold-based segment held the largest market share of 48.91% in 2025. This segment comprises hydrogels, polymeric scaffolds, micropatterned surface microplates, and nanofiber-based scaffolds. Growth is driven by increasing adoption of scaffold-based cultures in tissue engineering and regenerative medicine, advancements in scaffold materials and fabrication technologies, and rising research funding and collaborations. Hydrogels, widely used in 3D cell culture studies, enable the incorporation of biochemical and mechanical cues that closely mimic the native extracellular matrix. Furthermore, continuous technological progress, active research initiatives, and recent product launches are expected to support segment growth. For instance, in June 2022, Dolomite Bio introduced hydrogel-focused reagent kits for high-throughput cell encapsulation. In addition, ongoing research aimed at developing advanced scaffold-based technologies continues to strengthen overall 3D cell culture market expansion.

The scaffold-free segment is expected to register the fastest CAGR over the forecast period. Key growth drivers include enhanced cellular interactions, greater throughput and scalability, increasing demand for personalized medicine, and ongoing advancements in 3D culture platforms and technologies. In addition, strong adoption of scaffold-free systems by end users such as biopharmaceutical companies and research institutes further supports segment expansion.

Application Insights

Based on application, the market is segmented into cancer research, stem cell research & tissue engineering, drug development & toxicity testing, and others. The stem cell research & tissue engineering segment dominated the market with a share of 33.78% in 2025. Segment growth is primarily driven by rising demand for biopharmaceuticals, supported by the effectiveness of advanced therapies such as cell and gene therapies, along with increased innovation leading to higher product approvals. The U.S. FDA is expected to approve approximately 10-20 cell and gene therapy products annually by 2025, based on current clinical outcomes and pipeline strength. Furthermore, technological advancements, favorable government regulations, and growing funding for stem cell research have accelerated the adoption of 3D culture models. For example, the 2024 Stem Cell Therapies Grant Opportunity under the Medical Research Future Fund (MRFF) supports innovative stem cell research, offering total funding of up to USD 10 million, with project-level grants ranging from USD 200,000 to USD 1 million for durations of up to two years.

The cancer research segment is expected to register the fastest growth rate during the forecast period. Increasing cancer prevalence and the growing advantages of 3D culture models in oncology research are key growth drivers. In addition, the ability of 3D culture systems to influence cell proliferation and morphology, capture phenotypic heterogeneity, and offer experimental flexibility further supports segment expansion.

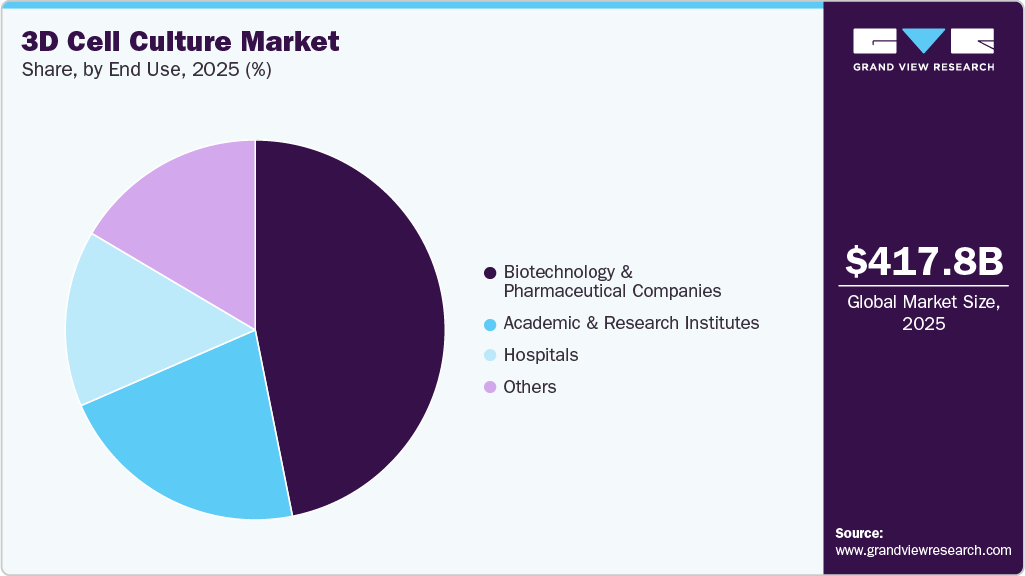

End Use Insights

Based on end use, the market is segmented into biotechnology & pharmaceutical companies, academic & research institutes, hospitals, and others. The biopharmaceutical & pharmaceutical companies segment dominated the market with a share of 46.86% in 2025. Sustained expansion and commercial success of biopharmaceuticals, along with utilization of extensive portfolios by leading pharmaceutical companies, have supported segment growth. The 3D model provides advantages such as improved oxygen and nutrient gradient formation and more realistic cellular interactions compared to two-dimensional culture systems for drug studies. These advantages encourage adoption in drug discovery and development, thereby driving market demand.

The academic & research institutes segment is expected to register the fastest CAGR during the forecast period. This growth is driven by advances in biomedical research, rising research intensity, increasing industry-academia collaborations, and focused efforts by research institutions in drug modeling and screening. For instance, in June 2024, the Indian Institute of Science (IISc) developed an innovative 3D hydrogel culture model to investigate tuberculosis infection and therapeutic approaches. This development enables enhanced understanding of host-pathogen interactions and drug effectiveness, supporting solutions to critical regional health challenges.

Regional Insights

North America 3D cell culture industry dominated the market and accounted for 38.66% share in 2025. The market is collectively driven by the presence of advanced healthcare infrastructure, developed economies, the presence of key players, and various strategic initiatives undertaken by them. In addition, a supportive regulatory framework, government support for the development of three-dimensional culture models, and a high number of research organizations and universities investigating different stem-cells based approaches are projected to support the regional market. For instance, in April 2023, the American Cancer Society (ACS) has announced the funding of more than USD 45 million for 90 novel Extramural Discovery Science (EDS) research at 67 institutes across U.S.

U.S. 3D Cell Culture Market Trends

The U.S. 3D cell culture industry held the largest share in 2025. Due to its strong pharmaceutical and biotechnology R&D activity, early adoption of advanced in vitro technologies, and substantial funding for cancer and stem cell research. Moreover, the presence of leading market players and well-established research infrastructure further supported market dominance.

Europe 3D Cell Culture Market Trends

Europe’s 3D cell culture industry is experiencing consistent growth, supported by rising adoption of physiologically relevant in vitro models across pharmaceutical and biotechnology research. Increasing emphasis on reducing animal testing, aligned with stringent regulatory expectations, is accelerating demand for advanced 3D systems. Strong academic-industry collaborations, expanding oncology and regenerative medicine research, and growing public funding across key countries further strengthen market momentum. In addition, technological advancements in organoids, microfluidics, and bioprinting are enhancing research efficiency, supporting broader commercialization and long-term market expansion across academic laboratories and contract research organizations regionwide ecosystem.

Germany 3D cell culture industry is one of Europe's 3D cell culture industry leaders, fueled by strong pharmaceutical and biotechnology research, robust public and private R&D funding, and advanced academic infrastructure. The presence of leading sciences companies and a focus on innovative drug discovery and regenerative medicine further support market leadership.

The UK 3D cell culture industry is expected to grow significantly during the forecast period. The various government and industry initiatives promoting advanced in vitro research, increased funding for life sciences innovation, and strong collaboration between academia and pharmaceutical companies.

Asia Pacific 3D Cell Culture Market Trends

Asia Pacific 3D cell culture industry is anticipated to witness the fastest 3D cell culture industry growth from 2026 to 2033, driven by rapid expansion of pharmaceutical and biotechnology sectors across China, India, Japan, and South Korea. Increasing R&D investments, rising clinical research activity, and growing adoption of advanced in vitro models for drug discovery and toxicity testing are key contributors. Government initiatives supporting life sciences innovation, improving research infrastructure, and favorable regulatory reforms further accelerate market adoption. In addition, expanding academic research, cost-effective manufacturing capabilities, and increasing participation of global players through partnerships and local facilities strengthen regional competitiveness, positioning Asia Pacific as a hub for 3D cell culture technologies over the forecast period.

The growth of the 3D cell culture industry in China is driven by expanding pharmaceutical and biotechnology R&D, rising government funding for life sciences, and rapid adoption of advanced in vitro models. Increasing focus on oncology research, regenerative medicine, and drug screening efficiency, along with improving laboratory infrastructure, continues to accelerate market expansion nationwide during the forecast period ahead.

Japan's 3D cell culture industry is projected to witness surging growth in the coming years owing to strong investments in regenerative medicine, advanced stem cell research, and precision drug discovery. Supportive government policies, robust academic infrastructure, and increasing adoption of physiologically relevant in vitro models by pharmaceutical companies further drive market expansion.

Latin America 3D Cell Culture Market Trends

The LATAM 3D cell culture industry is witnessing significant growth in the 3D cell culture market, driven by expanding pharmaceutical research, increasing clinical trial activity, and rising adoption of advanced in vitro models. Improving healthcare infrastructure, growing academic research, and supportive government initiatives are encouraging investments, while partnerships with global life sciences companies further accelerate technology adoption across key regional markets annually overall.

Brazil's 3D cell culture industry will see steady growth in the coming years due to improving research infrastructure, rising pharmaceutical and biotechnology investments, increasing academic research activity, and growing adoption of advanced in vitro models for drug discovery, toxicology testing.

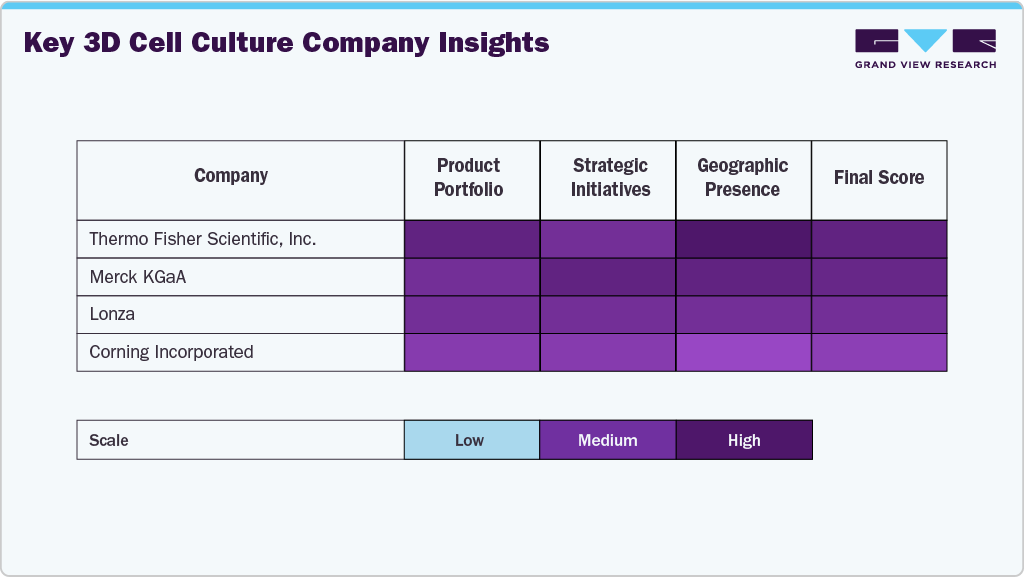

Key 3D Cell Culture Company Insights

The global 3D cell culture industry is moderately consolidated, with a mix of diversified life sciences conglomerates and specialized technology providers competing across consumables, instruments, and enabling platforms. Leading players leverage strong R&D capabilities, established distribution networks, and broad life sciences portfolios to maintain their competitive positions. Market leaders collectively account for a significant portion of global revenue, while a long tail of emerging companies and academic spin-offs continues to drive innovation, particularly in organoids, spheroids, and microphysiological systems.

Thermo Fisher Scientific, Merck KGaA, Corning Incorporated, Sartorius AG, and Lonza Group represent the core group of dominant players. Thermo Fisher and Merck benefit from comprehensive cell culture and reagents portfolios, allowing them to bundle 3D cell culture solutions with complementary laboratory consumables and analytical tools. Corning holds a strong position through its Life Sciences business, supported by proprietary surface technologies and 3D-optimized cultureware widely adopted in pharmaceutical and academic research. Sartorius and Lonza focus on advanced cell culture systems and cell-based technologies, with strengths in scalable platforms that bridge early research and translational applications.

Specialized companies such as REPROCELL, InSphero, MIMETAS, and Emulate have carved out differentiated niches by focusing on high-complexity 3D models, including organoids, spheroid systems, and organ-on-chip technologies. While these players hold comparatively smaller market shares, they exert outsized influence on innovation and pricing in premium research segments. Their solutions are increasingly adopted in oncological research, toxicology, and precision medicine, where physiologically relevant in vitro models are critical for improving drug discovery success rates.

From a market share perspective, consumables, including scaffolds, matrices, microplates, and reagents, account for the largest revenue contribution, driven by recurring demand and broad user adoption. Instrument-intensive segments such as bioreactors, microfluidics, and bioprinting represent a smaller but faster-growing share, supported by rising investments in complex disease modeling and advanced therapeutic development. Competitive strategies across the market emphasize product innovation, strategic collaborations with pharmaceutical companies and academic institutions, and targeted acquisitions to expand technology capabilities. As adoption of 3D cell culture accelerates across drug development and regenerative medicine, established players are expected to consolidate their positions, while specialized innovators continue to shape the next phase of market evolution.

Key 3D Cell Culture Companies:

The following are the leading companies in the 3D cell culture market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- PromoCell GmbH

- Lonza

- Corning Incorporated

- Avantor, Inc.

- Tecan Trading AG

- REPROCELL Inc.

- CN Bio Innovations Ltd

- Lena Biosciences

Recent Developments

-

In March 2025, PHC Corporation collaborated with Cyfuse Biomedical to develop a novel production technology for commercializing 3D cell products. The initiative focuses on real-time monitoring and improved manufacturing quality of 3D cell constructs, supporting advancements in regenerative medicine and 3D cell culture applications.

-

In September 2025, Advanced Biomed Inc. announced the launch of its A+PerfusC integrated perfusion 3D cell culture platform. The system is designed to support precision medicine and drug discovery by enabling advanced perfusion-based 3D cell culture applications.

-

In September 2025, TheWell Bioscience launched VitroGel Neuron, a synthetic hydrogel designed for superior 3D and 2D neuronal cell culture applications. The product supports advanced neuronal modeling by providing improved cellular growth and functionality, strengthening innovation within the 3D cell culture scaffold segment.

3D Cell Culture Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 1.34 billion

Revenue forecast in 2033

USD 2.27 billion

Growth rate

CAGR of 7.84% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico, Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; Merck KGaA, PromoCell GmbH; Lonza; Corning Incorporated; Avantor, Inc.; Tecan Trading AG; REPROCELL Inc.; CN Bio Innovations Ltd; and Lena Biosciences.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 3D Cell Culture Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global 3D cell culture market report based on technology, application, end use, and region:

-

Technology Outlook (Revenue, USD Billion, 2021 - 2033)

-

Scaffold Based

-

Hydrogels

-

Polymeric Scaffolds

-

Micropatterned Surface Microplates

-

Nanofiber Base Scaffolds

-

-

Scaffold Free

-

Hanging Drop Microplates

-

Spheroid Microplates with ULA Coating

-

Magnetic Levitation

-

-

Bioreactors

-

Microfluidics

-

Bioprinting

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cancer Research

-

Stem Cell Research & Tissue Engineering

-

Drug Development & Toxicity Testing

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Biotechnology and Pharmaceutical Companies

-

Academic & Research Institutes

-

Hospitals

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the 3D cell culture market growth include rising demand for organ transplantation & tissue engineering, technological advancements in scaffold-free technology, and a rise in investments and R&D funding for cell-based research.

b. Some key players operating in the 3D cell culture market include Thermo Fisher Scientific, Inc.; Merck KGaA, PromoCell GmbH; Lonza; Corning Incorporated; Avantor, Inc.; Tecan Trading AG; REPROCELL Inc.; CN Bio Innovations Ltd; Lena Biosciences.

b. The global 3D cell culture market size was estimated at USD 1.26 billion in 2025 and is expected to reach USD 1.34 billion by 2026.

b. The global 3D cell culture market is expected to grow at a compound annual growth rate of 7.84% from 2026 to 2033 to reach USD 2.27 billion by 2033.

b. Scaffold-based technology segment dominated the 3D cell culture market with a share of 48.91% in 2025. Factors such as increasing application of scaffold-based cultures in tissue engineering and regenerative medicine applications, advancements in scaffold materials and fabrication techniques, and increasing research funding and collaboration are anticipated to drive segment growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.