- Home

- »

- Organic Chemicals

- »

-

Hydrofluoric Acid Market Growth Analysis Report, 2030GVR Report cover

![Hydrofluoric Acid Market Size, Share & Trends Report]()

Hydrofluoric Acid Market (2022 - 2030) Size, Share & Trends Analysis Report By Grade (Anhydrous, Diluted), By Application (Fluorocarbon, Metal Pickling), By Region (North America, EU, APAC), And Segment Forecasts

- Report ID: GVR-4-68039-915-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hydrofluoric Acid Market Summary

The global hydrofluoric acid market size was valued at USD 1.04 billion in 2021 and is projected to reach USD 1.69 billion by 2030, growing at a CAGR of 5.6% from 2022 to 2030. The growth is attributed to the growing product utilization in several end-use applications, such as refrigerants, metal, fluorocarbon, aluminum, plastics, and oil refining among others.

Key Market Trends & Insights

- The Asia Pacific region dominated the global market with a revenue share of over 40.7% in 2021.

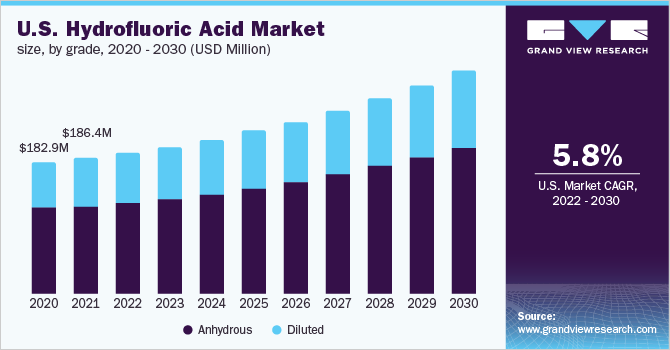

- By grade, the anhydrous grade segment dominated the market with a revenue share of more than 57.5% in 2021.

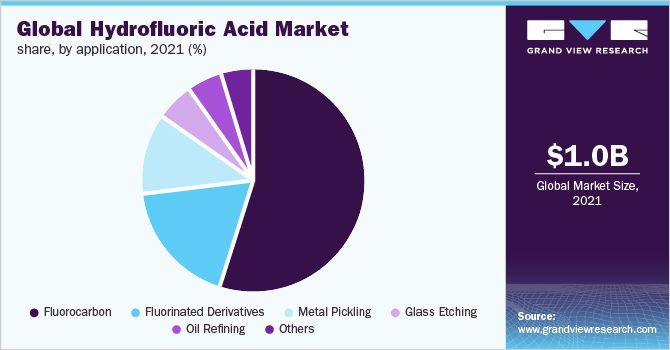

- By application, the fluorocarbon application segment dominated the market in 2021 and accounted for the largest share of more than 54.5% of the global revenue.

Market Size & Forecast

- 2021 Market Size: USD 1.04 Billion

- 2030 Projected Market Size: USD 1.69 Billion

- CAGR (2022-2030): 5.6%

- Asia Pacific: Largest market in 2021

Moreover, the growing demand for high-grade acids is likely to boost the product demand over the forecast period. Hydrofluoric acid is widely used in the chemical industry for the production of various fluorine components, such as fluorides, fluoropolymers, and fluorocarbon among others.

Hydrofluoro-olefins and hydrofluorcarbons are also used extensively in refrigerants worldwide due to their high-quality attributes. It is also used in manufacturing aluminum fluoride that has wide application in numerous aluminum products. The key raw materials used to manufacture hydrofluoric acid include fluorspar and sulphuric acid. Fluorspar is a source of fluorine that can be found naturally and artificially with the help of hydrothermal. It is widely used in the manufacturing process of uranium fuel, aluminum, steel, gasoline, refrigerants, and insulating foams among others.

The product is produced by heating purified fluorspar with concentrated sulfuric acid to make gas. It is then condensed by cooling and dissolving in water. Moreover, it is generally used in plastic containers since it is highly reactive to glass and moderately reactive to metals. It is sold in different packaging options, such as drums, IBCs, and jerrycans, according to the quantity and needs of the customer. These containers are built with the highest safety standards and offer tailored products.

Grade Insights

The anhydrous grade segment dominated the market with a revenue share of more than 57.5% in 2021. This is attributed to theincreased product inclusion in the formulation of surfactants, fluorochemicals, and fluoropolymers among others. It is used as a catalyst in petroleum alkylation. It is also used as a reagent in the acidolysis of the benzyl group in cysterine peptides. It improves production capabilities at lower temperatures, which, in turn, has a positive impact on the demand for anhydrous grade. Diluted or aqueous hydrofluoric acidis used in stainless steel pickling, metal coatings, glass etching, quartz purification, and exotic metal extraction.

It is also used to remove native silicon dioxide from wafers. It is commonly used in research due to its ability to etch silicon compounds. The product is highly corrosive to the skin and is toxic, which is creating a barrier to global market growth. The inhalation of a certain unit of anhydrous grade may cause severe respiratory issues. Thus, a specific range of acid up to 100 mg m3 is allowed for exposure to ensure the safety of the workers. Anhydrous hydrofluoric acid is gaining demand domestically as well in metal cleaners and wheel cleaners. This, in turn, is expected to trigger the segment growthover the forecast period.

Application Insights

The fluorocarbon application segment dominated the market in 2021 and accounted for the largest share of more than 54.5% of the global revenue. This is attributed to the rising demand for fluorocarbons from air conditioning systems and refrigerants, thus boosting production, especially in developing economies. The hydrofluoric acid demand in fluorocarbon is increasing as it is a non-chlorinated alternative to ozone-depleting chlorofluorocarbons. It is extensively used in the pickling of stainless steel and the semiconductor industry as a cleaning agent and an etchant.

It is used for various applications, such as in the purification of quartz, graphite, and ferrosilicon, ceramic production, metal pickling, glass etching, and cleaning chemical solutions among others. The product is also used in treatment metals by removing stains and layers from the surface and offers shine and finish to the surface of the material.It is extensively used to improve fuel efficiency during the alkylation process in the petrochemical industry. Hydrofluoric acid alkylation units are process units utilized in petroleum refining to convert alkenes and isobutane (primarily butylene or propylene) into alkylate, which is further utilized to make gasoline.

The product is also used as a raw material in the production of aluminum, and the growing demand for aluminum products from different industries worldwide is anticipated to boost the market growth in the coming years. Hydrofluoric acid is considered to be a highly corrosive and toxic substance in nature. Inhalation or direct contact with hydrofluoric acid can cause severe health impacts. These types of restraints can decrease the adoption of industrial-grade hydrofluoric acid, which can further hamper the product demand.

Regional Insights

The Asia Pacific region dominated the global market with a revenue share of over 40.7% in 2021. This is attributed to the presence of numerous manufacturers of fluorocarbons across the region. The industry is expected to be the fastest-growing market over the forecast period. The rising demand for metal and electronics & semiconductors in China is positively impacting the product demand in the country. Furthermore, the rising utilization in national defense, industrial, and civil production industries is expected to boost marketgrowth.

The market in Europe is likely to propel due to the increasing production of fluorochemicals across the region. The industry is growing across North America on the account of the increasing imports and the growing levels of R&D activities to make a better environmentally friendly product with the same performance. The manufacturing of hydrofluoric acid is significant in the Central & South America and the Middle East and Africa regions; however, the consumption level is comparatively lower than the other developed regions across the globe.

Key Companies & Market Share Insights

The competition in the market is highly dependent upon the product mix, the number of sellers, and geographical location. Key manufacturers are engaged in R&D activities to produce non-toxic products. Online distribution of products is growing rapidly compared to direct sales; however, direct sales still hold a larger market value due to easy access offered to customers. Key industry participants are focusing on mergers and acquisitions to increase their presence throughout the value chain. These players are simultaneously involved in several activities including the production and marketing of the final product to reduce the overall operational cost.Some prominent players in the global hydrofluoric acid market include:

-

Daikin

-

Dongyue Group

-

Sinochem

-

Yingpeng Chemical

-

Honeywell International Inc.

-

Stella Chemifa Corp.

-

Koura Global

-

Lanxess

-

Solvay

Hydrofluoric Acid Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 1.08 billion

Revenue forecast in 2030

USD 1.69 billion

Growth rate

CAGR of 5.6% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Grade, application, and region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Daikin; Dongyue Group; Sinochem; Yingpeng Chemical; Honeywell International Inc.; Stella Chemifa Corp.; Koura Global; Lanxess; Solvay

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global hydrofluoric acid market report on the basis of grade, application, and region:

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Anhydrous

-

Diluted

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Fluorocarbon

-

Fluorinated Derivatives

-

Metal Pickling

-

Glass Etching

-

Oil Refining

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The fluorocarbon application segment dominated the market with a revenue share of over 55.0% in 2021. This is attributed to the rising demand for fluorocarbons from air conditioning systems and refrigerants, thus boosting the production, especially in developing economies.

b. Some prominent players in the Hydrofluoric Acid market include Daikin, Dongyue Group, Sinochem, Yingpeng Chemical, Honeywell International Inc., Stella Chemifa Corporation, Koura Global, Lanxess, Solvay.

b. The hydrofluoric acid market is driven by its growing utilization in refrigerants, metal, fluorocarbon, aluminum, plastics, and oil refining. Moreover, the growing demand for high-grade acids is likely to boost the product demand over the forecast period.

b. Global hydrofluoric acid market size was valued at USD 1.04 billion in 2021 and is expected to reach USD 1.08 billion in 2022.

b. Global hydrofluoric acid market is forecasted to grow at a compound annual growth rate (CAGR) of 5.6% from 2022 to 2030 and reach USD 1.69 billion by 2030

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.