- Home

- »

- Advanced Interior Materials

- »

-

Hydrogen Storage Materials Market, Industry Report, 2033GVR Report cover

![Hydrogen Storage Materials Market Size, Share & Trends Report]()

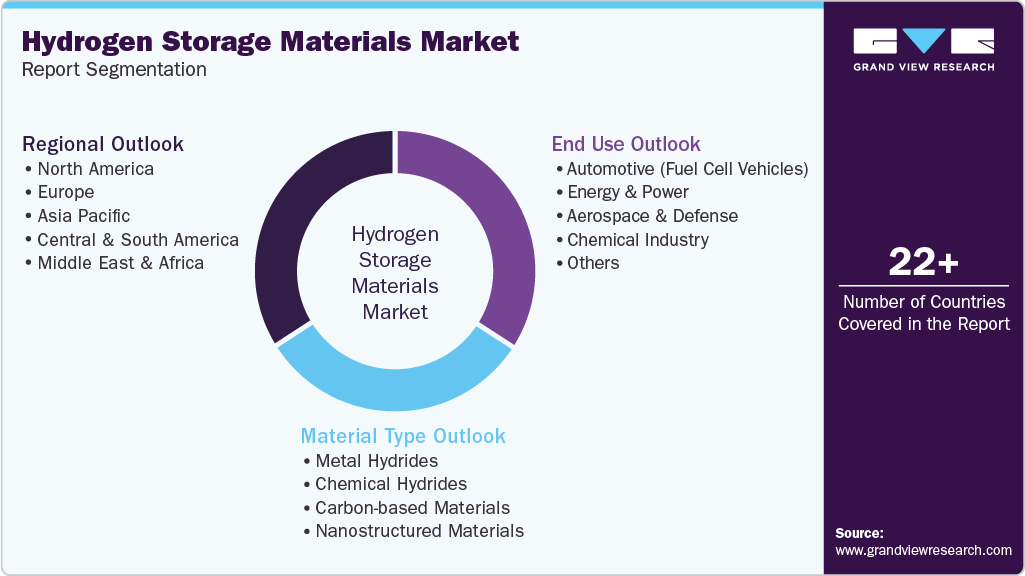

Hydrogen Storage Materials Market (2025 - 2033) Size, Share & Trends Analysis Report By Material Type (Metal Hydrides, Chemical Hydrides, Carbon-based Materials, Nanostructured Materials), By End Use (Automotive, Energy & Power), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-784-7

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hydrogen Storage Materials Market Summary

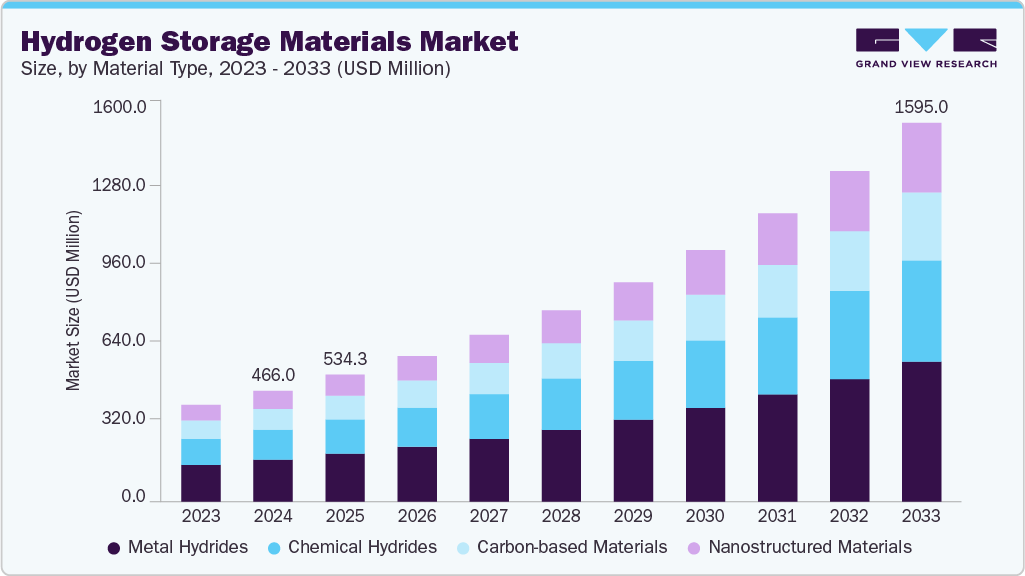

The global hydrogen storage materials market size was estimated at USD 466.0 million in 2024 and is projected to reach USD 1,595.0 million by 2033, growing at a CAGR of 14.7% from 2025 to 2033. The demand for hydrogen storage materials is increasing rapidly as the world transitions toward clean and renewable energy systems.

Key Market Trends & Insights

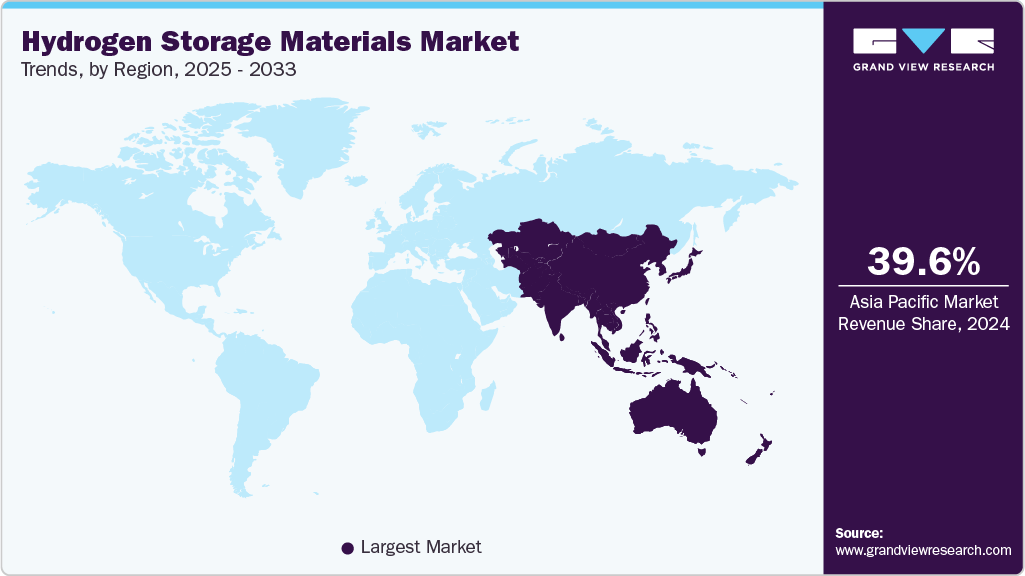

- Asia Pacific dominated the hydrogen storage materials market with the largest revenue share of 39.6% in 2024.

- By material type, the nanostructured materials segment is expected to grow at the fastest CAGR of 16.3% over the forecast period.

- By end use, the automotive (fuel cell vehicles) segment is expected to grow at the fastest CAGR of 15.3% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 466.0 Million

- 2033 Projected Market Size: USD 1,595.0 Million

- CAGR (2025-2033): 14.7%

- Asia Pacific: Largest market in 2024

Hydrogen is emerging as a critical energy carrier in decarbonization strategies across transportation, industrial, and power sectors. The rise in fuel cell electric vehicles (FCEVs) and the growing need for efficient and safe hydrogen storage systems are boosting market demand. In addition, global initiatives to replace fossil fuels with sustainable alternatives enhance the adoption of hydrogen-based technologies. The focus on achieving net-zero emissions by 2050 further propels investment in hydrogen infrastructure and storage innovations worldwide.Key drivers include technological advancements in solid-state, liquid, and chemical hydrogen storage methods, which improve efficiency and safety. The increasing deployment of hydrogen refueling stations and the expansion of green hydrogen production projects are fueling material requirements. Moreover, lightweight and high-capacity materials like metal hydrides, carbon nanotubes, and porous frameworks are becoming essential for storage optimization. Rising energy security concerns and a shift toward renewable energy integration in grid systems are additional growth accelerators. Collaboration between governments, energy firms, and automotive OEMs to build a hydrogen economy continues to strengthen material innovation and commercialization.

Recent innovations focus on high-density, lightweight materials such as metal-organic frameworks (MOFs), carbon nanostructures, and liquid organic hydrogen carriers (LOHCs). Research also emphasizes reversible hydrogen storage with faster kinetics and improved thermal management. Emerging trends include hybrid material systems combining chemical and physical storage, modular hydrogen tanks, and nanocomposite hydrides for improved storage efficiency. Industry players invest in scalable mobile and stationary fuel cell systems and storage materials. Furthermore, partnerships between energy companies and material developers are driving pilot-scale demonstrations to validate performance and cost efficiency in real-world environments.

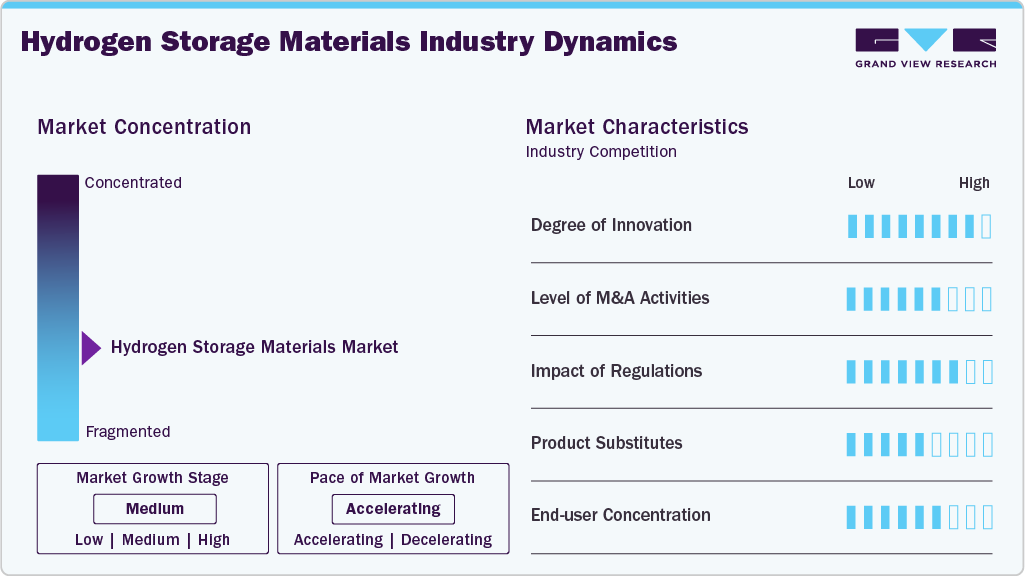

Market Concentration & Characteristics

The hydrogen storage materials industry is moderately fragmented, with a mix of established energy firms, advanced material producers, and research-driven startups. The sector’s competitive nature stems from varying technological capabilities, production costs, and patent portfolios. Continuous R&D investments and collaborations with automotive and energy OEMs are common strategies. However, high material costs and performance limitations still create space for innovation and new entrants, leading to a balanced but dynamic competitive landscape.

The threat of substitutes remains moderate, as hydrogen’s energy density and clean characteristics are difficult to match by alternatives. However, advancements in lithium-ion batteries, ammonia-based energy storage, and synthetic fuels could pose long-term competition. Electric mobility relying on battery technology presents a partial substitute in transportation applications. Nonetheless, hydrogen storage materials maintain a strong position for heavy-duty, long-range, and industrial uses. Hybrid storage systems integrating batteries and hydrogen technologies may reduce substitution risks and improve overall system performance in renewable energy grids and transport networks.

Material Type Insights

The metal hydrides segment held the highest revenue market share of 38.0% in 2024, due to their superior hydrogen absorption capacity, safety, and ability to operate under moderate temperatures and pressures. These materials store hydrogen in a solid form through reversible chemical reactions, making them ideal for stationary and mobile applications. Their stability, recyclability, and high volumetric density make them preferred over gaseous or liquid storage. Widely used alloys such as magnesium hydride, titanium hydride, and sodium alanate have proven effective for consistent performance. The strong focus on enhancing desorption kinetics and reducing material costs continues to strengthen the dominance of metal hydrides in the market.

The nanostructured materials segment is expected to grow at the fastest CAGR of 16.3% over the forecast period, driven by their exceptional surface area, tunable pore structures, and improved hydrogen adsorption properties. These materials, such as carbon nanotubes, graphene-based composites, and metal-organic frameworks (MOFs), enable lightweight, high-capacity, and reversible hydrogen storage. Their nanoscale engineering allows for enhanced diffusion and reduced activation energy, improving efficiency and performance. As R&D efforts focus on scalable synthesis methods and material stability, nanostructured materials are expected to be transformative in next-generation hydrogen storage systems for mobility and stationary energy applications.

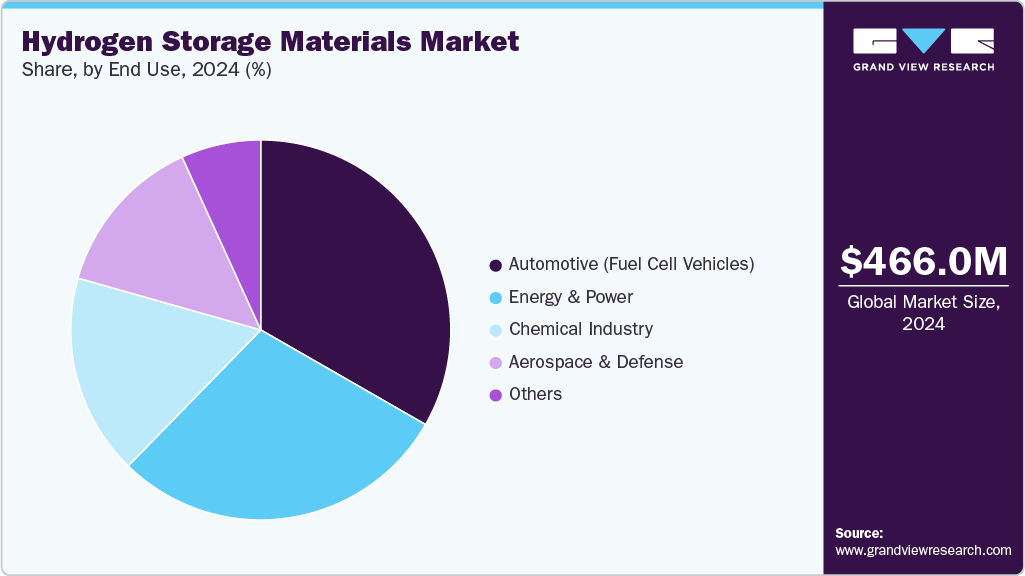

End Use Insights

The automotive (fuel cell vehicles) segment held the highest revenue market share of 33.3% in 2024, owing to the global shift toward zero-emission transportation. Automakers increasingly invest in hydrogen-powered mobility to meet stringent emission norms and sustainability targets. Hydrogen storage systems based on advanced materials are essential for ensuring high energy density, safety, and rapid refueling capability in FCEVs. Leading manufacturers like Toyota, Hyundai, and Honda actively deploy hydrogen-powered models supported by expanding refueling infrastructure. Integrating efficient storage materials has become critical to optimizing vehicle performance, making the automotive segment the largest consumer of hydrogen storage technologies.

The energy & power segment is expected to grow at a significant CAGR of 14.9% over the forecast period, driven by the need for large-scale renewable energy integration and grid stabilization. Hydrogen is an energy carrier that enables excess renewable power to be stored and converted into electricity during peak demand. Advanced storage materials such as metal hydrides and solid-state composites are increasingly used in stationary applications for backup power, microgrids, and energy storage plants. Governments and utilities are investing in hydrogen-based storage systems to enhance energy resilience and decarbonize electricity generation, positioning the sector as a major market growth driver.

Regional Insights

Asia Pacific dominated the global hydrogen storage materials market and accounted for the largest revenue share of 39.6% in 2024, due to rapid industrialization, strong government policies, and growing investments in hydrogen infrastructure. Japan, South Korea, and China are at the forefront of developing large-scale hydrogen refueling networks and integrating hydrogen into mobility and energy systems. The region’s strong focus on decarbonization and sustainable technologies creates a favorable environment for material innovation. Local manufacturers partner with global firms to develop cost-effective, high-density storage solutions. The emergence of renewable hydrogen projects in Australia and India further enhances regional market potential.

China Hydrogen Storage Materials Market Trends

The hydrogen storage materials market in China is aggressively expanding, with hydrogen production and storage capabilities to reduce carbon emissions and dependence on fossil fuels. The government’s strategic hydrogen plan supports infrastructure development and industrial use cases, particularly in fuel cell trucks and public transport. Chinese companies invest in solid-state and metal hydride technologies to enhance storage capacity and safety. In addition, collaborations with automotive giants are accelerating commercialization. The growing number of hydrogen refueling stations and domestic material R&D programs make China a critical hub for innovation in hydrogen storage materials.

North America Hydrogen Storage Materials Market Trends

The hydrogen storage materials market in North America is witnessing significant growth, led by strong policy support and R&D funding for hydrogen storage. The U.S. Department of Energy’s Hydrogen Shot initiative aims to reduce hydrogen costs and advance material technologies. Collaborations between national labs and private companies drive progress in lightweight, high-capacity storage materials. Increasing adoption in fuel cell vehicles, aerospace, and grid storage applications reinforces market expansion. Canada’s investments in hydrogen supply chains and partnerships with Europe also strengthen the region’s position in the global hydrogen economy.

The U.S. hydrogen storage materials market benefits from robust federal funding, private sector innovation, and academic research on hydrogen storage technologies. Companies like Plug Power and Ballard Power Systems are pioneering advanced materials and storage designs. Demand from the transportation and defense sectors is particularly strong, with initiatives targeting lightweight, safe, and compact storage systems. The rise of green hydrogen production facilities and renewable integration efforts further supports the market’s development trajectory. Strong policy backing ensures sustained growth in R&D and commercialization activities nationwide.

Europe Hydrogen Storage Materials Market Trends

The hydrogen storage materials market in Europe thrives under the EU’s Green Deal and Hydrogen Strategy. Countries such as Germany, France, and the Netherlands are investing heavily in hydrogen infrastructure and storage technologies. The focus is on achieving large-scale deployment through renewable energy integration and inter-country hydrogen pipelines. European manufacturers are leading research on high-performance materials, supported by government-funded projects and industrial collaborations. The region’s emphasis on circular economy principles and decarbonization aligns with the rising demand for advanced hydrogen storage solutions.

Germany hydrogen storage materials market is a central hub for hydrogen R&D, emphasizing innovation in solid and liquid hydrogen storage materials. The government’s National Hydrogen Strategy promotes domestic production and storage advancements. German firms and universities collaborate on scalable storage technologies for industrial and mobility applications. The growing adoption of hydrogen-powered vehicles and renewable hydrogen generation boosts material demand. With its strong engineering base and EU support, Germany continues to lead in driving efficiency and sustainability in the market.

Central & South America Hydrogen Storage Materials Market Trends

The hydrogen storage materials market in Central & South America is gradually entering the hydrogen storage materials space, with Chile and Brazil leading through green hydrogen initiatives. The region’s vast renewable energy resources are leveraged to develop hydrogen production and export capacities. Partnerships with European and Asian firms enable technology transfer for efficient hydrogen storage systems. Governments are focusing on policy frameworks to attract investments in hydrogen value chains. As projects mature, demand for storage materials is expected to rise sharply, particularly for export-oriented hydrogen operations.

Middle East & Africa Hydrogen Storage Materials Market Trends

The hydrogen storage materials market in the Middle East & Africa region is emerging as a promising player, leveraging its low-cost renewable energy potential for hydrogen production and storage development. Countries like Saudi Arabia and the UAE are investing in large-scale hydrogen projects under their energy diversification plans. Partnerships with European and Asian companies support the adoption of local storage technology. Africa’s interest in green hydrogen exports creates opportunities for advanced material applications. Growing focus on sustainable industrialization and clean fuel export potential drives steady market growth in the region.

Key Hydrogen Storage Materials Company Insights

Some key players operating in the market include Otto Chemie Pvt. Ltd. and Worthington Industries.

-

Otto Chemie Pvt. Ltd. develops and supplies advanced chemical materials suitable for hydrogen storage applications. The company focuses on high-purity metal hydrides, catalysts, and specialty materials that enhance hydrogen absorption and desorption efficiency. Otto Chemie contributes to India’s growing hydrogen value chain by serving research institutes and industrial clients. Its fine chemicals and material science expertise positions it as a niche supplier supporting R&D and pilot-scale hydrogen storage projects.

-

Worthington Industries is a leading manufacturer of high-pressure cylinders and bulk storage vessels for hydrogen applications. The company provides advanced steel and composite storage solutions to meet safety and performance standards across mobility, industrial, and energy sectors. Its hydrogen storage systems are used in refueling infrastructure and transport applications globally. Worthington enables large-scale hydrogen adoption and infrastructure deployment through continuous innovation in material strength and lightweight design.

Hexagon Composites ASA and GKN Hydrogen GmbH are some of the emerging market participants.

-

Hexagon Composites ASA is one of the global leaders in composite pressure vessel technology for hydrogen storage and transport. The company develops lightweight Type IV cylinders and modular systems for fuel cell vehicles, storage stations, and distribution networks. Its products offer superior energy density, safety, and durability, supporting hydrogen mobility and energy transition goals. With subsidiaries like Hexagon Purus, it is actively expanding into zero-emission mobility solutions, making it a central player in the global hydrogen storage materials ecosystem.

-

GKN Hydrogen GmbH specializes in solid-state hydrogen storage technology using advanced metal hydrides. Its innovative systems store hydrogen safely and efficiently in a solid form, offering high energy density and minimal leakage risk. GKN’s modular solutions are used in renewable energy storage, grid stabilization, and backup power applications. The company leverages decades of material engineering expertise to enhance the scalability and sustainability of hydrogen storage systems, positioning itself as a pioneer in next-generation solid-state hydrogen storage materials.

Key Hydrogen Storage Materials Companies:

The following are the leading companies in the hydrogen storage materials market. These companies collectively hold the largest market share and dictate industry trends.

- Otto Chemie Pvt. Ltd.

- NIPPON DENKO CO., LTD.

- Hexagon Composites ASA

- Worthington Industries

- Luxfer Holdings PLC

- Quantum Fuel Systems

- GKN Hydrogen GmbH

- Iwatani Corporation

- Steelhead Composites, Inc.

Hydrogen Storage Materials Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 534.3 million

Revenue forecast in 2033

USD 1,595.0 million

Growth rate

CAGR of 14.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material type, end use, region

Regional scope

North America; Europe; Aisa Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; China; Japan; India; South Korea; Saudi Arabia; UAE; Egypt; Kuwait; Qatar

Key companies profiled

Otto Chemie Pvt. Ltd.; NIPPON DENKO CO., LTD.; Hexagon Composites ASA; Worthington Industries; Luxfer Holdings PLC; Quantum Fuel Systems; GKN Hydrogen GmbH; Iwatani Corporation; Steelhead Composites, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hydrogen Storage Materials Market Report Segmentation

This report forecasts revenue growth at the regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global hydrogen storage materials market based on material type, end use, and region:

-

Material Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Metal Hydrides

-

Chemical Hydrides

-

Carbon-based Materials

-

Nanostructured Materials

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Automotive (Fuel Cell Vehicles)

-

Energy & Power

-

Aerospace & Defense

-

Chemical Industry

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

-

Saudi Arabia

-

UAE

-

Egypt

-

Qatar

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hydrogen storage materials market size was estimated at USD 466.0 million in 2024 and is expected to reach USD 534.3 million in 2025.

b. The global hydrogen storage materials market is expected to grow at a compound annual growth rate of 14.7% from 2025 to 2033 to reach USD 1,595.0 million by 2033.

b. The metal hydrides segment held the highest revenue market share of 38.0% in 2024, due to their superior hydrogen absorption capacity, safety, and ability to operate under moderate temperatures and pressures.

b. Some of the key players operating in the hydrogen storage materials market include Otto Chemie Pvt. Ltd., NIPPON DENKO CO., LTD., Hexagon Composites ASA, Worthington Industries, Luxfer Holdings PLC, Quantum Fuel Systems, GKN Hydrogen GmbH, Iwatani Corporation, and Steelhead Composites, Inc.

b. Rising adoption of fuel cell technologies, increasing demand for clean energy, and government support for hydrogen infrastructure are key factors driving the hydrogen storage materials market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.