- Home

- »

- Renewable Energy

- »

-

Hydropower Market Size And Share, Industry Report, 2030GVR Report cover

![Hydropower Market Size, Share & Trends Report]()

Hydropower Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Civil Construction, Electromechanical Equipment, Power Infrastructure), By Capacity (Mini, Small, Micro & Pico, Large & Medium), By Region, And Segment Forecasts

- Report ID: 978-1-68038-050-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hydropower Market Summary

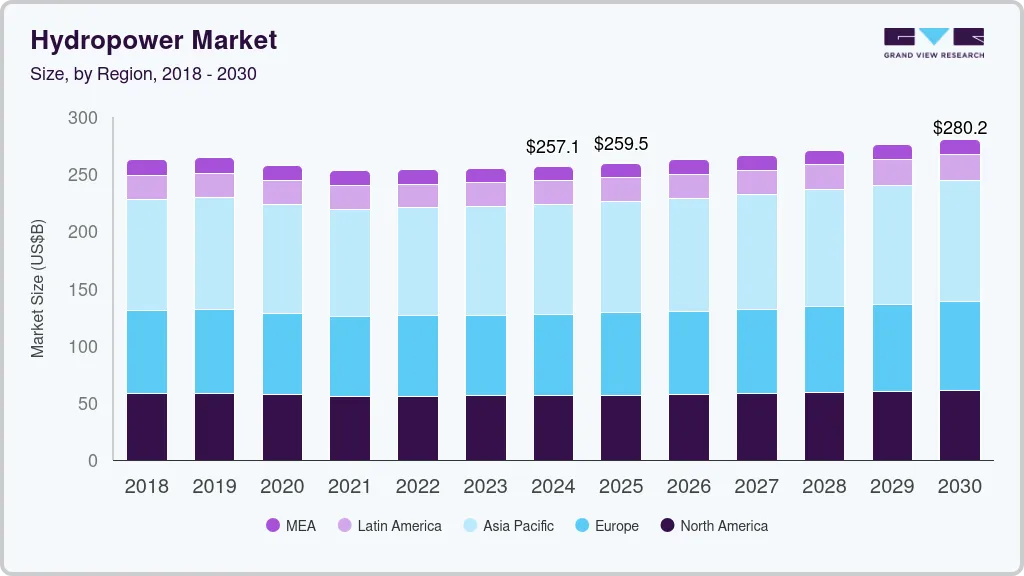

The global hydropower market size was estimated at USD 257.1 billion in 2024 and is projected to reach USD 280.20 billion by 2030, growing at a CAGR of 1.5% from 2025 to 2030. Depleting reserves of fossil fuels have prompted industry to shift to renewable sources.

Key Market Trends & Insights

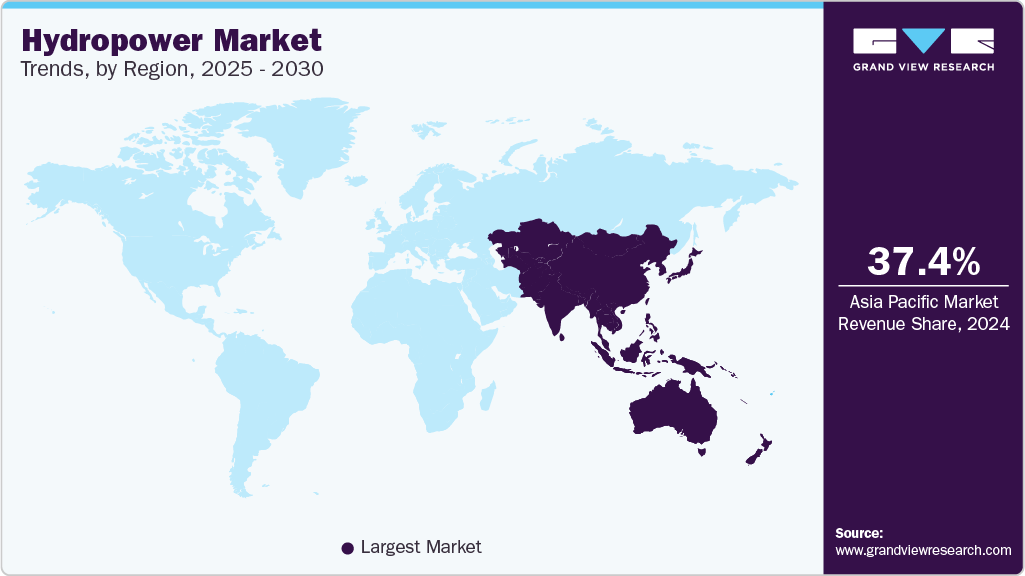

- Asia Pacific dominated the hydropower market and accounted for revenue share of 37.38% in 2024.

- The China hydropower market dominated the regional industry and accounted for a share of 42.72% in 2024.

- Based on components, the civil construction segment dominated the hydropower industry and accounted for a revenue share of 33.24% in 2024.

- By capacity, the large and medium capacity hydropower segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 257.1 Billion

- 2030 Projected Market Size:USD 280.20 Billion

- CAGR (2025-2030): 1.5%

- Asia Pacific: Largest market in 2024

The growing energy demand on account of the growing global population, coupled with the need to reduce reliance on conventional power generation, has been prompting the industry to use renewable power sources. One of the most popular renewable power generation technologies includes hydropower, which does not cause any greenhouse gas emissions or toxic waste.Depleting fossil fuels used in power generation, such as petroleum and coal, has presented an alarming need for a growing emphasis on energy solutions derived from renewable sources. Rising urbanization, increasing automation, technological advancements, and increasing dependability of critical infrastructures on energy supply, such as transport, water utility, healthcare, and others, have developed a growing demand for uninterrupted power supply. These aspects are expected to drive growth for the hydropower industry in the approaching years.

Concerns regarding climate change and the environmental footprint of multiple industries, including energy and power, are growing rapidly, as is the demand for energy solutions developed through renewable sources. Increasing awareness regarding the lasting impacts caused by processes and operations related to other forms of power generation and the scarcity of multiple resources has also contributed to the growing inclination towards renewable energy.

Governments are offering incentives, such as tax credits, grants, and feed-in tariffs, to encourage the development of new hydropower projects. For instance, in February 2024, the U.S. Department of Energy (DOE) selected 46 hydroelectric projects from 19 states to receive a Hydroelectric Efficiency Improvement Incentive up to USD 71.5 million. In 2023, the U.S. DOE announced a similar incentive for 66 facilities throughout the country.

Moreover, technological advancements in the hydropower industry, such as turbine design, materials, run-of-river systems, and construction techniques, have improved operational efficiency and reduced costs, making hydropower more competitive with other forms of energy.

Component Insights

Based on components, the civil construction segment dominated the hydropower industry and accounted for a revenue share of 33.24% in 2024. The demand for civil construction is driven by the need for robust infrastructure capable of withstanding natural forces and ensuring long-term operational stability. The physical structures essential for hydropower plants, such as dams, reservoirs, and tunnels, play a crucial role in the foundational stages of the projects. Small power projects contribute substantially to the total cost of the civil construction sector. Setting up the entire system requires specific arrangements to allow water to enter the turbines properly, ensuring optimal results.

The electromechanical equipment is expected to experience the fastest CAGR during the forecast period. Electromechanical equipment, including generators, turbines, and transformers, plays a crucial role in converting hydropower into usable electrical energy. As the demand for renewable energy sources rises owing to global environmental concerns and the push towards sustainability, the importance of this equipment has grown substantially.

Capacity Insights

The large and medium capacity hydropower segment accounted for the largest revenue share in 2024, driven by the continued demand for reliable and sustainable energy solutions. Large and medium hydropower plants, typically generating more than 10 MW of power, remain a critical component of national energy grids, providing a stable source of electricity for both urban and industrial needs. These plants are particularly well-suited to meet the increasing demand for renewable energy and support the transition away from fossil fuels.

The expansion of large and medium capacity hydropower is further supported by strong government policies that focus on reducing carbon emissions and advancing sustainable power generation. Additionally, significant investments in infrastructure and technology are enhancing the efficiency and scalability of these projects, making them more viable even in challenging geographical locations.

The micro & pico segment is anticipated to witness the fastest CAGR during the forecast period. These hydropower projects are developed for smaller power generation requirements, specifically for smaller communities and areas. The micro & pico capacity hydropower projects include lesser civil construction, smaller equipment, minor installations, and fewer other components.

Regional Insights

The North America hydropower market is expected to experience of CAGR 1.3% during the forecast period. The growth is driven by increasing demand for renewable energy, the presence of established large hydropower infrastructure in the U.S. and Canada, rising climate concerns, and growing focus on developing enhanced energy generation solutions based on renewable resources. The governments in the region are supporting the hydropower industry to meet goals related to reduced carbon footprint and minimized dependency on the availability of depleting fossil fuels.

U.S. Hydropower Market Trends

The U.S. dominated the regional hydropower market in 2024. High investment in renewable and cleaner energy is one of the primary factors in the growth of the U.S. hydropower market. Growing technology advancements and government initiatives to promote the adoption of renewable energy sources such as hydropower have also contributed to the growth of this market in recent years. Rising investment to achieve net zero and cleaner energy sources is anticipated to increase demand for the hydropower industry in the next few years. For instance, in December 2023, at the United Nations Climate Change Conference, Vice President Kamala Harris announced that the U.S. has joined more than 115 other countries in the commitment to doubling energy efficiency and enhancing renewable energy capacity by 2030.

Europe Hydropower Market Trends

The European hydropower market held 27.67% revenue share of the global industry in 2024. Increasing environmental awareness and demand for sustainable sources of energy are driving market growth. The growing shift towards a clean energy source drives hydropower projects, particularly mini and small hydropower, which is gaining significant traction and shaping the region's future energy sector.

Asia Pacific Hydropower Market Trends

Asia Pacific dominated the hydropower market and accounted for revenue share of 37.38% in 2024. The growth of his market is primarily driven by increasing energy demand, an abundance of hydropower resources, and the support of government policies. The Asia Pacific region is home to several rivers and the large organizations operating in the hydropower market, which presents opportunities for multiple hydropower developments.

The China hydropower market dominated the regional industry and accounted for a share of 42.72% in 2024. Supportive government policies, increased rural electrification by the government in recent years, and rising technological innovation have driven growth for this market. Increasing urbanization in the region leads to a larger demand for electricity, resulting in hydropower growth. The presence of the Three Georges Dam in China, one of the largest hydropower projects worldwide, meets around 10% of China's energy requirement, leading to the region's growth.

Key Hydropower Company Insights

Some key companies involved in the hydropower market include China Three Gorge Corporation, ABB Ltd., and Tata Power Corporation. With increasing focus on adoption of advanced technologies related to power generation via renewable sources, the key market participants in hydropower industry are adopting strategies such as enhanced research and development, innovation, and collaborations and partnerships with other organizations and governments to develop new projects in multiple locations.

- ABB, a global leader in power and automation technologies, operating in more than 100 countries, offers integrated electrical and automation solutions in the hydropower sector, including advanced SCADA systems, medium and high-voltage switchgear, and generator circuit breakers.

Key Hydropower Companies:

The following are the leading companies in the hydropower market. These companies collectively hold the largest market share and dictate industry trends.

- Siemens

- Stakraft Sweden

- ANDRITZ

- China Three Gorges Corporation

- Voith GmbH & Co. KGaA

- ALFA LAVAL

- ABB

- ENGIE

- Tata Power

- Norsk Hydro ASA

Recent Developments

- In August 2024, Tata Power and Druk Green Power Corporation (DGPC) partnered to establish the 600 MW Khorlochhu Hydropower facility. The DGPC would hold 60 %, and Tata Power would have 40% of the equity stake in this project. The development is expected to provide energy security to the region while fulfilling Tata Power’s commitment to offering a greener future.

Hydropower Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 259.51 billion

Revenue Forecast in 2030

USD 280.20 billion

Growth rate

CAGR of 1.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Component, capacity, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Spain; Russia; France; Netherlands; Germany; China; Japan; South Korea; India; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Siemens; Stakraft Sweden; ANDRITZ; China Three Gorges Corporation; Voith GmbH & Co. KGaA; ALFA LAVAL; ABB; ENGIE; Tata Power; Norsk Hydro ASA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hydropower Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hydropower market report based on component, capacity and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Civil Construction

-

Electromechanical Equipment

-

Power Infrastructure

-

Others

-

-

Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Mini

-

Micro & Pico

-

Small

-

Large & Medium

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Spain

-

Russia

-

France

-

Netherlands

-

Germany

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.