- Home

- »

- Network Security

- »

-

Password Management Market Size & Share Report, 2030GVR Report cover

![Password Management Market Size, Share & Trends Report]()

Password Management Market (2024 - 2030) Size, Share & Trends Analysis Report By Type, By Access, By Enterprise Size (SMEs, Large Enterprises), By End-use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-219-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Password Management Market Summary

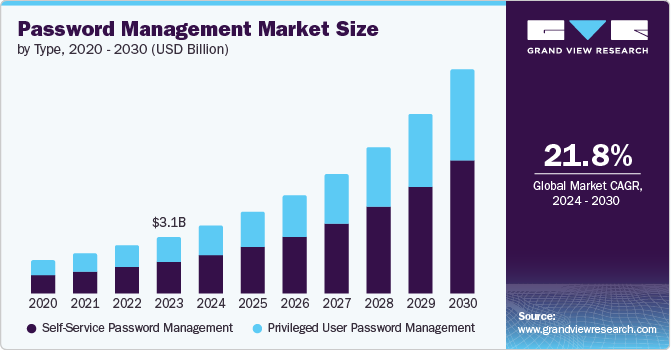

The global password management market size was estimated at USD 3,054.1 million in 2023 and is projected to reach USD 11,860.7 million by 2030, growing at a CAGR of 21.4% from 2024 to 2030. The increasing frequency and sophistication of cyberattacks have made robust cybersecurity measures imperative for individuals and organizations alike.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- In terms of segment, self-service password management accounted for a revenue of USD 3,054.1 million in 2023.

- Self-service password management is the most lucrative type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 3,054.1 million

- 2030 Projected Market Size: USD 11,860.7 million

- CAGR (2024-2030): 21.4%

- North America: Largest market in 2023

Data breaches, phishing schemes, and ransomware attacks are becoming more common, compromising sensitive information and causing substantial financial losses. As a result, there is heightened awareness about the importance of secure password practices, driving the need for password management tools that can generate, store, and manage strong, unique passwords for multiple accounts.

The market is driven by the benefits of the password manager, such as assisting in generating strong passwords, self-service reset of passwords, protection of the user identity from phishing sites, and so on. Moreover, some individuals and organizations rely on traditional methods for managing passwords and eventually become an easy target for hackers, which results in data breaches. According to a study by Varonis, human error is the most common factor in 74% of cybersecurity breaches. Therefore, this emphasizes the necessity for implementing the best password management techniques to tackle security issues.

Numerous organizations utilize multi-factor authentication (MFA) and frequent 'captcha' verifications to protect customers' identities and ensure a favorable user interface. Text messaging via SMS and other software authentication apps are the most commonly used methods for verification. According to a consumer digital identity report by LoginRadius, MFA is used by 59.1% of companies through SMS messaging and 40.9% through an authenticator app. Furthermore, rising demand for user-friendly authentication techniques is contributing to the market's growth in the forecast period.

Technological advancements have made password management solutions more accessible and user-friendly. Modern password managers offer features like biometric authentication, password autofill, and seamless integration with browsers and mobile devices, enhancing the user experience. This ease of use and the growing recognition of cybersecurity risks lead to the wider adoption of password management tools across various demographics and industries. As cyber threats evolve and digitalization progresses, the demand for effective password management solutions is expected to keep increasing globally.

Type Insights

Self-service password management held the largest market revenue share of 57.1% in 2023. It enhances user convenience by allowing individuals to reset and manage their passwords without IT assistance, reducing downtime and increasing productivity. This empowers users and eases the workload on IT departments, allowing them to focus on more critical tasks. Additionally, the rise in cyber threats has made organizations prioritize robust security measures, and self-service solutions often come with advanced features like multi-factor authentication and password-strength policies. The shift towards remote and hybrid work models has fueled this demand, as employees require efficient and secure access to systems from various locations.

The privileged user password management segment is expected to grow significantly over the forecast period. The demand for privileged user password management in the password management market is increasing due to the growing need for robust security measures to protect sensitive information and critical systems. Privileged users, such as system administrators and IT personnel, have extensive access to an organization’s most crucial resources, making their accounts prime targets for cyberattacks. As cyber threats become more sophisticated, organizations recognize the necessity of implementing stringent controls over privileged accounts to prevent unauthorized access and data breaches.

Access Insights

Desktops & laptops segment accounted for the largest market revenue share in 2023. With the rise in remote work and online activities, individuals and businesses rely more heavily on these devices to access sensitive information and conduct secure transactions. Desktops and laptops offer a more robust and secure environment for managing complex passwords, benefiting from more robust hardware security features than mobile devices. Additionally, the versatility and efficiency of desktops and laptops make them preferred choices for tasks that require multiple logins and secure data handling.

Voice-enabled password systems are expected to register the fastest CAGR during the forecast period. The demand for voice-enabled systems in the access segment of the password management market is increasing due to the growing need for enhanced security and convenience. Traditional password management methods often face challenges such as weak or forgotten passwords, which can lead to security breaches. Voice-enabled systems offer a more secure and user-friendly alternative by utilizing biometric authentication, which is harder to replicate or steal than conventional passwords.

Enterprise Size Insights

The large enterprises segment held the largest market revenue share in 2023. Large enterprises typically handle vast amounts of sensitive data, making robust cybersecurity measures critical to protect against increasingly sophisticated cyber threats. These organizations often have a complex IT infrastructure with numerous applications and systems requiring secure access, necessitating advanced password management solutions to streamline and secure authentication processes. Additionally, regulatory compliance requirements are becoming more stringent, compelling large enterprises to adopt comprehensive security measures, including password management.

The small and medium enterprises segment is expected to grow at the fastest CAGR over the forecast period. SMEs are increasingly becoming targets for cyber-attacks, making robust cybersecurity measures crucial. Password management tools offer these businesses a cost-effective way to enhance their security infrastructure without the need for extensive IT resources. Additionally, as remote work becomes more prevalent, SMEs require reliable solutions to manage and secure remote access. These tools help enforce strong password policies, reduce the risk of breaches, and ensure compliance with industry regulations.

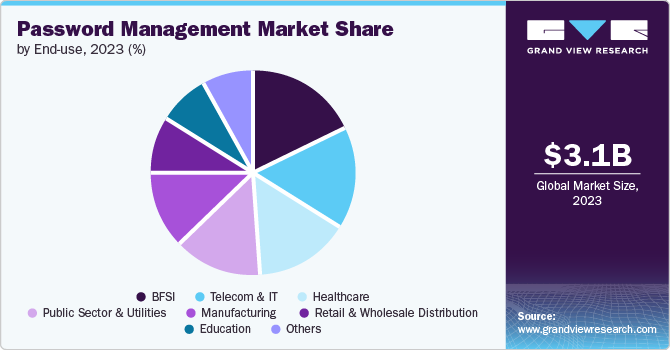

End-use Insights

The BFSI sector accounted for the largest market revenue share in 2023. BFSI organizations manage extensive sensitive financial and personal information with a focus on data security. Customized password management solutions for the BFSI industry ensure adherence to regulations, prevent data breaches and unauthorized entry, preserve customer confidence, and secure financial stability. Moreover, password management solutions assist in decreasing helpdesk queries and enhancing productivity and security levels.

The education sector is expected to grow at the fastest CAGR over the forecast period. Rising technological advancements and the digitalization of the education ecosystem are attributed to the increasing demand for the privacy and security of student data. Therefore, it is crucial to implement practical password management tools to secure the data. Organizations are focusing on innovating password managers for educational institutions, which offer benefits such as organized assessments for staff members, staff, and admins, safe password sharing, enhanced protection with multifactor authentication.

Regional Insights

North America password management market held the largest market revenue share in 2023. The increasing demand is due to heightened cybersecurity threats, the shift towards remote work, and the proliferation of digital services. As cyberattacks become more sophisticated and frequent, businesses and individuals recognize the need for robust security measures to protect sensitive information. The rise in remote work has further exacerbated this need, as employees access company networks from various locations, often using multiple devices. Additionally, expanding digital services, including online banking, e-commerce, and cloud applications, require users to manage an ever-growing number of passwords. This complex digital landscape necessitates efficient and secure password management solutions to safeguard data, streamline access, and comply with regulatory requirements, driving the surge in demand across the region.

U.S. Password Management Market Trends

The U.S. password management market held the largest market revenue share of 76.7% regionally in 2023. The demand for password management solutions in the U.S. is rising significantly due to several key factors. With the rapid digital transformation across various sectors, including healthcare, finance, and retail, the volume of sensitive data handled online has surged, necessitating robust cybersecurity measures. Additionally, the proliferation of remote work, accelerated by the COVID-19 pandemic, has led to a dispersed workforce accessing corporate networks from multiple locations, increasing vulnerability to cyber threats. High-profile data breaches and stringent regulations like the California Consumer Privacy Act (CCPA) further underscore the need for secure password management practices.

Europe Password Management Market Trends

Europe password management market was identified as a lucrative region in 2023. The demand for password management solutions in Europe is rising significantly due to several key factors. Firstly, the region has increasing cyber threats and data breaches, driving individuals and organizations to prioritize digital security. Stringent regulatory frameworks such as the General Data Protection Regulation (GDPR) have heightened the need for robust password management to ensure compliance and protect sensitive information. Additionally, the shift towards remote work has increased the number of online accounts and devices, necessitating secure password practices.

The UK password management market is expected to grow rapidly in the coming years due to rising cyber security breaches in the region. The demand for password management solutions in the UK is rising due to the increasing prevalence of cyber threats and data breaches. As businesses and individuals become more aware of the risks associated with weak or reused passwords, a growing emphasis is on enhancing cybersecurity measures. Additionally, implementing stringent data protection regulations, such as the General Data Protection Regulation (GDPR), has compelled organizations to adopt comprehensive password management systems to ensure compliance and safeguard personal data. This heightened awareness and regulatory environment are driving the adoption of password management solutions in the UK market.

Asia Pacific Password Management Market Trends

Asia Pacific password management market is expected to grow at the fastest CAGR over the forecast period. The market is driven by the growing number of small and medium-sized businesses in the region. China, Japan, India, Australia, and South Korea are the prominent markets for password management. Furthermore, an increasing number of technology users and continuously evolving infrastructure contribute to driving the market.

China password management market held a substantial market share in 2023 owing to the region's rising inclination towards digitalization and technological development. Moreover, various government authorities, such as the Ministry of State Security, are focused on alerting the public to the potential dangers of hacking and cyber ransom threats originating from other countries.

Key Password Management Company Insights

Some of the key companies in the password management market include 1Password., Avatier., Bravura Security Inc., Fortra, LLC (Core Security Technologies), Dashlane Inc., EmpowerID, Inc., FastPassCorp A/S., Intuit Inc., and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

1Password has set the standard for reliable and user-friendly security, transforming from a password manager to a worldwide expert in corporate security. It combines industry-level security with award-winning design to provide secure and user-friendly password management for all individuals.

-

Dashlane, Inc. develops and designs application software and caters to the global customer base. The company designed Dashlane application to safeguard online digital identity and personal information of the users. This application autofill, and saves password, payment details, and personal information automatically on all platforms and devices of the user, to assist in monitoring and safeguarding digital identity.

Key Password Management Companies:

The following are the leading companies in the password management market. These companies collectively hold the largest market share and dictate industry trends.

- 1Password

- Avatier.

- Bravura Security Inc.

- Fortra, LLC (Core Security Technologies)

- Dashlane Inc.

- EmpowerID, Inc.

- FastPassCorp A/S

- Intuit Inc.

- Keeper Security, Inc.

- LastPass US LP

- Microsoft

- SailPoint Technologies, Inc.

- Siber Systems, Inc.

- Trend Micro Incorporated

- Zoho Corporation Pvt. Ltd.

Recent Developments

-

In June 2024, Trend Micro announced the launch of the first security solutions specifically designed for consumer AI PCs. Unveiled at Computex 2024, these solutions address emerging cybersecurity threats associated with AI technologies. These innovations, developed in collaboration with Intel, aim to protect consumers from risks such as model tampering and data breaches.

-

In May 2024, 1Password announced the launch of a beta version of its Enterprise Password Manager tailored for managed service providers (MSPs). It offers streamlined billing and compliance management to enhance MSP operational efficiency and security service delivery.

Password Management Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.64 billion

Revenue forecast in 2030

USD 11.86 billion

Growth rate

CAGR of 21.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, access, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

1Password; Avatier.; Bravura Security Inc.; Fortra, LLC (Core Security Technologies); Dashlane Inc.; EmpowerID, Inc.; FastPassCorp A/S; Intuit Inc.; Keeper Security, Inc.; LastPass US LP; Microsoft; SailPoint Technologies, Inc.; Siber Systems, Inc.; Trend Micro Incorporated; Zoho Corporation Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Password Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global password management market report based on type, access, enterprise size, end-use, and region.

-

Password Management Market Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Self-Service Password Management

-

Privileged User Password Management

-

-

Password Management Market Access Outlook (Revenue, USD Million, 2018 - 2030)

-

Mobile Devices

-

Desktops & Laptops

-

Voice-Enabled Password Systems

-

Others

-

-

Password Management Market Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small and Medium Enterprises (SMEs)

-

Large Enterprises

-

-

Password Management Market End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Education

-

Healthcare

-

Manufacturing

-

Public Sector & Utilities

-

Retail & Wholesale Distribution

-

Telecom & IT

-

Others

-

-

Password Management Market Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.