- Home

- »

- Clinical Diagnostics

- »

-

In Vitro Diagnostics Quality Control Market Size Report, 2030GVR Report cover

![In Vitro Diagnostics Quality Control Market Size, Share & Trends Report]()

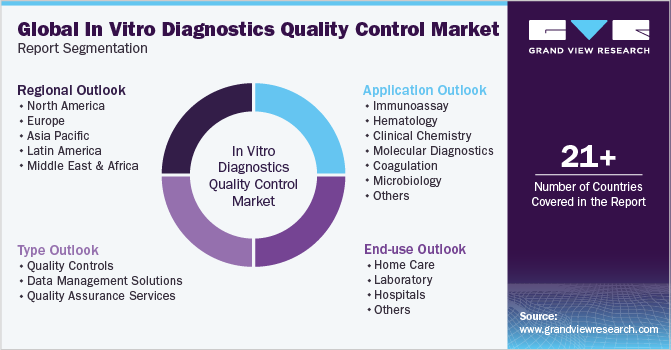

In Vitro Diagnostics Quality Control Market Size, Share & Trends Analysis Report By End-use (Hospitals, Laboratory), By Application (Hematology, Coagulation), By Type (Quality Control, Data Management Solutions), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-925-8

- Number of Pages: 185

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global in vitro diagnostics quality control market size was estimated at USD 1.16 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 2.12% from 2023 to 2030. An increasing number of accredited clinical laboratories worldwide and the presence of favorable regulatory bodies are expected to be the key factors driving the market growth. Due to the high prevalence rate of diseases, such as diabetes, cardiovascular diseases, and infectious diseases, diagnostic laboratories have gained demand. Many private as well as public laboratories are undergoing laboratory accreditation procedures to meet industry standards, improve their procedural volume, and attract more patients. Laboratories accredited by CLIA are eligible for reimbursement through Medicare and Medicaid Services.

The regulatory bodies monitoring quality control and regular quality check of in vitro diagnostics (IVD) devices and service providers include FDA for U.S.; Medicines and Healthcare Products Regulatory Agency (MHRA) for the UK; Therapeutic Goods Administration (TGA) for Australia; Central Drug Standard Control Organization (CDSCO) for India; Health Canada for Canada; European Medicines Agency (EMEA) for Europe; Ministry of Health, Labor & Welfare(MHLW) for Japan; Ministry of Health, Labor & Welfare (MHLW) for Brazil; and Ministry of Health for South Africa.

Moreover, Global Harmonization Task Force (GHTF) regulatory authorities, such as the U.S. FDA, are encouraging convergence of regulatory systems for medical devices, which is anticipated to encourage trade, while protecting public health through regulatory means. The American Clinical Laboratory Association states that more than 7.5 billion lab tests are performed in the U.S. annually and 80% of clinical decisions are taken after laboratory testing. According to the WHO, an estimated 537 million adults aged 20–79 years are suffering from diabetes. This represented 10.5% of the world’s population in this age group in 2021.

Application Insights

The immunology application segment dominated the market with a share of 32.76% in 2022. Immunology includes the study of molecular mechanisms for understanding the function of the immune system. It majorly involves the mechanism of action of antigens, antibodies, and their interactions. The key applications of the immunochemistry include detection of infectious microorganisms, such as viruses, bacteria, and fungi, by detecting the presence of their toxins and coat antigens.

An increase in the outbreaks of communicable and chronic diseases and the need for early diagnosis are the key drivers for increased demand for immunochemistry methods involving different types of ELISA. Molecular diagnostics is anticipated to be the fastest-growing segment over the forecast period. It is a set of complex tests for medical diagnosis of all major viral, bacterial, and parasitic infections. The introduction of advanced technology, such as PCR and next-generation sequencing, has overcome the drawback of traditional systems, such as speed, sensitivity, and accuracy.

Type Insights

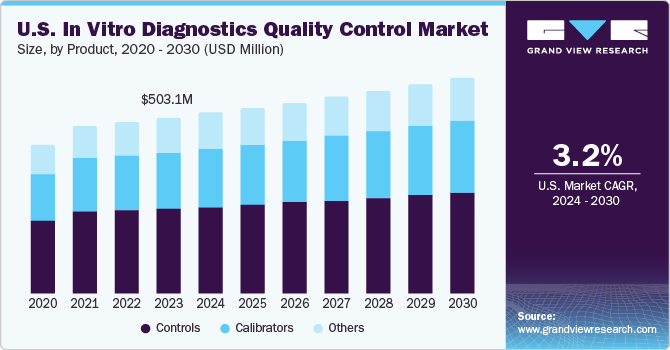

Quality control was the largest revenue-generating segment in 2022 and accounted for a share of 44.90% of the overall revenue. The segment is also anticipated to register the fastest CAGR over the forecast period. IVDs fall under the category of medical devices and, hence, are regulated for quality by the FDA. In the U.S., Quality Control (QC) refers to procedures monitoring work processes, detecting problems, and making corrections prior to delivery of products or services. Statistical QC is a major procedure for monitoring the analytical performance of clinical laboratory testing processes.

Controls, such as calibrators and known concentration reagents & buffers, are used for monitoring the precision & accuracy of instruments. The authorities that regulate the quality of these IVDs include the European Communities Confederation of Clinical Chemistry and Laboratory Medicine (EC4). American Association for Laboratory Accreditation (A2LA) and Clinical Laboratory Improvement Amendments (CLIA) have enhanced the demand for IVD quality control.

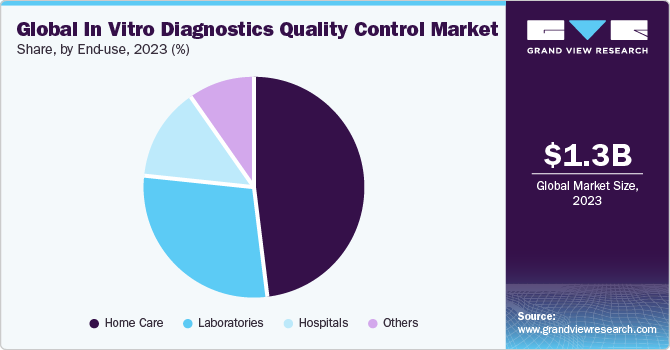

End-use Insights

The hospital end-use segment accounted for the largest share of 48.76% of the overall revenue in 2022 owing to the increased number of hospitalizations and reliability of healthcare professionals on clinical diagnosis for deciding treatment alternatives. Instruments and reagents are majorly used for the diagnosis of disorders in hospitals. The tests and instruments in this department need to be monitored regularly, owing to the high amount of procedural volumes carried out. Third-party companies, such as Bio-Rad and Randox, collaborated with hospitals for providing reagents pertaining to quality control. Another factor contributing to the dominance of this segment is the increasing demand for fast diagnostic tests in the critical care department and the presence of a large number of IVD instruments and reagent kits.

The home care segment is expected to register the fastest CAGR of 3.93% over the forecast period. Home care products include blood glucose monitoring devices for diabetic patients, pregnancy detection kits/devices, urine analyzers, hemoglobin sensors, and hormone home tests. These devices pose a high risk due to their use by laymen. Quality control of such devices is done by pre- and post-marketing quality assurance and quality control to ensure the safety of the patient.

Regional Insights

North America was the largest regional market with a revenue share of 47.17% in 2022 owing to the presence of the U.S.FDA and many accredited diagnostic laboratories coupled with strong quality control regulation systems. U.S. FDA along with GHTF regulates the North America region for the IVD quality control market. It regulates the quality from production to premarketing till post-marketing surveillance. Asia Pacific is expected to be the fastest-growing region over the forecast period.

Asia Pacific portrays a high potential for this market majorly due to the increasing number of companies getting engaged in the manufacturing of IVDs. Moreover, a rise in awareness for early and precise diagnosis fosters the demand for IVDs. For instance, the Asia Pacific Federation of Clinical Biochemistry and Laboratory Medicine (APFCB) is engaged in promoting awareness about the use of IVDs. Regulatory authorities in Japan include the Ministry of Health, Labor and Welfare (MHLW), the Pharmaceuticals and Medical Devices Evaluation Agency (PMDA), and the Ministry of Agriculture and Fisheries and Food.

Key Companies & Market Share Insights

Companies are focusing on expansions, development of innovative medical devices, and technological advances. Moreover, mergers and acquisitions for novel product development constitute some of the other strategic initiatives implemented by key players. For instance, in May 2023, ZeptoMetrix launched a new line of quality control products, PROtrol, designed for antigen-based diagnostics methods, such as the lateral flow immunoassay for infectious diseases. These materials are used to monitor and evaluate the performance of the antigen assays, leading to a higher quality of tests. This launch would help the company to attract various diagnostics test manufacturers for partnership. Some of the key players operating in the global in vitro diagnostics quality control market include:

-

Siemens Healthcare GmbH

-

F. Hoffmann-La Roche Ltd.

-

Alere, Inc.

-

Abbott

-

Bio-Techne

-

Hologic, Inc. (Gen-Probe)

-

Qiagen N.V.

-

Bio-Rad Laboratories, Inc.

-

Quidel Corp.

-

BD

-

bioMerieux, Inc.

-

Sysmex Corporation

-

Sero AS

-

Thermo Fisher Scientific, Inc.

In Vitro Diagnostics Quality Control Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.20 billion

Revenue forecast in 2030

USD 1.39 billion

Growth rate

CAGR of 2.12% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million/Billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Norway; Sweden; Denmark; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Siemens Healthcare GmbH; F. Hoffmann-La Roche Ltd.; Alere, Inc.; Bio-Techne; Hologic, Inc. (Gen-Probe); Qiagen N.V.; Bio-Rad Laboratories, Inc.; Quidel Corp.; BD; bioMerieux, Inc.; Sysmex Corp.; Sero AS; Thermo Fisher Scientific, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global In Vitro Diagnostics Quality Control Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global in vitro diagnostics quality control market report based on application, type, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Immunoassay

-

Hematology

-

Clinical Chemistry

-

Molecular Diagnostics

-

Coagulation

-

Microbiology

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Quality Controls

-

Quality Controls, by Type

-

Plasma-based Controls

-

Serum-based Controls

-

Whole Blood-based Controls

-

Other IVD Quality Controls

-

Quality Controls, by Application

-

Clinical Chemistry

-

Immunochemistry

-

Hematology

-

Molecular Diagnostics

-

Coagulation

-

Microbiology

-

Others

-

Data Management Solutions

-

Clinical Chemistry

-

Immunochemistry

-

Hematology

-

Molecular Diagnostics

-

Coagulation

-

Microbiology

-

Others

-

Quality Assurance Services

-

Clinical Chemistry

-

Immunochemistry

-

Hematology

-

Molecular Diagnostics

-

Coagulation

-

Microbiology

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Home Care

-

Laboratory

-

Hospitals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Thailand

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global in vitro diagnostics quality control market size was estimated at USD 1.16 billion in 2022 and is expected to reach USD 1.20 billion in 2023.

b. The global in vitro diagnostics quality control market is expected to grow at a compound annual growth rate of 2.12% from 2023 to 2030 to reach USD 1.39 billion by 2030.

b. Quality Control dominated the IVD quality control market with a share of 44.90% in 2022. This is attributable to the high usage of QC in monitoring work processes, detecting problems, and making corrections prior to delivery of products or services. Statistical QC is a major procedure for monitoring the analytical performance of clinical laboratory testing processes.

b. Some key players operating in the IVD quality control market include Siemens Healthcare GmbH; Roche Diagnostics; Alere, Inc.; Abbott Laboratories, Inc.; Bio-Techne; Hologic, Inc. (Gen-Probe); Qiagen N.V.; Bio-Rad Laboratories, Inc.; Quidel Corp.; Becton, Dickinson and Company (BD); bioMerieux, Inc.; Sysmex Corp.; Sero AS; and Thermo Fisher Scientific, Inc.

b. Key factors that are driving the market growth include the increasing number of accredited clinical laboratories worldwide and the presence of favorable regulatory bodies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."