- Home

- »

- Automotive & Transportation

- »

-

India Brake Pads Market Size, Share & Growth Report, 2030GVR Report cover

![India Brake Pads Market Size, Share & Trends Report]()

India Brake Pads Market Size, Share & Trends Analysis Report By Vehicle Type (Two-wheeler, Three-wheeler), By Position Type, By Sales Channel, By Material, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-118-9

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

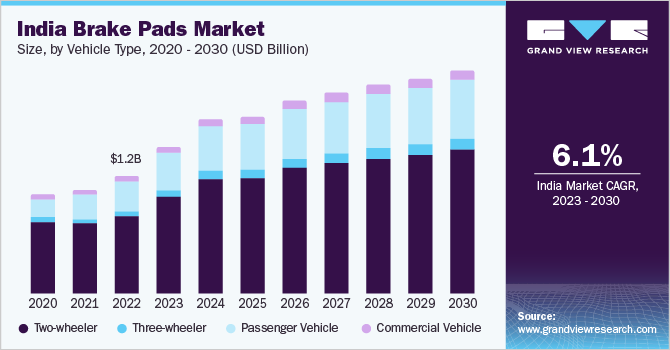

The India brake pads market size was valued at USD 1.19 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.1% from 2023 to 2030. In terms of volume, the market was estimated at 83,806 thousand units in 2022 and is projected to register a compound annual growth rate (CAGR) of 5.0% from 2023 to 2030. Increasing awareness regarding passenger and pedestrian safety, government mandates to include advanced safety features in vehicles, and increasing inclusion of brake wear sensors are major factors attributed to the growth of the market. The growing demand for high-performance vehicles, coupled with manufacturers developing advanced brake pads is driving the market growth. Development in brake pad material, such as using organic brake pads material, coupled with designing brake pads for specific terrain wheelers, is augmenting the market growth. The increasing demand for eco-friendly and sustainable brake pads coupled with growing traction for electric vehicles is expected to create new growth opportunities for the market.

There are rising concerns over occupant and driver safety, and to address them, the government is taking various safety measures, such as mandating the integration of anti-lock braking and autonomous brake systems, for vehicles operating in India. The implementation of advanced safety technologies is encouraging braking system manufacturers to use advanced brake material and components, which reduces the overall vehicle stoppage distance, thereby contributing in avoid collisions is another factor augmenting the market growth.

Moreover, the growing traction of luxury and high-performance vehicles equipped with advanced safety features is encouraging manufacturers to develop brake pads for luxury cars. For instance, in March 2023, Brakes India Private Limited, an automotive brake component manufacturer, announced the launch of platinum brake pads specifically for luxury cars. The brake pads are designed to provide a comfortable and enhanced driving experience. The brake pads are designed to cater to both rear and front bakes in premium vehicles. Moreover, the rising demand of the electric vehicle market in India is further expected to create new growth opportunities for India brake pads manufacturers to produce high-quality brake pads for electric vehicles. For instance, in March 2023, Brakes India Private Limited also announced the launch of ZAP brake pads with advance friction technology specifically designed for electric vehicles. The brake pads are treated with enhanced corrosion protection technology, produce low brake dust, and produce little to no noise while applying the brakes.

Digitalization has brought about a paradigm shift in the automotive industry. The increasing electrification of vehicles and the integration of sensors in different components of vehicles have promoted startups and brake pad manufacturers to develop smart pads that have sensors embedded within the brake pads. The basic concept behind smart pads includes the use of sensors and connected vehicle technology that converts friction technology from passive automotive components into an active system that collects real-time data aimed at improving driving efficiency and safety. The smart pads are able to determine the brake pad's temperature in real time and alert the driver in case of overheating. As overheating can result in worn-out pads, the sensors embedded in the smart pads can also monitor the residual pad life, aiding in avoiding such situations. The smart pads can withstand extreme temperatures, making them compatible with sports, off-road, and passenger cars. Integrating such technologies in brake pads is anticipated to create new growth opportunities for the market.

The increasing development of sustainable, organic, and eco-friendly brake pads creates new growth opportunities for the market. Brake pads are formed of heavy metals such as copper, lead, chromium, and asbestos. Brake pads are continuously used, and fine dust flakes off the pads, depositing on roads ways or entering the water system, which harms our environment and health. In response to the harmful effects of high metal concentrations in brake pads, manufacturers are experimenting with substitutes such as plant fiber, wheat or wood flour, and other organic materials to develop brake pads. Organic material in brakes carries advantages such as low density, low cost, lightweight, easy recycling of the material, and high strength and friction coefficient, which enhances the life span and functionality of brake pads. For instance, in February 2022, Brakes India Private Limited, a braking device manufacturer, announced the launch high performance “Elite” friction brake pads under its TVS Apache brand. The brake pads are stripe coated by using ABRACOAT technology, the abrasive film coat on brake pads improvise the friction performance. The brake pads have been developed using organic, low ceramic, and steel materials and are specifically designed for hilly terrain regions offering enhanced braking at high speed.

Advanced braking systems provide the shortest brake distance and increased vehicle stability; thus, brake pads are commonly used in most premium vehicles. The cost of maintenance and repair is higher for brake pads is than brake shoes used in drum brakes. As a result, firms are majorly working to develop innovative and cost-effective solutions for automobiles of different segments. However, the capital investment required to develop brake pads materials like ceramic, jute fiber, and steel is high. Therefore, the high research and development expenditure on brake pads is expected to stifle the growth of the Indian brake pads market over the forecast period. Moreover, the fluctuating prices of raw materials such as copper and other composite material are further resistant to the market growth.

Vehicle Type Insights

The two-wheeler segment accounts for the largest market share of more than 65% in 2022. The development of advanced braking system in high-performing bikes such as sports and racing bikes, rising integration of traction control system, electronic stability control system and rear lift off protection are major factors driving segmental growth. The growing demand for advanced friction and lightweight materials in two-wheeler is another factor driving segmental growth.

The three-wheeler segment is expected to witness the fastest growth during the forecast period. The rising demand for affordable public transportation and the growing traction of electric three-wheelers across the country is creating the demand for brake pads in the three-wheeler segment. The government’s PLI scheme to support the manufacturing of electric three-wheelers, is expected to drive the growth of electric three-wheelers and growth has cascading effects on the sales of brake pads in the market.

Position Type Insights

The front brake pads segment accounts for the largest market share of more than 74% in 2022. The front brake pads are the most used brakes throughout a vehicle's life cycle. When the brakes are applied to any vehicle, the front brake operates, and friction is generated between the disc and the brake pads, which results in vehicle stoppage. The continuous braking operation results in high wear and tear of braking material, thereby resulting in higher maintenance and replacement of existing brake pads. Therefore, to address such issues, brake pad manufacturers are working on improving the material quality and making them more eco-friendly. Hence, continuous innovation in brake pads with organic material, coupled with rising sales of passenger and commercial vehicles is contributing to the high growth of the segment.

The rear brake pads segment is expected to witness significant growth during the forecast period. The rear brake pads are designed to improve the stability of the vehicle. The rear brake pads handle lesser brake force but are pivotal when the emergency brakes are applied as they prevent skidding, spinouts, and rollovers, the brake also prevents the vehicles such as two wheelers from being unbalanced during braking due to the state of inertia. Therefore, innovation in brake pad material and increasing development in high performance vehicles such as sports bike and luxury cars are increasing the functionality of rear brake pads, thereby driving the segmental growth.

Sales Channel Insights

The OEM segment accounts for the largest market share of more than 55% in 2022. Factors such as partnerships with automotive OEMs to supply brake pads for vehicles and substantial investment in research and development for creating brake pads with organic material is expected to drive the market growth. The segment is further experiencing growth owing to the competitive market environment prompting OEM to implement organic and in-organic growth strategies to maintain their market dominance.

The aftermarket segment is expected to witness significant growth during the forecast period. The segmental growth of the aftermarket is attributed to multiple domestic suppliers and international brake pads suppliers taking initiatives to launch products for aftermarket use and to enhance their market presence in the Indian market. For instance, in April 2023, ZF Aftermarket, a division of ZF Friedrichshafen AG‘s expanded their aftermarket product portfolio with the launch of three TRW products including brake pads, brake disks, and shock absorbers. The TRW brake pads are designed and extensively tested ensure braking system safety to ensure longer life span of the brake pads.

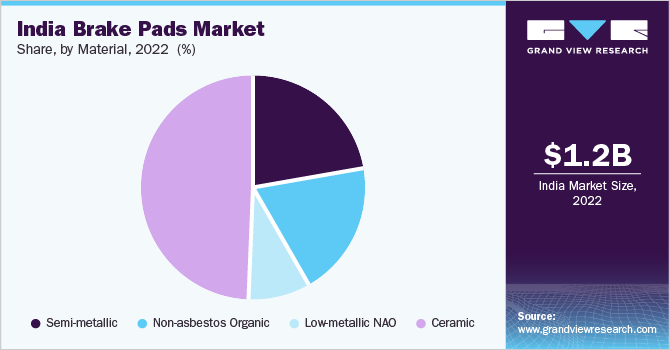

Material Insights

The ceramic material segment accounts for the largest market share of more than 49% in 2022. The segmental growth is attributed to factors such as increasing stability and the ability to function efficiently in different temperature variations. Ceramic brake pad material includes fine particles of copper fibers which helps in increasing heat conductivity. Moreover, ceramic brake pads offer noiseless operation during break peddling and have a lower cost of operation making them a preferred choice for two-wheelers and passenger vehicles. Their deterioration rate is much slower; as a result, despite the high costs of manufacturing, ceramic brake pads are preferred over their other counterparts.

Non-asbestos Organic (NAO) segmenthas is expected to witness significant growth during the forecast period. NAO brake pads are constructed of organic materials such as high-temperature resins, glass, rubber, fiber, and Kevlar. NAO have a softer consistency than copper brake pads, thus, NAO brake pads create less noise. The growing traction toward the use of eco-friendly material for manufacturing brake pads and technological development in the type of material used is expected to drive market growth.

Key Companies & Market Share Insights

The market is highly competitive, consisting of regional and global players present in the market. Players operating in the market focus on implementing strategic initiatives such as product launches, partnerships, and mergers and acquisitions. For instance, in June 2022, Endurance Technologies Limited. acquired 100% stakes in Frenotecnica Srl., an Italy-based manufacturer which is engaged in manufacturing braking system components and friction material for two-wheelers vehicles. The primary business activities include selling brake pads under the registered trademark “Brenta.” The acquisition has provided Endurance Technologies Limited with growth opportunities in the European aftermarket and enhanced their technical expertise on friction materials technology used in brake applications. Some of the key players operating in the India brake pads market include:

-

Brakes India Private Limited

-

Rane Holdings Limited

-

Endurance Technologies Limited

-

ASK Automotive Pvt. Ltd.

-

Brembo Brake India Pvt. Ltd.

-

Makino Auto Industries Pvt. Ltd.

-

Masu Brake Pads Pvt.Ltd

-

Allied Nippon Private Limited

-

Sagestics BRAKES

-

Ceratech Friction Composites

India Brake Pads Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 2.25 billion

Growth rate

CAGR of 6.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in Revenue, USD million/billion; Volume, Units, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vehicle type, position type, material, sales channel

Country scope

India

Key companies profiled

Brakes India Private Limited; Rane Holdings Limited; Endurance Technologies Limited; ASK Automotive Pvt. Ltd.; Brembo Brake India Pvt. Ltd.; Makino Auto Industries Pvt. Ltd.; Masu Brake Pads Pvt.Ltd; Allied Nippon Ltd; Sagestics BRAKES; Ceratech Friction Composites

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Brake Pads Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India brake pads market report based on vehicle type, position type, sales channel, and material:

-

Vehicle Type Outlook (Revenue, USD Million; Volume, Units; 2018 - 2030)

-

Two-wheeler

-

Three-wheeler

-

Passenger Vehicle

-

Commercial Vehicle

-

-

Position Type Outlook (Revenue, USD Million; Volume, Units; 2018 - 2030)

-

Front

-

Rear

-

-

Sales Channel Outlook (Revenue, USD Million; Volume, Units; 2018 - 2030)

-

OEM

-

Aftermarket

-

-

Material Outlook (Revenue, USD Million; Volume, Units; 2018 - 2030)

-

Semi-metallic

-

Non-asbestos Organic (NAO)

-

Low-metallic NAO

-

Ceramic

-

Frequently Asked Questions About This Report

b. The India brake pads market size was valued at USD 1.19 billion in 2022 and is expected to reach USD 1.48 billion in 2023.

b. The India brake pads market is expected to grow at a compound annual growth rate (CAGR) of 6.1% from 2023 to 2030 to reach USD 2.25 billion by 2030.

b. The material segment accounted for the largest market share owing to the development of brake pads using alternate materials that do not contain asbestos. Typically, brake pads include asbestos as a component in manufacturing brake pads, which is harmful owing to its microplastic content, which may cause life-threatening diseases.

b. Some key players of India brake pads market include Brakes India Private Limited, Rane Holdings Limited, Endurance Technologies Limited, ASK Automotive Pvt. Ltd., Brembo Brake India Pvt. Ltd., Makino Auto Industries Pvt. Ltd., Masu Brake Pads Pvt.Ltd, Allied Nippon Ltd, Sagestics India Brakes Private Limited, Ceratech Friction Composites,

b. Increasing awareness regarding passenger and pedestrian safety, government mandates to include advanced safety features in vehicles, and increasing inclusion of brake wear sensors are major factors attributed to the growth of the India brake pads market. The growing demand for high-performance vehicles coupled with manufacturers developing advanced brake pads is driving the India brake pads market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."