- Home

- »

- Homecare & Decor

- »

-

India Candle Market Size And Share, Industry Report, 2030GVR Report cover

![India Candle Market Size, Share & Trends Report]()

India Candle Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Votive, Container Candle), By Wax Type (Paraffin, Soy, Beeswax, Palm), By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-211-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

India Candle Market Size & Trends

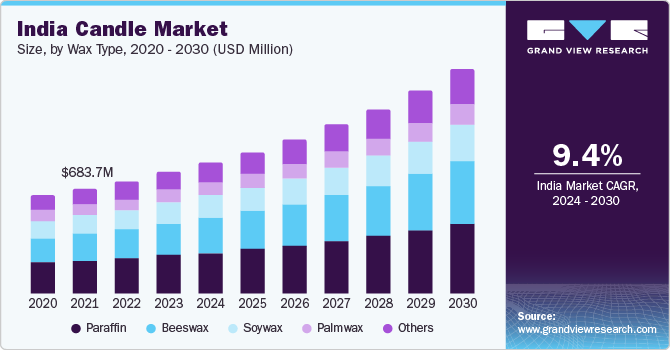

The India candle market size was estimated at USD 736.9 million in 2023 and is expected to grow at a Compound Annual Growth Rate (CAGR) of 9.4% from 2024 to 2030. The market growth is mainly attributed to factors such as increasing use of candles in domestic as well as commercial market across the country, growing popularity of scented candles, use of candles in home décor, and adoption of various types of candles in therapeutic spas. Various types of candles are used in resorts, hospitality destinations, hotels, restaurants owing to the product’s aesthetic appeal. This market is also driven basic desire to fit in and home décor trends as well as societal preferences regarding the use.

India candle market accounted for the share of 5.48 % of the global scented candles market in 2023. Use of candles to attain mental well-being and follow self-care routines, growing awareness about these personal mental health aspects, growing disposable income of customers, increased spending in the country on home décor and renovations are some of the other factors which have been fuelling the India candle market growth.

Commercial use of candles is at its par with preferences such as non-toxic paraffin wax candles and scented candles. Restaurant owners are adopting use of fragrance and scented candles in common areas, washrooms, etc. to develop and maintain pleasing atmosphere. In addition, lavish lobbies and luxury suites of reputed hotels prefer use of candles as they add unparalleled aesthetic value. Individual buyers usually purchase these types of products in order to create soothing atmospheres within living space.

The spa centres providing specialised solutions and noteworthy experienced regarding relief from back pain, headache, and anxiety have been using the candles in their setting to develop helpful surroundings. In addition, the traditional aspects associated with burning candles in some of the regional cultures have also been helping the candle market grow.

Market Concentration and Characteristics

The India candle market is growing at accelerating pace and the growth stage is identified as high. The market is fragmented to owing to existence of the several market participants. Some of these companies are fairly new in market and some of the participants have been operating in the candle business since a while now.

Degree of innovation high in the candle market of India. Companies offering the attractive range of candles have been innovating constantly on various fronts such as novel fragrances, personalised products and customised container delivery. This is often driven by the changing trends influenced by the consumer behaviour.

Market has low level of mergers and acquisition as industry is mainly reliant on collaborations and partnerships. However, these activities are not of sort, which involve absolute acquisitions. However, in terms of global market such acquisitions are done with an intent to expansion of the product portfolio.

The India candle market is moderately impacted by the regulations. The government body working in the sector of standardization, marking and quality certification of goods has led down rules and requirement regarding the development of candle and associated products as well. One of the basic requirements includes candle shall be clean, free from dirt or foreign materials.

The threat of substitutes is fairly low as these candles are often used with particular purpose, which cannot be sufficed by any other products. However, presence of locally made goods sold without any labels or declaration of information regarding the fragrance and elements used are posing challenged in front of organised candle market in India.

Product Insights

The votive candle market in India accounted for 27.77 % revenue share of the industry in 2023. The votive candles are typically used as votive offering in different traditions. Often, in modern markets these type of candles are sold by influencers and companies for lighting and decoration purpose as well. Individual buyers as well as hotels and restaurants use the votive candles, to develop tranquil décor styles and desired ambience. The votive candles are used by many household users, as they are small and designed in such a shape that they burn very slow.

India Tapers candle market is expected to grow at fastest growth rate of 11.17% from 2024 to 2030. The tapers are often developed with soy wax, beeswax or coconut wax in order to deliver premium quality to customers. These candles are typically used on special occasions such as wedding ceremonies for attractive decorations. The product is made in different colours right from classic ivory look to variants of red, green and more. Taper candles often tend to blend in the surroundings while adding elegance to décor style.

Wax Types Insights

Paraffin-based candle market in India held the market share of 30.63% in 2023. The paraffin wax is less in terms of cost, as compared to soy wax or bees wax. The type is popular in manufacturers as most of the scented or luxury candles are made out of paraffin wax. Increased awareness in buyers regarding burning paraffin-based candles has also been driving growth for this market. The wax type is characterised by higher capacity to hold the fragrance for longer period.

India beeswax-based candle market is expected to grow at highest CAGR of 10.45% from 2024 to 2030. The beeswax is naturally developed wax through bee’s hives. Honeybees secret this wax and it is utilised by them to build their honey combs. The beeswax-based candles are presented by manufacturers as one of the most naturally sourced products and emphasize on non-toxic burn it offers as the primary feature of the product.

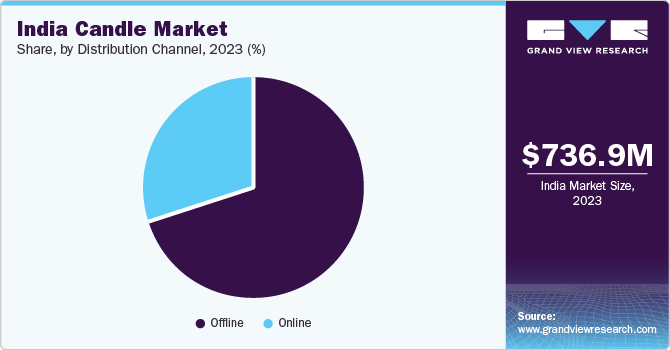

Distribution channel Insights

The sales generated through offline channels in India candle market accounted for 69.72% of the revenue share. The offline distribution channel often works through number of hypermarkets, supermarkets, convenience stores, local grocery shops, brand outlets, exhibitions, art stores, etc., which is easily accessible to for customers in their own localities or office places. This way of distribution generates higher volumes of sales as compared to online distribution.

Online shopping experience has also been driving the growth for market in effective way, and it is expected to grow at CAGR of 9.2% from 2024 to 2030. The potential growth for online sales can be attributed to presence of premium grade candle products on e-commerce websites and mobile applications of leading e-retailors in the country. Many shoppers prefer this experience; however, it lacks the element of personal examination and immediate possession.

Key India Candle Company Insights

The India candles industry is fragmented is comprised of a few established players and many start-up companies, which have entered the market in recent past. The presence of these elements develops highly competitive market, as use of products like scented candles is new to India if compared to other parts of the world.

-

Ekam, one of the popular brands for candles in India was founded in 2020. The brand launch during the peak of pandemic period resulted in overwhelming response to their soothing products.

-

Joy Candle India is key market participant of India candle market, and it specialises in naturally sourced beeswax and use of plant-based fragrance ingredients.

Key India Candle Companies:

- Ekam

- Joy Candle

- Maeva

- Miniso

- RAD Living

- Misa

- Smiisenses

- Bella Vita

- Veda Oils

- Joyous Beam Candles

Recent Developments

- Ekam, one among the top candle manufacturers in India market, launched its Luxury Soy Wax Candles in the market in September 2022. This collection featured 25 different variants of the scented candles.

India Candles Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 796.10 million

Revenue Forecast in 2030

USD 1,366.70 million

Growth Rate

CAGR of 9.4% from 2024 to 2030

Actuals

2018 - 2023

Forecasts

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report Coverage

Revenue forecast; company ranking; competitive landscape; growth factors; and trends

Segments Covered

Product, wax type, distribution channel

Key companies profiled

Ekam; Joy Candle; Maeva; Miniso; RAD Living; Misa; Smiisenses; Bella Vita; Veda Oils; Joyous Beam Candles

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Candle Market Report Segmentation

This report forecasts revenue growth at the country level and offers a scrutiny of the most recent industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India Candle market report based on product, wax type and distribution channel.

-

Product Outlook (Revenue; USD Million; 2018 - 2030)

-

Votive

-

Container Candles

-

Pillars

-

Tapers

-

Others

-

-

Wax Type Outlook (Revenue; USD Million; 2018 - 2030)

-

Paraffin

-

Soywax

-

Beeswax

-

Palmwax

-

Others

-

-

Distribution Channel Outlook (Revenue; USD Million; 2018 - 2030)

-

Offline

-

Online

-

Frequently Asked Questions About This Report

b. The India candle market size was estimated at USD 736.92 million in 2023 and is expected to reach USD 796.10 million in 2024.

b. The India candle market is expected to grow at a compound annual growth rate of 9.4% from 2024 to 2030 to reach USD 1,366.70 billion by 2030.

b. Paraffin wax candles dominated the India candle market with a share of 30.6% in 2023. Increased awareness among buyers regarding burning paraffin-based candles has also been driving growth in this market.

b. Some key players operating in the India candle include Ekam; Joy Candle; Maeva; Miniso; RAD Living; Misa; Smiisenses; Bella Vita; Veda Oils; Joyous Beam Candles

b. The market growth is mainly attributed to factors such as increasing use of candles in domestic as well as commercial market across the country, growing popularity of scented candles, use of candles in home décor, and adoption of various types of candles in therapeutic spas

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.