- Home

- »

- Homecare & Decor

- »

-

India Destination Wedding Market Size, Industry Report 2033GVR Report cover

![India Destination Wedding Market Size, Share & Trends Report]()

India Destination Wedding Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Beach & Island, Royal & Heritage, Hill Station & Mountain), By Service (Event Planning, Catering & Venue), By Expenditure, And Segment Forecasts

- Report ID: GVR-4-68040-730-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

India Destination Wedding Market Trends

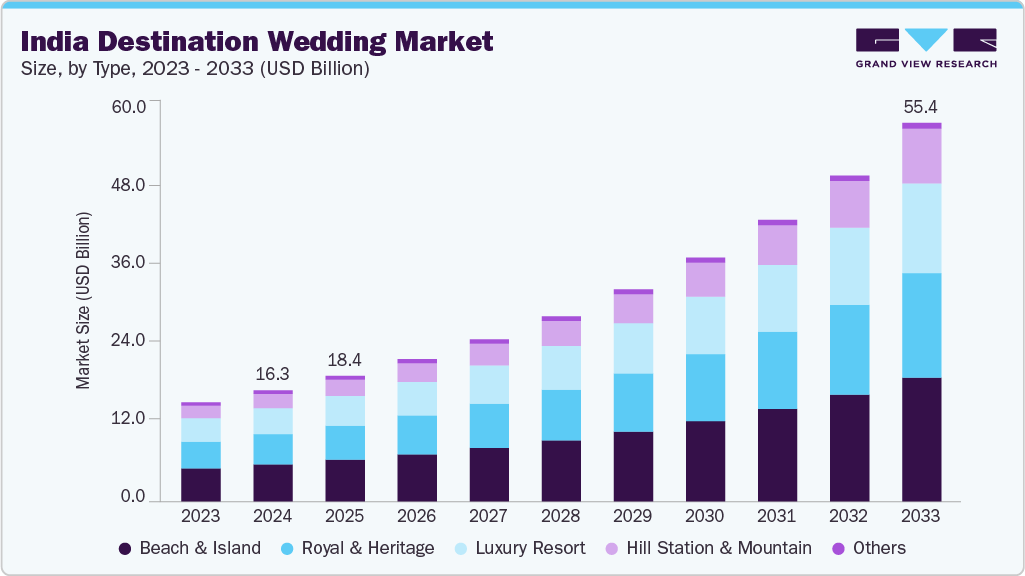

The India destination wedding market size was estimated at USD 16.25 billion in 2024 and is projected to reach USD 55.39 billion by 2033, growing at a CAGR of 14.8% from 2025 to 2033. The demand for destination weddings in India has seen an impressive uptrend in recent years, shaped by a blend of rising consumer affluence, aspirational lifestyles, and evolving expectations around marriage ceremonies. Increasingly, Indian couples are moving away from traditional hometown weddings in favour of immersive, curated experiences at picturesque locations.

From a policy standpoint, destination weddings have attracted strategic attention at both national and state levels. The Ministry of Tourism launched the “Wed in India” campaign in 2023 to promote the country as a global wedding destination. This initiative emphasises regional diversity by showcasing 25 handpicked venues across beaches, mountains, heritage towns, and cultural heartlands. Designed to attract both domestic and international clientele, the campaign leverages influencer marketing, digital media, and destination-focused storytelling.

A more recent policy push emerged from the Prime Minister’s appeal to Indians to choose India over overseas locations for their weddings, reflecting both an economic and cultural imperative. These moves align with the country’s broader tourism mission, aiming to formalise the wedding industry as a significant contributor to the national economy while simultaneously preserving and promoting local heritage and hospitality ecosystems.

Furthermore, state-level developments are reinforcing the national strategy. The Delhi government, for instance, has announced a comprehensive plan to position the capital as a global hub for destination weddings. The proposal involves opening up 70 to 80 heritage sites, including Ghalib Haveli and Mutiny Memorial, for private events. The initiative also includes a digital single-window clearance system to streamline permissions, alongside infrastructural upgrades covering safety, sanitation, lighting, and accessibility. This holistic approach not only unlocks new revenue streams through heritage tourism but also supports local artisans, event planners, and service providers by integrating them into the formal wedding economy. The state aims to attract high-spending domestic weddings as well as international NRI clients by offering venues that combine cultural gravitas with logistical convenience.

The hospitality industry has responded proactively to these trends by introducing wedding-centric services tailored specifically for destination events. Luxury hotel chains such as Taj, Oberoi, ITC, and Marriott have launched integrated destination wedding packages that cover accommodation, venue styling, cuisine, local rituals, entertainment, and guest management. Resorts located in heritage-rich areas such as Udaipur, Jaipur, and Khajuraho, as well as scenic coastal and mountain regions in Kerala, Goa, and Uttarakhand, are being repositioned as wedding-ready properties. These hotels are increasingly collaborating with regional florists, traditional artisans, and local performers to deliver culturally resonant and visually arresting wedding experiences. Services often extend beyond the wedding day itself; spa treatments, curated bridal menus, and locally inspired welcome kits are becoming standard components of premium packages. The goal is to transform weddings into holistic guest experiences that reflect both luxury and local flavour.

The rise in destination weddings in India can be attributed to a convergence of lifestyle shifts, strategic marketing, policy backing, and robust private sector innovation. As government campaigns like “Wed in India” scale further, and states implement enabling infrastructure and regulations, the country is poised to retain domestic wedding spending and attract cross-border wedding tourism. Together, consumer demand, policy direction, and private sector adaptability are laying the foundation for India’s emergence as a global leader in the destination wedding economy.

Consumer Insights

The recent report by WedMeGood for 2024-2025 highlights a significant rise in wedding expenditure across India, reflecting broader shifts in consumer aspirations and spending power. The average cost of a wedding now stands at approximately USD 44,000, while destination weddings command a much higher spend of around USD 61,600. This increase is primarily attributed to rising prices in venue rentals, catering, décor, and guest hospitality. Weddings crossing the USD 120,000 mark are also becoming more common, and notably, a majority of these high-end celebrations take place at destinations outside the couple’s hometown. This suggests that destination weddings are increasingly viewed as a premium format, combining celebration with travel and exclusivity.

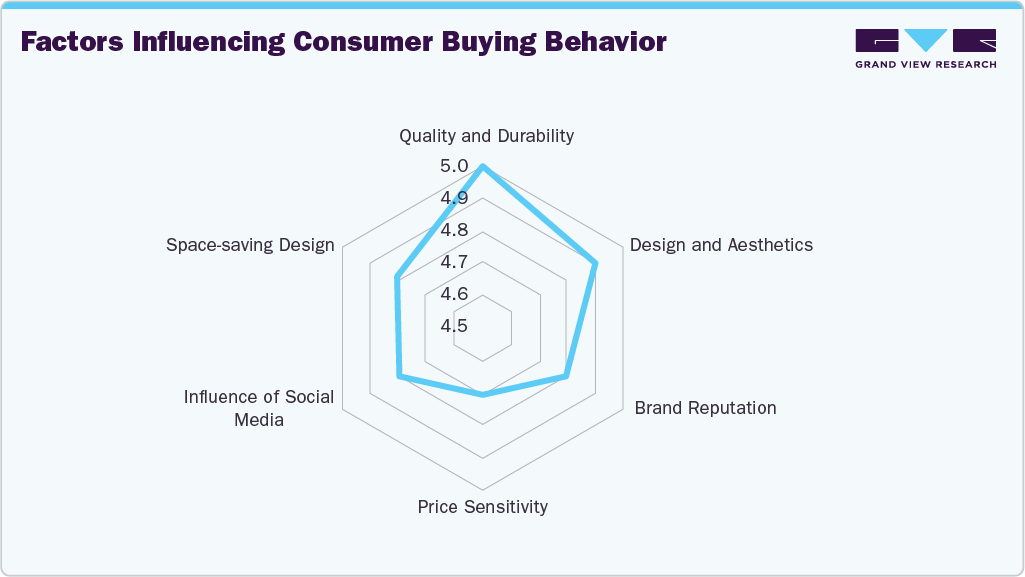

Consumer trends further support this shift. Destination weddings accounted for 26 % of all weddings in 2024, up from 18 % two years earlier. A larger share of these couples now hire professional planners, with 27 % choosing expert services for destination events, compared to just over 10 % for local weddings. This reliance on professional coordination reflects the complexity of hosting multi-day events at unfamiliar locations. In addition, the way couples select vendors has evolved. Over 40 % use a mix of online platforms, mobile apps, and social media to discover and book services. This move toward digital sourcing indicates an increasing demand for convenience, transparency, and a curated planning experience.

The preference for destination weddings is directly contributing to higher overall spending. Compared to traditional weddings, destination formats require significantly more investment in guest logistics, accommodation, and thematic execution. On average, couples spend around 40 % more when opting for a destination celebration. This premium is justified by the value placed on personalization, exclusivity, and experiential elements. As a result, the destination wedding segment is not only growing in volume but also setting the pace for innovation and service quality across the Indian wedding industry. It is becoming a defining force in shaping how modern Indian weddings are planned, celebrated, and commercialised.

According to Skyscanner’s “Destination ‘I Do’” survey, 48% of Indian couples planning a destination wedding prefer locations within Asia. This preference is largely influenced by proximity, affordability, and cultural comfort. Among specific destinations, Goa leads as the top choice, followed by Dubai, Bali, and Bangkok, all of which offer a balance of scenic beauty, hospitality infrastructure, and accessibility. Europe ranks as the second-most preferred region, with 31% of respondents considering countries such as Italy, France, Spain, and the United Kingdom for their weddings. These choices reflect a growing shift toward international and exotic settings that blend visual appeal with practical value.

The survey also outlined trends in thematic preferences. Beachside weddings are the most popular, chosen by 26% of respondents who seek relaxed, picturesque celebrations. Royal or palace-themed weddings appeal to 20%, particularly in heritage destinations such as Jaipur and Udaipur. Mountain settings are the preferred choice for 19% of couples, while 16% are inclined toward contemporary urban experiences in cities such as Dubai and Bangkok. These statistics suggest that Indian couples increasingly view weddings as travel-led experiences, designed not only for celebration but also for creating memorable, immersive moments in unique locations.

Type Insights

Beach & island destination weddings accounted for a revenue share of 33.21% in the India destination wedding industry in 2024. Locations such as Goa, Kerala, and the Andaman Islands offer a compelling mix of scenic landscapes, resort infrastructure, and relaxed ambience, making them ideal for multi-day wedding events. Couples are increasingly drawn to the exclusivity and immersive atmosphere these destinations provide, which also allows for tailored themes such as sunset ceremonies, seaside mandaps, and barefoot rituals. Moreover, the hospitality sector in these regions has adapted to this demand with comprehensive wedding packages, luxury accommodations, and curated local experiences, all of which contribute to higher spending per event.

Hill station & mountain destination weddings are projected to grow at a CAGR of 16.4% over the forecast period of 2025-2033, driven by a rising demand for serene, scenic, and climate-friendly venues that offer a distinct contrast to traditional wedding settings. Locations such as Shimla, Mussoorie, Manali, and parts of Uttarakhand and Himachal Pradesh are gaining popularity for their cool weather, panoramic views, and intimate ambience, qualities that appeal strongly to couples seeking experiential, nature-centric celebrations. This trend is further supported by improvements in accessibility, enhanced hospitality infrastructure, and a growing number of boutique resorts and luxury retreats offering customised wedding services.

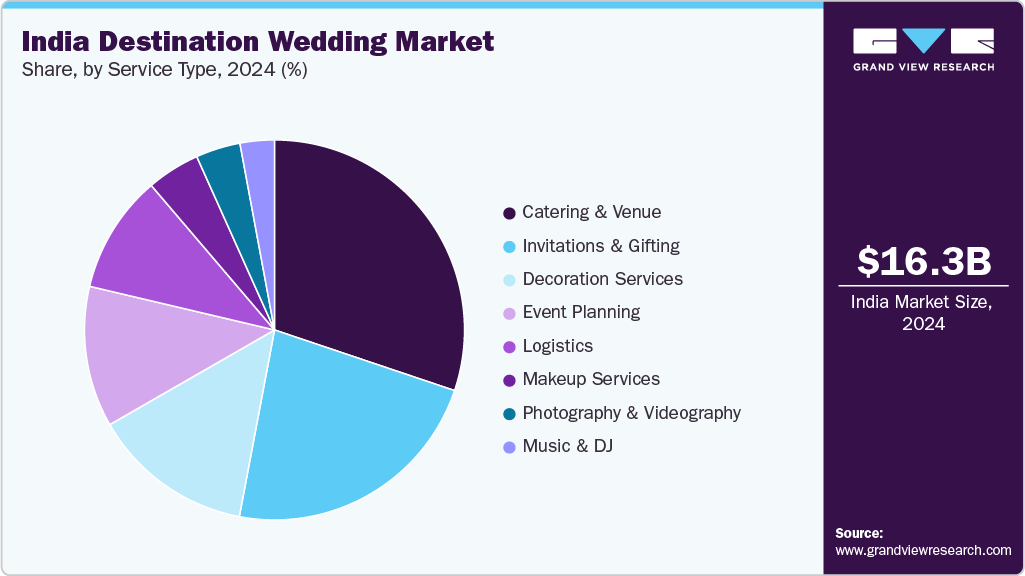

Service Type Insights

Catering & venue related services for destination weddings accounted for a revenue share of 30.17% in the year 2024 in the India destination wedding industry. As destination weddings increasingly revolve around curated, multi-day events, the demand for high-quality venues and customised culinary offerings has intensified. Premium resorts, heritage properties, and scenic outdoor locations often bundle venue charges with end-to-end services, including décor, lighting, and seating arrangements, driving up expenditure in this category. Simultaneously, catering has evolved beyond traditional menus to feature regional cuisines, fusion dishes, live food stations, and gourmet presentations, all tailored to enhance guest satisfaction and create memorable experiences.

Event planning for destination weddings is projected to grow at a CAGR of 17.5% over the forecast period of 2025-2033. As more couples opt for unique locations, multi-day itineraries, and personalised experiences, the need for professional planners who can manage logistics, vendor coordination, compliance, and thematic execution has grown significantly. Destination weddings often involve guests traveling from multiple locations, requiring detailed planning across accommodation, transport, and event flow. In addition, couples are seeking seamless, end-to-end services that reflect their vision while ensuring operational efficiency.

Expenditure Insights

Destination weddings under USD 18,000 accounted for a revenue share of 40.30% in the year 2024 in the India destination wedding industry. Couples are increasingly choosing intimate weddings that balance affordability with atmosphere, particularly in domestic locations such as Pushkar, Coorg, and Lonavala. These regions offer a compelling mix of natural beauty, cultural relevance, and reasonably priced hospitality services. For instance, a two-day event at a mid-range resort in Coorg can include venue access, themed décor, curated menus, and guest accommodation within this price point, without compromising the overall experience. This budget-friendly yet refined approach resonates with modern couples who prioritise thoughtful planning and destination appeal, positioning the sub-USD 18,000 segment as a key volume driver in the industry.

Destination weddings between expenditure of USD 60,000 - USD 120,000 are projected to grow at a CAGR of 15.9% over the forecast period of 2025-2033, driven by a growing segment of affluent consumers seeking high-end, immersive wedding experiences. This expenditure range allows couples to access premium venues, multi-course catering, bespoke décor, and curated entertainment across multiple days. Destinations such as Jaipur, Udaipur, and international locations such as the Maldives or Dubai are especially attractive to this demographic due to their reputation for offering luxury, heritage, and world-class hospitality. For example, a two-night wedding celebration at a five-star heritage hotel in Jaipur, featuring designer décor, live performances, and exclusive guest services, typically aligns with this budget.

Key India Destination Wedding Company Insights

The India destination wedding market is a vibrant blend of legacy planners, emerging experiential brands, and hospitality partners, all adapting to shifting expectations around scale, personalization, and location. Leading service providers focus on delivering high-touch, multi-day celebrations that combine cultural richness with logistical precision, offering everything from curated venues and décor to entertainment and guest hospitality. These businesses extend their reach through strategic ties with luxury resorts, heritage sites, tourism boards, and digital platforms, addressing the diverse preferences of modern Indian couples across budgets and geographies. With rising demand for immersive, meaningful weddings, the market is increasingly shaped by preferences for destination diversity, theme-based execution, and guest-centric experiences. Couples favor scenic domestic venues such as Jaipur, Udaipur, and Goa, alongside international favorites like Bali and Dubai, prompting vendors to innovate around storytelling, tech-enabled planning, and sustainability. Flexible delivery models and agile vendor networks allow providers to serve both intimate and large-scale events with equal attention to detail, aligning offerings with lifestyle aspirations and evolving cultural narratives.

Key India Destination Wedding Companies:

- Shaadi Squad

- Tamarind Global Weddings

- MOTWANE

- Weddingz.in

- Backstage Productions (The Wedding Design Company)

- IWP Weddings

- Vivaah Celebrations

- Shandaar Events

- The Grand Indian Wedding Co

- Touchwood Entertainment Ltd.

Recent Developments

-

In April 2025, Tivoli Hospitality Group introduced a new destination under its "Wedcation by Tivoli" brand in Jim Corbett, Uttarakhand. This property offers a mix of celebration and leisure, catering to weddings as well as nature-centric getaways. With 70 rooms, large banquet spaces, and wellness offerings, the venue is designed for multi-day wedding experiences set in a natural environment. Guests can enjoy activities like forest walks, yoga sessions, and safaris alongside the wedding festivities. Developed in partnership with a local collaborator, Tivoli manages the operations and guest experience, while the partner handles infrastructure and compliance. The launch supports Tivoli’s goal of expanding into emerging wedding destinations and offering immersive, eco-conscious celebrations beyond traditional venues.

-

In July 2024, Weddingz.in launched a specialized service to simplify destination wedding planning across India. This new offering assists couples in selecting ideal venues based on their preferences and budgets in key locations like Udaipur, Goa, Jaipur, and Lonavala, with plans to expand to scenic spots such as Shimla, Mussoorie, and Pushkar. The service includes venue shortlisting, guided site visits for families, deal negotiations, and logistical coordination, even across multiple cities. For those seeking a full-service experience, Weddingz.in also provides comprehensive planning and execution at a minimal additional cost. Partnering with renowned hospitality brands like Lemon Tree, Radisson, Holiday Inn, and ITC Hotels, the company aims to make destination weddings more streamlined and accessible for a broader range of couples.

India Destination Wedding Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 18.37 billion

Revenue forecast in 2033

USD 55.39 billion

Growth rate

CAGR of 14.8% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, service type, expenditure

Country scope

India

Key companies profiled

Shaadi Squad; Tamarind Global Weddings; MOTWANE; Weddingz.in; Backstage Productions (The Wedding Design Company); IWP Weddings; Vivaah Celebrations; Shandaar Events; The Grand Indian Wedding Co; Touchwood Entertainment Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Destination Wedding Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the India destination wedding market report on the basis of type, service type and expenditure:

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Beach & Island

-

Royal & Heritage

-

Luxury Resort

-

Hill Station & Mountain

-

Others

-

-

Service Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Event Planning

-

Makeup Services

-

Catering & Venue

-

Photography & Videography

-

Decoration Services

-

Logistics

-

Invitations & Gifting

-

Music & DJ

-

-

Expenditure Outlook (Revenue, USD Billion, 2021 - 2033)

-

Under USD 18,000

-

USD 18,000 - USD 30,000

-

USD 30,000 - USD 60,000

-

USD 60,000 - USD 120,000

-

Above USD 120,000

-

Frequently Asked Questions About This Report

b. The India destination wedding market was estimated at USD 16.25 billion in 2024 and is expected to reach USD 18.37 billion in 2025.

b. The India destination wedding market is expected to grow at a compound annual growth rate of 14.8% from 2025 to 2033 to reach USD 55.39 billion by 2033.

b. Beach & island destination weddings accounted for a revenue share of 33.21% in the India destination wedding industry in 2024. The segment benefits from the popularity of coastal resorts that combine leisure with celebration. Demand is further lifted by the trend of hosting weddings in naturally scenic, getaway-style settings.

b. Some of the key players in the India destination wedding market include Shaadi Squad; Tamarind Global Weddings; MOTWANE; Weddingz.in; Backstage Productions (The Wedding Design Company); IWP Weddings; Vivaah Celebrations; Shandaar Events; The Grand Indian Wedding Co; Touchwood Entertainment Ltd.

b. The India destination wedding market is fueled by rising disposable incomes and a growing preference for experiential celebrations. Hospitality and tourism infrastructure have expanded with luxury resorts and heritage properties catering to wedding events.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.