India Fluoropolymer Market Size & Trends

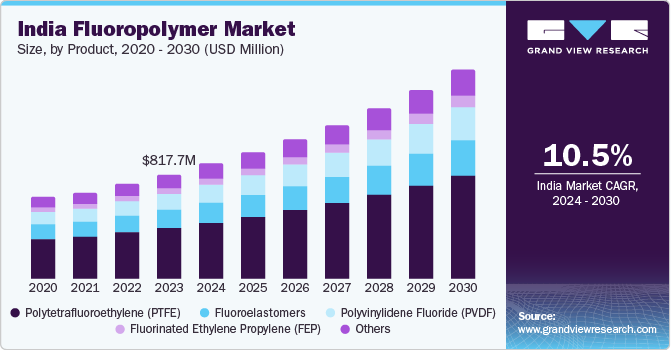

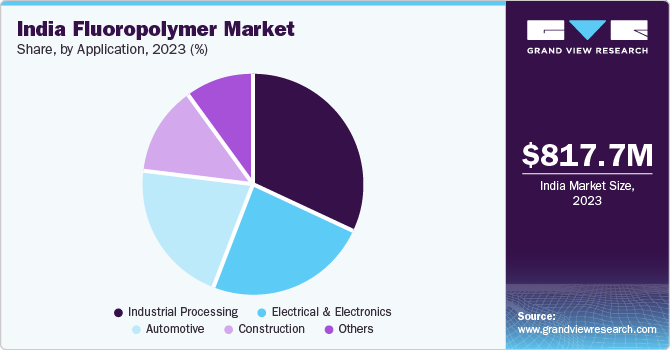

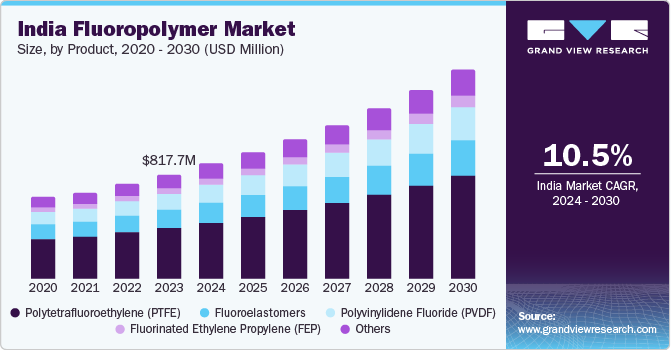

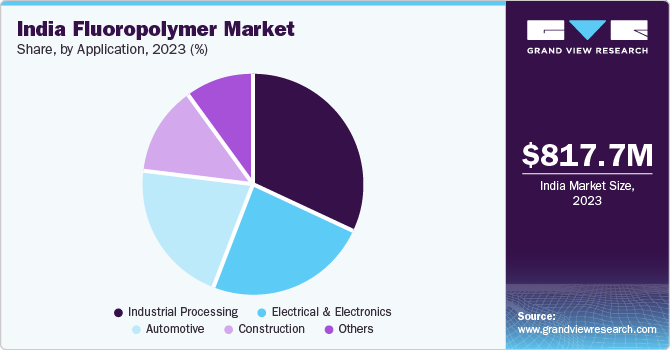

The India fluoropolymer market size was valued at USD 817.7 million in 2023 and is projected to grow at a CAGR of 10.5% from 2024 to 2030. The India fluoropolymer market has experienced sustained growth driven by factors such as rising demand from core industries, increased manufacturing activity, innovation, and the development of new products, as well as regulatory pressures and consumer awareness of high-performance materials.

The demand from various industries is a significant market driver in the country, with the automotive and electrical & electronics sectors being major contributors. Fluoropolymers are increasingly used in automotive components to enhance vehicle performance, safety, and efficiency, while their chemical resistance, thermal stability, low friction properties, and flame resistance make them an essential material in the electrical and electronic industry.

Government initiatives and policies also play a crucial role in driving the growth of the India fluoropolymer market. The National Chemical and Petrochemical Policy aims to promote research and development, enhance manufacturing capabilities, and foster innovation in the chemical industry, including fluoropolymers. The Make in India campaign has attracted domestic and foreign investments in fluoropolymer production, bolstering the domestic market. Furthermore, new environmental legislations that emphasize emission reduction and waste management are encouraging the use of better quality and eco-friendly materials, such as fluoropolymers.

Technological advancements are also driving growth in the India fluoropolymer market. Advances in production technologies have led to the creation of new grades of fluoropolymers that can meet specific requirements in different industries. Moreover, government spending on infrastructure projects is supporting the market growth. Fluoropolymers are used in construction applications, such as coatings and sealants, which provide resistance to weather and chemical conditions.

Product Insights

Polytetrafluoroethylene (PTFE) dominated the market with a revenue share of 48.9% in 2023. PTFE is a highly versatile material, renowned for its exceptional compatibility with a wide range of chemicals, making it a popular choice in the chemical, pharmaceutical, and food processing industries. Its low wear and tear properties also render it suitable for mechanical applications. Furthermore, its high electrical insulation properties make it an ideal material for electronic applications.

Fluorinated ethylene propylene (FEP) is expected to register the fastest CAGR of 11.6% during the forecast period. FEP is a high-performance material, boasting excellent chemical resistance, high thermal stability, and low friction properties. Its flexibility is a key factor driving its widespread adoption. Established manufacturers focus on producing high-quality FEP products, ensuring a steady supply and commitment to research and development to enhance its properties and expand its applications.

Application Insights

Industrial processing dominated the market with a revenue share of 31.7% in 2023. Fluoropolymers have become a vital component in various industries, including chemical and pharmaceutical, food processing, and electrical. Their applications are predominantly in coating, sealing, gaskets, and lining due to their exceptional heat and chemical resistance. As industries increasingly demand high-performance materials, fluoropolymers’ popularity has continued to grow, driven by the need for reliable and durable solutions.

The construction segment is expected to register the fastest CAGR of 11.4% over the forecast period. India is focusing on large-scale infrastructure development, particularly in smart cities and housing sectors. To meet these demands, high-performance materials are required, which fluoropolymers excel in delivering through their exceptional durability and longevity. Moreover, fluoropolymer-based insulation materials are gaining popularity in modern building construction, enabling efficient energy management and reduced energy consumption.

Key India Fluoropolymer Company Insights

Some key companies in the India fluoropolymer market include Gujarat Fluorochemicals Limited; GMM Pfaudler; and Nishigandha Polymers; among others. Owing to increasing competition, market participants have been implementing tactics and strategies such as new product launches, enhanced distribution, new product launches, geographical expansion and more.

-

Gujarat Fluorochemicals Limited specializes in the production of fluoropolymers and their derivatives. GFL has established itself as a large producer of fluorinated chemicals in the country.

-

Nishigandha Polymers is a manufacturer and developer of polymer products, with a primary focus on fluoropolymers. The company’s product portfolio includes PTFE, FEP, and PFA, offering a range of solutions for various industries.

Key India Fluoropolymer Companies:

- Gujarat Fluorochemicals Limited

- GMM Pfaudler

- Nishigandha Polymers

- Isha Fluoropolymer Co.

- NexGen

- Scorpion Industrial Polymers Private Limited

- Anhui Sinograce Chemical Co., Ltd.

- Dhwani Polymer

Recent Developments

-

In July 2024, GMM Pfaudler JDS celebrated the grand re-opening of its Americus, GA facility, marking a milestone in its growth and innovation. The newly equipped facility showcases enhanced capabilities and a customer-centric approach.

India Fluoropolymer Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 900.3 million

|

|

Revenue forecast in 2030

|

USD 1.64 billion

|

|

Growth rate

|

CAGR of 10.5% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

|

|

Report coverage

|

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, application

|

|

Country scope

|

India

|

|

Key companies profiled

|

Gujarat Fluorochemicals Limited; GMM Pfaudler; Nishigandha Polymers; Isha Fluoropolymer Co.; NexGen; Scorpion Industrial Polymers Private Limited; Anhui Sinograce Chemical Co., Ltd.; .Dhwani Polymer

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

India Fluoropolymer Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India fluoropolymer market report based on product, and application:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polytetrafluoroethylene (PTFE)

-

Polyvinylidene Fluoride (PVDF)

-

Fluorinated Ethylene Propylene (FEP)

-

Fluoroelastomers

-

Others

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Electrical & Electronics

-

Construction

-

Industrial Processing

-

Others