- Home

- »

- Beauty & Personal Care

- »

-

India Herbal Shampoo Market Size, Industry Report, 2030GVR Report cover

![India Herbal Shampoo Market Size, Share & Trends Report]()

India Herbal Shampoo Market (2025 - 2030) Size, Share & Trends Analysis Report By Form (Liquid, Bars, Powder), By Gender (Men, Women), By Distribution Channel (Supermarket and Hypermarket, Specialty Stores, Pharmacy, Online), And Segment Forecasts

- Report ID: GVR-4-68040-592-9

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

India Herbal Shampoo Market Size & Trends

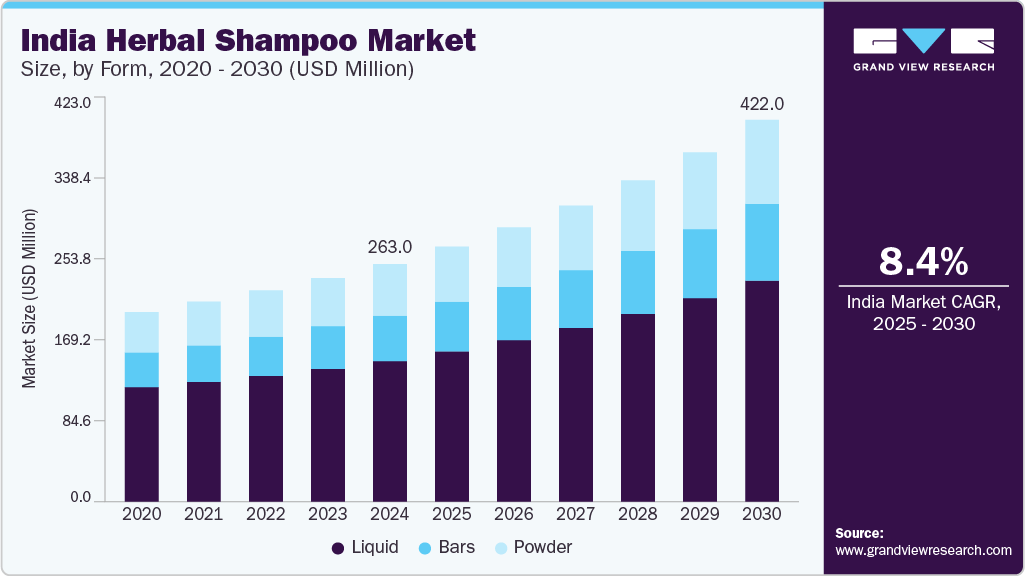

The India herbal shampoo market size was estimated USD 263.00 million in 2024 and is projected to grow at a CAGR of 8.4% from 2025 to 2030. The Indian market is experiencing robust growth in the herbal shampoo industry, driven by a confluence of consumer preferences, cultural heritage, product innovation, and strategic industry initiatives. The preference for ayurvedic products is also driven by consumer trust in their safety and efficacy. A study published in the International Journal of Creative Research Thoughts indicates that Indian consumers are increasingly inclined towards herbal products, perceiving them as more effective and free from harmful chemicals.

Indian consumer preference for natural, chemical-free alternatives rooted in traditional Indian wellness systems has prompted companies such as Patanjali, Dabur, and Hindustan Unilever (HUL) to invest heavily in this space. Patanjali has played a key role in popularizing ayurvedic products at scale, leveraging nationalistic sentiment and the appeal of swadeshi (local) goods.

In 2021, under the Atma Nirbhar Bharat initiative, the Ministry of Finance announced a ₹4,000 crore package to promote herbal cultivation. This scheme aims to boost the availability of quality raw materials for herbal products, including hair care items, by supporting the cultivation and marketing of medicinal plants. Additionally, initiatives like the AYUSH (Ayurveda, Yoga & Naturopathy, Unani, Siddha, and Homeopathy) Entrepreneurship Development Scheme offer financial aid, subsidies, and loans to startups and MSMEs engaged in the AYUSH sector, promoting innovation in herbal hair care products.

The dominance of sachets in India stems from the fact that a large portion of the population prefers to buy products in small quantities on a daily or weekly basis rather than monthly, making these small, affordable packs highly convenient. Additionally, sachets serve as an accessible entry point to premium brands that consumers might not otherwise afford in full-sized packaging.Sachets, priced as low as ₹1-₹2, make herbal shampoos accessible to a broader audience. Their affordability and convenience align perfectly with the daily or weekly purchasing habits of millions of consumers. For instance, Himalaya Wellness introduced Dandruff Control Aloe Vera and Hair Fall Control Bhringaraja shampoos in ₹2 sachets, catering to price-sensitive consumers.

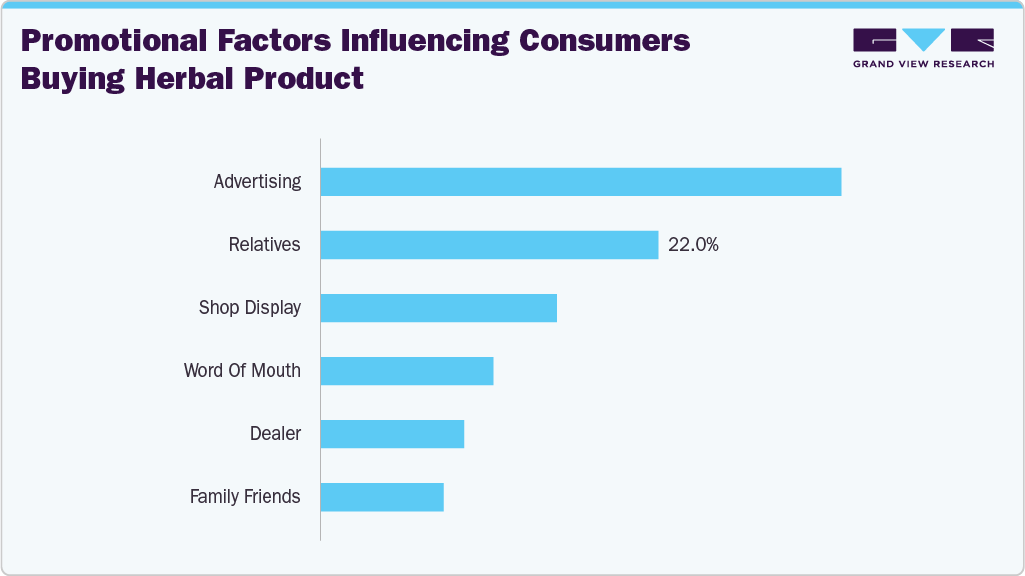

Consumer Insights & Surveys

According to the survey conducted by the International Journal of Emerging Technologies and Innovative Research on herbal hair care products in Tiruppur, Tamil Nadu, in November 2022, Of the 150 survey participants, it was observed that 34% of them were influenced by advertisement, making it the most impactful factor. 22% stated that recommendations from relatives guided their purchase. Another 15% mentioned that shop displays played a role in their decision-making. Meanwhile, 11% were motivated by word of mouth, 9% were influenced by dealers, and 8 said the opinions of family and friends affected their choice to buy herbal hair care products.

Monthly Spending on Herbal Hair Care Products (Rs.)

No. Of Respondents

Percentage

<500 per month

200

48.3%

500 - 1000 per month

129

31.2%

1000-2000 per month

64

15.5%

2000-3000 per month

15

3.6%

3000-4000 per month

5

1.2%

4000-5000 per month

1

0.2%

Above 5000 per month

0

0.0%

The survey of monthly spending on herbal hair‑care products shows that nearly half of respondents (48.3%) spend less than ₹500 per month. A further 31.2% fall into the ₹500-₹1,000 bracket, while 15.5% spend between ₹1,000 and ₹2,000. Relatively few respondents allocate more: 3.6% spend ₹2,000-₹3,000, 1.2% spend ₹3,000-₹4,000, just 0.2% spend ₹4,000-₹5,000, and none report spending above ₹5,000. Overall, over 94% of users invest ₹1,000 or less monthly in herbal hair care.

Form Insights

The liquid herbal shampoo segment accounted for a share of about 59.30% of the Indian herbal shampoo market in 2024, driven by several practical benefits that resonate with consumer preferences. First, its familiar liquid format is easy to apply and fits naturally into everyday hair‑care routines. Liquid shampoos are readily available through a wide range of outlets-supermarkets, pharmacies, and online retailers-offering convenience and broad distribution. Additionally, their flexible formulations allow manufacturers to blend diverse herbal ingredients tailored to specific hair types and concerns, further boosting their appeal.

Demand for herbal shampoo bars is projected to rise at a CAGR of 9.4% from 2025 to 2030 in the herbal shampoo industry.Solid shampoo bars are rapidly emerging as a sustainable alternative to conventional liquid shampoos, fueled by increased environmental consciousness and a shift toward zero‑waste living. Their minimal packaging and lower carbon footprint make them especially attractive to eco‑minded consumers. Because they’re highly concentrated, a single bar can last two to three times longer than a standard shampoo bottle, delivering cost savings over time. The compact, spill‑proof design also makes them perfect for travel. Formulated without sulfates and often enriched with natural ingredients, they’re gentler on sensitive scalps and free of harsh chemicals.

Gender Insights

Women segment accounted for the largest share of 70.56% of the overall India herbal shampoo market in 2024, due to a blend of biological, behavioral, and cultural influences that shape their hair care habits. Societal beauty norms and socialmedia exposure have amplified this tendency, as influencers and peer endorsements highlight the benefits of herbal hair care. Brands have capitalized on this dynamic through targeted marketing, offering products with features and packaging designed to appeal to female consumers and emphasizing values like sustainability. Moreover, cultural traditions celebrate natural and Ayurvedic hair‑care rituals, leading women to favor products rooted in herbal ingredients.

The men's segment is expected to grow at a CAGR of 8.8% from 2025 to 2030 in the herbal shampoo industry, driven by a growing recognition among men of the benefits of natural and organic hair‑care products. Rising interest in men’s grooming and self-care routines has prompted more male consumers to seek out premium, plant-based solutions. Furthermore, social‑media trends and targeted marketing campaigns positioning men’s hair care as essential for healthy, stylish looks are fueling this growth.

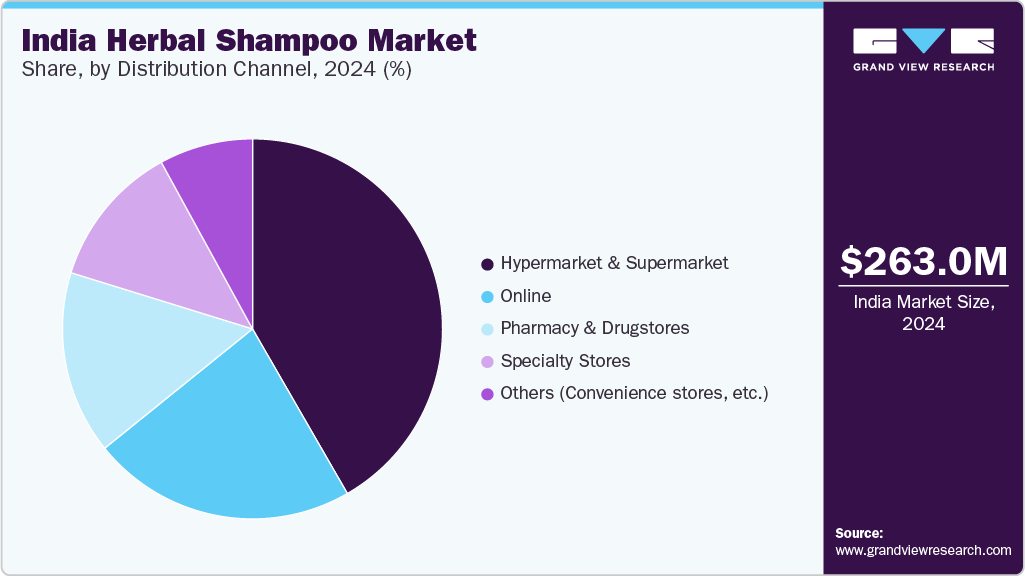

Distribution Channel Insights

The distribution through hypermarkets and supermarkets accounted for a share of 41.68% of the Indian herbal shampoo market in 2024 due to their ability to offer various products, competitive pricing, and enhanced customer convenience. The sophisticated supply chains guarantee consistent availability, even in smaller towns, fostering consumer trust and loyalty. Consumers are drawn to these markets and stores for their compelling discounts and promotional offers. The ability to physically interact with products-inspecting packaging, reviewing ingredient lists, and evaluating options in person.

The online sales channels are anticipated to register a CAGR of 9.4% from 2025 to 2030 in the herbal shampoo industry. Consumers are increasingly turning to e-commerce platforms for the convenience of 24/7 access, wider product variety, and the ability to read reviews and compare prices before purchasing. Subscription and auto‑reorder options ensure consumers never run out of their favorite formulas, and digital marketing via influencers, targeted ads, and social‑commerce tie‑ups keeps herbal lines in mind. Finally, as Internet and smartphone penetration deepen in smaller towns, the online channel has become the easiest way for consumers everywhere to access niche, premium, and hard‑to‑find herbal shampoos.

Key India Herbal Shampoo Company Insights

The dominance of major Indian herbal shampoo companies such as Procter & Gamble (P&G), Dabur Private Limited, and Himalaya Wellness Limited, continues to define the upper tier of the competitive spectrum.

-

CavinKare Private Limited, founded in 1983 and headquartered in Chennai, is a diversified FMCG company best known for pioneering the shampoo sachet in India. It has grown from a single personal‑care brand (Chik) into a portfolio of over 30 brands across hair care, skin care, foods & snacks, dairy and beverages, and professional salon products. With a strong rural distribution network, a dedicated R&D center, and a presence in more than 44 countries, CavinKare combines affordable and value‑priced innovations.

-

Himalaya Wellness Company, founded in 1930 and headquartered in Bengaluru, is India’s pioneer in ayurvedic‑inspired personal care and wellness products. Best known for its Himalaya Herbals line, the company combines traditional botanical knowledge with modern research to develop shampoos, skincare, baby care, and over‑the‑counter health supplements. With a presence in over 90 countries, Himalaya emphasizes rigorous quality control, sustainable sourcing of herbs, and eco‑friendly packaging.

Key India Herbal Shampoo Companies:

- The Procter & Gamble Company (Herbal Essences)

- Unilever PLC

- Dabur India Limited

- Cavinkare Private Limited

- Patanjali Ayurved Limited

- Himalaya wellness Company

- Khadi Natural Healthcare (India)

- Biotique Ayurvedics Pvt. Ltd.

- Forest Essentials (A luxasia Company)

- Amway India Private Limited

Recent Developments

-

In February 2024, Herbal Essences launched the "Pure Plants of Aloe and Camellia Oil" collection, comprising 11 new shampoos and conditioners. These products are formulated with at least 96% natural-origin ingredients, including aloe and camellia oil, and are certified by the Royal Botanic Gardens, Kew. The new formulations aim to provide nourishment without weighing down the hair and are free from parabens and sulfates. Additionally, the packaging has been redesigned to use 25% less plastic and includes tactile markings to assist visually impaired consumers.

-

In May 2023, CavinKare launched ‘Natural & Pure’ a sulfate-free haircare range under Nyle, a no‑sulfate, herbally infused shampoo range under its Nyle Naturals brand. Developed to deepen CavinKare’s footprint in “clean” hair care, the line features three variants-Argan Oil & Avocado, Tea Tree & Rosemary, and Murumuru Butter-each formulated to address specific concerns (frizz control, dandruff defense, deep nourishment) without parabens or harsh detergents.

-

In June 2022, P&G announced the launch of its first high-performing shampoo and conditioner bars across its European haircare portfolio, including Herbal Essences. These solid bars are packaged in recyclable, FSC-certified paper boxes, aligning with the company's commitment to reducing plastic waste. Each bar is designed to last as long as two 250ml bottles of liquid shampoo, offering an eco-friendly alternative without compromising performance. The bars feature easy-to-hold shapes with integrated cotton ropes for convenient storage in the shower. This initiative is part of P&G Beauty's broader goal to reduce virgin plastic usage by 50% by 2025, equivalent to eliminating approximately 300 Million plastic bottles annually.

India Herbal Shampoo Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 281.9 million

Revenue forecast in 2030

USD 422.0 million

Growth rate (Revenue)

CAGR of 8.4% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, gender, and distribution channel

Country Scope

India

Key companies profiled

The Procter & Gamble Company (Herbal Essences); Unilever PLC; Dabur India Limited; Cavinkare Private Limited; Patanjali Ayurved Limited; Himalaya wellness Company; Khadi Natural Healthcare (India); Biotique Ayurvedics Pvt. Ltd.; Forest Essentials (A luxasia Company); Amway India Private Limited.

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Herbal Shampoo Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India herbal shampoo market report based on form, gender, and distribution channel.

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid

-

Bars

-

Powder

-

-

Gender Outlook (Revenue, USD Million, 2018 - 2030)

-

Women

-

Men

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarket and Hypermarket

-

Specialty Stores

-

Online

-

Pharmacy and Drugstores

-

Others (Convenience stores, etc.)

-

Frequently Asked Questions About This Report

b. The India herbal shampoo market was estimated at USD 263.0 million in 2024 and is expected to reach USD 281.9 million in 2025.

b. The India herbal shampoo market is expected to grow at a compound annual growth rate of 8.4% from 2025 to 2030 to reach USD 422.0 million by 2030.

b. The liquid herbal shampoo segment accounted for a share of about 59.30% of the India herbal shampoo market in 2024 due to several practical advantages that align with consumer needs and habits. their flexible formulations allow manufacturers to blend diverse herbal ingredients tailored to specific hair types and concerns, further boosting their appeal.

b. Some of the key players in the India herbal shampoo market is - The Procter & Gambler Company (Herbal Essences); Unilever PLC; Dabur India Limited; Cavinkare Private Limited; Patanjali Ayurved Limited; Himalaya wellness Company; Khadi Natural Healthcare (India); Biotique Ayurvedics Pvt. Ltd.; Forest Essentials (A luxasia Company); Amway India Private Limited.

b. The Indian herbal shampoo market is experiencing robust growth in the herbal shampoo industry, driven by a confluence of consumer preferences, cultural heritage, product innovation and strategic industry initiatives.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.