- Home

- »

- Nutraceuticals & Functional Foods

- »

-

India Liquid Dietary Supplements Market Size Report, 2030GVR Report cover

![India Liquid Dietary Supplements Market Size, Share & Trends Report]()

India Liquid Dietary Supplements Market (2025 - 2030) Size, Share & Trends Analysis Report By Ingredients (Vitamins, Botanicals, Minerals), By Type (OTC, Prescribed), By Application, By End-use (Adults, Geriatric), By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-658-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

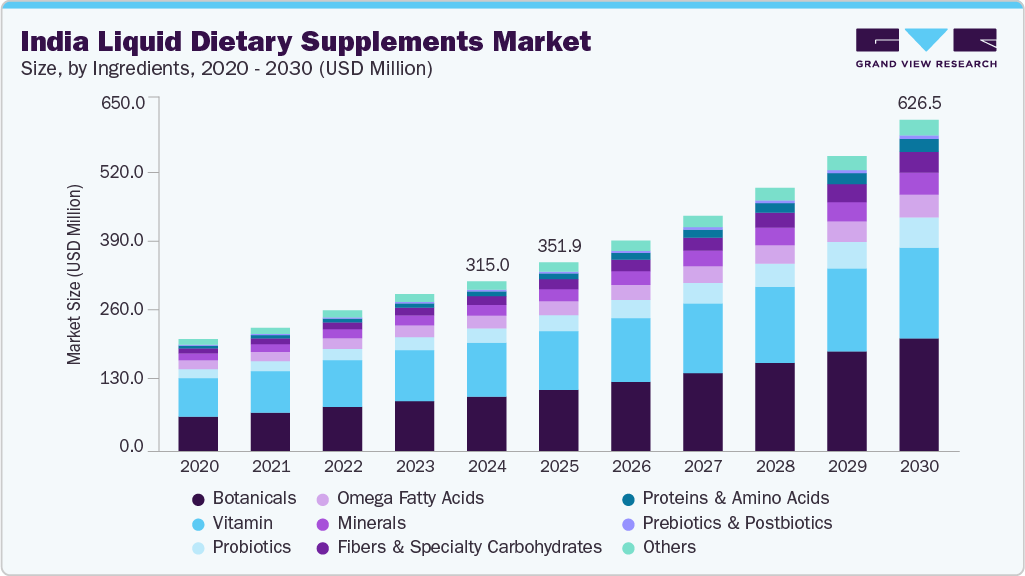

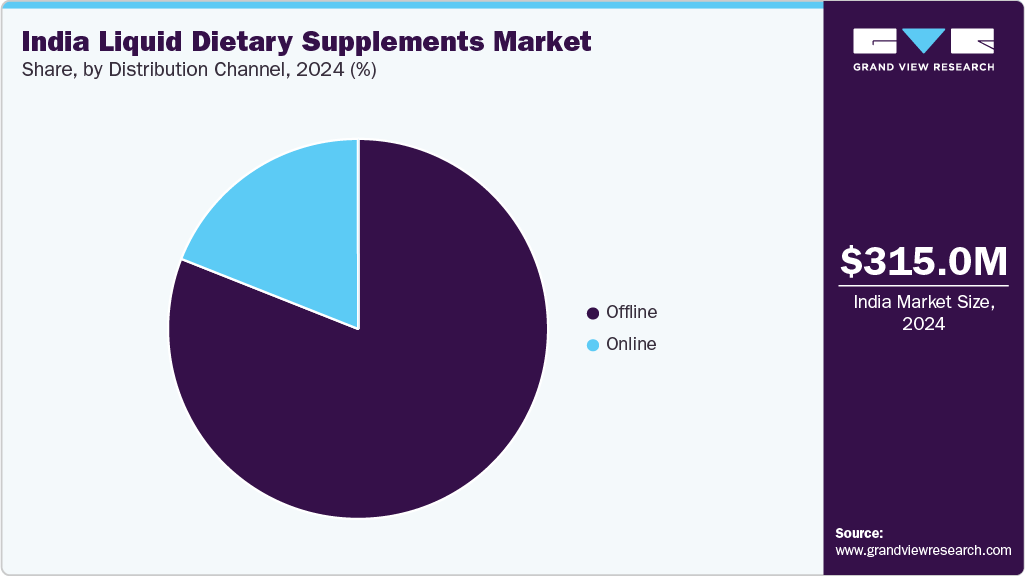

The India liquid dietary supplements market size was estimated at USD 315.0 million in 2024 and is projected to grow at a CAGR from 12.2% from 2025 to 2030. Growing awareness regarding personal health and wellness leads to the growing adoption of nutrition supplements. With changing lifestyles in urban areas, there’s a rising demand for convenient liquid supplements. Traditional herbs and Ayurveda ingredients in India are being reintroduced in modern liquid forms, appealing to a broad audience. The increase in disposable income and easy product availability are accelerating market growth.

There is a growing focus on health issues associated with modern lifestyles, such as fatigue, low immunity, digestive imbalances, and nutritional shortfalls. Consumers continuously recognize the significance of improved nutritional choices in preserving overall wellness. Liquid supplements are increasingly preferred for easy ingestion, quick absorption, and a natural base. Products such as amla shots, aloe vera juice, herbal concoctions, and multivitamin tonics are included in the nutrition regimes of numerous Indian consumers.

Changing consumer preferences stimulate product innovation, development of novel formulations and new product launches in India liquid dietary supplements market. For instance, Dabur offers “Restora Gold”, a nutritional tonic formulated with apples, dates, ashwagandha and grapes. Similarly, Cipla Health provides its multivitamins with a high-impact campaign led by a local celebrity, endorsing daily energy and immunity.

Companies are introducing new products in the country to cater to fitness enthusiasts and athletes. For instance, in 2022, MuscleBlaze, a nutraceutical company in India, rolled out new RTD protein shakes containing 18g of protein per bottle. These have been made available in country-specific flavors, including mango lassi and kulfi, boosting appeal and local connection. In addition, Amul, a prominent dairy and nutraceutical brand in India, also rolled out protein drinks with a line of flavors, increasing reach to mass consumers over premium fitness enthusiasts.

Emerging brands offer innovation-based product lines, including convenient nutrition products such as ready-to-drink protein blends, energy tonics, and liquid multivitamin solutions. These offerings are effectively distributed through e-commerce channels and subscriptions across key urban areas such as Mumbai, Delhi, Hyderabad, Bengaluru, Pune, Chennai, and others, where demand for such wellness products is rising. Growing product awareness and easy accessibility through online delivery portals, quick-commerce platforms, and e-commerce websites facilitate the growth of this market.

Consumer Insights

In India, many consumers opt for liquid dietary supplements as a part of their daily health routine. The consumers prefer convenience, quicker absorption, and improved taste over traditional capsules or powders. Working professionals and young adults exhibit a strong trend towards health tonics, multivitamin shots, and herbal juices that can be incorporated into daily routines without any inconvenience. These trends are encouraging companies to include more ready-to-drink liquid formats in portfolios usually formulated with natural ingredients such as Indian basil, gooseberry, or Ashwagandha, designed for applications such as immunity or digestion.

India liquid dietary supplements market is highly influenced by increasing awareness among urban consumers and growing availability information facilitated by increasing ubiquity of smartphones and technology driven devices. According to a survey conducted by LocalCircles in 2024, nearly 71.0% of the Indian households consume some form of nutraceuticals to fulfill their daily intake of vitamins, minerals, and protein. Particularly, working women aged 25-45 show higher adoption (48%) of supplements for immunity, digestion, and bone health. A majority of these consumers prefer OTC supplements in liquid form for ease of consumption and fast absorption.

Ingredient Insights

The botanical segment accounted for the largest revenue share of 33.0% in 2024.The growth of the segment is attributed to the strong positioning at the convergence of cultural familiarity, functional health relevance, and distribution strength. The dominance is sustained by consumer preference for herb-based formulations that are perceived as low-risk and suitable for routine intake. Local players, including Dabur, Sri Sri Tattva, and Baidyanath, include Ayurveda ingredients to formulate liquid dietary supplements, which widely distributed through organized retail chains. The portfolios, ranging from various Ayurveda-based tonics are delivered for specific applications such as immunity, digestion, and fatigue.

Proteins and amino acids segments are expected to grow at the highest CAGR of 17.4% during the forecast period. That rapid growth of the segment is fueled by growing awareness regarding significance of health & fitness in urban areas, especially among millennials and Gen Z population who prefer protein consumption on the go, avoiding the hassle of mixing powders or eating full meals. The increasing number of gyms, the growing influence of fitness bloggers, and awareness towards muscle recovery are driving demand for ready-to-consume protein drinks.

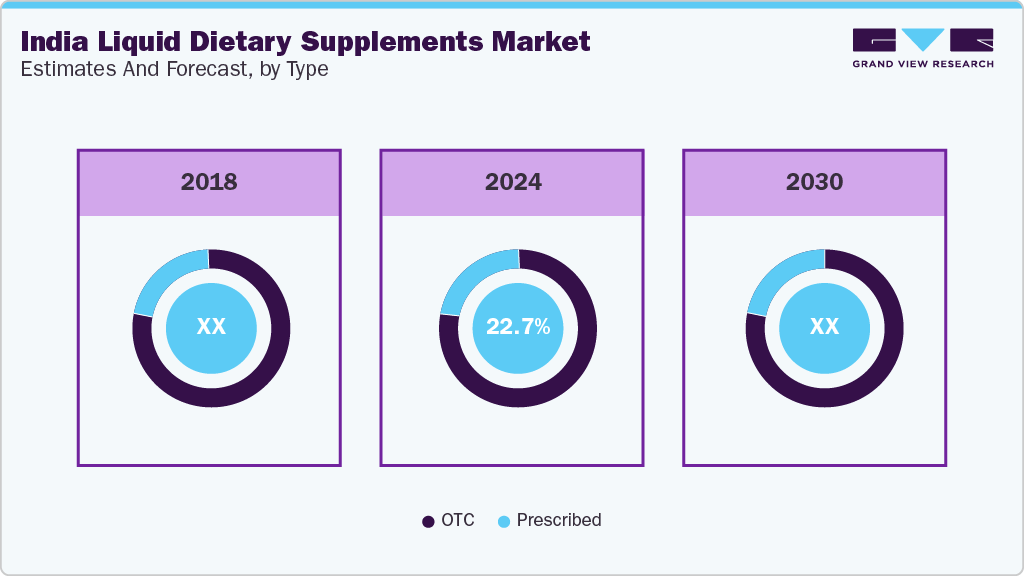

Type Insights

Based on the type, OTC dominates the liquid dietary supplement market in 2024. Increasing awareness towards preventive healthcare, mostly in the metro and tier-1 cities, makes OTC products dominant in the market. The demand for OTC supplements is encouraged by lifestyle-inspired health preferences, reflecting an extensive change in nutrition with health priorities. Liquid multivitamins, electrolyte drinks, and immune-boosting tonics are often procured from local retail chains and e-pharmacies. Homegrown players, including Dabur and Baidyanath Group, have also supported this category through their popular cognitive health-tonics, consistent product innovation, and extensive supply chain.

The prescribed liquid dietary supplements segment is estimated to experience the fastest growth during the forecast period. The growing clinical demand for targeted nutritional intervention, especially among patients looking to recover from surgery, handle chronic deficiencies, or achieve personal health goals, is growing significantly. Companies such as Cipla and Alkem Laboratories have introduced liquid supplements ingredients, including iron, calcium, and protein-rich tonic, for clinical recommendations. With a growing number of consumers opting for prescribed nutrition, the use of prescribed dietary supplements both at the personal and institutional levels is expected to increase.

Application Insights

The immunity segment dominated the market with the largest market share in 2024. This dominance reflects consumer awareness regarding significance of strong immunity, especially after the COVID-19 pandemic and continuous rise in urban pollution levels. Liquid immunity boosters such as Indian Basil-based herbal syrups, vitamin C tonics, and other herb-based drops continue to generate greater customer engagement owing to ease of consumption and fast absorption. Application specific new product developments also contribute to growth experienced by this segment. For instance, in January 2024, Dabur introduced a new ready-to-drink glucose-based immunity supplement with the combination of Tulsi, ashwagandha, and giloy extracts in liquid form. The launch was an addition to the company’s on-the-go glucose drink category, appealing to individuals requiring quick energy and sustained immunity during different seasons. The product was highly preferred by health-aware youngsters and working professionals seeking hydration along with immunity in one drink.

The anti-aging liquid dietary supplements segment is estimated to experience the fastest growth during the forecast period. Collagen-based liquid supplements are driving India’s beauty-from-within trend, as consumers shift from topical products to ingestible solutions that support skin health at a deeper level. These drinks are valued for their convenience and ability to seamlessly integrate into daily routines. This reflects how nutrition-led approaches are accelerating demand for collagen-infused formats that address aging from within. Collagen liquids are emerging as a preferred, science-backed solution for age-conscious Indian consumers seeking beauty through nutrition.

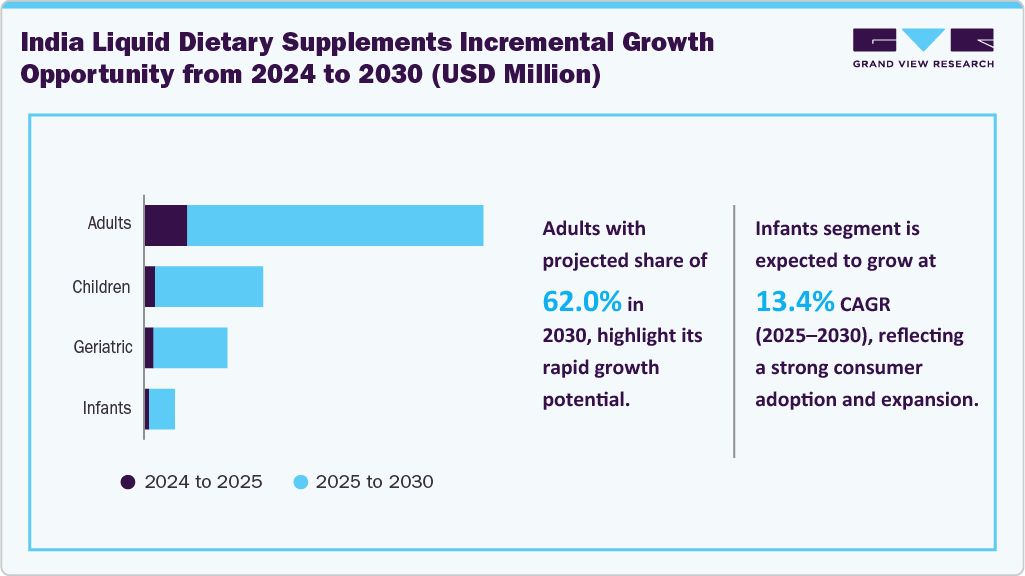

End-use Insights

The adult segment dominated the market with the largest market share in 2024. In India, consumers from the adult age group are actively looking for health and wellness solutions. With increasing stress levels, poor food habits, and busy routines, working adults prefer liquid supplements to increase immunity, support digestion, and manage weight. These supplements are easy to consume, function rapidly, and are often marketed to address common health issues such as fatigue, joint pain, or lifestyle-related deficiencies. In addition, increasing awareness towards preventive healthcare and fitness among young working professionals and elderly consumers significantly increases the demand for liquid dietary supplements.

The infants segment is estimated to witness the fastest growth during the forecast period, driven by rising awareness of early childhood nutrition, particularly in urban areas. Health-conscious parents increasingly prefer supplements that support brain development, immunity, and overall growth. Pediatricians also recommend liquid formats, as they are easier for infants to consume and absorb compared to powders or tablets. With more brands introducing safe, gentle, and organic infant-friendly formulations, this segment is poised for steady expansion, especially among mid- to high-income families in metropolitan regions.

Distribution Channel Insights

The offline channel dominated the market with the largest market share in 2024. The growth of the segment is primarily driven by firm consumer confidence in local pharmacies, health retailers, and over-the-counter outlets, which continue to play a pivotal role in supplementing purchases across the country. Traditional consumers and residents in tier 2 and tier 3 cities prefer conventional buying experiences that allow in-person product evaluation and pharmacist interaction for opinions. Offline formats also reduce dependency on digital access and online payments, making them more inclusive for a wider consumer segment. The channel further benefits from a well-established distribution network, immediate product availability, and trust-based, recommendation-led purchase behavior.

The online channel segment is estimated to witness the fastest growth during the forecast period. The rapid expansion of e-commerce platforms, health-focused portals, and direct-to-consumer brand websites fuels this acceleration. Urban consumers, particularly millennials and Gen Z, are increasingly opting for digital channels driven by convenience, broader product variety, and competitive pricing. Features such as subscription models, doorstep delivery, and real-time comparisons enhance the buyer experience. In addition, influencer marketing, targeted ads, and wellness content have improved brand visibility and consumer engagement. With growing digital literacy and mobile accessibility, online sales of liquid supplements are expected to expand rapidly across the country’s urban and semi-urban areas.

Key India Liquid Dietary Supplements Company Insights

Some of the key companies operating in India liquid dietary supplements industry include Amway India Enterprises Pvt. Ltd, Biovencer Healthcare Private Limited, Herbalife International India Private Ltd., Archer Daniels Midland Company, and others.

-

Biovencer Healthcare Pvt. Ltd. is recognized for its extensive range of liquid multivitamin and multimineral syrups, catering to diverse nutritional needs across age groups. Their offerings focus on immunity, bone health, and general wellness, providing easy-to-consume liquid formats that appeal to both children and adults.

-

Lifegenix offers a comprehensive selection of liquid nutraceutical products and syrups, designed to support overall health and targeted wellness goals. Their range includes liquid multivitamins, mineral supplements, and herbal tonics, all produced under stringent quality standards.

Key India Liquid Dietary Supplements Companies:

- Amway India Enterprises Pvt. Ltd.

- Herbalife International India Private Ltd.

- Lifegenix (Lifecare Neuro Products Ltd., India.)

- Archer Daniels Midland Company

- Abbott India Ltd.

- Pfizer Ltd.

- Biovencer Healthcare Private Limited

- Asterisk Healthcare

- Kabir Lifesciences

India Liquid Dietary Supplements Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 626.5 million

Growth rate

CAGR of 12.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Ingredients, form, type, application, end-use, distribution channel

Key companies profiled

Amway India Enterprises Pvt. Ltd., Herbalife International India Private Ltd., Lifegenix (Lifecare Neuro Products Ltd., India.), Archer Daniels Midland Company, Abbott India Ltd., Pfizer Ltd., Biovencer Healthcare Private Limited, Asterisk Healthcare, Kabir Lifesciences

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Liquid Dietary Supplements Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India liquid dietary supplements market report based on ingredients, form, type, application, end-use, and distribution channel:

-

Ingredients Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (Selenium, Chromium, Copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

OTC

-

Prescribed

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Boomers

-

Male

-

Female

-

-

-

Geriatric

-

Children

-

Infants

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Hypermarkets/Supermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioner

-

Others (Direct to Consumer, MLM)

-

-

Online

-

Amazon

-

Other Online Retail Stores

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.