- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Liquid Dietary Supplements Market Size, Share Report, 2030GVR Report cover

![Liquid Dietary Supplements Market Size, Share & Trends Report]()

Liquid Dietary Supplements Market (2024 - 2030) Size, Share & Trends Analysis Report By Ingredient (Vitamins, Botanicals, Minerals, Protein & Amino Acids, Omega fatty Acids), By Application, By End-user, By Type, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-255-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Liquid Dietary Supplements Market Summary

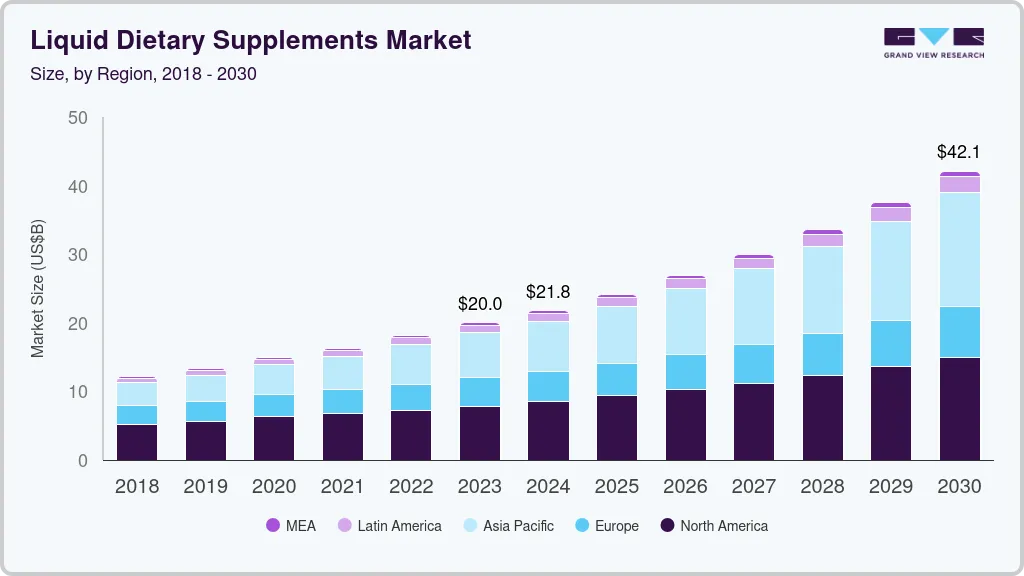

The global liquid dietary supplements market size was estimated at USD 21.56 billion in 2023 and is projected to reach USD 46.23 billion by 2030, growing at a CAGR of 11.6% from 2024 to 2030. Increasing consumer awareness regarding health & wellness, demand for convenient and easy-to-consume nutritional products and rise in the aging population are the major factors contributing to the market growth.

Key Market Trends & Insights

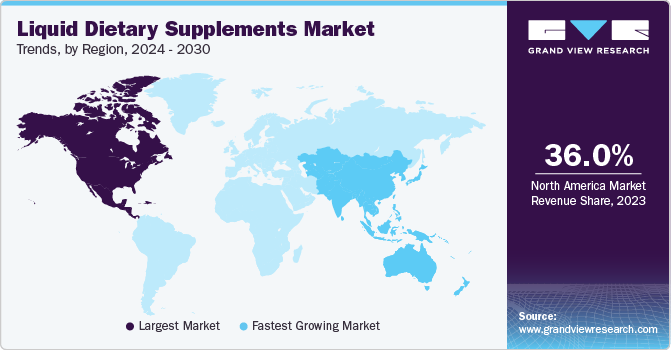

- The liquid dietary supplements market in North America held over 36% of the global revenue in 2023.

- The liquid dietary supplements market in the U.S. is expected to grow at a CAGR of 8.5% from 2024 to 2030.

- By ingedient, the liquid botanical dietary supplements segment accounted for a revenue share of 25.49% in 2023.

- By application, the energy & weight management application accounted for a revenue share of 22.87% in 2023.

- By end-user, the liquid dietary supplements for the geriatric population accounted for a revenue share of 32.33% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 21.56 Billion

- 2030 Projected Market Size: USD 46.23 Billion

- CAGR (2024 - 2030): 11.6%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

According to the World Social Report 2023, the number of people aged 65 years or older worldwide is projected to more than double, from 771 million in 2022 to 1.6 billion in 2050. Moreover, the number of people aged 80 years or older is growing even faster. The rising prevalence of chronic diseases such as obesity, diabetes, and cardiovascular diseasesis anticipated to be a key driver for the increased demand for liquid supplements. These health issues have led to a growing awareness among consumers about the importance of maintaining a healthy diet and taking nutritional supplements to support their overall well-being. Liquid dietary supplements provide an easy and convenient way to meet the recommended daily intake of essential vitamins and minerals, making them a popular choice among consumers.

With advancements in technology and the availability of personalized health data, consumers are now more aware of their unique nutritional needs. This has led to a rise in demand for customized supplements that cater to specific health concerns or deficiencies. Ready-to-drink (RTD) dietary supplements offer the flexibility to adjust the dosage as per individual requirements, making them a preferred choice for personalized nutrition. Besides, liquid food supplements, made from natural ingredients and free from artificial additives, are perceived as a healthier alternative to traditional supplements. This has led to a shift in consumer preferences towards liquid dietary supplements, further driving market growth.

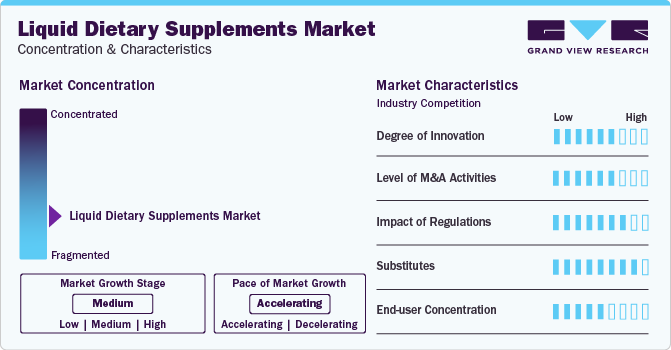

Market Concentration & Characteristics

The global liquid dietary supplements market is characterized by a high degree of innovation, with manufacturers continuously investing in research and development (R&D) to introduce new and innovative products to meet changing consumer needs. These innovations include the use of new ingredients, flavors, and packaging to make the supplements more appealing and convenient for consumers.

The liquid dietary supplements industry has witnessed a significant increase in mergers and acquisitions (M&A) activities in recent years. These activities are driven by the need for companies to expand their product portfolios, increase their market share, and reach new consumer segments.

Companies are required to adhere to various laws and regulations governing the manufacturing, labeling, and marketing of these products. For instance, the U.S. Food and Drug Administration (FDA) has strict regulations for dietary supplements, requiring manufacturers to ensure the safety and quality of their products.

Liquid dietary supplements face competition from various product substitutes, such as tablets, capsules, and powders. These substitutes offer similar benefits and are often considered more cost-effective and convenient by consumers. In addition, the rise of personalized nutrition and the availability of tailored supplements are also posing a threat to the market growth.

Ingredient Insights

The liquid botanical dietary supplements segment accounted for a revenue share of 25.49% in 2023. The dominance can be attributed to the increasing consumer health consciousness and demand for natural and organic products. Unlike traditional supplements in pill or capsule form, liquid herbs and extracts are easy to swallow and can be added to functional beverages, or pharmaceutical formulations. Moreover, the rising prevalence of chronic diseases such as arthritis, cardiovascular problems, and diabetes among the geriatric populace is anticipated to boost the product adoption rate.

The proteins & amino acid-based liquid supplements are anticipated to witness a CAGR of 13.4% from 2024 to 2030. They are essential nutrients that play a crucial role in maintaining overall health and well-being. Unlike protein powders or solid food sources, these liquid supplements can be quickly consumed on the go, making them a popular choice for people with busy lifestyles. According to the World Health Organization (WHO), North Americans consume over twice the protein intake suggested by the Dietary Recommended Intake (DRI). A study titled ‘Protein Fever’ found that over 25% of North Americans are willing to pay more for protein-rich diets.

Applications Insights

The energy & weight management application accounted for a revenue share of 22.87% in 2023. Rising awareness of the benefits of fiber for weight management is attracting sports enthusiasts and fitness professionals towards easy-to-consume formulations. Moreover, liquid pre-workout supplements containing ingredients like caffeine, B vitamins, proteins, and creatine are gaining popularity for their perceived ability to enhance energy, focus, and performance during workouts. Besides, rising awareness regarding weight management among working professionals, on account of increasing concerns over obesity disorders, is projected to amplify the utilization of easy-to-absorb health supplements.

The anti-aging application for liquid dietary supplements is estimated to grow at a CAGR of 15.3% from 2024 to 2030. Increasing demand for anti-aging products, driven by age-related skin problems, such as fine lines, wrinkles, and dullness has resulted in demand for effective nutraceutical products. Moreover, a rise in the spending power of consumers on supplements that help them maintain youthful skin will stimulate the liquid dietary supplements industry size. According to the Population Reference Bureau (PRB), the number of Americans ages 65 and older is projected to increase from 58 million in 2022 to 82 million by 2050.

End-user Insights

The liquid dietary supplements for the geriatric population accounted for a revenue share of 32.33% in 2023. Rising prevalence of cardiovascular diseases (CVD) among the geriatric populace has resulted in an increasing intake of health supplements for maintaining their health and well-being. Liquid dietary supplements have become a popular option for older adults due to their ease of consumption and potential health benefits. According to the American Heart Association (AHA), the incidence of CVD in the U.S. men and women is around 40% from 40 to 59 years, around 75% from 60 to 79 years, and around 86% in those above the age of 80.

The liquid dietary supplements for children are estimated to grow at a CAGR of 13.2% from 2024 to 2030. Factors such as rising awareness of the importance of nutrition for children's growth and development, as well as the convenience and ease of use of liquid supplements are driving the segment growth. With busy schedules and hectic lifestyles, many parents struggle to provide their children with a balanced and nutritious diet. According to the World Health Organization, childhood obesity has more than doubled in the past 20 years, with around 38.9 million children under the age of five being overweight or obese. As a result, parents are turning to liquid supplements as a convenient and effective way to ensure their child is getting the necessary nutrients for optimal growth and development.

Type Insights

The OTC segment accounted for a revenue share of 71.75% in 2023. OTC type offers benefits such as wider distribution of products, making them easily available to consumers in pharmacies, supermarkets, and online retailers. This accessibility, coupled with the rising trend of self-care and self-medication, has led to a significant increase in sales of liquid nutraceuticals through OTC channels. Besides, initiatives related to healthcare infrastructural development along with the introduction of favorable policies by local governments are likely to enhance the popularity and expansion of dietary supplements through OTC channels.

The prescribed segment is estimated to grow at a CAGR of 12.7% from 2024 to 2030. Growing awareness of nutritional deficiencies and the benefits of personalized medicine could drive interest in prescribed products as a potential solution. Hospitals and nursing homes are increasingly incorporating food supplements into their patient care plans, as these nutraceuticals are easy to administer and provide necessary nutrition to patients who are unable to consume solid food.Lower awareness among many individuals about self-medication will further boost the medical practitioners' prescribed products segment growth.

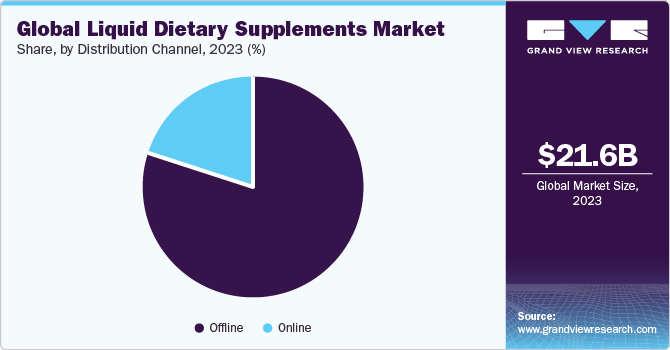

Distribution Channel Insights

The sales of liquid dietary supplements through offline channels accounted for a revenue share of 80.05% in 2023. Offline channels offer wider accessibility, especially in regions with limited internet penetration or for demographics less comfortable with online shopping. They also offer personalized shopping experience for consumers, with the opportunity to speak with knowledgeable staff and receive recommendations tailored to their specific needs. Easy availability of these products in supermarkets & hypermarkets, pharmacies, and specialty stores will further contribute to segment dominance over the coming years.

The sales of liquid dietary supplements through online channels are expected to grow at a CAGR of 12.7% from 2024 to 2030. Factors such as increasing number of internet users, ease of access to a number of brands, fast-paced lifestyle of the masses, 24/7 availability of products, convenience of shopping, and a wide range of products offered are contributing to segment growth. Moreover, the presence of different discussion portals, discounts and offers, easy payment options, and various promotion strategies are projected to further drive sales through online channels.

Regional Insights

The liquid dietary supplements market in North America held over 36% of the global revenue in 2023. North America has a vast population facing increased obesity levels and lifestyle-related diseases on account of their dietary habits, and availability of several processed & ready-to-eat foods, which are not necessarily good for consumer health. However, increasing consumer awareness about the benefits of dietary supplements, growth in aging population, and the rise of health and wellness trends are contributing to an increase in the adoption of food supplements and nutraceuticals among consumers in the region.

U.S. Liquid Dietary Supplements Market Trends

The liquid dietary supplements market in the U.S. is expected to grow at a CAGR of 8.5% from 2024 to 2030, owing to the increasing health consciousness and a rise in the aging population, the demand for liquid dietary supplements has surged, leading to a booming market for these products in the U.S. Moreover, rising awareness about the importance of maintaining a healthy lifestyle has created potential growth opportunities for the U.S. market. People are becoming more conscious of their diet and are actively seeking ways to improve their overall health and well-being. This has led to a shift towards preventive healthcare, with more and more individuals opting for dietary supplements to fill any nutritional gaps in their diet.

Asia Pacific Liquid Dietary Supplements Market Trends

The liquid dietary supplements market in Asia Pacific is set to grow at a CAGR of about 14.0% from 2024 to 2030. Increasing awareness of preventive healthcare and chronic disease management is driving demand for nutritional supplements. Moreover, with the rise in disposable income and urbanization, there has been a significant shift towards healthier lifestyles,especially among the younger generation. China, Japan, and India are among the largest markets in the Asia Pacific owing to the presence of a large geriatric population and the prevalence of lifestyle diseases such as obesity and diabetes. Furthermore, the busy lifestyle of people in the region has led to a rise in demand for convenient and on-the-go nutritional products.

Key Liquid Dietary Supplements Company Insights

The global liquid dietary supplements market is characterized by intense competition. Brand share analysis indicates that key market players are focusing on strategies such as new product launches, partnerships, mergers & acquisitions, global expansion, and others. Public companies have been proactive in initiating strategies to gain a competitive advantage in the market. In the near term, privately held market participants are expected to follow suit, given the increasing number of players within the industry.

Key Liquid Dietary Supplements Companies:

The following are the leading companies in the liquid dietary dupplements market. These companies collectively hold the largest market share and dictate industry trends.

- Amway

- Nestlé

- Herbalife Nutrition

- Nature's Bounty

- Abbott Laboratories

- DuoLife S.A.

- Pfizer Inc.

- BASF

- Arkopharma

- Bayer

Recent Developments

-

In May 2023, ChildLife Essentials launched a new organic liquid elderberry supplement for kids' immune health. This powerful formula is specifically designed to support kids' immune health and promote overall wellness.

-

In May 2022, Vantage Nutrition acquired Philadelphia-based AquaCap, an asset of Nestlé Health Science. The company specializes in the contract manufacturing of liquid-filled dietary supplement capsules, and its novel liquid delivery technology allows for the liquid filling of hard gelatin and vegetarian capsules.

-

In March 2020, Unilever signed an agreement to acquire Liquid I.V., a California-based nutrition and Wellness Company specializing in powdered drink mixes that utilize the company’s patented Cellular Transport Technology.

Liquid Dietary Supplements Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 23.91 billion

Revenue forecast in 2030

USD 46.23 billion

Growth rate

CAGR of 11.6% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Ingredient, application, end-user, type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; China; India; Japan; South Korea; Australia & New Zealand; Brazil; South Africa

Key companies profiled

Amway; Nestlé; Herbalife Nutrition; Nature's Bounty; Abbott Laboratories; DuoLife S.A.; Pfizer Inc.; BASF; Arkopharma; Bayer.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Liquid Dietary Supplements Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global liquid dietary supplements market report based on ingredient, application, end-user, type, distribution channel, and region:

-

Ingredient Outlook (Revenue in USD Million, 2018 - 2030)

-

Vitamins

-

Botanicals

-

Minerals

-

Proteins & Amino Acids

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Energy & Weight Management

-

General Health

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/Hair/Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

End-users Outlook (Revenue, USD Million, 2018 - 2030)

-

Adults

-

Geriatric

-

Pregnant Women

-

Children

-

Infants

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

OTC

-

Prescribed

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Hypermarkets/Supermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioner

-

Others

-

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global liquid dietary supplements market size was estimated at USD 21.56 billion in 2023 and is expected to reach USD 23.91 billion in 2024.

b. The global liquid dietary supplements market is expected to grow at a compounded growth rate of 11.6% from 2024 to 2030 to reach USD 46.23 billion by 2030.

b. The liquid botanical supplements accounted for a share of 25.50% in 2023. The dominance can be attributed to the increasing consumer health consciousness and demand for natural and organic products. Unlike traditional supplements in pill or capsule form, liquid herbs and extracts are easy to swallow and can be added to functional beverages, or pharmaceutical formulations.

b. Some key players operating in the liquid dietary supplements market include Amway, Nestle, Herbalife Nutrition, Nature's Bounty, Abbott Laboratories, and Pfizer Inc.

b. Key factors that are driving the market growth include Increasing consumer awareness regarding health & wellness, demand for convenient and easy-to-consume nutritional products and rise in the aging population across globe are major factors contributing to the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.