- Home

- »

- Advanced Interior Materials

- »

-

India Metal Stamping Market Size, Industry Report, 2030GVR Report cover

![India Metal Stamping Market Size, Share & Trends Report]()

India Metal Stamping Market (2024 - 2030) Size, Share & Trends Analysis Report By Process, By Application, By Thickness (Less Than & Upto 2.5 mm, More Than 2.5 mm), By Press Type (Mechanical Press, Hydraulic Press, Servo Press), And Segment Forecasts

- Report ID: GVR-4-68040-298-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

India Metal Stamping Market Size & Trends

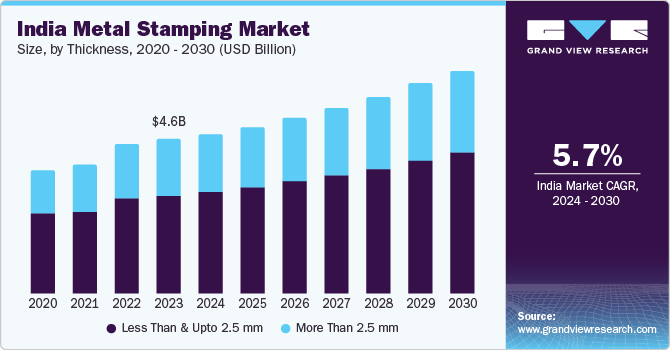

The India metal stamping market was estimated at USD 4.65 billion in 2023 and is projected to grow at a CAGR of 5.7% from 2024 to 2030. The growing demand for metal stamping from the burgeoning electronics industry in India is expected to be a significant driver of market growth. Metal stamping is a critical process that yields precise and vital parts for the manufacture of electronic products.

The increasing consumer demand stemming from the country's rising middle class has facilitated a rapidly growing electronics market. According to Invest India, the production value of electronic components in India is projected to reach USD 18 billion by 2026.

The nation’s robust automobile industry is a crucial driver of market growth, as metal stamping is essential in producing automotive components. The export of passenger vehicles experienced an increase of 14.7% from 2022 to 2023. The industry manufactured a total of 25.9 million vehicles from 2022 to 2023, as per Invest India. In addition, the electronic vehicle market is anticipated to expand at a CAGR of 49% from 2022 to 2030, a lucrative opportunity for market growth. Furthermore, the domestic sales of passenger vehicles have also risen considerably in recent years, and the country holds a strong position in the global heavy vehicles market.

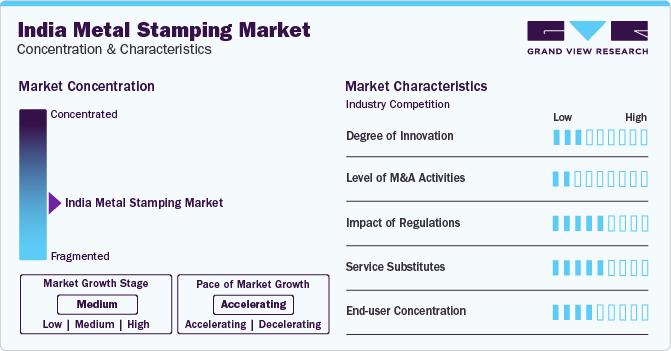

Market Concentration & Characteristics

The industry growth rate is medium, and the pace is accelerating. The industry is moderately fragmented, with the presence of large enterprises and small and medium enterprises (SMEs). The advent of advancements across industries that utilize metal stamping is increasing the requirement for alternatives to metal-stamped products, such as thermoplastics and vulcanized fiber, posing a moderate threat to substitutes.

The players in the industry compete by focusing on production processes that prioritize high levels of precision, cost-effectiveness, and minimal wastage. Moreover, the impact of regulations has been estimated to be moderate, with regulations such as the Restriction of Hazardous Substances (RoHS) Directive influencing material selection and production processes involving metal stamping for electrical and electronic equipment. Regulations established for the end-user industries regarding the safety, quality, and environmental impact play an influential role in the industry.

Process Insights

Based on process, the blanking segment led the market with the largest revenue share of 37.4% in 2023, due to its high relevance in manufacturing automotive components. In addition, the process's significance in India's construction industry, which is expected to witness considerable growth due to the country's increasing demand for residential housing, is boosting segment growth.

The embossing segment is expected to grow at a considerable CAGR over the forecast period. The process transforms metal sheets into durable and textured materials across numerous industries. The branding and functional needs of end-users drive the segment's growth. Companies engaged in manufacturing consumer electronics and numerous other end-users use the process to embed aesthetic 3D structures for their branding needs.

Application Insights

Based on application, the automotive & transportation segment led the market with the largest revenue share of 39.4% in 2023, due to the high demand for precise metal stamping parts due to the role of government regulations and quality control standards. Automakers employ metal stamping when building chassis, seat structures, and other components to adhere to stringent regulations that ensure high levels of consumer safety. For instance, automakers in India must adhere to the Bharat New Vehicle Safety Assessment Program (BNVSAP), a comprehensive vehicle safety assessment program launched by the Government of India to ensure that every new vehicle sold in the nation meets the specified standards.

The electrical & electronics segment is projected to grow at the fastest CAGR over the forecast period, due to the application of metal stamping in manufacturing electronic components such as antennas, casings, and connectors. Government initiatives are fostering the growth of the country's electronics sector. For instance, the government of India aims to make electronics one of the top three export categories by 2025-26, as per the Indian Brand Equity Foundation (an initiative by the Government of India).

Thickness Insights

Based on thickness, less than & upto 2.5 mm segment led the market with the largest revenue share of 63.7% in 2023, due to demand for lightweight and flexible materials. The increasing demand for smartphones and laptops drives the segment growth as metal sheets less than and upto 2.5 mm are used for battery and circuit board components. According to the Indian Brand Equity Foundation, the production value of smartphones in the domestic market has witnessed a growth of 11% from 2023 to 2024.

The segment with more than 2.5 mm is projected to expand at the fastest CAGR over the forecast period, due to high demand from manufacturing companies that operate with industrial machinery. These machineries require thick metal sheets that ensure durability to withstand heavy loads and prolonged usage. As per the Indian Brand Equity Foundation, manufacturing exports registered an export value of USD 447.46 billion in 2023, with a 6.03% growth from the export value in 2022.

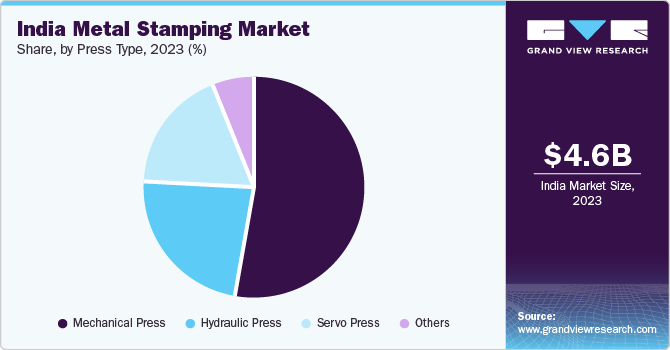

Press Type Insights

Based on press type, the mechanical press segment led the market with the largest revenue share of 52.3% in 2023, due to the high demand for blanking operations requiring consistent speed and force, a highly valued feature of the mechanical press. Companies employ the mechanical press in cases where the components involve uniform properties and straightforward shapes. Moreover, keeping manufacturing operations lean fosters segment growth as these presses offer a more cost-effective solution than servo and hydraulic presses.

The servo press segment is anticipated to grow at the fastest CAGR over the forecast period, due to innovations that offer enhanced capabilities. For instance, integrating artificial intelligence (AI) algorithms for adaptive control enables servo presses to adjust parameters based on real-time feedback, optimizing performance and quality and saving time.

Key India Metal Stamping Company Insights

Some key players operating within the market include Veer-O-Metals Private Limited, and CIE Automotive

-

Veer-O-Metals Private Limited is a company engaged in manufacturing stamped parts, machined components, and precision metal sheet fabrication parts. The company utilizes metal sheets of varied thicknesses, ranging from 0.5 mm to 5 mm, to cater to the various component needs of clients in the automotive, electronic, telecommunication, and other industries

-

CIE Automotive is a company engaged in metal stamping and tube forming. Its operations are also involved in several other aspects related to component manufacturing. The company’s metal stamping and tube forming division has 21 production facilities worldwide and had a turnover of approximately USD 1 billion in 2023

Key India Metal Stamping Companies:

- Caparo

- Magna International Inc.

- AMW Autocomponent

- CIE Automotive

- ASAL (TATA Autocomp Systems Limited)

- JBM Group

- HIGHCO

- BOMBAY METRICS SUPPLY CHAIN PVT. LTD.

- Gestamp

- Eigen

- Chennai Metal Stamping Pvt. Ltd.

- Synergy Global Sourcing

- M. Coil Spring Manufacturing Company

- Presco-Mec Group

- Victora Group

Recent Developments

-

In January 2023, Gestamp announced the launch of its fourth hot stamping line in India to establish itself as a key player in the automotive components sector and capitalize on the opportunity presented by the rapidly rising automotive industry

-

In May 2022, Edscha, a subsidiary of Gestamp, signed a joint venture agreement with Aditya Auto Products & Engineering. Through the partnership, Edscha acquired direct access to the Indian market through strategic locations as part of its supply chain. The newly formed corporation, called Edscha Aditya Automotive Systems, aims at manufacturing components such as door checks, latches, parking brakes, and hinge systems at market-driven costs, leveraging its facilities that engage in metal stamping and other processes that aid the company in catering to automotive companies

India Metal Stamping Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.82 billion

Revenue forecast in 2030

USD 6.74 billion

Growth rate

CAGR of 5.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, company ranking, trends, and growth factors

Segments covered

Process, application, thickness, press type

Country scope

India

Key companies profiled

Caparo; Magna International Inc.; AMW Autocomponent; CIE Automotive; ASAL (TATA Autocomp Systems Limited); JBM Group; HIGHCO; BOMBAY METRICS SUPPLY CHAIN PVT. LTD.; Gestamp; Eigen; Chennai Metal Stamping Pvt. Ltd.; Synergy Global Sourcing; M. Coil Spring Manufacturing Company; Presco-Mec Group; Victora Group

Customization scope

Free customization of report (equivalent to up to 8 analyst’s working days) with purchase. Alteration or addition to country, regional & segment scope.

Purchase and pricing options

Access to customizable purchase options to obtain your exact research needs. Explore purchase options

India Metal Stamping Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India metal stamping market report based on process, application, thickness, and press type.

-

Process Outlook (Revenue, USD Billion, 2018 - 2030)

-

Blanking

-

Embossing

-

Bending

-

Coining

-

Flanging

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Automotive & Transportation

-

Industrial Machinery

-

Consumer Electronics

-

Aerospace

-

Electrical & Electronics

-

Telecommunications

-

Building & Construction

-

Others (medical, furniture, hardware tools, and energy)

-

-

Thickness Outlook (Revenue, USD Billion, 2018 - 2030)

-

Less than & upto 2.5 mm

-

More than 2.5 mm

-

-

Press Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Mechanical Press

-

Hydraulic Press

-

Servo Press

-

Others

-

Frequently Asked Questions About This Report

b. The India metal stamping market size was estimated at USD 4.65 billion in 2023 and is expected to reach USD 4.82 billion in 2024

b. The global India metal stamping market is expected to grow at a compound annual growth rate of 5.7% from 2024 to 2030 to reach USD 6.74 billion by 2030

b. Based on application, the automotive and transportation segment dominated the India metal stamping market with a share of 39.4% in 2023. Factors such as increasing prominence of EVs in India and the rapid rise of the overarching automotive industry due to a strong international position and positive government influence, is driving the demand for metal stamping for automotive components.

b. Some key players operating in the India metal stamping market include Caparo, Magna International Inc., AMW Autocomponent, CIE Automotive, ASAL (TATA Autocomp Systems Limited), JBM Group, HIGHCO, BOMBAY METRICS SUPPLY CHAIN PVT. LTD., Gestamp, Eigen, Chennai Metal Stamping Pvt. Ltd., Synergy Global Sourcing, M. Coil, Spring Manufacturing Company, Presco-Mec Group, Victora Group

b. Factors such as the accelerating demand for precision automotive components and electronic components is driving the India metal stamping market growth

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.