- Home

- »

- Consumer F&B

- »

-

India Nutraceuticals Market Size, Industry Report, 2033GVR Report cover

![India Nutraceuticals Market Size, Share & Trends Report]()

India Nutraceuticals Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Dietary Supplements, Functional Food, Functional Beverages, Infant Formula), By Application, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-204-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

India Nutraceuticals Market Summary

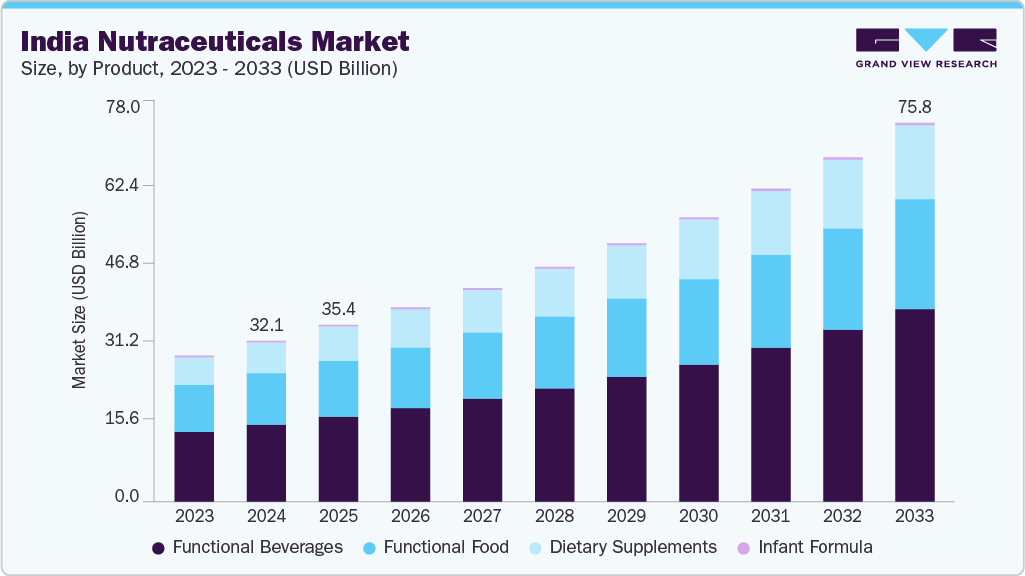

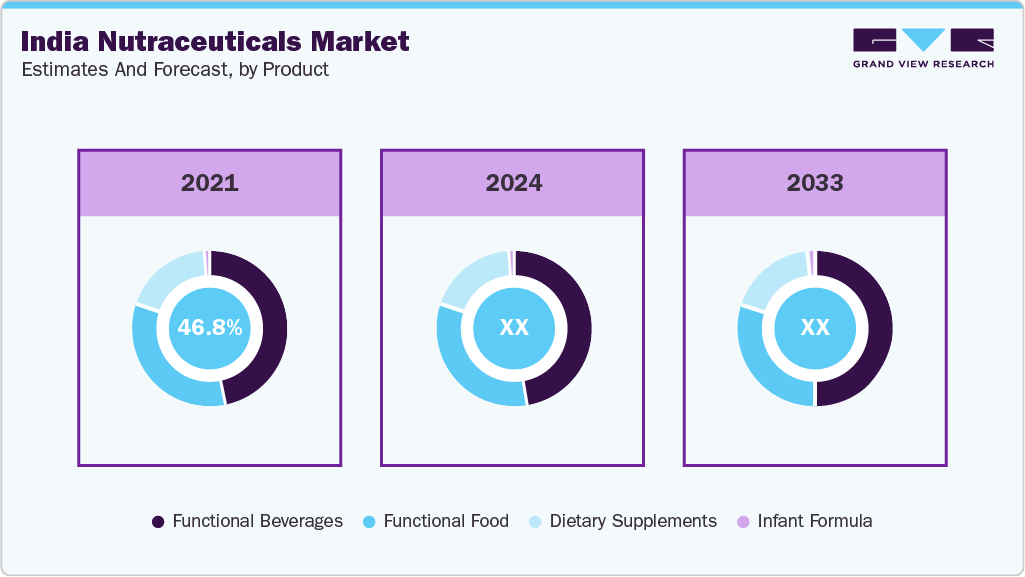

The India nutraceuticals market size was estimated at USD 32.14 billion in 2024, and is projected to reach USD 75.81 billion by 2033, growing at a CAGR of 10.0% from 2025 to 2033. A primary driver for market growth is the escalating health awareness among Indian consumers, particularly post-pandemic, leading to a proactive approach to well-being rather than reactive treatment.

Key Market Trends & Insights

- By product, the functional beverages segment held the highest market share of 47.9% in 2024.

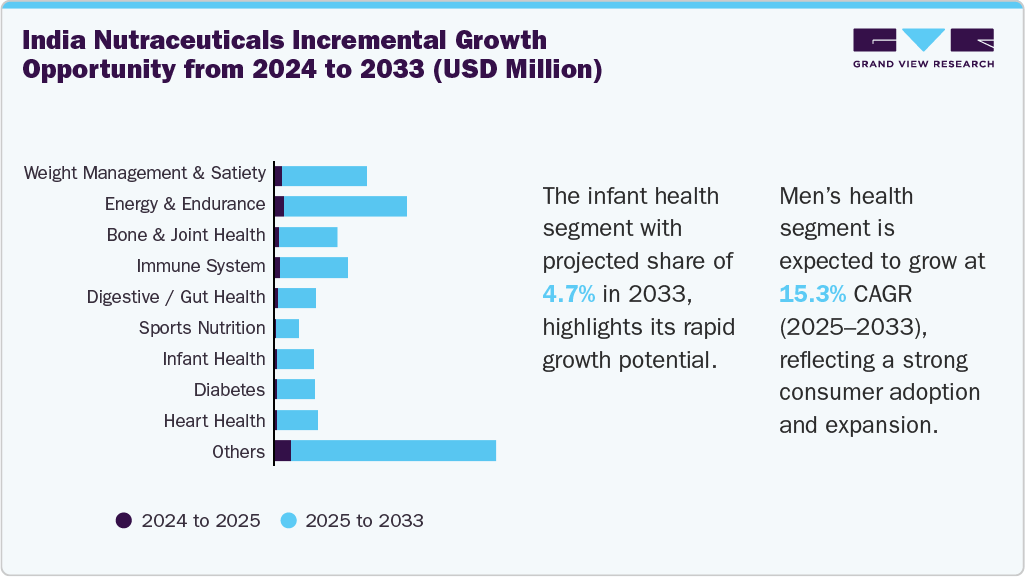

- Based on application, the weight management & satiety segment held the highest market share in 2024.

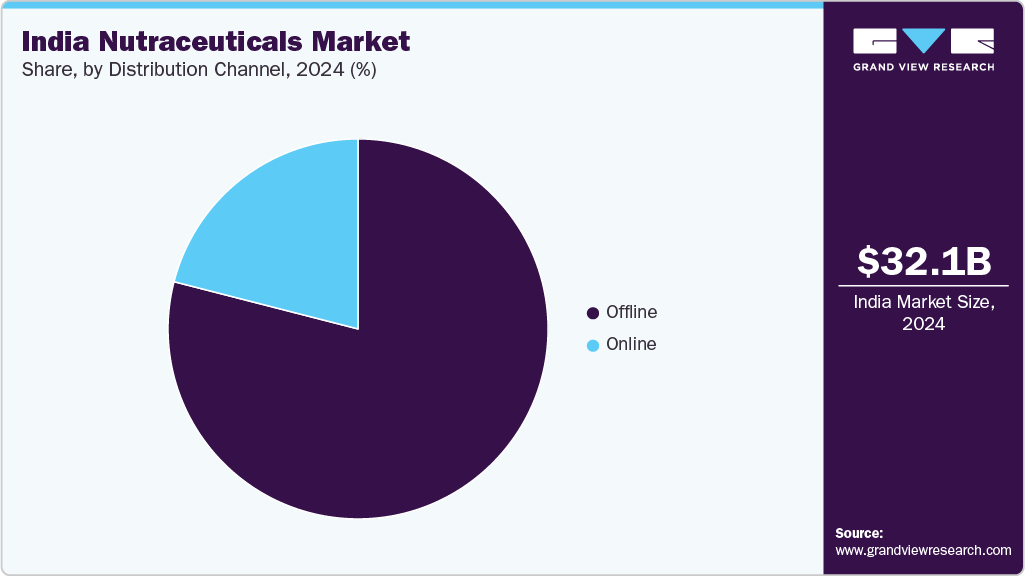

- By distribution channel, the offline segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 32.14 Billion

- 2033 Projected Market Size: USD 75.81 Billion

- CAGR (2025-2033): 10.0%

A heightened focus on immunity and holistic health fuels this shift. The increasing prevalence of lifestyle diseases such as diabetes, obesity, and cardiovascular disorders is compelling a larger segment of the population to seek out nutraceuticals as preventive and supplementary solutions. This growing demand underscores a fundamental change in how Indians approach health management. According to an article published by PharmaNutrition in March 2025, the receptiveness of the aging population to personalized nutrition presents ample growth opportunities for manufacturers, further solidifying the market’s upward trajectory.

India’s rapid urbanization and the adoption of sedentary lifestyles drive the market growth further, resulting in dietary imbalances. This has significantly amplified the demand for supplements and functional foods, especially among the younger, urban demographics like millennials and Gen Z. Concurrently, there is a pronounced consumer preference for natural, plant-based, and Ayurveda-inspired nutraceuticals, stemming from concerns about the side effects of synthetic medications and a desire for clean-label products. This trend aligns with India’s traditional embrace of alternative medicine.

Economic and regulatory factors also play a crucial role in market expansion. The burgeoning middle class and increasing disposable incomes enable more Indians to invest in health and wellness products, making nutraceuticals more accessible and desirable. Furthermore, the Food Safety and Standards Authority of India (FSSAI) has introduced clear regulations and standards, bolstering consumer trust and market credibility. According to an article published by Economic Times in February 2025, nutraceuticals are gaining popularity in India due to rising health awareness, increased lifestyle diseases, and a shift toward natural products. The market’s significant growth is further propelled by government initiatives, disposable incomes, and expanding online retail. These combined factors create a supportive environment for industry growth and innovation.

Consumer Insights

The 18-35 age group, comprising Millennials and Gen Z, constitutes the largest consumer base, with a focus on fitness, appearance, and immunity driving demand for protein powders, multivitamins, and beauty supplements. Consumers aged 35-55 prioritize preventive care for chronic conditions, favoring herbal and joint care products. While consumption among the elderly (55+) is rising for bone health and memory support, it remains sensitive to price and trust issues. Women demand more skin, hair, and hormonal balance products, while men lean towards muscle-building and performance-enhancing supplements. Income segmentation reveals that upper and upper-middle classes prefer premium international brands, whereas the growing middle class is cost-conscious, favoring Indian or Ayurveda-based nutraceuticals.

Consumer Demographics

Consumer preferences are deeply rooted in natural and herbal-based products. Strong demand for Ayurvedic and plant-based supplements is perceived as safer and culturally aligned, benefiting brands such as Himalaya and Dabur. There’s a growing trend towards flavored and convenient formats such as chewable, gummies, and effervescent tablets, alongside functional beverages, appealing to younger consumers. Health-conscious urban consumers prioritize “free-from” labels like sugar-free and non-GMO.

According to a study published by the National Family Health Survey (NFHS-5) in 2019-2021, approximately 23% of Indian men and 24% of Indian women were found to be overweight or obese. This prevalence contributed to various health issues, including cardiovascular diseases, diabetes, respiratory problems, and knee joint health concerns across the country.

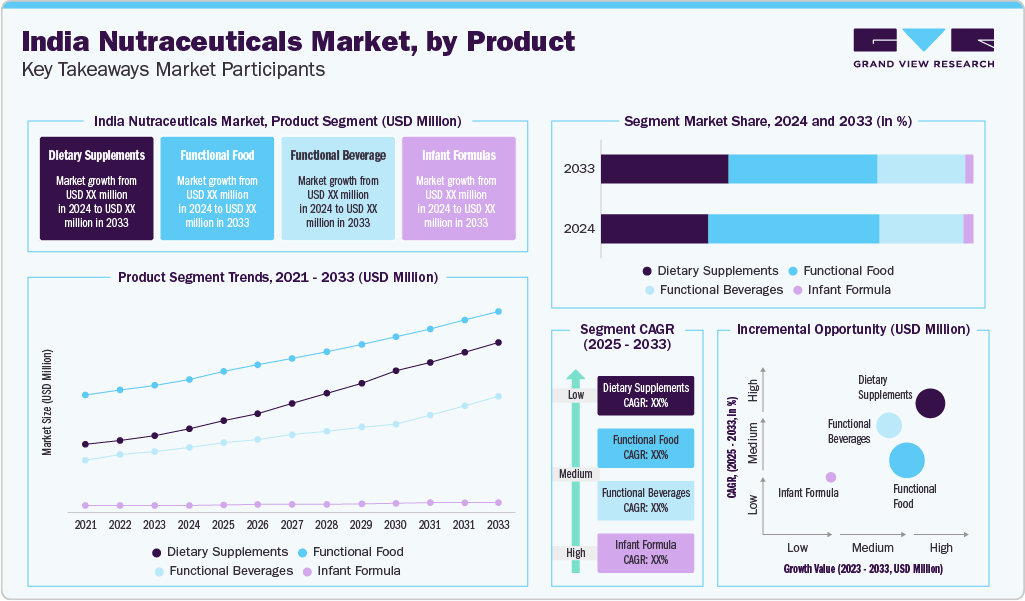

Product Insights

On the basis of product, the functional beverages segment dominated the market with a revenue share of 47.9% in 2024. These beverages are easier to consume than traditional pills or powders, appealing to time-strapped urban consumers seeking on-the-go options. They particularly resonate with younger demographics, who prefer functional waters, energy drinks, and protein shakes as healthier alternatives to sugary beverages. Their perceived dual benefits of hydration and specific health advantages, such as energy or immunity, coupled with rapid growth in urban fitness culture and continuous product innovation incorporating localized and fortified ingredients, solidify their market leadership.

The dietary supplements segment is projected to experience lucrative growth from 2025 to 2033. The demand for dietary supplements in India has surged due to rising health consciousness, a growing middle-class population, and increased awareness about preventive healthcare. The COVID-19 pandemic accelerated this trend as consumers sought immunity-boosting products such as vitamins, minerals, and herbal supplements. In addition, urbanization, lifestyle changes, and the prevalence of chronic diseases have prompted individuals to prioritize wellness. The popularity of nutraceuticals has also been fueled by India’s rich tradition of Ayurveda and natural remedies, with a preference for supplements containing herbal and organic ingredients.

Application Insights

The weight management & satiety segment held the largest revenue share of the Indian nutraceuticals market in 2024. Rising obesity rates in Indian metropolitan cities, driven by sedentary lifestyles and processed diets, are creating substantial opportunities for nutraceutical innovation in weight management and satiety. Younger consumers’ focus on body image fuels high demand for fat burners and meal replacements. For instance, in December 2024, OptiBiotix launched SlimBiome-containing products via Dr. Morepen’s LightLife brand in India, backed by a USD 2.0 million+ investment and a 360° weight management plan.

The men’s health segment is projected to experience the fastest CAGR from 2025 to 2033. There is greater openness regarding men’s wellness concerns, including testosterone health, performance, and hair loss. Brands are actively positioning products specifically for male-centric issues such as stamina, muscle building, and prostate health. Rising disposable income among urban male consumers, particularly those aged 25-45, enables investment in personal wellness. A cultural shift reducing traditional stigmas surrounding men’s health discussions, alongside the normalization of fitness supplements such as protein powders and pre-workouts, further contributes to this market growth.

Distribution Channel Insights

The offline distribution segment dominated the Indian nutraceuticals market in 2024. Pharmacies and practitioner outlets, including Ayurvedic clinics and nutritionists, provide crucial trusted recommendations, which are vital in a market segment still skeptical of supplements. Through brand ambassadors, physical stores offer product visibility, in-store demonstrations, and direct consumer education. In Tier 2 and Tier 3 towns and rural areas, limited internet access or digital trust still drives a preference for offline purchases. Doctor-driven purchases, often tied to specific retail points, and regulatory complexities for certain high-potency nutraceuticals further ensure their continued dominance in physical stores. For instance, in December 2024, Zeno Health, a prominent healthcare distributor in India, launched its 182nd medical store in Panvel, Maharashtra, expanding its omnichannel presence there. This new outlet, part of Zeno Health’s mission to reduce healthcare expenses for its consumers, offered a wide range of products including prescription medicines, wellness, and nutrition items to serve more customers.

The online segment is anticipated to experience fastest CAGR of 11.7% from 2025 to 2033. In November 2024, Amazon launched its ‘Clinic’ medical consultation service in India, offering online doctor consultations for over 50 conditions via its app. This platform featured nutrition specialists and integrated with Amazon’s pharmacy, aiding the demand for nutraceuticals online by providing direct pathways from consultation and prescription to convenient product purchase and home delivery.

Furthermore, the appeal of home delivery provided by online distribution websites is particularly in demand by time-pressed urban professionals and working parents. Online platforms, including major e-commerce sites and brand direct-to-consumer (DTC) websites, offer a wider product range, encompassing imported, niche, and new-age nutraceuticals. Financial incentives like discounts, loyalty points, and auto-refill subscriptions attract repeat buyers. Increased digital literacy and improved logistics coverage in non-metro regions are fueling e-commerce uptake. At the same time, influencer marketing and content-driven purchases on social media platforms accelerate product discovery and impulse buying, with user data enabling personalized product suggestions.

Key India Nutraceuticals Company Insights

Some of the key players in the India nutraceuticals market include Abbott; ADM; Amway Corp.; Cipla; Dabur.com; Danone India; and others. Key strategic movements include personalization via diagnostics, mergers & acquisitions, regulatory investments, gender/age-specific formulations, Tier 2/3 market focus, and global export expansion.

-

Himalaya Wellness Company is a Bengaluru-based pioneer leveraging Ayurveda for herbal nutraceuticals. The company offers a broad product portfolio, including Liv.52 and protein supplements, boasting high consumer trust, extensive distribution, and R&D-backed formulations. Strategic direction includes D2C growth and global exports.

-

GNC India, partnered with Guardian Healthcare, is a premium international brand in India, targeting urban, fitness-conscious consumers with high-quality vitamins, proteins, and fitness supplements. Its strategy focuses on global brand reputation, strong e-commerce presence, expanding retail footprint, and localizing offerings.

Key India Nutraceuticals Companies:

- Abbott

- ADM

- Amway Corp.

- Cipla

- Dabur.com

- Danone India

- GNC India

- Herbalife, Inc.

- Himalaya Wellness Company

- Nestlé India Limited

- Patanjali Ayurved Limited

Recent Developments

-

In June 2025, Dabur India launched Siens, a new nutraceutical brand in India. This strategic digital-first entry into the premium wellness segment offers beauty, gut health, and daily wellness supplements in modern formats like gummies and softgels. This aligns with Dabur’s revamped growth strategy for FY28.

-

In March 2025, GNC India, via Guardian Healthcare, launched “GNC Pro Performance 100% Whey + Nitro Surge” in India. This indigenously developed, groundbreaking whey protein features a unique cardioprotective formulation with clinically proven ingredients.

-

In March 2025, Amway India announced its active exploration of entering the Ayurveda segment in India. Leveraging the success of its Nutrilite brand, the company plans to launch new products integrating local traditional herbs within the next two to three years, reflecting a strategic focus on innovative, science-backed wellness solutions.

-

In February 2025, Herbalife India collaborated with IIT Madras to launch the Plant Cell Fermentation Technology Lab in Chennai, India. This CSR initiative aims to develop sustainable, high-quality herbal raw materials for nutraceuticals, bridging demand-supply gaps and aligning with India’s bio-manufacturing goals.

-

In November 2024, Nestlé India announced that it would launch new Cerelac variants with no refined sugar in India. This strategic move, initiated three years prior, followed criticism regarding added sugar in baby products in South Asian nations.

-

In September 2024, dsm-firmenich, a Swiss-Dutch nutrition, health, and beauty firm, announced plans to invest over USD 100 million in India. This investment, targeting capacity expansion including new manufacturing plants, aims to scale Indian operations and establish the country as an export base, expecting India to be among its top three global markets within five years.

-

In April 2024, Nestlé India and Dr. Reddy’s Laboratories formed a joint venture in India, headquartered in Hyderabad. This partnership combines Nestlé Health Science’s global nutritional solutions with Dr. Reddy’s commercial strengths to offer innovative nutraceutical brands across metabolic, general wellness, hospital nutrition, child nutrition, and women’s health categories.

India Nutraceuticals Market Report Scope

Report Attribute

Details

Revenue forecast in 2033

USD 75.81 billion

Growth rate

CAGR of 10.0% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, distribution channel

Key companies profiled

Abbott; ADM; Amway Corp.; Cipla; Dabur.com; Danone India; GNC India; Herbalife, Inc.; Himalaya Wellness Company; Nestlé India Limited; Patanjali Ayurved Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Nutraceuticals Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the India nutraceuticals market report based on product, application, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Dietary Supplements

-

Tablets

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Capsules

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Soft Gels

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Powders

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Gummies

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Liquid

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Others

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

-

Functional Food

-

Vegetable and Seed Oil

-

Sweet Biscuits, Snack Bars and Fruit Snacks

-

Dairy

-

Baby Food

-

Breakfast Cereals

-

Others

-

-

Functional Beverages

-

Energy drink

-

Sports drink

-

Others (Functional dairy based beverages, kombucha, kefir, probiotic drinks, and functional water)

-

-

Infant Formula

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Allergy & Intolerance

-

Healthy Ageing

-

Bone & Joint health

-

Cancer Prevention

-

Children’s Health

-

Cognitive Health

-

Diabetes

-

Digestive / Gut Health

-

Energy & Endurance

-

Eye Health

-

Heart Health

-

Immune System

-

Infant Health

-

Inflammation

-

Maternal Health

-

Men’s Health

-

Nutricosmetics

-

Oral care

-

Personalized Nutrition

-

Post Pregnancy Health

-

Sexual Health

-

Skin Health

-

Sports Nutrition

-

Weight Management & Satiety

-

Women’s Health

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Supermarkets & Hypermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioner

-

Grocery Stores

-

Others

-

-

Online

-

Amazon

-

Other Online Retail Stores

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.