- Home

- »

- Pharmaceuticals

- »

-

India Nutritional Supplements Market, Industry Report, 2030GVR Report cover

![India Nutritional Supplements Market Size, Share & Trends Report]()

India Nutritional Supplements Market (2025 - 2030) Size, Share & Trends Analysis Report, By Product (Sports Nutrition, Dietary Supplements), By Consumer Group (Infants, Adults), By Formulation, By Sales Channel, By Application, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-224-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

India Nutritional Supplements Market Trends

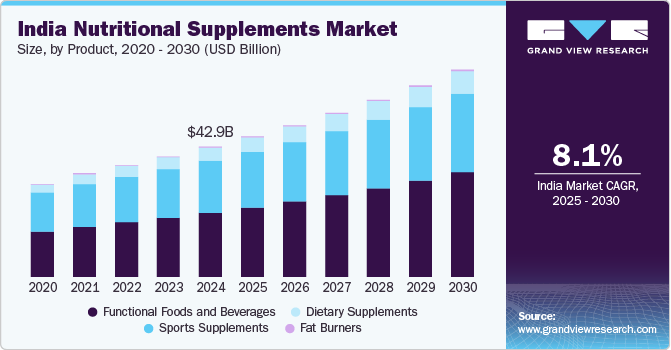

The India nutritional supplements market size was estimated at USD 42.97 billion in 2024 and is expected to grow at a CAGR of 8.1% from 2025 to 2030. India’s nutritional supplements market is primarily driven by its young population, increasing disposable incomes, and rising health awareness. The growing prevalence of lifestyle-related conditions like obesity, diabetes, and cardiovascular diseases has heightened the demand for supplements addressing weight management, immunity, and general wellness.

The popularity of Ayurveda and herbal-based supplements, combined with the government's support for the AYUSH (Ayurveda, Yoga, Unani, Siddha, and Homeopathy) industry, has spurred innovation in natural and plant-based products. In addition, the rapid expansion of e-commerce platforms and urbanization has improved access to a wide range of supplements, particularly among millennials and health-conscious consumers in metro and tier-2 cities.

According to the Youth in India 2022 report by the Ministry of Statistics and Programme Implementation of the Government of India (GOI), the youth population of India increased from 222.7 million in 1991 to 333.4 million in 2011 and is expected to reach 371.4 million in 2021. This rise in the younger population of the country is anticipated to fuel the market growth.

Growth of the nutritional supplement industry in India is driven by the increasing health awareness of nutritional supplements and the lack of a nutritional diet. The Indian population is witnessing a decline in the nutrients from daily diets, which is impacting their health adversely. The lack of nutrition in the diet is contributing to the rise of diseases such as anemia and obesity in the country. For instance, according to the National Family Health Survey (NFHS-5) 2019-21 of the GOI, 57.0% of the women and 25.0% of the men aged between 15 and 49 were anemic in India. These rising health conditions due to nutritional deficiencies are expected to drive industry growth.

The increasing income levels in the country are contributing to the betterment of the quality of life of people, which is leading to spending on personal health, thereby contributing to the market. According to the Ministry of Statistics & Programme Implementation of the GOI estimates, the per capita Net National Income (NNI) reached 2,071 USD in 2022-23 from 1,043 from 2014-15. These rising income levels in the country are increasing the affordability of nutritional supplements, thereby contributing to industry growth.

Product Insights

The functional food and beverages segment accounted for the largest revenue share of 49.20% in 2024. Increasing awareness about digestive diseases as well as gut health and increasing use of probiotics as functional foods have contributed to the segment’s growth. The benefit of consuming functional foods and providing health benefits beyond basic nutrition has further increased their demand. Moreover, the launch of new products by the companies in the segment is further contributing to the consumption of functional foods. For instance, in May 2022, Plix, a plant-based D2C wellness brand in the country, announced the launch of its 100% plant-based functional food product range. The company entered the health snack segment with the launch of this product range.

The sports nutrition segment is expected to grow at the fastest CAGR from 2025 to 2030. This can be attributed to the growing acceptance of protein supplements and the inclination of the younger population towards healthy lifestyles and fitness. Moreover, the increasing government initiatives to support sport and fitness enthusiasts in the country and increase access to sports nutrition are further expected to boost the segment growth. For instance, under the “Khelo India Scheme’s” vertical “Talent Search and Development," selected players are given special allowances by the government to facilitate better training, diet, and consumables. The increasing popularity of sports nutrients and government support are anticipated to drive the Indian nutritional supplements industry growth.

Formulation Insights

The powder segment accounted for the largest revenue share of 37.68% in 2024. Powdered supplements, such as protein powders, meal replacements, and herbal blends, are highly favored among fitness enthusiasts and individuals pursuing weight management goals. The rise of home workouts and fitness trends, accelerated by the COVID-19 pandemic, has further driven demand for such products. In addition, powders allow for easy customization of dosages and can be mixed into beverages or recipes, appealing to a broad demographic. The increasing prevalence of lactose intolerance in the region has also spurred the development of plant-based and dairy-free powder formulations, meeting the growing demand for allergen-free and vegan options.

The capsule segment is expected to grow at the fastest CAGR from 2025 to 2030. This is because functional food supplements like Omega-3 and certain probiotics are all in capsule formulations, and functional foods are a large market segment. The benefits associated with capsule formulation include including multiple supplements in one dose and ease of consumption by all age groups, which, in turn, is expected to fuel the nutritional supplements industry growth.

Consumer Group Insights

The adult segment accounted for the largest revenue share of 51.78% in 2024 and is expected to grow at the fastest CAGR during the forecast period. This can be attributed to the high risk of diseases such as chronic diseases and lifestyle diseases in adults. Indian adults have a high prevalence of diseases such as diabetes, heart disease, and joint pains. Nutritional supplements can offer solutions to these conditions, which increase their demand in the adult age group.

Moreover, the lack of nutrition in adults and the prevalence of conditions such as obesity further contribute to the demand for nutritional supplements in adults. For instance, according to the National Family Health Survey-5 2019-21 of GOI, 24% of the women and 22.9% of the men in the country were obese. The high prevalence of such conditions and the increasing threat of lifestyle diseases are anticipated to drive the segment growth.

The geriatric segment is expected to grow at a significant CAGR from 2025 to 2030. This can be attributed to the growing awareness of nutritional supplements in the elderly population and the growing geriatric population of the country. According to the INDIA AGING REPORT 2023 of the United Nations Population Fund (UNFPA), the elderly population in India aged above 60 years is expected to grow from 149 million in 2022 to 347 million in 2050. This increasing geriatric population of the country is expected to increase the demand for nutritional supplements, thereby contributing to the India nutritional supplements industry growth.

Sales Channel Insights

The brick & mortar segment accounted for the largest revenue share of 66.43% in 2024. The number of retail outlets selling and marketing nutritional supplements has increased. Outlets like Vitamin Shoppe and Walmart have various products from multiple brands. The players have been significantly investing in opening offline stores to reach a wider customer base. For instance, in January 2023, Nutrabay, a premium nutrition supplements brand, entered the offline retail market and planned to target up to 300 stores in India.

The e-commerce segment is projected to register the fastest CAGR from 2025 to 2030. This can be attributed to the rising awareness of e-commerce, attracting several market players to focus on e-commerce platforms. India has one of the largest internet user bases in the world, which offers significant opportunities for the country to grow its e-commerce. For instance, according to the Government of India's (GOI) Invest India platform, India is the second largest internet market globally, with over 800 million internet users.

Moreover, the GOI is taking significant steps to increase the country's e-commerce connectivity. For instance, in April 2022, GOI launched the Open Network for Digital Commerce (ONCD) platform in the country. These platforms allow any seller to register on the platform and sell the products through e-commerce. This increasing support for e-commerce in the country is anticipated to drive India nutritional supplements industry growth.

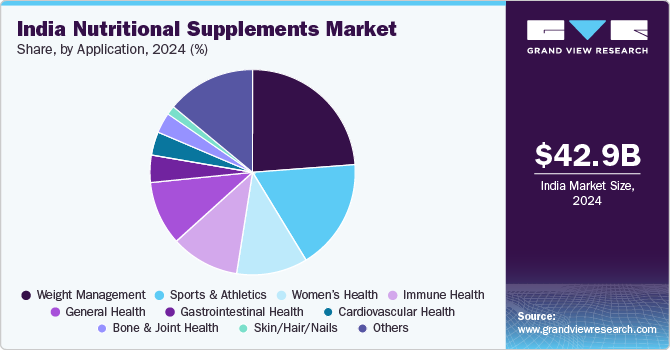

Application Insights

The weight management accounted for the largest revenue share of 23.77% in 2024. The growing prevalence of obesity and related health issues is a key driver of the weight management health supplements market in India. Increasing awareness about maintaining a healthy lifestyle has fueled demand for weight management products like fat burners, meal replacements, and appetite suppressants.

This trend is bolstered by urbanization, rising disposable incomes, and the growing influence of fitness trends through social media and digital platforms. In addition, a surge in e-commerce channels has made these products more accessible, particularly among younger demographics and working professionals seeking convenient solutions for weight control.

The sports & athletics segment is expected to grow significantly from 2025 to 2030. Rising awareness about supplements like protein powders, amino acids, and energy boosters in enhancing performance and recovery has significantly boosted demand. In addition, urbanization and the proliferation of gym chains, yoga studios, and fitness clubs have made athletic nutrition more accessible and mainstream. Governments and sports organizations across the region are also investing in programs that promote sports participation, further driving the adoption of supplements tailored to endurance, strength, and muscle-building. Social media influencers and athletes endorsing sports nutrition products add to the momentum, attracting younger demographics to this segment.

Key India Nutritional Supplements Company Insights

The market players operating in the Indian industry are adopting product approval to increase the reach of their products in the industry and improve the availability of their products in diverse geographical areas, along with expansion as a strategy to enhance production/research activities. In addition, several industry players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key India Nutritional Supplements Companies:

- Sun Pharmaceuticals Industries Ltd.

- Himalaya Wellness Company

- Unilever

- Cipla Health Limited (CHL)

- Dabur India Ltd

- GSK plc.

- Amway India Enterprises Pvt. Ltd.

- MuscleBlaze

- Britannia Industries

- Abbott Laboratories

Recent Developments

-

In January 2024, Dr. Reddy's Laboratories Ltd. announced that the company had acquired MenoLabs, a women's health & dietary supplement portfolio, from Amyris, Inc. This acquisition is anticipated to accelerate the company’s growth in the women's health and wellness market.

-

In July 2023, Oriflame Cosmetics AG announced the launch of two health supplements in India. The two supplements are Calcium fortified with vitamin D and magnesium, a facilitator for high bone density and Iron Complex to tackle iron deficiency in women.

-

In April 2023, Genetic Nutrition, a sports supplement brand in the UK, launched the company’s high-quality health and wellness segment in India. The company aims to provide the highest quality supplements to Indians through this segment.

-

In February 2022, Amway India Enterprises Pvt. Ltd. announced the launch of nutrition supplements in the format of mouth-dissolving jelly strips and favorable gummies under the company’s brand Nutrilite. These products are launched as an on-the-go nutrition solution, understanding the busy lifestyle of youngsters in the country.

India Nutritional Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 46.39 billion

Revenue forecast in 2030

USD 68.43 billion

Growth rate

CAGR of 8.1% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Products, consumer group, formulation, sales channel, application

Country scope

India

Key companies profiled

Sun Pharmaceuticals Industries Ltd.; Himalaya Wellness Company; Unilever; Cipla Health Limited (CHL); Dabur India Ltd; GSK plc.; Amway India Enterprises Pvt. Ltd.; MuscleBlaze; Britannia Industries; Abbott Laboratories.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Nutritional Supplements Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India nutritional supplements market report based on product, consumer group, formulation, sales channel, and application.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Sports Nutrition

-

Sports Supplements

-

Protein Supplements

-

Egg Protein

-

Soy Protein

-

Pea Protein

-

Lentil Protein

-

Hemp Protein

-

Casein

-

Quinoa Protein

-

Whey Protein

-

Whey Protein Isolate

-

Whey Protein Concentrate

-

-

-

Vitamins

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

-

Amino Acids

-

BCAA

-

Arginine

-

Aspartate

-

Glutamine

-

Beta-Alanine

-

Creatine

-

L-carnitine

-

-

Probiotics

-

Omega-3 Fatty Acids

-

Carbohydrates

-

Maltodextrin

-

Dextrose

-

Waxy Maize

-

Karbolyn

-

-

Detox Supplements

-

Electrolytes

-

Others

-

-

Sports Drinks

-

Isotonic

-

Hypotonic

-

Hypertonic

-

-

Sports Foods

-

Protein Bars

-

Energy Bars

-

Protein Gel

-

-

Meal Replacement Products

-

Weight Loss Product

-

-

-

Fat Burners

-

Green Tea

-

Fiber

-

Protein

-

Green Coffee

-

Others

-

-

Dietary Supplements

-

Vitamins

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin E

-

-

Minerals

-

Enzymes

-

Amino Acids

-

Conjugated Linoleic Acids

-

Others

-

-

Functional Foods and Beverages

-

Probiotics

-

Omega-3

-

Others

-

-

-

Consumer Group Outlook (Revenue, USD Million, 2018 - 2030)

-

Children

-

Infants

-

Adults

-

Age Group 21-30

-

Age Group 31-40

-

Age Group 41-50

-

Age Group 51-65

-

-

Pregnant

-

Geriatric

-

-

Formulation Outlook (Revenue, USD Million, 2018 - 2030)

-

Tablets

-

Capsules

-

Powder

-

Softgels

-

Liquid

-

Others

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Brick & Mortar

-

Direct Selling

-

Chemist/Pharmacies

-

Health Food Shops

-

Hypermarkets

-

Supermarkets

-

-

E-commerce

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Sports & Athletics

-

General Health

-

Bone & Joint Health

-

Brain Health

-

Gastrointestinal Health

-

Immune Health

-

Cardiovascular Health

-

Skin/Hair/Nails

-

Sexual Health

-

Women’s Health

-

Anti-aging

-

Weight Management

-

Others

-

Frequently Asked Questions About This Report

b. The India nutritional supplements market size was estimated at USD 42.97 billion in 2024 and is expected to reach USD 46.39 billion in 2025.

b. The India nutritional supplements market is expected to grow at a compound annual growth rate (CAGR) of 8.1% from 2025 to 2030 to reach USD 68.43 billion by 2030.

b. The functional foods and beverages dominated the market with the largest market share of around 49.2% in 2024. This high share is attributable to the increasing awareness about digestive diseases and the use of probiotics in functional foods.

b. Some of the key players operating in the India nutritional supplements include Sun Pharmaceuticals Industries Ltd.; Himalaya Wellness Company; Unilever; Cipla Health Limited (CHL); Dabur India Ltd; GSK plc.; Amway India Enterprises Pvt. Ltd.; MuscleBlaze; Britannia Industries; Abbott Laboratories; among others.

b. Key factors that are driving the market growth include increasing health awareness, rising income levels in the country, increasing health-conscious younger population, and nutritional deficiency.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.